| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Document Imaging Market Size 2024 |

USD 118,608.26 Million |

| Document Imaging Market, CAGR |

12.20% |

| Document Imaging Market Size 2032 |

USD 296,914.01 Million |

Market Overview

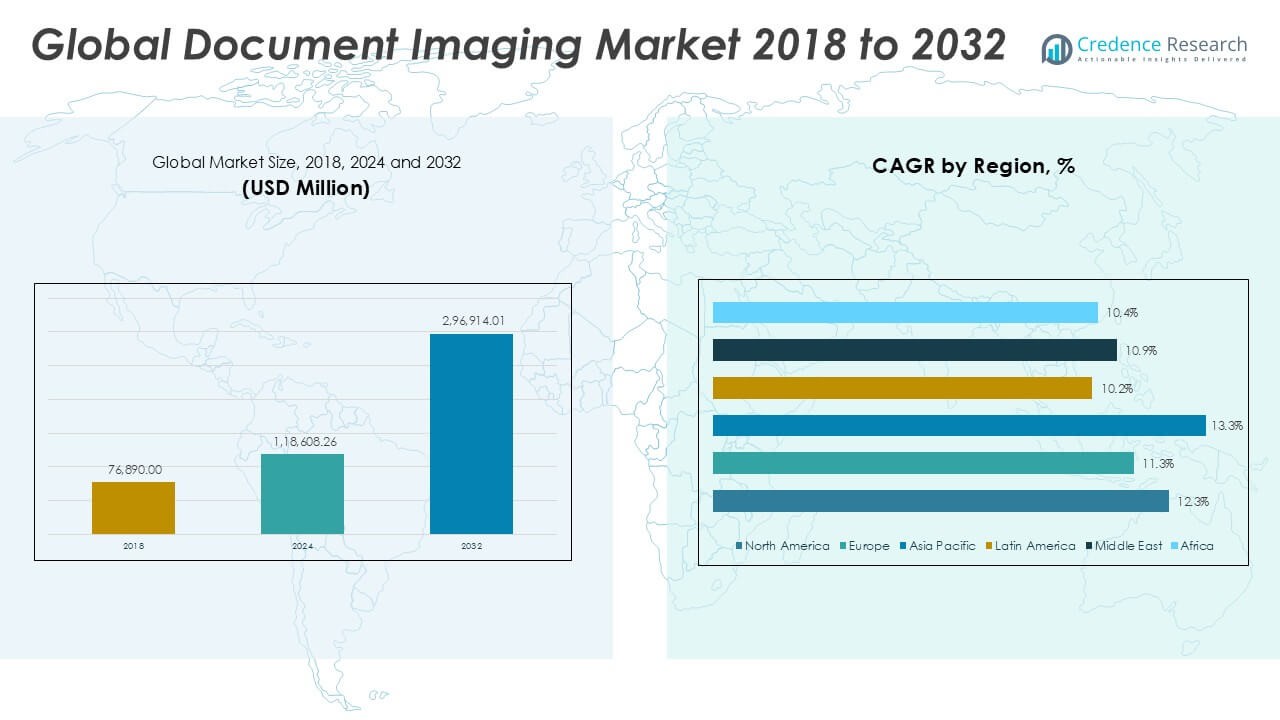

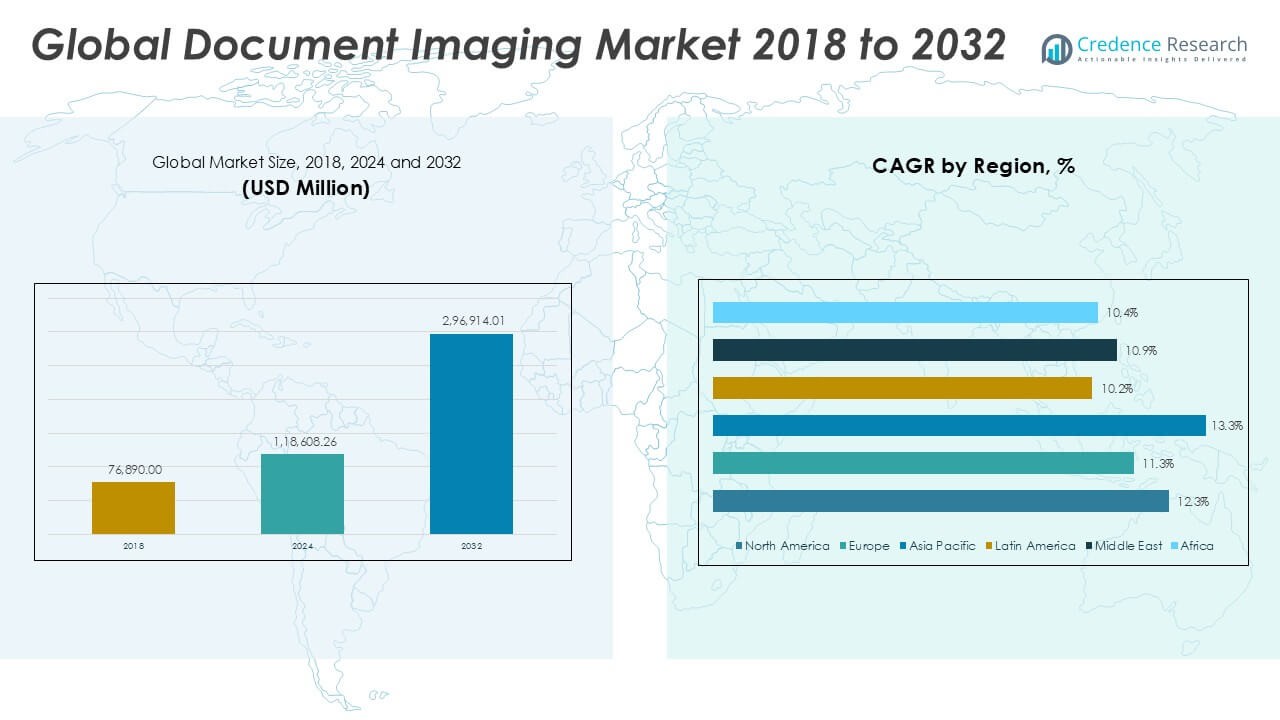

The Document Imaging Market size was valued at USD 76,890 million in 2018, reached USD 118,608.26 million in 2024, and is anticipated to reach USD 296,914.01 million by 2032, at a CAGR of 12.20% during the forecast period.

The Document Imaging Market is driven by the accelerating shift toward digital transformation across various industries, as organizations seek efficient ways to manage and store vast volumes of information. Growing adoption of cloud-based solutions, regulatory requirements for secure record-keeping, and the demand for streamlined workflows are fueling market growth. Advancements in artificial intelligence and machine learning have enabled enhanced image recognition and automated data extraction, making document imaging solutions more valuable for businesses aiming to optimize operational efficiency. The increasing prevalence of remote work has further highlighted the need for secure, accessible digital documentation. Trends such as the integration of document imaging with enterprise content management systems and the rise of mobile imaging applications are shaping the competitive landscape. As data privacy concerns intensify, providers are focusing on security features and compliance capabilities, positioning document imaging as a critical component of modern information governance strategies.

The geographical analysis of the Document Imaging Market highlights significant activity across North America, Europe, and Asia Pacific, with each region demonstrating strong demand for digital transformation solutions. North America leads in technological innovation and regulatory compliance, supported by high adoption rates in sectors such as healthcare and government. Europe emphasizes secure document management and digitalization initiatives, particularly in countries like Germany and the United Kingdom. Asia Pacific shows rapid growth fueled by expanding economies, digital government programs, and increased investments in education and financial services. Key players shaping the competitive landscape include Hewlett-Packard Company, Canon Inc., and Epson, all of which offer extensive product portfolios and invest in next-generation imaging technologies. These companies, along with Fujitsu Ltd., drive advancements in both hardware and software, providing organizations with integrated and scalable solutions to meet evolving document management needs across diverse industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Document Imaging Market was valued at USD 76,890 million in 2018, reached USD 118,608.26 million in 2024, and is projected to reach USD 296,914.01 million by 2032, registering a CAGR of 12.20% during the forecast period.

- Demand for efficient digital document management, data accessibility, and workflow automation continues to drive adoption across multiple industries.

- Strong trends include the integration of artificial intelligence, machine learning, and cloud-based deployment models, enabling advanced data extraction, mobile access, and seamless interoperability with enterprise systems.

- Leading competitors such as Hewlett-Packard Company, Canon Inc., and Epson invest in both hardware and software innovations, while companies like Adobe Systems Incorporated and IBM Corporation expand solution offerings in imaging software and cloud-based platforms.

- The market faces restraints from high integration costs, data migration challenges with legacy systems, and complex regulatory compliance requirements, particularly for organizations with sensitive records.

- North America leads growth due to advanced digital infrastructure and regulatory frameworks, while Asia Pacific demonstrates robust expansion supported by digitalization initiatives in China, Japan, and India.

- The market’s future will be shaped by ongoing innovation in AI, strong demand for secure and mobile-first imaging solutions, and vendor efforts to tailor offerings for sector-specific compliance and regional needs.

Market Drivers

Digital Transformation Initiatives Accelerate Adoption of Document Imaging Solutions

Organizations across industries are prioritizing digital transformation to improve efficiency, reduce manual processes, and enhance data accessibility. The Document Imaging Market benefits from these efforts, with enterprises replacing paper-based workflows with digital alternatives that support remote access and streamlined operations. Businesses now emphasize digitizing records to ensure business continuity and minimize the risks associated with physical document storage. The shift toward paperless offices, coupled with a demand for faster information retrieval, continues to drive investment in advanced imaging technologies. Public and private sectors recognize the importance of efficient document management for regulatory compliance and operational agility. Cloud-based document imaging services further support scalability and easy integration with existing enterprise applications. This focus on digital innovation establishes document imaging as a foundation for modern information management strategies.

- For instance, Canon Inc. reported that its imageRUNNER ADVANCE DX series enabled more than 70,000 organizations worldwide to digitize an average of 1.2 billion pages per year, supporting seamless transitions to paperless environments.

Stringent Regulatory Requirements and Focus on Information Security Drive Demand

Compliance with stringent data retention and privacy regulations compels organizations to implement secure document imaging systems. The Document Imaging Market reflects this trend, with businesses deploying solutions that provide robust encryption, audit trails, and secure access controls. Regulatory frameworks in healthcare, finance, and government sectors mandate secure storage, long-term retention, and reliable access to sensitive records. These requirements make it imperative for companies to upgrade legacy document management systems and adopt solutions aligned with international standards. The risk of data breaches and cyber threats highlights the necessity of comprehensive security features in document imaging products. Vendors invest in continuous product enhancements to address evolving compliance landscapes. Meeting these regulatory expectations remains a significant driver for market growth.

- For instance, IBM Corporation has equipped its FileNet Content Manager with AES 256-bit encryption and compliance certifications for HIPAA and GDPR, enabling over 4,000 healthcare and financial organizations to achieve regulatory alignment.

Advancements in Artificial Intelligence and Automation Enhance Efficiency

Rapid progress in artificial intelligence (AI) and automation has transformed the capabilities of modern document imaging systems. The Document Imaging Market incorporates AI-powered features such as optical character recognition (OCR), automated data extraction, and intelligent indexing. These advancements enable organizations to minimize manual data entry, reduce errors, and accelerate document processing. Automation supports seamless integration with enterprise content management platforms, allowing for quicker access and better data utilization. Businesses recognize that AI-driven imaging solutions improve overall productivity and free up resources for higher-value tasks. The ongoing development of machine learning algorithms continues to unlock new opportunities for process optimization. Increased efficiency through intelligent automation remains a core market driver.

Remote Work and Demand for Mobile Accessibility Shape Solution Preferences

The widespread adoption of remote work models has intensified the need for flexible document imaging tools. The Document Imaging Market sees strong demand for mobile-friendly applications that enable employees to scan, retrieve, and share documents securely from any location. Organizations prioritize cloud-based platforms that facilitate real-time collaboration and centralized document management. The convenience of mobile capture, coupled with secure digital workflows, addresses evolving workforce expectations. Companies now require scalable imaging solutions that adapt to fluctuating business needs and support hybrid work environments. It is essential for vendors to offer intuitive user interfaces and robust security protocols to remain competitive. The integration of mobility and remote access features significantly influences purchasing decisions in the market.

Market Trends

Integration of Document Imaging with Enterprise Content Management Systems

Enterprise content management (ECM) systems are becoming central to organizational digital strategies, and integration with document imaging has emerged as a prominent trend. The Document Imaging Market reflects strong demand for seamless interoperability between imaging solutions and ECM platforms. Organizations pursue unified workflows, making it possible to capture, index, store, and retrieve documents through a single system. ECM integration supports compliance, disaster recovery, and rapid information retrieval across distributed teams. Providers focus on compatibility with popular ECM tools and offer advanced connectors to enhance deployment flexibility. Businesses gain strategic advantages by leveraging this integration to improve collaboration and reduce information silos. It positions document imaging as a crucial component in end-to-end digital transformation journeys.

- For instance, Xerox Corporation integrated its DocuShare platform with leading ECM solutions, facilitating the automated processing of over 500 million documents annually for enterprise clients.

Adoption of Cloud-Based and Hybrid Deployment Models Grows Rapidly

Cloud-based and hybrid deployment models are gaining traction due to their scalability, cost efficiency, and support for distributed workforces. The Document Imaging Market is seeing a marked shift toward cloud platforms, where businesses can deploy, manage, and upgrade solutions without significant upfront infrastructure investments. Cloud adoption enables real-time access to documents from any location and supports collaboration among remote teams. Hybrid approaches provide flexibility by allowing organizations to combine on-premise control with the benefits of the cloud. Vendors respond by enhancing security, compliance, and integration features for cloud-based solutions. It remains essential for businesses seeking agility and future-proof capabilities. Cloud deployment continues to shape purchasing criteria and solution innovation.

- For instance, Newgen Software Technologies Limited reported that its cloud-based OmniDocs platform handled more than 400 million transactions per month across 60 countries, supporting hybrid and remote work environments.

Focus on Artificial Intelligence and Intelligent Automation Intensifies

Artificial intelligence and intelligent automation are redefining document imaging through features such as automatic data extraction, intelligent document classification, and predictive analytics. The Document Imaging Market incorporates these advancements to help organizations process large document volumes more efficiently and with fewer errors. AI-driven functionalities allow for faster onboarding, improved accuracy, and proactive insights from unstructured data. Solution providers invest in machine learning algorithms that continuously refine document understanding capabilities. Organizations benefit from reduced manual workload and improved compliance outcomes. It strengthens the value proposition of document imaging for forward-thinking enterprises. The focus on AI marks a transformative trend for future market evolution.

Growing Emphasis on Mobile Capture and User Experience Optimization

User experience and mobile capture capabilities are now at the forefront of product development priorities. The Document Imaging Market observes increasing demand for intuitive interfaces, mobile scanning apps, and simplified document workflows. Organizations expect solutions that empower employees to scan and process documents directly from smartphones and tablets. This trend aligns with evolving workplace dynamics and supports greater workforce mobility. Solution providers differentiate their offerings by emphasizing ease of use, quick deployment, and customizable features. It encourages higher adoption rates and greater user satisfaction across industries. The push for seamless user experiences and mobile-first functionality defines competitive differentiation in the market.

Market Challenges Analysis

Complex Integration with Legacy Systems and Data Silos Impede Progress

Organizations often face challenges when integrating document imaging solutions with legacy systems and disparate data sources. The Document Imaging Market must address complexities related to compatibility and data migration, especially for enterprises with long-standing paper-based or outdated digital archives. These integration barriers can slow digital transformation initiatives and increase implementation costs. Businesses may encounter disruptions to daily operations and require specialized support to ensure smooth transitions. Vendors need to invest in robust migration tools, flexible APIs, and extensive customer training programs. It remains essential for solution providers to minimize downtime and offer scalable integration options that fit diverse IT environments.

Evolving Data Privacy Regulations and Security Risks Intensify Compliance Demands

Compliance with evolving data privacy laws and heightened security expectations presents significant challenges for organizations adopting document imaging technologies. The Document Imaging Market must continuously adapt to changes in regulations such as GDPR, HIPAA, and local data protection mandates. Ensuring secure storage, transmission, and access control for sensitive documents requires ongoing investments in cybersecurity and policy updates. Businesses risk penalties, reputational damage, and operational setbacks if they fail to meet these compliance standards. It becomes critical for vendors to prioritize security certifications, regular audits, and comprehensive user authentication protocols. Navigating the complexities of regulatory compliance shapes both product development and long-term customer trust.

Market Opportunities

Expansion into Emerging Markets and Untapped Industry Verticals Drives Growth Potential

The Document Imaging Market offers significant opportunities for providers to expand into emerging markets and untapped industry verticals. Rapid digitization efforts in regions such as Asia Pacific, Latin America, and the Middle East present new avenues for solution adoption across both public and private sectors. Government initiatives supporting digital infrastructure and e-governance programs fuel demand for efficient document management systems. Sectors such as education, logistics, and healthcare present underpenetrated markets where digitization of records and workflow automation can deliver strong operational benefits. Vendors who tailor their offerings to meet regional compliance requirements and industry-specific needs can secure early-mover advantages. It remains important to align solutions with local languages, regulations, and business processes to capture this expanding customer base.

Innovation in AI, Cloud Integration, and Mobile Solutions Unlocks Competitive Advantage

Ongoing innovation in artificial intelligence, cloud integration, and mobile-first solutions provides strong growth prospects for the Document Imaging Market. AI-powered features such as automated data extraction and intelligent classification elevate the value of imaging platforms for enterprises seeking greater efficiency. Cloud-based deployment options enable organizations to scale quickly and provide secure remote access to information. The rising demand for mobile applications that facilitate on-the-go document capture and workflow management underscores the importance of flexibility and accessibility. Solution providers who invest in next-generation capabilities can differentiate themselves and build long-term customer loyalty. It becomes essential to anticipate evolving technology trends and incorporate them into product development roadmaps to maintain a leadership position in this dynamic market.

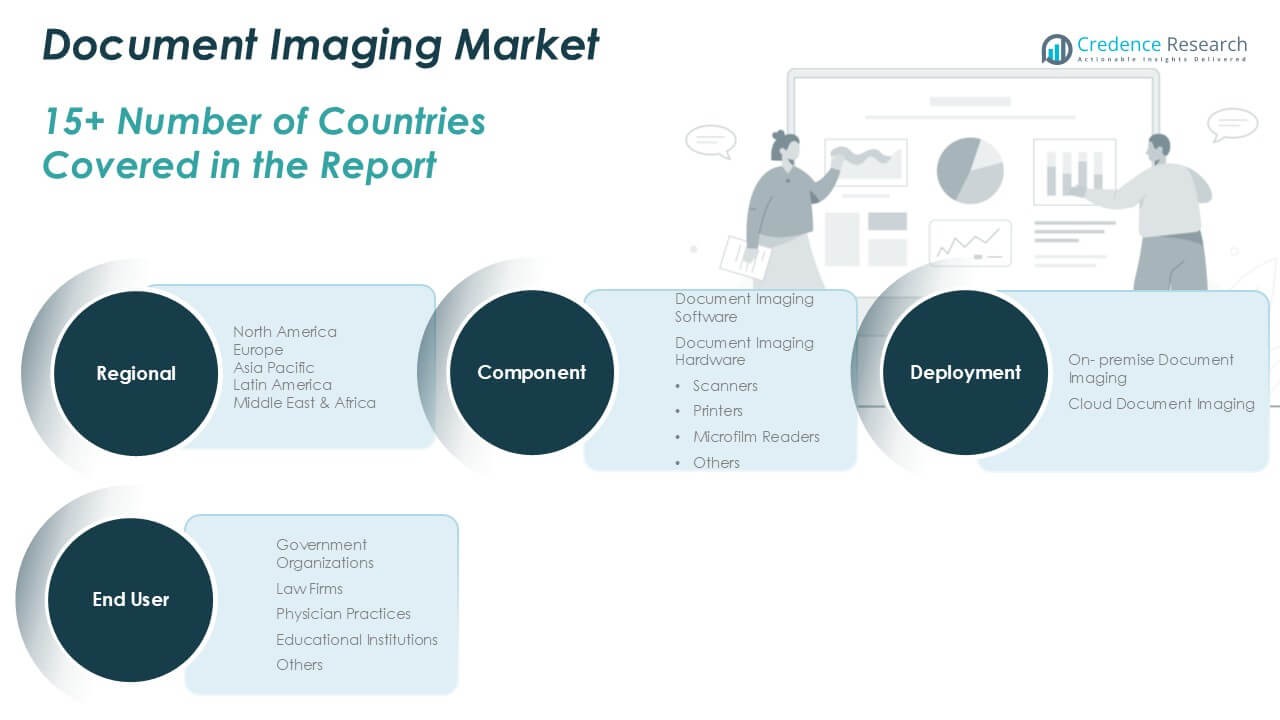

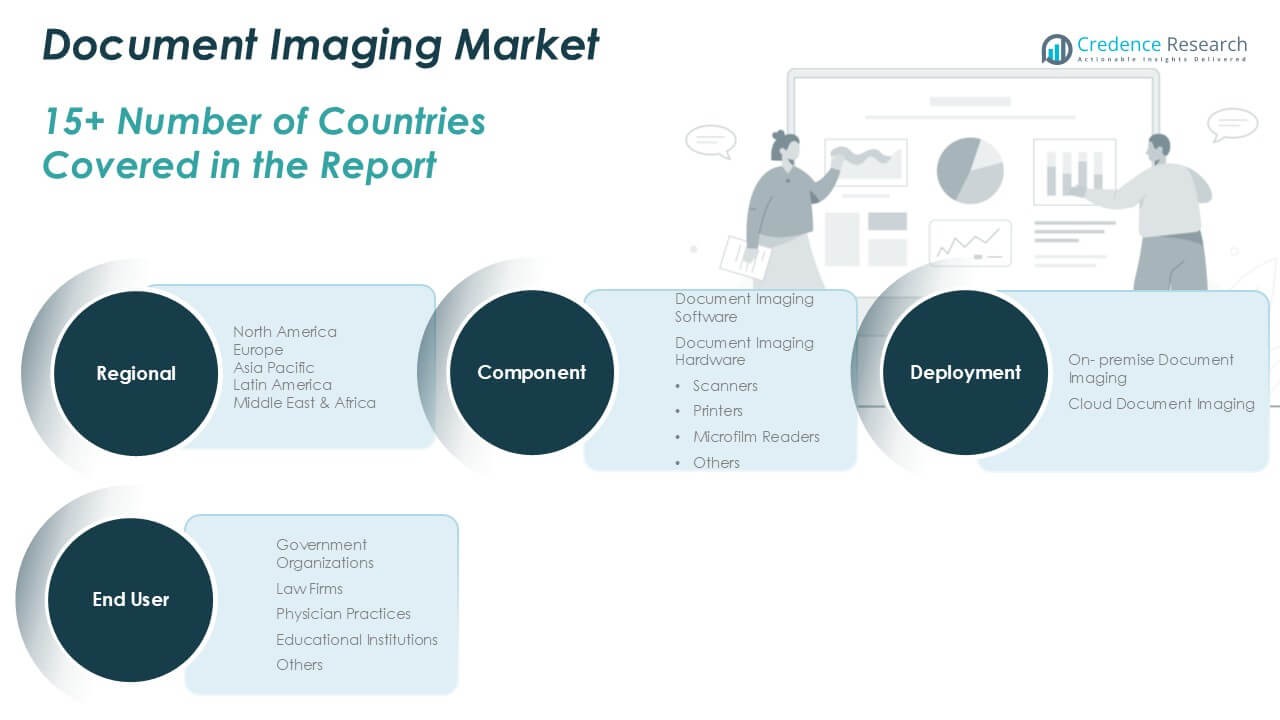

Market Segmentation Analysis:

By Component:

the market divides into document imaging software and hardware. Document imaging software remains essential for digital document management, supporting functions such as scanning, indexing, archiving, and retrieval. Software advancements now integrate artificial intelligence for intelligent data extraction and seamless workflow automation. Hardware represents a significant portion of the market, led by devices such as scanners, printers, and microfilm readers. Scanners drive adoption by facilitating rapid digitization of physical records, while printers support both document creation and reproduction needs. Microfilm readers remain relevant in sectors that require long-term storage and archival access, and the “others” category encompasses various specialized imaging devices that address unique business needs.

- For instance, Epson sold over 10 million scanning devices worldwide in the past five years, supporting large-scale digitization projects in education, healthcare, and banking sectors.

By Deployment:

Deployment models within the Document Imaging Market include on-premise and cloud-based solutions. On-premise document imaging remains popular among organizations that prioritize data control, regulatory compliance, or sensitive document handling. This deployment offers robust customization and integration with existing IT infrastructure. Cloud document imaging is gaining momentum due to its scalability, remote accessibility, and cost efficiency. Businesses adopt cloud-based solutions to enable seamless collaboration across distributed teams and minimize upfront capital expenditure. The demand for hybrid solutions is increasing as organizations seek the flexibility to manage sensitive data locally while leveraging the advantages of cloud technologies for broader access and disaster recovery.

- For instance, Fujitsu Ltd. reported that over 65% of its new document management deployments in 2023 included hybrid cloud features, reflecting evolving customer needs for flexible and secure data environments.

By End-User:

End-user segmentation highlights the diversity of adoption across various industries. Government organizations rely on document imaging for secure record-keeping, regulatory compliance, and efficient service delivery. Law firms use these solutions to streamline case management, enable digital evidence handling, and ensure data confidentiality. Physician practices leverage document imaging to digitize patient records, support electronic health records (EHR), and meet healthcare regulations. Educational institutions implement document imaging for managing student records, admissions, and administrative processes. The “others” segment includes industries such as financial services, logistics, and insurance, which benefit from digital workflows, regulatory compliance, and enhanced document security. The Document Imaging Market tailors its offerings to meet the unique requirements of each end-user segment, ensuring broad applicability and ongoing demand for advanced document management solutions.

Segments:

Based on Component:

- Document Imaging Software

- Document Imaging Hardware

- Scanners

- Printers

- Microfilm Readers

- Others

Based on Deployment:

- On-premise Document Imaging

- Cloud Document Imaging

Based on End-User:

- Government Organizations

- Law Firms

- Physician Practices

- Educational Institutions

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Document Imaging Market

North America Document Imaging Market grew from USD 28,295.52 million in 2018 to USD 43,200.09 million in 2024 and is projected to reach USD 108,597.78 million by 2032, reflecting a compound annual growth rate (CAGR) of 12.3%. North America is holding a 37% market share, driven by strong digital infrastructure, high regulatory compliance needs, and extensive adoption of advanced technologies. The United States leads the region, supported by robust demand in healthcare, government, and legal sectors. Canada follows with substantial investments in cloud-based solutions and workflow automation. Growing emphasis on data security and regulatory standards continues to fuel market momentum. The region’s focus on technological leadership keeps it at the forefront of innovation in the Document Imaging Market.

Europe Document Imaging Market

Europe Document Imaging Market grew from USD 19,714.60 million in 2018 to USD 29,198.11 million in 2024 and is forecasted to reach USD 68,638.40 million by 2032, with a CAGR of 11.3%. Europe accounts for a 23% market share, supported by digitalization initiatives and strict data privacy regulations. Germany, the United Kingdom, and France represent leading markets in the region, emphasizing paperless office environments and compliance with the General Data Protection Regulation (GDPR). Public sector modernization and the rise of e-government services drive further adoption. Industry players invest in scalable and secure imaging platforms to meet the evolving needs of diverse verticals. The region’s strong legal framework sustains ongoing investment in advanced document management solutions.

Asia Pacific Document Imaging Market

Asia Pacific Document Imaging Market grew from USD 22,067.43 million in 2018 to USD 35,326.97 million in 2024 and is expected to reach USD 95,648.71 million by 2032, achieving a CAGR of 13.3%. Asia Pacific captures a 32% market share, propelled by rapid economic growth and aggressive digital transformation strategies. China, Japan, and India stand out as key contributors, with widespread investments in education, healthcare, and financial services. Government initiatives to promote digital literacy and smart governance further accelerate adoption. The region experiences high demand for scalable cloud solutions and mobile-first document management tools. Expansion of multinational enterprises increases cross-border adoption of imaging technologies.

Latin America Document Imaging Market

Latin America Document Imaging Market grew from USD 3,167.87 million in 2018 to USD 4,814.31 million in 2024 and is projected to reach USD 10,460.28 million by 2032, registering a CAGR of 10.2%. Latin America holds a 4% market share, with Brazil and Mexico emerging as primary growth drivers. Organizations seek to modernize administrative processes and address compliance requirements across various sectors. Demand for affordable, easy-to-deploy imaging solutions is strong, particularly among small and medium-sized enterprises. Regional government digitization efforts foster new opportunities for vendors. The market’s growth reflects increased emphasis on operational efficiency and cost containment.

Middle East Document Imaging Market

Middle East Document Imaging Market grew from USD 2,652.71 million in 2018 to USD 3,806.55 million in 2024 and is set to reach USD 8,638.27 million by 2032, marking a CAGR of 10.9%. The Middle East represents a 3% market share, led by the United Arab Emirates and Saudi Arabia. Governments drive digital transformation projects across public administration, healthcare, and education. Large-scale infrastructure investments support the shift toward cloud-based document management systems. The need for regulatory compliance and data protection underpins the market’s trajectory. Local and multinational vendors compete to deliver regionally tailored solutions.

Africa Document Imaging Market

Africa Document Imaging Market grew from USD 991.88 million in 2018 to USD 2,262.22 million in 2024 and is expected to reach USD 4,930.57 million by 2032, reflecting a CAGR of 10.4%. Africa accounts for a 2% market share, with South Africa, Nigeria, and Kenya showing the highest growth potential. The region sees increasing adoption in government, education, and financial services as digitalization accelerates. Limited legacy infrastructure encourages organizations to leapfrog directly to advanced, cloud-based imaging platforms. Cost-effectiveness and ease of deployment are critical decision factors. The market presents untapped opportunities for vendors focused on scalable and accessible document imaging solutions.

Key Player Analysis

- Hewlett-Packard Company

- Epson

- Canon Inc.

- Fujitsu Ltd.

- Toshiba Corporation

- Newgen Software Technologies Limited

- Adobe Systems Incorporated

- Xerox Corporation

- IBM Corporation

- Eastman Kodak Company

Competitive Analysis

The competitive landscape of the Document Imaging Market is characterized by the presence of several global leaders, including Hewlett-Packard Company, Canon Inc., Epson, Fujitsu Ltd., Toshiba Corporation, Newgen Software Technologies Limited, Adobe Systems Incorporated, Xerox Corporation, IBM Corporation, and Eastman Kodak Company. These key players maintain their leadership through continuous innovation in both hardware and software, offering robust product portfolios that address evolving customer requirements for digital transformation and efficient document management. Software providers focus on expanding intelligent document management features, including workflow automation, cloud-based deployment, and robust security measures, addressing the needs of organizations navigating regulatory and operational complexities. Competitive strategies include continuous research and development, strategic partnerships, and tailored offerings for industry-specific requirements in sectors such as healthcare, government, and legal services. Vendors actively expand their presence in emerging markets and invest in customer support and service infrastructure to differentiate their solutions. The ability to deliver scalable, secure, and user-friendly platforms remains central to sustaining market leadership, while innovation in artificial intelligence and mobile accessibility sets the stage for future growth in the document imaging space.

Recent Developments

- In March 2025, HP Inc. announced significant advancements in its document imaging and workflow automation solutions at the annual HP Amplify Conference. Key developments include the introduction of HP Scan AI Enhanced, a cloud-based, AI-powered solution that utilizes Optical Character Recognition (OCR) to automate document processing. This technology recognizes, extracts, and integrates key data from scanned and digital documents into back-end systems, reducing manual effort and streamlining workflows.

- In September 2024, Canon Europe announced the launch of the image FORMULA DR-S350NW scanner, designed to meet the evolving needs of hybrid work environments. This advanced A4 desktop scanner offers high-speed scanning at up to 100 images per minute and features versatile connectivity options, including USB, LAN, and Wi-Fi, supporting both 2.5GHz and 5GHz frequencies.

Market Concentration & Characteristics

The Document Imaging Market exhibits a moderate to high level of market concentration, with a few global technology firms and specialized software vendors holding significant influence over market dynamics. It features a blend of established multinational corporations and innovative niche players, each leveraging proprietary technologies and extensive distribution networks to capture diverse customer bases. The market emphasizes product reliability, integration capabilities, and advanced features such as artificial intelligence and cloud compatibility to address the complex needs of various sectors. Organizations select vendors based on their ability to deliver secure, scalable, and user-friendly solutions tailored to compliance requirements and workflow efficiency. It responds quickly to technological shifts, with ongoing advancements in automation, mobile access, and intelligent data extraction shaping the competitive environment. Customers expect comprehensive support, rapid implementation, and seamless integration with existing systems, making service excellence a key characteristic of leading providers in the Document Imaging Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced document imaging solutions will increase with accelerated digital transformation across industries.

- Artificial intelligence and machine learning will drive greater automation and accuracy in document processing.

- Cloud-based deployment will remain a preferred choice due to its scalability, flexibility, and support for remote access.

- Mobile-friendly document imaging tools will gain traction as organizations adapt to hybrid and remote work models.

- Integration with enterprise content management systems will become more seamless, supporting unified workflows.

- Data security and compliance features will continue to shape product development and purchasing decisions.

- Emerging markets in Asia Pacific, Latin America, and Africa will present strong growth opportunities for solution providers.

- Industry-specific customization will expand, addressing the unique compliance and operational needs of sectors like healthcare and finance.

- Strategic partnerships and acquisitions will accelerate innovation and broaden product portfolios.

- Sustainability and eco-friendly practices in document imaging hardware and solutions will become more important to customers.