Market overview

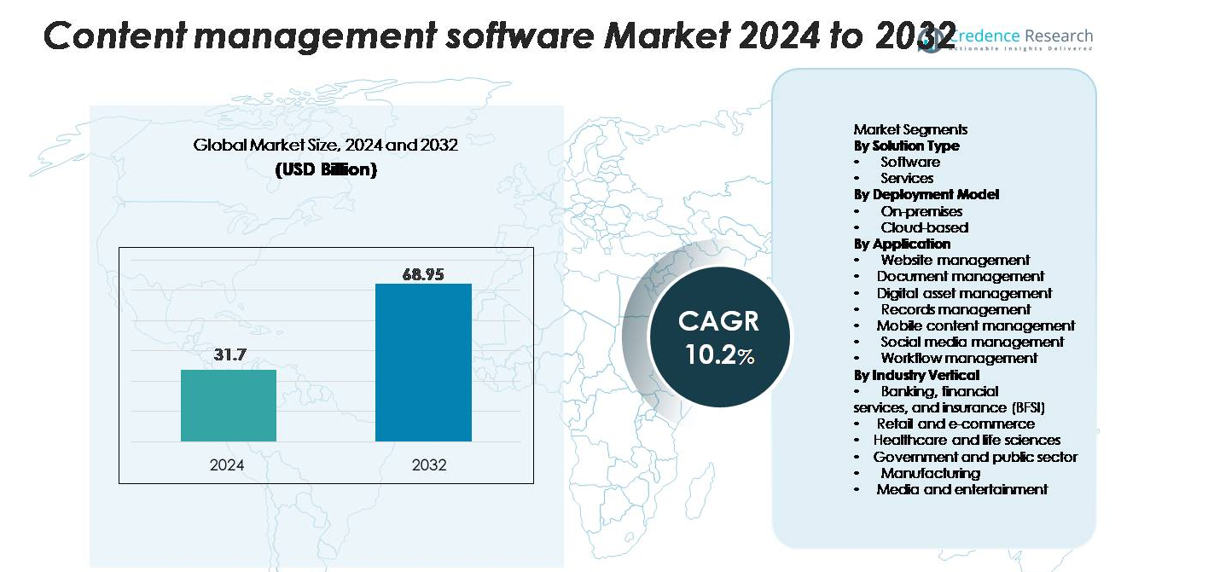

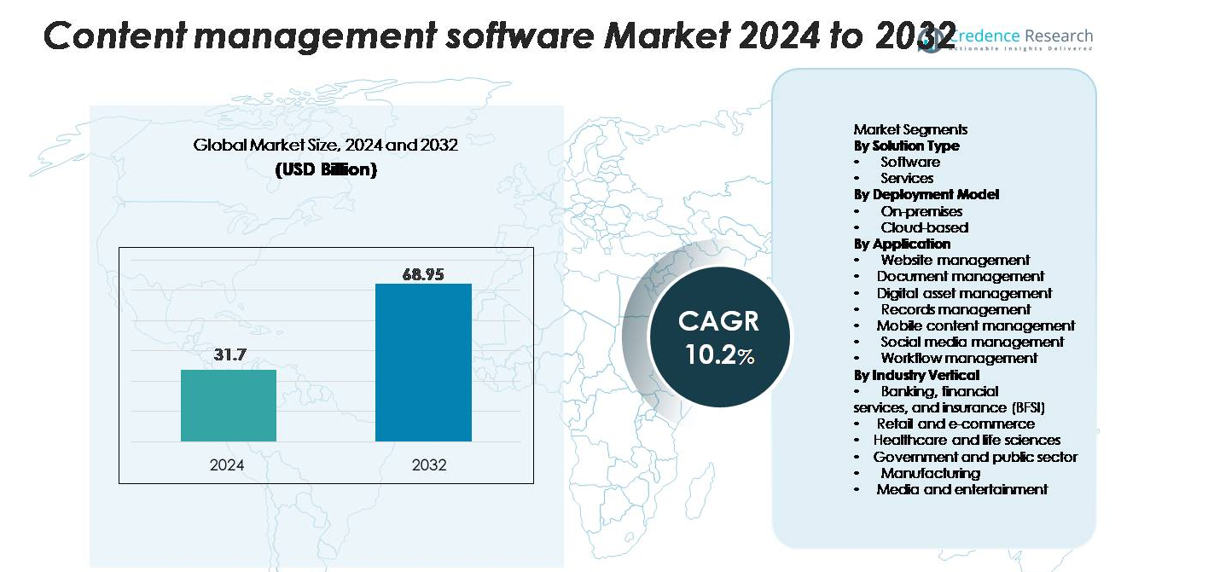

The Content Management Software Market was valued at USD 31.7 billion in 2024 and is expected to reach USD 68.95 billion by 2032, growing at a CAGR of 10.2% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Content Management Software Market Size 2024 |

USD 31.7 billion |

| Content Management Software Market, CAGR |

10.2% |

| Content Management Software Market Size 2032 |

USD 68.95 billion |

The content management software market includes established technology vendors and specialized platform providers offering web, document, and digital asset management solutions. Key players such as Adobe, Microsoft, OpenText, Oracle, IBM, Sitecore, and WordPress VIP compete through cloud-based deployments, AI automation, API integrations, and strong security capabilities. These companies focus on scalable platforms that support omnichannel publishing, enterprise collaboration, and compliance management. North America leads with a 37% global market share, supported by mature IT infrastructure, rapid digital transformation, and high adoption across BFSI, healthcare, retail, and media sectors. Europe and Asia-Pacific follow as major growth regions, driven by e-commerce expansion and cloud investments.

Market Insights

- The content management software market was valued at USD 31.7 billion in 2024 and is projected to reach USD 68.95 billion by 2032, registering a CAGR of 10.2% during the forecast period.

- Rising demand for centralized digital content control and cloud-based deployment drives adoption across enterprises, supported by workflow automation, real-time collaboration, and secure document handling.

- AI-enabled content personalization, headless CMS platforms, and omnichannel publishing trends are reshaping product innovation as enterprises push for faster, flexible content delivery.

- Competition remains strong with players such as Adobe, Microsoft, OpenText, and Oracle expanding product portfolios through security upgrades, API integrations, and subscription-based pricing models.

- North America leads with a 37% market share, followed by Europe at 28% and Asia-Pacific at 23%; software remains the leading segment, while cloud deployment holds the dominant share due to scalability and reduced infrastructure costs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution Type

Software holds the dominant share in the content management software market due to strong adoption across enterprises for data storage, collaboration, and content publishing. Organizations use software platforms to manage websites, digital assets, documents, and enterprise records in a unified framework. The growing shift toward omnichannel content delivery and the need for structured data management strengthen demand. Automation, AI-driven tagging, and workflow tools further support adoption. Services also grow, but software remains the primary revenue contributor as businesses continue integrating CMS platforms with CRM, analytics, and marketing automation systems to improve productivity and compliance.

- For instance, Adobe Experience Manager (AEM), a key component of the Adobe Experience Cloud, is an enterprise-grade solution for content and digital asset management that is designed to handle digital experiences at a massive scale”. It integrates with other Adobe products like Adobe Analytics and Adobe Target to deliver personalized, real-time content across various channels.

By Deployment Model

The cloud-based segment leads the market with a larger share, driven by scalability, remote access, and lower maintenance costs. Businesses prefer cloud-native CMS platforms to support distributed teams, real-time updates, and faster deployment. Cloud systems reduce dependency on IT infrastructure and ensure data accessibility across devices. Continuous upgrades, flexible subscription pricing, and improved security features encourage migration from on-premises models. Although on-premises deployment remains relevant for regulated sectors requiring strict data control, the rapid shift to hybrid and cloud ecosystems keeps cloud-based CMS as the dominant model in enterprise adoption.

- For instance, Contentful’s cloud-native platform handles approximately 110 billion API calls every month, according to recent company data, highlighting the massive scale at which the cloud CMS supports global content delivery for web, mobile, and IoT applications.

By Application

Website management represents the largest application share, supported by high demand for digital presence, e-commerce storefronts, and corporate portals. Companies deploy CMS platforms to update content quickly, manage user access, and automate publishing workflows. Document management, digital asset management, and workflow automation also show strong growth as enterprises handle rising volumes of multimedia and regulatory content. Mobile content and social media management gain traction due to omnichannel marketing needs. However, website management remains the key revenue segment because businesses continue prioritizing customer engagement, SEO optimization, and personalized digital content delivery across devices.

Key Growth Drivers

Rising Demand for Centralized Digital Content Management

Enterprises generate large volumes of digital content across websites, mobile apps, social platforms, and internal portals. Centralized CMS platforms help organizations store, organize, share, and retrieve data efficiently. This demand rises as companies adopt omnichannel communication to engage customers, support sales, and deliver personalized experiences. Modern CMS solutions include workflow automation, real-time collaboration, metadata tagging, and access control, reducing manual workload and content duplication. Analytics-enabled dashboards also help businesses monitor engagement and optimize digital strategies. As data volume grows across e-commerce, banking, education, and media sectors, adoption of unified content management platforms continues to expand. This strong need for structured digital control remains one of the primary market growth drivers.

- For instance, Microsoft confirms that over 200 million monthly active users rely on SharePoint Online, demonstrating the scale at which centralized content platforms support enterprise usage.

Rapid Cloud Adoption and Remote Workforce Expansion

Cloud-based content management solutions drive significant market growth as companies shift away from traditional, hardware-dependent systems. Cloud platforms provide lower upfront cost, easy deployment, and remote data access, supporting distributed teams and hybrid work environments. Enterprises can scale storage, upgrade features, and secure content without large IT investments. Continuous system updates, automated backups, and multi-device access also improve efficiency and reduce downtime. Rising digital transformation initiatives encourage organizations to migrate content workflows to the cloud, improving flexibility and collaboration. The growing reliance on mobile devices, e-commerce platforms, virtual training, and online customer support accelerates cloud CMS adoption across both large enterprises and SMEs. As businesses prioritize agility and real-time information access, the cloud deployment model becomes a major driver for market expansion.

- For instance, Box Shield scans 130 million files per day for potential malware and automatically classifies 6 million files daily. The platform also analyzes more than 48 billion files per year, providing real-time threat detection and secure content governance across enterprise deployments.

Growing Need for Regulatory Compliance and Secure Data Handling

Data privacy laws such as GDPR and industry-specific compliance standards push organizations to adopt secure content management solutions. Modern CMS platforms include permission controls, audit trails, encryption, role-based access, and document lifecycle management. These features protect sensitive information, prevent unauthorized access, and reduce legal risk. Companies in BFSI, healthcare, government, and telecom rely on CMS platforms to store confidential documents while maintaining full compliance reporting. Automated version control and policy enforcement also reduce human error during content handling. As cyber threats rise and global regulations tighten, organizations increasingly invest in CMS platforms with built-in compliance tools and advanced security layers. This shift positions secure content management as a long-term growth driver.

Key Trends & Opportunities

Adoption of AI-Enabled and Headless CMS Platforms

AI-powered CMS systems allow enterprises to automate metadata tagging, content categorization, personalization, and customer recommendations. Machine learning identifies content patterns, speeds up search, and improves publishing decisions. At the same time, headless CMS architectures offer strong growth opportunities by enabling content delivery across websites, apps, AR/VR, smart devices, and IoT platforms through APIs. Businesses prefer headless models for faster development, omnichannel marketing, and flexible design control. The combination of AI and headless CMS supports real-time content delivery, improves user experiences, and attracts sectors like media, retail, education, and entertainment.

- For instance, Contentful confirms that its headless CMS handles more than 10 billion API calls every month across customer applications, demonstrating how API-driven delivery supports large-scale digital experiences for global enterprises.

Growing Opportunity in e-Commerce and Enterprise Digitalization

E-commerce platforms rely heavily on CMS solutions to manage catalogs, blogs, product descriptions, user accounts, and marketing campaigns. With rising online retail and digital payments, demand increases for scalable content platforms that support multi-language sites, product updates, and promotional assets. Enterprises across manufacturing, banking, and healthcare use CMS solutions to build customer portals, knowledge bases, training systems, and self-service platforms. The trend toward paperless offices, virtual engagement, and data-driven content strategies creates strong expansion opportunities for CMS vendors, especially in emerging markets and small businesses adopting digital transformation.

- For instance, WooCommerce reports that more than 5 million active stores run on its platform, demonstrating the scale at which CMS-based commerce solutions manage product catalogs, transactions, and digital assets for global merchants.

Key Challenges

Data Security Risks and Cyber Threats

Although CMS platforms offer advanced security controls, cyberattacks like ransomware, data breaches, and unauthorized access remain major concerns. Businesses handling sensitive financial, healthcare, and customer data require continuous monitoring, encryption, and multi-factor authentication. Smaller companies may struggle to invest in cybersecurity tools, making them vulnerable. Security failures lead to downtime, financial losses, and reputational damage. CMS vendors must improve threat detection, patch management, and intrusion prevention to maintain trust. As cloud adoption accelerates, ensuring consistent security across distributed environments remains a key industry challenge.

Integration Complexity with Enterprise Systems

Enterprises often run CRM, ERP, analytics, HR, and marketing automation tools alongside CMS platforms. Integrating these systems can be complex, time-consuming, and costly. Legacy architecture, incompatible formats, and custom configuration needs may slow deployment. Organizations without strong IT support struggle with migration, data transfer, and workflow alignment. Integration challenges reduce user adoption and limit the full benefit of content management investments. Vendors must offer low-code connectors, standardized APIs, and plug-and-play modules to improve interoperability and reduce integration barriers.

Regional Analysis

North America

North America holds the dominant share of the content management software market, accounting for nearly 37% of global revenue. Strong digital transformation across enterprises, widespread cloud adoption, and a mature IT ecosystem support growth. Companies in the United States and Canada invest in website platforms, digital asset systems, and workflow automation to strengthen customer engagement and data governance. High internet penetration and strong e-commerce growth also increase spending on CMS solutions. Large technology vendors, continuous platform innovation, and high demand from BFSI, retail, and healthcare sectors keep North America ahead of other regions in terms of adoption and revenue.

Europe

Europe accounts for about 28% of the global market share, driven by strict data privacy regulations, widespread cloud usage, and the high digital maturity of enterprises. The region sees strong CMS adoption across banking, manufacturing, media, and government organizations that prioritize secure content storage, compliance, and workflow automation. The presence of multilingual markets accelerates demand for advanced publishing and localization tools. Growth is further supported by rising investments in e-commerce platforms, digital marketing, and enterprise mobility. Countries such as Germany, the United Kingdom, France, and the Netherlands remain key contributors to technology spending and CMS adoption.

Asia-Pacific

The Asia-Pacific region is one of the fastest-growing markets and holds roughly 23% of global market share. Rapid digital adoption, expansion of online retail, and government-led digitization projects drive demand for cloud-based CMS platforms. SMEs and large enterprises in India, China, Japan, South Korea, and Australia invest in website management, mobile content workflows, and document automation to support business expansion. The growth of digital payments, telecom networks, and media streaming platforms increases the need for scalable content management solutions. Competitive pricing, rising cloud adoption, and increased mobile internet usage provide strong future potential for CMS vendors in the region.

Latin America

Latin America captures nearly 7% of market share, supported by growing internet penetration, digital media consumption, and expanding e-commerce activities. Businesses in Brazil, Mexico, Argentina, and Chile are adopting CMS platforms to streamline document workflows, manage online storefronts, and strengthen branding. Cloud deployment is gaining traction among SMEs due to lower infrastructure costs and easier scalability. Public sector digitalization, online banking, and education platforms further contribute to market growth. However, challenges such as limited IT budgets and slower technology adoption speed restrict overall expansion compared to developed regions.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of global market share. Governments and enterprises adopt CMS platforms to support digital governance, financial modernization, and online service delivery. The rise of cloud infrastructure in the UAE, Saudi Arabia, and South Africa encourages adoption among enterprises and educational institutions. Demand increases for multilingual content, mobile portals, and digital record management. Growth remains moderate due to budget constraints and low IT maturity in several African nations. However, ongoing smart city projects, fintech expansion, and rising e-commerce activity create long-term opportunities for CMS vendors in the region.

Market Segmentations:

By Solution Type

By Deployment Model

By Application

- Website management

- Document management

- Digital asset management

- Records management

- Mobile content management

- Social media management

- Workflow management

By Industry Vertical

- Banking, financial services, and insurance (BFSI)

- Retail and e-commerce

- Healthcare and life sciences

- Government and public sector

- Manufacturing

- Media and entertainment

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the content management software market features a mix of global technology providers, specialized CMS vendors, and cloud-based platform developers. Leading companies offer integrated solutions that combine website management, digital asset control, document workflows, and analytics capabilities. Vendors compete through cloud migration support, API integration, and security enhancements to serve enterprises with complex content needs. Frequent software updates, AI-driven automation, multilingual publishing, and omnichannel delivery strengthen product differentiation. Partnerships with e-commerce and marketing platforms expand market reach, while subscription-based pricing helps attract SMEs. Major players also focus on scalability, compliance features, and customizable modules to meet sector-specific requirements in BFSI, healthcare, retail, and government. Continuous innovation and strong customer support remain key factors in maintaining market presence and gaining new clients.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kentico Software

- HubSpot, Inc.

- Microsoft Corporation

- Contentful

- Lexmark International, Inc.

- Broadcom, Inc.

- Hyland Software, Inc.

- Dribbble

- Box Inc.

- Adobe

Recent Developments

- In October 2025, Broadcom announced a collaboration with OpenAI to deploy custom AI accelerators for enterprise software workloads, enhancing its software stack around content and process automation.

- In March 2025, Box, Inc. partnered with DataBank, a provider of process automation and data solutions, combining their top-tier offerings to revolutionize content management for organizations. This collaboration will utilize their respective products and services to deliver AI-driven solutions that optimize business processes such as contract lifecycle management, digital asset management, and intelligent document processing.

- In March 2025, Dribbble published a “Work In Progress” update noting rapid growth in transaction activity and new features aimed at enhancing its design-service marketplace for clients and creators

Report Coverage

The research report offers an in-depth analysis based on Solution type, Deployment model Application, Industry vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud-based CMS adoption will continue to rise as enterprises migrate from on-premises systems.

- AI and machine learning will automate tagging, personalization, and content recommendations.

- Headless CMS platforms will expand to support omnichannel delivery across web, mobile, and IoT devices.

- Demand for secure content governance will increase due to stricter data privacy regulations.

- Digital asset management will gain more relevance as brands produce large multimedia libraries.

- SMEs will adopt subscription-based CMS solutions to reduce infrastructure and maintenance costs.

- Integration with CRM, ERP, and marketing tools will become a major purchasing factor.

- Multilingual publishing and localization capabilities will see higher demand from global enterprises.

- No-code and low-code CMS workflows will help non-technical teams manage content independently.

- Analytics-driven insights will guide content performance tracking and improve digital engagement.