Market Overview:

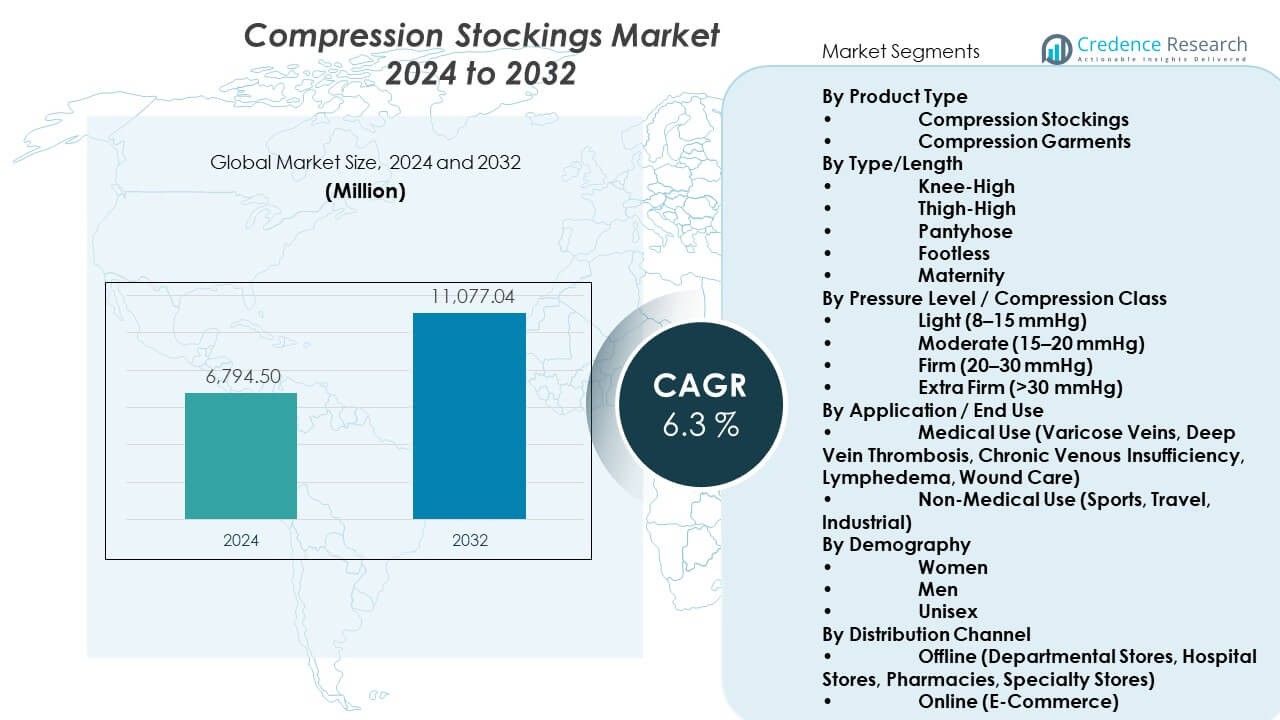

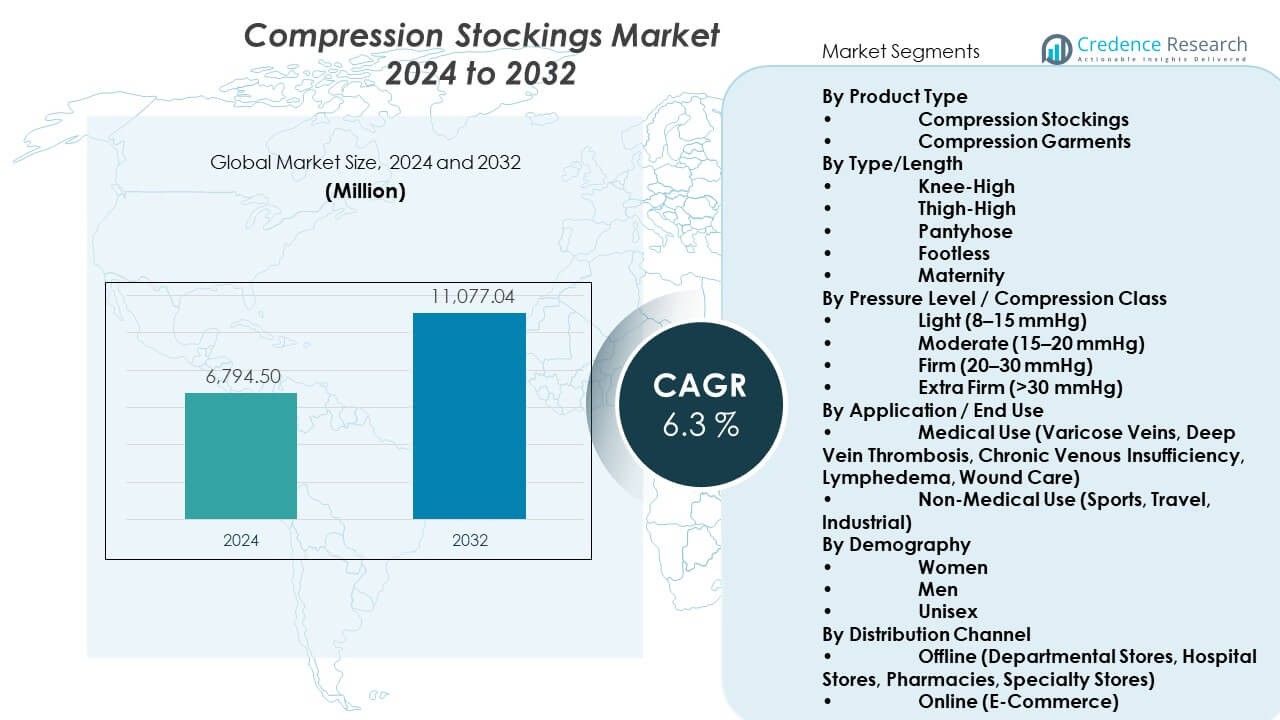

The Compression Stockings Market shows steady expansion due to rising awareness of vein care and preventive therapy. The market is projected to grow from USD 6,794.5 million in 2024 to USD 11,077.04 million by 2032, with a compound annual growth rate (CAGR) of 6.3% during the forecast period. Strong product innovation and wider retail access improve overall penetration.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Compression Stockings Market Size 2024 |

USD 6,794.5 Million |

| Compression Stockings Market, CAGR |

6.3% |

| Compression Stockings Market Size 2032 |

USD 11,077.04 Million |

The market records stronger drivers due to a higher focus on vascular health and early intervention. Rising sedentary lifestyles and long working hours increase leg discomfort, which lifts stocking use among office workers. Athletes adopt graduated compression for better blood flow and recovery support. Home-care growth encourages user-friendly designs with softer fabrics and better breathability. Hospitals prescribe these stockings for post-surgery care and long-term circulation support. More brands develop fashion-friendly designs that appeal to younger users. Medical professionals promote compression therapy in preventive care programs. These factors sustain broad adoption across age groups.

Regional demand varies due to lifestyle patterns and healthcare awareness. North America leads due to strong clinical adoption and early diagnosis of venous disorders. Europe follows with wide usage among elderly groups and strong medical guidelines. Asia Pacific is emerging due to urban lifestyles, a rising elderly population, and wider retail access. Countries like China and India expand faster because of improving healthcare access and growing preventive care habits. Latin America and the Middle East show moderate but rising demand as awareness improves. Africa remains early-stage but benefits from gradual expansion of vascular care services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Compression stockings market reached USD 6,794.5 million in 2024 and is projected to hit USD 11,077.04 million by 2032, growing at a 3% CAGR during the forecast period.

- North America leads with 34% share due to strong clinical adoption, high awareness, and established vascular care programs.

- Europe follows with 29% share, supported by advanced healthcare systems and broad acceptance among elderly populations; Asia Pacific holds 24% share, driven by urbanization and wider preventive care adoption.

- Asia Pacific is the fastest-growing region, supported by rising venous disorder cases, improving hospital infrastructure, and increased lifestyle use across China, India, and Japan.

- The Knee-High segment holds the largest share at 41%, driven by comfort and clinical preference, while the Moderate Compression (15–20 mmHg) class accounts for 33%, supported by strong demand for daily preventive use.

Market Drivers:

Growing Need for Circulation Support Across Age Groups

The Compression Stockings Market grows due to rising cases of venous disorders in aging groups. Many adults face leg fatigue from long hours of sitting or standing in daily routines. Doctors recommend stockings for post-surgery care and chronic venous conditions. Sports users adopt higher compression levels to improve circulation during training. Office workers use light compression to reduce swelling after extended workdays. Home-care settings prefer soft fabrics that support long-term therapy. Wider medical awareness increases early adoption across demographics. Product diversity lifts acceptance among younger and older users.

- For instance, CEP Sportswear uses medi Compression Technology that maintains medically tested graduated pressure for performance and recovery, verified through medi GmbH’s clinical compression standards.

Rising Prevalence of Lifestyle-Related Vascular Issues

Demand increases due to higher cases of varicose veins linked to inactive routines. People with obesity experience more circulation concerns that require preventive therapy. Hospitals prescribe medical-grade stockings after orthopedic or vascular procedures. Athletes use compression gear to improve recovery and reduce muscle stress. Busy professionals seek wearable solutions that ease daily discomfort. Brands develop lighter, breathable designs for long shifts and travel. Improved fabric strength supports steady pressure for clinical outcomes. Retail channels expand access for consumers with lifestyle-linked conditions.

- For instance, Sigvaris medical stockings are ISO 13485–certified and validated for precise graduated compression through controlled manufacturing and pressure testing.

Expansion of Preventive Healthcare and Home-Based Therapy

Preventive care programs highlight early management of leg swelling and circulation issues. Consumers learn about compression benefits through clinics and fitness centers. Home-care support teams encourage stockings for mobility improvement. Elderly users adopt compression gear to reduce discomfort during walking. Medical-grade variants aid long-term treatments for chronic venous insufficiency. Product innovation supports easy wearing mechanisms for daily use. Hospitals use stockings in recovery rooms to reduce deep vein thrombosis risk. Preventive messaging lifts trust in compression therapy.

Higher Adoption Driven by Sports, Travel, and Work Routines

Active groups use compression stockings to improve performance and reduce fatigue. Frequent travelers adopt graduated compression to manage swelling during long flights. Office staff rely on mild compression to ease daily strain from prolonged work. Healthcare providers promote compression during pregnancy for leg relief. Athletes prefer durable fibers that maintain pressure during intense movement. Retailers offer wider designs to match lifestyle needs and comfort habits. Awareness campaigns highlight benefits for recovery and circulation improvement. Broader lifestyle adoption supports steady demand.

Market Trends:

Shift Toward Advanced Fabrics and Seamless Construction

The Compression Stockings Market witnesses stronger interest in breathable and soft materials. Manufacturers use seamless knitting to increase comfort during long wear hours. Newer fabric blends offer moisture control for active and medical users. Brands integrate stronger elasticity to maintain consistent pressure levels. Consumers prefer lightweight designs that look closer to daily wear socks. Hospitals request durable materials that hold compression after repeated washing. Trend shifts favor thin compression apparel suitable for long shifts. Better textile engineering supports product acceptance across regions.

- For instance, Juzo applies its exclusive FiberSoft® technology, which wraps every elastic (Lycra) fiber with soft, protective threads (polyamid fibers), to provide a comfortable, breathable, and durable garment.

Increasing Interest in Fashion-Friendly and Discreet Designs

Users now demand products that blend with everyday outfits for better comfort. Brands offer skin-tone shades that match diverse user groups. Fashion-forward patterns gain adoption in younger demographics. Travel users prefer sleek stockings that fit active wardrobes. Athletes choose bold colors and modern cuts for sport routines. Design-led innovation improves confidence among first-time users. Retailers expand options that resemble modern hosiery. Style upgrades support broader lifestyle integration.

Growing Use of Digital Platforms for Custom Fit Solutions

Consumers rely on digital tools to pick correct compression levels. Retailers provide online measurement guides to support proper sizing. Users check mobile apps that track leg symptoms and usage patterns. E-commerce platforms expand access in areas with limited retail networks. Digital channels help compare product types for home-care or travel use. Clinics use virtual fitting support during telehealth consultations. Brands offer size calculators for accurate fitting. Online engagement improves confidence in product selection.

Rising Integration of Smart Textiles and Performance Features

Smart fabrics attract interest due to embedded sensors for health tracking. These designs monitor pressure distribution to improve medical outcomes. Athletes explore variants with temperature regulation for outdoor routines. Brands test fabrics that adjust compression during movement. Hospitals show interest in heat-regulating fibers that aid recovery. Travel-friendly options include odor control and antibacterial layers. Sports users benefit from reinforced zones for high-intensity use. Innovation enhances performance-oriented adoption.

Market Challenges Analysis:

Limited Awareness and Adoption Barriers Among New Users

The Compression Stockings Market faces challenges due to low understanding of correct usage. Many users struggle with sizing, which reduces comfort during daily wear. Incorrect pressure selection leads to dissatisfaction and early discontinuation. Retail staff often lack training for guiding buyers through technical grades. Elderly users find difficulty wearing high-compression variants without assistance. Fashion concerns lower acceptance among younger groups. Hospitals need better patient education after surgical procedures. Limited clarity on product types affects overall adoption rates.

High Product Costs and Variations in Medical Compliance

Price-sensitive users hesitate to purchase premium medical-grade variants. Some buyers shift to low-cost options that lack quality and durability. Insurance coverage varies across regions, limiting adoption in specific groups. Users avoid regular replacement cycles due to higher expenses. Hospitals face budget limits when procuring large volumes for patient care. Non-compliance reduces clinical outcomes among chronic condition users. Product misuse leads to discomfort and lower adherence. Market growth slows where affordability remains a concern.

Market Opportunities:

Rising Focus on Preventive Care and Customized Compression Solutions

The Compression Stockings Market gains new opportunities through advanced sizing systems and tailored compression levels. Medical teams promote early screening for venous disorders, increasing product uptake. Brands develop personalized fit solutions that improve comfort for long-term users. Hospitals incorporate compression therapy into preventive care programs. Sports groups demand performance-oriented compression gear with stronger durability features. Digital platforms enable guided selection for new buyers. Companies expand premium offerings for professional and lifestyle users. Growing health awareness lifts adoption across diverse age brackets.

Growth Potential in Emerging Markets and Lifestyle-Driven Segments

Emerging economies show rising demand due to urban lifestyles and higher healthcare access. Younger consumers adopt compression gear for fitness and travel routines. Clinics expand vascular care services in fast-developing regions. Retail channels grow through pharmacies, sports stores, and digital platforms. Product innovation targets breathable, stylish, and easy-wear designs. Hospitals support compression therapy in more recovery plans. Brands explore partnerships to strengthen regional distribution. Lifestyle-focused adoption widens the overall market base.

Market Segmentation Analysis:

By Product Type

The Compression Stockings Market leads with compression stockings due to strong clinical adoption across hospitals and home-care settings. Compression garments follow as users seek broader coverage for chronic venous issues. Stockings retain higher preference for daily wear and preventive use. Garments gain traction among patients who require extended support across larger leg areas. Sports users adopt lighter designs for comfort during training. Medical teams recommend stockings after surgery for circulation improvement. Both categories benefit from better fabric technology. It supports demand across long-term therapy groups.

- For instance, Thuasne’s Venoflex Medical line undergoes laboratory-controlled gradient compression testing to ensure accuracy for medical use.

By Type/Length

Knee-high stockings hold stronger usage due to comfort and easy application for daily routines. Thigh-high variants serve patients with advanced venous concerns. Pantyhose designs attract users seeking full-leg coverage in lifestyle or work settings. Footless styles gain adoption in warmer regions. Maternity variants support swelling and circulation needs during pregnancy. Each type meets specific mobility and comfort needs. Broader choices improve adoption across age groups. Retailers expand these options to support personal preference.

- For instance, Sigvaris pantyhose styles use double-covered yarns tested for stretch retention and glide performance during donning.

By Pressure Level / Compression Class

Light and moderate compression levels record higher use among first-time buyers and lifestyle-focused users. Firm and extra-firm classes serve clinical needs for chronic venous insufficiency and post-treatment care. Light compression suits long work shifts, travel routines, and mild symptoms. Moderate pressure supports early varicose vein management. Stronger classes require professional guidance to ensure correct application. Each level targets specific therapeutic needs. Better product labeling supports correct pressure selection. Awareness campaigns help users understand benefits.

By Application / End Use

Medical use dominates due to rising venous disorders and wider hospital adoption. Conditions like varicose veins, DVT, and lymphedema drive steady demand. Wound care teams integrate compression for recovery protocols. Non-medical use grows in sports, travel, and industrial routines. Athletes use compression to ease muscle fatigue and improve performance. Travelers choose it for swelling management. Industrial workers adopt mild compression for long standing hours. Each segment supports diverse usage needs.

By Demography

Women lead usage due to higher prevalence of venous concerns and pregnancy-related swelling. Men adopt compression during sports, industrial work, and medical therapy. Unisex designs support broader comfort and fit preferences. Retailers expand neutral shades for both gender groups. Demographic diversity strengthens category appeal. Product lines adapt to body shape variations. Wider size ranges increase accessibility. Each group contributes to stable category growth.

By Distribution Channel

Offline channels lead due to strong trust in pharmacies, hospital stores, and specialty outlets. Trained staff guide buyers through sizing and pressure selection. Department stores offer lifestyle variants. Online channels grow quickly with better convenience and digital measurement guides. E-commerce platforms expand access in remote areas. Users compare brands and compression levels more easily. Online growth supports new consumer entry. Digital reach lifts overall market penetration.

Segmentation:

By Product Type

- Compression Stockings

- Compression Garments

By Type/Length

- Knee-High

- Thigh-High

- Pantyhose

- Footless

- Maternity

By Pressure Level / Compression Class

- Light (8–15 mmHg)

- Moderate (15–20 mmHg)

- Firm (20–30 mmHg)

- Extra Firm (>30 mmHg)

By Application / End Use

- Medical Use (Varicose Veins, Deep Vein Thrombosis, Chronic Venous Insufficiency, Lymphedema, Wound Care)

- Non-Medical Use (Sports, Travel, Industrial)

By Demography

By Distribution Channel

- Offline (Departmental Stores, Hospital Stores, Pharmacies, Specialty Stores)

- Online (E-Commerce)

By Region

- North America (US, Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, New Zealand, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East & Africa (MEA)

Regional Analysis:

North America

The Compression Stockings Market holds a leading position in North America with nearly 34% share. Strong clinical use supports higher adoption across hospitals and home-care settings. The region records greater awareness of venous disorders and preventive therapy. It benefits from wider insurance coverage for medical compression products. Retail presence in pharmacies and specialty stores strengthens access for adults and elderly users. Sports adoption also grows as athletes use compression for recovery. Technology-driven product upgrades help maintain strong market penetration.

Europe

Europe follows with an estimated 29% share, driven by strong clinical guidelines and wide acceptance among aging groups. Healthcare systems in Germany, France, and the UK integrate compression therapy into vascular care. Users adopt stockings for long work shifts, travel, and pregnancy-related swelling. Manufacturers in the region offer advanced textile solutions that improve comfort. Retail networks support access through pharmacies and medical stores. Awareness campaigns help users adopt compression early. The market stays stable due to high preventive care focus.

Asia Pacific

Asia Pacific accounts for nearly 24% share and shows the fastest growth due to rising urban lifestyles and larger elderly populations. Countries like China, India, and Japan drive strong adoption across medical and non-medical applications. It benefits from expanding vascular care centers in urban hospitals. Younger users adopt compression for sports, travel, and long working hours. E-commerce growth supports access to multiple pressure levels and wearable designs. Manufacturers launch affordable options to meet regional needs. Market expansion continues with higher preventive care awareness.

Latin America and Middle East & Africa (MEA)

Latin America holds around 8% share, supported by growing healthcare access and rising awareness of venous disorders. Brazil and Mexico lead usage due to wider hospital networks. MEA captures nearly 5% share, with growth driven by increasing chronic venous cases and expanding retail channels. Both regions show rising adoption in travel and industrial sectors. Hospitals promote compression therapy in surgical recovery. Digital retail platforms support product reach in developing urban areas. Market growth improves as awareness expands across demographics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SIGVARIS GROUP

- medi GmbH & Co. KG

- BSN Medical GmbH (Essity)

- 3M Company (3M Health Care)

- Enovis Corporation (DJO Global)

- Julius Zorn GmbH (Juzo)

- Cardinal Health

- Essity Aktiebolag

- Mölnlycke Health Care AB

- Tactile Systems Technology, Inc. (Tactile Medical)

- Paul Hartmann AG

- Medtronic Plc

- Medline Industries

- 2XU Pty Ltd.

- Spanx, LLC

- Triumph International Corporation

- Leonisa, Inc.

- European Lingerie Group AB

- Creswell Sock Mills

- Bio Compression Systems, Inc.

- Stryker

- FIGS, Inc.

- Thuasne

Competitive Analysis:

The Compression Stockings Market shows strong competition led by global medical textile brands and specialist compression manufacturers. Leading players focus on advanced knitting technologies, improved fabric durability, and better pressure accuracy. It benefits from companies expanding clinical-grade offerings to address venous disorders and post-surgical needs. Many brands strengthen portfolios with breathable designs and lifestyle-friendly variants. Partnerships with hospitals improve adoption across recovery programs. Sports brands also enter the category with performance-oriented compression products. Established players maintain dominance through wide retail networks and strong medical endorsements. Competitive pressure increases as new entrants introduce affordable digital-fit solutions.

Recent Developments:

- In October 2025, Cardinal Health announced the international launch of the Kendall SCD SmartFlow™ Compression System, extending its availability beyond the U.S. market. The all-in-one solution is designed to enhance blood circulation and treat pain and swelling related to venous stasis, providing clinicians with operational efficiencies through its automated technology features.

- In June 2025, Mölnlycke Health Care AB announced its largest investment to date—a €115 million expansion of its wound care manufacturing capacity in Brunswick, Maine, USA. The five-year investment will increase the facility’s production capabilities by 10% and create new employment opportunities. Although primarily focused on wound care products, this expansion strengthens Mölnlycke’s overall U.S. manufacturing infrastructure and supply chain capabilities.

Report Coverage:

The research report offers an in-depth analysis based on By Product Type and By Type/Length. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise due to higher awareness of venous disorders across age groups.

- Preventive care adoption will expand in office workers and travel users.

- Medical-grade variants will gain traction in postoperative recovery programs.

- Lifestyle compression designs will grow with improved fabric comfort.

- Digital measurement tools will improve product fit and reduce sizing errors.

- Sports and fitness use will expand among younger consumers.

- E-commerce will strengthen distribution across emerging markets.

- Manufacturers will focus on breathable, skin-friendly materials.

- Hospitals will integrate compression therapy into broader vascular care.

- New entrants will target affordable compression solutions for home users.