Market Overview

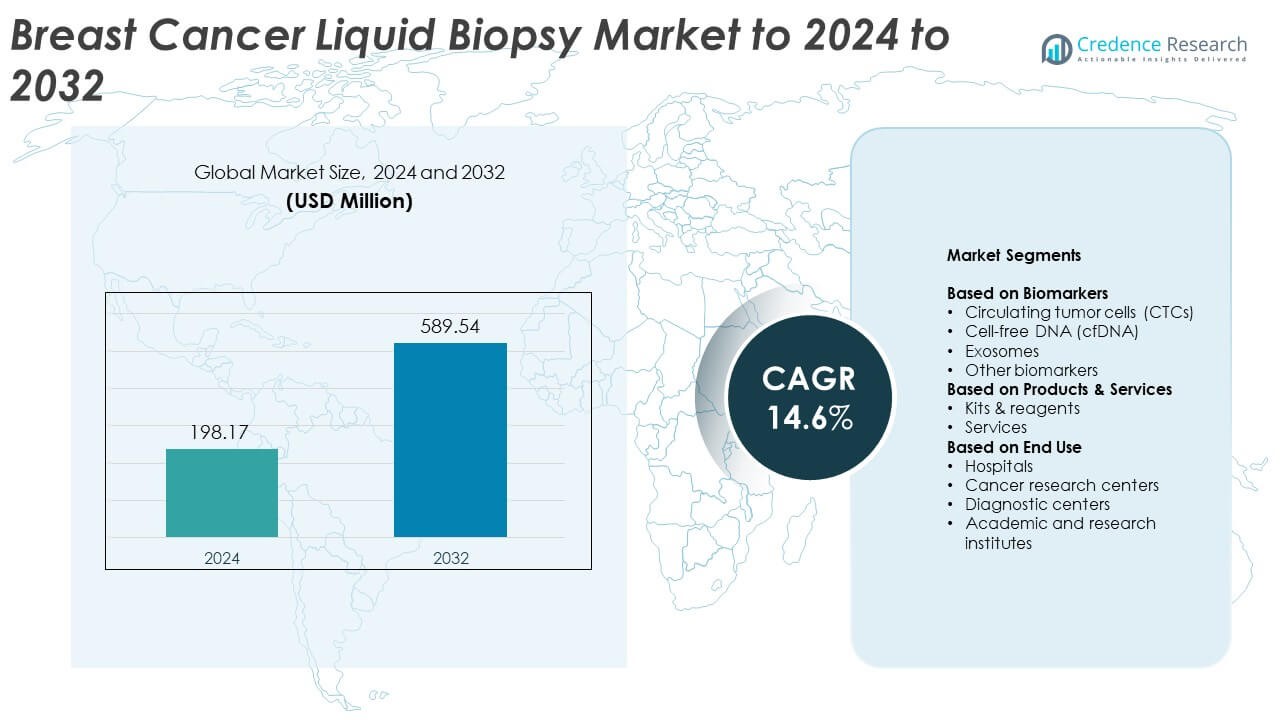

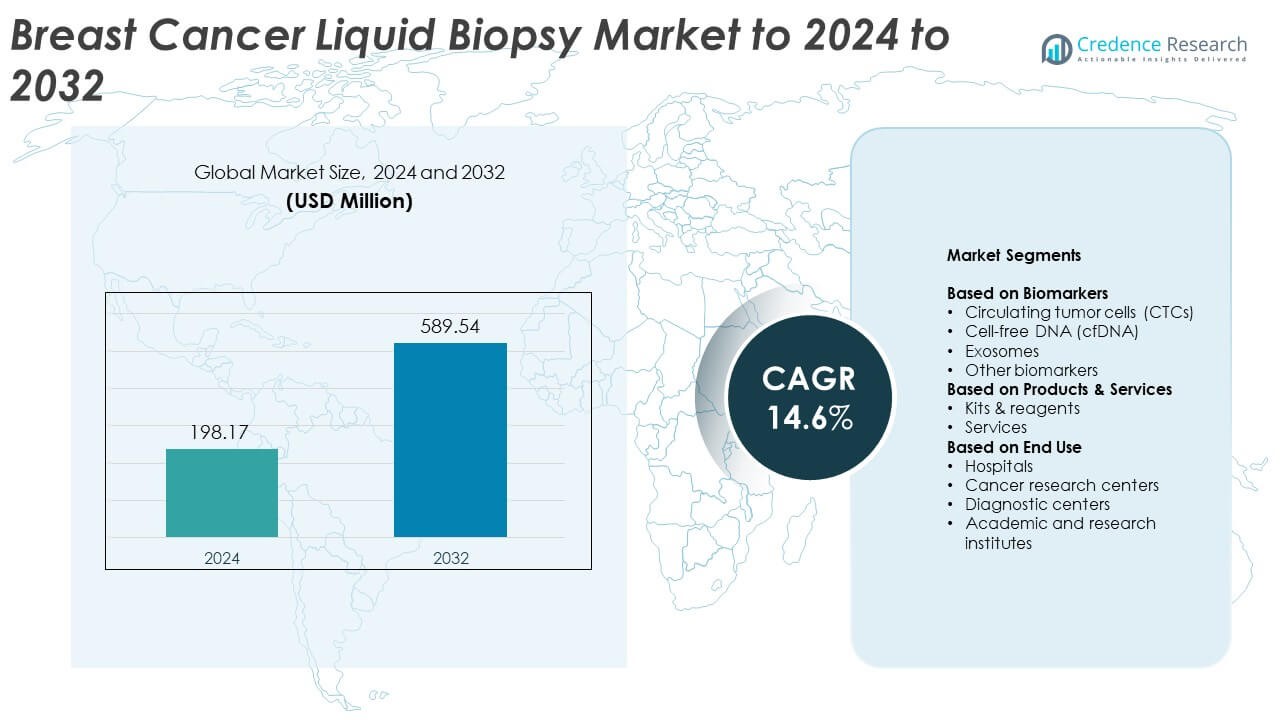

Breast Cancer Liquid Biopsy Market size was valued at USD 198.17 Million in 2024 and is anticipated to reach USD 589.54 Million by 2032, at a CAGR of 14.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Breast Cancer Liquid Biopsy Market Size 2024 |

USD 198.17 Million |

| Breast Cancer Liquid Biopsy Market , CAGR |

14.6% |

| Breast Cancer Liquid Biopsy Market Size 2032 |

USD 589.54 Million |

The Breast Cancer Liquid Biopsy Market is shaped by key participants including QIAGEN, Genes2me, Sysmex, Menarini Silicon Biosystems, Illumina, OncoDNA, Epic Sciences, Myriad Genetics, F. Hoffmann-La Roche, and Datar Cancer Genetics. These companies advance high-sensitivity biomarker assays, sequencing technologies, and AI-enabled analysis tools that support wider clinical adoption. North America leads the market with about 41% share due to strong diagnostic infrastructure and rapid integration of precision oncology. Europe follows with nearly 29% share, supported by robust cancer screening programs, while Asia-Pacific holds about 21% share and continues to grow quickly as genomic testing capabilities expand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Breast Cancer Liquid Biopsy Market was valued at USD 198.17 Million in 2024 and is projected to reach USD 589.54 Million by 2032 at a CAGR of 14.6%.

• Strong demand for minimally invasive diagnostics drives adoption, with circulating tumor cells leading the biomarker segment at about 42% share due to high clinical utility.

• AI-enabled analysis, multi-omics integration, and rising use of cfDNA for mutation tracking shape major market trends while improving detection accuracy and treatment monitoring.

• The competitive landscape involves companies expanding assay sensitivity, sequencing platforms, and data-interpretation capabilities while forming partnerships with hospitals and research centers.

• North America leads with around 41% share, followed by Europe at about 29%, while Asia-Pacific holds nearly 21% and grows fastest; hospitals dominate end use with about 48% share as they expand precision oncology and recurrence-monitoring practices.

Market Segmentation Analysis:

By Biomarkers

The circulating tumor cells segment leads this category with about 42% share in 2024. This dominance comes from strong clinical use in early detection, recurrence monitoring, and therapy response analysis. CTCs offer high diagnostic value because they provide intact cellular material for genetic and phenotypic assessment. The cfDNA segment grows fast due to rising demand for noninvasive genomic profiling and mutation tracking. Exosomes gain traction as researchers expand work on microRNA signatures in breast cancer. Other biomarkers hold a smaller share but support niche diagnostic applications.

- For instance, Guardant Health, Inc. reported 18 abstracts (including four oral sessions) on its ShieldTM multi-cancer detection (MCD) test at the 2025 American Association for Cancer Research Annual Meeting.

By Products and Services

Kits and reagents dominate this segment with nearly 63% share in 2024, supported by frequent test usage, high consumable demand, and recurring revenue models in diagnostic workflows. The strong uptake comes from rising adoption of liquid biopsy panels, mutation detection kits, and sample preparation reagents in hospitals and research labs. Services continue to expand as cancer centers outsource genomic testing, sequencing, and data analysis. Growth remains linked to increasing personalization of breast cancer treatment and broader integration of biomarker-driven decision tools.

- For instance, QIAGEN N.V. disclosed that its consumables and related sales made up nearly 90 % of its total sales, and the Diagnostic Solutions Product Group saw an 8 % CER sales rise in Q2 FY24.

By End Use

Hospitals hold the leading share of about 48% in 2024 due to high patient volume, growing adoption of liquid biopsy for monitoring treatment response, and rapid integration of minimally invasive diagnostics. Cancer research centers follow as they increase clinical trials and molecular research focused on early detection biomarkers. Diagnostic centers expand use of advanced sequencing platforms for routine screening. Academic and research institutes contribute steady growth by advancing biomarker discovery, assay refinement, and validation studies that support broader market adoption.

Key Growth Drivers

Growing demand for minimally invasive diagnostics

Hospitals and cancer centers continue to increase the use of liquid biopsy because the method offers a safer and more comfortable alternative to tissue biopsy. Clinicians adopt these tests to monitor treatment response, detect recurrence earlier, and reduce repeated surgical procedures. Rising awareness among patients also supports wider acceptance. The push toward precision oncology strengthens this growth because liquid biopsy enables real-time molecular insights that guide therapy changes. Together, these factors make minimally invasive diagnostics a primary growth driver.

- For instance, Guardant Health announced data for its Shield MCD test across 10 tumour types, showing “high specificity and clinically meaningful sensitivity” in April 2025.

Rising focus on precision medicine in breast cancer care

Oncologists rely more on biomarker-driven decisions to choose targeted therapies and evaluate treatment effectiveness. Liquid biopsy supports this model by allowing frequent genomic assessments without invasive procedures. This capability helps identify emerging mutations, track tumor evolution, and adjust therapies faster. Pharmaceutical companies also expand companion diagnostic partnerships to align new drugs with liquid biopsy platforms. These advances make precision medicine a major driver of sustained market expansion.

- For instance, A large-scale analysis demonstrated that presence of circulating tumour cells (CTCs) predicted worse outcomes with HRs of 1.82 for DFS, 1.89 for distant DFS in breast cancer.

Advancements in biomarker technologies and assay sensitivity

Improved detection of circulating tumor cells, cfDNA, and exosomes enhances diagnostic accuracy and supports deeper clinical adoption. Companies launch high-sensitivity assays capable of identifying low-frequency mutations that previously went undetected. Better sample preparation tools and sequencing platforms increase test reliability across diverse patient profiles. These improvements enable broader use in early detection, prognosis evaluation, and longitudinal monitoring. As a result, technological progress stands as a core market driver.

Key Trends and Opportunities

Expansion of multi-omics liquid biopsy platforms

Developers integrate genomics, transcriptomics, and proteomics into unified liquid biopsy assays to improve prediction power. Multi-omics platforms help clinicians gain a more complete view of tumor biology, enabling stronger personalization of treatment. Research centers invest in these technologies to validate new biomarker combinations. This trend creates opportunities for companies offering hybrid assay panels and advanced data-analytics solutions.

- For instance, PrognomiQ announced promising results from a deep multi-omics case-control study of 2,513 subjects and subsequently launched a large-scale prospective clinical program of 15,000 subjects.

Rising adoption of AI-enabled data interpretation

AI tools support faster and more accurate interpretation of complex biomarker patterns such as cfDNA fragmentation, CTC morphology, and exosomal signatures. Machine-learning models help reduce diagnostic errors and enhance prediction of relapse risk. Technology firms collaborate with research institutes to build algorithms trained on large patient datasets. This creates new opportunities for precision-focused liquid biopsy solutions with stronger clinical utility.

- For instance, HEALWELL AI Inc.’s subsidiary Pentavere Research Group published a study in the Journal of Liquid Biopsy showing its DARWEN™ AI system achieved a 100-fold improvement in time compared to manual review of complex NGS/liquid-biopsy reports.

Growing use in treatment-response monitoring and recurrence tracking

More oncologists use liquid biopsy to evaluate therapy effectiveness after each treatment cycle. This enables earlier detection of resistance mutations and faster therapy adjustment. The opportunity grows as clinical guidelines shift toward continual monitoring in metastatic breast cancer. Companies benefit through increased demand for longitudinal testing panels.

Key Challenges

Limited standardization across testing platforms

- Laboratories use different extraction methods, sequencing workflows, and biomarker thresholds, leading to variations in test results. This inconsistency reduces confidence among clinicians and slows broader clinical integration. Regulatory agencies work to define harmonized protocols, but adoption remains uneven. The lack of uniform standards continues to be a major market challenge.

High test costs and reimbursement barriers

Many advanced liquid biopsy assays remain expensive due to sequencing requirements and specialized reagents. Limited reimbursement coverage restricts access for many patients and reduces routine testing in smaller hospitals. Payers demand stronger clinical-utility evidence before expanding coverage. These financial constraints present a persistent challenge for market growth.

Regional Analysis

North America

North America holds about 41% share in 2024 because hospitals and cancer centers rapidly adopt liquid biopsy for early detection and treatment monitoring. Strong presence of diagnostic companies, high awareness among patients, and wide access to genomic testing support regional leadership. Research institutes also run large clinical studies that validate new biomarkers, increasing confidence among clinicians. Favorable reimbursement expansion in select states improves testing uptake. Growing integration of cfDNA and CTC-based assays in precision cancer care keeps North America the dominant regional contributor.

Europe

Europe accounts for nearly 29% share in 2024, supported by strong cancer screening programs and steady investment in molecular diagnostics across major countries. Hospitals adopt liquid biopsy for tracking metastatic breast cancer and guiding targeted therapy decisions. Regulatory agencies promote high-quality standards, which boosts clinical trust in biomarker-based tests. Research collaborations between universities and diagnostic firms also accelerate technology validation. Rising focus on reducing invasive procedures strengthens regional growth, keeping Europe a key participant in the global market.

Asia-Pacific

Asia-Pacific captures about 21% share in 2024 and represents the fastest-growing region due to rising breast cancer incidence, growing healthcare spending, and expanding genomic testing infrastructure. Countries such as China, Japan, and South Korea increase adoption of cfDNA and CTC assays for early diagnosis and monitoring. Government-backed precision oncology programs further boost uptake. Private diagnostic labs introduce advanced sequencing services that improve accessibility. The combination of rising patient awareness and rapid technology expansion positions Asia-Pacific as a major growth hub.

Latin America

Latin America holds close to 6% share in 2024, driven by gradual expansion of molecular diagnostics and increasing adoption in urban cancer centers. Larger hospitals integrate liquid biopsy for monitoring therapy response in advanced breast cancer cases. Limited access in rural areas slows wider uptake, but private labs introduce cost-effective testing panels that improve availability. Government health programs in select countries work to expand cancer screening infrastructure. Steady improvements in diagnostic capacity help the region progress at a moderate pace.

Middle East and Africa

Middle East and Africa account for around 3% share in 2024, supported by rising investments in cancer care and the gradual expansion of precision medicine facilities in Gulf countries. Adoption is higher in specialized oncology centers that use liquid biopsy for treatment monitoring and recurrence assessment. Limited laboratory infrastructure in several African nations slows broader penetration. Increasing partnerships with international diagnostic companies improve access to advanced biomarker technologies. Although the smallest contributor, the region shows steady long-term potential.

Market Segmentations:

By Biomarkers

- Circulating tumor cells (CTCs)

- Cell-free DNA (cfDNA)

- Exosomes

- Other biomarkers

By Products & Services

By End Use

- Hospitals

- Cancer research centers

- Diagnostic centers

- Academic and research institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Breast Cancer Liquid Biopsy Market features active participation from QIAGEN, Genes2me, Sysmex, Menarini Silicon Biosystems, Illumina, OncoDNA, Epic Sciences, Myriad Genetics, F. Hoffmann-La Roche, and Datar Cancer Genetics in the competitive landscape. Companies focus on developing high-sensitivity assays, improving biomarker detection accuracy, and expanding multi-omics capabilities to strengthen their positions. Many firms invest in advanced sequencing platforms and automated workflows to support large-scale clinical adoption. Strategic partnerships with hospitals, research institutions, and pharmaceutical developers help expand clinical trial involvement and improve validation of emerging biomarkers. Providers also work on enhancing turnaround time, reducing testing complexity, and improving data-analysis tools to meet rising demand for real-time treatment monitoring. Strong emphasis on regulatory compliance, quality standards, and geographical expansion further shapes competition across the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Genes2me launched liquid biopsy NGS panels, including a breast cancer panel covering 36 clinically relevant genes.

- In 2023, QIAGEN launched QIAseq targeted cfDNA ultra panels to enable easy and speedy diagnosis of cancers, including breast cancer.

- In 2023, Datar Cancer Genetics received its third Breakthrough Device Designation from the US FDA for its TriNetra-Glio blood test to help diagnose brain tumors, completing a set of three designations that include earlier-stage breast and prostate cancer liquid biopsy tests

Report Coverage

The research report offers an in-depth analysis based on Biomarkers, Products & Services, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Liquid biopsy adoption will rise as hospitals expand precision breast cancer care.

- High-sensitivity biomarker assays will improve early detection accuracy.

- AI-driven analytics will strengthen mutation tracking and recurrence prediction.

- Multi-omics platforms will gain traction for deeper tumor biology insights.

- Companion diagnostics partnerships will increase as targeted therapies expand.

- Testing costs will gradually decline with wider sequencing availability.

- Clinical guidelines will incorporate liquid biopsy more often for treatment monitoring.

- Emerging biomarkers such as exosomal RNA will unlock new diagnostic pathways.

- Decentralized testing models will grow across developing regions.

- Regulatory approvals will accelerate market entry for next-generation liquid biopsy tools.