Market Overview

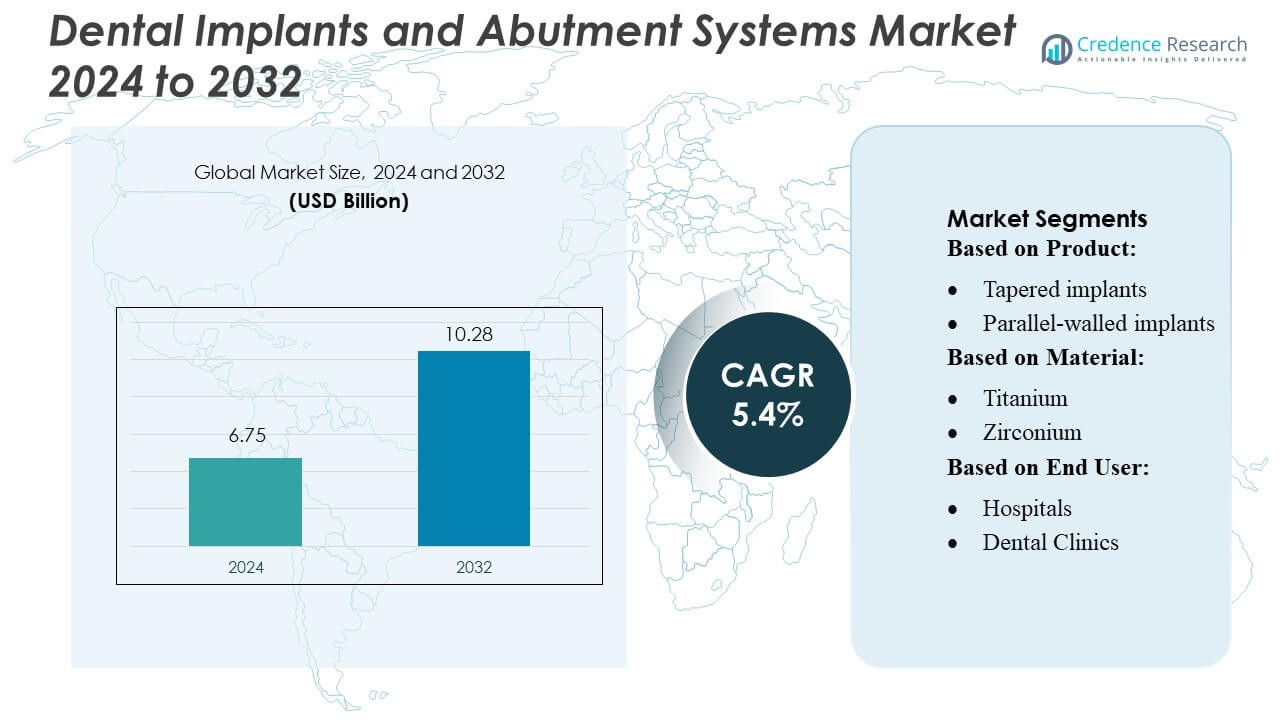

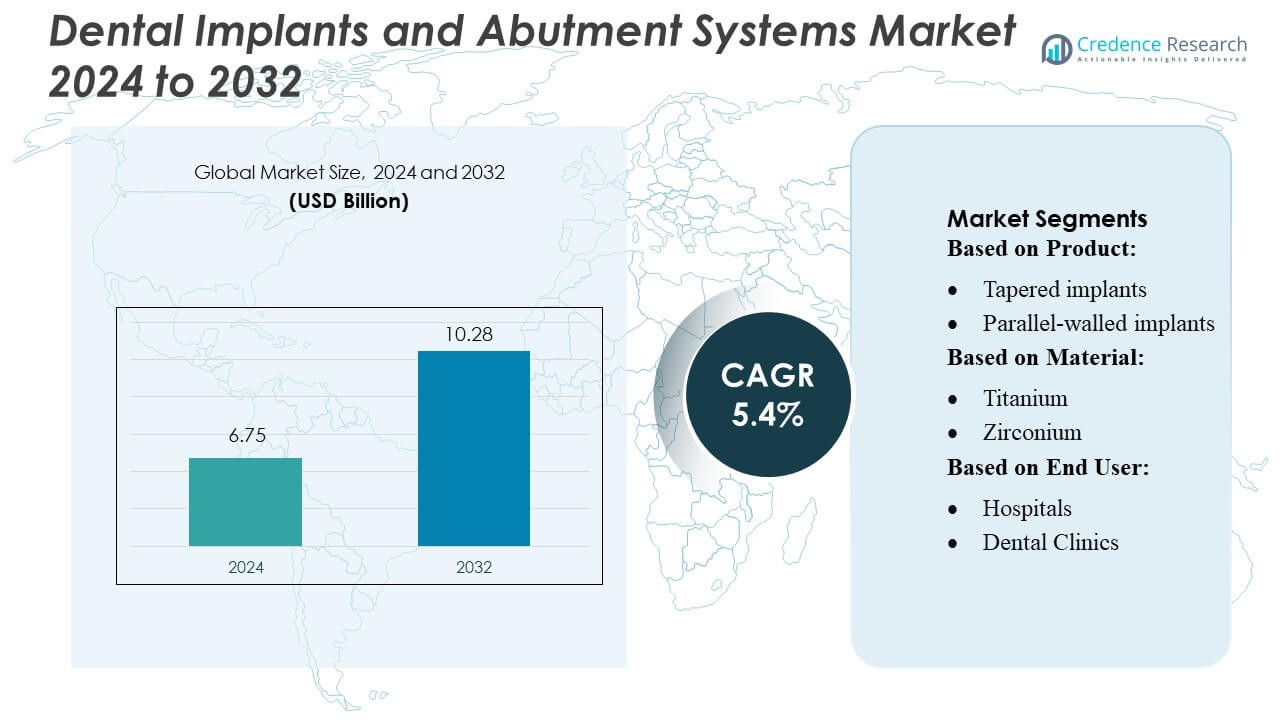

Dental Implants and Abutment Systems Market size was valued USD 6.75 billion in 2024 and is anticipated to reach USD 10.28 billion by 2032, at a CAGR of 5.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Implants and Abutment Systems Market Size 2024 |

USD 6.75 Billion |

| Dental Implants and Abutment Systems Market, CAGR |

5.4% |

| Dental Implants and Abutment Systems Market Size 2032 |

USD 10.28 Billion |

The Dental Implants and Abutment Systems market is characterized by strong competition among global manufacturers that continue to expand their portfolios, upgrade surface technologies, and integrate digital workflows to strengthen clinical outcomes. Companies focus on advanced implant designs, customized abutments, and CAD/CAM-driven restorative solutions to meet rising demand for precision and aesthetics. Strategic investments in clinician training, regional distribution, and research support sustained competitiveness across end-user segments. North America leads the global market with an approximate 36–37% share, supported by high dental expenditure, strong digital adoption, and a large base of trained implant specialists.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Dental Implants and Abutment Systems Market was valued at USD 6.75 billion in 2024 and is projected to reach USD 10.28 billion by 2032, advancing at a CAGR of 5.4%, supported by rising dental restoration demand and improvements in implant technologies.

- Market growth is driven by increasing adoption of digital dentistry, expanding geriatric populations, and higher preference for permanent, aesthetic solutions; dental implants hold the dominant product share, while titanium remains the leading material segment.

- Key trends include rapid expansion of customized CAD/CAM abutments, growing acceptance of zirconia implants, and broader integration of guided surgery systems in clinics seeking precision and workflow efficiency.

- Competitive activity intensifies as manufacturers upgrade surface coatings, invest in clinician training, and expand regional distribution, though high treatment costs and limited reimbursement continue to restrain adoption in price-sensitive markets.

- Regionally, North America leads with around 36–37% market share, followed by Europe and the fast-growing Asia-Pacific region, supported by dental tourism and expanding clinic infrastructure.

Market Segmentation Analysis:

By Product

In the product segment, dental implants hold the dominant share of the market at around 75–80%, driven by rising demand for permanent tooth restoration and improvements in implant design. Tapered implants lead within this category because their conical shape provides stronger primary stability in varied bone conditions. Stock abutments remain the largest abutment sub-segment due to their lower cost and easy availability. Growth across the product segment is supported by expanding dental tourism, rising cosmetic dentistry preference, and wider adoption of digital workflows such as guided implant surgery.

- For instance, Leader Medica’s TiSmart® implant is available in three diameters—3.5 mm, 4.0 mm, and 4.8 mm—and in lengths from 7 mm to 15 mm, offering a conical body that ensures strong primary stability.

By Material

Titanium implants represent the dominant material sub-segment, holding over 60% of the market due to their superior biocompatibility, high strength, and long-term clinical success. Zirconium implants continue to grow quickly as a metal-free option preferred for aesthetics and patients with metal sensitivities. Other materials, including advanced polymers, serve niche requirements for lightweight or flexible implant components. The material segment is expanding as manufacturers introduce improved surface-treatment technologies that enhance osseointegration and shorten healing times.

- For instance, ZimVie’s TSV™ (Tapered Screw-Vent) Implant is made of grade-5 titanium alloy and its triple-lead threads deliver primary stability at insertion torque of up to 40 Ncm.

By End User

Among end users, dental clinics account for the largest share at over 60%, driven by the high volume of outpatient implant procedures and increasing adoption of chairside CAD/CAM systems. Hospitals follow, primarily handling complex surgical cases and trauma-related implant needs. Other end-use settings, including academic institutes and specialty centers, contribute to training and advanced procedures. Growing patient footfall in clinics, combined with improved insurance coverage and rising oral-care awareness, continues to support dominance in this segment.

Key Growth Drivers

Rising Prevalence of Tooth Loss and Expanding Geriatric Population

Increasing tooth loss due to aging, periodontal disease, and trauma continues to drive demand for dental implants and abutment systems. The expanding global elderly population requires long-term restorative solutions, strengthening implant adoption over traditional dentures. Improved awareness of oral rehabilitation standards and patient willingness to opt for permanent replacements further accelerate usage. Additionally, better affordability in developing economies and wider insurance coverage in mature markets support consistent patient inflow, reinforcing long-term growth across the implant treatment ecosystem.

- For instance, Dentium’s SuperLine® implant system, widely used for elderly patients with compromised bone, is manufactured from grade-4 pure titanium and features an S.L.A. surface engineered with a micro-roughness of Ra 2.5–3.0 μm, enabling faster bone–implant contact during early healing.

Advancements in Digital Dentistry and Implant Workflow Technologies

Rapid integration of CAD/CAM systems, intraoral scanners, and 3D-guided surgery significantly enhances implant accuracy, reduces chair time, and improves treatment outcomes. These technologies enable better customization, particularly for abutment systems, boosting adoption in clinics and labs. Digital workflows also streamline case planning and prosthetic design, improving efficiency and reducing procedural errors. The industry benefits from faster turnaround times and improved patient satisfaction, encouraging clinics to invest heavily in digital solutions and accelerating the transition from conventional to technology-enabled implant procedures.

- For instance, OneGuide system enables implant placement using only 2–4 drills, depending on bone quality, thanks to an optimized Taper 122 concept.The side-entry “open guide” design requires just 30 mm of interocclusal space, compared with 51 mm in conventional guides, allowing procedures in challenging anatomical regions.

Growing Demand for Aesthetic Dentistry and Immediate-Load Implants

Patient preference for aesthetic, natural-looking dental restorations has increased demand for both implants and custom abutments. Immediate-load implants, which allow quicker restoration and minimize waiting periods, are becoming a preferred option for eligible cases. The rise of cosmetic dentistry, influenced by lifestyle shifts and social media visibility, supports higher procedural volumes globally. Additionally, improvements in implant surface technologies and biomaterials enable faster healing and improved osseointegration, making these advanced options more accessible and helping providers meet patient expectations for faster and more aesthetic rehabilitation.

Key Trends & Opportunities

Shift Toward Metal-Free and Zirconia-Based Implant Systems

A significant trend involves the rising adoption of zirconia implants and abutments driven by patient preference for metal-free, aesthetically superior, and biocompatible solutions. Zirconia’s tooth-colored properties and resistance to corrosion make it increasingly attractive in anterior restorations. Manufacturers are investing in next-generation ceramic materials with improved strength and durability, expanding clinical indications. As concerns over metal allergies grow and clinicians embrace holistic dentistry, the zirconia segment presents substantial opportunities for differentiation, premium pricing, and greater penetration across cosmetic and lifestyle-driven markets.

- For instance, Bicon, LLC, whose Integra-CP™ ceramic restorations make use of a locking-taper connection that delivers 360° of abutment positioning while forming a bacterial seal.

Growing Penetration of Personalized and CAD/CAM-Customized Abutments

Demand for customized abutments continues to rise as clinicians prioritize precision fit, improved gingival contours, and enhanced long-term prosthetic outcomes. CAD/CAM manufacturing enables tailored solutions for complex anatomies, leading to better function and aesthetics compared with stock components. The trend aligns with the broader movement toward individualized treatment planning supported by digital imaging and design platforms. As more clinics adopt chairside milling and partner with digital laboratories, the customized abutment segment offers strong growth potential through workflow integration and premium-value restorative solutions.

- For instance, Dentis’s own Link Abutment, which supports cement gaps of 50 μm, 80 μm, 100 μm, or 140 μm, allowing labs to tailor emergence profiles precisely to gingival height and soft-tissue thickness.

Expansion in Emerging Markets and Medical Tourism Hubs

Emerging economies in Asia-Pacific, Latin America, and Eastern Europe present strong opportunities as dental tourism grows and private clinics expand implant services. Lower treatment costs, rising disposable incomes, and improved access to trained implantologists accelerate adoption. Governments and private providers increasingly invest in modern dental infrastructure, including digital systems and advanced surgical tools. These regions benefit from growing awareness of implant-based restoration as a long-term solution, making them high-potential markets for global manufacturers seeking volume growth and broader brand penetration.

Key Challenges

High Treatment Costs and Limited Reimbursement Coverage

Despite technological advancements, the high cost of implant procedures remains a major barrier, particularly in price-sensitive markets. Limited or partial insurance coverage increases out-of-pocket expenses for patients, reducing accessibility. Premium materials, digital tools, and customized components further elevate costs for providers and patients. Clinics in developing regions also face financial constraints in adopting advanced implant systems. This cost burden slows adoption among middle-income populations and challenges manufacturers to balance innovation with affordability to expand penetration.

Complex Surgical Requirements and Shortage of Trained Professionals

Dental implant placement demands specialized surgical expertise, accurate case selection, and comprehensive postoperative management. In many regions, a shortage of trained implantologists limits procedural capacity and slows market expansion. Complexity increases further in cases involving compromised bone quality or anatomical limitations, requiring advanced techniques and experience. Insufficient training infrastructure and uneven skill distribution between urban and rural areas compound the challenge. As patient demand rises, addressing this workforce gap becomes essential to support safe, scalable, and predictable implant therapy delivery.

Regional Analysis

North America

North America holds the largest market share of about 36–37%, supported by high dental spending, strong adoption of digital dentistry, and a large base of trained implant specialists. The region benefits from advanced clinics, wider availability of premium implant systems, and a growing elderly population with higher rates of tooth loss. The U.S. drives most of the demand due to established reimbursement structures and rapid integration of CAD/CAM and guided-surgery technologies. Continuous product innovation and strong presence of global implant manufacturers further reinforce the region’s dominance.

Europe

Europe accounts for roughly 29–30% of the global market, driven by widespread oral-care awareness, structured reimbursement systems, and strong adoption of aesthetic implant solutions. Germany, France, Italy, and the UK lead the region through high procedural volumes and advanced prosthetic laboratories. Integration of digital workflows, preference for zirconia-based solutions, and consistent regulatory standards support steady market expansion. Europe’s mature clinical infrastructure, along with increasing demand for personalized abutments and immediate-load implants, continues to strengthen its position as the second-largest regional market.

Asia-Pacific

Asia-Pacific captures around 25–26% of the global share and stands as the fastest-growing region due to expanding dental tourism, improving affordability, and rising disposable incomes. China, India, Japan, and South Korea contribute significantly as they scale modern dental clinics and invest heavily in advanced implant technologies. Increased awareness of long-term restorative solutions and rapid adoption of CAD/CAM-based workflows also support growth. A large patient pool and competitive pricing compared to Western countries make the region attractive for both patients and manufacturers, driving sustained market acceleration.

Latin America

Latin America shows steady growth with an estimated 6–7% market share, driven by expanding private dental clinics and rising interest in cosmetic and restorative procedures. Brazil and Mexico lead adoption as middle-income populations increasingly choose implant-based solutions over traditional prosthetics. Although limited reimbursement remains a challenge, competitive treatment pricing and growing dental tourism strengthen regional demand. Investments in digital radiography, guided surgery, and new implant centers help improve procedural efficiency and accessibility, enabling higher patient uptake across urban markets.

Middle East & Africa (MEA)

The Middle East & Africa region holds around 10–11% of the market, supported by rising investments in advanced dental clinics and growing demand for premium cosmetic procedures. The UAE, Saudi Arabia, and South Africa lead adoption, driven by expanding medical tourism and rapid modernization of dental care infrastructure. While affordability remains an issue in several countries, increasing awareness of implant benefits and higher income levels in Gulf nations support market growth. Ongoing training programs and partnerships with international implant manufacturers are improving access to modern restorative solutions.

Market Segmentations:

By Product:

- Tapered implants

- Parallel-walled implants

By Material:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dental Implants and Abutment Systems market features a diverse mix of global and regional players, including Leader Medica, ZimVie Inc., Dentium Co., Ltd., Osstem Implant, Bicon, LLC, Dentis, Institut Straumann AG, T-Plus Implant Tech Co. Ltd., BioHorizons, Dentsply Sirona, and Nobel Biocare (Envista). The Dental Implants and Abutment Systems market is characterized by strong innovation, increasing digitalization, and continual product diversification. Companies focus on enhancing implant surface technologies, expanding immediate-load and minimally invasive solutions, and developing more personalized abutments using advanced CAD/CAM workflows. Digital integration—such as guided surgery, intraoral scanning, and AI-supported treatment planning—has become a major differentiator, improving precision and reducing clinical time. Manufacturers are strengthening global distribution networks, forming partnerships with dental clinics and labs, and investing in clinician training programs to increase adoption. Growing demand for aesthetic, metal-free implants and patient-specific prosthetics is pushing firms to refine materials, expand zirconia offerings, and optimize restorative workflows.

Key Player Analysis

- Leader Medica

- ZimVie Inc.

- Dentium Co., Ltd.

- Osstem Implant

- Bicon, LLC

- Dentis

- Institut Straumann AG

- T-Plus Implant Tech Co. Ltd.

- BioHorizons

- Dentsply Sirona

- Nobel Biocare (Envista)

Recent Developments

- In July 2025, ZimVie Inc. announced a strategic, exclusive distribution partnership with Osstem Implant Co., Ltd., a prominent provider of high-quality dental implants and integrated dental technologies. This collaboration focuses specifically on the Chinese market, granting Osstem Implant the commercial responsibility for distributing ZimVie implant systems within China.

- In June 2025, INSTITUT STRAUMANN AG will the Villeret site in Switzerland over the next five years. Villeret will continue to focus on the production of high-value-added products, including the newly launched iEXCEL high-performance implant system.

- In May 2025, Dentsply Sirona launched the CEREC Cercon 4D™ Multidimensional Zirconia Abutment Block, a CAD/CAM zirconia material designed to combine high strength with esthetics for use in hybrid abutment crowns and abutments.

- In February 2024, Avista Capital Partners acquired Terrats Medical, a global provider of oral care solutions, from Miura Partners. As part of the deal, the founders of Terrats Medical reinvested in the company and will continue to lead the business to ensure management and strategic direction continuity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Material, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue expanding as aging populations increase demand for long-term restorative dental solutions.

- Digital dentistry adoption will accelerate, with greater use of CAD/CAM systems, intraoral scanners, and guided surgery.

- Customized abutments and patient-specific implants will gain traction due to rising preference for precision and aesthetics.

- Zirconia and other metal-free implants will grow rapidly as patients seek biocompatible and natural-looking options.

- Immediate-load and minimally invasive implant procedures will become more common as clinical outcomes improve.

- Dental clinics will strengthen their role as the primary treatment centers through wider adoption of digital workflows.

- Training programs for implantologists will expand to address the global shortage of skilled professionals.

- Manufacturers will increase investments in surface-enhancement technologies to improve osseointegration speed and stability.

- Emerging markets will see strong adoption driven by rising dental tourism and improving affordability.

- AI-assisted planning and software-driven workflows will enhance treatment predictability and procedural efficiency.