Market Overview

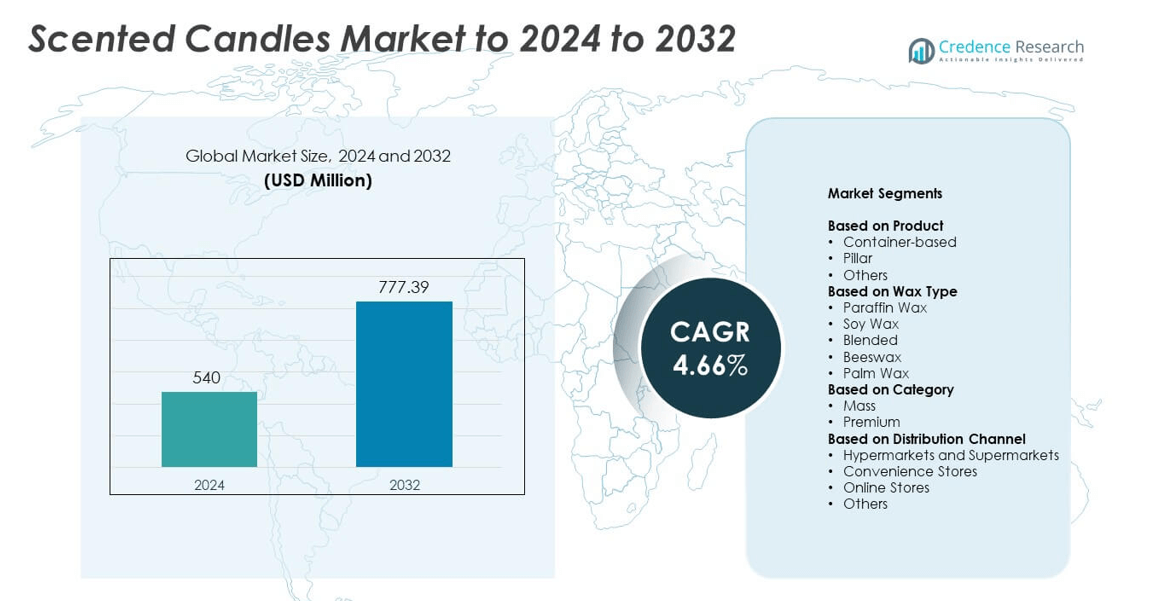

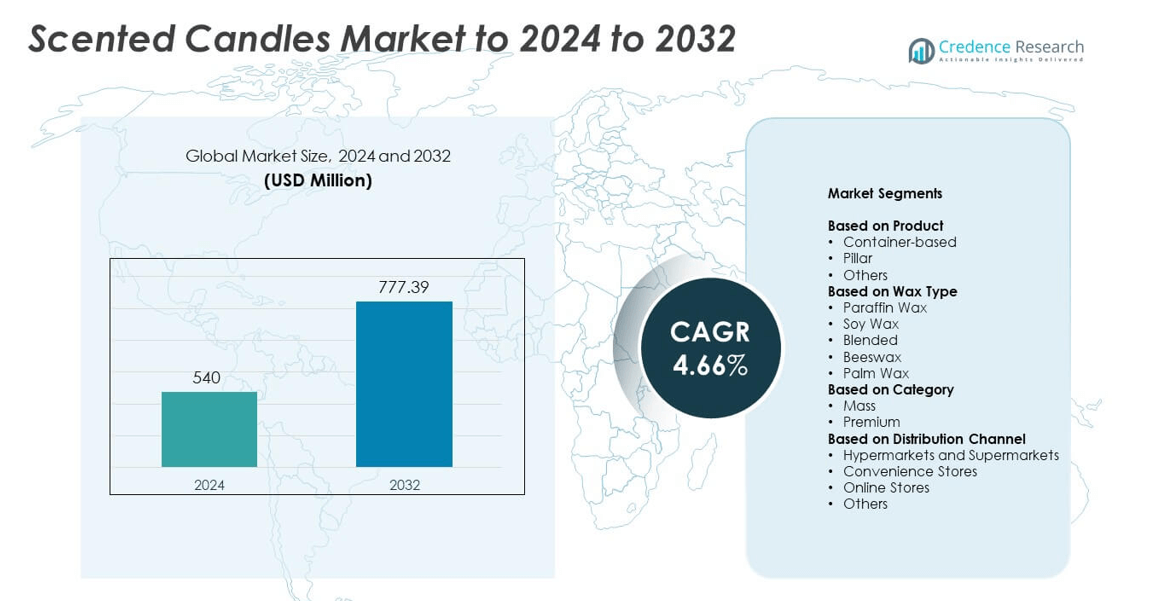

Scented Candles Market size was valued at USD 540 Million in 2024 and is anticipated to reach USD 777.39 Million by 2032, at a CAGR of 4.66% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Scented Candles Market Size 2024 |

USD 540 Million |

| Scented Candles Market, CAGR |

4.66% |

| Scented Candles Market Size 2032 |

USD 777.39 Million |

The scented candles market includes major players such as NEST New York, Hotel Lobby Candle, L Brands, Diptyque Paris, Lalique Group SA, MVP Group International, Village Candle, Newell Brands, Portmeirion Group PLC, and Thymes. These companies grow through premium fragrances, clean-label wax blends, and strong retail and online distribution. North America leads the global market with about 37% share in 2024, driven by high home fragrance adoption and strong gifting demand. Europe follows with around 29% share, supported by premium product preference and established décor culture, while Asia Pacific expands rapidly due to rising urban incomes and wellness-focused spending.

Market Insights

- The scented candles market reached USD 540 Million in 2024 and is projected to hit USD 777.39 Million by 2032, advancing at a CAGR of 4.66%.

• Growing use of candles for home ambience and aromatherapy drives demand, with container-based products holding about 62% share due to safer burning and stronger fragrance performance.

• Trends shift toward natural waxes and clean-label blends, supporting the dominance of soy wax at nearly 48% share and boosting premium, wellness-inspired collections.

• Competition intensifies as brands expand seasonal launches, invest in sustainable packaging, and strengthen online visibility, while value-focused players maintain reach through mass retail; however, rising raw material prices limit margins.

• North America leads with about 37% share, followed by Europe at 29% and Asia Pacific at 22%, while Latin America (7%) and the Middle East & Africa (5%) show steady growth supported by rising lifestyle spending and broader retail access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Container-based candles lead this segment with about 62% share in 2024. Buyers prefer container formats because the enclosed design offers safer burning, longer fragrance diffusion, and stronger aesthetic appeal for homes and offices. Brands widen adoption by launching glass jars, ceramic holders, and reusable vessels that match interior décor trends. Pillar and other formats grow at a steady pace as consumers purchase decorative shapes for events and seasonal themes, but container-based products remain dominant due to strong retail visibility and frequent gifting demand.

- For instance, Newell Brands’ primary home fragrance manufacturing facility in Whately, Massachusetts, maintains a production volume of more than 85 million candles and 15 million flameless products per year.

By Wax Type

Soy wax dominates this segment with nearly 48% share in 2024. Demand rises because soy delivers cleaner burning, longer lifespan, and better scent throw than paraffin, which helps eco-conscious buyers shift toward natural wax products. Brands promote soy-based blends to meet sustainability expectations and reduce soot formation. Paraffin maintains usage in low-cost candles, while beeswax and palm wax gain niche traction among premium buyers. However, soy wax continues to lead due to strong availability, renewable sourcing, and broad acceptance across mass and premium price points.

- For instance, Aveda sells its Rosemary Mint Vegan Soy Candle in sizes including 7.8 oz (230ml) and 3.5 oz options. These products explicitly specify a 100% naturally derived soy wax formulation, demonstrating how Aveda emphasizes plant-based ingredients in its home-fragrance candles.

By Category

The mass category holds the leading position with around 67% share in 2024. High-volume retail sales, competitive pricing, and wide fragrance variety support stronger penetration across supermarkets, discount stores, and online platforms. Consumers purchase mass candles for everyday ambiance, seasonal gifting, and home décor needs, keeping demand steady throughout the year. The premium segment grows as buyers seek artisanal scents, natural wax blends, and visually distinctive jars, but mass products remain dominant due to affordability, repeat purchases, and strong private-label expansion.

Key Growth Drivers

Rising Home Fragrance Adoption

Growing interest in home fragrance boosts scented candle demand as consumers seek relaxed indoor environments. Households use candles for mood setting, décor enhancement, and aromatherapy, which strengthens repeat purchases. Retailers expand fragrance choices such as floral, woody, and wellness-focused blends that appeal to diverse preferences. This wider availability supports strong market momentum across both mass and premium categories.

- For instance, the National Candle Association notes that U.S. consumers can choose from more than 10,000 different candle scents, underlining how broad fragrance variety now supports frequent home-fragrance purchasing and usage.

Growth of Premium and Decorative Candles

Premium candle lines gain traction due to the rising preference for elegant jars, natural waxes, and sophisticated fragrances. Consumers view premium candles as décor items and lifestyle products, leading to higher spending in urban markets. Brands introduce artisanal scents and limited-edition designs that increase perceived value and encourage gifting. This shift toward premiumization strengthens brand differentiation and accelerates revenue growth.

- For instance, Diptyque runs 140 standalone boutiques worldwide and has a presence across roughly 1,000 points of sale spanning over 30 countries, offering approximately 300 SKUs that include premium scented candles in distinctive glass and decorative vessels.

Expanding E-commerce Penetration

Online platforms play a major role in driving sales through broad fragrance assortments, competitive pricing, and subscription-based models. Digital promotions help brands reach new customer groups, especially young buyers who rely on product reviews and curated collections. Faster delivery and attractive bundle packs further improve adoption. E-commerce also boosts visibility for small and craft producers, raising overall market expansion.

Key Trends and Opportunities

Shift Toward Natural and Clean-Label Formulations

Demand rises for candles made with soy, beeswax, essential oils, and non-toxic ingredients as consumers focus on healthier living. Brands highlight clean-burning properties, cruelty-free sourcing, and sustainability benefits to attract eco-conscious shoppers. This shift encourages broader innovation across wax blends, wicks, and fragrances. Natural candle lines create a strong opportunity for premium positioning, helping manufacturers compete in a crowded market.

- For instance, NEOM Organics markets its Feel Refreshed 1-wick candle with a wax weight of 185 g and an advertised burn time of up to 35 hours, using natural wax and essential oils to address demand for cleaner-burning, naturally formulated scented candles.

Strong Growth in Wellness-Oriented Fragrance Collections

Aromatherapy-inspired candles gain popularity as consumers seek stress relief and emotional balance. Products featuring lavender, eucalyptus, chamomile, and sandalwood attract buyers wanting wellness-linked benefits at home. Retailers promote wellness collections through curated sets and themed launches. This trend opens opportunities for brands to align with spa-inspired experiences and expand into lifestyle gifting, supporting steady segment growth.

- For instance, Jo Malone London states that its fragrance and home-scent range is available in 82 countries and territories, reflecting global distribution of mood-linked candles and room scents positioned around relaxation, comfort, and other wellness-related experiences.

Key Challenges

Rising Raw Material Costs

Price volatility in waxes, fragrance oils, and packaging materials creates pressure on manufacturers, especially smaller brands. Natural waxes such as soy and beeswax experience supply fluctuations, increasing production expenses. These cost swings reduce profit margins and limit premium product affordability for some buyers. Manufacturers adjust strategies by using blended waxes or optimizing sourcing, but cost instability remains a key market hurdle.

Safety and Indoor Air Quality Concerns

Concerns about soot, synthetic fragrances, and emissions challenge consumer trust in conventional scented candles. Awareness of potential indoor air impacts encourages buyers to seek verified clean alternatives, pushing brands to reformulate products. Compliance with safety standards and transparent labeling also becomes more important. These concerns slow growth in lower-quality candles and increase pressure on manufacturers to upgrade formulations.

Regional Analysis

North America

North America leads the scented candles market with about 37% share in 2024. Demand stays strong as consumers buy candles for home décor, wellness routines, and gifting. Retail chains expand fragrance selections, while premium brands gain traction through clean-label and soy-based products. Seasonal launches and high gifting volumes during holidays further support market strength. The U.S. drives most sales due to higher discretionary spending and strong e-commerce penetration. Canada shows steady growth as natural and artisanal candles gain visibility across specialty stores and online platforms.

Europe

Europe holds around 29% share in 2024, supported by strong demand for decorative and premium candles across major markets. Consumers value higher-quality waxes, unique fragrances, and elegant packaging, which boosts uptake of premium and artisanal lines. Sustainability also drives purchasing as buyers shift toward natural wax blends and reusable containers. Germany, France, and the U.K. lead market activity, helped by strong home décor culture and mature retail networks. Seasonal and festive themes remain major sales contributors, strengthening long-term regional growth.

Asia Pacific

Asia Pacific accounts for nearly 22% share in 2024 and shows the fastest growth rate. Rising urban incomes and growing interest in home fragrance boost adoption across China, India, Japan, and South Korea. Consumers increasingly use candles for relaxation, aromatherapy, and home ambiance, expanding demand beyond traditional gifting seasons. Regional manufacturers introduce affordable soy and blended wax options to attract mass buyers. E-commerce expansion helps international brands enter new markets, supporting wider product availability and sustained regional momentum.

Latin America

Latin America captures about 7% share in 2024, driven by rising interest in home décor and wellness-themed products. Brazil and Mexico lead demand as consumers seek affordable scented candles for routine use and festive occasions. Local producers focus on cost-effective paraffin and blended wax candles, while premium imports gain niche traction in urban areas. Growth is supported by expanding retail channels and online marketplaces. Although price sensitivity limits premium expansion, increasing lifestyle spending strengthens long-term market potential.

Middle East and Africa

The Middle East and Africa hold around 5% share in 2024. Demand grows as households and hospitality spaces use scented candles for ambience, luxury appeal, and aromatherapy. Gulf countries, especially the UAE and Saudi Arabia, dominate sales due to higher spending on premium home fragrance items. Local preferences for strong oriental and floral scents also influence product offerings. Africa shows gradual growth as affordable mass-category candles become more accessible. Expanding specialty stores and international brand entry support regional development despite limited penetration in rural areas.

Market Segmentations:

By Product

- Container-based

- Pillar

- Others

By Wax Type

- Paraffin Wax

- Soy Wax

- Blended

- Beeswax

- Palm Wax

By Category

By Distribution Channel

- Hypermarkets and Supermarkets

- Convenience Stores

- Online Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The scented candles market features leading companies such as NEST New York, Hotel Lobby Candle, L Brands, Diptyque Paris, Lalique Group SA, MVP Group International, Village Candle, Newell Brands, Portmeirion Group PLC, and Thymes. Competition grows as brands focus on cleaner wax blends, safer wicks, and stronger scent performance. Makers invest in new fragrance lines and seasonal themes to increase repeat sales across retail and online channels. Premium labels gain visibility through elegant jars and wellness-driven aromas that appeal to higher-income buyers. Mass producers strengthen reach through wide distribution and value-focused collections. Many firms expand digital marketing programs to raise customer loyalty and speed product trials. Sustainability also shapes competition, with more companies using natural wax, recycled glass, and eco-friendly packaging. Growth depends on how well brands balance cost control, clean ingredients, and new scent ideas while meeting rising global demand.

Key Player Analysis

- NEST New York

- Hotel Lobby Candle

- L Brands

- Diptyque Paris

- Lalique Group SA

- MVP Group International, Inc.

- Village Candle

- Newell Brands

- Portmeirion Group PLC

- Thymes, LLC

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Recent Developments

- In 2025, Newell Brands introduced the “YC Collection” under Yankee Candle, emphasizing quiet luxury and modern elegance.

- In 2024, Hotel Lobby Candle announced a strategic partnership with Solage to launch the “Napa Valley Candle,” a new product that captures the essence of the region with a unique fragrance profile of black currant and aged oak.

- In 2023, Diptyque introduced a limited-edition refillable candle vessel, a development that emphasized circular economy principles and appealed to environmentally conscious luxury consumers.

Report Coverage

The research report offers an in-depth analysis based on Product, Wax Type, Category, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as home fragrance use becomes a daily routine.

- Premium candle demand will rise due to interest in natural wax and cleaner scents.

- Brands will expand aromatherapy lines to meet wellness-focused consumer needs.

- Eco-friendly packaging and reusable jars will gain wider adoption.

- E-commerce sales will increase as digital discovery and reviews shape buying habits.

- Personalized and customized fragrance options will attract younger buyers.

- Sustainable wax sourcing will become a priority for major manufacturers.

- Innovative fragrance blends and seasonal themes will support recurring purchases.

- Clean-label and toxin-free candles will gain stronger regulatory and consumer focus.

- Growth in emerging markets will accelerate as lifestyle spending rises.