Market Overview

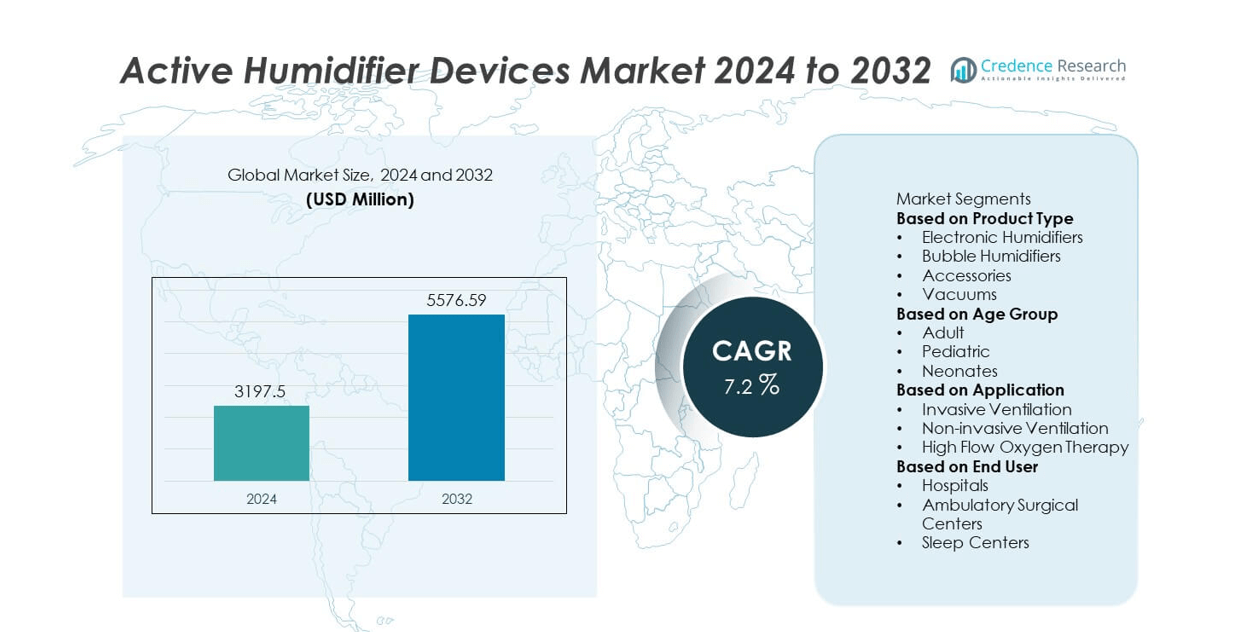

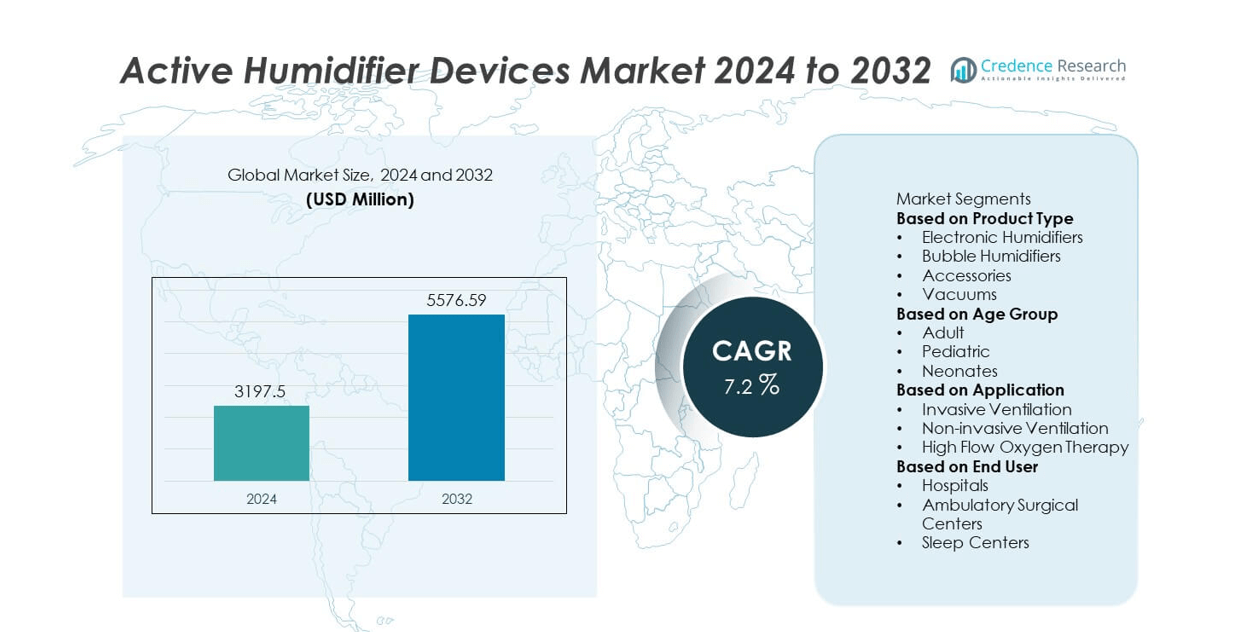

The Active Humidifier Devices market was valued at USD 3,197.5 million in 2024 and is projected to reach USD 5,576.59 million by 2032, registering a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Active Humidifier Devices Market Size 2024 |

USD 3,197.5 million |

| Active Humidifier Devices Market, CAGR |

7.2% |

| Active Humidifier Devices Market Size 2032 |

USD 5,576.59 million |

The Active Humidifier Devices market is driven by leading companies such as Fisher & Paykel Healthcare, Teleflex Incorporated, Draegerwerk AG & Co. KGaA, Medtronic plc, Armstrong Medical, Hamilton Medical, Vapotherm Inc., Heinen + Löwenstein GmbH, Flexicare Medical Limited, and Intersurgical Ltd. These manufacturers focus on electronic humidifiers, high-flow oxygen therapy devices, and advanced circuit accessories that support invasive and non-invasive ventilation in critical care and home-care settings. Innovation centers on infection-control design, automated humidity regulation, and neonatal-safe temperature management. North America leads the market with a 38% share, supported by strong ICU capacity and home respiratory therapy adoption. Europe holds 27%, driven by advanced critical care protocols, while Asia Pacific accounts for 23% due to expanding neonatal and respiratory care infrastructure.

Market Insights

- The Active Humidifier Devices market reached USD 3,197.5 million in 2024 and is expected to expand at a 7.2% CAGR through 2032, supported by rising demand for advanced respiratory care in hospitals and home settings.

- Growing incidence of COPD, asthma, and post-viral respiratory complications drives adoption of humidification systems, with electronic humidifiers holding a 52% segment share due to precise humidity control and improved airway protection during invasive and non-invasive ventilation.

- Key trends include wider use of high-flow oxygen therapy and smart humidity regulation, along with increasing neonatal and pediatric respiratory support in NICUs and emergency units, enhancing clinical outcomes and patient comfort.

- Competitive activity intensifies as major players invest in infection-prevention features, disposable humidification chambers, and automated temperature monitoring, while higher device cost and complex maintenance remain key restraints in cost-sensitive healthcare environments.

- North America leads with 38% regional share, followed by Europe at 27% and Asia Pacific at 23%, supported by expanding critical care infrastructure, while Latin America holds 7% and Middle East & Africa 5%, reflecting gradual improvements in respiratory care capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type:

Electronic humidifiers lead the market with a 52% share, driven by growing adoption in intensive care units and advanced respiratory therapy. These systems offer precise temperature and humidity control, improving airway protection and patient comfort during ventilation. Hospitals prefer electronic humidifiers due to better infection control, real-time monitoring, and compatibility with invasive and non-invasive ventilation equipment. Bubble humidifiers maintain usage in low-acuity oxygen therapy, especially in cost-sensitive settings. Accessories such as breathing circuits, heaters, and chambers generate recurring sales and support long-term device utilization. Vacuums represent a smaller share, mainly for secretion management in respiratory care facilities.

- For instance, Medline Industries acquired a significant portion of the Teleflex respiratory business (under the Hudson RCI brand), including products for oxygen and aerosol therapy and active humidification

By Age Group:

The adult segment dominates with a 64% share in the Active Humidifier Devices market due to rising incidence of COPD, asthma, and post-operative respiratory complications in aging populations. Ventilated adults require active humidification to reduce airway dryness, improve mucociliary function, and minimize infection risk. Pediatric and neonatal segments collectively contribute significant demand, particularly in NICUs where humidified gas therapy supports premature and low-birth-weight infants. Neonatal care devices are designed with controlled temperature delivery to protect fragile lung tissue. Growth in neonatal respiratory distress cases and expanded critical care infrastructure support steady demand in these patient categories.

- For instance, Hamilton Medical’s HAMILTON-H900 humidifier is designed for critical care ventilation solutions, enhancing humidity delivery for a variety of patients, including pediatric and neonatal, and can be used for non-invasive ventilation. It is used in numerous installations worldwide.

By Application:

Invasive ventilation holds the largest share at 47%, driven by its essential role in ICU respiratory management for trauma, surgical recovery, and severe pulmonary disease. Active humidifiers help reduce airway obstruction, ventilator-associated infections, and patient discomfort during prolonged ventilation. Non-invasive ventilation shows strong growth as hospitals expand treatment for obstructive sleep apnea, COPD exacerbations, and emergency respiratory support. High flow oxygen therapy gains traction in emergency and home-care settings, offering heated and humidified gas delivery for hypoxemic patients. Increased adoption in step-down units and tele-respiratory support strengthens long-term utilization across care environments.

Key Growth Drivers

Rising Burden of Respiratory Diseases

Increasing prevalence of chronic respiratory disorders such as COPD, asthma, and pulmonary infections drives steady adoption of active humidifier devices across hospitals and home-care settings. Patients receiving invasive or non-invasive ventilation require humidified airflow to maintain mucosal moisture, reduce airway inflammation, and prevent secretion buildup. Growing global pollution levels, smoking habits, and post-viral respiratory complications also contribute to higher patient admissions requiring respiratory support. Healthcare systems expand ICU capacity and invest in advanced humidification systems to improve outcomes and reduce ventilator-associated complications, strengthening market demand across both developed and emerging regions.

- For instance, Philips Respironics initiated a major recall involving approximately 15 million ventilators, CPAP, and BiPAP devices globally in June 2021 due to potential health risks associated with the breakdown of PE-PUR sound abatement foam.

Growing Demand for Critical and Neonatal Care

Rising neonatal respiratory distress cases and increased survival rates among preterm infants support the use of active humidifiers in NICUs. Controlled humidification protects delicate airway tissue and improves oxygen delivery efficiency in neonates and pediatric patients. In adult intensive care, growing surgical procedures and trauma cases require long-term mechanical ventilation, further driving product adoption. Expansion of critical care infrastructure, especially in Asia Pacific and Latin America, increases equipment procurement. Healthcare providers emphasize patient comfort and faster recovery, positioning active humidifiers as essential components of advanced respiratory care systems.

- For instance, Drägerwerk AG & Co. KGaA supplied ventilators to more than 120 countries, almost tripling its production in 2020 due to the COVID-19 pandemic, and is a leading player in the Brazil market.

Expansion of Home-Based Respiratory Therapy

Rapid growth in home healthcare fuels demand for user-friendly active humidifier devices that support long-term respiratory management. Patients with chronic conditions benefit from continuous humidified airflow while using CPAP, BiPAP, or high-flow oxygen systems outside hospital settings. Aging populations choose home therapy to minimize hospitalization and reduce medical expenses. Telehealth and remote monitoring help clinicians adjust humidification settings, ensuring safer therapy at home. Increasing reimbursement coverage and availability of compact, quiet, and energy-efficient humidifiers strengthen adoption, especially in North America and Europe.

Key Trends & Opportunities

Integration of Smart Monitoring and Automation

Manufacturers incorporate digital interfaces, auto-adjust humidity controls, and connectivity features that support real-time monitoring and improved clinical outcomes. Smart humidification systems evaluate airway temperature, flow rates, and patient breathing patterns to optimize moisture delivery. IoT-based platforms allow respiratory therapists to track performance and predict maintenance needs. These advancements reduce complications and support precision respiratory therapy. As remote respiratory care expands, connected humidifiers present strong commercial potential for hospitals and home-care providers seeking data-driven treatment solutions.

- For instance, Draegerwerk AG & Co. KGaA produces the Evita ventilator platform, which supports comprehensive lung-protective ventilation strategies across adult, pediatric, and neonatal patients.

Rising Opportunity in High-Flow Oxygen and Non-Invasive Therapy

High-flow nasal cannula therapy adoption grows rapidly for treating hypoxemia, post-surgical recovery, and viral respiratory complications. Active humidifiers improve patient tolerance and reduce airway dryness, expanding usage in emergency departments and step-down units. Non-invasive ventilation also gains traction for sleep apnea and COPD management. Market growth accelerates as physicians prefer heated and humidified gas therapy to enhance comfort and prevent mucosal injury. Increasing clinical research and expanded product availability in ambulatory and home-care settings present long-term adoption opportunities.

- For instance, Vapotherm confirmed that its Precision Flow systems have supported more than 17 million high-flow therapy patient hours across hospitals and transport units.

Key Challenges

High Equipment Cost and Limited Access in Low-Resource Markets

Active humidifier systems and replacement accessories require higher investment than basic bubble humidifiers, limiting adoption in cost-sensitive healthcare settings. Hospitals in low-income regions may prioritize essential ventilators over advanced humidification technologies. Limited reimbursement coverage for respiratory equipment also restricts home-care use. Manufacturers face pricing pressures and must provide cost-effective models and flexible procurement programs to expand penetration.

Risk of Contamination and Maintenance Complexity

Active humidifier devices require strict hygiene, regular disinfection, and proper water management to prevent microbial contamination and hospital-acquired infections. Inadequate training can lead to condensation buildup, circuit blockage, and inconsistent temperature control. These issues increase clinical risk and may discourage adoption in settings lacking skilled respiratory technicians. Manufacturers must enhance infection control features and provide training to address safety concerns and improve device utilization.

Regional Analysis

North America

North America holds a 38% share of the Active Humidifier Devices market, supported by advanced respiratory care infrastructure and high adoption of invasive and non-invasive ventilation systems. The United States leads demand due to a strong incidence of COPD, asthma, and post-viral respiratory complications requiring humidified oxygen therapy. Hospitals and home-care providers invest in electronic humidifiers with automated temperature and humidity controls. Canada contributes steady growth with government-supported respiratory treatment programs and expanding usage in neonatal intensive care units. Strong reimbursement systems and continuous product innovation reinforce regional dominance across acute and chronic respiratory care settings.

Europe

Europe accounts for a 27% share, driven by well-established hospital networks and growing emphasis on critical care and infection prevention. Germany, the United Kingdom, and France lead adoption of heated active humidifiers in intensive care units and long-term ventilation therapy. Rising prevalence of chronic respiratory diseases and policies supporting neonatal and pediatric care enhance market growth. Manufacturers benefit from increasing demand for energy-efficient systems and accessories, including sterile circuits and disposable chambers. Expansion of home-based respiratory therapy and remote monitoring solutions also supports broader use across the region.

Asia Pacific

Asia Pacific holds a 23% share and represents the fastest-growing region, driven by rising healthcare spending, expanding ICU capacity, and increasing neonatal respiratory distress cases. China, Japan, India, and South Korea show strong adoption of active humidification for invasive ventilation, high-flow oxygen therapy, and non-invasive respiratory support. Urban pollution, smoking rates, and seasonal viral outbreaks drive higher patient volumes requiring humidified oxygen delivery. Growth of home-care respiratory services and medical device production encourages cost-efficient product availability, strengthening market penetration in both top-tier and secondary hospital networks.

Latin America

Latin America accounts for a 7% share, supported by expanding access to respiratory therapy and increasing hospital admissions for asthma, COPD, and post-infection lung complications. Brazil and Mexico lead adoption, with growing investment in neonatal care and emergency treatment units. Public and private healthcare systems gradually incorporate electronic humidifiers to improve ventilator outcomes and reduce airway complications. Economic constraints encourage procurement of cost-effective devices and replacement accessories. Training programs in respiratory medicine and partnerships with global medical device suppliers improve availability across regional healthcare facilities.

Middle East & Africa

The Middle East & Africa region holds a 5% share, driven by expanding critical care capacity and greater focus on neonatal and trauma respiratory management. The United Arab Emirates and Saudi Arabia adopt advanced humidification systems for invasive and non-invasive ventilation in tertiary hospitals. African markets show increasing demand for essential respiratory devices due to rising infectious respiratory diseases and premature birth rates. Limited hospital infrastructure and budget constraints restrict broad adoption, particularly in rural areas. Growing healthcare modernization programs and NGO-supported neonatal initiatives gradually enhance market access for active humidifier devices.

Market Segmentations:

By Product Type

- Electronic Humidifiers

- Bubble Humidifiers

- Accessories

- Vacuums

By Age Group

By Application

- Invasive Ventilation

- Non-invasive Ventilation

- High Flow Oxygen Therapy

By End User

- Hospitals

- Ambulatory Surgical Centers

- Sleep Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis of the Active Humidifier Devices market includes key players such as Fisher & Paykel Healthcare, Teleflex Incorporated, Draegerwerk AG & Co. KGaA, Medtronic plc, Armstrong Medical, Hamilton Medical, Vapotherm Inc., Heinen + Löwenstein GmbH, Flexicare Medical Limited, and Intersurgical Ltd. These companies compete by offering advanced humidification systems designed for invasive ventilation, non-invasive ventilation, and high-flow oxygen therapy across ICU, emergency, and home-care environments. Leading manufacturers focus on precision temperature and humidity control, infection-prevention features, and compatibility with modern ventilators and respiratory circuits. Product strategies emphasize disposable chambers, integrated monitoring sensors, and automated humidification modes that improve patient comfort and reduce airway complications. Companies strengthen market presence through hospital partnerships, clinical training programs, and technology upgrades supporting neonatal and critical care units. Rising demand for home-based respiratory therapy encourages suppliers to develop compact, quiet, and energy-efficient humidifiers. Competitive differentiation continues to center on safety, reliability, and lower total cost of ownership for long-term respiratory management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, Fisher & Paykel Healthcare launched the F&P my820 System in the U.S., its new humidifier for home mechanical ventilation with automatic temperature adaptation to reduce condensate.

- In April 2024, Condair announced that Konvekta, an energy recovery specialist, is utilizing the Condair ME evaporative humidifier as a standard adiabatic cooling solution in its exhaust air cooling systems. The company aims to achieve up to 92% annual energy recovery for its clients’ buildings.

- In March 2024, Vapotherm announced plans to unveil its Access365 home ventilation solution at MEDTRADE Dallas (held March 27-28, 2024) as a product “under development” which includes a built-in medical-grade humidifier and integrated Bluetooth pulse oximetry and spirometry, with anticipated FDA clearance in early 2025.

- In September 2023, Smartmi introduced its High-Capacity Evaporative Humidifier 3, designed to improve air quality and convenienc

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for active humidifiers will increase with higher respiratory disease prevalence.

- ICUs and emergency care units will continue adopting automated humidification systems.

- Neonatal care expansion will strengthen usage in NICUs and pediatric units.

- High-flow oxygen therapy will gain wider adoption in hospitals and home care.

- Smart sensors and remote monitoring will enhance treatment precision and safety.

- Disposable chambers and circuits will grow due to stronger infection control needs.

- Hybrid systems integrating humidifiers with ventilators will improve workflow efficiency.

- Training and clinical education will support safe device use in emerging markets.

- Cost-optimized humidifiers will create opportunities in low-resource healthcare settings.

- Partnerships between respiratory device manufacturers and telehealth platforms will enhance long-term respiratory management.