Market Overview

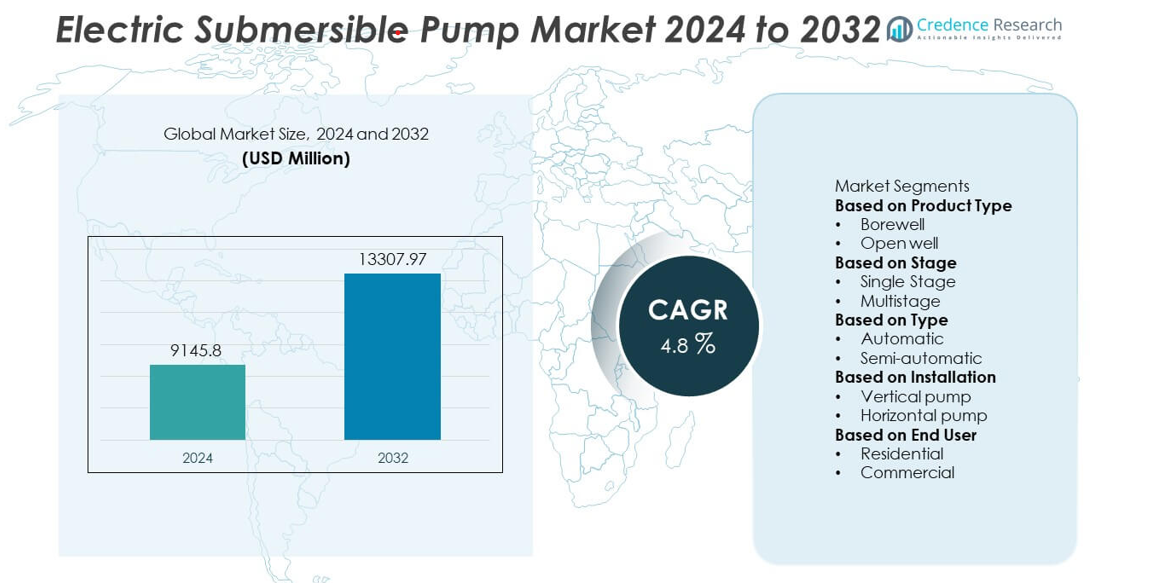

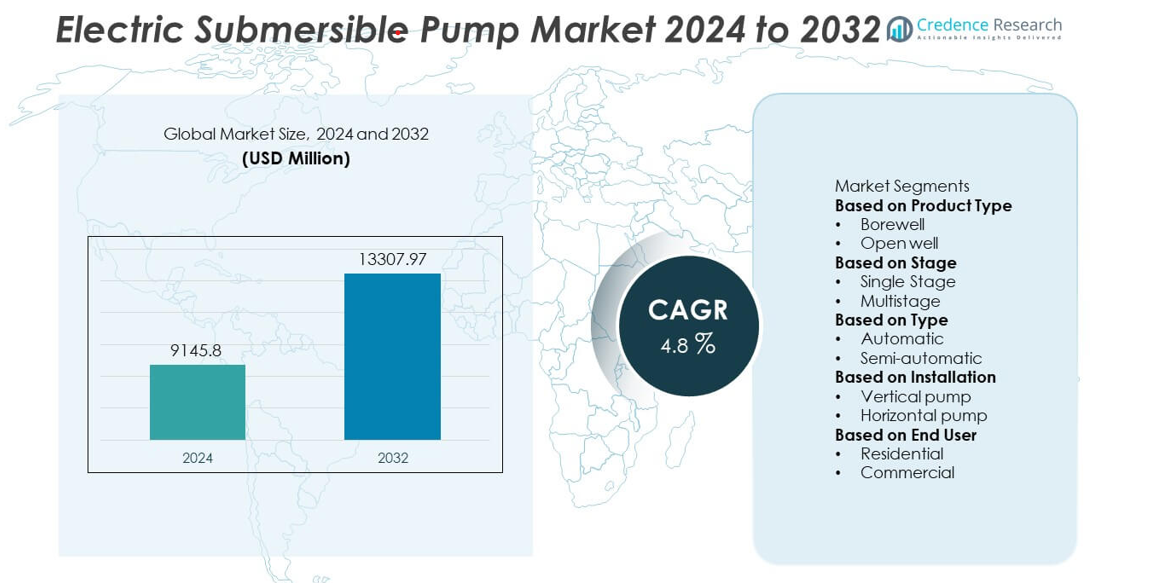

The Electric Submersible Pump Market was valued at USD 9,145.8 million in 2024 and is projected to reach USD 13,307.97 million by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Submersible Pump Market Size 2024 |

USD 9,145.8 million |

| Electric Submersible Pump Market, CAGR |

4.8% |

| Electric Submersible Pump Market Size 2032 |

USD 13,307.97 million |

The Electric Submersible Pump market is led by major companies including EBARA, Atlas Copco, Pleuger, Baker Hughes, Proril Pumps, Aqua Group, SLB, Pedrollo, Flexachem, and Dab Pumps. These players dominate through advanced product portfolios, digital monitoring integration, and strong distribution networks. Asia-Pacific emerged as the leading region with a 38 percent market share in 2024, driven by rapid industrialization and extensive agricultural irrigation demand. North America followed with 27 percent, supported by ongoing oil and gas exploration. Europe maintained steady growth at 21 percent, supported by sustainability-focused investments and water management modernization programs.

Market Insights

- The Electric Submersible Pump market was valued at USD 9,145.8 million in 2024 and is projected to reach USD 13,307.97 million by 2032, growing at a CAGR of 4.8 percent.

- Rising demand for groundwater extraction and increasing oil and gas exploration activities are major growth drivers, supported by expanding urban and industrial water infrastructure.

- Technological trends include the integration of IoT-based monitoring, energy-efficient motor designs, and corrosion-resistant materials to improve performance and durability.

- The market is competitive with key players such as EBARA, Atlas Copco, Baker Hughes, SLB, and Pedrollo focusing on innovation, partnerships, and regional expansion to strengthen their presence.

- Asia-Pacific held the largest share of 38 percent in 2024, followed by North America with 27 percent and Europe with 21 percent, while the borewell product segment led with 61 percent share due to high agricultural and municipal water demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

The borewell submersible pump segment dominated the market in 2024, accounting for nearly 61% of the total share. Its leadership stems from wide use in agriculture, municipal water supply, and groundwater extraction. Borewell pumps provide higher discharge rates, durability, and energy efficiency, making them ideal for deep-well applications. The growing demand for irrigation systems and reliable water access in developing regions supports steady growth. Government initiatives promoting rural water infrastructure and precision farming further accelerate borewell pump adoption across Asia-Pacific and the Middle East.

- For instance, EBARA s borehole pump series includes models delivering a total head up to 682 m with capacities reaching 75 m³/h. Other models like the 6BHE and 8BHE series also achieve powerful performance, demonstrating that EBARA manufactures pumps with these capabilities.

By Stage

The multistage submersible pump segment held the largest share of about 68% in 2024. Multistage systems offer higher pressure and efficiency for deep-well pumping and industrial operations. These pumps are widely used in oil and gas, mining, and water treatment due to their ability to handle high head requirements. Increasing industrial water use and deeper groundwater extraction have boosted demand. Manufacturers are also focusing on corrosion-resistant materials and variable frequency drives to improve operational reliability and energy performance in large-scale installations.

- For instance, Atlas Copco’s PAC H108 JD model handles flows up to 6,400 gpm at a head up to 360 ft in dewatering service.

By Type

The automatic submersible pump segment led the market with approximately 57% share in 2024. Automatic pumps are favored for their smart operation, reduced maintenance, and energy-saving capabilities. These systems feature built-in sensors and controllers that regulate water levels, ensuring efficient use and preventing dry runs. Rising adoption of automation in residential and agricultural sectors drives segment expansion. The trend toward intelligent water management and integration with IoT-based monitoring systems continues to strengthen the preference for automatic submersible pumps globally.

Key Growth Drivers

Rising Demand for Groundwater Extraction

Growing dependence on groundwater for agriculture and municipal supply is a major driver for electric submersible pumps. Expanding irrigation networks and depleting surface water sources are increasing the use of borewell systems. These pumps provide efficient water delivery and long-term reliability in deep aquifer operations. Government initiatives promoting sustainable irrigation and rural water access further encourage installation. Continuous focus on water security and efficient usage supports strong adoption across developing economies.

- For instance, Grundfos supplied pumps for water projects in India, including those under the Jal Jeevan Mission, using high-efficiency SP submersible pumps. The pumps feature stainless-steel components for corrosion resistance and sand handling, ensuring long service life in continuous groundwater operations.

Expanding Oil and Gas Exploration Activities

Increased exploration of both offshore and onshore oil reserves is boosting demand for electric submersible pumps. These pumps are widely used to enhance oil recovery and maintain steady production rates in deep wells. Advancements in high-temperature and corrosion-resistant technologies are improving pump performance under demanding conditions. Energy producers rely on these systems to optimize operations and lower production costs. Growing investments in energy exploration across key oil-producing regions continue to strengthen market growth.

- For instance, Schlumberger’s REDA Maximus ESP system is designed for enhanced reliability in challenging conditions, with high-efficiency motor technology capable of withstanding high temperatures up to 204°C.

Rapid Industrialization and Urban Infrastructure Development

Industrial expansion and urbanization are accelerating the need for efficient water management systems. Sectors such as mining, wastewater treatment, and manufacturing depend on submersible pumps for reliable fluid handling. Urban projects require advanced pumping systems for water supply, flood control, and drainage. Governments are integrating automated and smart pumping technologies into infrastructure plans. This trend supports continuous market expansion driven by modernization and industrial growth across developing regions.

Key Trends and Opportunities

Integration of Smart and Connected Technologies

Smart monitoring systems and IoT-based controls are transforming the performance of electric submersible pumps. These technologies enable real-time tracking, predictive maintenance, and improved energy efficiency. Manufacturers are adopting digital controllers and cloud-based monitoring to reduce downtime and extend equipment life. The integration of automation in water and wastewater applications enhances operational reliability. Growing adoption of smart water management platforms creates strong opportunities for technologically advanced pump solutions.

- For instance, Baker Hughes deploys digital systems like its ProductionLink™ platform for Electrical Submersible Pumps (ESPs). The platform enables well performance tracking, including predictive failure analytics powered by machine learning, to identify potential issues before costly failures occur.

Shift Toward Energy-Efficient and Eco-Friendly Designs

Energy efficiency and sustainability are becoming central to pump design. Manufacturers are focusing on high-efficiency motors, variable frequency drives, and recyclable materials. These innovations help reduce energy consumption and meet environmental standards. Demand for eco-friendly systems is rising in agriculture, construction, and municipal sectors. The focus on reducing carbon footprints and lifecycle costs positions energy-efficient submersible pumps as a preferred choice for modern applications.

- For instance, Franklin Electric introduced its high-efficiency 6-inch E-Tech borehole motor capable of operating up to 18.5 kW with a 92% efficiency rating. The motor uses 316-grade stainless steel construction and recyclable copper windings, which improve corrosion resistance and reduce power losses in continuous agricultural pumping operations.

Key Challenges

High Maintenance and Operational Complexity

Frequent exposure to corrosive fluids, sand, and high-pressure conditions increases wear on submersible pumps. This leads to high maintenance requirements and operational costs, especially in remote locations. Failures in seals or impellers can disrupt operations and increase downtime. Manufacturers are developing durable designs with self-cleaning and anti-corrosive components to reduce service frequency. However, maintenance costs remain a major constraint for small and medium users.

Fluctuating Raw Material Prices

Volatility in prices of metals such as copper and stainless steel affects production stability. These materials are vital for pump casings and motor components, making manufacturing costs sensitive to market fluctuations. Global supply chain disruptions and energy cost variations add further uncertainty. Companies are exploring alternative materials and efficient fabrication techniques to manage price risks. Despite these efforts, raw material instability continues to challenge profitability in the submersible pump market.

Regional Analysis

North America

North America held a market share of 27 percent in 2024, driven by increasing oil and gas production in the United States and Canada. The region’s shale exploration and offshore drilling projects continue to strengthen demand for advanced electric submersible pumps. Growing adoption in municipal water supply and wastewater treatment also supports steady growth. Key manufacturers are investing in digital pump monitoring and energy-efficient designs to improve operational reliability. Government focus on upgrading industrial and urban water systems further enhances market expansion across the region.

Europe

Europe accounted for 21 percent of the total market share in 2024, supported by strong industrial and municipal water management programs. Countries such as Germany, France, and the United Kingdom are adopting energy-efficient submersible pumps to meet sustainability goals. Investments in wastewater treatment and flood control systems boost product deployment. Rising demand for automation in water infrastructure and environmental compliance under EU regulations further strengthens growth. Manufacturers in the region are focusing on low-noise, corrosion-resistant models for long-term durability and reduced lifecycle costs.

Asia-Pacific

Asia-Pacific dominated the global market with a 38 percent share in 2024, led by rapid industrialization and agricultural development in China, India, and Southeast Asia. Expanding irrigation networks and rising groundwater extraction drive significant demand for borewell submersible pumps. Urbanization and infrastructure investments continue to enhance water distribution and sewage systems. Governments across the region are promoting rural electrification and sustainable water supply projects. The strong presence of domestic manufacturers offering cost-effective and energy-efficient solutions further boosts market growth across Asia-Pacific.

Middle East and Africa

The Middle East and Africa captured 9 percent of the global share in 2024, supported by ongoing oil field development and water desalination projects. Electric submersible pumps are widely used for artificial lift in high-temperature oil wells. Gulf nations such as Saudi Arabia and the UAE are major adopters due to large-scale energy and water initiatives. In Africa, rising agricultural irrigation and rural water supply projects contribute to steady demand. The focus on expanding infrastructure and industrial capacity is expected to sustain regional market growth.

Latin America

Latin America accounted for 5 percent of the total market share in 2024, driven by oil exploration activities and agricultural water applications. Countries such as Brazil and Mexico are leading adopters due to increased drilling operations and groundwater extraction. Government programs promoting rural electrification and efficient irrigation further boost pump installation. Local manufacturing improvements and partnerships with international players enhance product availability. Continued investment in mining and energy infrastructure is expected to support consistent demand for electric submersible pumps across the region.

Market Segmentations:

By Product Type

By Stage

By Type

By Installation

- Vertical pump

- Horizontal pump

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Electric Submersible Pump market includes key players such as EBARA, Atlas Copco, Pleuger, Baker Hughes, Proril Pumps, Aqua Group, SLB, Pedrollo, Flexachem, and Dab Pumps. These companies focus on expanding product portfolios, enhancing energy efficiency, and integrating digital monitoring technologies to strengthen market presence. Strategic investments in automation and smart pumping systems are becoming a major differentiator among global and regional manufacturers. Companies are actively pursuing mergers, partnerships, and capacity expansions to address growing demand in oil and gas, municipal water, and industrial sectors. Product reliability, lifecycle cost efficiency, and aftersales service capabilities remain key competitive factors. Manufacturers are also emphasizing sustainability, introducing pumps with corrosion-resistant materials and variable frequency drives to improve performance in harsh environments. Continuous innovation and regional expansion strategies are shaping long-term competition across developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- EBARA

- Atlas Copco

- Pleuger

- Baker Hughes

- Proril Pumps

- Aqua Group

- SLB

- Pedrollo

- Flexachem

- Dab Pumps

Recent Developments

- In September 2025, Pleuger highlighted its StEnSea offshore energy-storage submersible pump work.

- In 2025, SLB (and Baker Hughes) reported Q2 2025 earnings; SLB’s Production Systems division (which includes pumping and artificial lift) showed 3 % sequential revenue growth.

- In May 2024, Baker Hughes and the Azneft production association reached an agreement to set up the assembly of electric submersible pumps (ESPs) in Azerbaijan.

- In March 2023, Atlas Copco launched an updated WEDA D electric submersible dewatering pump

Report Coverage

The research report offers an in-depth analysis based on Product Type, Stage, Type, Installation, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to rising global water demand.

- Increasing use in deep-well and offshore oil extraction will sustain long-term adoption.

- Smart pump technologies with IoT integration will enhance performance and monitoring.

- Energy-efficient and eco-friendly pump designs will gain strong market preference.

- Rural electrification projects will drive installation in developing regions.

- Demand for automated and variable frequency-controlled systems will increase rapidly.

- Manufacturers will focus on durable materials to reduce maintenance and downtime.

- Expansion of wastewater treatment facilities will boost product utilization.

- Partnerships between global and regional players will strengthen supply chains.

- Asia-Pacific will remain the leading growth hub supported by industrial and agricultural development.