Market Overview

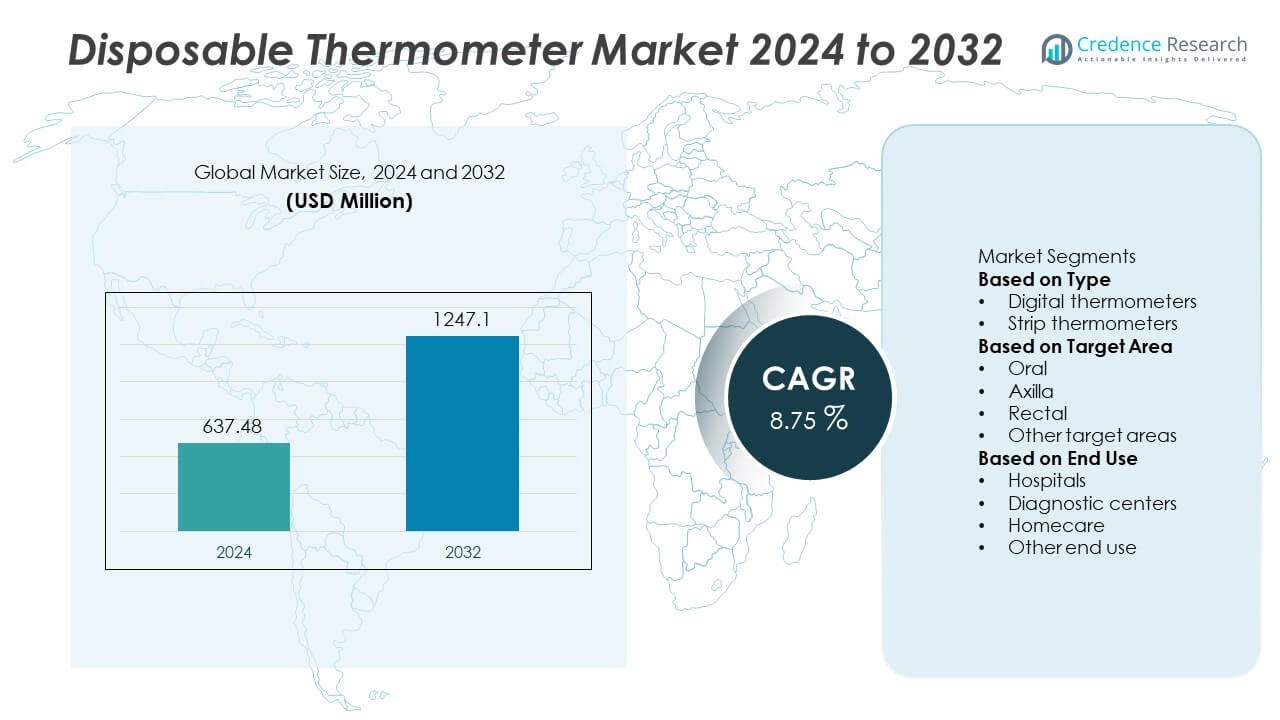

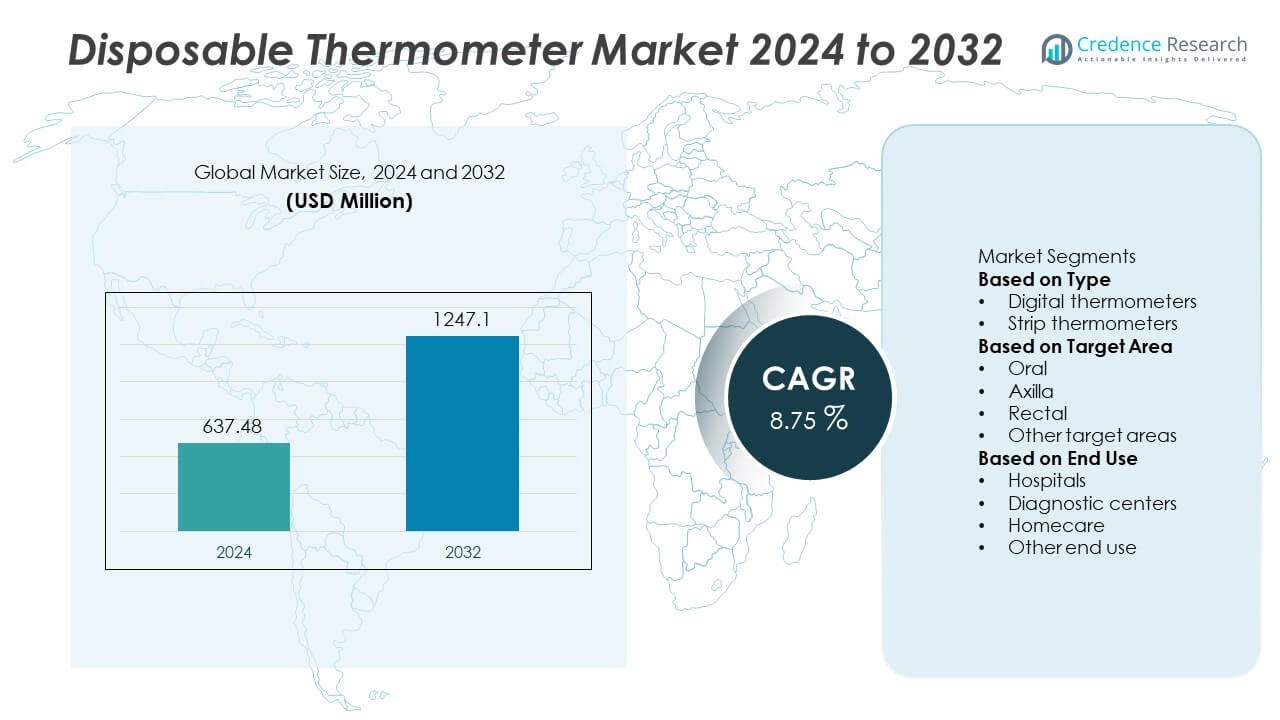

The Disposable Thermometer Market was valued at USD 637.48 million in 2024. It is projected to grow steadily and reach USD 1,247.1 million by 2032, expanding at a CAGR of 8.75% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Disposable Thermometer Market Size 2024 |

USD 637.48 Million |

| Disposable Thermometer Market, CAGR |

8.75% |

| Disposable Thermometer Market Size 2032 |

USD 1,247.1Million |

The Disposable Thermometer market includes top players such as LCRHallcrest, graham field, MEDICAL INDICATORS, American Diagnostics Corporation, H-B Instrument, 3M, FIRST AID ONLY, Advanced Meditech Internationals (AMI), Hopkins Medical Products, and Acme United Corporation, all focusing on accurate, single-use temperature monitoring to support infection control and rapid screening. North America leads the market with a 36% share, supported by strong demand in hospitals, emergency care, and workplace health programs. Europe follows with a 29% share, driven by stringent hygiene regulations and adoption in neonatal and geriatric care. Asia Pacific holds a 24% share, expanding rapidly due to large-scale public health screenings and growing homecare use.

Market Insights

- The Disposable Thermometer market reached USD 637.48 million in 2024 and is projected to reach USD 1,247.1 million by 2032, growing at a CAGR of 8.75%, supported by strong demand for single-use temperature monitoring in infection-control environments.

- Higher adoption in hospitals and urgent care facilities drives growth, with digital disposable thermometers holding a 61% share due to fast readings and reduced contamination risks during patient assessments.

- Key trends include color-change sensor technology, biodegradable materials, and expanding use in travel, workplace, and event-based screening programs, strengthening product penetration beyond clinical care settings.

- Competitive activity intensifies as major players enhance accuracy, bulk packaging, and rapid-response performance, while price sensitivity and concerns over medical waste generation restrain adoption in low-resource healthcare systems.

- Regionally, North America leads with a 36% share, followed by Europe at 29%, Asia Pacific at 24%, and Latin America and Middle East & Africa at 6% and 5%, driven by growing emergency preparedness and home monitoring usage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type:

The digital disposable thermometers segment holds a 61% share of the market, driven by strong adoption in hospitals and homecare settings that require fast and reliable temperature readings with minimal infection risk. These single-use digital devices offer clear numeric displays and reduce cross-contamination, making them suitable for infectious disease monitoring. Strip thermometers remain popular in pediatric use and travel kits because they provide quick forehead readings and eliminate contact with body fluids. However, the digital category dominates due to higher accuracy, improved battery-free designs, and wider acceptance in clinical protocols requiring consistent screening outcomes.

- For instance, Medical Indicators developed the NexTemp Ultra thermometer using a precision phase-change matrix with a reading tolerance of ±0.2°C, and the company supplies more than 45 million units annually to hospitals and emergency care networks.

By Target Area:

The oral temperature measurement segment leads the market with a 46% share, supported by broad clinical acceptance and convenience for adult and pediatric use. Disposable oral thermometers are preferred for faster placement and lower discomfort during patient assessments, making them widely used across emergency rooms and primary care settings. Axillary thermometers gain traction in neonatal and sensitive-care units, while rectal measurements remain essential for infants and critical care situations requiring highly precise core readings. Despite these uses, oral monitoring remains dominant because it balances speed, patient comfort, and hygienic handling across large patient volumes.

- For instance, American Diagnostics Corporation designed the Adtemp 413 digital oral thermometer with a typical response time of 30-40 seconds and distributes devices to thousands of healthcare and long-term care facilities. A faster model, the Adtemp 415 Flex, provides oral readings in about 18 seconds and rectal readings in about 10 seconds.

By End Use:

The hospital segment accounts for a 54% share of the disposable thermometer market, driven by strict infection prevention protocols and high patient turnover. Hospitals rely on single-use options to limit pathogen spread in emergency wards, intensive care units, and isolation zones. Diagnostic centers adopt disposable thermometers to maintain sterile screening processes for walk-in patients, while homecare settings see rising demand due to telehealth growth and self-monitoring needs during flu and viral outbreaks. Although home and outpatient use is increasing, hospitals retain the largest share because institutional procurement policies prioritize medical-grade, contamination-free temperature assessment tools.

Key Growth Drivers

Rising Demand for Infection-Control and Single-Use Medical Supplies

Growing emphasis on infection prevention in hospitals and clinics drives the demand for disposable thermometers. Healthcare providers reduce cross-contamination risk by using single-patient devices in emergency rooms, ICUs, and isolation wards. Increased incidence of viral and bacterial infections strengthens adoption across diagnostics and home monitoring. The shift toward safer patient handling practices also aligns with regulatory hygiene standards. As infection control remains a priority in global healthcare, disposable thermometers become an essential tool for rapid, contamination-free temperature assessment.

- For instance, 3M, through its Bair Hugger patient warming technology, provides a comprehensive solution for managing patient temperature throughout the surgical journey to help maintain normothermia and reduce the risk of surgical site infections.

Expansion of Homecare and Remote Patient Monitoring

Disposable thermometers see higher use in home settings as telehealth and remote care services expand. Patients and caregivers rely on single-use options for quick temperature checks during flu seasons and chronic disease management. Easy-to-read formats and contact-free forehead strips support safe monitoring for children and elderly patients. Rising preference for self-care and over-the-counter medical supplies boosts retail and online sales. Growing consumer awareness of infection control strengthens long-term demand across households and home nursing programs.

- For instance, Acme United Corporation includes First Aid Only as one of its prominent brands in its first aid and medical products division. The company supplies various first aid items, including disposable thermometers, to major retailers and e-commerce platforms.

Growth in Emergency, Travel, and Workplace Screening

Widespread temperature screening in airports, transport hubs, workplaces, and events supports steady market growth. Disposable thermometers offer rapid screening capability for large populations, making them suitable for travel health protocols and public safety procedures. Employers prioritize single-use devices for workforce monitoring during outbreaks. Portable strip products and instant-reading solutions are increasingly stocked in first-aid and travel kits. As global mobility increases, demand for convenient, hygiene-focused thermometer solutions continues to rise.

Key Trends & Opportunities

Increased Use of Eco-Friendly and Biodegradable Materials

Manufacturers explore biodegradable films and recyclable components to reduce medical plastic waste. Hospitals and government agencies encourage procurement of sustainable disposable supplies. Eco-friendly oral covers and forehead strips help brands differentiate within competitive retail channels. Growing demand for low-waste healthcare packaging presents new product innovation opportunities and enhances green brand positioning.

- For instance, LCR Hallcrest introduced new thermometer strip packaging, supplying units to healthcare and consumer markets.

Advancements in Rapid Reading and Color-Change Technology

Color-change and heat-sensitive strip thermometers gain traction as they require no power and provide instant results. New sensor coatings improve reading accuracy and forehead response time. Compact, travel-ready designs support wider consumer adoption. This trend enables product diversification and strengthens usage beyond clinical settings.

- For instance, H-B Instrument (a Division of Bel-Art – SP Scienceware) is a brand that produces a variety of liquid-in-glass thermometers and other scientific measurement tools.

Rising Opportunities in Low-Resource and Emergency Medical Settings

Disposable thermometers provide cost-effective and easy-to-deploy options in rural clinics, disaster relief missions, and mobile medical units. International health programs and NGOs expand distribution to improve temperature screening capacity. Demand increases in markets with limited diagnostic infrastructure, creating strong growth potential.

Key Challenges

Accuracy Limitations Compared to Reusable Electronic Devices

Some disposable thermometers offer lower precision, especially in outdoor or varied environmental conditions. Clinical professionals may prefer reusable digital devices for critical care accuracy. This perception challenges adoption in advanced diagnostic workflows. Manufacturers must enhance reliability and clinical validation to expand use across high-acuity settings.

Waste Management and Environmental Concerns

High-volume disposal of single-use thermometers contributes to medical waste streams. Hospitals and regulators seek solutions that balance hygiene with sustainability goals. Disposal compliance and waste handling costs affect purchasing decisions. Addressing environmental concerns through recyclable materials and minimal packaging will be essential to maintain long-term acceptance.

Regional Analysis

North America

North America holds a 36% share of the Disposable Thermometer market, driven by strong infection control protocols and high adoption across hospitals and emergency care facilities. The United States leads demand due to widespread use in outpatient clinics, telehealth-supported homecare, and workplace screening programs. Rising flu cases and continuous pandemic-preparedness efforts support procurement of single-use devices. Canada expands usage across long-term care and pediatric facilities, reinforcing regional growth. E-commerce channels improve access to home-use disposable temperature strips, supporting increasing retail sales.

Europe

Europe accounts for a 29% share of the market, supported by stringent hygiene guidelines and increased adoption of single-use medical supplies in public and private healthcare institutions. Countries including Germany, the United Kingdom, France, and Italy lead consumption, particularly in neonatal, geriatric, and infectious disease monitoring. Growing demand for eco-friendly disposable thermometers encourages innovation in bio-based and recyclable materials. Widespread travel and workplace screening standards reinforce consistent demand for rapid temperature assessment tools across the region.

Asia Pacific

Asia Pacific holds a 24% share and represents the fastest-growing region, fueled by expanding hospital capacity, rising infectious disease cases, and large-scale community screening programs. China and Japan lead usage in emergency care and home monitoring, while India and South Korea adopt disposable thermometers through public health campaigns and improved healthcare access. Increased travel safety protocols and growing telemedicine adoption further strengthen regional growth. Local production and low-cost distribution models support wider product penetration across rural and urban areas.

Latin America

Latin America represents a 6% share of the Disposable Thermometer market, supported by greater investment in primary healthcare and vaccination monitoring. Brazil and Mexico drive demand, particularly in hospital emergency departments and outpatient fever screening. Public health programs and NGO-supported medical supply distribution improve access to low-cost disposable thermometers in underserved regions. Economic constraints challenge premium product adoption, yet market prospects remain favorable as governments advance infectious disease surveillance capabilities.

Middle East and Africa

The Middle East and Africa account for a 5% share, supported by increased healthcare infrastructure development and infection prevention guidelines in hospitals. The United Arab Emirates and Saudi Arabia lead adoption due to higher healthcare expenditure and demand for rapid screening tools in travel hubs and workplaces. South Africa shows increased consumption in community clinics and mobile health units. Limited distribution networks in remote areas restrict broader adoption, but expanding telemedicine initiatives offer new growth potential.

Market Segmentations:

By Type

- Digital thermometers

- Strip thermometers

By Target Area

- Oral

- Axilla

- Rectal

- Other target areas

By End Use

- Hospitals

- Diagnostic centers

- Homecare

- Other end use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape or analysis in the Disposable Thermometer market includes key players such as LCRHallcrest, graham field, MEDICAL INDICATORS, American Diagnostics Corporation, H-B Instrument, 3M, FIRST AID ONLY, Advanced Meditech Internationals (AMI), Hopkins Medical Products, and Acme United Corporation. Companies compete by improving reading accuracy, enhancing rapid temperature response, and integrating color-change indicators for faster screening. Leading manufacturers focus on infection-control designs aimed at high-volume hospital use, along with single-patient formats that reduce cross-contamination. Growth strategies include expanding production capacity, developing eco-friendly materials, and strengthening distribution through medical supply chains and e-commerce platforms. Public health programs, corporate wellness screening, and emergency response kits further support market penetration. Price-sensitive buyers influence competition, encouraging suppliers to offer value-based packaging and bulk procurement options for clinics and NGO-supported field operations. Continuous product validation, compliance with medical temperature-monitoring standards, and partnerships with healthcare organizations remain essential for maintaining competitive advantage and long-term customer trust.

Key Player Analysis

- LCRHallcrest

- graham field

- MEDICAL INDICATORS

- American Diagnostics Corporation

- H-B Instrument

- 3M

- FIRST AID ONLY

- Advanced Meditech Internationals (AMI)

- Hopkins Medical Products

- Acme United Corporation

Recent Developments

- In August 2025, Medical Indicators Inc. published a white paper on disposable thermometers emphasising improved infection control, cost‐efficiency and clinical accuracy for single-use devices.

- In 2024, the Medical Indicators’ disposable thermometers are manufactured in the USA in an FDA and ISO certified environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Target Area, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Disposable thermometers will see broader use as hospitals prioritize single-patient infection-control tools.

- Demand will grow in homecare and telehealth programs for safe and simple temperature monitoring.

- Color-change and rapid-read technology will improve speed and usability in clinical and field settings.

- Eco-friendly and biodegradable materials will gain importance as medical waste concerns increase.

- Workplace, travel, and event health screening will continue to drive large-volume procurement.

- Smart packaging and inventory indicators may support better supply management for healthcare facilities.

- Government preparedness initiatives will boost emergency stockpiling and distribution in public health programs.

- Manufacturers will expand production capacity and lower unit costs to serve developing markets.

- Partnerships with NGOs and disaster-response organizations will increase adoption in mobile and rural care.

- Product innovation will strengthen accuracy and reliability, improving acceptance in critical-care applications.