Market Overview

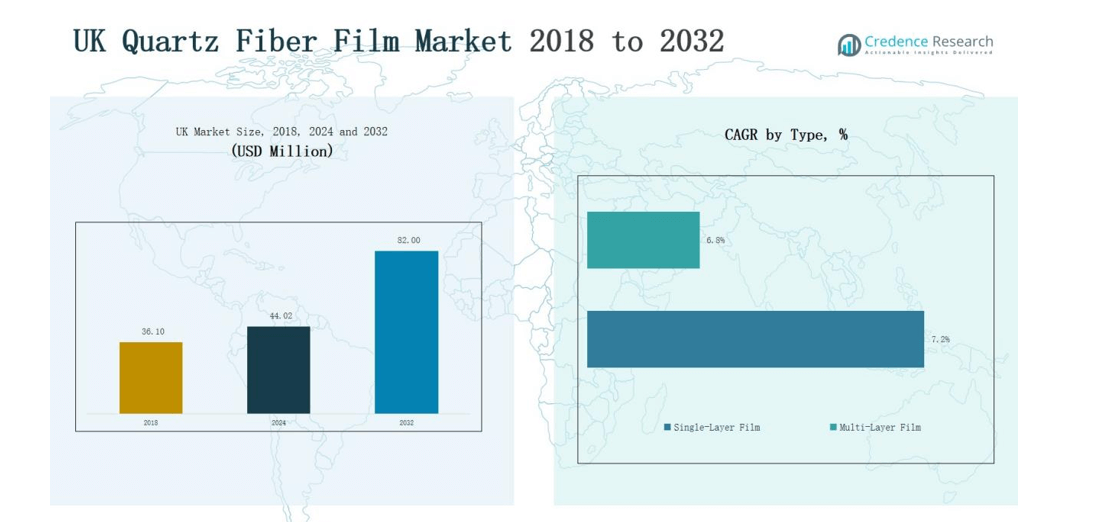

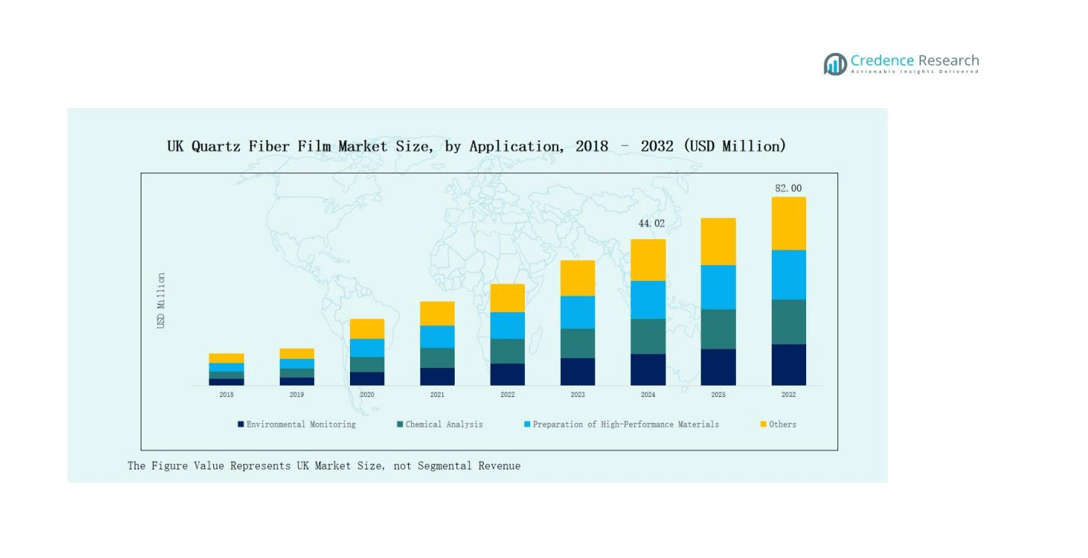

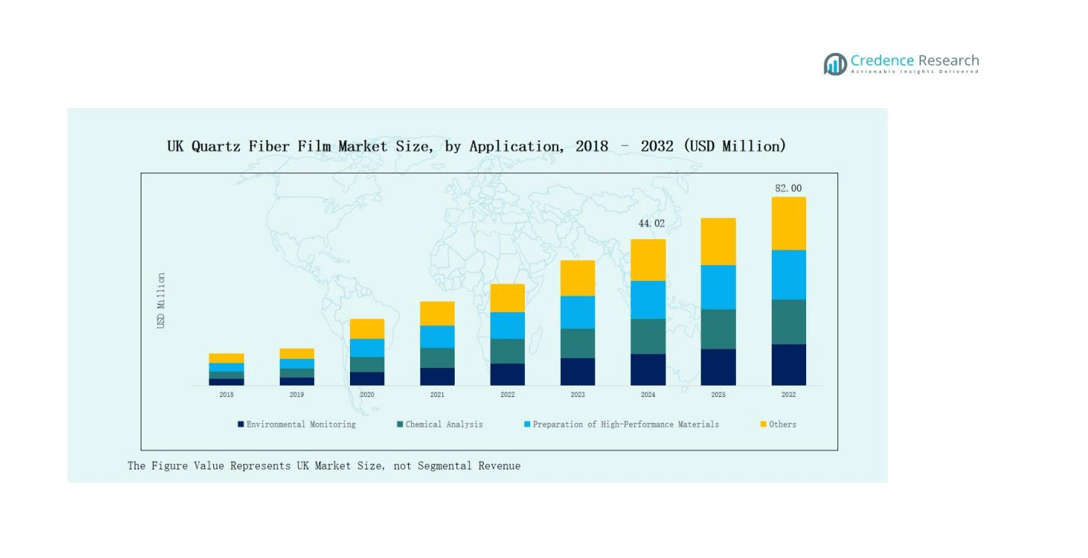

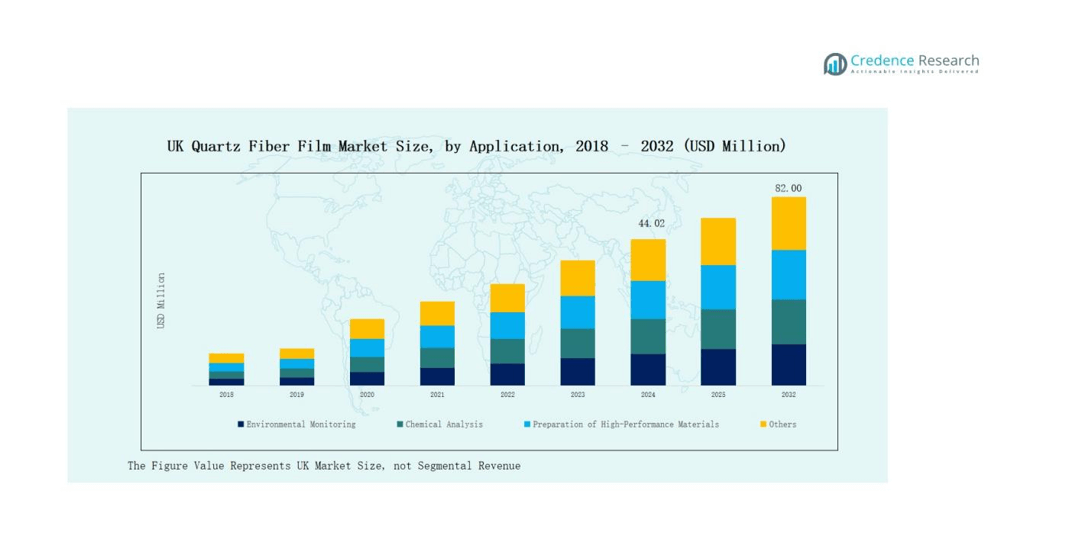

The UK Quartz Fiber Film Market size was valued at USD 36.10 million in 2018, increased to USD 44.02 million in 2024, and is projected to reach USD 82.00 million by 2032, growing at a CAGR of 8.09% during.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Quartz Fiber Film Market Size 2024 |

USD 44.02 million |

| UK Quartz Fiber Film Market, CAGR |

8.09% |

| UK Quartz Fiber Film Market Size 2032 |

USD 82.00 million |

The UK Quartz Fiber Film Market is led by major players such as Saint-Gobain Quartz, GVS Life Sciences, 3M, Merck Millipore, Pall Corporation, QSIL Group, Hitex Composites, Munktell Filter, and Sterlitech. These companies focus on developing high-purity, thermally stable films used in semiconductor, analytical, and optical applications. They emphasize process automation, R&D investment, and sustainable production methods to enhance performance and reliability. Strategic collaborations with research institutions further drive innovation. England emerged as the leading region in 2024, commanding 58% of the market share, supported by its advanced industrial base and strong R&D ecosystem.

Market Insights

- The UK Quartz Fiber Film Market grew from USD 36.10 million in 2018 to USD 44.02 million in 2024, projected to reach USD 82.00 million by 2032, at a CAGR of 8.09%.

- England dominated the market with a 58% share in 2024, supported by strong R&D infrastructure, semiconductor manufacturing, and industrial innovation.

- The Single-Layer Film segment led with a 4% share, driven by high purity, heat resistance, and demand from semiconductor and laboratory applications.

- The Environmental Monitoring segment held a 8% share, supported by growing adoption in air and water filtration across research and industrial sectors.

- Major companies including Saint-Gobain Quartz, GVS Life Sciences, 3M, Merck Millipore, Pall Corporation, QSIL Group, Hitex Composites, Munktell Filter, and Sterlitech drive innovation through R&D and sustainable production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The Single-Layer Film segment dominated the UK Quartz Fiber Film Market in 2024 with a 61.4% share. Its high purity, excellent heat resistance, and uniform thickness make it suitable for filtration, insulation, and precision optical applications. The segment’s dominance is driven by its widespread use in semiconductor and laboratory environments requiring minimal thermal expansion. The Multi-Layer Film segment, holding 38.6%, continues to grow due to its enhanced strength and suitability for advanced composite manufacturing.

- For instance, Saint-Gobain Quartz offers Quartzel single-layer quartz films designed for semiconductor furnace linings to ensure dimensional stability under high temperatures.

By Application

The Environmental Monitoring segment led the UK Quartz Fiber Film Market in 2024, accounting for a 37.8% share. Its leadership stems from the rising demand for air and water filtration systems across industrial and research sectors. The Chemical Analysis segment held 28.5%, supported by extensive use in analytical instruments and laboratory testing. Preparation of High-Performance Materials and Others collectively contributed 33.7%, driven by applications in composites, optics, and specialty chemical processes.

- For instance, Analytik Jena AG provides high-sensitivity atomic absorption spectrometers and mass spectrometers for trace metal detection in water samples

Key Growth Drivers

Expanding Semiconductor and Electronics Industry

The growing semiconductor and electronics production in the UK drives strong demand for quartz fiber films. These films offer high purity, dielectric stability, and thermal resistance, essential for advanced chip manufacturing and circuit insulation. Increasing adoption of high-performance materials in cleanroom environments and precision devices further boosts usage. Investments in semiconductor R&D and government support for localized chip production strengthen the market’s long-term growth potential.

Rising Focus on Environmental and Analytical Applications

Quartz fiber films are increasingly used in environmental monitoring and analytical instrumentation. Their superior heat tolerance and chemical inertness make them ideal for filtration and sample preparation in laboratories and air-quality systems. The UK’s growing emphasis on environmental compliance and industrial emission control enhances adoption. Expanding air and water testing facilities across research institutions and regulatory agencies continues to propel demand within this application segment.

- For instance, Whatman’s QM-C high purity quartz fiber filters provide thermal stability up to 1200°C and extremely low heavy metal content, enabling accurate air sampling in harsh industrial environments.

Advancements in Material Engineering and Processing

Ongoing technological developments in thin-film processing and material engineering have improved quartz film quality and performance. UK manufacturers are adopting precision coating and plasma-based treatment technologies to produce films with better uniformity, flexibility, and contamination control. These innovations enhance film usability across high-temperature and optical applications. Increasing R&D collaboration between material scientists and industrial users also fosters new product development, expanding opportunities for customized and high-purity film solutions.

- For instance, UK company H&T Presspart has developed a patented plasma coating process, in license from Portal Medical, that achieves uniform, pinhole-free coatings on complex geometries by using a plasma treatment process inside canisters, improving contamination control and film robustness.

Key Trends & Opportunities

Adoption of Sustainable and Energy-Efficient Manufacturing

Sustainability trends are shaping the UK Quartz Fiber Film Market as companies move toward eco-friendly production. Manufacturers are focusing on energy-efficient furnaces, low-emission fabrication, and recyclable packaging. Growing environmental regulations encourage the use of green technologies throughout production cycles. This shift not only reduces operational costs but also aligns with the UK’s national sustainability goals, creating opportunities for manufacturers to market environmentally responsible quartz film products.

- For instance, NatureFlex by Futamura, a cellulose-based compostable film used by brands like Alter Eco for chocolate bar wrappers, exemplifies advancements in renewable, high-barrier packaging options.

Growth of Smart Laboratories and Advanced Research Infrastructure

The rise of smart laboratories and advanced testing infrastructure across the UK boosts demand for precision-engineered materials. Quartz fiber films are gaining traction in research applications requiring high purity, minimal outgassing, and superior optical clarity. Universities, defense labs, and private research facilities increasingly integrate these films into analytical instruments and high-performance sensors. This development supports consistent long-term demand, particularly in nanotechnology and material science research segments.

- For instance, a novel hybrid quartz-based photo-mobile polymer film developed by researchers exhibits high temperature resistance of at least 350°C, enabling its use in sensors and energy harvesting applications in nanotechnology research.

Key Challenges

High Manufacturing and Processing Costs

Quartz fiber film production requires complex thermal processing and precision control, which drive up costs. The high price of raw quartz and specialized equipment limits entry for smaller manufacturers. Energy-intensive production processes further increase operational expenses. These factors restrict scalability and make it difficult for companies to maintain competitive pricing while ensuring product purity and consistency.

Supply Chain Dependence and Limited Domestic Production

The UK relies heavily on imported quartz raw materials and intermediate products, making the market vulnerable to global supply disruptions. Fluctuations in international logistics, trade tariffs, and raw material prices can affect timely production and delivery. Limited domestic manufacturing capabilities hinder flexibility in scaling up operations. This dependency pressures producers to diversify sourcing and build local partnerships to ensure supply stability.

Technical Complexity and Product Customization Needs

Manufacturing quartz fiber films with precise thickness, uniformity, and purity requires advanced technical expertise. Customization for diverse applications such as semiconductors, optical filters, or environmental instruments adds further complexity. Inadequate standardization and specialized equipment demands can delay product development. Meeting evolving performance expectations from end-users while managing production precision remains a major challenge for UK manufacturers.

Regional Analysis

England

England dominated the UK Quartz Fiber Film Market in 2024, accounting for 58% share. The region benefits from a strong industrial base, advanced semiconductor manufacturing, and extensive R&D infrastructure. Major companies and research institutions across London, Cambridge, and Manchester focus on innovation in high-performance materials. It continues to lead in demand from electronics, environmental testing, and analytical applications. Government initiatives supporting digital and clean technologies further strengthen market development. Steady investment in microelectronics and optics sectors ensures sustained growth.

Scotland

Scotland held a 17% share of the market in 2024, driven by its growing focus on renewable energy and advanced research facilities. The region’s universities and technology centers in Glasgow and Edinburgh contribute significantly to material science development. It shows rising adoption of quartz fiber films in laboratory filtration, emission testing, and semiconductor research. Strong collaboration between academia and industry supports innovation and commercialization of high-purity film solutions. Continuous infrastructure improvement in manufacturing enhances its regional competitiveness.

Wales

Wales captured a 14% share of the UK market in 2024. Its growth stems from the expansion of chemical analysis laboratories and electronics assembly facilities in Cardiff and Swansea. The region’s government programs promote high-tech material production and industrial modernization. It benefits from an increasing number of small and medium enterprises integrating quartz fiber films for filtration and precision coating applications. The local innovation ecosystem and export-oriented production support future scalability.

Northern Ireland

Northern Ireland accounted for an 11% share of the market in 2024. The region’s industrial development in aerospace, defense, and environmental sectors is driving quartz fiber film adoption. Local companies are investing in specialized testing and microelectronics manufacturing to align with international quality standards. Research hubs in Belfast and Derry emphasize clean material production and advanced composite integration. It remains a developing market with rising demand for energy-efficient and heat-resistant film technologies.

Market Segmentations:

By Type

- Single-Layer Film

- Multi-Layer Film

By Application

- Environmental Monitoring

- Chemical Analysis

- Preparation of High-Performance Materials

- Others

By Region

- England

- Scotland

- Wales

- Northern Island

Competitive Landscape

The UK Quartz Fiber Film Market features a moderately consolidated competitive landscape, led by global and regional players focusing on product innovation and quality improvement. Key companies such as Saint-Gobain Quartz, GVS Life Sciences, 3M, Merck Millipore, Pall Corporation, QSIL Group, Hitex Composites, Munktell Filter, and Sterlitech compete through advanced production technologies and material refinement. It emphasizes high-purity, thermally stable films suited for semiconductor, optical, and environmental applications. Companies invest in R&D, automation, and strategic partnerships with local laboratories to enhance performance and supply reliability. The market sees rising collaborations between research institutions and manufacturers to develop custom-grade films for analytical and high-temperature uses. Sustainability and cost-efficiency remain key differentiators, with firms adopting energy-efficient processes to meet regulatory expectations. Continuous technological upgrades and an expanding domestic demand for precision materials reinforce competition and drive innovation across the UK market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- GVS Life Sciences

- Saint-Gobain Quartz

- 3M

- Hitex Composites

- Merck Millipore

- Munktell Filter

- Pall Corporation

- QSIL Group

- Sterlitech

Recent Developments

- In September 2024, Changfei Quartz introduced its new high-performance quartz materials, including the Long Fly Quartz YS-two330, YS-330L, and meter-level synthetic quartz products, aimed at enhancing optical and semiconductor applications.

- In early 2025, Heraeus Comvance expanded its product line with the launch of Pandia® and Supuria® optical fibers made from high-purity quartz glass, designed to improve signal performance in telecom applications.

- In June 2025, Triumph Composites and Quartz Fiber initiated a merger approval process to strengthen their market position and streamline production capabilities within the global quartz fiber industry.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz fiber films will increase across semiconductor and analytical industries.

- Local manufacturing capacity will expand to reduce import dependence and enhance supply stability.

- Advancements in thin-film processing will improve product performance and consistency.

- Environmental monitoring applications will continue driving steady market adoption.

- Research collaborations will support the development of customized and high-grade film solutions.

- Energy-efficient and sustainable production methods will gain stronger regulatory support.

- Integration of quartz films in optical and photonic systems will create new opportunities.

- Market competition will intensify with the entry of regional material producers and startups.

- Automation and precision engineering will lower production costs and boost output quality.

- Increased investment in R&D and technological innovation will sustain long-term market growth.