Market Overview

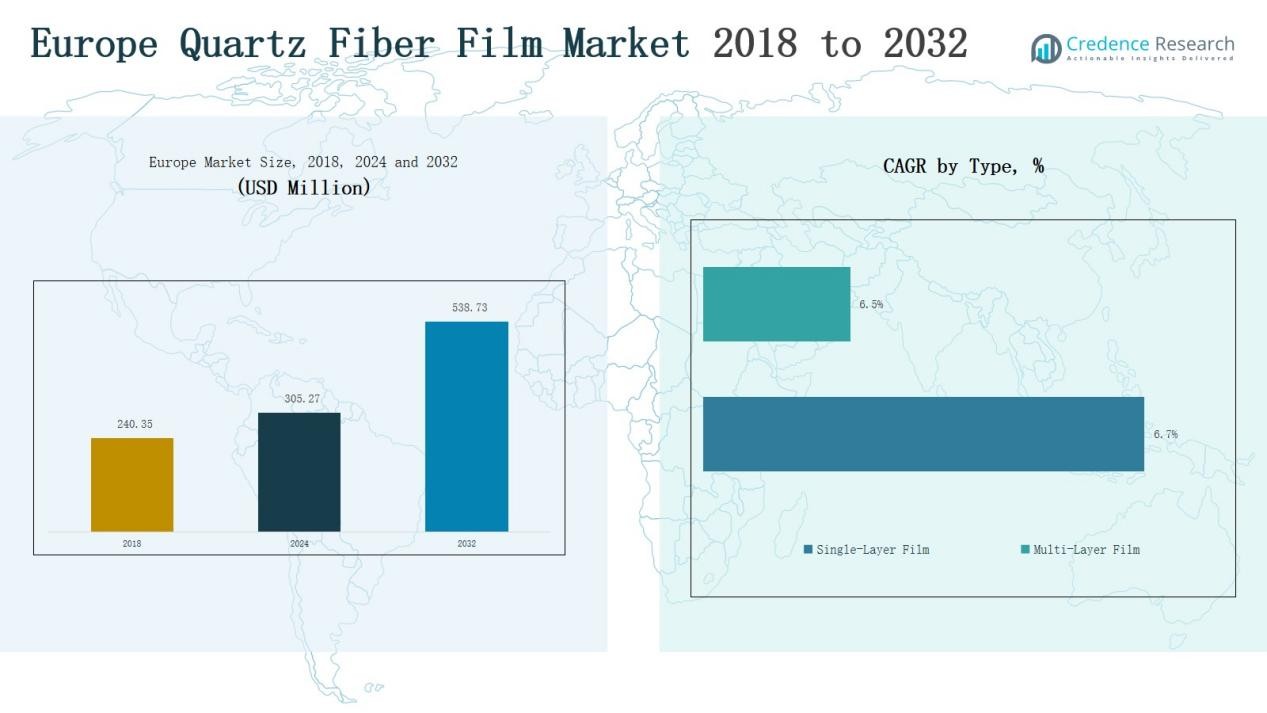

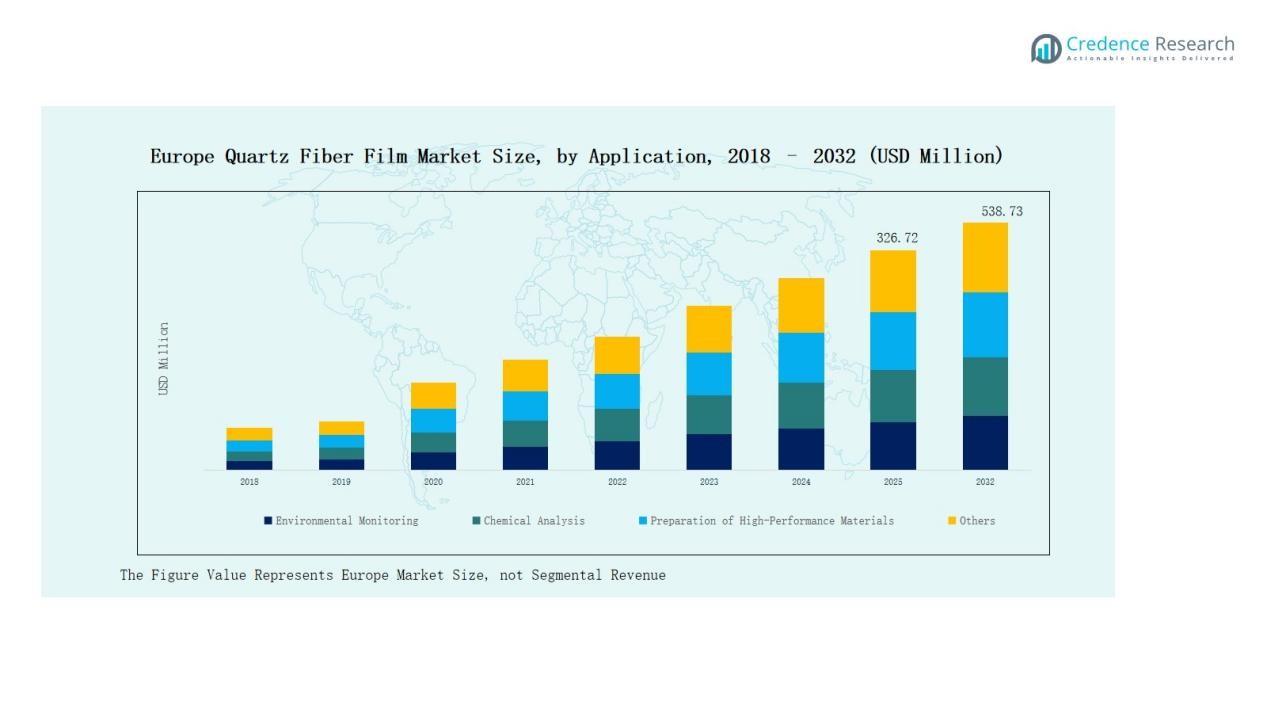

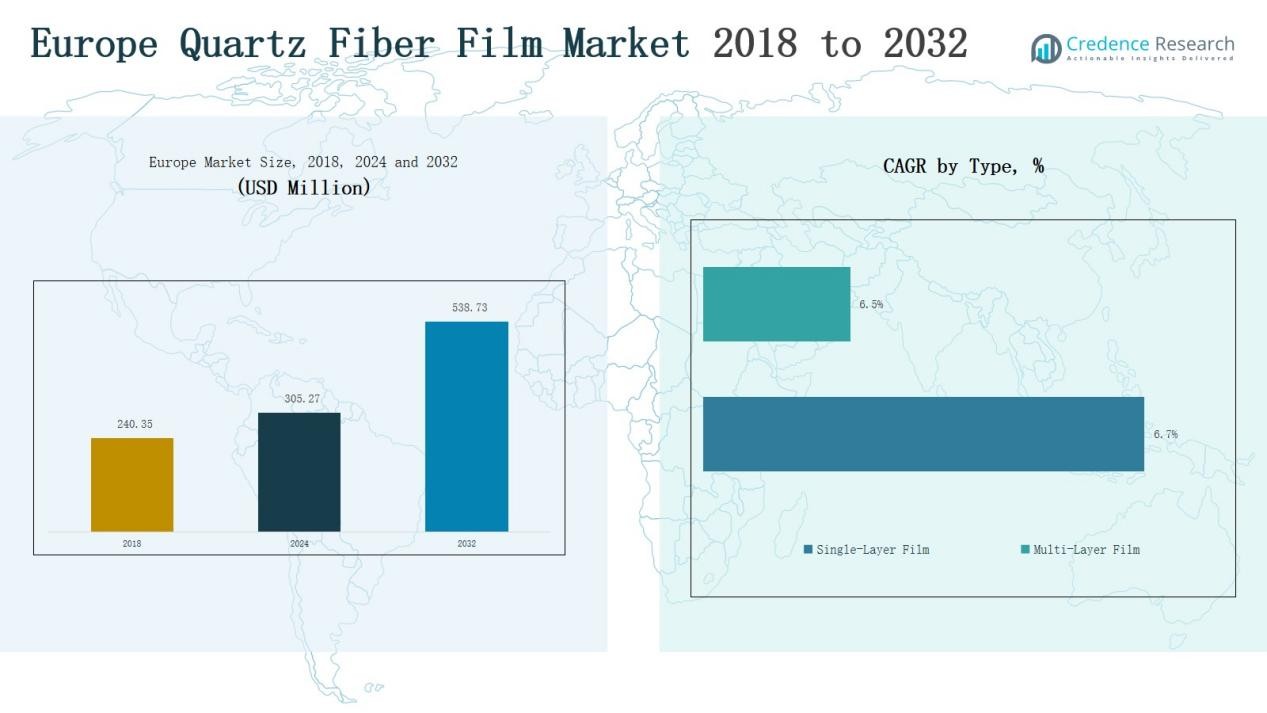

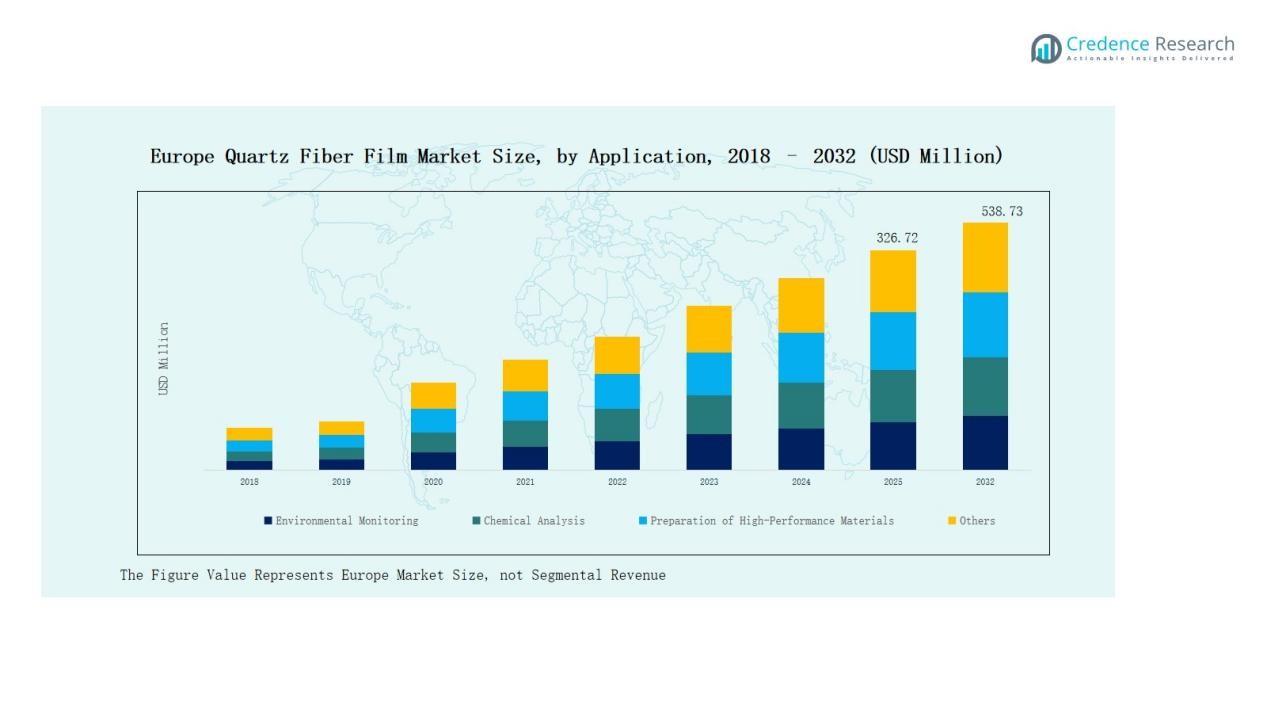

The Europe Quartz Fiber Film Market size was valued at USD 240.35 million in 2018, increased to USD 305.27 million in 2024, and is anticipated to reach USD 538.73 million by 2032, growing at a CAGR of 7.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Quartz Fiber Film Market Size 2024 |

USD 305.27 Million |

| Europe Quartz Fiber Film Market, CAGR |

7.49% |

| Europe Quartz Fiber Film Market Size 2032 |

USD 538.73 Million |

The Europe Quartz Fiber Film Market is led by major players such as Saint-Gobain Quartz, Heraeus, Schott AG, 3M, QSIL Group, WONIK Quartz Europe, Lenzing AG, Cytiva, Merck Millipore, and Pall Corporation. These companies focus on producing high-purity films with superior thermal stability and chemical resistance for use in semiconductors, optics, and environmental monitoring. They invest heavily in R&D, automation, and sustainable production technologies to enhance performance and scalability. Germany remains the leading regional market, commanding a 28% share in 2024, supported by its strong manufacturing base and advanced material innovation ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe Quartz Fiber Film Market grew from USD 240.35 million in 2018 to USD 305.27 million in 2024 and is projected to reach USD 538.73 million by 2032, growing at 7.49%.

- Germany led the market with a 28% share in 2024, supported by strong semiconductor, electronics, and chemical manufacturing industries.

- The Single-Layer Film segment dominated with a 62.4% share, driven by high demand in optical and electronic applications requiring heat resistance.

- The Environmental Monitoring segment held a 38.7% share, fueled by increased environmental testing and industrial emission monitoring.

- Key players include Saint-Gobain Quartz, Heraeus, Schott AG, 3M, QSIL Group, WONIK Quartz Europe, Lenzing AG, Cytiva, Merck Millipore, and Pall Corporation.

Market Segment Insights

By Type

The Single-Layer Film segment dominated the Europe Quartz Fiber Film Market in 2024 with a 62.4% share. Its strong position stems from widespread use in optical and electronic applications requiring high transparency and heat resistance. Manufacturers favor single-layer films for their cost efficiency, superior dielectric strength, and flexibility in high-temperature environments. The Multi-Layer Film segment is growing steadily, driven by demand in advanced semiconductor and aerospace applications requiring improved insulation and structural stability.

- For instance, Heraeus implemented single-layer quartz fiber films in high-frequency circuit substrates for aerospace avionics, enhancing thermal stability.

By Application

The Environmental Monitoring segment led the Europe Quartz Fiber Film Market with a 38.7% share in 2024. Its growth is fueled by increasing environmental testing, air quality monitoring, and filtration needs across industrial sectors. Chemical Analysis followed, supported by rising use in laboratory filtration and precision testing. The Preparation of High-Performance Materials segment is expanding rapidly as industries adopt quartz films for composites and specialty coatings requiring high purity and thermal durability.

- For nistance, Eurofins Scientific expanded its air quality testing services in Germany, using high-purity quartz fiber filters to capture particulate matter in compliance with EN 12341 standards.

Key Growth Drivers

Rising Demand in Semiconductor and Electronics Industry

The Europe Quartz Fiber Film Market benefits from increasing adoption in semiconductor and electronic manufacturing. Quartz fiber films provide high dielectric strength, chemical resistance, and low thermal expansion, making them ideal for advanced circuit insulation and display panels. Growing production of microchips and optoelectronic components across Germany, France, and the UK further strengthens demand. Continuous investments in clean energy electronics and miniaturized devices support steady consumption, positioning the segment as a core driver of market expansion.

- For instance, Saint-Gobain uses high-purity quartz in advanced specialty glass for aerospace and medical technologies, reflecting the material’s critical role beyond semiconductors.

Expansion of Environmental Monitoring Applications

Rising environmental safety regulations across Europe have elevated demand for quartz fiber films in air and water monitoring systems. Their superior temperature stability, low impurity levels, and resistance to chemical corrosion make them essential in analytical filtration processes. Environmental agencies and research laboratories increasingly rely on quartz filters for precise particulate analysis. Expanding governmental monitoring programs and industrial emission controls continue to drive adoption, particularly in Western Europe’s established environmental research and testing sectors.

- For instance, Saint-Gobain Quartz collaborated with the UK’s Centre for Ecology & Hydrology to supply precision-cut quartz fiber films for advanced atmospheric particulate sampling across national air quality stations.

Growing Preference for High-Performance Materials

Industries such as aerospace, automotive, and defense are increasing reliance on high-performance materials that enhance durability and performance under extreme conditions. Quartz fiber films meet these requirements through their lightweight structure, mechanical strength, and resistance to radiation and high temperatures. The growing need for advanced composites and insulation materials in critical engineering applications drives market expansion. European manufacturers are also integrating these films in specialty coatings and structural components to meet evolving performance and sustainability standards.

Key Trends & Opportunities

Rising Focus on Advanced Manufacturing and R&D

The market is witnessing increased investment in advanced manufacturing and R&D facilities. Companies are focusing on enhancing film purity, mechanical precision, and scalability through automation and nanotechnology integration. This shift supports the development of customized films for next-generation electronics, optical devices, and aerospace applications. Collaborative R&D projects between European research institutes and industry leaders present long-term opportunities to accelerate innovation and maintain regional competitiveness in precision quartz materials.

- For instance, the EU-funded QUEEN project, involving a consortium from eight countries, aims to domestically produce high-purity metallurgical silicon from quartz sand with near-zero CO2 emissions, targeting 56% coverage of EU demand by 2032.

Increasing Shift Toward Sustainable Production

European manufacturers are emphasizing eco-friendly quartz fiber film production methods to align with sustainability goals. The transition includes reducing carbon emissions, optimizing raw material utilization, and incorporating renewable energy in production facilities. This approach enhances brand credibility and meets stringent EU environmental regulations. The trend also opens opportunities for recycling and recovery of high-purity silica materials, supporting a circular economy while catering to the growing demand from environmentally conscious end users.

- For instance, Saint-Gobain Quartz in France integrated solar-powered systems at its Nemours facility to cut CO₂ emissions from quartz processing and enhance energy efficiency.

Key Challenges

High Production and Processing Costs

Quartz fiber film manufacturing involves complex processing, requiring high-purity raw materials and advanced equipment. These factors significantly elevate production costs compared to conventional polymer-based films. The need for controlled temperature environments and specialized machinery further increases operational expenses. Smaller producers face entry barriers due to the capital-intensive nature of production, while large firms struggle to balance cost efficiency with quality consistency, limiting widespread market penetration across cost-sensitive sectors.

Supply Chain Disruptions and Raw Material Dependency

The market faces challenges due to dependence on limited suppliers of high-purity quartz materials. Any disruption in raw material supply or transportation delays directly impacts production schedules. The Russia-Ukraine conflict and global logistics uncertainties have intensified sourcing risks for European manufacturers. Dependence on imports from Asia adds volatility to costs. Strengthening regional supply chains and establishing long-term partnerships with raw material providers remain critical to mitigating these disruptions.

Technological Limitations in Mass Customization

While the market is evolving, large-scale customization of quartz fiber films remains technologically constrained. Achieving uniform mechanical and optical properties across varied specifications poses challenges. Manufacturers must balance between precision engineering and scalability without compromising product integrity. These limitations hinder the rapid adoption of quartz films in emerging high-volume applications such as flexible electronics. Continuous technological advancements and material innovation are essential to overcome these scalability barriers and meet expanding industry needs.

Regional Analysis

Germany

Germany dominated the Europe Quartz Fiber Film Market in 2024 with a 28% share. The country leads due to its advanced semiconductor, electronics, and chemical industries. Strong investment in cleanroom manufacturing and optical component production supports steady demand for high-purity quartz fiber films. German research institutes and industrial firms actively collaborate to develop innovative materials with superior thermal and mechanical performance. The presence of major players such as Heraeus and Schott AG enhances domestic supply capacity. It continues to attract investment in sustainable material processing and precision filtration applications.

France

France held a 17% share in 2024, driven by its robust aerospace, defense, and environmental monitoring sectors. The nation focuses on using quartz fiber films in emission control and analytical testing laboratories. French manufacturers leverage local R&D capabilities to produce lightweight and heat-resistant materials for high-performance industries. Growing adoption of quartz-based composites in industrial coating and sensor applications strengthens market expansion. It benefits from government-led initiatives supporting clean manufacturing and high-tech materials innovation. Strong domestic demand across industrial and environmental sectors sustains growth momentum.

UK

The UK accounted for 15% of the regional market in 2024. Demand is increasing due to applications in research institutions, advanced materials labs, and semiconductor component production. British companies emphasize the use of quartz fiber films for precision testing, optical instruments, and energy-efficient electronics. Supportive government policies for clean energy and digital infrastructure enhance industrial usage. It is also witnessing rising imports of specialized quartz films for environmental testing and chemical analysis. The UK market is expected to expand with ongoing investments in sustainable material technologies.

Italy

Italy represented a 13% share of the market in 2024. The growth is supported by a strong presence of glass, ceramics, and composite manufacturing industries. Italian producers increasingly adopt quartz fiber films in high-temperature insulation and specialty material production. The country’s industrial modernization efforts encourage adoption of advanced quartz materials for performance enhancement. It also benefits from collaborations with European research institutions focusing on nanostructured materials. Steady growth in environmental and analytical applications continues to drive national demand.

Rest of Europe

The Rest of Europe segment, including Spain, Russia, and other Eastern European nations, captured a 27% share in 2024. Expanding industrial capacity, rising investments in semiconductor manufacturing, and environmental testing programs contribute to regional demand. Russia and Poland are focusing on improving domestic materials technology to reduce import dependence. Spain shows rising adoption in chemical analysis and cleanroom applications. The region benefits from EU funding for sustainable material development and laboratory infrastructure. It continues to emerge as a vital growth contributor to the European market landscape.

Market Segmentations:

By Type:

- Single-Layer Film

- Multi-Layer Film

By Application:

- Environmental Monitoring

- Chemical Analysis

- Preparation of High-Performance Materials

- Others

By Country:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Competitive Landscape

The Europe Quartz Fiber Film Market features a moderately consolidated competitive landscape with several global and regional manufacturers focusing on high-performance material innovation. Leading players such as Saint-Gobain Quartz, Heraeus, Schott AG, 3M, QSIL Group, and WONIK Quartz Europe dominate through strong product portfolios and advanced manufacturing technologies. These companies emphasize high-purity production, enhanced durability, and superior thermal resistance to cater to semiconductor, optical, and environmental applications. Strategic collaborations with research institutions and investments in sustainable production methods strengthen their market presence. Regional firms in Germany, France, and the UK are expanding capacity to meet growing demand across aerospace, chemical, and electronic industries. It continues to witness rising R&D expenditure aimed at improving cost efficiency and scalability. Competitive differentiation is largely driven by product quality, technical expertise, and long-term client partnerships within Europe’s precision materials ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- WONIK Quartz Europe

- Saint-Gobain Quartz

- 3M

- Heraeus

- SCHOTT AG

- Lenzing AG

- QSIL Group

- Hubei Feilihua Quartz Glass

- Cytiva

- GVS Life Sciences

- Merck Millipore

- Munktell Filter

- Pall Corporation

Recent Developments

- In February 2024, Saint-Gobain announced plans to expand its oxide and quartz fiber material production in Europe to meet rising demand for ceramic matrix composites (CMCs).

- In July 2023, Heraeus Comvance acquired a part of OFS Fitel Denmark’s Brøndby plant to strengthen its fiber manufacturing capabilities

- In January 2025, Vadara Quartz Surfaces announced expansion via a distribution partnership to enter the UK market.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz fiber films will rise across semiconductor and electronics industries.

- Environmental monitoring applications will expand with stricter EU emission standards.

- Manufacturers will focus on developing lightweight and high-durability film structures.

- Integration of automation and precision control will enhance production efficiency.

- Research partnerships will strengthen innovation in advanced filtration and insulation materials.

- Sustainable manufacturing practices will gain importance across European producers.

- Growth in aerospace and defense sectors will drive use of heat-resistant quartz materials.

- Regional suppliers will invest in capacity expansion to reduce import reliance.

- Technological upgrades in cleanroom and analytical laboratories will support steady demand.

- The market will move toward customized quartz fiber films for niche industrial applications.