Market Overview:

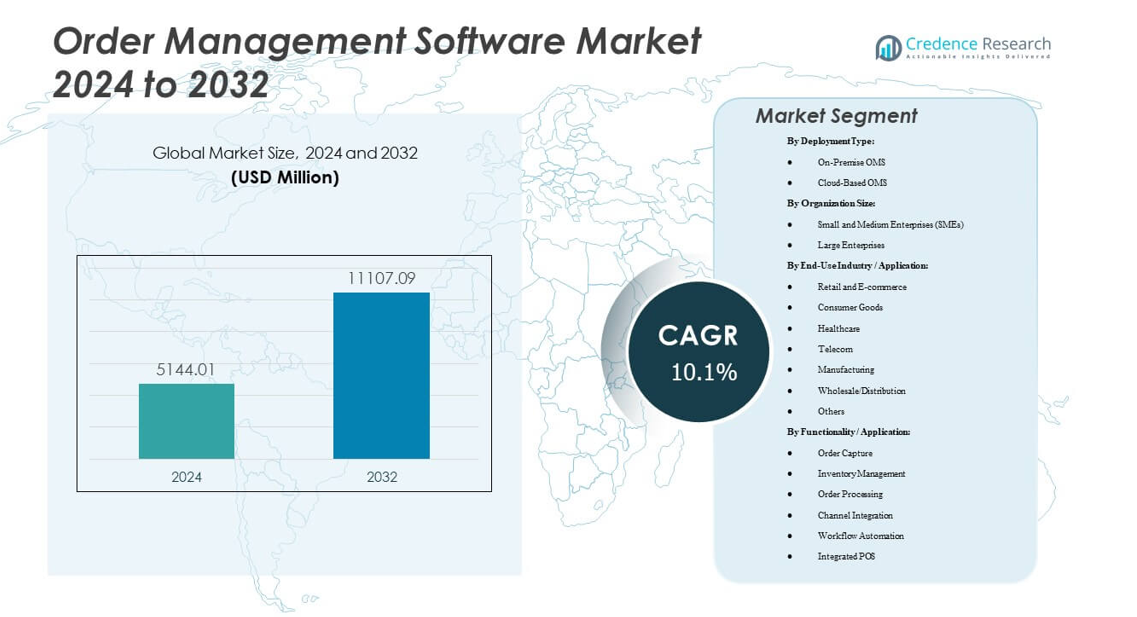

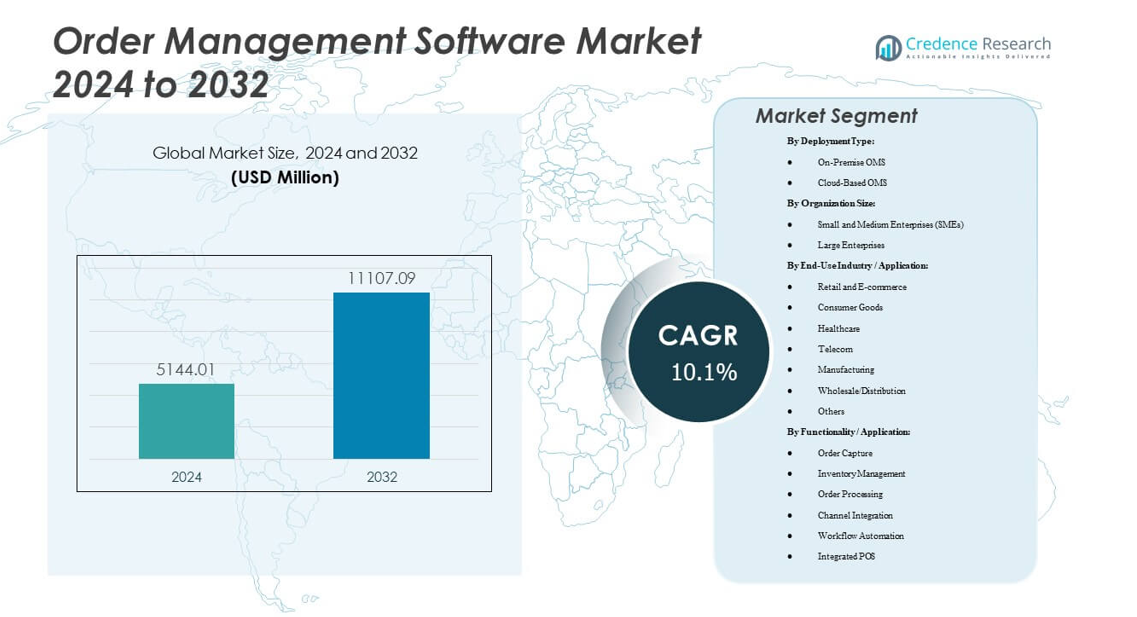

The Order Management Software Market is projected to grow from USD 5,144.01 million in 2024 to an estimated USD 11,107.09 million by 2032, with a compound annual growth rate (CAGR) of 10.1% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Order Management Software Market Size 2024 |

USD 5,144.01 million |

| Order Management Software Market, CAGR |

10.1% |

| Order Management Software Market Size 2032 |

USD 11,107.09 million |

The market growth is fueled by strong adoption of cloud-based solutions, automation, and AI-enabled order orchestration. Retailers and manufacturers rely on real-time analytics to manage inventory and fulfillment across multiple sales channels. Integration with ERP, CRM, and warehouse systems supports efficient data flow and transparency in global operations. It helps enterprises reduce delays, improve service accuracy, and manage complex logistics networks efficiently. Increasing preference for subscription-based SaaS models further boosts market scalability.

North America leads due to early technology adoption, robust retail ecosystems, and advanced e-commerce infrastructure. Europe follows with strong demand for omnichannel retail and compliance-focused solutions. Asia-Pacific emerges as the fastest-growing region due to expanding online retail, SME digitalisation, and rapid logistics infrastructure growth in countries like China, India, and Indonesia. Latin America and the Middle East & Africa show steady potential, driven by rising digital payment systems and increasing retail modernization efforts across urban centers.

Market Insights:

- The Order Management Software Market is projected to grow from USD 5,144.01 million in 2024 to USD 11,107.09 million by 2032, registering a CAGR of 10.1% during the forecast period.

- Rising adoption of cloud-based solutions and SaaS models drives efficiency and scalability across enterprises of all sizes.

- Integration of AI and automation enhances order accuracy, streamlines fulfillment, and reduces operational costs.

- High initial implementation costs and integration complexity with legacy systems limit adoption in smaller firms.

- North America leads with about 43% market share due to mature retail systems and strong digital infrastructure.

- Europe holds nearly 28% share, supported by omnichannel retail and regulatory compliance focus.

- Asia-Pacific emerges as the fastest-growing region with around 22% share, driven by expanding e-commerce and SME digitalization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Real-Time Order Visibility and Customer Experience Enhancement

Businesses prioritise real-time visibility to meet rising customer expectations. Advanced analytics and automation enable faster order fulfilment. Retailers integrate data-driven platforms to improve operational control. Visibility across channels supports accuracy in inventory and delivery. Cloud-based models enhance scalability for peak seasons. It improves customer satisfaction by reducing errors and delays. The Order Management Software Market grows as enterprises adopt unified dashboards. End-to-end visibility strengthens responsiveness and boosts overall service efficiency.

Increasing Shift Toward Cloud-Based and SaaS Deployment Models

Organisations adopt cloud OMS for flexibility and lower maintenance needs. Scalable infrastructure supports global operations efficiently. Cloud tools reduce dependency on in-house IT resources. Firms gain faster access to system updates and security patches. Subscription models help manage operational budgets effectively. It allows seamless integration with third-party logistics and payment systems. Remote accessibility enables 24/7 monitoring across global supply networks. The rising transition to SaaS models drives long-term adoption.

Expansion of E-Commerce and Omnichannel Retail Operations

The e-commerce boom drives greater OMS adoption across industries. Unified platforms connect web, mobile, and in-store sales channels. Integration ensures accurate fulfilment and inventory balancing. Brands achieve consistency across multiple digital platforms. It helps retailers handle rising order volumes with reduced manual work. Automated routing reduces bottlenecks during promotional campaigns. Global marketplaces rely on OMS for multi-location operations. The Order Management Software Market benefits from robust omnichannel expansion.

- For instance, Shopify reported that its merchants generated USD 11.5 billion in global sales during the Black Friday–Cyber Monday 2024 weekend, with performance data directly published on Shopify’s official dashboard and confirmed through its annual BFCM report.

Automation and AI Integration Transforming Supply Chain Efficiency

AI-driven OMS enhances decision-making and operational precision. Predictive analytics anticipate order surges and optimise workflows. Automation minimises human errors in processing and delivery. Smart algorithms recommend faster fulfilment routes. It accelerates demand forecasting accuracy for retailers. Machine learning tools strengthen inventory planning capabilities. Businesses use automation to maintain real-time operational control. AI integration continues to drive market innovation and performance.

- For instance, Unilever’s Mannheim, Germany facility implemented layer-picking automation technology to boost warehouse efficiency, increasing picking capacity by around 50% and generating annual savings exceeding €1 million, as confirmed through Unilever’s official supply chain publications and operational reports.

Market Trends

Emergence of Headless Commerce and API-Driven Integrations

Headless architecture supports custom front-end experiences. API-driven integration enables faster adaptation to new channels. Modular systems offer brands flexibility in workflow configuration. Businesses upgrade OMS to support scalable commerce operations. It simplifies third-party connectivity and reduces downtime. Open APIs enhance collaboration with logistics partners. Retailers benefit from reduced deployment time for new features. The Order Management Software Market grows through demand for composable solutions.

- From a case study published by Coca‑Cola Hellenic Bottling Company (Coca-Cola HBC) and SAP Commerce Cloud, the company now supports 160,000 business customers and processes over 130,000 orders monthly using its cloud commerce platform.

Adoption of Mobile and Remote OMS Solutions for On-the-Go Management

usinesses adopt mobile-enabled OMS for field-based control. Managers track fulfilment operations remotely via secure platforms. It ensures continuous visibility during business travel or off-site work. Real-time notifications support faster response to disruptions. SMEs benefit from mobile tools offering instant analytics. Teams coordinate tasks more efficiently across dispersed networks. The mobility trend enhances agility in global operations. Growing mobile adoption reinforces OMS scalability and adoption.

- For instance, Rossum’s order management platform enables automated order capture across email, EDI, web portals, and mobile apps, helping users save up to 95% of time per document and achieve 71% straight-through processing, as confirmed in Rossum’s officially published impact reports and customer case studies.

Integration of OMS With Advanced Warehouse and ERP Systems

Integrated systems enable end-to-end control across supply chains. Synchronised data ensures real-time visibility in inventory levels. Automated stock updates prevent double-booking issues. OMS-ERP integration supports unified customer management. It drives efficiency by aligning finance, logistics, and sales functions. Warehouse connectivity enables faster picking and shipping. Enterprises achieve higher process consistency and traceability. The Order Management Software Market gains value through cross-platform integration.

Focus on Sustainability and Green Fulfilment Initiatives

Enterprises adopt OMS to support sustainable delivery networks. Route optimisation reduces fuel consumption in logistics. OMS-driven insights promote energy-efficient inventory management. Brands track carbon emissions during distribution cycles. It aligns business operations with environmental standards. Paperless invoicing and digital documentation gain traction. Supply chains benefit from lower waste levels. Sustainability-focused practices enhance brand credibility and customer loyalty.

Market Challenges Analysis

Integration Complexity Across Multi-Platform Environments

Enterprises struggle to integrate OMS with legacy and external systems. Disconnected data sources lead to fulfilment inconsistencies. Complex environments delay implementation timelines. It increases the cost of custom integration services. Managing multiple vendors raises technical challenges. Data migration requires skilled IT resources for accuracy. Limited interoperability restricts system performance across regions. The Order Management Software Market faces friction from integration difficulties.

High Cost of Deployment and Data Security Risks

Implementation costs deter smaller firms from early adoption. Custom configuration adds to development expenses. Security risks increase with cloud-based connectivity. It pushes companies to invest in encryption and compliance tools. Breaches threaten financial and customer data integrity. Regulatory complexities vary across regions, creating confusion. Continuous monitoring demands higher operational budgets. These factors limit large-scale adoption across price-sensitive industries.

Market Opportunities

Expansion Across Emerging Digital Economies

Emerging markets show strong demand for digital retail systems. SMEs adopt OMS to manage rising online sales volumes. Cloud availability lowers barriers to software adoption. It enables businesses to participate in global e-commerce networks. Local logistics partners benefit from OMS integration. Government-led digitalisation initiatives further boost adoption. Rising mobile commerce accelerates transformation in retail operations. The Order Management Software Market gains traction through emerging economies’ digital progress.

Growth Potential Through AI, Analytics, and Robotic Integration

Advanced AI tools reshape fulfilment and forecasting capabilities. Robotics improve picking accuracy in warehouses. It enhances speed and reduces manual workload. Predictive analytics identify performance inefficiencies early. Integration with IoT sensors supports real-time shipment visibility. Companies use AI to personalise customer experiences. Smart data-driven decisions improve profit margins. Innovation in automation creates new growth opportunities globally.

Market Segmentation Analysis:

By Deployment Type

The Order Management Software Market by deployment type divides into on-premise and cloud-based systems. On-premise OMS solutions remain preferred by large enterprises requiring tighter control and data security. These deployments cater to firms with established IT infrastructure. Cloud-based OMS dominates growth due to its flexibility, scalability, and low maintenance needs. It allows remote access and real-time updates across locations. SMEs increasingly select cloud platforms for quick implementation and affordability. Enterprises value cloud models for API connectivity with logistics and ERP systems. The shift toward SaaS-based architecture continues to strengthen this segment’s expansion.

- For instance, IBM Sterling Order Management was deployed by Lowe’s across its more than 1,700 US stores to centralise the fulfilment process and secure order-data management. This on-premise implementation supports the retailer’s in-store and online operations with single-system inventory visibility and fulfilment orchestration.

By Organization Size

SMEs adopt OMS to manage growing digital sales and reduce manual processing errors. Cloud-based platforms help small firms scale operations without major capital investment. These systems streamline multi-channel order management for retail and service providers. Large enterprises focus on automation and integration across global supply chains. It supports end-to-end visibility and compliance with corporate data policies. Larger organisations invest heavily in advanced analytics to optimise fulfilment accuracy. Both segments show rising preference for unified dashboards. Demand from mid-tier enterprises supports balanced market growth.

By End-Use Industry / Application

Retail and e-commerce lead adoption due to the surge in online shopping. Consumer goods brands rely on OMS for improved demand forecasting. Healthcare institutions use it to manage supply delivery and patient orders efficiently. Telecom providers streamline customer provisioning through automated order routing. Manufacturing and distribution players focus on inventory accuracy and faster turnaround. It enhances product tracking and resource planning. Other sectors, including food, automotive, and BFSI, leverage OMS for compliance and multi-channel integration. Strong cross-industry adoption underpins market resilience.

By Functionality / Application

Order capture systems ensure precise entry and validation of sales data. Inventory management modules track stock levels and prevent shortages. Order processing functions cover payment handling, shipping, invoicing, and returns. Channel integration tools synchronise multiple sales platforms under one system. Workflow automation improves fulfilment speed and operational efficiency. Integrated POS bridges in-store and online orders for unified visibility. It allows enterprises to create a seamless purchasing journey for customers. These combined functionalities define the technological depth of the market.

- For instance, TOMS (Tejas Order Management System) offers real-time inventory updates across all channels and integrates with shipping carriers, ERP systems, and label printing tools.

Segmentation:

By Deployment Type:

- On-Premise OMS

- Cloud-Based OMS

By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By End-Use Industry / Application:

- Retail and E-commerce

- Consumer Goods

- Healthcare

- Telecom

- Manufacturing

- Wholesale/Distribution

- Others (including Food & Beverage, Automotive, Electronics, BFSI, IT, Energy Utilities)

By Functionality / Application:

- Order Capture

- Inventory Management

- Order Processing (Payment Processing, Shipping, Invoicing, Returns Management)

- Channel Integration

- Workflow Automation

- Integrated POS

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Leading With High Market Share

North America commands roughly 43 % of the global Order Management Software Market share due to advanced e-commerce infrastructure and mature retail ecosystems. The U.S. and Canada host strong supplier networks and early cloud adoption, driving demand for scalable fulfilment solutions. Enterprises in this region prioritise order accuracy, fast delivery and multi-channel integration. It supports large-scale roll-outs and cross-border operations. Technology investment remains high, allowing deeper system penetration. The region’s regulatory clarity and developed logistics infrastructure further encourage OMS deployment.

Europe Holding Significant Share While Transitioning

Europe holds around 28 % of the market share and benefits from well-developed retail chains, cross-border trade and strong IT services. Several nations focus on GDPR-compliant order-management solutions and cross-EU fulfilment models. It faces moderate growth due to saturated markets, but firms continue upgrading legacy systems. It supports cloud-based OMS roll-outs linked to warehouse automation and omni-channel retail expansion. Firms in the region emphasise sustainability, compliance and fulfilment transparency. These factors sustain steady adoption growth.

Asia-Pacific Emerging Rapidly With Strong Growth Potential

The Asia-Pacific region holds about 22 % of the market share and leads in growth momentum due to digital commerce expansion in China, India and Southeast Asia. Rapid infrastructure build-out, growing middle-class consumption and mobile commerce drive elevated OMS adoption. SMEs in this region embrace cloud-based models to scale quickly with limited budgets. It supports cross-border fulfilment for international brands. Investment in logistics and last-mile networks advances system uptake. Regulatory reforms and increasing internet penetration accelerate market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Oracle Corporation

- IBM Corporation

- SAP SE

- Salesforce, Inc.

- Microsoft Corporation

- HCL Technologies

- NetSuite (Oracle)

- Adobe Inc. (Magento Commerce)

- Zoho Corporation

- com

- Unicommerce eSolutions

- Brightpearl

- Blue Yonder (formerly JDA Software)

- Manhattan Associates

- Vinculum Solutions

Competitive Analysis:

The Order Management Software Market features a competitive landscape with global leaders such as Oracle Corporation, SAP SE, IBM Corporation, and Salesforce, Inc. These firms offer broad enterprise platforms with extensive integration capabilities and strong brand recognition. Mid-tier and niche players like Zoho Corporation Pvt. Ltd., Vinculum Solutions Pvt. Limited, and Manhattan Associates attract SMEs and regional clients with flexible cloud models. It expects M&A activity, partnerships, and platform enhancements to define upcoming competitive moves. Providers invest in analytics, automation, and specialised fulfilment tools to differentiate. Strong customer service, global reach, and continuous innovation determine leadership positions in this market.

Recent Developments:

- In November 2025, Microsoft Corporation made headlines with the launch of 80 new offers in its cloud solutions marketplace, prominently featuring updates to order management tools focused on integration and AI-driven optimization for business processes.

- In November 2025, Zoho Corporation announced a major update to its Zoho One business OS fusing advanced AI features and a redesigned interface to further optimize order and inventory workflows for SMEs globally.

- In October 2025, Vinculum launched an enhanced version of its modular order management system, offering real-time order processing and flexible integration capabilities tailored for evolving business needs. This update enables businesses to adapt quickly to changing market demands and streamline their omnichannel operations more efficiently.

- In October 2025, NetSuite (Oracle) expanded its SuiteCloud Developer partner program at SuiteWorld emphasizing AI-driven innovation for its cloud ERP and order management offerings, enabling faster deployment and improved customization for partners and customers.

- In September 2025, Microsoft Dynamics 365 introduced new features within its Intelligent Order Management component, focusing on advanced order orchestration, fulfillment, and lifecycle management.

- In May 2025, QuickOrders released a new version of its order management platform, emphasizing real-time inventory synchronization, intelligent order routing, and robust automation tools. This update is designed to help businesses scale their operations and provide a more seamless customer experience across various sales channels.

Report Coverage:

The research report offers an in-depth analysis based on Deployment Type, Organization Size, End-Use Industry / Application and Functionality / Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Cloud-based deployment will dominate as enterprises prioritise flexibility, scalability, and reduced infrastructure costs.

- SMEs will increasingly adopt subscription-based OMS to enhance multi-channel visibility and reduce operational delays.

- Integration with AI and predictive analytics will transform decision-making, driving smarter fulfilment operations.

- Omnichannel retail growth will strengthen demand for systems that unify online and offline order workflows.

- Automation of inventory management and workflow orchestration will boost productivity and accuracy in fulfilment.

- API-driven and headless OMS architecture will gain traction, allowing rapid adaptation to new sales platforms.

- Data security and compliance solutions will become a key differentiator among leading OMS vendors.

- Strategic partnerships between OMS providers and logistics firms will redefine real-time order tracking standards.

- Regional growth will accelerate in Asia-Pacific, supported by expanding e-commerce and SME digitalisation.

- Continuous product innovation and M&A activities will intensify competition across global OMS suppliers.