Market Overview

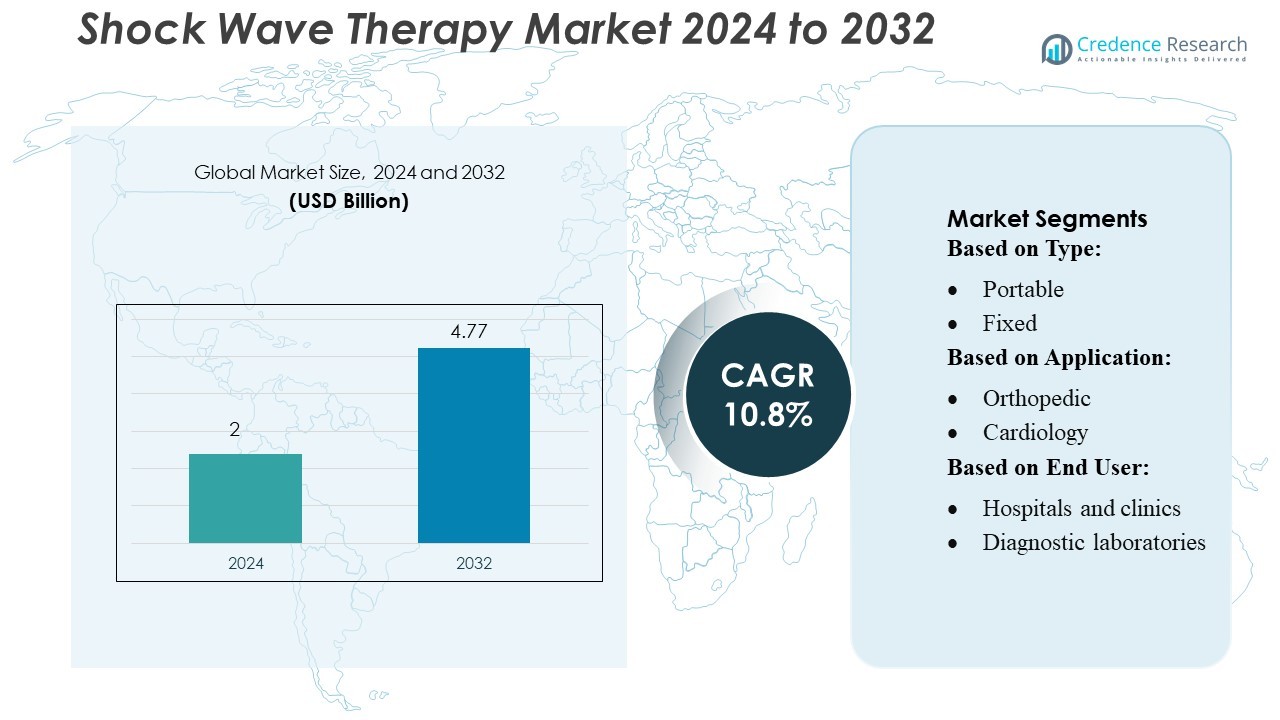

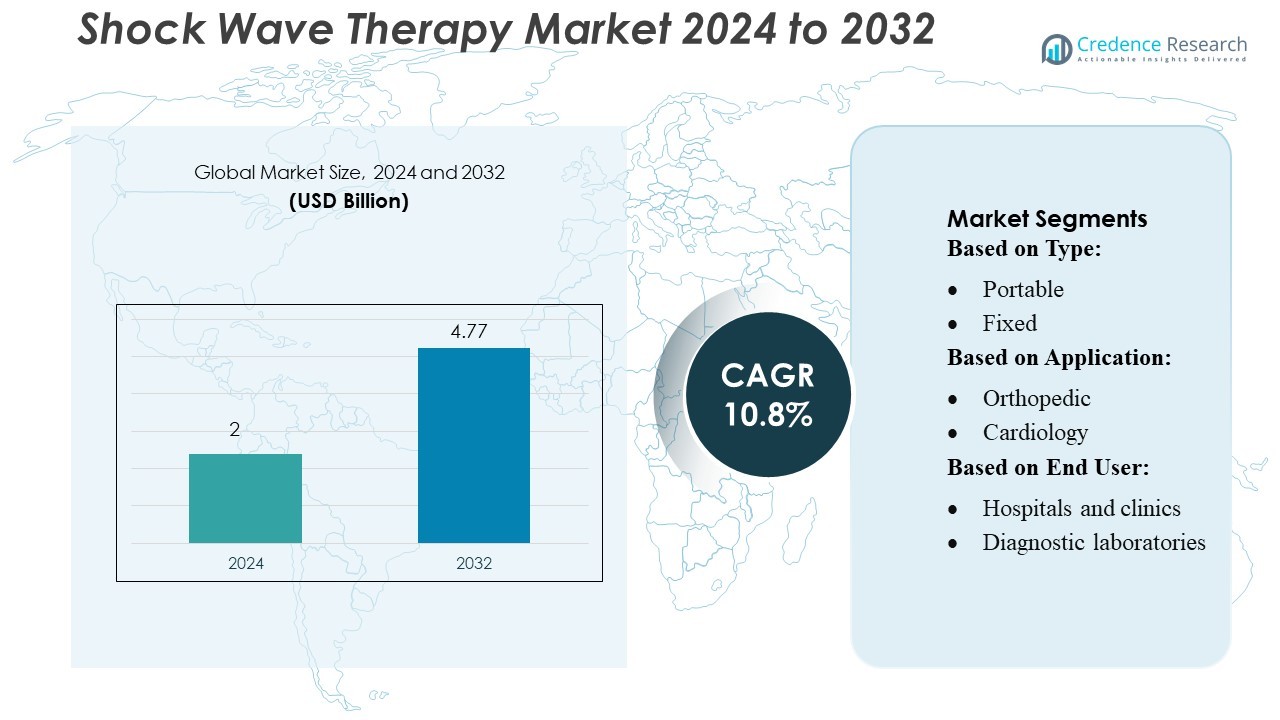

Shock Wave Therapy Market size was valued USD 2 billion in 2024 and is anticipated to reach USD 4.77 billion by 2032, at a CAGR of 10.8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Shock Wave Therapy Market Size 2024 |

USD 2 Billion |

| Shock Wave Therapy Market, CAGR |

10.8 % |

| Shock Wave Therapy Market Size 2032 |

USD 4.77 Billion |

The Shock Wave Therapy Market features strong participation from leading medical device manufacturers known for advancing non-invasive treatment technologies across orthopedics, urology, and rehabilitation care. These companies compete by introducing systems with enhanced energy precision, expanded therapy modes, and integrated digital interfaces that improve clinical efficiency. Strategic initiatives—including product upgrades, global distribution expansion, and partnerships with physiotherapy and sports medicine centers—strengthen their market positioning. North America leads the global market with an estimated 35% share, supported by advanced healthcare infrastructure, high adoption of outpatient therapies, and strong utilization of both focused and radial shock wave systems across clinical settings.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Shock Wave Therapy Market was valued at USD 2 billion in 2024 and is projected to reach USD 4.77 billion by 2032, registering a CAGR of 10.8%, driven by expanding adoption of non-invasive treatments across multiple medical specialties.

- Rising musculoskeletal disorders, increasing sports injury cases, and growing demand for outpatient rehabilitation drive strong utilization of both focused and radial shock wave systems.

- Key market players enhance competitiveness through technological advancements, including improved energy precision, multimode devices, and digital interfaces that support guided therapy and analytics.

- Limited reimbursement coverage and high upfront device costs remain key restraints, slowing adoption in smaller clinics and cost-sensitive markets.

- North America leads with 35% regional share, while portable shock wave systems dominate the type segment with over 60% share, reinforced by demand from physiotherapy centers and ambulatory surgical facilities.

Market Segmentation Analysis:

By Type

Portable shock wave therapy systems dominate the market with an estimated over 60% share, driven by their ease of deployment, lower capital cost, and expanding use in outpatient rehabilitation and sports medicine centers. Their compact form factor supports point-of-care treatment and accelerates adoption in physiotherapy practices managing high patient throughput. Fixed systems retain demand in large hospitals for high-energy protocols, but growth in decentralized care models and home-based physiotherapy continues to shift preference toward portable units, strengthening their position as the leading segment.

- For instance, CARTISTEM® delivers 7.5 million mesenchymal stem cells per vial, leveraging MEDIPOST’s precise cell-handling capabilities to ensure consistent potency—a level of process control that mirrors the precision and repeatability required in portable shock-wave devices.

By Application

Orthopedic applications hold the largest share, accounting for more than 50% of the shock wave therapy market, supported by strong clinical adoption for chronic tendinopathies, plantar fasciitis, calcific shoulder conditions, and non-union fractures. Demand is propelled by rising sports injuries and the need for non-invasive alternatives to steroid injections and surgery. While urology maintains a stable base in lithotripsy procedures and cardiology sees growing use in refractory angina management, the scale and recurrence of musculoskeletal cases keep orthopedics the primary revenue contributor.

- For instance, Anterogen Co., Ltd. has demonstrated significant technical achievement with its Cupistem® product, which uses 3 × 10⁷ autologous adipose-derived mesenchymal stem cells per mL, and achieved 82% complete healing of Crohn’s fistula at week 8 and 81% sustained response at week 96, according to regulatory filings.

By End User

Hospitals and clinics lead the market with over 55% share, driven by their broad patient pool, advanced therapeutic infrastructure, and higher adoption of both high-energy and radial shock wave systems. These facilities manage complex orthopedic and urological cases, positioning them as primary centers for shock wave therapy delivery. Ambulatory surgical centers show steady growth due to increasing outpatient procedures and demand for cost-efficient care, while diagnostic laboratories hold a smaller share, largely performing assessment and referral functions rather than therapy administration.

Key Growth Drivers

- Rising Incidence of Musculoskeletal Disorders and Sports Injuries

The rapid increase in musculoskeletal conditions—such as plantar fasciitis, tendinopathies, and chronic back pain—continues to drive global demand for shock wave therapy. Growing sports participation and higher injury rates in both professional and recreational athletes accelerate utilization of non-invasive treatment options. Healthcare providers increasingly adopt shock wave therapy as a first-line alternative to corticosteroids and surgical interventions due to faster recovery timelines, minimal downtime, and reduced long-term costs, supporting steady market expansion.

- For instance, AAOS 2025, J&J showcased its VELYS™ robotic-assisted total knee system, which has supported over 100,000 knee replacement surgeries across 31 global markets.

- Expanding Adoption in Outpatient and Ambulatory Care Settings

Ambulatory surgical centers and physiotherapy clinics increasingly integrate shock wave systems to offer cost-effective, walk-in treatment options. The availability of portable, high-performance devices makes it easier for outpatient facilities to deliver therapy without large infrastructure investments. As patient volumes shift from hospital-based care to decentralized settings, demand for mobile and user-friendly shock wave equipment rises. This trend supports broader accessibility, shortens waiting periods, and improves operational efficiency, strengthening market penetration across emerging and developed regions.

- For instance, JW Therapeutics’ relmacabtagene autoleucel (Carteyva®) was supported by a treatment network that enabled over 200 patients to be treated across certified infusion centers demonstrating the scalability of advanced therapies outside large hospitals.

- Growing Clinical Validation and Technological Advancements

Increasing clinical evidence supporting the therapeutic efficacy of focused and radial shock wave systems boosts clinician confidence and reimbursement potential. Manufacturers continue to introduce devices with enhanced energy precision, improved penetration depth, and integrated digital interfaces for better treatment tracking. Advances such as multi-mode systems and AI-supported therapy optimization contribute to improved patient outcomes. These innovations enable broader usage in orthopedics, urology, cardiology, and wound care, ultimately accelerating market growth.

Key Trends & Opportunities

1. Increasing Integration of Digital Monitoring and Smart Therapy Platforms

Manufacturers are incorporating digital tools—such as treatment analytics, guided protocols, and cloud-based patient monitoring—into shock wave systems to enhance clinical efficiency. Smart interfaces allow practitioners to customize therapy parameters more precisely, improving outcomes and reducing variability in treatment results. This trend presents opportunities for companies to differentiate products through software-driven capabilities, expand service offerings, and build subscription-based digital ecosystems. Adoption of AI-driven decision support further positions the technology for long-term integration in modern rehabilitation workflows.

- For instance, S. BIOMEDICS’ TED-A9 program delivers either 3.15 million or 6.3 million dopaminergic progenitor cells per dose, derived from hESCs, and in its Phase 1/2a trial for Parkinson’s disease demonstrated cell survival and engraftment post-transplant.

2. Expanding Applications Beyond Orthopedics

While orthopedics remains the dominant segment, new opportunities emerge in dermatology, wound healing, sexual medicine, and cardiology. Studies demonstrating improved vascularization, pain reduction, and tissue regeneration broaden the therapeutic profile of shock wave systems. The introduction of devices optimized for low-intensity protocols accelerates adoption in erectile dysfunction, chronic wounds, and peripheral vascular disease. These expanding clinical indications allow manufacturers to tap into diverse patient pools and increase treatment frequency, strengthening multi-disciplinary market expansion.

- For instance, bispecific antibody pumitamig (BNT327/BMS986545), developed with BioNTech, demonstrated a 76.3% confirmed objective response rate (cORR) and a median progression-free survival of 6.8 months in a Phase 2 study of extensive-stage small cell lung cancer.

3. Rising Demand for Portable and Home-Use Devices

The shift toward patient-centric care and increased preference for non-invasive home therapies are creating opportunity for compact, portable shock wave devices. Advancements in ergonomics, energy control, and safety features support the development of consumer-grade solutions under professional guidance. As aging populations seek accessible treatment for chronic pain and mobility limitations, home-use platforms offer a scalable growth avenue for device manufacturers. This transition also enables recurring revenue models through consumables, accessories, and digital service integration.

Key Challenges

1. Limited Reimbursement and High Upfront Cost of Equipment

Despite growing clinical acceptance, reimbursement pathways remain inconsistent across regions, often categorizing shock wave therapy as an elective or adjunctive treatment. This poses challenges for providers seeking cost recovery and limits adoption in smaller clinics. High initial investment in advanced focused shock wave systems—combined with ongoing maintenance—can deter budget-constrained facilities. Limited reimbursement discourages patient uptake, prompting manufacturers and healthcare organizations to advocate for stronger clinical evidence to improve coverage policies.

2. Variability in Clinical Outcomes and Operator Dependency

Therapy effectiveness can vary significantly based on practitioner expertise, device type, and treatment protocol, creating uncertainty in clinical outcomes. Inconsistent application parameters—such as energy flux density, frequency, and number of pulses—may lead to suboptimal results and hinder provider confidence. Lack of standardized training programs exacerbates the challenge, especially in emerging markets. Addressing this requires development of unified clinical guidelines, enhanced training frameworks, and smart systems capable of assisting clinicians in delivering consistent, evidence-based therapy.

Regional Analysis

North America

North America accounts for around 35% of the global market, driven by strong adoption of non-invasive therapies across sports medicine, orthopedics, and rehabilitation centers. High prevalence of musculoskeletal disorders, advanced healthcare infrastructure, and favorable reimbursement for select shock wave indications support continued growth. The U.S. leads due to widespread use of focused and radial systems across hospitals, ambulatory surgical centers, and physiotherapy chains. Increasing investments in outpatient care and rising preference for portable, digitally enabled devices further strengthen the region’s dominant position in the global shock wave therapy market.

Europe

Europe holds approximately 30% market share, supported by strong clinical acceptance of shock wave therapy in orthopedic, urological, and rehabilitation settings. Countries such as Germany, Switzerland, and Italy demonstrate high penetration due to well-established physiotherapy practices and early regulatory acceptance of focused shock wave technologies. The region benefits from extensive R&D activities and participation in clinical studies validating new therapeutic applications. Adoption of portable systems continues to grow, driven by rising demand for home-based and outpatient treatments, solidifying Europe as a mature and technologically progressive market.

Asia-Pacific

Asia-Pacific captures about 25% of the global market, emerging as the fastest-growing region due to expanding healthcare infrastructure, rising sports injuries, and increasing awareness of non-invasive pain management therapies. China, Japan, South Korea, and India see rising utilization of shock wave systems across physiotherapy centers and hospitals. The availability of cost-effective domestic devices accelerates adoption, especially in small clinics. Growing medical tourism and investments in advanced rehabilitation technologies further amplify demand. As chronic musculoskeletal conditions increase with aging populations, APAC is expected to gain additional market share.

Latin America

Latin America represents around 6% market share, with growth driven by increasing demand for affordable non-invasive treatments and expanding physiotherapy services. Brazil, Mexico, and Argentina lead adoption, particularly in sports medicine and orthopedic clinics. Market expansion is supported by improving access to portable shock wave systems and rising investments in private healthcare facilities. However, limited reimbursement and uneven distribution of advanced technologies slower adoption in rural areas. Despite these gaps, rising awareness of regenerative therapies and growing medical tourism continue to create opportunities for manufacturers.

Middle East & Africa

The Middle East & Africa region holds approximately 4% market share, supported by gradual expansion of advanced rehabilitation and orthopedic services. Gulf countries such as the UAE and Saudi Arabia lead adoption due to investments in modern healthcare infrastructure and rising demand for sports injury management. Portable systems gain traction in private clinics due to lower operational costs. However, limited clinical training availability and lower purchasing power in parts of Africa restrict wider penetration. Continued government healthcare modernization and increasing private-sector investments are expected to support moderate market growth.

Market Segmentations:

By Type:

By Application:

By End User:

- Hospitals and clinics

- Diagnostic laboratories

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Shock Wave Therapy Market features a diverse mix of global healthcare innovators, with companies such as MEDIPOST, Anterogen Co., Ltd., Johnson & Johnson Services, Inc., JW Therapeutics, S. BIOMEDICS, Bristol-Myers Squibb Company, Novartis AG, Atara Biotherapeutics, Gilead Sciences, Inc., and JCR Pharmaceuticals Co., Ltd. The Shock Wave Therapy Market is characterized by strong technological innovation, expanding clinical applications, and increasing competition among device manufacturers focused on non-invasive therapeutic solutions. Companies emphasize advancements in focused and radial shock wave systems, improved energy precision, and enhanced ergonomics to differentiate their product portfolios. Digital integration—including guided treatment protocols, real-time analytics, and connectivity features—has become a core strategic priority as providers seek more consistent outcomes and streamlined workflows. Market players also expand distribution networks and target outpatient and rehabilitation centers with portable, cost-efficient systems. Furthermore, growing demand in sports medicine, chronic pain management, and urology drives continuous product upgrades, clinical validation efforts, and strategic collaborations with hospitals and physiotherapy chains to strengthen market positioning globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- MEDIPOST

- Anterogen Co., Ltd.

- Johnson & Johnson Services, Inc.

- JW Therapeutics

- BIOMEDICS

- Bristol-Myers Squibb Company

- Novartis AG

- Atara Biotherapeutics

- Gilead Sciences, Inc.

- JCR Pharmaceuticals Co., Ltd.

Recent Developments

- In November 2025, Bharat Biotech International Ltd entered the cell and gene therapy sector by launching Nucelion Therapeutics Pvt Ltd, a wholly owned CRDMO dedicated to research, development, and manufacturing in this field.

- In March 2025, Shockwave Medical launched the Javelin Peripheral IVL Catheter in the United States, featuring a 150 cm working length and single distal emitter capable of generating 120 shockwave pulses for treating peripheral artery disease.

- In May 2024, Johnson & Johnson completed its acquisition of Shockwave Medical, integrating the company’s intravascular lithotripsy platform into Johnson & Johnson MedTech to enhance cardiovascular intervention capabilities.

- In March 2024, EDAP TMS received FDA Breakthrough Device Designation for its Focal One system in treating Deep Infiltrating Rectal Endometriosis, expanding shock wave therapy applications into gynecological conditions.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see expanding adoption of shock wave therapy as a preferred non-invasive alternative for managing chronic musculoskeletal conditions.

- Portable and home-use devices will gain wider acceptance as patient-centric care models continue to grow.

- Digital integration, including AI-guided protocols and remote treatment monitoring, will enhance therapy precision and clinical outcomes.

- Clinical indications will expand further into dermatology, wound care, sexual medicine, and cardiovascular applications.

- Outpatient and ambulatory centers will increasingly drive demand due to lower treatment costs and higher patient throughput.

- Manufacturers will focus on developing multi-mode systems offering both focused and radial energy options in a single unit.

- Training and standardized treatment protocols will improve, reducing variability in therapy outcomes across regions.

- Regulatory approvals will accelerate as stronger clinical evidence supports long-term therapeutic efficacy.

- Emerging markets will contribute significantly to growth due to improving healthcare infrastructure and rising awareness.

- Strategic collaborations between device makers, physiotherapy chains, and sports medicine centers will strengthen market penetration.