Market Overview

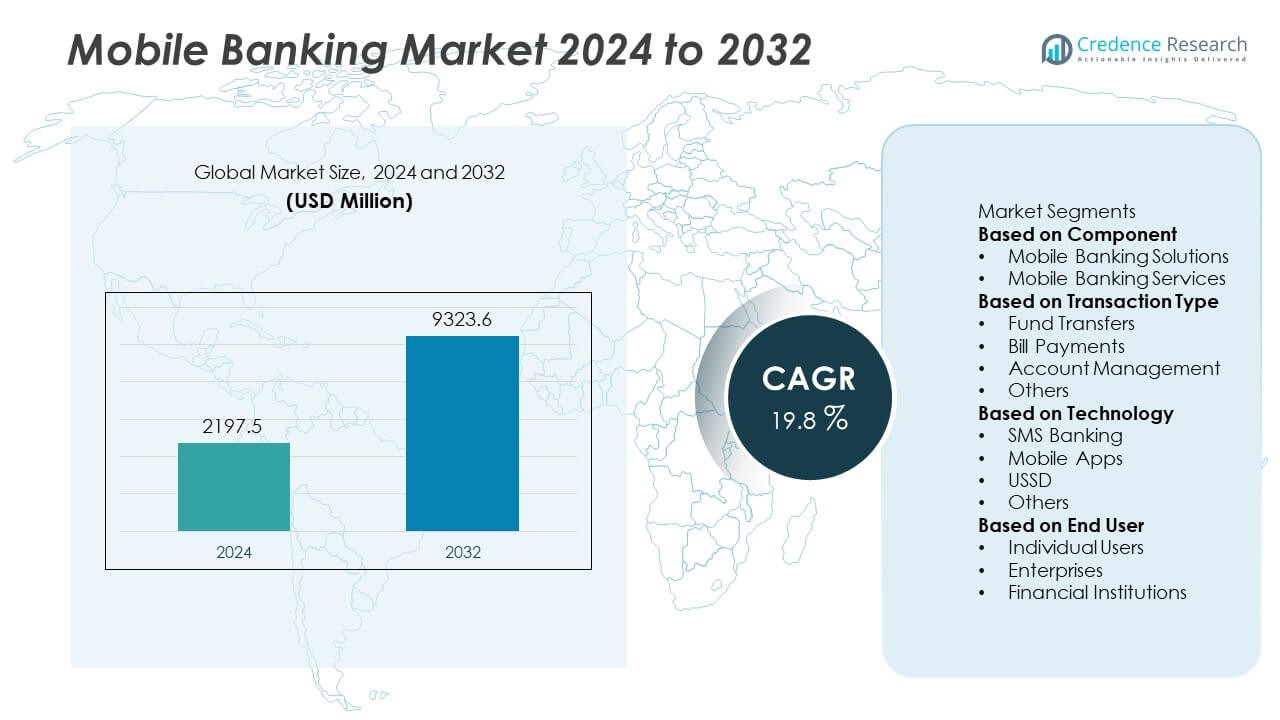

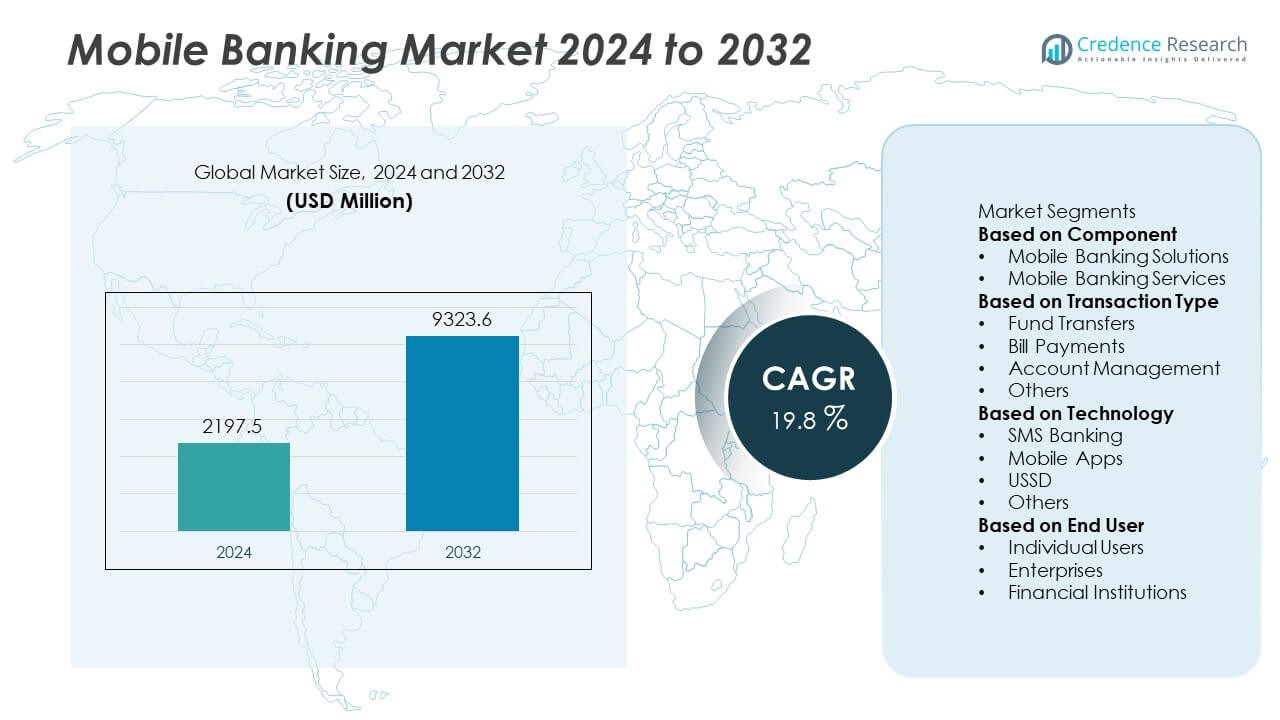

The Mobile Banking Market reached USD 2,197.5 million in 2024 and is projected to hit USD 9,323.6 million by 2032, supported by a CAGR of 19.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mobile Banking Market Size 2024 |

USD 2,197.5 Million |

| Mobile Banking Market, CAGR |

19.8% |

| Mobile Banking Market Size 2032 |

USD 9,323.6 Million |

The top players in the Mobile Banking market include leading global banks and fintech-driven financial institutions that invest heavily in secure, high-performance mobile platforms. These companies enhance user experience through real-time payments, biometric login, digital onboarding, and AI-based personalization. North America remains the leading region with a 34% share, supported by advanced financial infrastructure and strong digital adoption. Asia-Pacific follows closely with a 31% share, driven by rising smartphone penetration, government-led cashless initiatives, and rapid fintech expansion. Europe holds a 28% share, strengthened by open banking regulations and seamless API-driven integrations. These regions continue to shape innovation and competitive growth in the mobile banking ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mobile Banking market reached USD 2,197.5 million in 2024 and will rise to USD 9,323.6 million by 2032, supported by a CAGR of 19.8%.

- Market growth is driven by rising smartphone penetration and strong demand for real-time transactions, with Mobile Banking Solutions holding a 62% share as the dominant component.

- Key trends include rapid expansion of AI-enabled personalization, biometric security, and app-based payment ecosystems, supported by the 58% share held by Mobile Apps in the technology segment.

- Competitive activity intensifies as global banks invest in secure mobile platforms, API integrations, and fintech partnerships to expand digital payments and strengthen user engagement.

- Regional performance is led by North America with a 34% share, followed by Asia-Pacific at 31% and Europe at 28%, while emerging markets adopt SMS and USSD channels to overcome infrastructure limits.

Market Segmentation Analysis:

By Component

Mobile Banking Solutions lead this segment with a 62% share, driven by rising adoption of advanced mobile applications across global banks. These solutions support secure authentication, instant alerts, remote onboarding, and AI-driven personalization, which boosts user engagement across retail and corporate customers. Banks invest in feature-rich mobile platforms to reduce branch visits and enhance operational efficiency. Mobile Banking Services follow as institutions expand advisory, support, and transaction-related assistance within app ecosystems. Strong demand for self-service channels and continuous improvements in security frameworks help Mobile Banking Solutions maintain dominance in the component category.

- For instance, JPMorgan Chase has integrated biometric authentication into its systems, enabling customers who opt-in to access mobile banking features via device-level methods like fingerprint or face scans, and utilizing a robust cloud network across multiple data centers to manage data securely and provide fast, reliable service.

By Transaction Type

Fund Transfers dominate this segment with a 48% share, supported by strong demand for instant payments, peer-to-peer transfers, and real-time settlement features. Users rely on mobile platforms for quick domestic and cross-border transfers, which enhances satisfaction and reduces dependency on physical banking. Bill Payments follow as utilities, telecom firms, and merchants integrate digital payment gateways into mobile banking channels. Account Management also shows steady growth due to rising use of mobile statements, balance checks, and card controls. Advancements in biometric authentication and secure APIs further strengthen the leading position of fund transfer services.

- For instance, the Zelle network, owned by a consortium of banks including Wells Fargo, processed 3.6 billion P2P and small business transactions in 2024, with system latency designed for speed, often enabling payments to be available in minutes.

By Technology

Mobile Apps hold a 58% share, making them the dominant technology segment due to their user-friendly interfaces, strong security features, and wide adoption across smartphones. Banks enhance app ecosystems with AI-based chat support, predictive analytics, QR payments, and card-less cash withdrawal options, which drives higher engagement among retail users. SMS Banking and USSD remain relevant in regions with limited internet access, supporting financial inclusion across rural markets. However, the continuous shift toward app-centric banking experiences and seamless integration with wallets, loyalty programs, and digital onboarding tools helps Mobile Apps retain the largest share in the technology category.

Key Growth Drivers

Rising Smartphone Penetration and Digital Adoption

Smartphone penetration increases across both developed and emerging regions, pushing banks to expand mobile-first platforms. Users prefer fast and convenient digital transactions, which boosts the need for advanced mobile banking ecosystems. Financial institutions upgrade apps with biometric login, instant transfers, and personalized dashboards to improve user retention. Governments also promote digital payments through incentives, supporting higher adoption. As internet connectivity improves, mobile banking becomes the preferred channel for daily transactions. This shift strengthens the market as banks focus on delivering seamless, secure, and real-time services through feature-rich mobile applications.

- For instance, Citi has enhanced its mobile banking platform with biometric authentication. The bank also uses AI for purposes such as fraud detection, anti-money laundering, and personalized services in wealth management, leveraging its digital channels to improve customer engagement.

Shift Toward Real-Time Payments and Instant Transactions

The demand for instant payments continues to rise as consumers expect quick and secure money transfers. Banks integrate real-time payment networks and API-based systems to handle high transaction volumes without delays. Mobile banking platforms now support QR payments, peer-to-peer transfers, and instant merchant settlements. This capability improves customer trust and reduces reliance on traditional banking channels. Businesses also prefer real-time transactions for faster cash flow and better financial control. The strong push toward digital economies further accelerates the adoption of instant mobile banking transactions across retail and enterprise users.

- For instance, financial institutions are upgrading their real-time payment (RTP) capabilities, which allows for instant settlement and improved transaction transparency.

Growing Security Enhancements and Regulatory Support

Banks invest in advanced security systems, including biometric authentication, device binding, encryption, and fraud detection, to strengthen user safety. These improvements increase customer confidence and drive greater adoption of mobile banking platforms. Regulators introduce frameworks that promote secure digital payments and compliance with updated cybersecurity norms. These guidelines ensure that banks maintain strong security while expanding mobile-based services. Rising cyber threats encourage institutions to innovate and deploy multi-factor authentication and risk-scoring models. As security strengthens, more users shift to mobile banking for reliable and protected financial transactions.

Key Trends & Opportunities

Expansion of AI-Powered and Personalized Banking Features

AI-enabled tools reshape mobile banking by offering personalized insights, automated spending analysis, and advanced risk alerts. Banks deploy chatbots, virtual assistants, and real-time analytics to improve customer experience. These features help users manage budgets, track transactions, and receive proactive recommendations. AI also enhances fraud detection through behavioral analysis and predictive monitoring. The shift toward hyper-personalization creates opportunities for cross-selling and tailored financial products. As digital users seek smarter and more intuitive services, AI-driven enhancements become a priority for banks aiming to deliver differentiated mobile experiences.

- For instance, Bank of America expanded its AI assistant Erica, which has surpassed 3 billion client interactions since its 2018 launch. It serves nearly 50 million users and averages more than 58 million interactions monthly.

Growing Opportunities in Financial Inclusion and Rural Banking

Mobile banking expands financial access in underserved and rural areas, where traditional banking infrastructure remains limited. USSD and SMS-based platforms support feature phone users, enabling secure and low-cost digital services. Governments promote financial inclusion through subsidy transfers, digital IDs, and mobile-linked accounts, increasing adoption in low-income segments. Banks partner with telecom operators to improve outreach and provide essential financial services. This trend unlocks new customer bases and strengthens digital transaction networks. Rising mobile literacy and affordable data plans further boost opportunities in remote and emerging markets.

- For instance, HSBC was the first international bank to establish a presence in China’s rural market in 2007 with a strategy to build a sustainable rural banking business tailored to the specific needs of local communities and enterprises.

Key Challenges

Rising Cybersecurity Threats and Data Breaches

The growth of mobile banking increases exposure to cyber risks, including phishing, malware attacks, and identity fraud. Hackers target digital channels to exploit vulnerabilities in app security and user behavior. Banks must invest heavily in advanced security frameworks, real-time monitoring, and authentication tools to mitigate threats. Users often lack awareness of fraud risks, which raises the chances of unauthorized transactions. Regulatory pressures require strict compliance, adding to operational costs. These challenges make cybersecurity a critical concern for mobile banking providers aiming to maintain trust and protect sensitive financial data.

Limited Digital Literacy and Infrastructure Gaps in Emerging Markets

Mobile banking adoption faces barriers in regions with low digital literacy and poor network quality. Users struggle to navigate advanced mobile apps or lack access to smartphones with updated operating systems. Rural areas often suffer from unstable connectivity, restricting seamless digital transactions. Banks must invest in education programs and simplified interfaces to support first-time users. Feature phone reliance also limits the functionality of mobile banking services. These constraints delay adoption and slow market growth across developing nations, where significant potential remains untapped due to digital infrastructure limitations.

Regional Analysis

North America

North America holds a 34% share, driven by strong digital banking adoption and advanced financial infrastructure. Banks invest in AI-enabled mobile apps that support instant payments and personalized insights. High smartphone use and secure authentication features strengthen customer engagement. Users prefer mobile channels for daily transactions and financial management. Fintech partnerships expand digital wallets and real-time transfers across retail users. Regulatory bodies promote secure digital ecosystems and enhance consumer protection. Continuous upgrades in payment networks and cloud-based platforms help institutions deliver faster and safer mobile banking experiences.

Europe

Europe captures a 28% share, supported by open banking regulations and strong fintech growth. Banks integrate API-driven platforms that enable seamless data sharing across financial services. Users rely on mobile apps for card control, contactless payments, and instant balance updates. Rising demand for cashless transactions strengthens the region’s digital ecosystem. The shift toward biometric security enhances user confidence and reduces fraud risks. Cross-border payment innovations also support mobile banking expansion. Growing adoption of AI tools helps banks offer personalized insights and efficient customer support across major European markets.

Asia-Pacific

Asia-Pacific leads with a 31% share, driven by rising smartphone access and fast digital payment adoption. Growing young populations prefer mobile platforms for daily financial needs. Governments promote cashless economies and support mobile-linked identity systems. Banks partner with telecom firms and fintech players to expand low-cost digital services. Mobile apps offer QR payments, micro-loans, and instant transfers for urban and rural users. Strong growth in e-commerce boosts mobile banking usage across the region. Expanding 4G and 5G networks further strengthen access to secure and reliable mobile banking services.

Latin America

Latin America holds a 4% share, supported by expanding mobile wallets and rising digital literacy. Users adopt mobile banking to avoid long branch queues and access faster payments. Banks focus on simplified apps that support instant transfers and bill payments. Fintech firms help deliver low-cost digital solutions across underserved communities. Governments encourage financial inclusion through digital ID systems and mobile-linked accounts. Economic shifts also push consumers toward secure cashless options. Growing smartphone penetration and improving network connectivity help drive steady mobile banking adoption across key markets.

Middle East & Africa

Middle East & Africa account for a 3% share, driven by rising demand for mobile-first financial services. Users rely on mobile banking for remittances, bill payments, and balance checks. Telecom-led mobile money platforms support unbanked and underbanked populations. Governments promote digital transformation through regulatory reforms and national payment strategies. Banks introduce lightweight apps and USSD services to reach rural users. Investments in cybersecurity enhance trust and protect sensitive data. Expanding smartphone access and improving broadband coverage help strengthen mobile banking adoption across diverse markets.

Market Segmentations:

By Component

- Mobile Banking Solutions

- Mobile Banking Services

By Transaction Type

- Fund Transfers

- Bill Payments

- Account Management

- Others

By Technology

- SMS Banking

- Mobile Apps

- USSD

- Others

By End User

- Individual Users

- Enterprises

- Financial Institutions

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Mobile Banking market includes major players such as JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Company, Citigroup Inc., HSBC Holdings plc, Standard Chartered plc, Barclays Bank plc, BNP Paribas, Deutsche Bank AG, and U.S. Bank. These institutions invest in high-performance mobile platforms that support real-time payments, biometric authentication, and AI-driven personalization. Banks enhance app ecosystems with secure APIs, predictive analytics, and digital onboarding tools to improve customer experience. Strategic collaborations with fintech firms help expand digital wallets, instant credit services, and cross-border payment capabilities. Companies also strengthen cybersecurity frameworks to mitigate fraud risks and safeguard user data. Continuous upgrades in cloud-based infrastructure, user-friendly interfaces, and multi-channel integration enable these players to remain competitive. As mobile-first banking continues to grow, leading institutions focus on innovation, faster service delivery, and improved digital engagement to expand their customer base and strengthen market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JPMorgan Chase & Co.

- Bank of America Corporation

- Wells Fargo & Company

- Citigroup Inc.

- HSBC Holdings plc

- Standard Chartered plc

- Barclays Bank plc

- BNP Paribas

- Deutsche Bank AG

- S. Bank (U.S. Bancorp)

Recent Developments

- In August 2025, Citigroup Inc. deployed enhancements to its CitiDirect® Commercial Banking platform, adding AI-driven features for digital access via mobile and web.

- In March 2025, Standard Chartered plc launched its SC GPT generative-AI tool across 41 markets to enhance mobile banking, operations and client engagement.

- In 2025, HSBC Holdings plc rolled-out a refreshed mobile banking app in Hong Kong, featuring improved navigation and personalisation for daily finance management.

Report Coverage

The research report offers an in-depth analysis based on Component, Transaction Type, Technology, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Mobile banking use will rise as consumers shift toward fully digital financial services.

- Banks will deploy more AI tools to deliver personalized insights and faster support.

- Real-time payment adoption will expand across both retail and business users.

- Biometric and multi-factor security will strengthen protection against digital threats.

- Cloud-based platforms will help banks scale features and improve app performance.

- Fintech partnerships will grow, enabling wider access to digital wallets and micro-services.

- Rural and underserved regions will see stronger adoption through SMS and USSD channels.

- Cross-border mobile payments will become faster through improved global payment rails.

- Mobile apps will add more self-service tools to reduce branch dependency.

- Regulatory support for secure digital finance will accelerate long-term mobile banking growth.