Market Overview

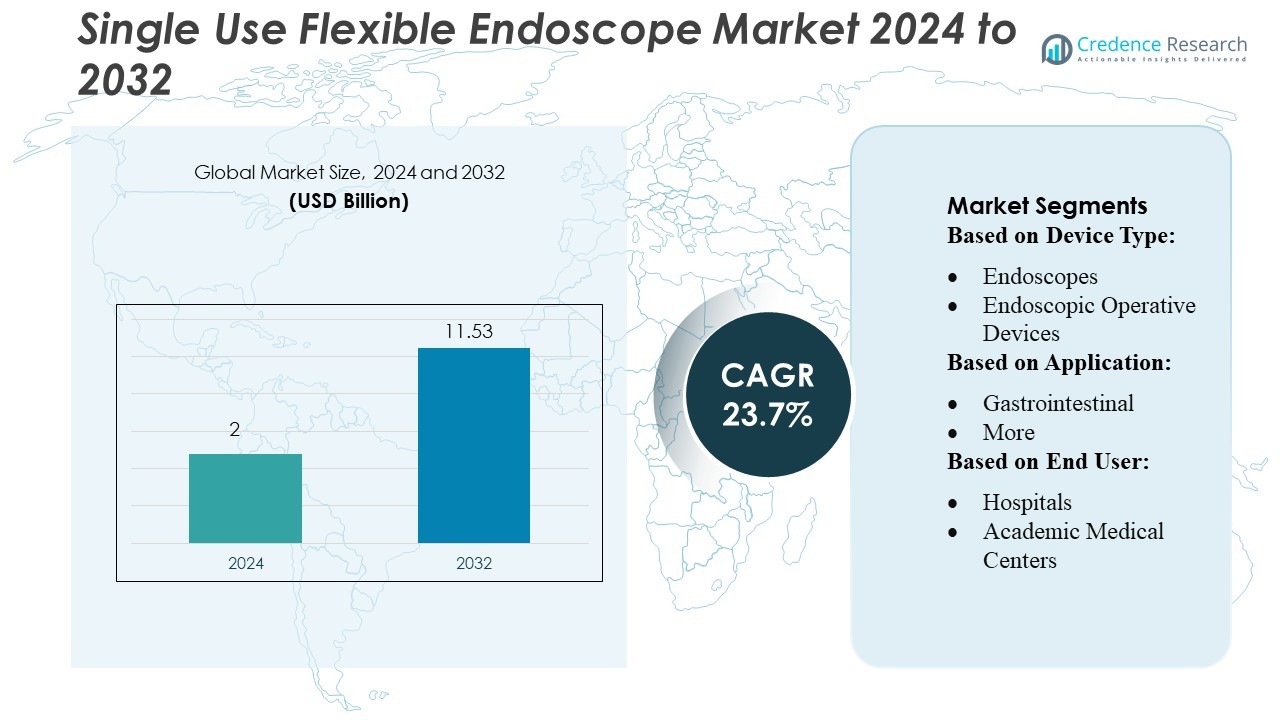

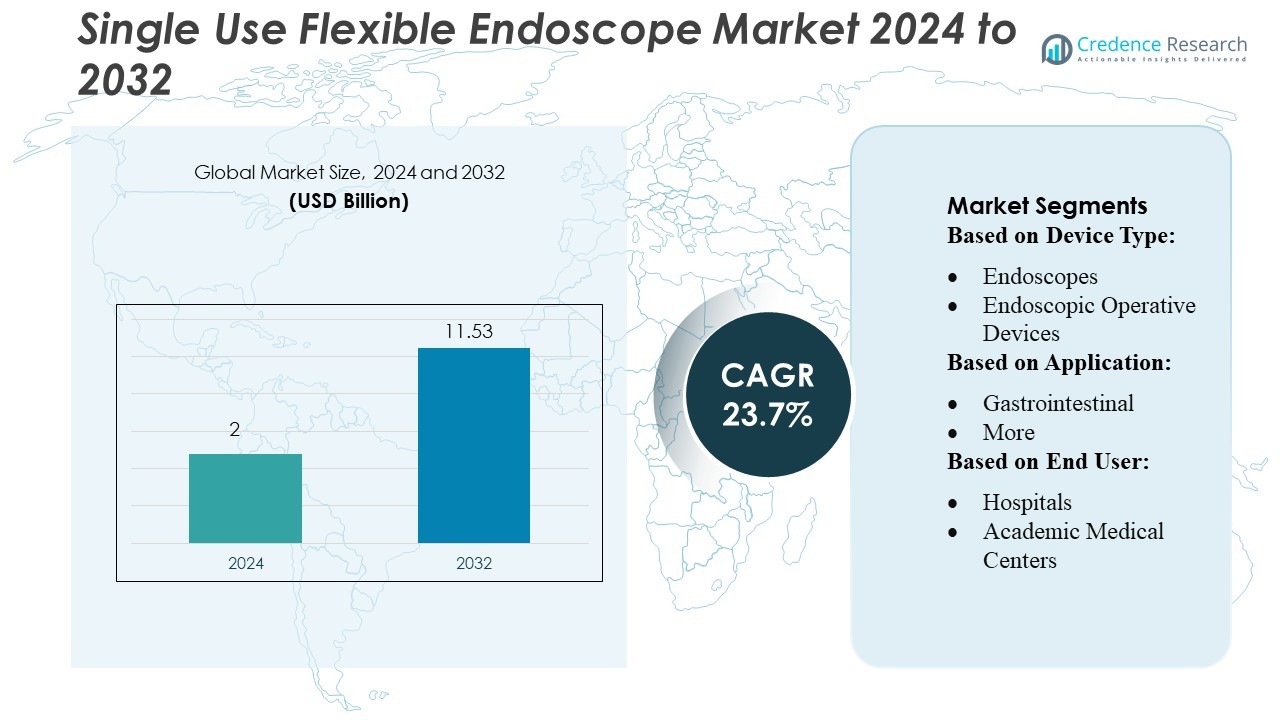

Single Use Flexible Endoscope Market size was valued USD 2 billion in 2024 and is anticipated to reach USD 11.53 billion by 2032, at a CAGR of 23.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single Use Flexible Endoscope Market Size 2024 |

USD 2 Billion |

| Single Use Flexible Endoscope Market, CAGR |

23.7% |

| Single Use Flexible Endoscope Market Size 2032 |

USD 11.53 Billion |

In the Single-Use Flexible Endoscope Market, top players such as OTU Medical, KARL STORZ, COOPERSURGICAL, Olympus Corporation, HOYA Corporation, Ambu A/S, obp Surgical Corporation, Flexicare Medical Limited, Welch Allyn (Hill Rom), and Boston Scientific Corporation compete fiercely through continual innovation, product diversification, and strategic collaborations. North America emerges as the leading region, commanding about 40% of the global market share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single-Use Flexible Endoscope Market reached USD 2 billion in 2024 and is projected to hit USD 11.53 billion by 2032, growing at a strong CAGR of 23.7%, driven by rapid adoption across hospital and ambulatory settings.

- Rising infection-control requirements, elimination of reprocessing costs, and improved procedural efficiency accelerate market growth, with the single-use flexible endoscope segment accounting for over 70% of total demand due to its consistent performance and safety advantages.

- The market experiences strong innovation momentum as leading players intensify competition through advanced CMOS imaging, ergonomic designs, and expanded specialty-specific models, strengthening product differentiation and pricing strategies.

- Regulatory uncertainties, concerns about medical waste, and higher per-procedure costs in low-volume facilities act as restraints, slowing adoption in cost-sensitive healthcare systems.

- North America leads with around 40% market share, supported by strong reimbursement structures and high procedural volumes, while Europe and Asia-Pacific show fast uptake driven by infection-control priorities and expanding outpatient care infrastructure.

Market Segmentation Analysis:

By Device Type

Endoscopes represent the dominant device type in the single-use flexible endoscope market, accounting for an estimated over 55% share due to their high utilization in routine diagnostic and therapeutic procedures. Within this category, flexible endoscopes outperform rigid variants as hospitals prioritize devices that reduce cross-contamination risks and eliminate reprocessing delays. Demand strengthens further as manufacturers introduce improved imaging sensors, enhanced angulation control, and integrated suction/irrigation channels, enabling clinicians to achieve higher procedural efficiency. Growth is also driven by increasing adoption in emergency and outpatient settings, where rapid device turnover and infection prevention remain critical requirements.

- For instance, WiScope single-use digital flexible ureteroscope features an 8.6 Fr insertion tube, a working channel diameter of 3.6 Fr, and a 275° bi-directional deflection capability, greatly enhancing maneuverability and procedural control.

By Application

The gastrointestinal (GI) segment holds the largest market share, exceeding 40%, supported by the high global volume of procedures including colonoscopy, gastroscopy, and ERCP. Single-use GI endoscopes gain traction because they help mitigate infection-transmission risks associated with reusable duodenoscopes and bronchoscopes, a concern highlighted by multiple regulatory bodies worldwide. Their rapid availability and zero reprocessing downtime support higher patient throughput. Additionally, rising incidence of colorectal cancer, inflammatory bowel disease, and upper GI disorders drives steady procedural growth, reinforcing GI endoscopy as the leading application area for disposable flexible endoscopes.

- For instance, Five S 091361-06 single-use video intubation endoscope features a distal outer diameter of 3.5 mm, a working channel of 1.2 mm, and full 180°/180° tip deflection, enabling precise maneuvering even in narrow anatomy.

By End User

Hospitals remain the primary end-user segment with more than 50% market share, driven by their high case volumes, broad specialty coverage, and strong emphasis on infection-control compliance. Single-use endoscopes support hospital initiatives to reduce hospital-acquired infections (HAIs), streamline workflow, and avoid capital-heavy sterilization infrastructure. Academic medical centers also contribute meaningfully as they adopt disposable systems for training environments where multiple users handle equipment. However, hospitals dominate due to increasing preference for predictable per-procedure costs, reduced reprocessing workload, and the ability to deploy sterile devices immediately during peak demand or emergency interventions.

Key Growth Drivers

- Rising Infection-Control Requirements and HAIs Reduction

Stringent infection-control protocols and increasing hospital-acquired infection (HAI) concerns strongly accelerate adoption of single-use flexible endoscopes. Reusable endoscopes require complex, labor-intensive reprocessing steps that still pose residual contamination risks, especially in GI and pulmonary procedures. Hospitals increasingly shift toward disposables to eliminate reprocessing failures, reduce cross-contamination incidents, and comply with updated regulatory guidelines. The ability to ensure sterility at every procedure supports predictable clinical outcomes and aligns with value-based care models, making infection prevention a major growth catalyst across high-volume medical settings.

- For instance, CooperSurgical’s Endosee Advance system uses a single-use cannula that is 455 mm long and attaches to a reusable handheld monitor.

- Growing Procedure Volumes in Gastrointestinal and Pulmonary Care

Rising incidence of colorectal cancer, COPD, asthma, and chronic respiratory infections drives higher volumes of GI and pulmonary diagnostic procedures, directly boosting demand for single-use flexible endoscopes. Healthcare systems prefer disposable devices to handle increasing throughput without adding sterilization bottlenecks or investing in new capital equipment. As outpatient and ambulatory care centers expand minimally invasive interventions, the need for ready-to-use, zero-maintenance devices grows sharply. This shift supports cost and workflow efficiencies, reinforcing procedure volume growth as a key market driver.

- For instance, Olympus offers a single-use air/water, suction and biopsy valve kit called CleverShield, featuring irrigation flow rates optimized for clinical efficiency and compatibility with its OFP-2 pumps.

- Technological Enhancements Improving Clinical Performance

Advancements in imaging resolution, distal-tip articulation, integrated LEDs, and ergonomic designs make modern disposable endoscopes clinically comparable to reusable systems. Manufacturers introduce improved CMOS sensors, enhanced suction channels, and wireless display connectivity, enabling high-quality visualization and ease of maneuvering. These innovations increase physician confidence in single-use platforms, extending adoption beyond low-complexity procedures. As reliability improves and per-procedure costs decrease through scaled production, technology-driven performance gains significantly expand the addressable market across various specialties.

Key Trends & Opportunities

1. Expansion into High-Risk and Emergency Care Settings

Single-use endoscopes increasingly penetrate emergency departments, ICUs, and infectious-disease units, where immediate availability and rapid turnover are essential. Clinicians prefer disposables for emergent airway management, trauma care, and critically ill patients who require sterile, on-demand equipment. Growth opportunities emerge as hospitals prioritize faster response times and reduced contamination risks. Additionally, single-use bronchoscopes and duodenoscopes gain traction in high-risk cases, creating a strong adoption pathway for advanced disposable systems across acute-care environments.

- For instance, HOYA’s PENTAX Medical ONE Pulmo™ single-use bronchoscope (model EB15-S01) features an insertion tube diameter of 5.3 mm (max 5.8 mm), a working channel of 3.0 mm (min 2.95 mm), and a tip angulation range of 210° up / 180° down, delivering high suction capacity and reliable navigation in critical airway procedures.

2. Growing Adoption in Ambulatory and Remote Care Facilities

Ambulatory surgical centers (ASCs), mobile clinics, and remote healthcare sites adopt single-use flexible endoscopes to avoid investment in expensive reprocessing infrastructure. As decentralized care delivery grows, disposable devices offer logistical advantages including portability, low upfront cost, and simplified workflow. These trends open opportunities in rural healthcare programs, military medical units, and home-based diagnostic services. The ability to deploy sterile endoscopes in resource-limited settings positions single-use platforms as a scalable solution for expanding procedural accessibility.

- For instance, Ambu’s aScope 5 Uretero has an insertion cord outer diameter of 8.1 Fr (2.7 mm) and offers 270°/270° tip bending, enabling excellent maneuverability even when used in minimal-resource settings.

Key Challenges

1. Higher Per-Procedure Cost Compared to Reusable Systems

Despite eliminating reprocessing costs, single-use endoscopes often present higher per-procedure expenses, especially in high-volume departments such as GI suites. Hospitals with existing sterilization infrastructure may find the cost difference difficult to justify. Budget constraints in public healthcare facilities further limit adoption. Additionally, reimbursement variability across regions creates uncertainty in long-term cost planning. The challenge lies in demonstrating total cost-of-care benefits that outweigh upfront per-use spending, particularly for large healthcare institutions with optimized reusable endoscope workflows.

2. Environmental Concerns Related to Medical Waste

Single-use endoscopes generate significant plastic and electronic waste, raising sustainability concerns as procedure volumes grow. Hospitals face increasing pressure to reduce medical waste and comply with environmental guidelines. The lack of standardized recycling programs for electronic medical disposables compounds the challenge. Manufacturers must develop eco-friendly materials, recycling pipelines, or energy-efficient disposal solutions to address criticism regarding the environmental footprint. Without clear mitigation strategies, sustainability concerns may limit widespread adoption in environmentally regulated healthcare markets.

Regional Analysis

North America

North America leads the global single-use flexible endoscope market with an estimated 40% share, supported by advanced healthcare systems, high diagnostic procedure volumes, and strong institutional focus on infection-control compliance. Hospitals increasingly adopt disposable endoscopes to reduce cross-contamination risks and address reprocessing failures associated with reusable devices. Favorable reimbursement structures and rapid regulatory approvals further accelerate commercialization. The presence of major manufacturers offering technologically enhanced single-use bronchoscopy and GI platforms boosts penetration. Growing demand across ICUs, emergency departments, and outpatient centers reinforces the region’s leadership, with continued growth driven by workflow efficiency priorities.

Europe

Europe holds approximately 30% of the global market, driven by strict infection-prevention regulations and national healthcare systems shifting toward disposable solutions to reduce contamination incidents. Countries such as Germany, the U.K., France, and the Nordics demonstrate strong adoption as hospitals prioritize safe, standardized procedures. Rising endoscopy volumes for GI, pulmonary, and critical-care applications support consistent growth. Procurement support from public healthcare authorities improves accessibility, while ongoing product launches by established European device manufacturers enhance technology visibility. Environmental considerations remain influential, prompting opportunities for recyclable materials and circular-economy waste-management programs.

Asia Pacific

Asia Pacific captures nearly 20% market share, fueled by rapid healthcare modernization, rising hospital investments, and expanding diagnostic capacity across China, India, Japan, South Korea, and Southeast Asia. The growing prevalence of GI and respiratory diseases drives higher procedure volumes, encouraging adoption of single-use devices to prevent infection risks in resource-constrained settings. Private hospital chains and urban specialty centers accelerate uptake due to reduced maintenance overhead and faster device availability. Although cost sensitivity remains a challenge, emerging local manufacturers and competitive pricing strategies strengthen long-term adoption prospects, positioning the region for the fastest growth rate globally.

Latin America

Latin America represents about 6–7% of the global market, with demand concentrated in Brazil, Mexico, Chile, and Colombia. Hospitals increasingly adopt disposable endoscopes to overcome gaps in reprocessing infrastructure and address infection-control deficiencies. Rising GI disease burden and the expansion of private healthcare facilities support market growth, particularly in urban regions. Public hospitals face budget constraints, slowing broad implementation, yet partnerships between global suppliers and regional distributors improve device availability. Growing investment in outpatient and day-surgery centers further enhances adoption, positioning the region for gradual but steady long-term expansion.

Middle East & Africa

The Middle East & Africa region accounts for roughly 4–5% market share, with uptake strongest in the Gulf Cooperation Council (GCC) countries including the UAE, Saudi Arabia, and Qatar. Investments in hospital modernization, infection-control programs, and expansion of tertiary care facilities support early adoption of single-use flexible endoscopes. Increased emphasis on high-quality sterile instruments in ICUs and emergency care strengthens market penetration. However, much of Africa faces cost and training barriers that limit widespread adoption. Growing involvement of international manufacturers and the expansion of private hospitals gradually create new opportunities across both subregions.

Market Segmentations:

By Device Type:

- Endoscopes

- Endoscopic Operative Devices

By Application:

By End User:

- Hospitals

- Academic Medical Centers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Single-Use Flexible Endoscope Market includes key players such as OTU Medical, KARL STORZ, COOPERSURGICAL, Olympus Corporation, HOYA Corporation, Ambu A/S, obp Surgical Corporation, Flexicare Medical Limited, Welch Allyn (Hill Rom), and Boston Scientific Corporation. the Single-Use Flexible Endoscope Market is defined by rapid technological advancement, strong R&D investment, and growing emphasis on infection prevention. Manufacturers focus on enhancing visualization quality through high-resolution CMOS sensors, improving articulation mechanisms for better maneuverability, and integrating wireless or plug-and-play connectivity to streamline clinical workflows. Cost efficiency remains a core competitive factor, driving companies to adopt automated production, lightweight polymer engineering, and scalable supply chains. As healthcare facilities increasingly shift toward disposable devices to eliminate reprocessing complexity, market participants differentiate through improved durability, consistent performance, and specialized models tailored for ENT, bronchoscopy, GI, and urology applications. Sustainability initiatives—such as recyclable components and reduced packaging—are also emerging as competitive levers, addressing environmental concerns associated with single-use medical devices. Overall, competition centers on performance innovation, regulatory compliance, pricing strategies, and partnerships with hospitals and ambulatory care providers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- OTU Medical

- KARL STORZ

- COOPERSURGICAL, INC.

- Olympus Corporation

- HOYA Corporation

- Ambu A/S

- obp Surgical Corporation

- Flexicare Medical Limited

- Welch Allyn (Hill Rom)

- Boston Scientific Corporation

Recent Developments

- In May 2025, FUJIFILM Healthcare Europe launched the ELUXEO EG-840T and the specially designed narrow EG-840TP, as part of the new 800 Series ELUXEO Endoscopes. These endoscopes are the second release under the ‘WELCOME, FUTURE’ initiative, following the ELUXEO 8000 system.

- In October 2024, Lumicell announced that it is developing a novel flexible endoscope for the detection of precancerous and early-stage esophageal adenocarcinoma (EAC) in patients with Barrett’s esophagus.

- In August 2024, KARL STORZ United States partnered with FUJIFILM Healthcare Americas Corporation (Fujifilm) to provide comprehensive solutions for endoscopists and surgeons. This partnership aims to transform endoscopy by combining Fujifilm’s industry-leading flexible gastrointestinal (GI) endoscopes with OR integration solutions from KARL STORZ.

- In April 2024, Olympus received U.S. FDA 510(k) clearance for its first single-use flexible ureteroscope system, named RenaFlex. This innovative device is designed to assist healthcare professionals in diagnosing and treating urinary diseases and disorders, such as kidney stones.

Report Coverage

The research report offers an in-depth analysis based on Device Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as hospitals prioritize infection prevention and eliminate risks linked to endoscope reprocessing.

- Single-use systems will gain wider adoption in high-volume procedures due to improved imaging quality and consistent device performance.

- Manufacturers will integrate more advanced CMOS sensors, enhancing clarity and diagnostic confidence across clinical applications.

- Automated and scalable production processes will lower per-unit costs, strengthening competitiveness against reusable devices.

- Adoption will accelerate in ambulatory surgical centers and emergency departments where turnaround time and workflow efficiency are critical.

- Sustainability initiatives will grow as companies develop recyclable materials and low-waste device designs.

- Regulatory agencies will introduce more standardized guidelines, supporting broader acceptance of single-use endoscopic technologies.

- AI-assisted imaging and real-time decision support tools will gradually incorporate into next-generation single-use platforms.

- Specialty-specific disposable endoscopes will expand, enabling tailored solutions for ENT, urology, GI, and pulmonary procedures.

- Strategic partnerships between device manufacturers and healthcare networks will shape pricing models and long-term market penetration.