Market overview

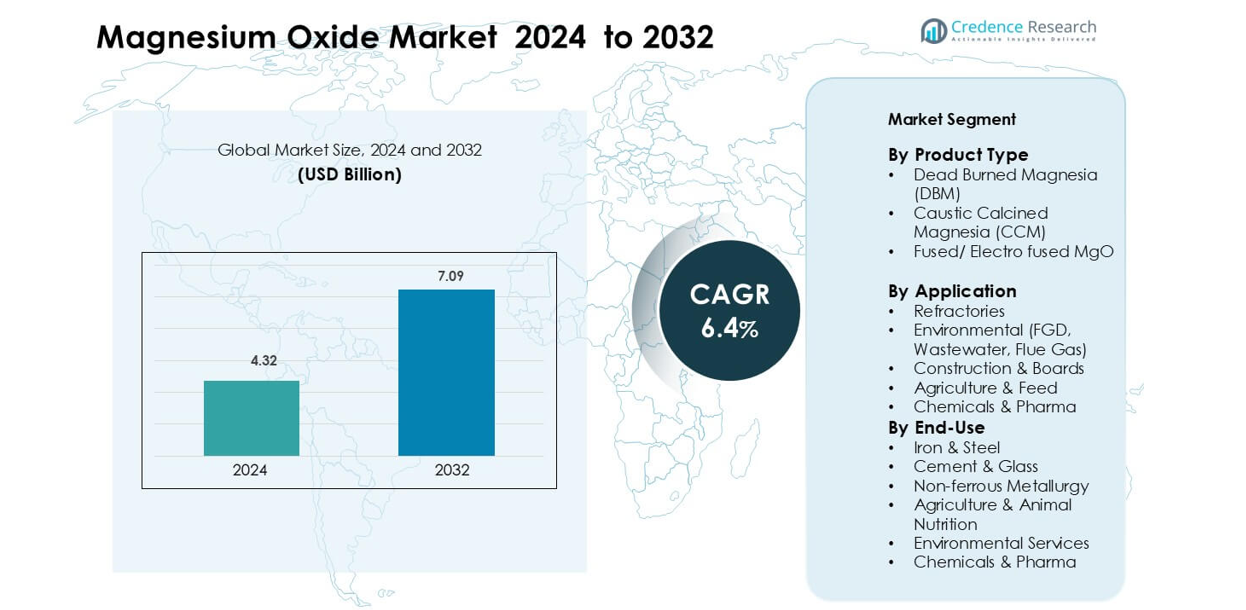

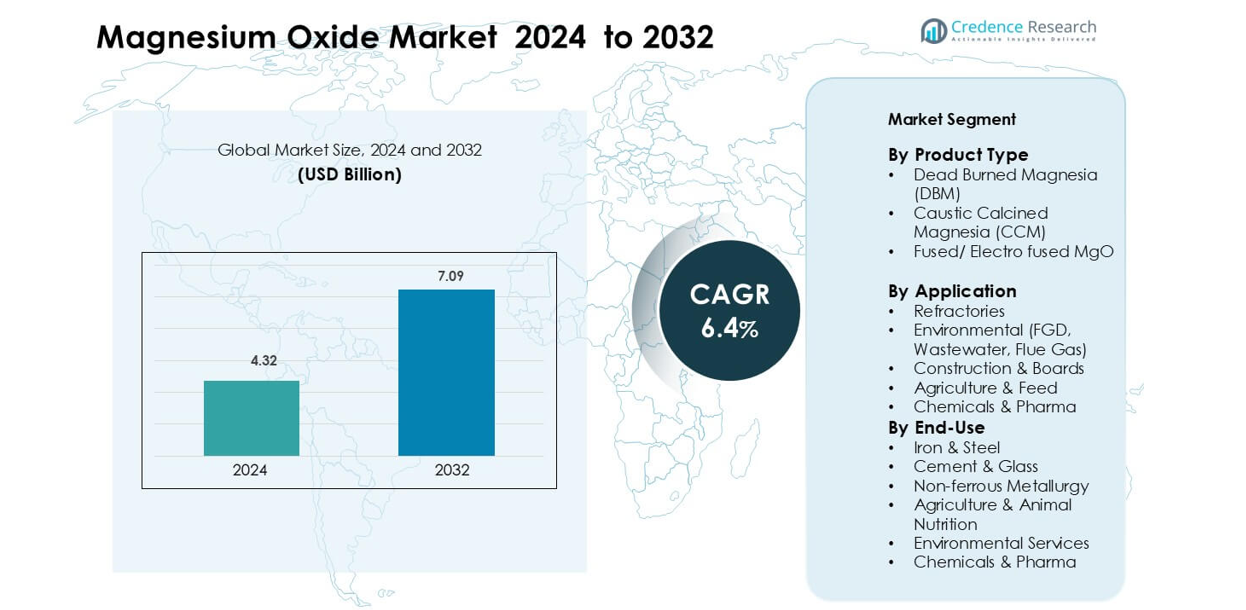

Magnesium Oxide Market was valued at USD 4.32 billion in 2024 and is anticipated to reach USD 7.09 billion by 2032, growing at a CAGR of 6.4 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Magnesium Oxide Market Size 2024 |

USD 4.32 billion |

| Magnesium Oxide Market, CAGR |

6.4% |

| Magnesium Oxide Market Size 2032 |

USD 7.09 billion |

The magnesium oxide market features prominent players including Ube Corporation, Premier Magnesia, RHI Magnesita, Xinyang Mineral Group, Magnezit Group, Nedmag, Martin Marietta Materials, ICL Group, Kumas Magnesite, and Grecian Magnesite. These companies focus on advancing refractory-grade and high-purity magnesia for industrial, environmental, and agricultural applications. Strategic initiatives such as vertical integration, technology upgrades, and capacity expansion enhance global competitiveness. Asia-Pacific leads the global magnesium oxide market with a 38.4% share, driven by robust steel, cement, and environmental infrastructure sectors. Major producers in China and Japan continue to invest in sustainable production technologies, reinforcing the region’s dominance.

Market Insights

- The global Magnesium Oxide Market was valued at USD 4.32 billion in 2024 and is projected to reach USD 7.09 billion by 2032, growing at a CAGR of 6.4%.

- Rising demand from steel and cement industries drives market expansion, supported by increased usage of Dead Burned Magnesia (DBM), which holds a 52.4% share.

- Advancements in sustainable MgO production and high-purity synthetic grades create new opportunities across environmental and agricultural applications.

- Market growth faces restraints from raw material price volatility and high energy consumption during calcination, affecting production costs.

- Asia-Pacific dominates the market with a 38.4% regional share, followed by North America and Europe, supported by large-scale industrialization, construction growth, and strong refractory production capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The Dead Burned Magnesia (DBM) segment holds the largest market share of 52.4% in the magnesium oxide market. DBM’s dominance stems from its extensive use in refractory applications due to high density, purity, and resistance to extreme temperatures. The material is essential in producing furnace linings, kilns, and crucibles for the steel and cement industries. Growth in steel manufacturing and infrastructure expansion further boosts DBM demand. Its superior thermal stability and corrosion resistance also enhance operational lifespan, reducing maintenance costs for heavy industrial users.

- For instance, RHI Magnesita reports that one of its new DBM production kilns is capable of producing 170,000 tonnes per year of DBM at a density of around 3.45 g/cm³, enabling high-performance refractory bricks for steel ladles and cement kilns.

By Application

The refractories segment dominates the application category with a 48.7% share. It drives demand through widespread use in steelmaking furnaces, cement kilns, and glass production units. The increasing global production of steel and cement, along with rising investments in industrial infrastructure, fuels segment growth. Additionally, magnesium oxide’s high melting point, low reactivity, and superior thermal insulation make it ideal for extreme processing environments. Manufacturers continue to invest in high-purity magnesia formulations to improve furnace efficiency and energy conservation, reinforcing the segment’s leadership.

- For instance, RHI Magnesita’s Brazilian mine at Brumado reported a production of 345,000 tonnes of magnesite in 2023 and completed a new rotary kiln with an annual capacity of 140,000 tonnes around 2022 to enhance its high-purity refractory magnesia supply chain.

By End-Use

The iron and steel industry leads the magnesium oxide market with a 46.5% share. This dominance is attributed to magnesium oxide’s role in refractory bricks, slag conditioners, and furnace linings used in steel production. The surge in construction, automotive manufacturing, and industrial development sustains strong steel output, supporting steady MgO consumption. Environmental and quality compliance in steelmaking also drive adoption of high-grade DBM and CCM. Continuous investments in steel capacity expansion across Asia-Pacific further reinforce the segment’s position as the principal end-use industry

Key Growth Drivers

Expanding Steel and Refractory Production

The rising demand for steel and refractory materials is a key growth driver for the magnesium oxide market. Dead Burned Magnesia (DBM) and Fused MgO are vital components in refractory linings used in blast furnaces, converters, and electric arc furnaces. Rapid industrialization and infrastructure projects in Asia-Pacific have increased steel production, enhancing MgO consumption. According to industry data, China produced over 1 billion metric tons of crude steel in 2024, driving the use of high-purity refractory-grade MgO. Manufacturers like RHI Magnesita and Magnezit Group are expanding capacity to meet this growing demand. The trend of energy-efficient steel manufacturing further strengthens the need for durable, heat-resistant refractory materials.

- For instance, Magnezit Group is investing in its Kirgiteiskoye and Talskoye deposits to raise fused magnesia production to a target of 50,000 metric tons/year via new melting capacity.

Rising Environmental and Agricultural Applications

Magnesium oxide is increasingly used in environmental and agricultural sectors, boosting market growth. In environmental applications, MgO plays a vital role in flue gas desulfurization (FGD), wastewater treatment, and neutralization of acidic effluents. Its ability to control emissions and stabilize waste aligns with stricter global environmental regulations. In agriculture, MgO improves soil quality and animal nutrition by supplying essential magnesium nutrients. The European Feed Manufacturers Federation reports that magnesium supplementation enhances livestock health and feed efficiency. Growth in sustainable farming and environmental remediation projects drives higher adoption. Companies such as Grecian Magnesite and Premier Magnesia are developing eco-friendly MgO formulations to expand their environmental and agricultural product portfolios.

- For instance, Grecian Magnesite’s VitalMag® 96 grade offers a MgO content of 96.0 % with iron content of 0.025 % Fe₂O₃, designed specifically for high-end animal feed applications.

Growing Demand from Construction and Cement Industries

The construction and cement industries significantly contribute to the magnesium oxide market’s expansion. MgO-based boards and cements are gaining traction as eco-friendly alternatives to traditional Portland cement, offering enhanced fire resistance, durability, and insulation. Rapid urbanization in developing economies and rising infrastructure investment accelerate demand for magnesium oxide boards and flooring materials. For instance, the Global Cement Association reports that global cement production exceeded 4.2 billion tons in 2024, increasing the need for refractory and insulating materials. Innovations in lightweight and energy-efficient MgO-based construction composites are also supporting green building trends. This surge in construction activities globally positions MgO as a sustainable additive in next-generation construction materials.

Key Trends & Opportunities

Shift Toward High-Purity and Synthetic Magnesia

A growing shift toward high-purity and synthetic magnesium oxide grades presents new opportunities. Industries such as electronics, pharmaceuticals, and food processing require consistent purity levels, driving demand for synthetic MgO with controlled particle size and reactivity. High-purity magnesia also enables superior performance in refractory and catalyst applications. Companies like Tateho Chemical and Ube Material Industries are investing in high-grade magnesia production using advanced calcination and electrofusion technologies. This trend supports premium-grade MgO adoption in specialty ceramics, insulation, and semiconductor applications, aligning with the broader move toward material quality and performance optimization.

- For instance, Tateho Chemical introduced its PUREMAG® FNM‑G product with a magnesium oxide purity of 99.99 % MgO.

Advancements in Sustainable and Circular Production

Sustainability is becoming central to magnesium oxide production. Manufacturers are adopting carbon capture, utilization, and storage (CCUS) systems, energy-efficient kilns, and waste recycling processes. The development of carbon-neutral MgO production through electrolysis of seawater brines and magnesium carbonate decomposition is gaining momentum. For example, Calix Limited and MCi Carbon are exploring low-emission magnesia production methods that reduce CO₂ intensity by over 40%. These green manufacturing practices not only support environmental goals but also open new opportunities in carbon credit markets. The integration of renewable energy in MgO production plants further enhances sustainability and cost competitiveness across global supply chains.

- For instance, MCi Carbon, in cooperation with RHI Magnesita, is developing a CCU pilot plant that is planned to capture and convert 50,000 tons of CO₂ annually at a refractory site in Austria.

Key Challenges

Price Volatility and Raw Material Dependency

Price fluctuations of raw materials such as magnesite and brucite pose significant challenges for MgO manufacturers. Limited availability of high-grade magnesite and uneven distribution of natural reserves primarily concentrated in China create supply instability. Trade restrictions and export regulations from major producers can lead to sharp price spikes. Additionally, energy-intensive calcination processes add to operational costs, impacting profit margins. Companies are now investing in synthetic magnesia production and exploring alternative feedstocks like seawater magnesium hydroxide to reduce dependency. However, high capital requirements and complex production processes limit scalability, maintaining raw material volatility as a key concern.

Environmental Regulations and Energy Consumption

Stringent environmental regulations regarding emissions and waste management challenge magnesium oxide producers. The calcination of magnesite releases CO₂, contributing to environmental concerns. Compliance with carbon emission standards, particularly in the EU and North America, increases operational costs for producers relying on fossil fuels. High energy consumption during production also affects the market’s sustainability profile. Manufacturers like Martin Marietta and RHI Magnesita are investing in low-carbon kilns and renewable-powered operations to meet emission targets. Despite these efforts, balancing cost efficiency and environmental compliance remains a critical challenge for maintaining competitiveness in the global MgO industry.

Regional Analysis

North America

North America holds a 31.2% share of the global magnesium oxide market, driven by strong demand from steel, environmental, and agricultural industries. The United States leads regional growth due to the high consumption of DBM in refractory applications and growing use of MgO in wastewater treatment. Expanding clean energy and infrastructure projects also support market development. Companies such as Martin Marietta and Premier Magnesia focus on sustainable production methods and product diversification. Increasing environmental regulations and investments in green construction materials continue to reinforce North America’s market position.

Europe

Europe accounts for a 27.6% market share, fueled by rising adoption of magnesium oxide in cement, glass, and environmental applications. Strict emission control norms and a shift toward eco-friendly materials have encouraged MgO-based solutions in construction and flue gas desulfurization systems. Germany, Italy, and the U.K. remain key markets due to their strong industrial base and technological advancements in high-purity magnesia production. Manufacturers like Grecian Magnesite and RHI Magnesita are leading innovation in low-carbon MgO production. The region’s sustainability-driven initiatives and regulatory compliance support steady market expansion.

Asia-Pacific

Asia-Pacific dominates the magnesium oxide market with a 38.4% share, led by China, Japan, and India. The region’s leadership stems from extensive steel and cement production, where DBM is widely used in refractory applications. Rapid industrialization and infrastructure development drive substantial demand for MgO in metallurgical and construction sectors. China remains the largest producer and exporter of magnesite, supplying global markets. Continuous capacity expansion by companies such as Qinghai Western Magnesium and Tateho Chemical enhances regional competitiveness. Government-backed investments in green building materials and wastewater treatment further strengthen Asia-Pacific’s market dominance.

Latin America

Latin America represents a 6.5% market share, with growth driven by increasing steel and cement production across Brazil, Mexico, and Argentina. Expanding mining and agricultural activities contribute to steady MgO demand in soil treatment and metallurgical applications. Brazil is emerging as a key producer due to accessible magnesite reserves and rising domestic industrial consumption. Companies are focusing on localized production to reduce import dependency. Infrastructure modernization and environmental remediation initiatives are expected to support long-term market growth, while evolving industrial standards continue to attract new investment in MgO processing technologies.

Middle East & Africa

The Middle East and Africa collectively account for a 6.3% share of the global magnesium oxide market. The region’s growth is primarily driven by increasing demand from cement, steel, and environmental management sectors. Gulf countries such as Saudi Arabia and the UAE are investing in large-scale infrastructure and energy projects, boosting MgO consumption in refractories and construction materials. African nations are witnessing gradual growth due to agricultural and industrial development. Strategic initiatives to establish magnesite processing units and partnerships with global suppliers are enhancing supply stability and regional manufacturing capacity.

Market Segmentations

By Product Type

- Dead Burned Magnesia (DBM)

- Caustic Calcined Magnesia (CCM)

- Fused/ Electrofused MgO

By Application

- Refractories

- Environmental (FGD, Wastewater, Flue Gas)

- Construction & Boards

- Agriculture & Feed

- Chemicals & Pharma

By End-Use

- Iron & Steel

- Cement & Glass

- Non-ferrous Metallurgy

- Agriculture & Animal Nutrition

- Environmental Services

- Chemicals & Pharma

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The magnesium oxide market is moderately consolidated, with major players focusing on product quality, technological innovation, and sustainability to maintain competitiveness. Leading companies such as Ube Corporation, Premier Magnesia, RHI Magnesita, Xinyang Mineral Group, Magnezit Group, Nedmag, Martin Marietta Materials, ICL Group, Kumas Magnesite, and Grecian Magnesite collectively dominate global production. These firms invest heavily in advanced calcination technology, high-purity magnesia development, and low-carbon manufacturing methods. Strategic mergers, capacity expansions, and long-term supply partnerships enhance market presence across industrial, environmental, and agricultural sectors. For instance, RHI Magnesita and Ube Corporation are advancing high-performance refractory and synthetic magnesia materials to meet stringent industrial requirements. Continuous investment in R&D, coupled with vertical integration and regional expansion, positions these companies to capitalize on growing demand from steel, cement, and environmental applications while ensuring compliance with evolving global emission and quality standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ube Corporation

- Premier Magnesia

- RHI Magnesita

- Xinyang Mineral Group

- Magnezit Group

- Nedmag

- Martin Marietta Materials

- ICL Group

- Kumas Magnesite

- Grecian Magnesite

Recent Developments

- In July 2025, RHI Magnesita: Released its H1 results highlighting increased recycling of raw materials in the U.S., focus on sustainability and network optimisation in its MgO value chain.

- In January 2025, UBE Corporation: Started business restructuring under its Vision 2030 plan, which implicates its basic materials business including MgO‑related operations, by accelerating shutdown of high‑GHG production (ammonia, caprolactam) and shifting resources toward specialty chemicals.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for high-purity and synthetic magnesium oxide will continue to rise in advanced industries.

- Growing investments in refractory production will strengthen the material’s role in steel and cement manufacturing.

- Expansion of environmental applications such as flue gas treatment and wastewater management will drive future adoption.

- Technological upgrades in calcination and fusion processes will improve production efficiency and material consistency.

- The shift toward eco-friendly and low-carbon magnesia production will shape sustainable growth strategies.

- Increased construction activity and green building initiatives will boost demand for MgO-based boards and cement.

- Agricultural applications will expand due to rising awareness of magnesium’s role in soil and livestock health.

- Strategic mergers and partnerships will help manufacturers secure supply chains and expand regional reach.

- Asia-Pacific will maintain dominance due to industrial expansion and growing refractory exports.

- Ongoing R&D in nano and specialty magnesium oxide grades will open new opportunities in electronics and healthcare.