Market Overview

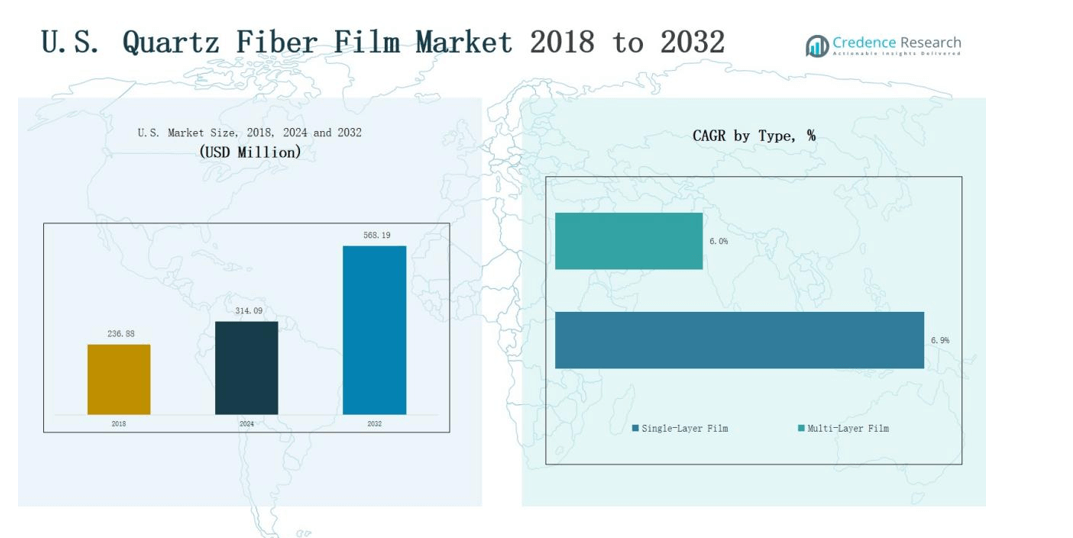

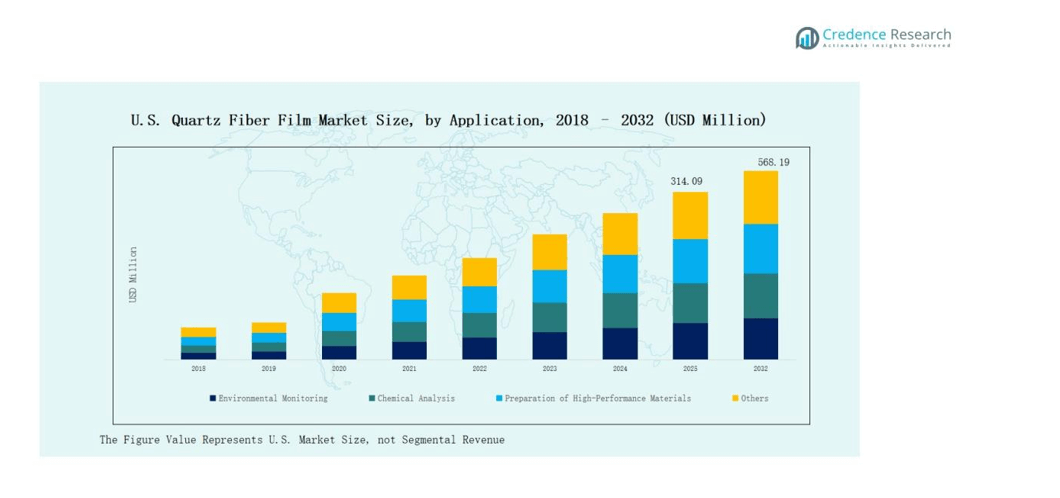

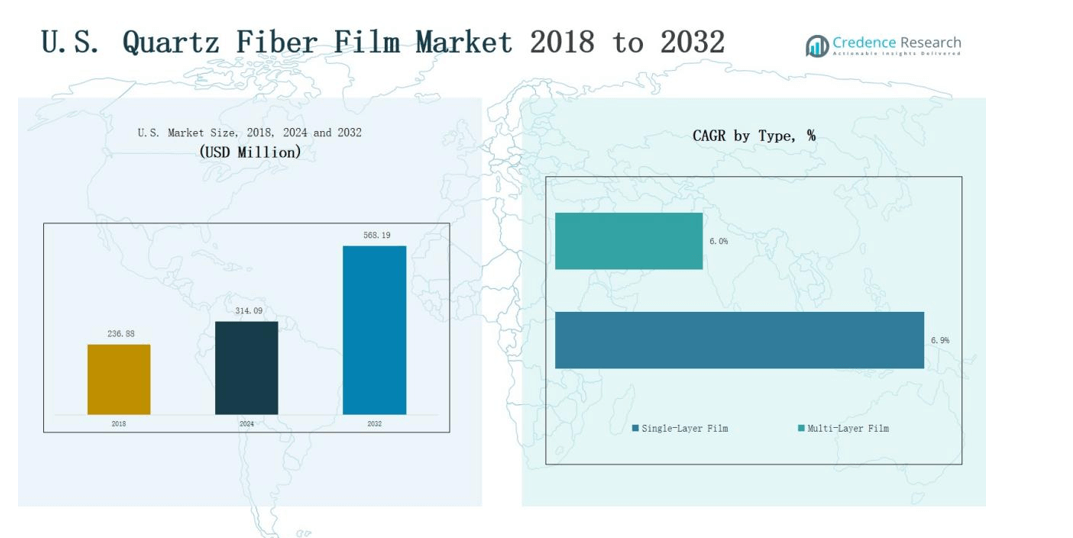

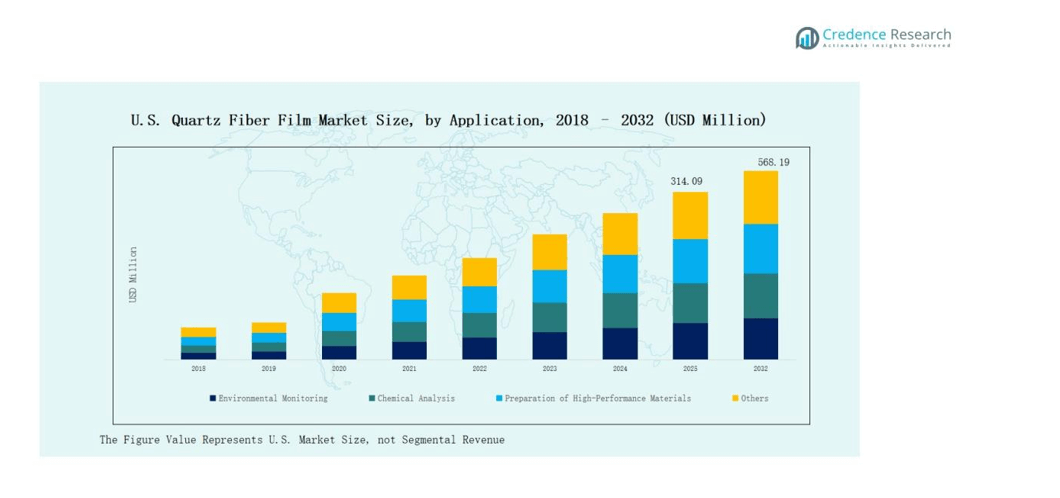

U.S. Quartz Fiber Film Market size was valued at USD 236.88 million in 2018, increased to USD 314.09 million in 2024, and is anticipated to reach USD 568.19 million by 2032, growing at a CAGR of 7.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Fiber Film Market Size 2024 |

USD 314.09 million |

| U.S. Quartz Fiber Film Market, CAGR |

7.69% |

| U.S. Quartz Fiber Film Market Size 2032 |

USD 568.19 million |

The U.S. Quartz Fiber Film Market is led by major companies such as Saint-Gobain Quartz, GVS Life Sciences, 3M, Pall Corporation, QSIL Group, AGY Holding Corp., Sterlitech Corporation, and Tosoh Corporation. These players focus on advanced material purity, heat resistance, and coating innovation to meet the needs of semiconductor, aerospace, and environmental industries. They emphasize automation, R&D investment, and sustainable manufacturing practices to strengthen competitiveness. The West region emerged as the leading market in 2024, accounting for 27% share, supported by strong technological infrastructure and growing microelectronics production.

Market Insights

- The S. Quartz Fiber Film Market grew from USD 236.88 million in 2018 to USD 314.09 million in 2024, and is projected to reach USD 568.19 million by 2032, expanding at a 7.69% CAGR.

- The Single-Layer Film segment led with a 8% share in 2024, driven by high purity, heat resistance, and suitability for semiconductor and optical uses.

- The Environmental Monitoring segment dominated applications with a 5% share, supported by demand from air and water testing industries.

- The West region held the largest 27% share in 2024, led by California’s robust electronics and aerospace base, followed by the Northeast with an equal 27%.

- Leading companies such as Saint-Gobain Quartz, GVS Life Sciences, 3M, Pall Corporation, QSIL Group, AGY Holding Corp., Sterlitech, and Tosoh Corporation focus on R&D, automation, and sustainable production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The Single-Layer Film segment dominated the U.S. Quartz Fiber Film Market with a 61.8% share in 2024. Its strong performance is driven by superior purity, heat resistance, and dimensional stability, making it ideal for semiconductor and optical applications. Manufacturers prefer this type for precision coating, insulation, and filtration uses. The Multi-Layer Film segment, holding 38.2%, is growing due to its enhanced strength, flexibility, and suitability for aerospace and high-performance composite materials.

- For instance, GE Aviation uses advanced materials like Ceramic Matrix Composites (CMCs) and specialized Thermal Barrier Coatings (TBCs) on superalloy turbine blades to resist the extreme temperatures and mechanical stress within its jet engines.

By Application

The Environmental Monitoring segment led the U.S. Quartz Fiber Film Market with a 33.5% share in 2024, supported by its reliability in air and water testing due to chemical inertness and durability. The Chemical Analysis segment followed with 28.6%, driven by its use in spectroscopy and chromatography. The Preparation of High-Performance Materials segment captured 25.9%, fueled by aerospace and defense demand, while Others held 12.0%, reflecting growth in research and photonics applications.

- For instance, Thermo Fisher Scientific integrated high-purity quartz fiber filters in its continuous ambient air monitoring systems used by the U.S. Environmental Protection Agency.

Key Growth Drivers

Rising Semiconductor and Electronics Production

The U.S. Quartz Fiber Film Market is expanding due to strong growth in semiconductor and electronics manufacturing. High-purity quartz fiber films are essential for insulation, microfiltration, and optical clarity in wafer processing and electronic devices. Increased investments in domestic chip production under U.S. CHIPS Act initiatives have boosted material demand. The trend toward miniaturized and high-performance electronic components further accelerates adoption, positioning quartz fiber films as a critical material in advanced fabrication and precision processing.

- For instance, Sibelco, a key player, produces high-purity quartz rods and tubes with purity levels exceeding 99.99%, ensuring stability in high-temperature wafer manufacturing processes.

Growing Adoption in Environmental Monitoring

Rising environmental awareness and tighter emission standards drive strong demand for quartz fiber films in filtration and analytical monitoring systems. Their chemical resistance, purity, and thermal stability make them suitable for sampling air pollutants, particulates, and organic compounds. Government-led initiatives targeting air quality improvement have increased the use of high-performance filtration materials. These factors enhance adoption across industrial and research laboratories, strengthening the role of quartz fiber films in supporting sustainability and environmental safety.

- For instance, Whatman QM-C quartz fiber filters offer thermal stability up to 1200°C with extremely low heavy metal content, enabling accurate heavy metal testing in industrial stacks and flues.

Expanding Applications in High-Performance Materials

The demand for high-strength, thermally stable materials in aerospace, defense, and energy sectors is fueling market growth. Quartz fiber films enable lightweight composite structures and temperature-resistant insulation layers for engines, sensors, and precision devices. Their ability to maintain performance in extreme conditions makes them valuable in advanced material engineering. Increasing R&D investment in next-generation composites and electronic substrates continues to create new application avenues, reinforcing the material’s strategic importance in U.S. industrial innovation.

Key Trends & Opportunities

Shift Toward Sustainable Manufacturing and Recycling

Manufacturers are increasingly focusing on eco-efficient production and waste reduction in quartz fiber film manufacturing. The adoption of low-emission production lines and closed-loop recycling processes supports sustainability goals. Companies are integrating renewable energy and solvent-free coating methods to reduce environmental impact. These initiatives align with U.S. regulatory guidelines for green manufacturing, creating opportunities for companies that emphasize eco-conscious material development and sustainable supply chain management across electronics and specialty materials industries.

- For instance, in April 2023, Saint-Gobain Quartz evolved into Saint-Gobain Advanced Ceramic Composites (ACC), which offers ultra-pure fused quartz fiber products under the brand name Quartzel®.

Integration of Quartz Films in Advanced Photonics and Optoelectronics

The growing use of quartz fiber films in optoelectronics, sensors, and photonic systems presents a major opportunity. Their superior transparency and dielectric stability support high-precision optical signal transmission. Demand is rising for these films in fiber optics, lasers, and micro-electromechanical systems (MEMS). Emerging applications in 5G infrastructure and quantum computing are expected to enhance utilization. This integration trend is fostering innovation in material composition and coating technologies within the U.S. advanced materials sector.

- For instance, Shin-Etsu Chemical Co., Ltd. produces synthetic quartz preforms with high purity and precise internal structures that enable optical fibers to transmit light without attenuation, supporting advanced optoelectronic devices.

Key Challenges

High Production and Processing Costs

Manufacturing quartz fiber films involves complex processes and precision-based techniques, leading to high production costs. Advanced purification, melting, and coating stages increase material expenses and limit scalability for smaller producers. The cost barrier affects price competitiveness compared to alternative materials like glass or polymer films. Maintaining cost efficiency while ensuring quality and purity remains a major challenge for U.S. manufacturers seeking to expand capacity and meet growing domestic and export demand.

Technical Limitations in Large-Scale Fabrication

Producing uniform, defect-free quartz fiber films on a large scale requires advanced equipment and process stability. Small variations in temperature or raw material quality can affect transparency and performance. Scaling up production without compromising dimensional precision or purity remains difficult. Limited expertise and technological constraints hinder mass production efficiency. Addressing these limitations through automation, digital monitoring, and R&D investment is essential to meet the increasing industrial and commercial application demands.

Supply Chain Dependence and Raw Material Volatility

The U.S. Quartz Fiber Film Market faces challenges from supply chain disruptions and raw material dependency on global quartz sources. Fluctuating import costs and logistical delays impact production timelines and pricing stability. High reliance on ultra-pure quartz sand from limited suppliers poses risks amid global trade uncertainties. Companies are investing in domestic sourcing and strategic stockpiling to minimize risks, but maintaining a steady supply of high-purity feedstock continues to be a critical challenge.

Regional Analysis

Northeast United States

The Northeast region held 27% share of the U.S. Quartz Fiber Film Market in 2024, driven by the strong presence of semiconductor and research industries. States such as New York and Massachusetts lead adoption due to advanced cleanroom facilities and analytical laboratories. The region benefits from significant investments in nanotechnology and material science. It also supports environmental monitoring applications through multiple government and private research centers. Continuous technological upgrades in optics and photonics strengthen its market leadership.

Midwest United States

The Midwest accounted for 21% share of the U.S. Quartz Fiber Film Market in 2024. The region’s manufacturing base in Michigan, Illinois, and Ohio supports rising demand from chemical analysis and industrial filtration sectors. It benefits from a growing focus on energy-efficient production and material innovation. Manufacturers in this region invest in automated systems and high-purity processing technologies. The market expansion is further supported by collaborations between industrial research institutions and local producers. It remains a key contributor to domestic material supply.

South United States

The South captured 25% share of the U.S. Quartz Fiber Film Market in 2024, led by states such as Texas, Florida, and North Carolina. Growth is supported by strong semiconductor manufacturing, aerospace activities, and energy infrastructure projects. The region benefits from expanding clean technology and environmental testing facilities. It experiences increased adoption in advanced composites and high-performance materials. Local government initiatives promoting industrial innovation continue to attract investment in advanced material processing and sustainable production capabilities.

West United States

The West region held 27% share of the U.S. Quartz Fiber Film Market in 2024, led by California’s dominance in electronics, aerospace, and environmental research. Strong R&D infrastructure and the presence of major technology companies boost market activity. It shows high demand for quartz fiber films in microelectronics, clean energy, and photonics applications. Strategic collaborations between research universities and private companies drive material innovation. Continuous focus on sustainable and precision manufacturing enhances production capacity across key industrial hubs.

Market Segmentations:

By Type

- Single-Layer Film

- Multi-Layer Film

By Application

- Environmental Monitoring

- Chemical Analysis

- Preparation of High-Performance Materials

- Others

By Region

- Northeast United States

- Midwest United States

- South United States

- West United States

Competitive Landscape

The U.S. Quartz Fiber Film Market features strong competition among established global and domestic players focused on innovation, precision, and reliability. Key participants include Saint-Gobain Quartz, GVS Life Sciences, 3M, Pall Corporation, QSIL Group, AGY Holding Corp., Sterlitech Corporation, and Tosoh Corporation. These companies compete on parameters such as product purity, heat resistance, and optical clarity. Many invest in automation, advanced coating technologies, and sustainable production to enhance performance and supply stability. Strategic collaborations with semiconductor, aerospace, and research industries strengthen their market presence. Continuous R&D efforts aim to meet rising demand for high-purity films in environmental monitoring, electronics, and high-performance materials. The competitive environment remains moderately consolidated, with leading firms holding significant market share through strong distribution networks and specialized product portfolios. Growing emphasis on localized production and quality assurance further defines the market’s competitive dynamics across the United States.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- GVS Life Sciences

- Saint-Gobain Quartz

- 3M

- AGY Holding Corp.

- Pall Corporation

- QSIL Group

- Sterlitech Corporation

- Tosoh Corporation

Recent Developments

- In June 2024, Sico / East Coast Inc. acquired Quartz Scientific Inc. (QSI) to enhance its quartz glass and fiber production capabilities in the United States.

- In February 2025, Hexcel Corporation launched its HexShape textile line, incorporating advanced quartz fiber materials designed for aerospace and automotive applications.

- In December 2024, SCHOTT AG completed the acquisition of QSIL GmbH Quarzschmelze Ilmenau, expanding its portfolio of high-purity quartz materials for semiconductor and fiber applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity quartz fiber films will increase with semiconductor industry expansion.

- Advancements in optical and photonic technologies will boost product utilization.

- Adoption of automation and precision coating will enhance manufacturing efficiency.

- Growth in environmental monitoring and analytical testing will drive film consumption.

- Aerospace and defense sectors will expand usage for high-temperature materials.

- Research and innovation partnerships will strengthen domestic production capabilities.

- Sustainability initiatives will encourage eco-friendly and energy-efficient film production.

- Technological upgrades in microelectronics will create new application opportunities.

- Companies will focus on localized sourcing to reduce supply chain disruptions.

- Rising investments in advanced materials will sustain long-term market competitiveness.