Market Overview

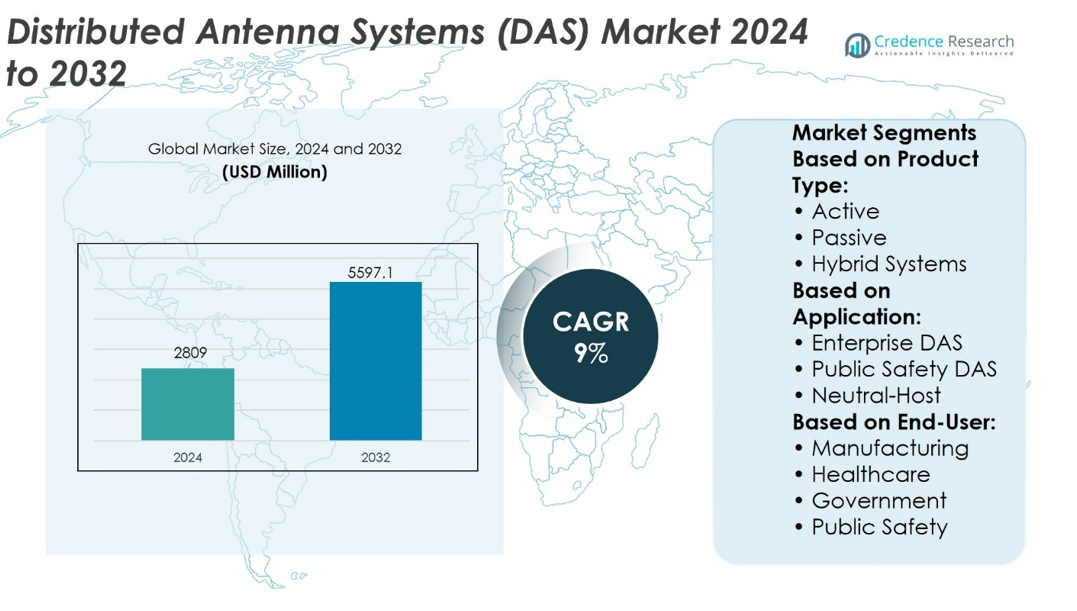

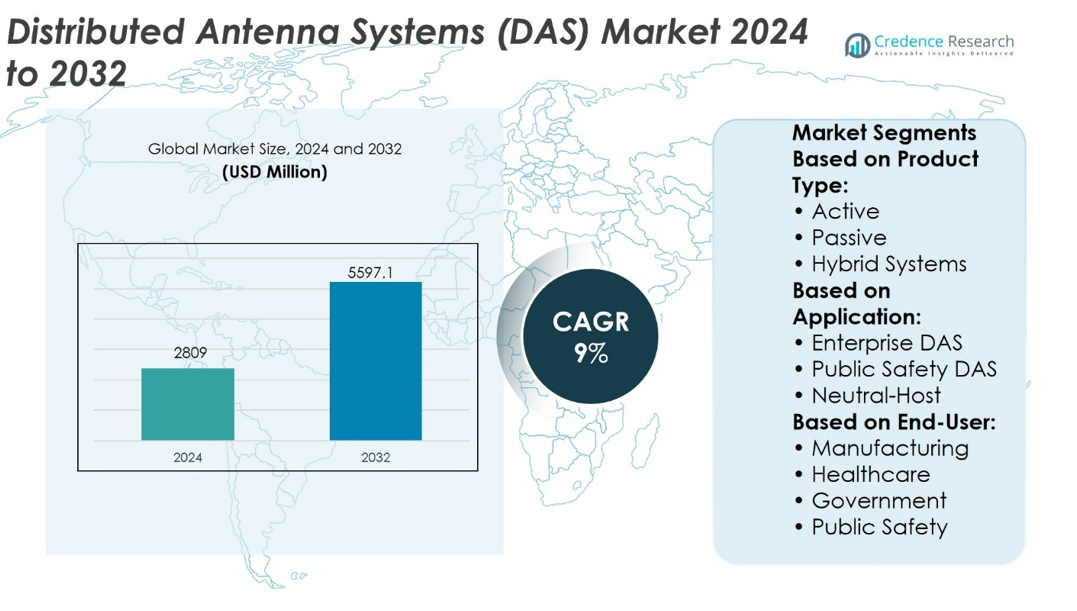

Distributed Antenna Systems (DAS) Market size was valued at USD 2809 million in 2024 and is anticipated to reach USD 5597.1 million by 2032, at a CAGR of 9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Distributed Antenna Systems (DAS) Market Size 2024 |

USD 2809 million |

| Distributed Antenna Systems (DAS) Market, CAGR |

9% |

| Distributed Antenna Systems (DAS) Market Size 2032 |

USD 5597.1 million |

The Distributed Antenna Systems (DAS) Market grows driven by increasing demand for reliable wireless connectivity in complex indoor and outdoor environments. The widespread adoption of 5G technology and rising data traffic intensify the need for scalable, high-capacity network solutions. Integration with smart city projects and critical sectors like healthcare, transportation, and public safety further propels market expansion. Trends include the deployment of cloud-based management systems, energy-efficient designs, and multi-operator DAS platforms that optimize infrastructure sharing. Continuous technological advancements and growing investments in digital infrastructure support sustained growth and evolving market dynamics.

The Distributed Antenna Systems (DAS) Market shows significant growth across North America, Europe, and Asia-Pacific, with North America leading due to advanced infrastructure and early 5G adoption. Europe follows with strong regulatory support, while Asia-Pacific experiences rapid urbanization and smart city developments. Key players driving the market include Corning Incorporated, TE Connectivity, JMA Wireless, Boingo Wireless, Cobham Wireless, and SOLiD. These companies focus on innovation, strategic partnerships, and expanding their global presence to capitalize on regional opportunities.

Market Insights

- The Distributed Antenna Systems (DAS) Market size was valued at USD 2809 million in 2024 and is expected to reach USD 5597.1 million by 2032, growing at a CAGR of 9% during the forecast period.

- Increasing demand for reliable wireless connectivity in complex indoor and outdoor environments drives market growth.

- The widespread adoption of 5G technology and rising data traffic create a need for scalable, high-capacity DAS solutions.

- Integration with smart city initiatives and critical sectors like healthcare and public safety further propels expansion.

- Trends include cloud-based management systems, energy-efficient designs, and multi-operator platforms optimizing infrastructure sharing.

- The market remains competitive with key players such as Corning Incorporated, TE Connectivity, and JMA Wireless focusing on innovation and strategic partnerships.

- North America leads regional growth due to advanced infrastructure and early 5G adoption, followed by Europe and Asia-Pacific with strong regulatory support and rapid urbanization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Enhanced Indoor and Outdoor Wireless Connectivity in Urban and Commercial Spaces

The increasing reliance on mobile devices and wireless applications drives the need for reliable network coverage in large buildings, stadiums, airports, and urban environments. Distributed Antenna Systems (DAS) provide a scalable solution to overcome coverage gaps and signal interference, improving user experience. Businesses and public venues invest in DAS to support seamless communication and high data throughput for employees, visitors, and customers. The surge in data traffic and the expansion of smart devices further accelerate DAS adoption. Telecommunications providers deploy DAS to offload network congestion and extend coverage in high-density areas. It addresses challenges posed by complex building structures and underground locations where conventional macro cell towers fail to reach.

- For instance, Boingo Wireless had 41.2 million DAS nodes active as of with an additional 11.5 million nodes awaiting deployment in backlog.

Increasing Adoption of 5G Networks and Need for Infrastructure Upgrades

The rollout of 5G technology demands significant upgrades to existing wireless infrastructure. Distributed Antenna Systems support 5G deployment by enabling better signal distribution and low latency connectivity, essential for emerging applications like IoT and augmented reality. It allows operators to densify networks efficiently without excessive new tower construction. The integration of DAS with 5G enhances capacity and coverage in both new and existing facilities. Market participants focus on developing DAS solutions compatible with multiple frequency bands and technologies to future-proof network investments. The growing emphasis on high-speed, low-latency communication fuels DAS market expansion.

- For instance, Boingo Wireless deployed a next‑generation 5G DAS network covering six underground PATCO stations, collectively supporting connectivity for more than 5.5 million annual regional riders as part of this upgrade effort.

Rising Investments in Healthcare, Transportation, and Public Safety Sectors

Critical sectors such as healthcare, transportation, and public safety require uninterrupted wireless communication for operational efficiency and emergency responsiveness. Distributed Antenna Systems ensure consistent coverage within hospitals, tunnels, rail stations, and emergency response centers. It supports mission-critical communication systems, including push-to-talk and real-time monitoring devices. Governments and private entities allocate funds to upgrade communication infrastructure, driving demand for DAS installations. The ability to support multiple carriers and technologies makes DAS a preferred choice for these sectors. Its deployment improves overall safety and operational effectiveness in public and private institutions.

Stringent Regulatory Requirements and Growing Focus on Network Reliability and Security

Regulatory bodies worldwide enforce strict guidelines for wireless network performance and emergency communication standards. Distributed Antenna Systems assist operators in meeting these mandates by delivering reliable, resilient coverage in complex environments. It enables compliance with regulations related to signal strength, emergency call routing, and data security. The growing awareness of cybersecurity threats encourages the integration of secure DAS components and monitoring systems. Network operators prioritize DAS solutions that offer robust performance and adaptability to evolving standards. The need to maintain service continuity during disasters and large events further propels DAS adoption.

Market Trends

Expanding Integration of 5G Technology with Distributed Antenna Systems for Enhanced Network Performance

The Distributed Antenna Systems (DAS) Market increasingly focuses on integrating 5G capabilities to meet growing demands for higher speed and lower latency. It supports multi-band and multi-technology compatibility, enabling seamless transition between 4G and 5G networks. Operators deploy DAS solutions to densify networks in urban and indoor environments, improving capacity and user experience. The technology facilitates efficient spectrum utilization and supports emerging applications such as augmented reality and IoT. Vendors innovate to design modular and scalable DAS architectures that accommodate evolving 5G standards. It becomes a critical enabler in the widespread adoption of next-generation wireless services.

- For instance, Boingo Wireless operates 41,200 active Distributed Antenna System (DAS) nodes and has an additional 11,500 nodes in its deployment backlog.

Rising Deployment of DAS in Smart Cities and Connected Infrastructure Projects

Urban development initiatives drive demand for robust wireless infrastructure, positioning DAS as a vital component of smart city ecosystems. It supports connectivity in public transportation hubs, commercial complexes, and municipal buildings. The Distributed Antenna Systems Market benefits from government investments aiming to improve digital infrastructure and public safety communication. Integration with other smart technologies such as surveillance systems and environmental sensors expands its application scope. Operators leverage DAS to enhance network reliability in densely populated areas with complex architectural layouts. It enables continuous and high-quality connectivity critical for smart city operations.

- For instance, Boingo Wireless manages 41.2 million active DAS nodes, enabling seamless connectivity across large-scale smart city transportation hubs, commercial districts, and public venues.

Adoption of Cloud-Based DAS Management and Remote Monitoring Solutions

Cloud computing trends influence DAS operations by introducing centralized management and remote monitoring capabilities. It allows network operators to optimize performance, detect faults, and implement updates without physical site visits. The Distributed Antenna Systems Market experiences growth in solutions offering real-time analytics and automated reporting. Cloud integration enhances scalability, reduces operational expenses, and supports multi-tenant environments. Vendors prioritize security features to protect data and network integrity within cloud-managed DAS systems. These advancements improve overall system efficiency and customer satisfaction.

Focus on Energy Efficiency and Sustainable DAS Infrastructure Development

Environmental concerns and rising energy costs prompt the Distributed Antenna Systems Market to emphasize energy-efficient designs and sustainable practices. It promotes the use of low-power components, intelligent power management, and integration with renewable energy sources. Manufacturers develop DAS equipment with reduced carbon footprints and longer operational lifespans. The market shifts toward modular and compact solutions that minimize material usage and installation impact. Energy-efficient DAS contributes to green building certifications and compliance with environmental regulations. Sustainability efforts align with broader industry goals of reducing ecological impact while maintaining high network performance.

Market Challenges Analysis

Complexity and High Initial Investment Pose Significant Barriers to Distributed Antenna Systems (DAS) Market Expansion

The Distributed Antenna Systems (DAS) Market faces challenges due to the complexity involved in designing and deploying comprehensive network solutions. Integrating DAS within existing infrastructure often requires detailed planning and coordination with multiple stakeholders, increasing project timelines. The high upfront costs for equipment, installation, and maintenance deter smaller enterprises and slow adoption in cost-sensitive markets. Technical challenges arise when ensuring compatibility with diverse wireless technologies and frequencies, demanding advanced engineering expertise. It requires ongoing investment to upgrade systems in line with evolving network standards, which strains budgets. These factors contribute to cautious investment decisions and limit rapid market penetration.

Regulatory Constraints and Interference Issues Affect DAS Deployment and Performance

Compliance with stringent regulatory requirements on wireless communication and safety standards complicates Distributed Antenna Systems deployment. Operators must navigate varying regional regulations, which can delay project approvals and increase costs. Interference from other wireless devices and systems disrupts signal quality, necessitating robust interference mitigation techniques. It demands continuous monitoring and fine-tuning to maintain optimal performance, increasing operational complexity. Limited availability of suitable real estate for equipment placement in urban and indoor environments further constrains deployment. These challenges require comprehensive strategies to ensure reliable coverage and network integrity, impacting overall market growth.

Market Opportunities

Expanding Demand for Reliable Wireless Connectivity in Emerging Markets Drives New Growth Prospects

The Distributed Antenna Systems (DAS) Market finds significant opportunity in emerging economies where urbanization and digitalization accelerate wireless infrastructure needs. Rapid growth in commercial complexes, healthcare facilities, and transportation hubs fuels demand for enhanced indoor and outdoor network coverage. It offers scalable solutions to address connectivity challenges in areas with complex architecture and high user density. Investments in smart city projects and expanding mobile subscriber bases further increase the need for efficient DAS deployments. Market participants can capitalize on these trends by tailoring solutions to local requirements and cost sensitivities. Partnerships with governments and telecom operators enable faster project execution and wider adoption.

Advancements in Technology and Integration with IoT and 5G Create New Market Potential

Technological advancements in DAS design and integration with Internet of Things (IoT) devices and 5G networks open new avenues for market growth. It supports multi-technology and multi-band systems, improving network capacity and reducing latency for critical applications. The Distributed Antenna Systems Market benefits from the rising demand for real-time data transmission in sectors such as manufacturing, logistics, and public safety. Enhanced analytics and cloud-based management platforms enable operators to optimize network performance and reduce operational costs. Innovators focus on developing energy-efficient and modular DAS solutions that meet evolving infrastructure needs. These opportunities position the market for sustained expansion in a competitive wireless landscape.

Market Segmentation Analysis:

By Type:

The Distributed Antenna Systems (DAS) Market segments into active, passive, and hybrid types, each serving distinct deployment needs. Active DAS use powered components to amplify signals, supporting large or complex venues such as airports and stadiums. Passive DAS rely on unpowered components, offering cost-effective coverage for smaller buildings with simpler requirements. Hybrid DAS combine features of both, allowing tailored configurations based on specific coverage challenges. Active DAS leads the market due to its scalability and support for multi-operator environments, though it demands specialized installation and maintenance.

- For instance, Comba Telecom deployed an active DAS solution at Hong Kong International Airport, integrating over 5,000 remote units to deliver high-speed LTE and 5G connectivity across 1.27 million square meters.

By Application:

Enterprise DAS caters to corporate campuses, educational institutions, and hospitals by delivering dedicated network coverage to support business and institutional activities. Public safety DAS focuses on providing reliable communication systems for first responders and emergency services, ensuring communication integrity in critical situations. Neutral-host or multi-operator DAS allow multiple carriers to share infrastructure, optimizing costs and simplifying deployments in high-traffic venues such as shopping malls and transit hubs. It facilitates efficient spectrum use and enhances user connectivity across diverse environments.

- For instance, Boingo Wireless implemented a multi-operator DAS at Chicago O’Hare International Airport, supporting over 1,000 antennas and enabling seamless connectivity for more than 80 million passengers annually.

By End-User:

Transportation and Logistics, Sports and Entertainment Venues, and Others

Different industries utilize DAS to enhance wireless connectivity and operational efficiency. Manufacturing sectors deploy DAS for wireless automation and real-time data transmission critical to production workflows. Healthcare facilities rely on DAS to maintain uninterrupted communication for patient monitoring and emergency response. Government and public safety agencies use DAS to enable mission-critical communication during emergencies. Transportation and logistics centers implement DAS for seamless network coverage across expansive terminals and warehouses. Sports and entertainment venues improve fan engagement and operational coordination through advanced DAS installations. It addresses sector-specific connectivity challenges while ensuring compliance with regulatory standards.

Segments:

Based on Type:

- Active

- Passive

- Hybrid Systems

Based on Application:

- Enterprise DAS

- Public Safety DAS

- Neutral-Host

Based on End-User:

- Manufacturing

- Healthcare

- Government

- Public Safety

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Distributed Antenna Systems (DAS) Market in North America accounts for approximately 38% of the global share. The United States drives this dominance with widespread DAS adoption across commercial buildings, transportation hubs, and public safety systems. Robust investments in wireless infrastructure and early 5G deployment support this growth. It benefits from strong telecom operator presence and regulatory frameworks that encourage improved indoor connectivity. Ongoing smart city initiatives and increasing demand from healthcare and manufacturing sectors further enhance the region’s market position.

Europe

Europe commands about 28% of the DAS Market, fueled by rapid urbanization and strict regulations mandating reliable communication systems. Countries such as the UK, Germany, and France lead with government-backed infrastructure upgrades and digital transformation projects. The region emphasizes sustainability and energy efficiency, prompting vendors to develop innovative DAS solutions. It experiences strong adoption in complex indoor environments, including airports, stadiums, and transportation networks. Public safety DAS deployments contribute to maintaining mission-critical communication standards across the region.

Asia-Pacific

Asia-Pacific holds approximately 24% of the DAS Market, driven by increasing mobile penetration and infrastructure development in countries like China, Japan, India, and South Korea. The region witnesses growing DAS deployment in urban centers, manufacturing facilities, and public venues. Expansion of smart city initiatives and commercial real estate boosts demand. Despite regulatory diversity and varying regional requirements, it offers significant growth potential due to accelerated digitalization and 5G technology adoption.

Latin America

Latin America accounts for around 6% of the DAS Market, with Brazil and Mexico leading regional activity. Efforts to improve network coverage in expanding urban areas and commercial sectors stimulate market growth. Telecom infrastructure investments and smart building developments create new opportunities. Economic volatility and infrastructure gaps pose challenges, but steady progress occurs through government initiatives and private sector engagement. Cost-effective and scalable DAS solutions remain a priority.

Middle East and Africa

The Middle East and Africa (MEA) region captures about 4% of the DAS Market, driven by telecommunications expansion and infrastructure modernization. Key countries include the UAE, Saudi Arabia, and South Africa, where large projects in commercial, transportation, and government sectors propel growth. DAS adoption improves indoor wireless coverage and supports critical communications. Regulatory complexities and infrastructure variability create challenges, but partnerships between governments and global providers promote gradual expansion and network enhancement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Boingo Wireless

- Corning Incorporated

- JMA Wireless

- Bird Technologies

- Anixter Inc

- SOLiD

- TE Connectivity

- Axell Wireless (now part of Cobham Wireless)

- Galtronics

- Cobham Wireless

Competitive Analysis

The Distributed Antenna Systems (DAS) Market is highly competitive, with key players including Corning Incorporated, TE Connectivity, JMA Wireless, Boingo Wireless, Cobham Wireless, SOLiD, Axell Wireless (now part of Cobham Wireless), Anixter Inc, Bird Technologies, and Galtronics. The Distributed Antenna Systems (DAS) Market is characterized by intense competition driven by rapid technological innovation and evolving customer demands. Companies prioritize developing scalable, multi-band, and multi-technology solutions to support increasing data traffic and the rollout of 5G networks. Market participants focus on enhancing system efficiency, energy consumption, and ease of deployment to reduce operational costs and improve user experience. Strategic collaborations with telecom operators, infrastructure providers, and integrators play a critical role in expanding market reach and accelerating project execution. Additionally, the demand for solutions tailored to specific sectors such as healthcare, transportation, and public safety intensifies competition. Providers continuously refine their product portfolios to meet stringent regulatory standards and adapt to regional market variations. Success in the market depends on the ability to innovate rapidly, offer customizable solutions, and maintain high service quality amid increasing connectivity requirements.

Recent Developments

- In January 2025, Boingo Wireless was awarded a Multiple Award Schedule (MAS) contract by the U.S. General Services Administration (GSA) to provide 5G, DAS, and high-speed Wi-Fi connectivity solutions for federal, state, local governments, tribal organizations, and eligible contractors, expanding their public sector footprint.

- In May 2024, Solid Gear Inc. announced that Wireless Services, a systems integrator, has chosen the SOLiD ALLIANCE 5G Distributed Antenna System (DAS) to improve the 5G connection at the New Orleans Ernest N Morial Convention Center.

- In April 2024, Bird Technologies Inc. introduced the BNA 100 and BNA 1000 series Vector Network Analyzers (VNA). These introductions illustrate Bird’s commitment to microwave frequency and low RF power domains, leveraging its extensive RF technological expertise to suit the changing expectations of the Application.

- In March 2024, AT&T Inc. introduced AT&T Internet Air for Business, a wireless service for small, medium, and large businesses with the most dependable 5G network in America.

Market Concentration & Characteristics

The Distributed Antenna Systems (DAS) Market exhibits a moderately concentrated structure, dominated by a handful of well-established players that command significant market shares through technological expertise and extensive distribution networks. It features high entry barriers due to the complex nature of DAS technology, stringent regulatory requirements, and the need for substantial capital investment. Market leaders focus on continuous innovation to maintain competitive advantages, investing in research and development to support evolving wireless standards such as 5G. The market also demonstrates regional diversity, with varying adoption rates influenced by infrastructure maturity and regulatory environments. Mid-sized companies and new entrants often target niche applications or regional markets to gain footholds, contributing to fragmented competition at local levels. Customer demand for customizable, scalable, and energy-efficient solutions drives vendors to differentiate their offerings through product performance and service quality. The interplay between telecom operators, infrastructure providers, and system integrators shapes market dynamics, emphasizing collaboration and partnerships. It also requires adherence to evolving industry standards and rapid adaptation to technological shifts. Overall, the market balances consolidation among key players with competitive pressures from emerging firms, creating a dynamic environment that rewards innovation, operational excellence, and strategic alignment with end-user requirements.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Distributed Antenna Systems (DAS) Market will expand with growing demand for seamless indoor and outdoor wireless connectivity.

- It will benefit from widespread 5G network deployments requiring enhanced coverage and capacity.

- Integration of IoT devices will drive the need for scalable and flexible DAS solutions.

- Smart city initiatives globally will increase investments in DAS infrastructure.

- The market will see advances in energy-efficient and environmentally sustainable DAS technologies.

- Public safety and emergency communication requirements will continue to boost DAS adoption.

- Cloud-based DAS management and remote monitoring will become standard features.

- Multi-operator and neutral-host DAS solutions will gain popularity for cost-effective network sharing.

- Customized DAS deployments targeting specific industries will create new growth opportunities.

- Continuous innovation and strategic partnerships will remain critical for competitive advantage.