Market Overview

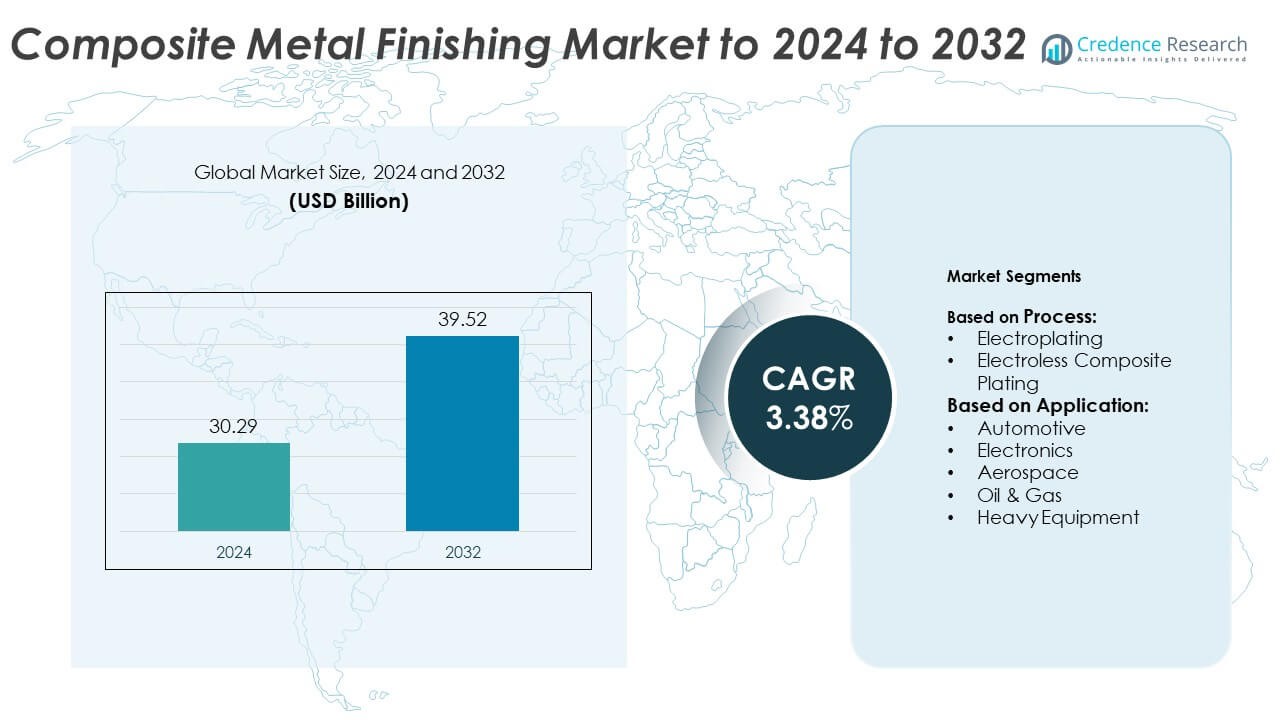

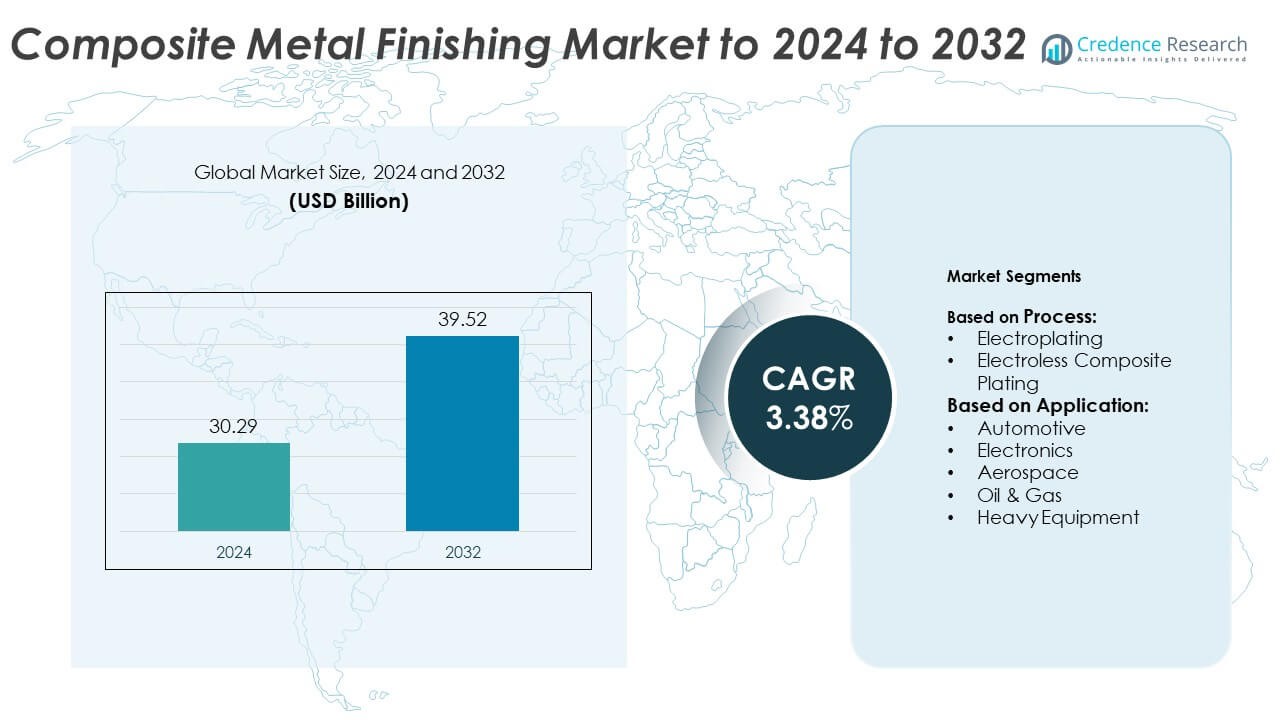

Composite Metal Finishing Market size was valued at USD 30.29 Billion in 2024 and is anticipated to reach USD 39.52 Billion by 2032, at a CAGR of 3.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Composite Metal Finishing Market Size 2024 |

USD 30.29 Billion |

| Composite Metal Finishing Market, CAGR |

3.38% |

| Composite Metal Finishing Market Size 2032 |

USD 39.52 Billion |

The Composite Metal Finishing Market is dominated by major players such as Aalberts Surface Treatment, Chemetall GmbH, Techmetals, Inc., Coventya International, and Atotech. These companies focus on expanding their global footprint through advanced plating technologies, sustainable coating formulations, and strategic collaborations with OEMs across automotive, aerospace, and electronics industries. Continuous R&D investment supports innovations in nanocomposite and eco-friendly electroless coatings that enhance durability and environmental compliance. Regionally, North America led the market in 2024 with a 34% share, driven by strong industrial production and high adoption of automated surface finishing systems, followed by Europe and Asia Pacific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Composite Metal Finishing Market was valued at USD 30.29 billion in 2024 and is projected to reach USD 39.52 billion by 2032, growing at a CAGR of 3.38%.

- Demand growth is driven by expanding automotive, aerospace, and electronics industries requiring durable and corrosion-resistant coatings.

- Technological advancements in nanocomposite coatings and automation are shaping production efficiency and sustainability in surface finishing.

- The market remains competitive with key players focusing on innovation, eco-friendly materials, and strategic partnerships to expand global presence.

- North America led the market with a 34% share in 2024, followed by Europe at 28% and Asia Pacific at 25%, while the electroplating segment dominated with 61% share due to wide industrial adoption.

Market Segmentation Analysis:

By Process

The electroplating segment dominated the composite metal finishing market in 2024, accounting for around 61% of the total share. Its strong presence is due to widespread adoption in automotive, electronics, and aerospace components requiring high corrosion and wear resistance. Electroplating provides precise thickness control and uniform coating, making it ideal for mass manufacturing, Atotech applied nickel-tungsten composite coatings on over 45 million automotive parts annually, enhancing surface durability and heat resistance. Growing demand for high-performance coatings in industrial machinery continues to strengthen the dominance of electroplating technologies.

- For instance, Aalberts Surface Technologies processes over 1 billion components per year, covering plating and other finishes for mass manufacturing across mobility and electronics. This scale underscores electroplating’s high-throughput dominance.

By Application

The automotive segment led the composite metal finishing market in 2024, capturing about 42% of the total share. Rising vehicle production and increasing use of lightweight materials drive this demand. Composite coatings improve component lifespan, fuel efficiency, and resistance to wear and corrosion, Coventya’s NiKlad ELV composite plating is used on more than 25 million automotive pistons yearly to enhance thermal stability. Expanding electric vehicle manufacturing and the need for extended drivetrain reliability further propel adoption in this segment.

- For instance, Oerlikon Balzers coats 200 million+ parts each year, including automotive tools and precision components across its global coating-center network. That volume reflects strong automotive demand for durable composite finishes.

Key Growth Drivers

Rising Demand from Automotive and Aerospace Industries

The growing need for enhanced durability and corrosion protection in automotive and aerospace parts drives market growth. Composite metal finishing improves wear resistance and extends component lifespan, especially in high-stress environments, Henkel applied advanced electroless nickel-boron coatings across 30,000 aircraft parts annually to reduce friction and maintenance. Increasing production of electric vehicles and lightweight aircraft structures continues to boost adoption across these industries.

- For instance, Nihon Parkerizing supports customers through its global group network, which comprises 51 affiliated companies operating in 12 countries and regions, in addition to its 45 domestic operational bases in Japan.

Expansion of Electronics and Semiconductor Manufacturing

Rapid miniaturization and performance optimization in electronic devices have accelerated the use of composite coatings. These coatings provide excellent conductivity, oxidation resistance, and thermal stability for circuit boards and connector, MacDermid Alpha supplies over 120 tons of composite plating chemicals yearly for semiconductor applications. Continuous innovation in surface protection technologies supports reliable device performance in harsh operating conditions, strengthening demand in the electronics sector.

- For instance, TTM Technologies operates 23 manufacturing facilities globally to serve PCB and interconnect customers, requiring advanced surface finishing.

Shift Toward Sustainable Surface Finishing Solutions

Environmental regulations and the need for eco-friendly manufacturing are promoting sustainable composite finishing techniques. Companies are reducing hazardous waste and developing recyclable coating formulations, Dipsol introduced a trivalent chromium-based plating solution that replaced over 1,000 tons of hexavalent chromium annually. Such advancements align with global sustainability goals and attract adoption across automotive, electronics, and heavy industries seeking to reduce emissions and comply with RoHS and REACH standards.

Key Trends & Opportunities

Integration of Automation and Digital Monitoring Systems

The introduction of automated plating lines and digital control technologies is transforming process efficiency. Smart sensors and real-time analytics enable consistent coating quality and reduced operational costs, Uyemura deployed automated bath monitoring systems across 40 facilities, improving process control accuracy by 25%. Automation enhances scalability and reliability, creating strong opportunities for manufacturers adopting Industry 4.0-based surface finishing solutions.

- For instance, Oerlikon Balzers implements its ORBIS MES to digitalize process control and improve efficiency across its network, which includes more than 110 coating centers globally, while more than 1,300 of their coating systems are in operation worldwide, used by both Oerlikon Balzers and its customers.

Growing Focus on Composite Nanocoatings

Nanocomposite metal coatings are gaining traction due to superior hardness, corrosion resistance, and self-lubricating properties. These coatings find use in precision tools, medical devices, and aerospace components, Integran Technologies applied nanocrystalline nickel coatings to over 5,000 turbine blades, improving fatigue strength and oxidation resistance. As nanotechnology becomes mainstream, manufacturers see strong potential in developing multifunctional coatings for high-performance industrial applications.

- For instance, Ionbond’s Italy facility processes over 100,000 tools per month with advanced PVD and DLC coatings, pushing nano-coating adoption in tooling and wear segments.

Key Challenges

High Cost of Advanced Coating Materials and Equipment

The adoption of composite metal finishing processes faces challenges due to high costs of raw materials and precision machinery. Advanced electroless systems and nanocomposite materials require significant investment, installation of a fully automated plating line can exceed million per facility. This cost barrier limits uptake among small and mid-sized manufacturers, restricting market penetration in cost-sensitive regions.

Stringent Environmental and Waste Management Regulations

Environmental compliance remains a major restraint for metal finishing operations. The use of heavy metals and chemical effluents requires complex waste treatment and disposal systems, facilities in the EU must comply with REACH and RoHS limits, often adding up to 20% operational cost for wastewater management. These strict policies increase production expenses and discourage expansion in regions with limited regulatory flexibility.

Regional Analysis

North America

North America held the largest share of 34% in the composite metal finishing market in 2024. The region’s dominance is supported by strong demand from automotive, aerospace, and electronics manufacturing sectors. The United States leads in adopting advanced surface finishing technologies, with major players investing in automation and eco-friendly coating systems. High production of electric vehicles and aircraft components continues to drive growth. Ongoing technological integration, along with stringent quality and emission standards, further accelerates market adoption across industrial applications in both the United States and Canada.

Europe

Europe accounted for 28% of the global composite metal finishing market in 2024, driven by strong automotive and aerospace industries. Countries such as Germany, France, and the United Kingdom lead in precision metal finishing, focusing on sustainability and reduced environmental impact. The implementation of REACH and RoHS regulations has encouraged manufacturers to shift toward eco-friendly plating solutions. Increasing production of electric and hybrid vehicles also fuels demand for corrosion-resistant coatings. Continuous R&D investments in nanocomposite technologies strengthen Europe’s position in advanced finishing applications.

Asia Pacific

Asia Pacific captured 25% of the composite metal finishing market in 2024, supported by rapid industrialization and expanding automotive and electronics production. China, Japan, South Korea, and India are major contributors, with growing investments in surface treatment infrastructure. The region benefits from lower manufacturing costs and government incentives for green industrial processes. High consumption of finished metal parts in consumer electronics and electric vehicles boosts demand. Increasing foreign investment and technological advancements in composite coatings further enhance the region’s competitiveness.

Latin America

Latin America held an 8% share of the composite metal finishing market in 2024. Growth is driven by expanding automotive assembly operations and rising investments in oil and gas equipment manufacturing. Brazil and Mexico are key contributors, supported by increasing adoption of anti-corrosion and wear-resistant coatings. Local companies are focusing on improving finishing standards to meet international export requirements. Infrastructure development and industrial automation projects also support demand. However, slower adoption of advanced technologies compared to developed regions limits large-scale expansion potential.

Middle East & Africa

The Middle East and Africa accounted for 5% of the global composite metal finishing market in 2024. The region’s demand is primarily driven by oil and gas, construction, and heavy equipment sectors requiring corrosion-resistant coatings. Countries such as Saudi Arabia and the United Arab Emirates are investing in manufacturing diversification and industrial modernization. The growing aerospace maintenance sector also supports adoption of composite finishing solutions. However, limited technological expertise and high installation costs for advanced plating systems restrict faster market penetration across developing economies in the region.

Market Segmentations:

By Process:

- Electroplating

- Electroless Composite Plating

By Application:

- Automotive

- Electronics

- Aerospace

- Oil & Gas

- Heavy Equipment

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The composite metal finishing market is characterized by strong competition among leading players such as Aalberts Surface Treatment, Chemetall GmbH, Techmetals, Inc., Coventya International, Advanced Plating Technologies, Surface Technology, Inc., Atotech, Anoplate Corporation, DOWA Holdings Co., Ltd., Endura Coatings, Plating Technology Inc., Element Solutions Inc., Praxair Surface Technologies, Inc., Sharretts Plating Company, Inc., and Quaker Houghton. These companies compete through technological innovation, quality enhancement, and global expansion strategies. Most focus on developing environmentally sustainable finishing solutions, integrating automation, and offering customized coating services for automotive, aerospace, and electronics industries. Continuous R&D investment supports the introduction of advanced electroless plating, nanocomposite coatings, and eco-friendly formulations. Strategic partnerships with OEMs and surface treatment providers help strengthen distribution networks and regional presence. Market leaders also invest in digital process monitoring and smart production systems to ensure consistent coating quality, operational efficiency, and compliance with evolving global environmental regulations.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Aalberts Surface Treatment

- Chemetall GmbH

- Techmetals, Inc.

- Coventya International

- Advanced Plating Technologies

- Surface Technology, Inc.

- Atotech

- Anoplate Corporation

- DOWA Holdings Co., Ltd.

- Endura Coatings

- Plating Technology Inc.

- Element Solutions Inc.

- Praxair Surface Technologies, Inc.

- Sharretts Plating Company, Inc.

- Quaker Houghton

Recent Developments

- In 2025, Quaker Houghton Acquired Natech (UK) and Dipsol Chemicals (Japan) in April, expanding its global portfolio of surface treatment and plating solutions.

- In 2023, MKS Instruments (Atotech) unveiled the Atotech CMA Closed-Loop System, designed to reduce water and chemical consumption in zinc-nickel plating, improving sustainability in the metal finishing chemicals sector.

- In 2023, Element Solutions Inc. Acquired Kuprion, a developer of nano-copper technology for semiconductors, and re-acquired distribution rights for its ViaForm® electrochemical deposition products to enhance its electronics capabilities.

Report Coverage

The research report offers an in-depth analysis based on Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for composite metal finishing will rise with increasing electric vehicle production worldwide.

- Manufacturers will adopt eco-friendly plating systems to comply with strict environmental standards.

- Automation and AI-based process monitoring will improve coating precision and productivity.

- Nanocomposite coatings will gain popularity for superior hardness and corrosion resistance.

- Aerospace and defense sectors will expand usage of lightweight composite coatings for high-performance parts.

- Electronics manufacturers will increase adoption for improved conductivity and oxidation protection.

- Research into recyclable and low-toxicity coating materials will accelerate sustainability goals.

- Partnerships between coating suppliers and OEMs will strengthen customized surface finishing solutions.

- Emerging economies in Asia Pacific and Latin America will become major growth hubs.

- Continuous innovation in electroless and hybrid plating technologies will enhance cost efficiency and durability.