Market Overview

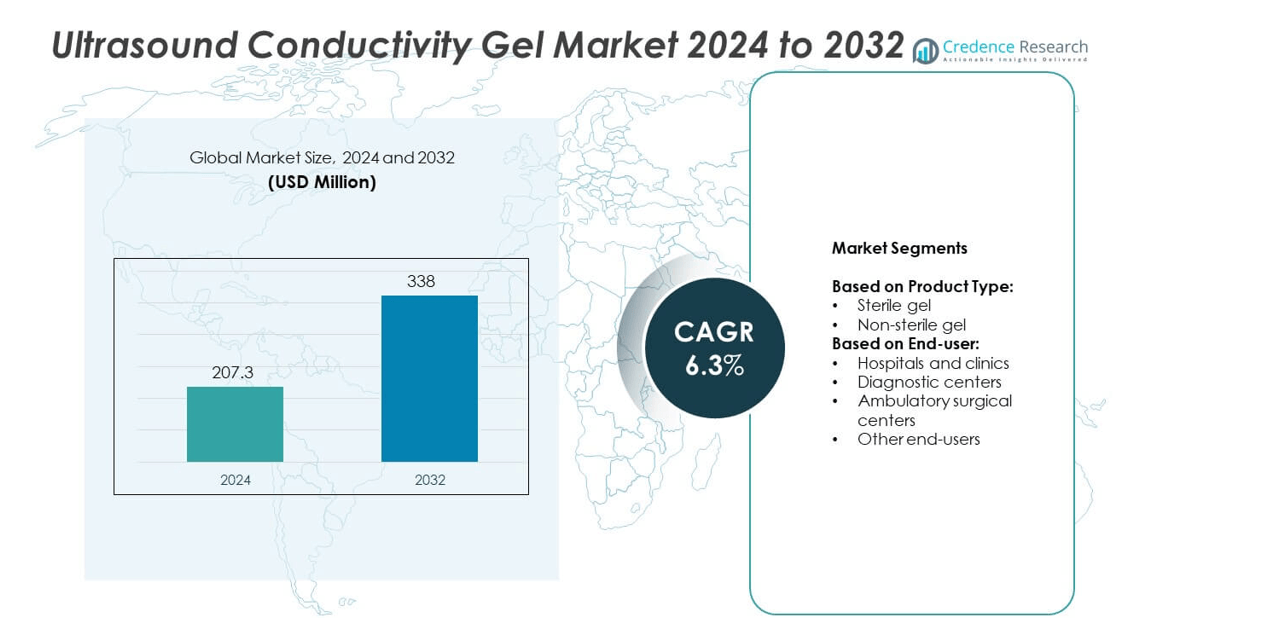

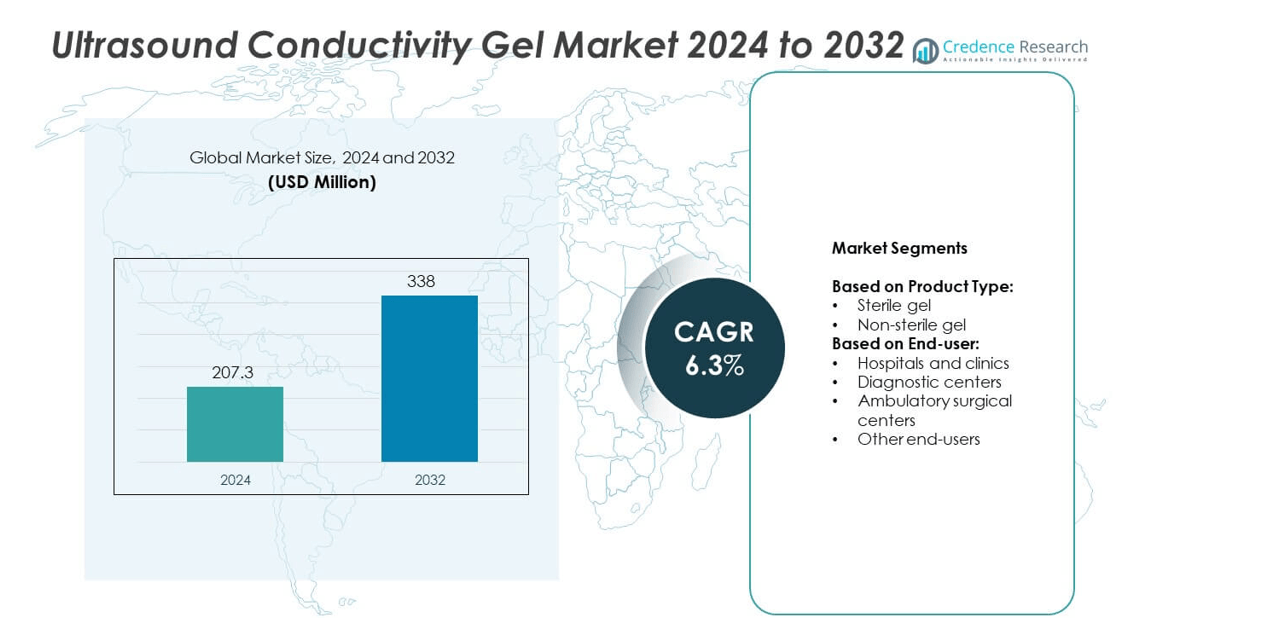

The Ultrasound Conductivity Gel Market size was valued at USD 207.3 million in 2024 and is anticipated to reach USD 338 million by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultrasound Conductivity Gel Market Size 2024 |

USD 207.3 million |

| Ultrasound Conductivity Gel Market, CAGR |

6.3% |

| Ultrasound Conductivity Gel Market Size 2032 |

USD 338 million |

The Ultrasound Conductivity Gel market grows through rising demand for diagnostic imaging, supported by increasing cases of cardiovascular, obstetric, and chronic diseases. Hospitals and diagnostic centers adopt sterile gels to ensure patient safety and meet infection-control standards. Portable and handheld ultrasound systems expand usage in emergency and rural care, creating steady demand for single-use packs. Manufacturers focus on eco-friendly, hypoallergenic, and high-performance formulations to align with evolving healthcare needs. These drivers and trends continue to strengthen the market’s long-term growth.

North America leads the Ultrasound Conductivity Gel market with advanced healthcare systems and strong adoption of sterile products, while Europe follows with strict regulatory standards and widespread use in hospitals and clinics. Asia-Pacific records the fastest growth due to expanding healthcare infrastructure and rising ultrasound procedures. Latin America and the Middle East & Africa show steady progress through growing diagnostic facilities. Key players shaping the market include Cardinal Health, Parker Laboratories, Medline Industries, and ECO-MED Diagnostic Imaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ultrasound Conductivity Gel market was valued at USD 207.3 million in 2024 and is projected to reach USD 338 million by 2032, growing at a CAGR of 6.3%.

- Rising demand for diagnostic imaging, driven by cardiovascular, obstetric, and chronic disease cases, fuels strong adoption of conductivity gels.

- The market trends highlight increasing preference for sterile, hypoallergenic, and eco-friendly gels, alongside higher usage in portable and handheld ultrasound systems.

- Competitive dynamics are shaped by global players offering wide product portfolios and regional firms focusing on cost-effective solutions to cater to diverse healthcare settings.

- Restraints include price pressures, limited awareness in smaller facilities, and risks of allergic reactions from certain gel formulations, which challenge wider adoption.

- Regional analysis shows North America leading with advanced infrastructure, Europe growing with strict regulations, Asia-Pacific expanding fastest with rising healthcare investments, while Latin America and the Middle East & Africa progress steadily with diagnostic facility improvements.

- Future opportunities lie in product differentiation, with developments such as temperature-sensitive gels, biodegradable formulations, and single-use sterile packaging gaining traction across hospitals, clinics, and emerging healthcare markets.

Market Drivers

Rising Demand for Diagnostic Imaging Procedures

The growth of diagnostic imaging procedures is a key driver for the Ultrasound Conductivity Gel market. Increasing prevalence of cardiovascular diseases, cancers, and musculoskeletal disorders fuels demand for accurate imaging. Hospitals and diagnostic centers expand ultrasound services to manage rising patient volumes. It supports enhanced visualization by improving transmission of sound waves during scans. This ensures precise results across abdominal, obstetric, and vascular applications. The steady rise in imaging tests strengthens the adoption of conductivity gels globally.

- For instance, In 2023, Philips Healthcare continued to provide its EPIQ Elite ultrasound systems for use in healthcare facilities across Europe. These systems, which rely on conductivity gels for consistent acoustic coupling, were used to perform a wide variety of diagnostic imaging procedures. The total European market for ultrasound devices was valued at $2,605.8 million in 2023.

Technological Advancements in Ultrasound Equipment

Advancements in ultrasound equipment directly impact the need for effective conductivity gels. Modern imaging systems deliver higher frequencies and require gels with improved acoustic properties. It ensures clarity in high-resolution imaging used in cardiology, oncology, and prenatal care. Manufacturers develop specialized formulations to match performance standards of advanced devices. Increased integration of portable and handheld ultrasound systems widens the usage scope. These innovations accelerate consistent demand for gels across diverse clinical environments.

- For instance, GE HealthCare’s LOGIQ E10 ultrasound platform supports a wide range of imaging frequencies, with specific high-frequency probes enabling imaging up to 20 MHz or higher.

Growing Adoption of Point-of-Care Ultrasound

Point-of-care ultrasound is becoming a common practice in emergency medicine and critical care. It provides fast diagnostic support in trauma cases, intensive care units, and remote settings. The Ultrasound Conductivity Gel market benefits from this trend with rising consumption rates. It enables seamless patient monitoring by improving scan quality in bedside examinations. Emergency and rural healthcare providers rely on gels for portable systems. Expanding adoption in non-hospital facilities continues to support significant market growth.

Regulatory Standards and Clinical Safety Requirements

Strict regulatory guidelines for medical devices drive higher quality standards for conductivity gels. Healthcare institutions prioritize products that comply with FDA and CE certifications. It ensures patient safety by reducing risks of infection or allergic reactions. Manufacturers focus on sterile and hypoallergenic formulations to meet regulatory norms. Demand increases for single-use and sterile packaging in clinical practices. Strengthening compliance frameworks contributes to sustainable expansion of the Ultrasound Conductivity Gel market.

Market Trends

Shift Toward Eco-Friendly and Biocompatible Formulations

The Ultrasound Conductivity Gel market reflects a trend toward eco-friendly and biocompatible solutions. Manufacturers invest in gels free from parabens and artificial dyes. It reduces risks of skin irritation and allergic responses during repeated diagnostic use. Clinics and hospitals increasingly prefer gels with safer, sustainable ingredients. Growing patient awareness about product safety fuels adoption of these advanced formulations. This trend strengthens the position of manufacturers focused on clean-label and environmentally safe products.

- For instance, During 2023, Fujifilm SonoSite, a leading manufacturer of portable ultrasound units, continued to serve healthcare facilities globally with its equipment, including its new Sonosite ST POCUS system. All of the company’s portable units depend on conductivity gels for rapid bedside diagnostics. For the fiscal year ending March 31, 2023, Fujifilm’s Medical Systems business, which includes ultrasound diagnostic systems, reported revenue of ¥917.9 billion

Expansion of Portable and Handheld Ultrasound Devices

The adoption of portable and handheld ultrasound devices is accelerating worldwide. Compact imaging systems increase the need for ready-to-use gels in emergency and remote care. It supports rapid diagnostics in ambulances, sports medicine, and rural healthcare units. Rising popularity of point-of-care systems drives higher gel consumption. Healthcare providers demand small packaging formats for quick accessibility. This expansion reinforces steady demand for conductivity gels across diverse medical environments.

- For instance, Parker Laboratories produces a variety of sterile ultrasound gel products, such as its Aquasonic 100 brand, which are tested to meet specific safety and effectiveness standards, including requirements for Class II medical devices

Increasing Preference for Single-Use and Sterile Packaging

Healthcare facilities adopt single-use sterile gels to minimize infection risks. Growing focus on patient safety supports this packaging trend across hospitals and clinics. It aligns with global infection-control protocols and rising awareness about cross-contamination. Manufacturers supply individually packed gels for diagnostic centers with high patient turnover. This ensures safety and consistency during imaging procedures. The Ultrasound Conductivity Gel market continues to shift toward sterile formats, reducing reliance on bulk containers.

Integration with Advanced Imaging Technologies

New imaging technologies influence the performance requirements of conductivity gels. Higher-frequency probes demand gels with superior acoustic impedance. It ensures sharper imaging in cardiology, oncology, and prenatal diagnostics. Research centers collaborate with manufacturers to design gels tailored for advanced ultrasound systems. Clinical adoption of 3D and 4D imaging further elevates the need for high-performance gels. This integration highlights a steady move toward specialized formulations that match evolving diagnostic technologies.

Market Challenges Analysis

Concerns Related to Product Safety and Allergic Reactions

The Ultrasound Conductivity Gel market faces challenges linked to product safety and patient sensitivity. Certain formulations contain chemicals that may trigger skin irritation or allergic responses. It creates concerns for patients undergoing frequent diagnostic procedures. Regulatory agencies impose strict standards, requiring manufacturers to ensure compliance with safety norms. Hospitals and clinics prefer hypoallergenic and sterile gels, but limited awareness in smaller facilities restricts adoption. Maintaining consistent product quality across diverse regions remains a major challenge for producers.

Price Pressures and Supply Chain Limitations

Intense price competition creates difficulties for manufacturers operating in cost-sensitive healthcare markets. The demand for low-cost alternatives impacts profitability and slows innovation efforts. It also pressures established players to balance affordability with product quality. Supply chain disruptions further limit availability of raw materials used in gel production. Delays in distribution create shortages, especially in emerging regions. Rising logistics costs and fluctuating material prices continue to pose barriers for steady market expansion.

Market Opportunities

Rising Adoption of Ultrasound in Emerging Healthcare Markets

The Ultrasound Conductivity Gel market holds strong opportunities in developing healthcare systems. Expanding access to diagnostic imaging in Asia-Pacific, Latin America, and Africa increases demand for gels. It supports growing investments in maternal health, cardiovascular screening, and chronic disease management. Governments and private players expand ultrasound infrastructure to serve larger patient populations. Affordable, locally produced gels can capture significant market share in these regions. The rising number of diagnostic centers and mobile clinics creates long-term growth potential.

Innovation in Specialized and Value-Added Formulations

Advances in ultrasound technology open opportunities for specialized conductivity gels. High-frequency and 3D imaging systems require gels with superior acoustic properties. It allows manufacturers to design products that enhance diagnostic precision across multiple specialties. Development of eco-friendly, biodegradable, and hypoallergenic gels meets demand for safer solutions. Premium offerings, such as temperature-sensitive or fast-drying gels, create differentiation in competitive markets. These innovations enable companies to build strong positioning while addressing evolving clinical requirements.

Market Segmentation Analysis:

By Product Type:

Sterile and non-sterile gels. Sterile gels dominate due to their critical role in minimizing infection risks during diagnostic and surgical procedures. Hospitals and clinics increasingly adopt sterile gels to comply with infection-control protocols and safety regulations. It ensures patient protection in high-risk environments such as obstetrics, cardiology, and interventional radiology. Non-sterile gels remain relevant in low-risk diagnostic imaging, where cost-efficiency is prioritized. Their continued use in smaller facilities and routine examinations sustains balanced demand across both segments.

- For instance, EcoVue, manufactured by HR Pharmaceuticals, developed a sustainable ultrasound gel line in 2018, featuring a natural, biodegradable formulation and waste-reducing FlexPac® packaging. The packaging allows for up to 99.5% gel evacuation.

By End-User:

In the Ultrasound Conductivity Gel market, hospitals and clinics lead adoption due to large patient volumes and wide imaging requirements. It supports diverse applications in cardiology, obstetrics, oncology, and general diagnostics where accuracy and safety are essential. Diagnostic centers represent the next major segment, fueled by increasing demand for specialized outpatient services. Ambulatory surgical centers also expand usage, relying on sterile gels to ensure safe minimally invasive procedures. Other end-users such as veterinary clinics, academic institutions, and research facilities contribute steadily, reflecting the broader adoption of ultrasound technology across medical and non-medical fields.

- For instance, During 2023, Clarius Mobile Health, a provider of AI-powered wireless handheld ultrasound scanners, continued to innovate and supply its equipment to clinicians globally. These scanners require specialized conductivity gels for acoustic coupling, and in March 2024, the company announced that it had delivered more than 25,000 systems into the hands of clinicians since its inception in 2016.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product Type:

- Sterile gel

- Non-sterile gel

Based on End-user:

- Hospitals and clinics

- Diagnostic centers

- Ambulatory surgical centers

- Other end-users

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for the largest share in the Ultrasound Conductivity Gel market with 36%. Strong healthcare infrastructure, advanced diagnostic imaging technologies, and a high prevalence of chronic diseases drive regional demand. Hospitals and clinics in the United States lead adoption with extensive use of ultrasound for cardiology, oncology, and women’s health. It benefits further from significant investments in portable ultrasound devices, which expand usage in outpatient and emergency settings. Canada also contributes to market expansion with rising government spending on maternal and neonatal healthcare. Growing demand for sterile gels that comply with FDA and Health Canada regulations strengthens product uptake across clinical environments. The presence of leading medical device manufacturers and established distribution networks further solidifies North America’s dominant market position.

Europe

Europe holds the second-largest share in the Ultrasound Conductivity Gel market with 28%. Widespread adoption of advanced imaging systems across Germany, France, the United Kingdom, and Italy supports steady demand. It reflects the region’s strong focus on patient safety, with hospitals and diagnostic centers prioritizing sterile gels. Government-backed programs for maternal health and cancer screening encourage higher ultrasound utilization. In countries such as Germany, strong demand emerges from both hospitals and ambulatory surgical centers. Eastern Europe also records growth as healthcare infrastructure modernizes and diagnostic imaging expands. The region’s emphasis on sustainable and hypoallergenic formulations fuels product innovations that match regulatory requirements under the European Medicines Agency (EMA).

Asia-Pacific

Asia-Pacific represents the fastest-growing region in the Ultrasound Conductivity Gel market, with a share of 22%. Expanding healthcare infrastructure in China, India, and Southeast Asian countries drives higher ultrasound adoption. It benefits from large patient populations requiring affordable diagnostic services for cardiology, obstetrics, and oncology. Rising government initiatives to expand maternal and child healthcare further increase demand. Japan and South Korea contribute through advanced imaging adoption in hospitals and clinics, where sterile gels remain standard practice. Manufacturers target Asia-Pacific with cost-effective and localized gel production to improve access. Expanding private healthcare investment in India and China sustains long-term growth, making the region a critical contributor to overall market expansion.

Latin America

Latin America accounts for a smaller but growing share in the Ultrasound Conductivity Gel market with 8%. Brazil and Mexico dominate regional demand due to large healthcare networks and expanding diagnostic facilities. It supports growing use of ultrasound for maternal care, emergency diagnostics, and chronic disease management. Limited infrastructure in other countries slows adoption, but government initiatives to improve healthcare access create opportunities. Demand for cost-effective non-sterile gels remains high in smaller clinics and rural centers. International manufacturers collaborate with local distributors to address pricing challenges and regulatory complexities. The region’s gradual shift toward sterile packaging formats highlights rising awareness of infection prevention.

Middle East and Africa

The Middle East and Africa together hold the smallest share in the Ultrasound Conductivity Gel market with 6%. Hospitals in Gulf countries such as Saudi Arabia and the UAE lead adoption with investments in advanced imaging systems. It also records growing demand across South Africa, supported by improvements in diagnostic infrastructure. Rising cases of maternal health concerns and cardiovascular diseases expand the role of ultrasound in clinical practice. However, limited availability of sterile products and high pricing constraints restrict faster growth in underdeveloped regions. Governments invest in modernizing healthcare facilities, creating gradual improvements in ultrasound services. The reliance on imported gels continues, but increasing awareness about patient safety is expected to stimulate adoption of sterile and hypoallergenic formulations.

Key Player Analysis

- Cardinal Health, Inc.

- Ceracarta Spa

- Medline Industries Inc.

- Pharmaceutical Innovation Inc.

- ECO-MED Diagnostic Imaging

- Roscoe Medical

- Modul Diagram S.r.l

- Parker Laboratories, Inc.

- DJO Global, Inc.

- National Therapy Products Inc.

Competitive Analysis

The leading players in the Ultrasound Conductivity Gel market include Cardinal Health, Parker Laboratories, Medline Industries, Roscoe Medical, ECO-MED Diagnostic Imaging, Pharmaceutical Innovation Inc., DJO Global, Modul Diagram S.r.l, National Therapy Products Inc., and Ceracarta Spa. These companies hold strong positions through wide product portfolios, global distribution networks, and consistent focus on clinical safety standards. The competitive landscape is shaped by continuous product innovation, with firms investing in sterile and hypoallergenic formulations to meet rising demand for safe diagnostic solutions. Market leaders prioritize compliance with FDA, CE, and other regulatory requirements, strengthening their acceptance in hospitals and diagnostic centers. Many companies expand through partnerships and distributor collaborations, ensuring product availability across developed and emerging regions. Cost-effective non-sterile gels continue to be supplied for smaller clinics, while premium sterile single-use packaging gains adoption in advanced healthcare settings. The presence of both multinational corporations and specialized regional firms enhances competition, encouraging differentiation through sustainable, patient-friendly formulations. With growing healthcare access in Asia-Pacific and Latin America, global players aim to strengthen local presence, while regional firms focus on affordability and tailored solutions. This balance between innovation, compliance, and distribution defines the competitive direction of the market.

Recent Developments

- In 2023, Enovis signed a definitive agreement to acquire LimaCorporate, an Italian orthopedic company.

- In September 2022, Parker Laboratories partnered with Tristel, a UK-based infection prevention company, to manufacture and distribute an ultrasound disinfectant in the U.S. market.

- In January 2021, DJO Global Inc, announced the acquisition of Trilliant Surgical. The acquisition of Trilliant Surgical’s leading product technologies supported the DJO’s focused expansion into the adjacent high-growth segment and increased revenue generation.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Ultrasound Conductivity Gel market will expand with rising global demand for diagnostic imaging.

- Hospitals and clinics will continue to dominate adoption due to wide imaging requirements.

- Portable and handheld ultrasound devices will boost demand for single-use gel packs.

- Sterile gels will gain traction as infection-control protocols strengthen across healthcare systems.

- Manufacturers will focus on eco-friendly, hypoallergenic, and biodegradable gel formulations.

- Asia-Pacific will remain the fastest-growing region supported by expanding healthcare access.

- Europe will drive innovation through regulatory pressure for safe and sustainable products.

- Partnerships between global and local suppliers will improve distribution in emerging economies.

- Research and academic institutions will expand usage for training and simulation purposes.

- Product differentiation with temperature-sensitive and fast-drying gels will create new opportunities.