Market Overview

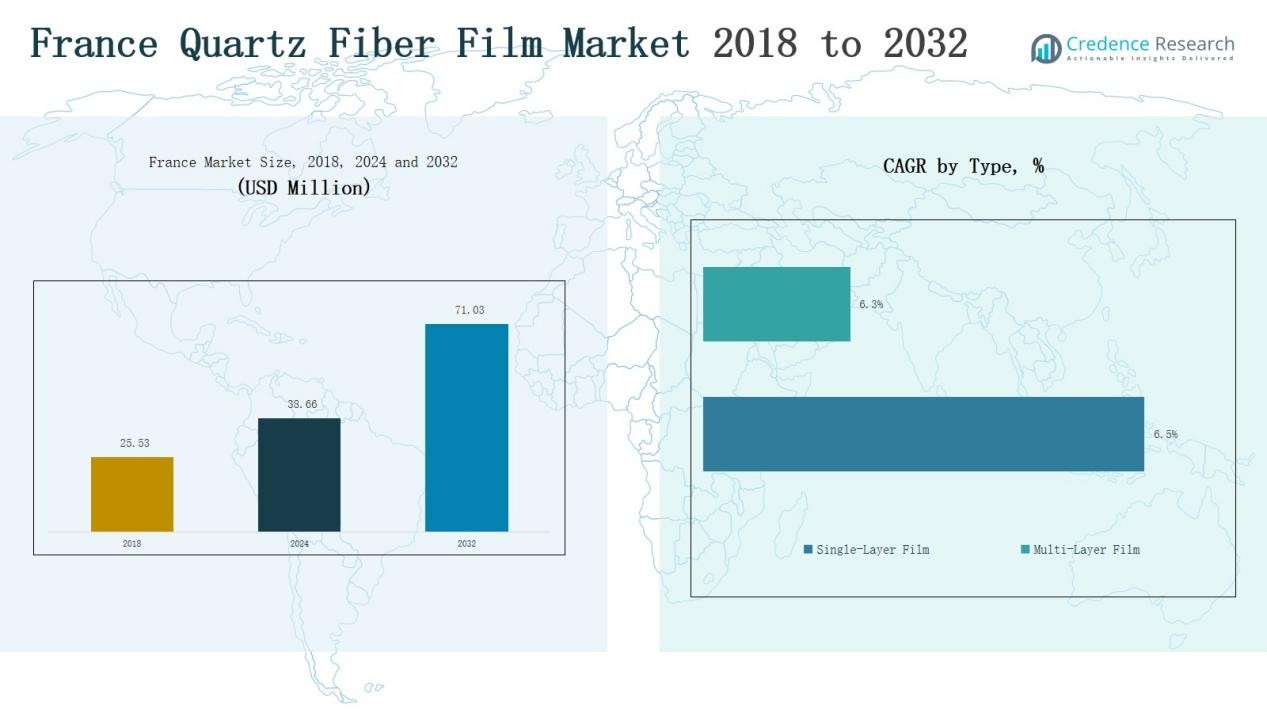

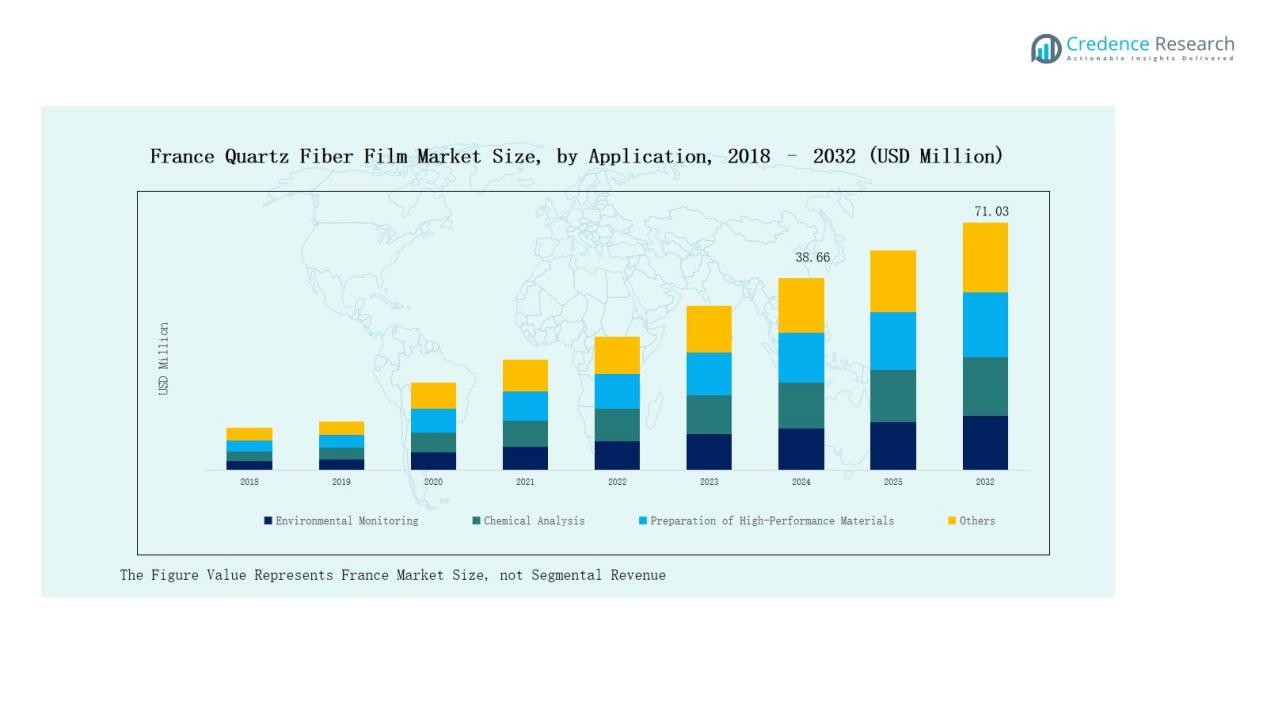

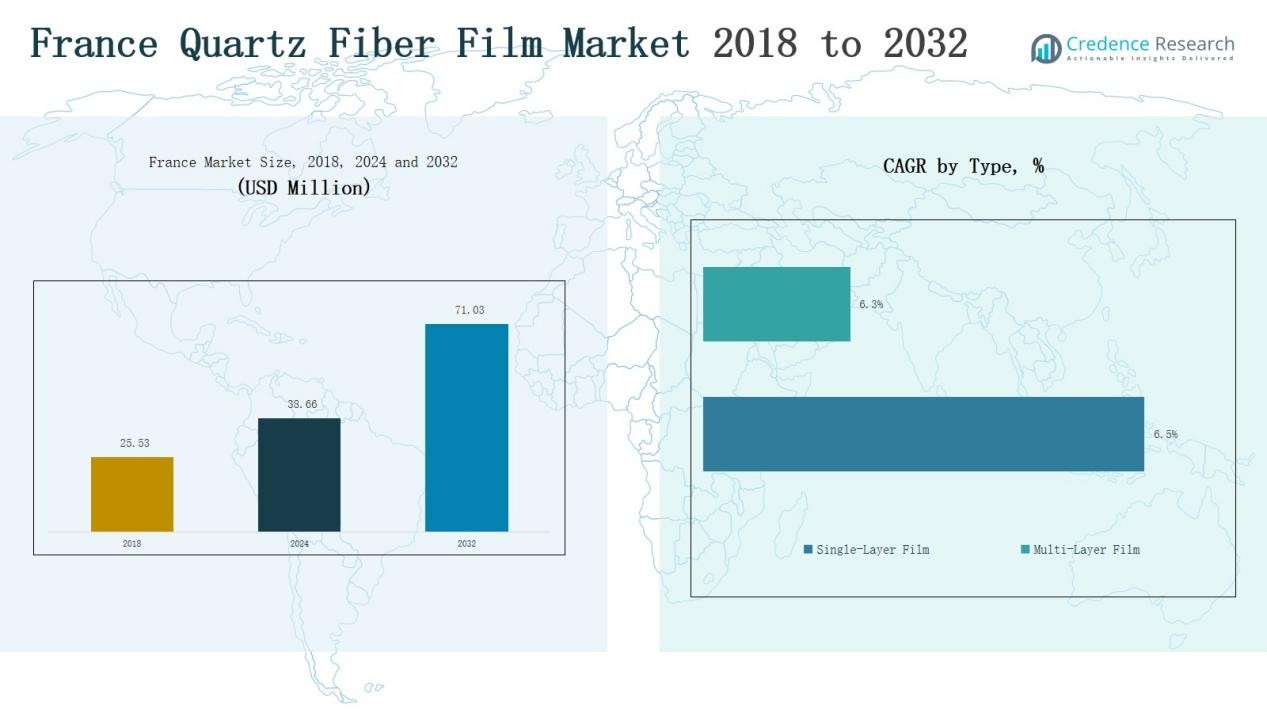

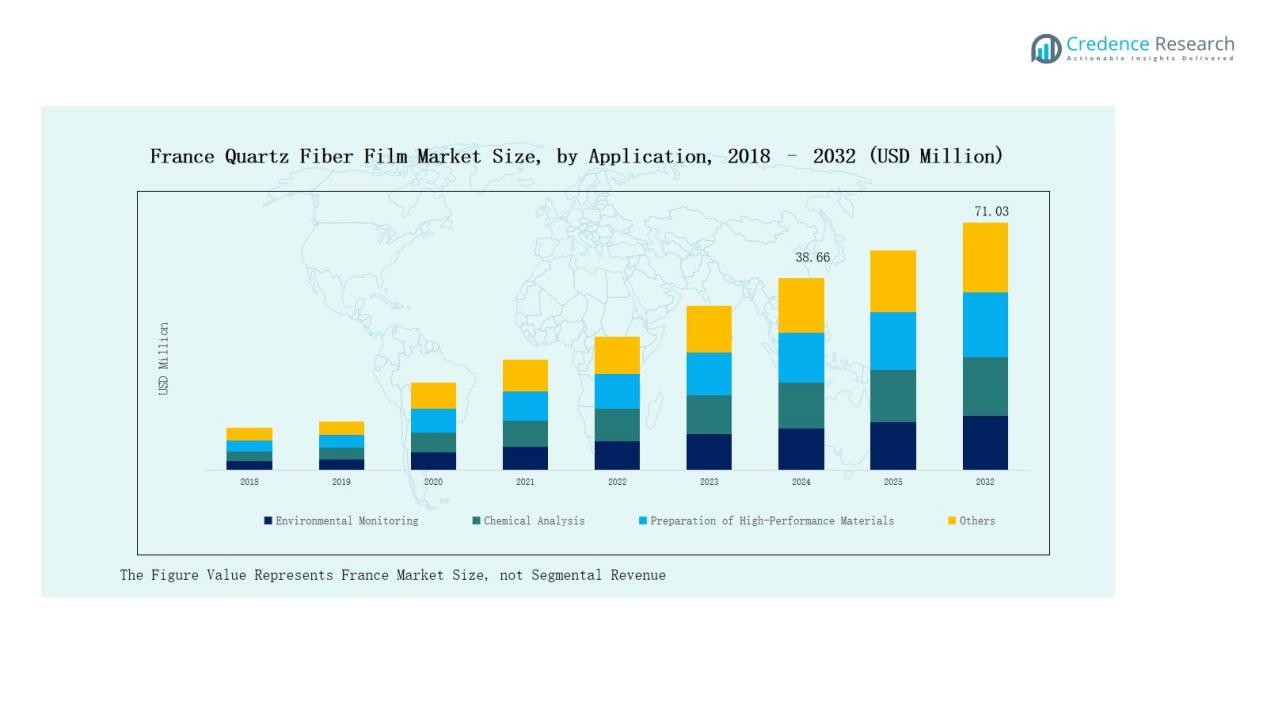

France Quartz Fiber Film Market size was valued at USD 25.53 million in 2018, increased to USD 38.66 million in 2024, and is anticipated to reach USD 71.03 million by 2032, growing at a CAGR of 7.90% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Quartz Fiber Film Market Size 2024 |

USD 38.66 Million |

| France Quartz Fiber Film Market, CAGR |

7.90% |

| France Quartz Fiber Film Market Size 2032 |

USD 71.03 Million |

The France Quartz Fiber Film Market is driven by leading companies such as Saint-Gobain Quartz, GVS Life Sciences, Merck Millipore, 3M, Pall Corporation, QSIL Group, Hitex Composites, Munktell Filter, and Sterlitech. These players focus on producing high-purity, thermally stable films used in semiconductor, optical, and analytical applications. They invest heavily in R&D, automation, and sustainable manufacturing to enhance performance and supply reliability. Strategic partnerships and capacity expansions strengthen their competitiveness across domestic and export markets. Île-de-France emerged as the leading region, commanding 32% of the total market share in 2024, supported by its advanced industrial base, strong research infrastructure, and concentration of high-technology manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The France Quartz Fiber Film Market grew from USD 25.53 million in 2018 to USD 38.66 million in 2024, projected to reach USD 71.03 million by 2032, at a 90% CAGR.

- Single-Layer Film led the market with a 5% share in 2024, driven by high demand in semiconductor and optical coating industries for its purity and thermal resistance.

- The Environmental Monitoring segment dominated applications with a 2% share, supported by stricter environmental regulations and growing demand for air and water testing.

- Île-de-France was the leading region, commanding a 32% market share, backed by strong R&D infrastructure and concentration of high-technology manufacturing facilities.

- Key players such as Saint-Gobain Quartz, GVS Life Sciences, Merck Millipore, 3M, Pall Corporation, QSIL Group, Hitex Composites, Munktell Filter, and Sterlitech drive innovation through R&D, automation, and sustainable manufacturing initiatives.

Market Segment Insights

By Type

The Single-Layer Film segment dominated the France Quartz Fiber Film Market in 2024, accounting for 63.5% of the total revenue. Its dominance stems from strong adoption in semiconductor and optical coating applications requiring high purity, heat resistance, and mechanical strength. Industries prefer single-layer films for precise filtration and stable performance under harsh conditions. The Multi-Layer Film segment, holding 36.5% share, is expanding steadily due to increasing demand for advanced materials in electronics and environmental technologies.

- For instance, Saint-Gobain Quartz introduced enhanced single-layer quartz sheets for optical fiber coating processes, improving refractive index control and minimizing contamination risks.

By Application

The Environmental Monitoring segment led the France Quartz Fiber Film Market in 2024 with a 38.2% revenue share. Rising environmental regulations and growth in air and water quality testing drive segment leadership. The Chemical Analysis segment followed with 27.6%, driven by laboratory and pharmaceutical applications. The Preparation of High-Performance Materials segment accounted for 22.8%, supported by composites and advanced coatings demand, while Others represented 11.4%, covering niche industrial and research applications.

- For instance, HORIBA France enhanced its air pollution monitoring stations in 2024 using high-purity quartz fiber substrates to improve particulate matter collection efficiency.

Key Growth Drivers

Expanding Semiconductor and Electronics Manufacturing

The growing semiconductor and electronics industry in France drives strong demand for quartz fiber films. These films offer high thermal stability, dielectric strength, and purity, ideal for microelectronics fabrication and optical components. With increased investments in cleanroom technologies and miniaturized devices, manufacturers adopt quartz films to enhance performance and reliability. The rising integration of advanced materials in photolithography and wafer processing further supports market growth, positioning France as a key European hub for precision electronic material production.

- For instance, Trelleborg Sealing Solutions operates cleanroom manufacturing facilities in France adhering to ISO Class 7 and ISO Class 5 standards to produce contamination-free components essential for semiconductor fabrication.

Rising Adoption in Environmental and Analytical Applications

Quartz fiber films are increasingly used in environmental monitoring and chemical analysis due to their superior filtration efficiency and resistance to chemical corrosion. Regulatory standards promoting air and water quality testing have accelerated adoption across laboratories and research centers. France’s focus on sustainability and emission control strengthens the demand for high-purity films in sampling and detection systems. Continuous innovation in material purity and film uniformity enhances performance reliability, driving consistent growth in analytical and environmental applications.

- For instance, global companies such as Rémy Martin are actively integrating sustainability targets, with their focus on reducing packaging-related emissions by 50% by 2030 through recycling and supplier emissions monitoring.

Advancements in Material Science and Manufacturing Processes

Technological improvements in film manufacturing, including automation and nanostructuring, are fueling market expansion. Enhanced production techniques allow manufacturers to achieve better dimensional precision, thermal resistance, and cost efficiency. French and European research initiatives focusing on advanced composites and engineered materials contribute to product innovation. These advancements enable broader application in optics, aerospace, and energy sectors. The improved scalability and sustainability of production processes further enhance the competitiveness of quartz fiber films in the domestic and export markets.

Key Trends & Opportunities

Shift Toward Sustainable and Energy-Efficient Production

French manufacturers are emphasizing sustainable and energy-efficient quartz fiber film production processes. The use of renewable energy and waste reduction technologies supports France’s carbon neutrality goals. This transition presents opportunities for local producers to align with EU green manufacturing standards and attract eco-conscious clients. Adoption of recycling and closed-loop production systems also reduces operational costs while enhancing brand value. Companies integrating sustainability in their operations are expected to capture larger contracts from industries prioritizing low environmental impact materials.

- For instance, Sofra Film, established in Claye-Souilly, has integrated closed-loop recycling systems that cut operational costs and support France’s carbon neutrality goals.

Growing Integration in High-Performance Composite Materials

Quartz fiber films are finding expanded use in high-performance composite materials for aerospace, defense, and advanced optics. Their mechanical strength and resistance to high temperatures make them suitable for next-generation composite layers and laminates. French R&D programs focusing on lightweight materials and nanocomposites create new market opportunities. Collaborations between universities and industrial players are accelerating product innovations. This integration trend supports the development of precision-engineered components, further strengthening France’s leadership in advanced material manufacturing.

- For instance, Airbus Atlantic partnered with ONERA to develop quartz-based composite skins for thermal protection panels used in hypersonic flight prototypes.

Key Challenges

High Production Costs and Complex Manufacturing

The production of quartz fiber films involves complex processing steps and high raw material purity requirements, which increase manufacturing costs. Maintaining uniform film thickness and quality demands advanced equipment and skilled labor, adding to capital expenditure. Smaller manufacturers face difficulty competing with global firms benefiting from scale efficiencies. High operational costs can restrict market penetration in cost-sensitive applications, limiting widespread adoption despite strong performance benefits across industrial and analytical sectors.

Limited Domestic Raw Material Supply

France relies on imported quartz materials due to limited domestic availability, increasing vulnerability to supply chain disruptions and price volatility. Dependence on international suppliers, particularly from Asia, raises procurement risks and impacts production timelines. Fluctuations in global silica and quartz prices further constrain manufacturers’ profit margins. This reliance underscores the need for local sourcing initiatives or long-term supplier partnerships to ensure stable input supply and reduce exposure to global material market uncertainties.

Intense International Competition

Global players such as 3M, Saint-Gobain Quartz, and Merck Millipore dominate the market with advanced technologies and extensive distribution networks. French producers face challenges in scaling production and matching innovation speed. Price competition from low-cost Asian manufacturers further pressures local margins. To sustain competitiveness, domestic firms must invest in R&D, quality differentiation, and strategic alliances. Without technological and operational advancements, maintaining market share in both domestic and export segments remains a significant challenge.

Regional Analysis

Île-de-France

Île-de-France dominated the France Quartz Fiber Film Market in 2024, holding 32% share. The region benefits from a strong presence of research institutions, cleanroom facilities, and semiconductor manufacturing clusters. It serves as a major hub for R&D and production in electronics, optics, and analytical instruments. Companies invest in advanced material development and automation technologies, driving product innovation. The concentration of high-tech industries and government-backed innovation programs continues to support steady market expansion and export growth from this region.

Auvergne-Rhône-Alpes

Auvergne-Rhône-Alpes accounted for 24% share of the France Quartz Fiber Film Market in 2024. The region’s strong industrial base and advanced material manufacturing capabilities contribute to consistent growth. It hosts several precision engineering and chemical processing firms that utilize quartz films in high-performance applications. Continuous investment in aerospace and photonics industries fuels product demand. The region’s proximity to European trade routes strengthens its role in cross-border distribution and collaboration with international material suppliers.

Provence-Alpes-Côte d’Azur

Provence-Alpes-Côte d’Azur held 18% share in 2024, supported by expanding industrial and environmental technology sectors. The regional market benefits from increased demand for quartz fiber films in environmental monitoring and analytical testing. Growing investments in sustainable technologies and clean manufacturing enhance local production. It continues to attract small and medium enterprises specializing in precision materials and laboratory equipment. Supportive infrastructure and export-oriented operations make it an emerging hub for high-value material solutions.

Occitanie

Occitanie captured 14% market share in 2024, driven by growing research activity in aerospace and advanced composites. The region’s innovation centers and university collaborations help develop specialized applications of quartz fiber films. It has a rising demand from laboratories and testing facilities engaged in chemical and environmental analysis. Continuous funding in applied sciences strengthens product adoption across diverse industries. Strong connections with European R&D networks improve its position within the national material innovation landscape.

Other Regions

Other French regions collectively accounted for 12% share in 2024, contributing through smaller but growing manufacturing and research operations. These include Nouvelle-Aquitaine, Grand Est, and Hauts-de-France, which are seeing gradual increases in electronics and material-based industries. Government incentives and regional innovation clusters encourage technology transfer and localized production. It reflects growing nationwide adoption of advanced quartz-based materials across industrial and scientific sectors. Expansion of small-scale manufacturing units continues to reinforce the country’s overall market footprint.

Market Segmentations:

By Type

- Single-Layer Film

- Multi-Layer Film

BY Application

- Environmental Monitoring

- Chemical Analysis

- Preparation of High-Performance Materials

- Others

By Region

- Île-de-France

- Auvergne-Rhône-Alpes

- Provence-Alpes-Côte d’Azur

- Occitanie

- Other Regions

Competitive Landscape

The France Quartz Fiber Film Market features a moderately consolidated competitive landscape, led by global and regional manufacturers focusing on high-purity, thermally stable films. Major participants such as Saint-Gobain Quartz, GVS Life Sciences, Merck Millipore, 3M, Pall Corporation, and QSIL Group maintain strong market presence through advanced production capabilities and long-term supply partnerships. These companies emphasize innovation in microstructure uniformity, heat resistance, and chemical inertness to meet the evolving needs of semiconductor, optics, and analytical industries. Domestic producers and research-driven firms enhance competitiveness through R&D collaborations and localized manufacturing. Strategic mergers, capacity expansions, and sustainable manufacturing initiatives remain central to growth strategies. Competition centers on product quality, customization, and reliability rather than price. Continuous investment in automation and environmentally responsible production provides a key differentiator, helping leading manufacturers strengthen their foothold in France’s high-value material and advanced manufacturing ecosystem.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In December 2024, ANDRITZ launched a new pilot line and technical center in Montbonnot, France, focused on dry-molded fiber production.

- In January 2025, IDIL Fibres Optiques (France) joined Fiber Optics Group, strengthening capabilities in optical fiber / photonic components.

- In December 2024, SCHOTT acquired QSIL GmbH Quarzschmelze Ilmenau, enhancing its quartz materials portfolio across Europe.

- In February 2024, Saint-Gobain Advanced Ceramic Composites advanced its quartz and oxide fiber production strategy, reinforcing France’s position in high-performance material innovation.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz fiber films will increase in semiconductor and photonics industries.

- Manufacturers will focus on developing eco-friendly and energy-efficient production technologies.

- Integration of quartz films in advanced composites will expand across aerospace and defense sectors.

- Domestic R&D partnerships will strengthen material innovation and reduce import dependency.

- Automation and precision manufacturing will enhance film consistency and cost efficiency.

- Environmental monitoring and analytical testing will remain key application growth areas.

- Investments in local cleanroom facilities will support small-scale production and quality control.

- Strategic alliances with European research centers will accelerate product diversification.

- Digitalization and smart manufacturing adoption will improve supply chain responsiveness.

- Sustainable sourcing of raw quartz materials will gain importance among leading producers.