Market Overview:

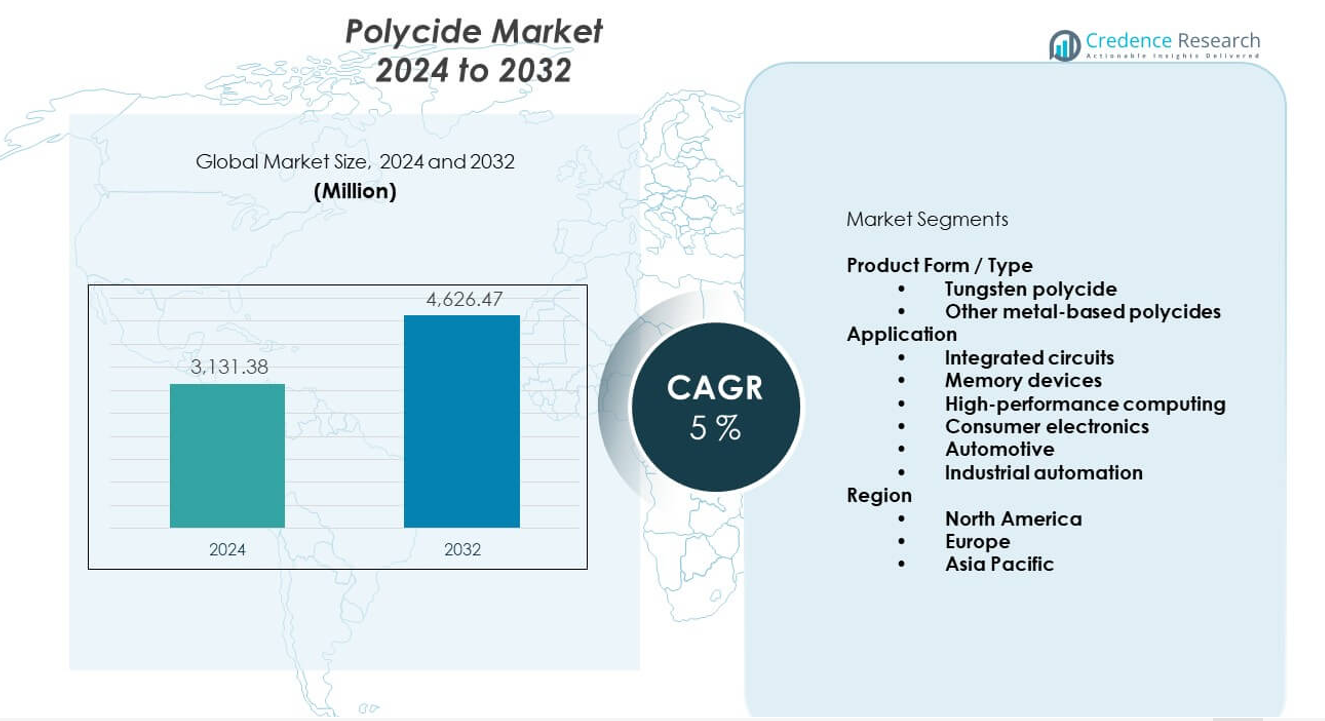

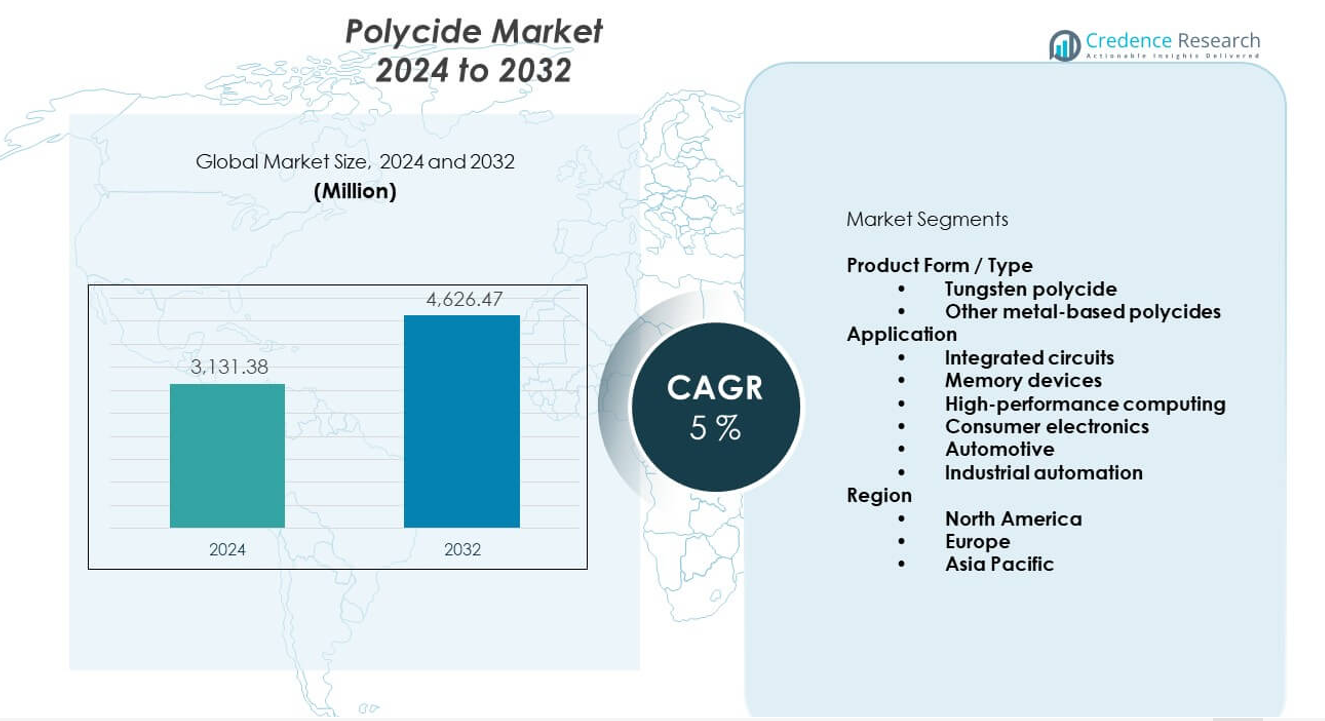

The Polycide market is projected to grow from USD 3131.38 million in 2024 to USD 4626.47 million by 2032, with a CAGR of 5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polycide Market Size 2024 |

USD 3131.38 million |

| Polycide Market, CAGR |

5% |

| Polycide Market Size 2032 |

USD 4626.47 million |

The market gains steady traction due to rising use of polycide layers in semiconductor structures. Manufacturers adopt polycide for stable resistance control and better gate performance. Strong use across memory and logic devices pushes producers to improve deposition quality. Chipmakers focus on reliable materials that support shrinking node sizes. It benefits from broad demand in advanced microelectronics where uniform conductivity is essential. Growth in fabrication units strengthens global consumption. Technology upgrades across the supply chain keep adoption steady.

Regional growth remains strong in Asia Pacific because of dense semiconductor fabrication activity in countries with large chip foundries. North America maintains high adoption due to long-standing leadership in integrated circuit design and strong investment in process advancement. Europe shows stable progress driven by industrial electronics and automotive chip demand. Emerging markets in Southeast Asia build capacity as new fabrication plants expand. Middle East regions focus on entry-level manufacturing support. Latin America shows early adoption as local electronics production rises.

Market Insights:

- The Polycide market is valued at USD 3131.38 million in 2024 and is projected to reach USD 4626.47 million by 2032, growing at a 5% CAGR driven by rising semiconductor fabrication needs.

- Asia Pacific leads with 38% share, followed by North America at 32% and Europe at 24%, supported by strong fabrication density, advanced design ecosystems, and steady industrial electronics demand.

- Asia Pacific remains the fastest-growing region with its 38% share, driven by expanding foundry capacity and increasing production of logic, memory, and consumer electronics.

- Integrated circuits hold the largest application share at about 40%, led by high demand in computing and consumer electronics.

- Tungsten polycide leads the product segment with about 55% share, supported by strong thermal stability and reliable resistance performance across advanced nodes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Advanced Semiconductor Gate Materials

The Polycide market grows due to strong use of polycide layers in advanced transistor structures. Fabrication units rely on these layers to maintain controlled sheet resistance in shrinking gate designs. It supports stable performance in memory and logic devices that now require tighter electrical tolerance. Foundries deploy polycide in high-volume production to secure predictable current flow. Leading chipmakers invest in improved silicide formation to limit variability. Stable thermal endurance strengthens adoption across advanced CMOS lines. Producers refine deposition steps to support higher density wafers. Growing reliance on miniaturised nodes boosts overall demand.

- For instance, TSMC disclosed that cobalt-based contacts used in its 7nm process reduced contact resistance by over 50%, improving current flow and resistance control in dense transistor layouts (TSMC Technology Symposium data).

Rapid Growth in Logic and Memory Manufacturing Expansion

Global expansion in DRAM, NAND, and microprocessor lines drives larger consumption of polycide structures. Modern fabs require uniform gate materials to handle faster switching speeds. It enables reduced RC delays across devices that operate at higher frequencies. Strong investment in AI, 5G, and cloud hardware lifts wafer output. Memory producers use polycide for maintaining durability in repeated cycles. Logic manufacturers adopt stable materials to lower leakage in high-performance chips. Fabrication plants upgrade tools to improve silicide thickness control. The steady rise of data infrastructure supports stronger uptake.

- For instance, Samsung confirmed that its 14nm EUV-enabled DRAM enhanced overall wafer productivity by approximately 20% and reduced power consumption by nearly 20% compared to the previous generation, a feat documented in official Samsung newsroom announcements.

Increased Shift Toward High-Performance Device Architectures

Semiconductor companies adopt device structures where polycide enhances conductivity across narrow gate widths. It helps maintain predictable behaviour in transistors with dense layouts. Producers aim for materials that tolerate advanced etch steps and thermal cycles. The push for powerful chipsets in mobile and computing systems boosts adoption. Foundries integrate new silicide chemistries to stabilise resistance at lower dimensions. It forms part of key process modules required for next-generation nodes. Device engineers rely on polycide to meet strict performance targets. Adoption strengthens as more products migrate to compact designs.

Stronger Investment in Fabrication Technology Upgrades

Global fabrication hubs allocate significant budgets to improve front-end process tools. It aligns with demand for precise silicide formation that supports long-term device reliability. Adoption rises in fabs with aggressive roadmaps for scaling. Equipment makers develop deposition and annealing solutions to optimise polycide layers. Semiconductor firms focus on material stacks that enable stable performance under high thermal stress. It improves uniformity, which remains critical in mass production. Upgraded inspection systems enhance defect detection across polycide regions. Expanding technological capability reinforces market growth.

Market Trends:

Growing Integration of Polycide in Next-Generation Transistor Nodes

The Polycide market observes strong integration in nodes targeting higher speed and lower power. Manufacturers introduce improved silicide processes to support thinner gate structures. It gains traction in devices pushing frequency limits. New transistor designs require uniform resistance across compact gate lengths. Foundries evaluate hybrid approaches that combine polycide with advanced materials. High-performance computing growth increases demand for reliable gate stacks. Engineers test new silicide refinement techniques to reduce variability. These shifts strengthen long-term adoption.

- For instance, Intel reported that its 10nm process introduced cobalt (Co) interconnects for the lowest two metal layers (M0 and M1) to significantly lower line and via resistance, as well as improve electromigration reliability.

Expansion of Automation and Precision Process Control

Automation in semiconductor lines drives better control over deposition and annealing steps. It helps minimise fluctuation in silicide thickness and uniformity. Intelligent process monitoring tools refine polycide quality at scale. Advanced metrology systems detect deviations earlier. It supports stringent control in fabs producing high-value chips. Demand for machine-learning-based process tuning grows. Fabrication centres pursue continuous optimisation to meet tighter design rules. The trend enhances production efficiency.

Increasing Use of Hybrid Material Stacks

Producers test hybrid stacks that combine polycide with improved dielectric layers. It helps manage electrical behaviour in devices requiring low resistance paths. Research teams examine new material chemistries to extend endurance. Foundries explore innovative silicide-plus-polysilicon blends for high-density circuits. It aligns with industry moves toward more specialised chip designs. Hybridisation aims to reduce parasitic effects in scaled nodes. Adoption expands as new devices demand enhanced gate uniformity. This trend pushes continuous R&D growth.

Rising Focus on Process Sustainability and Resource Efficiency

Global fabs push sustainability within high-volume manufacturing. It encourages low-waste process flows in silicide formation. Producers refine chemical use to reduce environmental load. Improved furnace systems lower power use during annealing. It supports corporate targets for greener semiconductor production. Leading fabs track resource consumption during polycide processing. Upgraded material-handling systems reduce loss and defect risks. Sustainability concerns shape long-term process strategies.

Market Challenges:

Complex Process Integration Across Shrinking Semiconductor Nodes

The Polycide market faces pressure due to demanding process requirements in smaller geometries. Integration challenges increase when gate widths shrink and tolerances tighten. It becomes harder to maintain uniform silicide formation across full wafers. Variability risks increase with aggressive patterning. Strong control systems are required to prevent resistance drift. Fabs must invest heavily in metrology to validate each step. Rising complexity raises overall cost of ownership. This pressure limits adoption for smaller manufacturers.

High Dependency on Capital-Intensive Fabrication Infrastructure

Polycide implementation requires advanced deposition, etching, and annealing equipment. It restricts adoption to fabs with strong financial resources. Upgraded tools carry high maintenance needs. Producers must allocate budgets for process monitoring systems. It becomes challenging for emerging regions to scale quickly. Skilled workforce shortages complicate process stability. Strict reliability requirements increase operational demands. These factors collectively slow expansion speed.

Market Opportunities:

Rising Expansion of Global Foundry Capacity for Advanced Chip Production

The Polycide market benefits from new foundry projects across Asia, North America, and Europe. High-performance chips for AI, automotive, and communication systems require stable gate materials. It creates openings for suppliers offering refined silicide technology. New plants focus on nodes where polycide enhances device reliability. Manufacturers test advanced annealing solutions to improve scalability. Wider fabrication footprints increase sourcing demand. This expansion strengthens long-term growth prospects.

Growing Use in Specialised and High-Value Semiconductor Applications

Specialised devices for sensors, industrial electronics, and medical equipment require precise gate control. It supports markets where reliability remains essential. Producers deploy polycide to ensure stable performance under varied operating conditions. Demand rises for devices with long service life. New designs in power electronics encourage adoption of advanced gate materials. Opportunities grow for suppliers offering tailored material stacks. These applications help diversify market reach.

Market Segmentation Analysis:

Product Form / Type

The Polycide market gains strong demand from tungsten polycide due to its stable resistance control and reliable performance in scaled devices. Tungsten-based layers support high-temperature endurance, which strengthens their role in advanced gate structures. It remains the preferred choice for fabs producing high-density logic and memory chips. Other metal-based polycides hold a steady share where specialised performance or unique compatibility is required. These materials support device designs that target specific conductivity or thermal behaviour. Producers refine metal chemistries to improve uniformity across wafers. The segment benefits from continuous innovation in front-end semiconductor processing. Strong adoption across new fabrication lines keeps demand stable.

- For instance, Lam Research confirmed that its etch platforms using the Hydra® uniformity system achieved sub-1nm critical-dimension uniformity across 300mm wafers, supporting resistance stability in advanced gate formation, as stated in Lam Research’s official process technology updates.

Application

Integrated circuits hold a dominant share due to broad use across consumer and industrial systems. The segment grows with rising need for efficient transistor behaviour in compact layouts. Memory devices adopt polycide to secure consistent resistance during repeated cycles. It supports reliable operation in DRAM and NAND designs. High-performance computing uses polycide for faster switching needs in dense architectures. Consumer electronics drive volume demand through expanding production of mobile and smart devices. Automotive and industrial automation segments integrate polycide to support durable, long-life semiconductor components. These applications reinforce stable expansion across global fabrication hubs.

- For instance, Micron confirmed that its 1β DRAM node reduced power use by 15% while improving stability through refined gate stack engineering, verified through Micron’s 1β node technology disclosure.

Segmentation:

Product Form / Type

- Tungsten polycide

- Other metal-based polycides

Application

- Integrated circuits

- Memory devices

- High-performance computing

- Consumer electronics

- Automotive

- Industrial automation

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The Polycide market records strong adoption in North America with an estimated 32% share, supported by a large base of advanced semiconductor design companies. The region benefits from steady investment in front-end processing and material innovation. It gains momentum from strong demand for high-performance computing, AI hardware, and industrial electronics. Fabrication facilities in the U.S. seek polycide layers to stabilise gate resistance in advanced nodes. It shows consistent uptake across logic and memory production. Research clusters strengthen development of high-purity material inputs. The region maintains a lead in process technology refinement.

Europe

Europe holds roughly 24% share, driven by strong automotive electronics, industrial automation, and power semiconductor activity. The region focuses on quality-driven fabrication needs, which increases demand for uniform polycide layers. It plays a key role in supplying semiconductor materials to global fabs. Production lines in Germany and the Netherlands adopt polycide for applications that require long-term stability. It gains steady traction from increasing use of advanced sensors and control systems. Research institutes support material process development for scalable integration. Regional policies encourage technology upgrades in microelectronics.

Asia Pacific

Asia Pacific dominates with an estimated 38% share, driven by dense fabrication clusters in China, Taiwan, South Korea, and Japan. The region expands capacity for logic, memory, and consumer electronics, which lifts demand for polycide gate structures. It benefits from large-scale production that requires consistent resistance control across shrinking geometries. Major foundries integrate refined polycide processes to supply global markets. Strong growth in mobile and computing hardware drives higher wafer output. Local suppliers develop advanced silicide materials to support expanding chip ecosystems. The region remains the fastest-growing contributor to market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Air Liquide

- Linde plc

- Merck KGaA

- JSR Corporation

- Entegris, Inc.

- Applied Materials, Inc.

- Lam Research Corporation

- Tokyo Electron Limited

- Hitachi High-Tech Corporation

- SUMCO Corporation

- GlobalWafers Co., Ltd.

- ASM International N.V.

- SAMSUNG SDI Co., Ltd.

- SK Materials

- Cabot Microelectronics Corporation

- ULVAC, Inc.

- BASF SE

- Hemlock Semiconductor Operations LLC

- Siltronic AG

- Shanghai Hipoly Bio-tech

- DynaChem Inc.

- Purestreak Chemicals

- Shanghai Jiangqing International

- Weifang Maochen Chemical

- Valtris Specialty Chemicals

Competitive Analysis:

The Polycide market features a competitive landscape led by material suppliers, wafer producers, and semiconductor equipment companies that support front-end processing. Leading firms focus on stable silicide formation, high-purity material supply, and precise deposition technologies. It shows strong rivalry among global players that compete on quality, process control, and reliability. Leading companies enhance portfolios through R&D in advanced metal chemistries. Equipment manufacturers strengthen their positions with tools that improve uniformity and resistance stability. Material specialists broaden supply chains to support rising wafer output in Asia Pacific and North America. Strategic partnerships between fabs and suppliers tighten performance standards across all tiers. This dynamic environment drives consistent innovation across the value chain.

Recent Developments:

- In August 2025, Air Liquide announced a binding agreement to acquire South Korea’s DIG Airgas for approximately €2.85 billion, marking its largest acquisition in Asia to strengthen its presence in the semiconductor and hydrogen industrial gas sectors.

- In September 2025, Merck KGaA and Siemens extended their strategic partnership to accelerate digital transformation in the life science industry by signing a Memorandum of Understanding to develop AI-driven tools and integrated software solutions spanning drug discovery, development, and manufacturing.

Report Coverage:

The research report offers an in-depth analysis based on Product Form/Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand grows with expanding fabrication capacity in key semiconductor regions.

- Adoption increases as logic and memory nodes require tighter resistance control.

- New silicide chemistries gain traction for next-generation gate structures.

- Equipment upgrades improve process precision across high-volume fabs.

- Material suppliers expand purification technologies for advanced requirements.

- Hybrid gate stack development opens new market opportunities.

- AI and high-performance computing drive wider polycide integration.

- Consumer electronics manufacturing strengthens volume demand globally.

- Automotive and industrial automation applications widen usage scope.

- Overall growth remains steady due to continuous scaling and process refinement.