Market overview

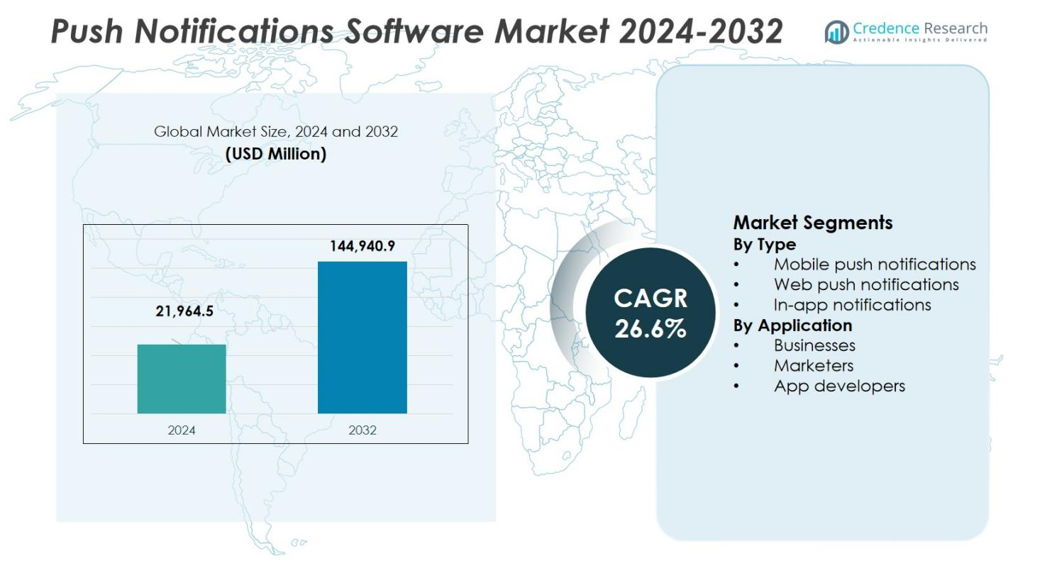

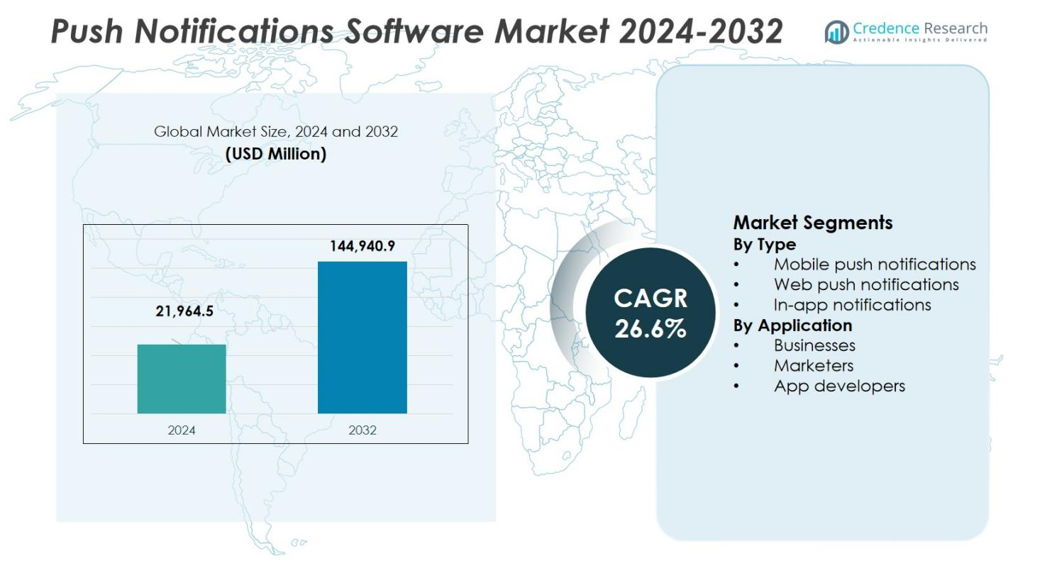

Push Notifications Software Market size was valued at USD 21,964.5 million in 2024 and is anticipated to reach USD 144,940.9 million by 2032, at a CAGR of 26.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Push Notifications Software Market Size 2024 |

USD 21,964.5 million |

| Push Notifications Software Market, CAGR |

26.6% |

| Push Notifications Software Market Size 2032 |

USD 144,940.9 million |

The Push Notifications Software Market is shaped by prominent players such as OneSignal, Firebase, Airship, PushEngage, WebEngage, Leanplum, Pusher, VWO, Aimtell, and PushCrew, each contributing advanced engagement capabilities and multi-channel delivery solutions. These providers focus on enhancing personalization, automation, and AI-driven targeting to strengthen user retention and campaign effectiveness across mobile and web platforms. Regionally, North America leads the market with a 37% share, supported by its mature digital ecosystem and strong adoption of marketing technologies. Europe and Asia-Pacific follow as key growth regions, driven by rising mobile usage, expanding e-commerce activity, and increasing investments in data-driven communication tools.

Market Insights

- The Push Notifications Software Market reached USD 21,964.5 million in 2024 and will grow to USD 144,940.9 million by 2032 at a CAGR of 26.6%, driven by rapid digital engagement across industries.

- Strong market drivers include expanding mobile app ecosystems, rising demand for personalized communication, and increased adoption of automated, event-based messaging to enhance customer retention.

- Key trends include the integration of AI for predictive targeting, growing preference for omnichannel engagement, and wider use of rich media notifications to boost interaction and conversion rates.

- Market activity intensifies as players such as OneSignal, Firebase, Airship, and PushEngage strengthen analytics, automation, and cross-platform capabilities, though privacy regulations and rising opt-out rates act as restraints.

- North America leads with a 37% share, followed by Europe at 27% and Asia-Pacific at 26%, while mobile push notifications dominate segments with a 54% share and businesses lead applications with a 48% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Mobile push notifications dominate the Push Notifications Software Market with a 54% share in 2024, driven by the widespread adoption of smartphones, high app engagement rates, and the ability to deliver personalized, real-time messages directly to users. Their strong performance is supported by richer formats such as images, action buttons, and deep-linking, which significantly enhance user interaction and retention. Web push notifications hold a growing share as browsers expand support, while in-app notifications continue to play a crucial role in driving contextual engagement within applications.

- For instance, brands using rich‑media push notifications (e.g., images, GIFs or videos + action buttons) reported click‑through rates that were 25% higher than plain‑text pushes.

By Application

Businesses lead the Push Notifications Software Market with a 48% share in 2024, supported by their extensive use of notification tools for customer engagement, retention, and personalized communication across digital platforms. Their dominance is driven by increasing dependence on automated messaging workflows, behavioral targeting, and omnichannel marketing strategies. Marketers follow closely as they leverage advanced segmentation and analytics to improve campaign performance, while app developers contribute steadily by integrating push technologies to maintain user activity and optimize in-app experiences.

- For instance, Chemist Warehouse used personalized web push notifications that led to an 85% conversion rate uplift, showcasing how targeted messaging boosts customer actions.

Key Growth Drivers

Rising Adoption of Personalized Customer Engagement

Personalized communication remains a major growth driver for the Push Notifications Software Market as businesses increasingly rely on behavior-based targeting, real-time triggers, and AI-driven segmentation to improve engagement. Companies use personalized notifications to boost conversions, reduce churn, and enhance customer lifetime value across mobile and web platforms. As consumer expectations shift toward tailored interactions, enterprises adopt advanced push engines capable of delivering dynamic content based on user preferences, location, and activity patterns. This growing focus on individualized experiences accelerates demand for robust and scalable notification solutions.

- For instance, Walgreens harnesses AI-powered push notifications in its mobile app to send medication refill reminders tailored to each patient’s prescription history, resulting in higher adherence rates and improved user retention.

Expansion of Mobile App Ecosystems

The rapid growth of mobile applications across e-commerce, fintech, gaming, and social media significantly propels the Push Notifications Software Market. Organizations deploy push notifications to re-engage users, drive session frequency, and support app monetization strategies. With billions of active smartphone users generating continuous digital interactions, companies increasingly depend on push technology to maintain visibility and stimulate user retention. The expansion of app-based services, combined with rising mobile internet penetration, strengthens demand for advanced notification platforms that ensure high delivery rates and measurable performance outcomes.

- For instance, in e-commerce, Kith’s push notifications promoting seasonal sales effectively drive user engagement by highlighting exclusive offers, encouraging timely purchases.

Increased Adoption of Marketing Automation

The growing shift toward automated, data-driven marketing workflows amplifies the need for integrated push notification tools. Businesses automate customer journeys to deliver timely, event-triggered messages that guide users from onboarding to conversion. Push notifications play a crucial role in these ecosystems by offering reliable touchpoints that improve engagement efficiency. As companies adopt omnichannel marketing strategies, the integration of push solutions with CRM, analytics, and automation platforms accelerates. This trend strengthens market growth as enterprises prioritize consistent, cross-platform communication supported by intelligent automation.

Key Trends & Opportunities

Growth of AI-Enhanced Notification Capabilities

Artificial intelligence is reshaping the Push Notifications Software Market by enabling smarter targeting, predictive engagement, and automated content optimization. AI-driven algorithms analyze user patterns to determine the best time, frequency, and format for message delivery, improving click-through rates and reducing opt-outs. Natural language generation is also elevating content relevance by personalizing message tone and intent. As companies invest in AI-powered martech solutions, vendors offering machine learning–based notification engines gain a competitive edge, creating strong opportunities for advanced, analytics-driven push platforms.

- For instance, MoEngage reported that iOS push notifications personalised by user behaviour achieved up to 35.8 % conversion rates—around 4.2 × the rate of non‑personalised pushes.

Expansion of Omnichannel Engagement Solutions

The increasing focus on unified customer experiences presents significant opportunities for push notification providers. Businesses are integrating push notifications with email, SMS, in-app messaging, and web engagement channels to create cohesive, multi-touchpoint communication strategies. This shift supports improved customer journeys, stronger brand loyalty, and higher engagement consistency across devices. Vendors offering cross-channel orchestration and real-time campaign syncing see rising demand as enterprises seek platforms that eliminate data silos and ensure seamless delivery. This trend drives innovation in integrated engagement suites within the market.

- For instance, Ryde, Norway’s largest micromobility company, uses real-time transactional push notifications to alert users about each step of their rental, including proactive solutions like switching scooters seamlessly when a battery is low, enhancing customer satisfaction and preventing ride interruptions.

Key Challenges

Rising Concerns Over User Privacy and Compliance

Growing awareness of data privacy and stricter regulations pose challenges for the Push Notifications Software Market. Frameworks such as GDPR, CCPA, and browser-level privacy restrictions require businesses to secure explicit user consent before sending notifications. These regulations complicate targeting capabilities and increase compliance-related costs. Furthermore, consumers are increasingly cautious about sharing personal data, prompting companies to adopt transparent permission strategies and robust data management practices. Ensuring lawful data processing while maintaining personalization effectiveness remains a key operational challenge for market participants.

Increasing Opt-Out Rates and Notification Fatigue

High message frequency and poorly targeted notifications contribute to rising opt-out rates, creating a significant challenge for market growth. Users often disable notifications or uninstall apps when overwhelmed with irrelevant or intrusive messages, reducing the effectiveness of marketing campaigns. Businesses must adapt by implementing frequency capping, contextual targeting, and relevant content strategies to maintain user trust. Vendors face pressure to enhance delivery intelligence and user segmentation features to mitigate fatigue. Balancing engagement with user experience becomes essential to sustain long-term notification performance.

Regional Analysis

North America

North America holds a 37% share of the Push Notifications Software Market, driven by high digital adoption, a mature mobile ecosystem, and strong investments in marketing automation across industries. Businesses in the region leverage advanced targeting tools, AI-powered engagement workflows, and omnichannel communication platforms to deepen customer interaction. The presence of major technology vendors and a strong app-based economy further accelerates adoption. Enterprises in e-commerce, fintech, and media rely heavily on push technologies to enhance retention and improve user lifetime value, reinforcing North America’s leadership position.

Europe

Europe accounts for a 27% share of the Push Notifications Software Market, supported by rising digital transformation initiatives and widespread adoption of data-driven engagement strategies. Businesses increasingly implement push notifications to maintain compliance with stringent data privacy regulations while optimizing customer communication. The region’s growth is strengthened by expanding online retail activity and increasing reliance on automation platforms among enterprises. Adoption gains momentum in countries such as Germany, the U.K., and France, where mobile app usage and personalized marketing practices continue to surge, advancing Europe’s position in the global market.

Asia-Pacific

Asia-Pacific captures a 26% share of the Push Notifications Software Market, fueled by rapid smartphone penetration, booming app ecosystems, and strong uptake of digital services across emerging economies. Businesses in e-commerce, mobility, gaming, and financial services rely heavily on push notifications to drive user engagement at scale. The region’s expanding mobile-first consumer base encourages organizations to adopt advanced messaging tools and real-time personalization. Countries such as India, China, and Indonesia lead growth due to high digital consumption and increasing investment in mobile marketing platforms, positioning Asia-Pacific as a high-growth regional market.

Latin America

Latin America holds a 6% share of the market, driven by growing digital engagement, rising adoption of mobile apps, and expanding e-commerce activity across major economies such as Brazil and Mexico. Businesses increasingly use push notifications to support customer retention, encourage repeat purchases, and enhance app engagement. The region’s improving digital infrastructure and competitive mobile service landscape contribute to stronger adoption of cloud-based notification platforms. Despite economic variability, expanding online services and increased use of personalized marketing tools create new growth opportunities for push notification providers.

Middle East & Africa

The Middle East & Africa region accounts for a 4% share of the Push Notifications Software Market, supported by rising smartphone usage, expanding digital commerce, and growing investment in marketing technology across sectors. Businesses increasingly deploy push notifications to improve user engagement for banking, retail, travel, and service apps. The region’s adoption is also influenced by government-led digitalization initiatives and increasing demand for mobile-first customer communication. While market maturity varies across countries, improving connectivity and expanding mobile ecosystems drive steady growth prospects for push notification solutions.

Market Segmentations:

By Type

- Mobile push notifications

- Web push notifications

- In-app notifications

By Application

- Businesses

- Marketers

- App developers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Push Notifications Software Market features leading players such as OneSignal, Firebase, Airship, PushEngage, WebEngage, Leanplum, Pusher, VWO, Aimtell, and PushCrew, all competing through advanced engagement capabilities and multi-channel delivery solutions. Vendors focus on enhancing personalization engines, AI-driven targeting, and cross-platform message orchestration to improve user retention and campaign effectiveness. The market is characterized by continuous innovation in automation workflows, analytics dashboards, A/B testing, and real-time segmentation to support enterprise-grade engagement needs. Strategic partnerships, feature upgrades, and integrations with CRM, CDP, and marketing automation platforms strengthen competitive positioning. Additionally, providers are expanding data privacy and compliance frameworks to meet evolving regulatory requirements, while offering scalable infrastructure designed for high-volume mobile and web interactions. Increasing demand for omnichannel engagement and predictive outreach continues to intensify competition among established players and emerging SaaS providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Firebase

- Aimtell

- PushEngage

- WebEngage

- Pusher

- OneSignal

- Leanplum

- Airship

- VWO

- PushCrew

Recent Developments

- In February 2024, Brevo launched its Customer Data Platform (CDP), enhanced AI‑features and Mobile Push Notifications capability for enterprise customers.

- In October 2025, Attentive announced new platform features including Push Notifications for in‑app messaging integration, along with enhanced analytics and AI‑powered models.

- In April 2025, CleverTap partnered with Infobip to strengthen its omnichannel offering with RCS messaging.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as businesses intensify their focus on personalized and behavior-driven customer engagement.

- AI-powered targeting and predictive analytics will increasingly guide notification timing, content, and delivery.

- Omnichannel engagement strategies will expand as companies integrate push notifications with email, SMS, and in-app messaging.

- Automation workflows will become more advanced, enabling real-time, event-based customer journeys across platforms.

- Adoption will rise among SMEs as cloud-based push solutions become more scalable and cost-effective.

- Data privacy regulations will shape platform capabilities, driving demand for compliant and transparent consent management features.

- Rich media notifications will gain traction, enhancing user interaction and boosting engagement rates.

- Integration with CRM, CDP, and marketing automation tools will accelerate to support unified customer experience strategies.

- Notification fatigue management solutions will evolve, emphasizing relevance, frequency control, and user-centric design.

- Market competition will intensify as emerging vendors innovate with analytics-driven and AI-first notification platforms.