Market Overview:

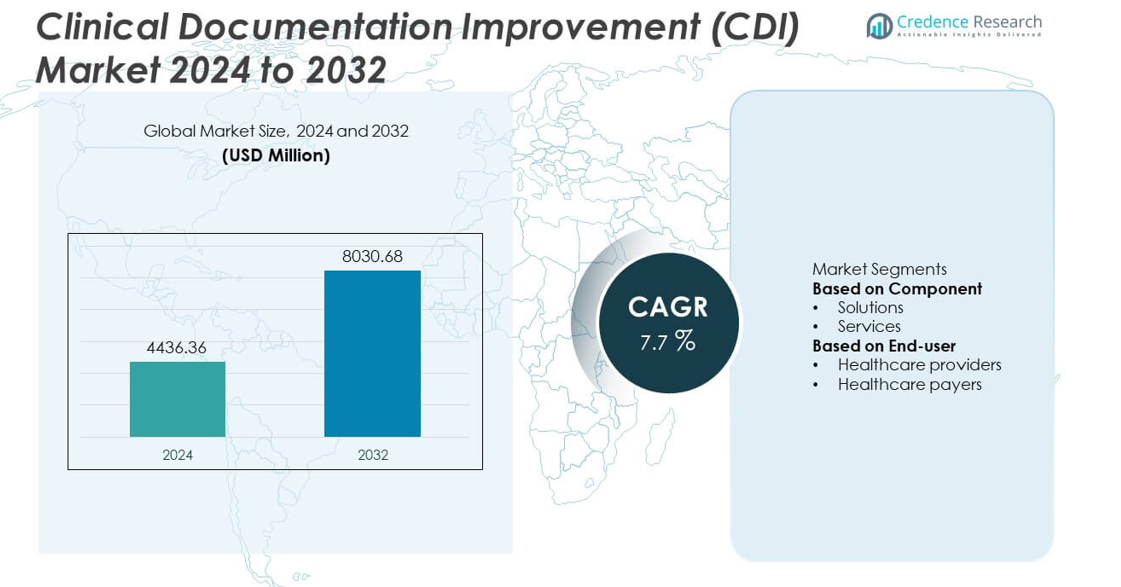

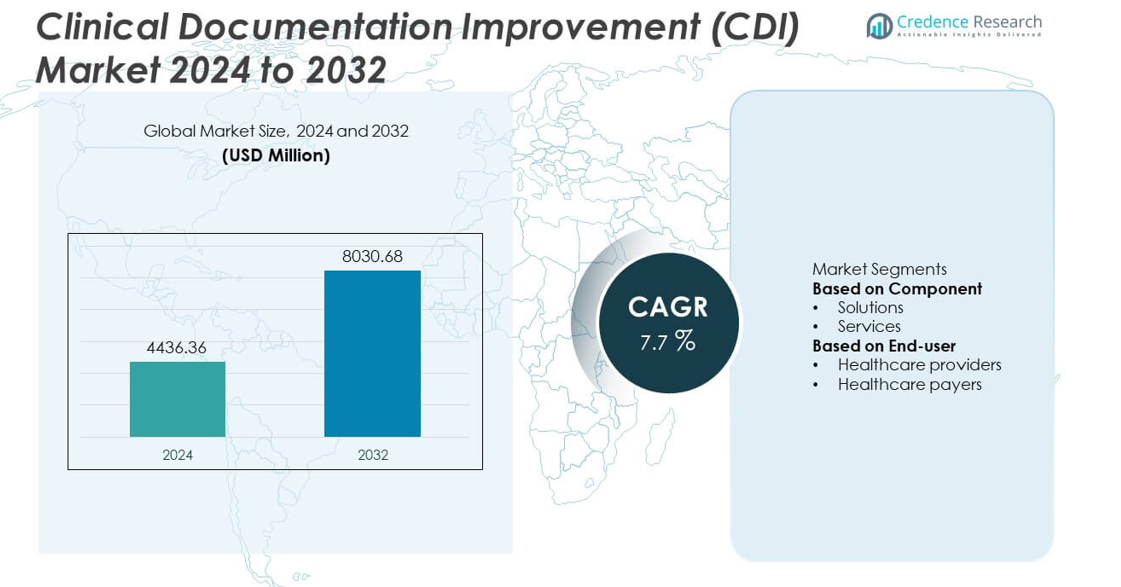

The Clinical Documentation Improvement (CDI) market was valued at USD 4436.36 million in 2024 and is projected to reach USD 8030.68 million by 2032, expanding at a CAGR of 7.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Clinical Documentation Improvement (CDI) Market Size 2024 |

USD 4436.36 million |

| Clinical Documentation Improvement (CDI) Market, CAGR |

7.7% |

| Clinical Documentation Improvement (CDI) Market Size 2032 |

USD 8030.68 million |

The Clinical Documentation Improvement (CDI) market is led by prominent companies including 3M, AGS Health, AQuity Solutions, Claro Healthcare, CorroHealth Inc., Craneware, GeBBS, Health Catalyst, Infinx Healthcare, and Iodine Software. These players dominate through AI-driven CDI platforms, real-time analytics, and advanced natural language processing (NLP) capabilities that enhance coding accuracy and clinical compliance. North America led the global market with a 43.7% share in 2024, supported by strong healthcare digitization, robust EHR integration, and regulatory mandates for accurate documentation. Europe followed with a 27.4% share, while Asia-Pacific emerged as the fastest-growing region, driven by rising healthcare investments and digital transformation initiatives.

Market Insights

- The Clinical Documentation Improvement (CDI) market was valued at USD 4436.36 million in 2024 and is projected to reach USD 8030.68 million by 2032, expanding at a CAGR of 7.7%.

- Growing demand for accurate clinical documentation and improved reimbursement accuracy is driving market growth, supported by the integration of AI and NLP technologies that enhance coding precision and compliance.

- Cloud-based CDI solutions and expanding adoption across ambulatory and post-acute care facilities are key trends shaping the market, promoting interoperability and operational efficiency.

- The market remains competitive with key players such as 3M, AGS Health, AQuity Solutions, CorroHealth Inc., and Iodine Software focusing on automation, analytics, and strategic collaborations to strengthen portfolios.

- North America dominated the CDI market with a 43.7% share in 2024, followed by Europe at 27.4%, while the solutions segment led by component with 68.3% share, driven by advanced data accuracy tools and EHR integration.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Solutions dominated the Clinical Documentation Improvement (CDI) market in 2024, accounting for 68.3% of the total share. This dominance is attributed to the widespread adoption of AI-powered and natural language processing (NLP)-based CDI tools that automate data capture, coding accuracy, and compliance reporting. Hospitals and clinics are prioritizing CDI solutions to reduce claim denials, improve reimbursement rates, and enhance clinical efficiency. The demand for integrated CDI platforms that work seamlessly with electronic health records (EHR) systems continues to rise, driven by the need for real-time clinical insights and improved data integrity.

- For instance, 3M Health Information Systems’ (now Solventum) CDI Collaborate platform used AI-driven NLP algorithms, helping healthcare organizations automate documentation reviews and achieve faster, compliant coding outcomes.

By End-user

Healthcare providers held the largest share of 74.5% in the Clinical Documentation Improvement (CDI) market in 2024. The segment’s leadership stems from the growing focus on accurate patient data documentation to support value-based care and regulatory compliance. Providers, including hospitals and specialty clinics, increasingly rely on CDI programs to minimize medical errors and optimize coding workflows. The integration of CDI tools into clinical practice supports better patient outcomes and financial performance, especially as healthcare institutions shift toward outcome-based reimbursement models and digital transformation initiatives.

- For instance, Iodine Software’s cognitive CDI platform supported more than 800 healthcare facilities, analyzing 1.5 trillion data elements each year to enhance documentation accuracy and automate over 70 million clinical query decisions through AI-driven reasoning models.

Key Growth Drivers

Rising Focus on Healthcare Reimbursement Accuracy

Increasing demand for accurate clinical documentation to support coding precision and reimbursement accuracy is a major growth driver for the CDI market. Hospitals and payers are adopting CDI tools to minimize claim denials and revenue leakage. The transition toward value-based care models further accelerates CDI adoption, as it ensures proper documentation of clinical quality and patient outcomes. Enhanced data integrity and audit readiness remain critical for healthcare organizations aiming to improve financial performance and compliance with reimbursement regulations.

- For instance, CorroHealth’s AI-powered platform, such as its VISION clinical validation and PULSE medical coding automation technologies, helps healthcare facilities optimize clinical documentation and revenue integrity.

Integration of AI and Natural Language Processing (NLP)

The integration of artificial intelligence and NLP technologies is transforming CDI processes by automating medical record analysis and identifying documentation gaps in real time. Advanced algorithms enhance clinical decision-making and coding accuracy while reducing administrative workload. AI-driven CDI platforms enable healthcare professionals to focus more on patient care instead of manual documentation. This technological advancement supports scalability across multi-specialty hospitals and drives higher adoption among healthcare providers seeking cost-efficient data management solutions.

- For instance, 3M s Modal Fluency Direct platform uses speech recognition and NLU technology to enable physicians to conversationally create, review, edit, and sign clinical notes directly in the EHR, thus improving documentation accuracy and efficiency across large hospital networks.

Regulatory Pressure and Compliance Requirements

Stringent healthcare regulations and quality reporting mandates are compelling institutions to adopt CDI systems. Governments and accreditation bodies emphasize data transparency, coding accuracy, and documentation consistency for reimbursement and compliance. Hospitals invest in CDI programs to meet evolving regulatory frameworks such as ICD-10 and Meaningful Use standards. These solutions also facilitate audit readiness and reduce compliance risks. The increasing frequency of regulatory audits and penalties for inaccurate coding further encourages healthcare organizations to strengthen their CDI infrastructure.

Key Trends & Opportunities

Expansion of Cloud-Based CDI Solutions

Cloud-based CDI solutions are gaining traction due to their scalability, lower deployment costs, and remote accessibility. These platforms support integration with electronic health records (EHRs) and offer real-time collaboration across clinical teams. The trend enables healthcare organizations to streamline operations and enhance interoperability. Growing investments in digital health infrastructure and the need for data security compliance are driving adoption of cloud-based CDI platforms, particularly among mid-sized hospitals and outpatient facilities transitioning from legacy on-premise systems.

- For instance, AQuity Solutions provides a cloud-based CDI platform and tech-enabled solutions that are HIPAA-compliant and use a fully encrypted cloud infrastructure. The combined entity with IKS Health serves over 150,000 clinicians across many of the largest hospitals, health systems, and specialty groups in the United States.

Growing Adoption Across Ambulatory and Post-Acute Care Settings

Beyond hospitals, CDI programs are expanding into ambulatory and post-acute care facilities. The shift is driven by rising documentation demands in outpatient treatments and home healthcare services. As these facilities play a growing role in patient care, accurate data capture becomes critical for billing and care continuity. Vendors are developing specialized CDI modules tailored for smaller healthcare settings. This trend presents a major opportunity for solution providers to tap into new customer bases and diversify revenue streams.

- For instance, “AGS Health’s AI-assisted computer-assisted coding (CAC) and clinical documentation integrity (CDI) solutions support over 150 customers, including nearly 50% of the 20 most prominent U.S. hospitals.

Key Challenges

High Implementation and Training Costs

The initial investment for CDI systems, including software integration and staff training, remains a significant barrier, especially for small and medium-sized hospitals. Customizing CDI solutions to align with existing workflows and EHR systems can require considerable technical support and time. Limited budgets and resource constraints often delay adoption in developing regions. Vendors must offer flexible pricing models and simplified deployment options to overcome this challenge and encourage broader CDI adoption across healthcare organizations.

Data Integration and Interoperability Issues

Integrating CDI systems with multiple healthcare information platforms poses a persistent challenge. Variations in data formats and documentation standards hinder seamless interoperability between EHRs, billing systems, and CDI software. These issues can result in data inconsistencies and incomplete clinical insights. Healthcare organizations face difficulties achieving end-to-end automation and accurate reporting. Enhancing data standardization and adopting interoperable technologies remain key to improving the efficiency and effectiveness of CDI implementation.

Regional Analysis

North America

North America dominated the Clinical Documentation Improvement (CDI) market in 2024, accounting for 43.7% of the total share. The region’s leadership is driven by advanced healthcare infrastructure, high electronic health record (EHR) adoption, and stringent regulatory compliance requirements. Growing emphasis on accurate clinical documentation to support value-based reimbursement models continues to boost CDI investments. Major healthcare providers in the United States are integrating AI-driven CDI tools to reduce claim denials and improve coding accuracy. Strategic collaborations among software vendors and hospitals further enhance market growth and strengthen the regional competitive landscape.

Europe

Europe held a 27.4% share of the CDI market in 2024, supported by robust healthcare digitization initiatives and regulatory mandates for accurate patient documentation. Countries such as Germany, the United Kingdom, and France are leading adopters of CDI solutions due to their focus on healthcare quality reporting and data standardization. The European market benefits from increasing demand for cloud-based platforms that streamline documentation across public and private healthcare systems. Ongoing implementation of interoperability standards and government-backed funding for digital transformation continues to strengthen CDI adoption across the region.

Asia-Pacific

Asia-Pacific accounted for 18.6% of the CDI market in 2024 and is expected to record the fastest growth during the forecast period. Rising investments in healthcare infrastructure, expanding hospital networks, and growing awareness of clinical data accuracy are driving adoption. Countries such as China, Japan, and India are increasingly implementing EHR systems and CDI software to improve billing efficiency and clinical outcomes. Government initiatives promoting digital healthcare transformation further accelerate market penetration. The expanding base of private hospitals and growing demand for AI-enabled documentation tools also support regional market expansion.

Latin America

Latin America captured 6.3% of the CDI market share in 2024, driven by gradual adoption of healthcare IT solutions and a growing need for documentation accuracy. Brazil and Mexico are leading contributors, supported by increasing healthcare expenditure and modernization of hospital information systems. Rising regulatory oversight and focus on reducing claim rejections are motivating healthcare providers to implement CDI solutions. The presence of international CDI vendors and local partnerships enhances accessibility and system integration. Continuous efforts toward digital health advancement and staff training further strengthen market prospects in the region.

Middle East & Africa

The Middle East & Africa held a 4.0% share of the CDI market in 2024, with growth supported by expanding hospital infrastructure and rising investments in digital health technologies. Gulf Cooperation Council (GCC) countries are leading adoption due to strong government focus on healthcare modernization and clinical data transparency. CDI solutions are increasingly deployed to enhance coding accuracy and optimize revenue cycle management. Growing collaborations with global IT vendors and initiatives to improve clinical quality documentation are strengthening the market. However, limited skilled workforce and high implementation costs remain key challenges in some parts of the region.

Market Segmentations:

By Component

By End-user

- Healthcare providers

- Healthcare payers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Clinical Documentation Improvement (CDI) market is highly competitive, featuring key players such as 3M, AGS Health, AQuity Solutions, Claro Healthcare, CorroHealth Inc., Craneware, GeBBS, Health Catalyst, Infinx Healthcare, and Iodine Software. These companies focus on advanced CDI solutions integrating artificial intelligence (AI), natural language processing (NLP), and automation to enhance documentation accuracy and clinical efficiency. Strategic partnerships, mergers, and service expansions are common as vendors aim to strengthen their global presence and technological capabilities. For instance, major players are investing in cloud-based CDI platforms and analytics-driven tools that align with evolving regulatory standards. Continuous innovation in AI-powered documentation review, real-time coding feedback, and data security solutions positions these firms to meet rising demand from hospitals and healthcare payers. The growing emphasis on interoperability and scalable integration with electronic health record (EHR) systems further defines competition in this dynamic market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2025, Infinx Healthcare announced a strategic investment in Maverick AI to bring real-time autonomous medical coding and documentation workflows into its service platform.

- In April 2025, Health Catalyst released a tailored analytics solution for community health systems and multi-site practices to support clinical documentation and revenue cycle workflows.

- In October 2023, CorroHealth, Inc. launched its “VISION” DRG revenue integrity solution aimed at CDI and HIM teams, ingesting hospital patient encounter data and applying advanced analytics to flag under- or over-documented records.

Report Coverage

The research report offers an in-depth analysis based on Component, End-user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The CDI market will continue to expand with increasing adoption of AI and NLP technologies.

- Hospitals will invest more in real-time documentation tools to enhance coding accuracy.

- Cloud-based CDI platforms will gain traction due to flexibility and lower operational costs.

- Integration with electronic health record systems will become a core requirement for CDI solutions.

- Healthcare providers will prioritize CDI programs to improve reimbursement efficiency and compliance.

- Vendors will focus on developing multilingual and region-specific CDI solutions.

- Automation and predictive analytics will play a key role in reducing administrative burden.

- Collaboration between CDI vendors and healthcare payers will strengthen data transparency.

- Emerging markets in Asia-Pacific and Latin America will witness rapid CDI adoption.

- Ongoing regulatory updates and quality reporting mandates will sustain steady demand for advanced CDI systems.