Market Overview:

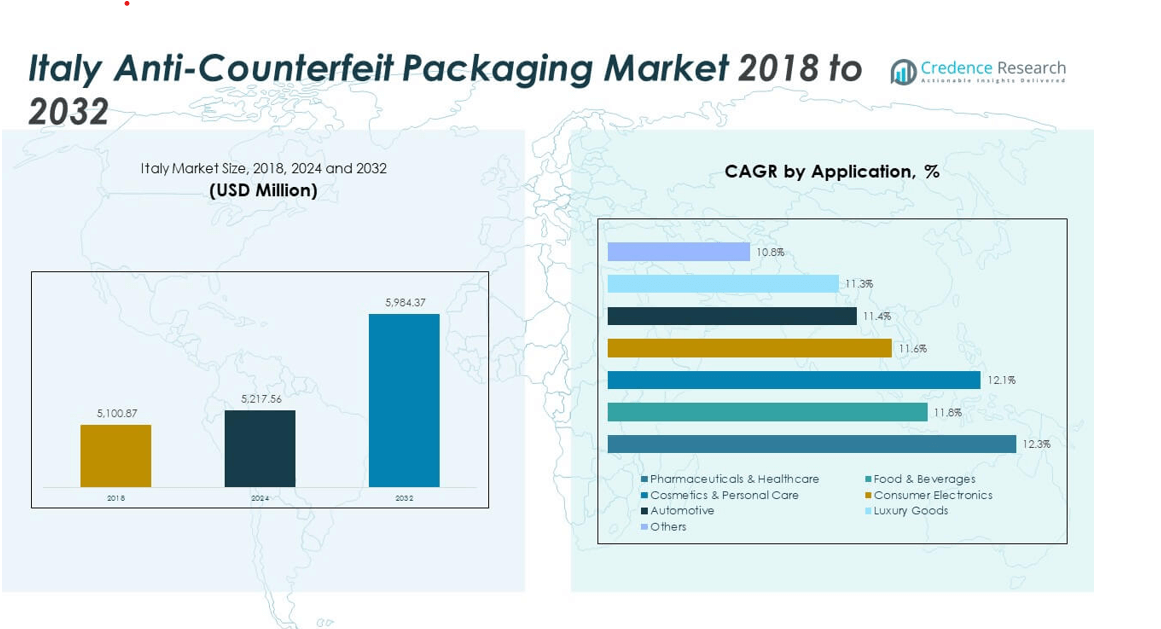

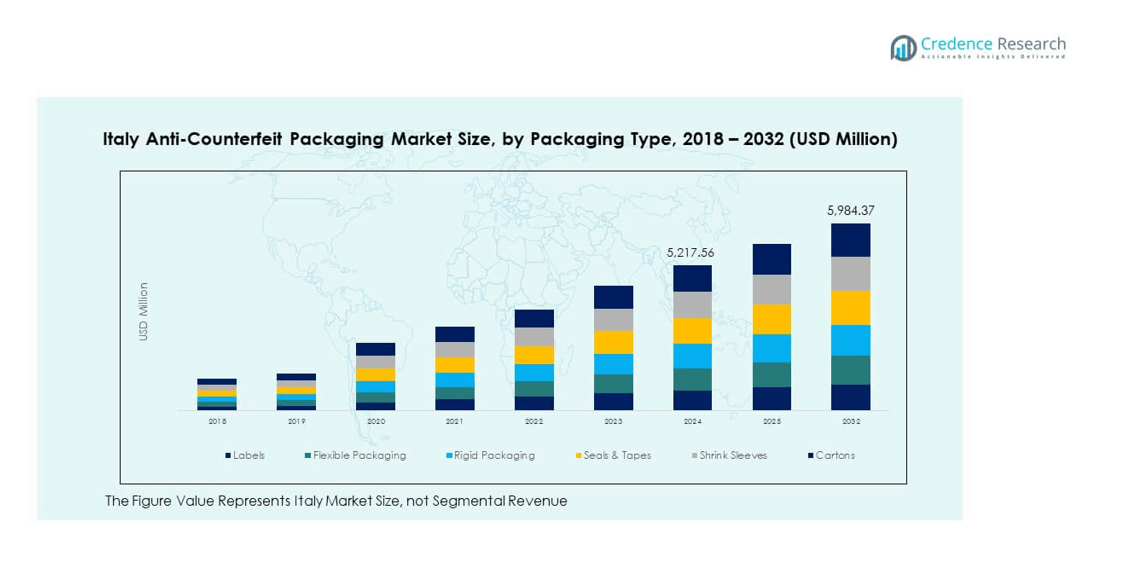

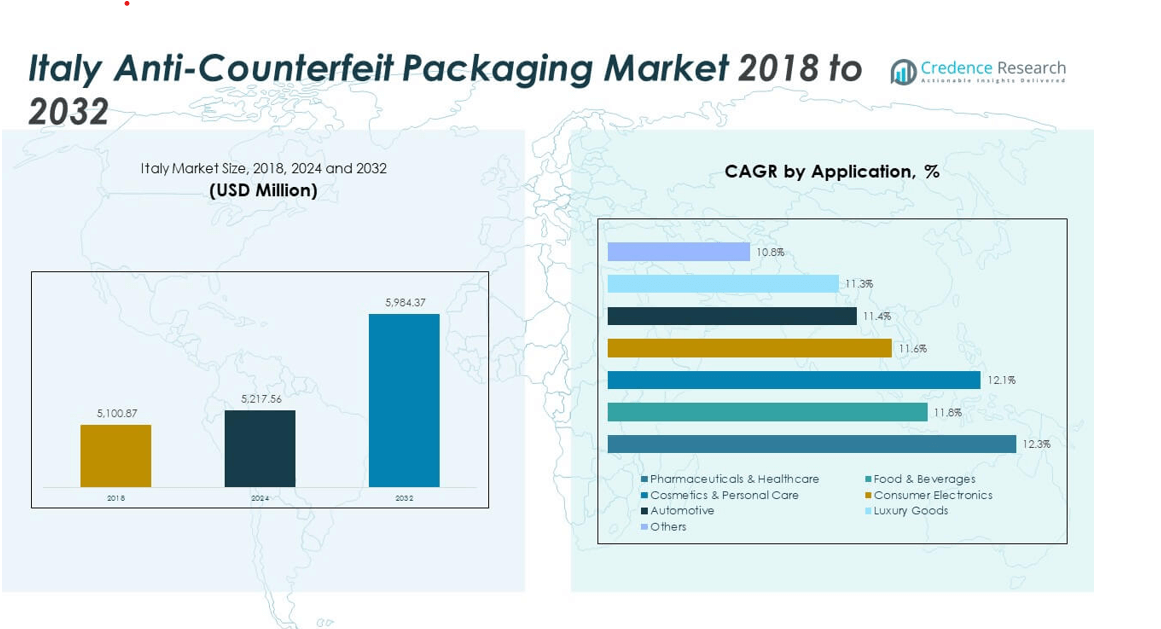

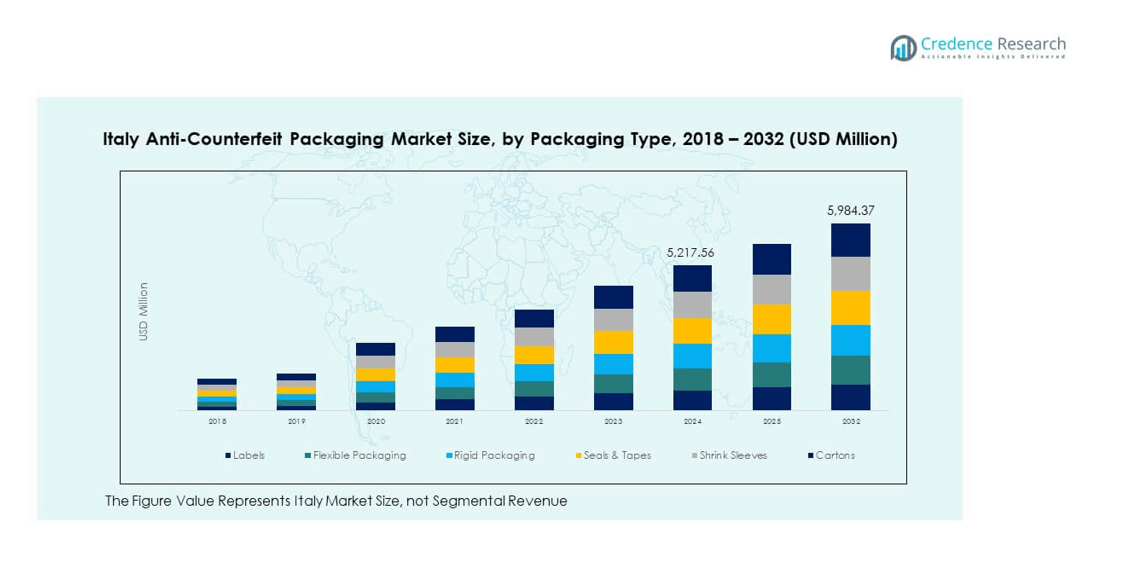

The Italy Anti-Counterfeit Packaging Market size was valued at USD 5,100.87 million in 2018 to USD 5,217.56 million in 2024 and is anticipated to reach USD 5,984.37 million by 2032, at a CAGR of 1.73% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Anti-Counterfeit Packaging Market Size 2024 |

USD 5,217.56 million |

| Italy Anti-Counterfeit Packaging Market, CAGR |

1.73% |

| Italy Anti-Counterfeit Packaging Market Size 2032 |

USD 5,984.37 million |

Growing counterfeit threats across pharmaceuticals, luxury goods, and consumer electronics compel manufacturers to adopt secure packaging. Italian firms deploy serialization, RFID/NFC tags, and covert markers to protect brand integrity. Stringent European regulations drive compliance investments and traceability systems. Rising consumer demand for authenticity creates pressure on supply chains to be transparent and verifiable. E-commerce growth increases exposure to fake goods and forces packaging innovation for online retail. Collaboration among brands, technology providers, and enforcement agencies strengthens the ecosystem for secure solutions.

Northern Italy leads due to established manufacturing hubs, luxury-goods exporters, and advanced logistics networks driving high adoption of anti-counterfeit technologies. Central Italy is emerging rapidly through growing e-commerce, consumer goods production, and packaging SMEs integrating smart labels and traceability. Southern Italy and the islands are gaining pace by leveraging export-oriented food, beverage, and artisan goods industries that require secure packaging to meet global standards and protect authenticity.

Market Insights

- The Italy Anti-Counterfeit Packaging Market was valued at USD 5,100.87 million in 2018, reached USD 5,217.56 million in 2024, and is projected to reach USD 5,984.37 million by 2032, expanding at a CAGR of 1.73%.

- Northern Italy commands about 47% share, supported by industrial hubs and high-tech packaging integration across luxury and pharmaceutical sectors.

- Central Italy holds approximately 31% share, driven by growth in e-commerce, printing technologies, and secure packaging for consumer and healthcare products.

- Southern Italy and Islands collectively represent around 22% share, emerging as the fastest-growing region due to export-led food, wine, and artisan goods requiring advanced traceability.

- By segment, Labels lead with around 32% share, followed by Flexible Packaging at 24%, reflecting strong adoption for serialization, QR codes, and tamper-evident applications across industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Counterfeit Threats in High-Value Sectors Stimulating Security Packaging Demand

The Italy Anti-Counterfeit Packaging Market expands due to persistent threats across pharmaceuticals, cosmetics, and luxury goods. Manufacturers strengthen protection systems to secure brand equity and prevent revenue loss. Regulatory frameworks enforce strict serialization norms and tamper-proof labeling. Brands invest in multi-layered authentication such as holographic seals and forensic inks. Growing awareness among consumers enhances adoption of secure packaging formats. The rise in counterfeit incidents across online retail accelerates innovation in traceable materials. Companies introduce advanced QR codes for end-user verification. It continues to gain attention from authorities emphasizing consumer safety and product integrity.

Pharmaceutical Sector Enforcement Driving Widespread Serialization Adoption

Italy enforces robust compliance standards under EU Falsified Medicines Directive. Pharmaceutical firms integrate serialization and data matrix codes across production lines. These systems ensure full tracking from factory to patient, improving authenticity checks. Global supply chains rely on these features to maintain product visibility. Compliance with national authorities drives continuous innovation in code management platforms. Software-enabled tracking enhances warehouse accuracy and batch monitoring. Local packaging companies expand partnerships with healthcare brands for secure labeling. It benefits from the nation’s emphasis on traceability in regulated drug markets.

Luxury Goods and Fashion Industry Boosting Smart Label Deployments

Luxury and fashion exports contribute significantly to the demand for security features. Italian brands use embedded NFC chips and tamper-evident labels to ensure originality. Retailers use blockchain-based product passports to link authenticity with ownership history. Counterfeit accessories and apparel push investment in advanced tracking solutions. These innovations protect heritage brands from imitation and parallel trade. Adoption of digital verification enables buyers to scan and confirm authenticity. Smart packaging increases consumer engagement through unique digital experiences. It strengthens its position as a trusted market for premium goods security.

- For instance, in the luxury goods sector, LVMH Group, owner of Louis Vuitton, has publicly showcased the use of NFC-enabled smart packaging that consumers scan to verify authenticity. LVMH’s blockchain initiatives for product passports linking goods to ownership history are verified by their corporate sustainability and innovation reports.

E-Commerce and Cross-Border Trade Supporting Digital Verification Technologies

Growth in e-commerce platforms drives need for secure packaging to prevent fake listings. Online channels require faster authentication tools for imported and domestic goods. Companies introduce serialized barcodes and invisible ink identifiers for better traceability. Import regulations ensure packages meet verified labeling standards before retail entry. The expansion of logistics networks enhances packaging traceability across supply chains. Real-time verification through smartphone apps improves consumer confidence. Partnerships between logistics and technology providers support innovation in secure delivery systems. It maintains strong potential in cross-border product authentication frameworks.

- For example, Avery Dennison has been recognized for integrating serialized barcode labels with invisible ink identifiers in its secure labeling solutions used by multinational brands in Europe, including Italy. Their patent-protected secure RFID and barcode technologies support online retail authentication and logistics traceability to combat counterfeits.

Market Trends

Integration of Blockchain Technology for Transparent Supply Chains

Brands across Italy integrate blockchain platforms to enhance traceability and transparency. The distributed ledger allows stakeholders to record every transaction securely. It prevents alteration or duplication of product origin details. Luxury and pharmaceutical sectors leverage blockchain for end-to-end authenticity assurance. QR-enabled verification connects customers directly with trusted databases. Startups collaborate with established manufacturers to build interoperable verification networks. Technology providers focus on simplifying integration with existing packaging lines. The market benefits from blockchain’s role in reducing verification time and manual audits.

- For instance, Pfizer participates in the MediLedger Project, a blockchain-based initiative developed with Chronicled to meet U.S. Drug Supply Chain Security Act (DSCSA) requirements. The system enhances drug serialization and verification processes, improving traceability and preventing counterfeit medicines within the regulated pharmaceutical supply chain.

Increased Use of Smart Labels and Embedded Sensors for Real-Time Tracking

Smart labels equipped with RFID and NFC enable instant data capture and verification. Businesses track product location, storage condition, and authenticity in real-time. This digital evolution promotes efficiency in logistics and retail operations. Connected packaging supports predictive maintenance and reduces losses in transit. Italy’s manufacturers integrate sensors to monitor high-value pharmaceutical and fashion goods. Retailers use cloud-based dashboards for inventory and theft prevention. Consumers access detailed origin data through interactive scanning. It progresses toward more automated packaging ecosystems linking physical and digital layers.

- For instance, OTB Group, the Italian fashion conglomerate behind Diesel and Marni, integrates blockchain registration and NFC-enabled digital IDs within apparel to authenticate products and provide transparency on materials and production processes. These smart tags allow customers to verify originality and access detailed garment information directly through connected devices.

Growing Preference for Eco-Secure and Sustainable Anti-Counterfeit Solutions

Sustainability influences the design of anti-counterfeit materials in Italy. Producers adopt biodegradable holograms and recyclable inks for lower environmental impact. Brands balance eco-friendly objectives with high security performance. Governments encourage greener innovation to align with EU packaging directives. Security printers develop compostable labels containing digital identifiers. Biopolymer substrates replace synthetic laminates while retaining tamper resistance. Retailers promote eco-verified packaging to attract environmentally aware consumers. It supports a sustainable shift where authenticity meets environmental responsibility.

Expansion of AI and Machine Vision in Authentication and Quality Control

AI-driven inspection tools gain traction in industrial packaging lines. Machine vision detects micro defects, misprints, and fake identifiers instantly. Automated systems improve accuracy and speed over manual inspection. Manufacturers deploy algorithms trained on real product signatures for validation. Integration with ERP systems enhances compliance tracking. Advanced cameras verify serial numbers at high-speed production lines. Real-time analytics identify anomalies and improve packaging reliability. It benefits from increasing digitalization of inspection processes in manufacturing facilities.

Market Challenges Analysis

High Implementation Costs and Integration Barriers Limiting Adoption Among SMEs

The Italy Anti-Counterfeit Packaging Market faces hurdles from high technology and setup costs. Small and medium firms find serialization, holography, and digital tracking expensive. Integrating new machinery with legacy production systems remains difficult. Lack of technical expertise increases dependence on external service providers. Long return-on-investment cycles discourage fast adoption across traditional industries. Equipment maintenance and software upgrades create recurring financial burdens. Limited awareness about total cost efficiency hinders transition toward smart packaging. It continues to face pressure balancing compliance and cost efficiency for small players.

Fragmented Supply Chains and Counterfeit Penetration Across Online Markets

Widespread counterfeit entry through e-commerce and parallel imports challenges enforcement. Fragmented supply chains complicate tracking across multiple intermediaries. Verification gaps occur in repackaging or third-party logistics centers. Limited cross-platform data sharing weakens visibility between brands and customs authorities. Fake labeling technologies become sophisticated and difficult to detect visually. Consumers often lack tools to verify authenticity independently. Weak synchronization between regulatory bodies reduces response speed against fake products. It experiences growing demand for unified platforms that integrate trade and security data.

Market Opportunities

Rising Investments in Digital Authentication Startups and Innovation Ecosystems

Italy attracts technology investors focusing on traceability and smart packaging. Startups introduce cloud-based verification tools and encrypted digital identities. Partnerships between research institutions and packaging firms drive innovation. Government funding supports pilot programs for blockchain and IoT-enabled packaging. The market benefits from collaboration between security printers and digital firms. Local production hubs experiment with integrated serialization embedded at printing stage. It leverages its innovation network to develop scalable, export-ready solutions.

Expansion in Luxury, Food, and Pharmaceutical Exports Driving Secure Packaging Demand

Export-oriented sectors present major potential for anti-counterfeit packaging deployment. International buyers prefer verified supply chains from trusted Italian manufacturers. High-value goods such as cosmetics and gourmet foods demand authenticity certification. Regulatory alignment with global standards enhances acceptance of Italian products abroad. Packaging producers invest in advanced inks, holograms, and traceability codes for exports. Brand reputation protection remains a strategic focus for exporters. It continues to explore security-led competitiveness in global markets.

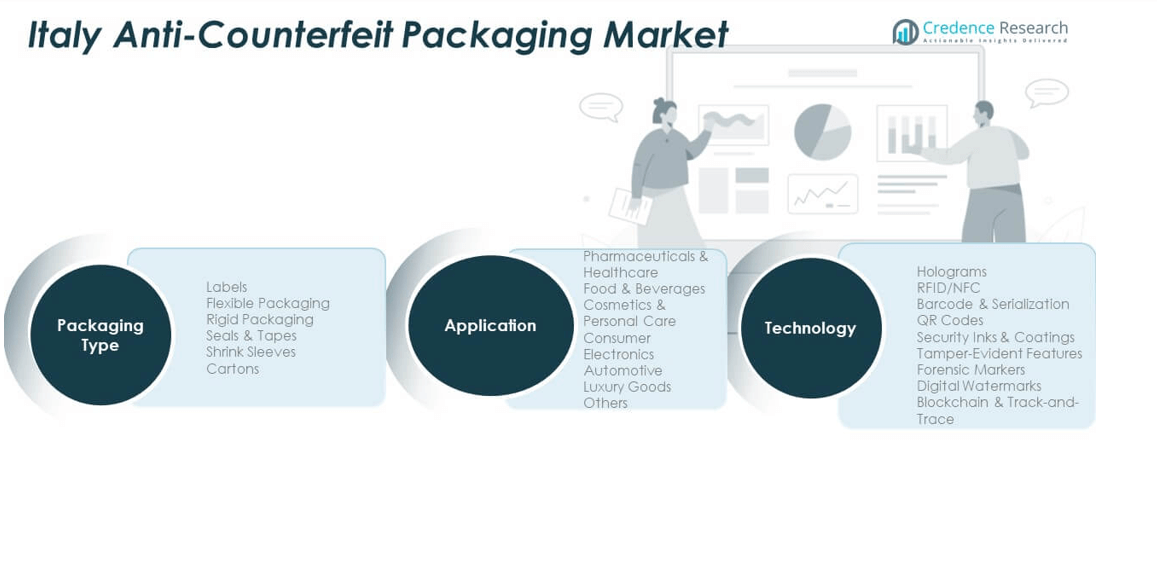

Market Segmentation Analysis

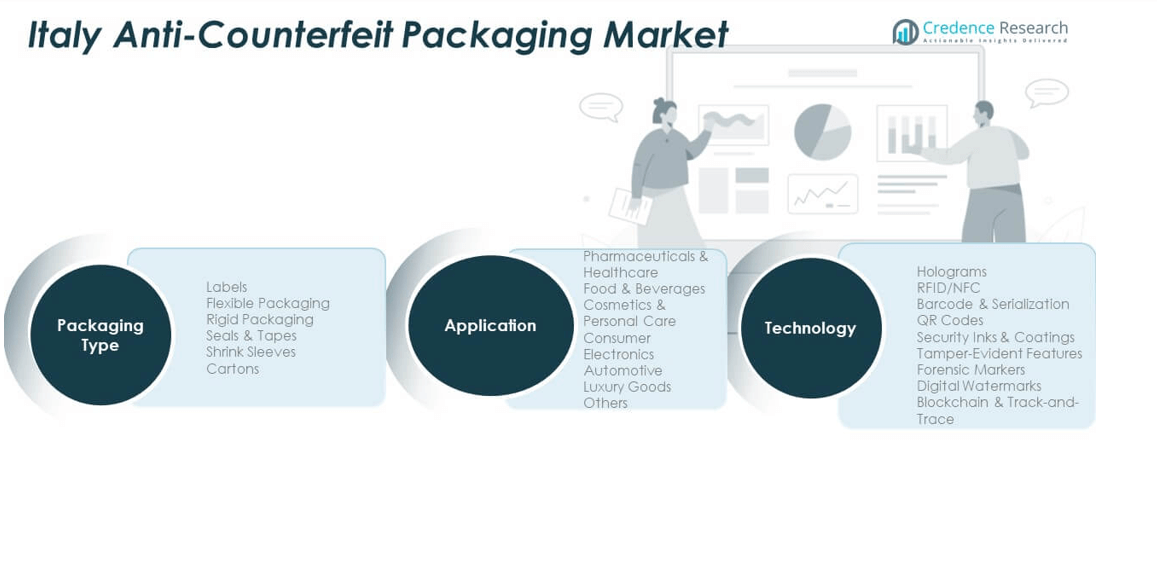

By Packaging Type

Labels dominate the market due to wide adaptability and cost efficiency. Flexible packaging gains traction for customizable designs and lightweight properties. Rigid packaging supports premium products demanding tamper-proof resistance. Seals and tapes ensure quick identification of unauthorized openings in logistics. Shrink sleeves integrate branding with hidden authenticity layers for retail visibility. Cartons embed RFID tags and printed codes to enhance tracking. The Italy Anti-Counterfeit Packaging Market benefits from multi-layered protection within these categories.

- For example, Avery Dennison’s Fasson® AT20 adhesive label is verified for a service temperature range from -65°F to +200°F (-54°C to +93°C). It shows durable adhesion on surfaces like stainless steel and treated HDPE with peel adhesion values between 2.2 to 3.0 lbs. Its adhesive is FDA-compliant (FDA 175.105) and ideal for cold storage warehouse labeling applications, proving extreme environment adaptability and cost-efficient labeling solutions in flexible packaging and other label uses.

By Application

Pharmaceuticals and healthcare lead due to strict traceability and patient safety norms. Food and beverage brands adopt verification tools to maintain hygiene compliance. Cosmetics and personal care use holographic foils for brand differentiation. Consumer electronics employ NFC tags and digital labels for rapid scanning. Automotive parts require serialization to verify component originality. Luxury goods maintain strong use for authenticity validation. Other sectors explore advanced labeling to strengthen distribution security.

By Technology

Holograms remain widely accepted for visible authentication and consumer trust. RFID/NFC provides digital connectivity for real-time tracking and verification. Barcode and serialization enable batch-level traceability across supply chains. QR codes empower consumers to confirm product legitimacy through smartphones. Security inks and coatings add covert layers for forensic testing. Tamper-evident features ensure packaging integrity after shipment. Forensic markers and digital watermarks advance hidden protection standards. It maintains dynamic technological diversity supporting scalable security solutions.

- For example, Avery Dennison’s aluminum foil thermal transfer label “Alu Tag 175 White TOP” is engineered for extreme environments, withstands temperatures up to 550°C without compromising barcode readability. This product is used for hot metal tracking in industrial environments, showcasing advanced technology in tamper-evident, heat-resistant labels with thermal print fixation for forensic-level durability.

Segmentation

By Packaging Type

- Labels

- Flexible Packaging

- Rigid Packaging

- Seals & Tapes

- Shrink Sleeves

- Cartons

By Application

- Pharmaceuticals & Healthcare

- Food & Beverages

- Cosmetics & Personal Care

- Consumer Electronics

- Automotive

- Luxury Goods

- Others

By Technology

- Holograms

- RFID/NFC

- Barcode & Serialization

- QR Codes

- Security Inks & Coatings

- Tamper-Evident Features

- Forensic Markers

- Digital Watermarks

Regional Analysis

Northern Italy Dominating with Established Industrial Hubs and Luxury Manufacturing Base

Northern Italy holds around 47% share of the Italy Anti-Counterfeit Packaging Market, supported by strong industrial clusters and advanced technology adoption. Lombardy, Veneto, and Emilia-Romagna host large pharmaceutical and packaging manufacturing units that integrate serialization and smart labeling systems. High export activities in Milan and Turin encourage adoption of premium security packaging for cosmetics and luxury goods. Investments in RFID-enabled logistics and traceable supply chains further strengthen regional competitiveness. Local innovation centers and compliance-driven production ensure a consistent demand for tamper-proof and trackable materials. It benefits from well-developed infrastructure and close collaboration between technology firms and regulatory bodies.

Central Italy Expanding Through Growing E-Commerce and Specialty Packaging Adoption

Central Italy accounts for around 31% of the national market, driven by rapid growth in e-commerce fulfillment and specialty packaging activities. Regions such as Tuscany and Lazio record increased implementation of anti-counterfeit features across retail and consumer products. The rise of online luxury and personal care sales creates higher demand for authentication labels and QR-based tracking systems. Printing and packaging SMEs in Florence and Rome collaborate with brand owners to integrate covert markers and digital watermarks. Pharmaceutical and healthcare sectors in this zone rely on data-rich packaging to ensure traceability from production to patient delivery. It continues to expand through modernized logistics and rising awareness among digital retailers.

Southern Italy and Islands Gaining Momentum Through Export-Oriented Packaging Networks

Southern Italy and the islands collectively represent about 22% share, showing steady improvement through export-oriented packaging developments. Campania, Apulia, and Sicily leverage agricultural and food exports to introduce secure traceability systems. Local firms adopt serialized barcodes and tamper-evident packaging to comply with European food safety and labeling laws. The focus on protecting regional specialty products, such as wines and gourmet foods, drives authentication innovation. Support from regional programs encourages adoption of blockchain-based tracking and smart labeling. It progresses toward higher market participation as awareness and technological capabilities improve across small producers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Marchesini Group S.p.A.

- Leonhard Kurz Stiftung & Co. KG (Kurz)

- Tesa Scribos GmbH

- Arca Etichette S.p.A.

- Arvato Systems GmbH

- Atlantic Zeiser GmbH

- Schreiner Group GmbH & Co. KG

- Avery Dennison Corporation

- CCL Industries Inc.

- SICPA Holdings SA

- U-NICA Group AG

- 3M Company

- Authentix Inc.

- UPM Raflatac Oy

- Securikett Ulrich & Horn GmbH

Competitive Analysis

The Italy Anti-Counterfeit Packaging Market features a balanced mix of global leaders and specialized local firms offering authentication technologies. Key participants include CCL Industries Inc., Avery Dennison Corporation, SICPA Holdings SA, U-NICA Group, 3M Company, Authentix Inc., and Schreiner Group GmbH & Co. KG. Domestic firms collaborate with these global providers to implement localized traceability solutions for pharmaceuticals, luxury goods, and consumer products. Competition focuses on cost-effective smart labels, eco-secure materials, and real-time data integration. Players emphasize partnerships with regulatory authorities to ensure compliance and secure data exchange frameworks. Research investment targets expansion of RFID/NFC and digital watermark solutions suited to Italian manufacturing environments. It maintains strong rivalry centered around innovation speed, customization ability, and sustainability alignment within brand protection strategies.

Recent Developments

- In September 2024, kdc/one completed the acquisition of an Italian packaging specialist (S.r.l.) focused on cosmetics packaging to enhance its anti-counterfeit offerings in beauty and personal care.

- In April 2024, Avery Dennison Corporation announced the expansion of its AD Pure range of inlays and tags which are entirely plastic-free and utilize antenna manufacturing technology applied directly on paper.

Report Coverage

The research report offers an in-depth analysis based on packaging type, application, and technology segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising regulatory compliance across pharmaceuticals and luxury goods will strengthen adoption of advanced authentication technologies.

- Integration of blockchain and IoT will transform traceability and data transparency across packaging networks.

- Demand for eco-secure packaging materials will grow, aligning sustainability with anti-counterfeit innovation.

- Automation in smart labeling and digital watermarking will improve speed and accuracy in production.

- Increased collaborations between technology startups and established packaging firms will drive product innovation.

- Expansion of e-commerce channels will elevate demand for serialized and tamper-evident packaging solutions.

- Artificial intelligence in inspection systems will enhance real-time detection of counterfeit packaging anomalies.

- Export-focused industries will prioritize authentication to maintain brand credibility in global trade.

- Rising consumer awareness of authenticity and safety will reshape buying preferences in retail markets.

- Strategic partnerships with European compliance agencies will ensure broader standardization across industries.