Market Overview:

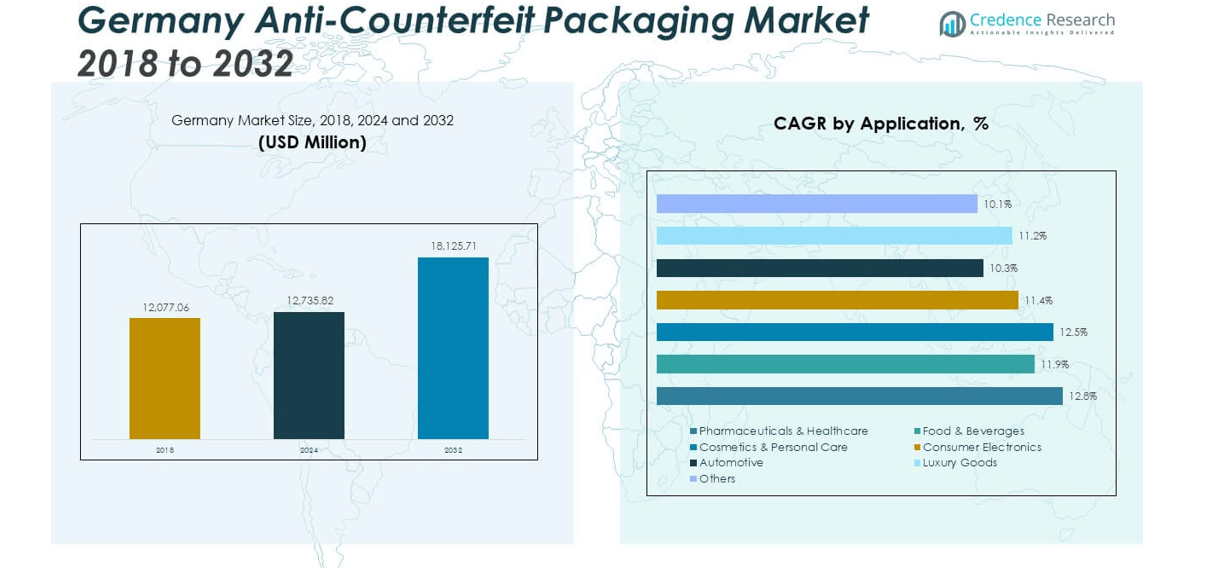

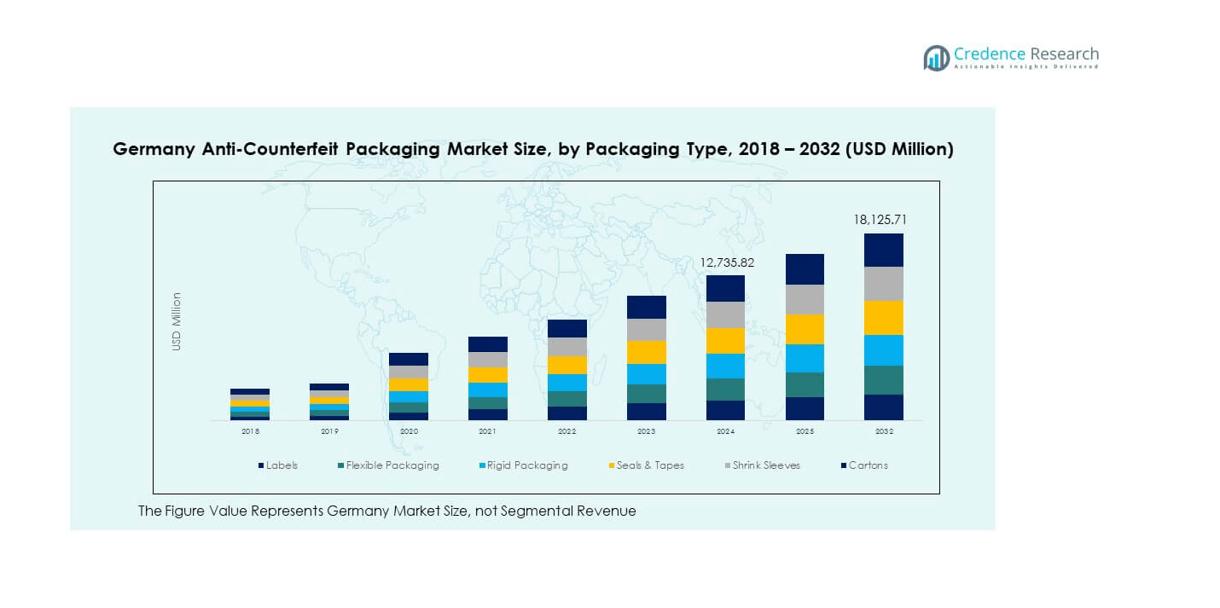

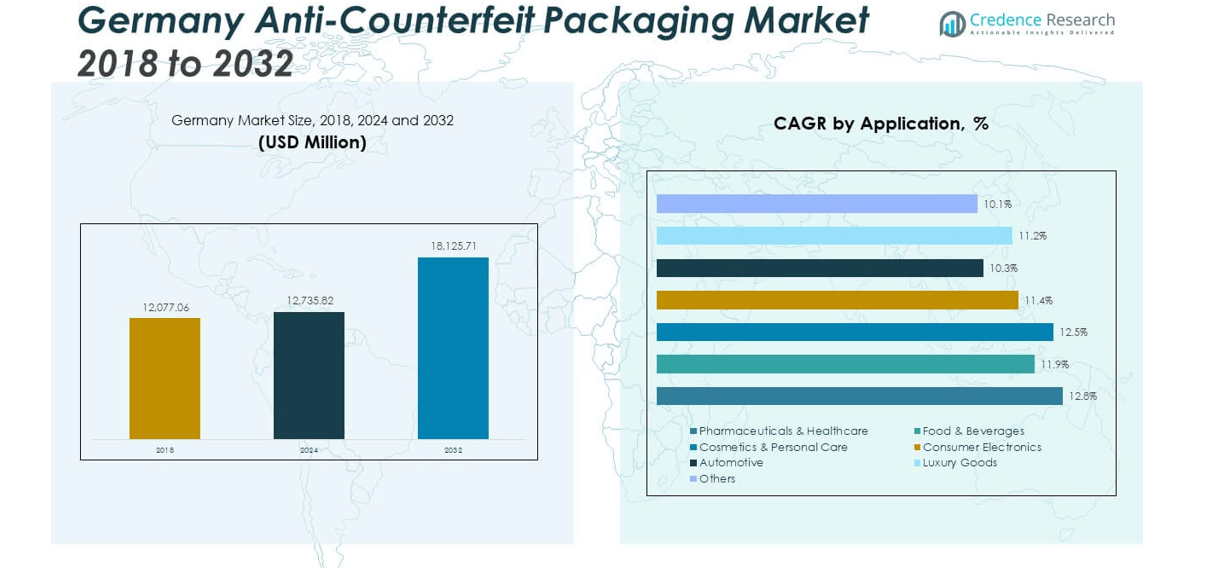

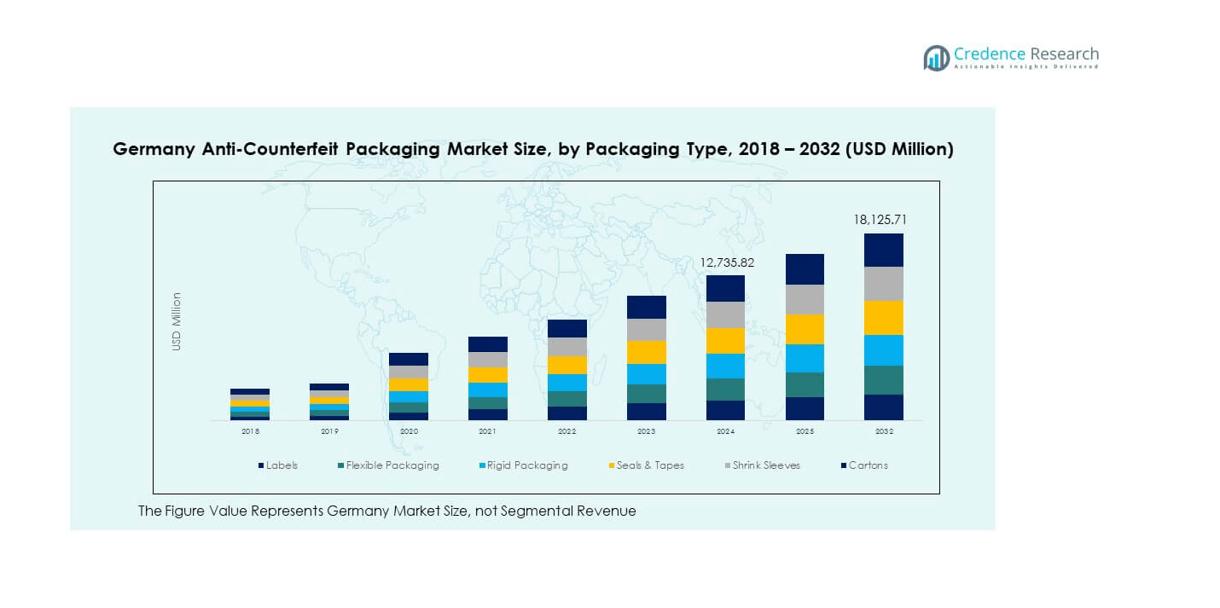

The Germany Anti-Counterfeit Packaging Market size was valued at USD 12,077.06 million in 2018 to USD 12,735.82 million in 2024 and is anticipated to reach USD 18,125.71 million by 2032, at a CAGR of 4.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Anti-Counterfeit Packaging Market Size 2024 |

USD 12,735.82 million |

| Germany Anti-Counterfeit Packaging Market, CAGR |

4.51% |

| Germany Anti-Counterfeit Packaging Market Size 2032 |

USD 18,125.71million |

Robust uptake in regulatory-driven authentication and serialization fuels market momentum. In Germany the demand for advanced security labels, tamper-evident seals and real-time traceability systems expands across pharmaceuticals, consumer goods and industrial segments. Manufacturers embed RFID, QR codes and holographic features to combat counterfeiting. Rising e-commerce and cross-border supply volumes intensify pressure to secure packaging and maintain brand integrity. Producers and retailers invest in holistic solutions that link product IDs to digital verification. Such investments support efficient operations and strengthen consumer trust in authenticity.

Germany leads Europe in secure packaging innovation while neighboring countries show rapid adoption. Southern and western industrial hubs drive deployment of anti-counterfeit solutions thanks to high-value manufacturing and export orientation. Emerging markets in Eastern Europe gain traction by adopting digital labeling and smart packaging as they align with EU compliance norms. Germany remains the benchmark region and acts as technology provider and exporter of secure packaging formats across adjacent countries.

Market Insights

- The Germany Anti-Counterfeit Packaging Market was valued at USD 12,077.06 million in 2018, reached USD 12,735.82 million in 2024, and is projected to attain USD 18,125.71 million by 2032, expanding at a CAGR of 4.51%.

- Southern Germany holds the highest share at 38%, driven by dense industrial clusters, advanced manufacturing bases, and extensive adoption of RFID and serialization systems in automotive and pharmaceuticals.

- Western Germany follows with 32% share, supported by strong logistics networks and a high concentration of packaging producers in North Rhine-Westphalia and Hesse. Northern and Eastern Germany together hold 30%, showing rapid growth due to rising digital packaging startups and regional R&D initiatives.

- The fastest-growing region is Northern and Eastern Germany, advancing with innovation hubs in Berlin, Hamburg, and Dresden that promote digital watermarking and sustainable coatings, fueling new adoption across FMCG and electronics sectors.

- Segment-wise, Labels account for about 26% of the Germany Anti-Counterfeit Packaging Market, followed by Cartons (21%), Shrink Sleeves (18%), Flexible Packaging (14%), Rigid Packaging (11%), and Seals & Tapes (10%). By application, Pharmaceuticals & Healthcare leads with around 28%, followed by Food & Beverages (24%) and Consumer Electronics (18%), highlighting strong traceability demand in regulated and high-value sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Regulatory Enforcement and Pharmaceutical Safety Mandates

Strict European and national regulations drive higher adoption of secure packaging formats across industries. The Germany Anti-Counterfeit Packaging Market gains traction from regulatory frameworks that prioritize consumer protection and pharmaceutical traceability. It benefits from the EU Falsified Medicines Directive, which mandates serial numbers and tamper-evident seals. Drug makers focus on maintaining compliance and preventing counterfeit drugs in medical supply chains. Companies deploy serialization systems to authenticate every package. Automation in packaging lines supports continuous traceability. Healthcare institutions rely on visible authentication to ensure patient safety. Strong oversight encourages technology upgrades across distribution networks.

- For instance, Germany’s national verification system securPharm e.V. supports the legal supply chain of pharmaceuticals by enabling package authenticity checks through serialized identifiers and anti-tamper features.

Growing Demand from E-Commerce and Cross-Border Trade Channels

Rapid e-commerce expansion has increased the flow of goods across multiple delivery stages. It boosts the risk of counterfeit infiltration during transport and storage. The Germany Anti-Counterfeit Packaging Market expands as logistics and retail players demand better authentication tools. Secure barcodes, QR codes, and RFID labels enable origin verification at every step. Brand owners invest in tamper-evident packaging to protect goods during last-mile delivery. Retailers promote smart scanning to assure authenticity at consumer endpoints. Importers and exporters adopt blockchain-based records to track inventory integrity. Growing consumer awareness of fake goods supports consistent demand for secure solutions.

Advancement in Smart Packaging and Digital Authentication Technologies

Rapid digitization across packaging formats supports innovation in security features. Manufacturers integrate data-embedded elements for real-time tracking. The Germany Anti-Counterfeit Packaging Market benefits from expansion in connected packaging ecosystems. RFID, NFC, and digital watermarks offer dual authentication functions. It enhances transparency in high-value segments like electronics and pharmaceuticals. Packaging developers work with data analytics providers to link serial codes with supply chain intelligence. Smart systems generate alerts during deviation or tampering incidents. These features reduce manual inspection and strengthen brand reputation through trust-driven engagement.

Increased Focus on Brand Protection and Consumer Trust Enhancement

Counterfeit goods harm brand value, making security investment a core business strategy. Companies aim to protect identity and ensure consistent consumer experiences. The Germany Anti-Counterfeit Packaging Market supports enterprises in maintaining authenticity across every sale point. Tamper-proof seals, holograms, and coded identifiers ensure visible assurance. It improves consumer loyalty by preventing counterfeits in retail shelves. FMCG, cosmetics, and beverage manufacturers integrate anti-fraud labels for transparency. Retail chains demand packaging that aligns with traceability goals. Widespread adoption across premium and mass-market goods strengthens overall compliance culture.

- For instance, Avery Dennison Corporation provides tamper-evident and anti-counterfeit labeling solutions across Europe, featuring holographic films, void materials, and security inks used in FMCG, pharmaceutical, and electronics sectors to enhance packaging integrity and consumer trust.

Market Trends

Integration of Artificial Intelligence and Blockchain in Traceability Solutions

AI and blockchain technologies redefine packaging security across Germany. Companies deploy smart sensors for pattern recognition in counterfeit detection. The Germany Anti-Counterfeit Packaging Market sees growth through transparent and tamper-proof records. Blockchain systems ensure immutability of product data, improving traceability accuracy. AI algorithms analyze supply chain anomalies to detect risks early. Manufacturers employ predictive analytics for quality monitoring. These digital solutions simplify compliance management and build data-driven trust. AI-driven image verification tools assist consumers in validating authenticity instantly.

- For instance, Zebra Technologies Corporation and Merck KGaA, Darmstadt, Germany collaborated to develop M-Trust™, a cyber-physical trust platform that merges blockchain-based authentication with AI-enhanced verification, and the prototype was demonstrated at Hannover Messe 2025.

Adoption of Sustainable and Eco-Friendly Security Materials

Sustainability trends reshape packaging security choices. Firms prioritize eco-safe materials without losing protective integrity. The Germany Anti-Counterfeit Packaging Market evolves toward recyclable holographic films and biodegradable inks. It aligns brand ethics with environmental goals. Companies invest in energy-efficient label production systems. Paper-based smart labels replace synthetic variants in large-scale packaging lines. Security printers focus on compostable coatings with embedded watermarks. Recyclable anti-tamper seals gain traction among food and personal care brands.

- For example, Avery Dennison upgraded its Schwelm (Germany) facility with a €17 million coater installation, enhancing its label-manufacturing capacity and solidifying its regional footprint in secure and high-performance packaging solutions.

Expansion of Digital Consumer Engagement Platforms through QR and NFC Labels

Interactive packaging enables direct communication between brands and consumers. The Germany Anti-Counterfeit Packaging Market benefits from QR and NFC-enabled packaging growth. These labels connect customers to verification portals and product histories. It enhances transparency while building personalized shopping experiences. Consumers scan items using smartphones to confirm originality. Brands use these scans to gather behavioral insights. The trend encourages dual-purpose packaging that combines security with marketing. Integration with loyalty apps strengthens consumer trust and retention.

Collaborations Between Technology Providers and Packaging Manufacturers

Strategic partnerships strengthen the technology ecosystem supporting secure packaging. Firms combine digital innovation with print expertise to deliver robust solutions. The Germany Anti-Counterfeit Packaging Market grows through co-development projects involving RFID, ink, and label specialists. Cross-sector alliances improve scalability and compliance. It allows faster adaptation to evolving counterfeit tactics. Large packaging converters work with cybersecurity firms to enhance encryption protocols. Collaborative R&D accelerates commercial rollout of advanced verification tools. Such integrations enable unified solutions across multiple industrial applications.

Market Challenges Analysis

High Implementation Costs and Integration Barriers Among SMEs

Small and medium enterprises face high entry costs when deploying authentication technologies. The Germany Anti-Counterfeit Packaging Market contends with financial constraints limiting adoption among local producers. It requires hardware, software, and training investments that burden smaller brands. Integration into existing production lines disrupts operations and demands technical expertise. SMEs often depend on external vendors for serialization or RFID management. Lack of standardization complicates cross-platform interoperability. Many firms delay adoption due to uncertain returns. Broader cost optimization and modular systems remain critical to expand participation.

Complex Supply Chain Structures and Limited Consumer Awareness

Multiple stakeholders in logistics networks make data tracking difficult. The Germany Anti-Counterfeit Packaging Market faces visibility gaps between suppliers, distributors, and retailers. It increases vulnerability to counterfeiting during cross-border transfers. Weak awareness among end users reduces the impact of visible security features. Many consumers still overlook authentication labels or QR scans. Fragmented regulation across trade zones complicates enforcement consistency. Collaboration among regulators and private players becomes vital. Strong education campaigns can bridge knowledge gaps and improve consumer vigilance.

Market Opportunities

Emergence of Digital Authentication Startups and Cloud-Based Security Platforms

Technology startups introduce new tools that make security integration faster and affordable. The Germany Anti-Counterfeit Packaging Market benefits from SaaS-based verification and remote monitoring platforms. It enables companies to track serialized codes in real time. Cloud analytics simplify scalability for large manufacturers and SMEs alike. These platforms support remote audits and instant tamper alerts. Integration with ERP systems strengthens traceability accuracy. Digital innovation attracts investor interest toward long-term packaging modernization.

Growing Potential in Export-Oriented and Luxury Goods Sectors

Germany’s export strength drives demand for high-grade security packaging. The Germany Anti-Counterfeit Packaging Market expands through luxury, automotive, and electronics exports. It ensures product integrity across complex distribution networks. Brands adopt layered security, including holograms and forensic markers, to maintain global credibility. Premium packaging enhances reputation in international markets. Evolving buyer awareness sustains investment in anti-fraud systems. Global supply partners seek standardized verification formats to ease import compliance.

Market Segmentation Analysis

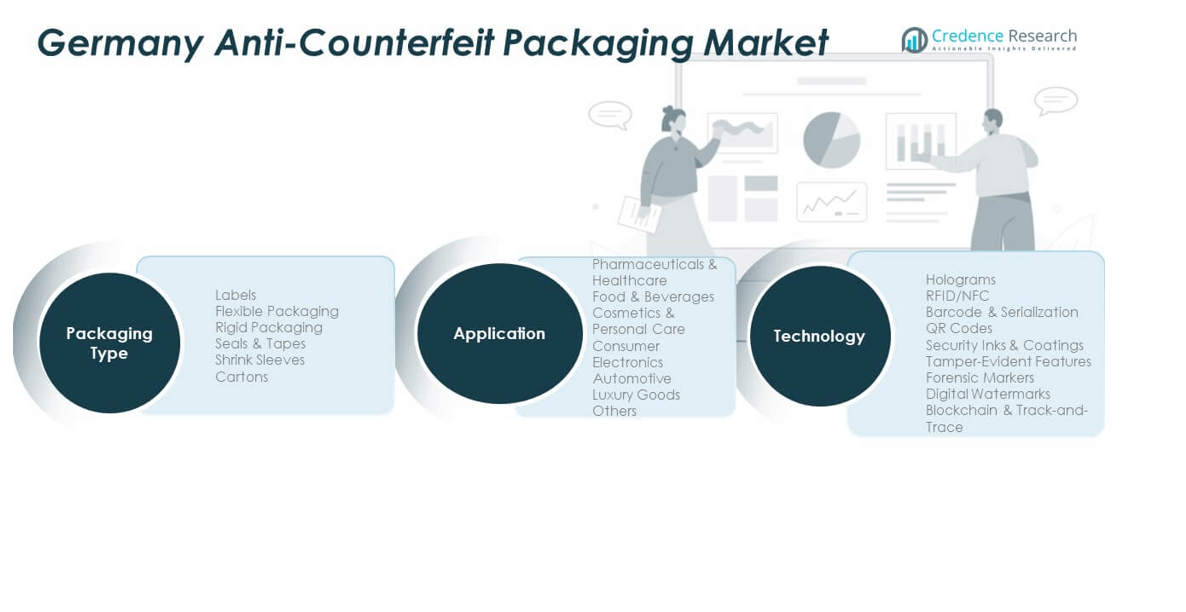

By Packaging Type

Labels dominate due to their versatility and compatibility with varied product categories. The Germany Anti-Counterfeit Packaging Market relies heavily on serialized labels to ensure traceability. Flexible packaging supports customization for consumer goods, while rigid formats serve industrial sectors needing tamper resistance. Seals and tapes enhance protection against unauthorized openings. Shrink sleeves enable complete surface branding and hidden codes. Cartons integrate RFID and barcodes for advanced multi-layer authentication.

- For instance, Schubert Group collaborated with CSL Behring AG in Germany on a compact pharmaceutical packaging system that bundles anti-counterfeit labelling with a process-stable colour-change varnish fully integrated into the MES.

By Application

Pharmaceuticals and healthcare lead adoption to prevent counterfeit drug circulation. Food and beverages implement smart labeling for freshness validation. Cosmetics and personal care brands deploy holographic foils for authenticity and aesthetic appeal. Consumer electronics use embedded chips for instant verification. Automotive and luxury sectors rely on serialization for supply chain assurance. Other sectors like logistics and retail invest in anti-tamper formats to maintain inventory trust.

By Technology

Holograms deliver high visual deterrence through layered optical structures. RFID and NFC allow real-time location tracking and smart authentication. Barcode and serialization remain scalable options for large-scale packaging runs. QR codes bridge digital engagement with consumer education. Security inks and coatings embed invisible identifiers for covert checks. Tamper-evident features reveal breach attempts instantly. Forensic markers and digital watermarks add advanced traceability across premium and regulated products.

- For technology, CCL Industries Inc. offers security solutions like tamper-evident films and covert optical variable devices used for anti-counterfeit packaging. Their forensic markers and embedded security features support invisible authentication methods crucial for high-value products in regulated sectors, with proven deployments in Germany and Europe’s pharmaceutical and cosmetics industries.

Segmentation

By Packaging Type

- Labels

- Flexible Packaging

- Rigid Packaging

- Seals & Tapes

- Shrink Sleeves

- Cartons

By Application

- Pharmaceuticals & Healthcare

- Food & Beverages

- Cosmetics & Personal Care

- Consumer Electronics

- Automotive

- Luxury Goods

- Others

By Technology

- Holograms

- RFID/NFC

- Barcode & Serialization

- QR Codes

- Security Inks & Coatings

- Tamper-Evident Features

- Forensic Markers

- Digital Watermarks

Regional Analysis

Dominance of Southern Germany with Industrial and Automotive Concentration

Southern Germany holds around 38% market share, driven by dense manufacturing and industrial activity across Bavaria and Baden-Württemberg. The Germany Anti-Counterfeit Packaging Market benefits from high adoption in automotive, engineering, and chemical sectors located in this region. It gains momentum through technology hubs like Munich and Stuttgart, where advanced labeling and serialization tools are integrated into supply systems. Major automotive suppliers use RFID and QR-enabled cartons to protect spare parts against counterfeiting. Pharmaceutical packaging facilities around Ulm and Nuremberg employ holographic features and tamper-evident seals to secure exports. Strong infrastructure and export orientation further solidify Southern Germany’s leadership in anti-counterfeit packaging innovation.

Strong Presence of Western Germany Driven by Pharmaceuticals and Logistics

Western Germany accounts for about 32% market share, supported by thriving pharmaceutical and logistics industries centered around North Rhine-Westphalia and Hesse. The region’s dense transport network promotes secure traceability standards for medical and consumer goods. The Germany Anti-Counterfeit Packaging Market expands here due to presence of packaging giants and labeling specialists serving both domestic and EU markets. Cologne and Frankfurt emerge as central nodes for supply chain traceability software and RFID development. It benefits from continuous investments by logistics firms in packaging visibility and secure product flow. The strong export corridor to Benelux nations ensures ongoing demand for authentication technologies.

Rising Potential of Northern and Eastern Germany with Emerging Innovation Hubs

Northern and Eastern Germany collectively contribute around 30% market share, showing growing adoption in electronics, food, and FMCG sectors. The Germany Anti-Counterfeit Packaging Market gains traction from technology clusters in Berlin, Hamburg, and Dresden, where digital watermarking and forensic ink research advance. Food exporters in Hamburg utilize QR-coded packaging to maintain traceability for cross-border shipments. Eastern regions attract packaging start-ups focusing on sustainable holographic materials and biodegradable coatings. Government-backed innovation programs in Brandenburg support digital labeling pilot projects. The rising focus on regional compliance and consumer protection strengthens growth across these subregions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Germany Anti-Counterfeit Packaging Market features a competitive landscape defined by technology integration and specialization. Leading participants include SICPA Holding SA, Avery Dennison Corporation, CCL Industries, 3M Company, Zebra Technologies, Authentix Inc., and Tesa SE. These companies focus on advanced labeling, serialization, and RFID-enabled packaging to serve pharmaceutical, food, and automotive clients. It maintains strong innovation momentum through collaboration with digital security and printing solution providers. German packaging converters invest in R&D for tamper-proof cartons and interactive smart labels. Startups enter the market with blockchain and cloud-based authentication tools that enhance accessibility for mid-sized manufacturers. Key players differentiate through scalable traceability systems, eco-friendly material choices, and robust technical support. Continuous mergers and strategic alliances shape a dynamic ecosystem favoring technology-driven anti-counterfeit solutions.

Recent Developments

- In November 2024, Ennoventure, a leader in AI brand protection, secured funding of $8.9 million for expanding its AI-powered anti-counterfeiting technology, which is expected to influence the German market significantly.

- In September 2024, kdc/one completed the acquisition of an Italian packaging specialist (S.r.l.) focused on cosmetics packaging to enhance its anti-counterfeit offerings in beauty and personal care.

- In April 2024, Avery Dennison Corporation announced the expansion of its AD Pure range of inlays and tags which are entirely plastic-free and utilize antenna manufacturing technology applied directly on paper

Report Coverage

The research report offers an in-depth analysis based on packaging type, application, and technology segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing focus on supply chain transparency will drive large-scale adoption of digital traceability systems.

- Increasing deployment of RFID and NFC technologies will enhance real-time product verification.

- Rising demand from pharmaceuticals and luxury sectors will sustain steady expansion across Germany.

- E-commerce growth will amplify the need for tamper-evident and smart packaging formats.

- Cloud-based monitoring solutions will simplify implementation for mid-sized manufacturers.

- Strong regulatory enforcement will push compliance-driven innovation in labeling and serialization.

- Investments in sustainable security materials will align anti-counterfeit practices with green policies.

- Integration of AI-enabled inspection tools will improve counterfeit detection accuracy.

- Strategic collaborations between tech providers and converters will strengthen domestic manufacturing capacity.

- Broader consumer engagement through QR-enabled authentication will reinforce brand trust and market stability.