Market Overview:

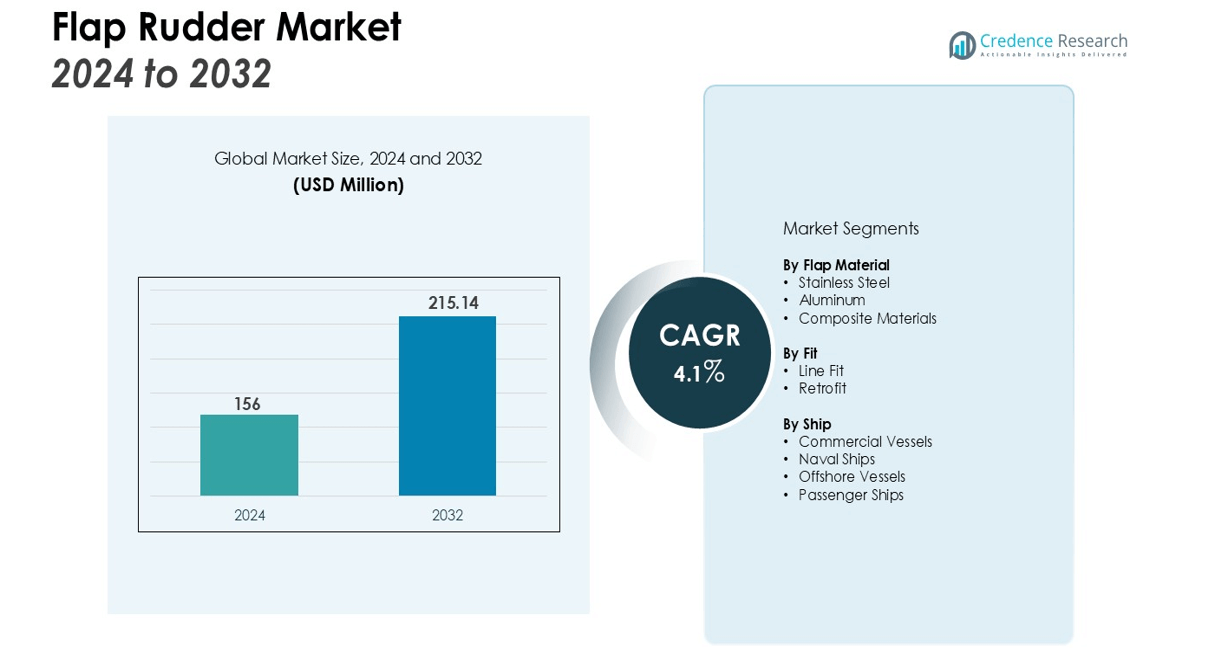

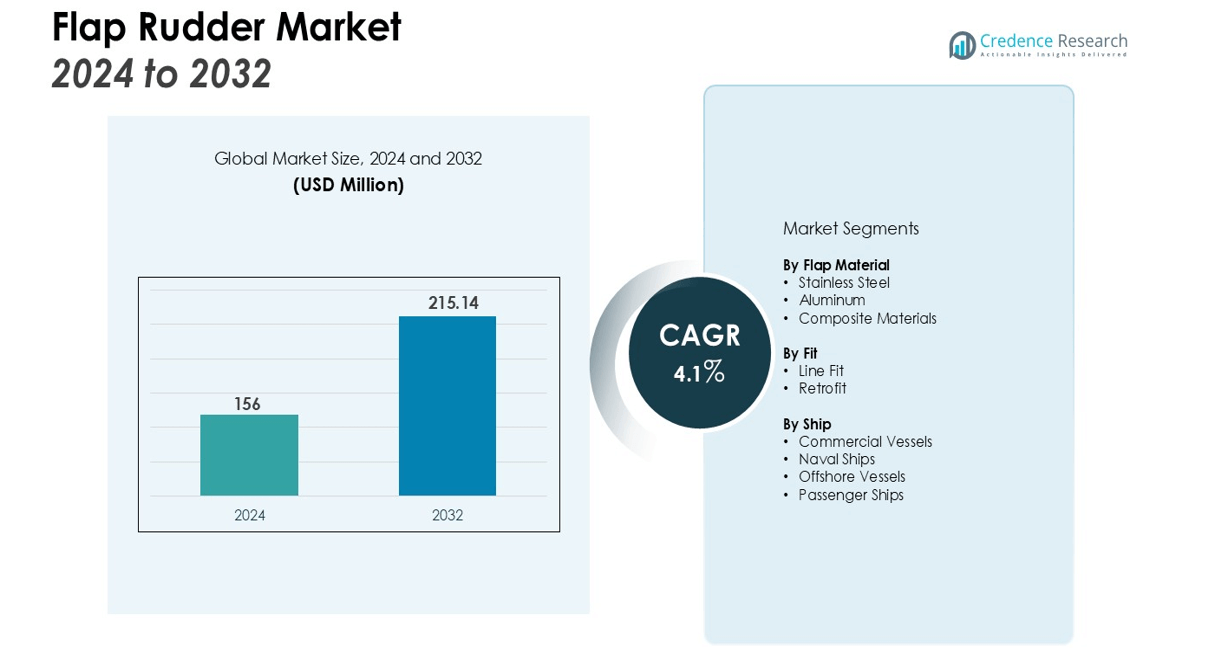

The Flap Rudder Market size was valued at USD 156 million in 2024 and is anticipated to reach USD 215.14 million by 2032, at a CAGR of 4.1% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Flap Rudder Market Size 2024 |

USD 156 million |

| Flap Rudder Market, CAGR |

4.1% |

| Flap Rudder Market Size 2032 |

USD 215.14 million |

Key drivers include the increasing focus on fuel-efficient vessel operations and improved navigation performance in congested ports and narrow waterways. The rise in global seaborne trade, coupled with ongoing fleet modernization and sustainability initiatives, is pushing manufacturers to develop compact, hydrodynamic flap rudders that reduce drag and enhance propulsion efficiency. However, high maintenance costs and complex installation requirements continue to limit adoption among smaller ship operators.

Asia Pacific dominates the flap rudder market due to strong shipbuilding activity in China, Japan, and South Korea. Europe maintains a significant share driven by sustainable maritime technology adoption and strict emission norms. North America shows moderate growth, supported by naval modernization programs and offshore exploration, while the Middle East and Latin America present emerging opportunities through port expansion and regional trade development.

Market Insights:

- The Flap Rudder Market is valued at USD 156 million and expected to reach USD 215.14 million by 2032, growing at a CAGR of 4.1%.

- Rising focus on fuel-efficient operations and improved vessel maneuverability drives market adoption across commercial and naval fleets.

- Increasing global seaborne trade and fleet modernization initiatives stimulate demand for compact, hydrodynamic rudder systems.

- Strict environmental regulations, including IMO’s EEXI and CII standards, encourage the integration of energy-saving flap rudders.

- High production and installation costs, along with complex maintenance, continue to challenge adoption among smaller operators.

- Asia Pacific leads with a 46% share due to strong shipbuilding activity, followed by Europe with 28% emphasizing sustainable technologies.

- North America accounts for 16% share driven by naval upgrades, while the Middle East and Latin America hold 10%, supported by port expansion and offshore developments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Fuel Efficiency and Enhanced Maneuverability

The Flap Rudder Market experiences strong growth due to the global push for improved fuel efficiency and precise vessel control. Flap rudders generate higher lift at lower angles, helping ships achieve better steering performance with less energy use. It enables faster turning and smoother navigation, reducing overall fuel consumption and emissions. Shipowners prioritize such systems to meet operational efficiency targets and comply with maritime sustainability regulations. These factors collectively reinforce market adoption among both commercial and naval vessels.

Expansion of Global Trade and Fleet Modernization Programs

Global trade expansion and fleet modernization efforts significantly drive market demand. Rising seaborne trade volumes increase the need for vessels with enhanced navigation and control systems. Many shipping companies are replacing traditional rudders with flap rudders to improve vessel agility and reliability during high-traffic operations. It supports safer maneuvering in congested ports and narrow channels. Governments and private operators are also investing in retrofitting existing fleets to align with modern maritime standards.

- For instance, Becker Marine Systems has successfully equipped vessels worldwide with its high-lift flap rudder, with the total number of units sold exceeding 7,000.

Adoption of Advanced Marine Technologies and Hydrodynamic Designs

Growing use of hydrodynamic design and digital control systems supports steady adoption of flap rudders. Integration of computational fluid dynamics and automated steering control has improved performance precision and reduced maintenance frequency. It helps operators manage vessel stability and fuel economy with higher accuracy. Manufacturers focus on compact and modular designs that optimize flow patterns around the hull. These innovations enhance long-term durability and ensure compliance with performance-based maritime regulations.

Environmental Regulations Driving Efficient Vessel Design

Strict global emission norms and energy efficiency standards promote the shift toward optimized rudder systems. Regulatory frameworks, including IMO’s EEXI and CII standards, encourage shipbuilders to integrate energy-saving components. It leads to wider use of flap rudders due to their ability to minimize drag and lower carbon output. Operators benefit from measurable reductions in operational costs while maintaining environmental compliance. This regulatory influence continues to stimulate technological innovation and long-term demand.

- For instance, by March 2013, the installation of the Becker Mewis Duct®, a device that improves water flow to the propeller and is often combined with a flap rudder, had already led to a total CO2 reduction of 250,000 tons.

Market Trends:

Integration of Smart Control Systems and Hydrodynamic Optimization

The Flap Rudder Market is witnessing a clear shift toward smart control technologies and advanced hydrodynamic designs that improve steering efficiency. Modern vessels are adopting sensor-driven and electronically controlled flap systems that automatically adjust rudder angles based on vessel speed, sea conditions, and propulsion load. It enhances navigational accuracy, fuel efficiency, and overall safety during critical maneuvers. Shipbuilders and system integrators are investing in digital twin simulations and computational fluid dynamics to refine rudder geometry and flow patterns. These innovations minimize drag, improve lift performance, and reduce wear on mechanical components. The trend aligns with the maritime sector’s focus on performance optimization and predictive maintenance, creating demand for adaptive and connected steering solutions.

- For instance, Becker Marine Systems’ flap rudder technology demonstrates superior maneuverability by achieving a 90-degree flap angle when the main rudder is turned to only 45 degrees, a design feature that enhances vessel control in narrow waterways.

Growing Preference for Sustainable Shipbuilding and Retrofitting Solutions

The market shows increasing emphasis on sustainability-driven designs and retrofit applications across global fleets. Shipowners seek flap rudder systems that reduce energy consumption and comply with emission control standards under the IMO’s efficiency framework. It supports fleet operators in achieving environmental certifications while improving operational profitability. Retrofitting activities have expanded as existing vessels adopt high-efficiency rudder systems to extend operational lifespans. Manufacturers are also introducing lightweight, corrosion-resistant materials that improve long-term durability in harsh marine environments. Integration with hybrid propulsion and electric drive systems further reinforces the market’s transition toward low-emission vessel architecture. This sustainability-driven approach continues to redefine rudder innovation and shipbuilding standards worldwide.

- For instance, Canal Barge Company opted to retrofit its 140-foot vessel, the Eugenie P. Jones, built in 1975, with a modern Becker Flap Rudder system to extend its operational life and improve maneuverability.

Market Challenges Analysis:

High Manufacturing Costs and Complex Installation Requirements

The Flap Rudder Market faces challenges due to high production and installation costs associated with advanced rudder systems. Precision engineering, specialized materials, and complex control mechanisms increase the overall manufacturing expense. It limits adoption among small and mid-sized ship operators with budget constraints. Installation also requires skilled labor and dry-docking facilities, which raise operational downtime and costs. The integration of electronic control systems demands expertise and maintenance, further discouraging large-scale deployment in older fleets. These factors create barriers to entry for emerging shipbuilders and retrofit projects in cost-sensitive regions.

Maintenance Complexity and Limited Standardization in System Design

Maintenance of flap rudder systems poses difficulties due to their mechanical complexity and exposure to harsh marine environments. Wear and corrosion on hinges, actuators, and linkages often require frequent inspection and replacement. It increases lifecycle costs and impacts vessel availability during extended maintenance periods. The lack of design standardization across manufacturers complicates part compatibility and repair logistics. Limited global service infrastructure for advanced rudder systems also delays maintenance support in remote ports. These challenges hinder consistent adoption across diverse vessel categories and reduce the pace of technology standardization in the global market.

Market Opportunities:

Rising Demand for Green Ship Technologies and Sustainable Operations

The Flap Rudder Market presents strong opportunities through the global transition toward green and energy-efficient vessels. Growing emphasis on reducing carbon emissions and fuel consumption drives interest in hydrodynamic rudder designs that enhance propulsion efficiency. It enables operators to meet evolving environmental standards while improving voyage economy. Governments and maritime organizations support this shift through incentives for low-emission ship designs and modernization projects. Adoption of eco-friendly rudder materials and coatings further expands potential for innovation in sustainable manufacturing. Shipyards and retrofit service providers benefit from the rising need for efficient steering solutions aligned with clean energy goals.

Expansion of Autonomous and Digitally Controlled Vessel Technologies

Rapid digitalization in marine operations creates opportunities for integrating flap rudders with automated navigation and AI-based control systems. It allows ships to optimize steering responses in real time, reducing human error and fuel usage. Autonomous vessels and smart fleet management systems are expected to rely heavily on intelligent rudder mechanisms. Manufacturers focusing on control software integration, sensor calibration, and adaptive rudder systems can capture a growing segment of high-value applications. Partnerships between shipbuilders and maritime technology firms will accelerate these advancements. The convergence of automation, data analytics, and hydrodynamic design opens new growth avenues for global market expansion.

Market Segmentation Analysis:

By Flap Material

The Flap Rudder Market is segmented by flap material into stainless steel, aluminum, and composite materials. Stainless steel holds the largest share due to its durability, corrosion resistance, and suitability for heavy-duty marine applications. Aluminum is gaining traction in lightweight vessels for its ease of fabrication and fuel efficiency benefits. It offers a balance between strength and reduced weight, making it ideal for coastal and passenger ships. Composite materials are emerging rapidly with improved strength-to-weight ratios and lower maintenance requirements, supporting future demand in advanced vessel designs.

- For instance, Becker Marine Systems has engineered its flap rudder to achieve a flap angle of up to 100 degrees for precise maneuvering.

By Fit

Based on fit, the market is divided into line fit and retrofit segments. Line fit dominates due to its integration into new vessel constructions by major shipyards in Asia Pacific and Europe. It supports long-term performance optimization through design-level customization. Retrofit installations are expanding steadily as fleet operators replace conventional rudders to enhance maneuverability and meet energy efficiency targets. It provides a cost-effective solution for extending vessel lifespan and aligning older fleets with new maritime standards.

- For instance, Damen Marine Components was selected to supply its Van der Velden® Atlantic Rudders as a line fit for six new 7,100 TEU container vessels built by Dalian Shipbuilding Industry Co.

By Ship

By ship type, the market includes commercial vessels, naval ships, and offshore vessels. Commercial vessels account for the largest share driven by growing global trade and fleet expansion. Naval applications adopt flap rudders for precise control and tactical maneuvering. Offshore vessels use them for stability in harsh marine conditions and operational safety in exploration activities. It continues to support efficiency and control across varied vessel categories.

Segmentations:

By Flap Material

- Stainless Steel

- Aluminum

- Composite Materials

By Fit

By Ship

- Commercial Vessels

- Naval Ships

- Offshore Vessels

- Passenger Ships

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Leading the Global Shipbuilding and Retrofit Demand

Asia Pacific holds a 46% share of the Flap Rudder Market, maintaining leadership through strong shipbuilding capacity and modernization efforts. The region benefits from dominant production hubs in China, Japan, and South Korea, supported by continuous maritime infrastructure investment. It gains traction from government programs aimed at fleet renewal and energy efficiency improvements. Growing port development in India and Southeast Asia strengthens regional demand for advanced rudder systems. Shipyards across the region actively integrate flap rudders in both new builds and retrofit projects, reinforcing Asia Pacific’s position as the global center for marine innovation.

Europe Focusing on Sustainable Marine Technology Integration

Europe accounts for 28% of the market, driven by a clear focus on sustainability and regulatory compliance in marine operations. The region’s strict environmental standards encourage adoption of high-performance rudder technologies in commercial, naval, and passenger vessels. It benefits from a strong engineering base and collaboration between shipyards and research institutions. Countries such as Germany, Norway, and the Netherlands lead in integrating hybrid propulsion and low-emission vessel technologies. The shift toward automation and digital control continues to enhance Europe’s role in sustainable maritime advancements.

North America, Middle East, and Latin America Showing Emerging Potential

North America captures a 16% share of the market, supported by naval modernization initiatives and offshore exploration projects. The region invests heavily in intelligent steering systems and automation to improve operational safety and performance. It also benefits from increased focus on green port infrastructure and autonomous vessel development. The Middle East and Latin America collectively hold a 10% share, driven by expanding maritime trade and offshore energy activities. Large-scale infrastructure projects in Brazil, Saudi Arabia, and the UAE continue to create new opportunities for global rudder manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kemp Propulsion Systems

- De Waal BV

- Becker Marine Systems GmbH

- Kongsberg Gruppen

- Damen Marine Components

- Kamome Propeller

- Wuxi Delin Marine Equipment Co., Ltd.

- Jiangsu China Empire Offshore Engineering Equipment Manufacture Co., Ltd.

- Nakashima Propeller Co., Ltd.

- YMV Kreyn ve Makina Sistemleri A.

Competitive Analysis:

The Flap Rudder Market features a competitive landscape led by established marine equipment manufacturers focusing on innovation and performance efficiency. Key players emphasize product durability, hydrodynamic optimization, and integration with digital control systems to strengthen market presence. It reflects increasing collaboration between shipbuilders and component suppliers to enhance energy efficiency and maneuverability. Companies invest in advanced materials and precision engineering to improve corrosion resistance and reduce operational costs. Strategic partnerships and expansion into ship repair and retrofit services drive business growth across emerging regions. Firms also prioritize compliance with international maritime regulations and sustainability goals to meet customer expectations. Competition remains strong as players diversify their portfolios with lightweight, customizable flap rudders designed for commercial, naval, and offshore vessels, ensuring long-term competitiveness and reliability in evolving maritime operations.

Recent Developments:

- In October 2025, MinebeaMitsumi finalized the acquisition of all shares of a new company created by TSUBAKI NAKASHIMA CO., LTD., to grow its precision technologies business.

- In January 2025, Kongsberg Discovery acquired Naxys Technologies AS, a company known for its passive hydroacoustic technology used for environmental monitoring in the oil and gas sector.

Report Coverage:

The research report offers an in-depth analysis based on Flap Material, Fit, Ship and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Flap Rudder Market will experience steady demand driven by the global shift toward energy-efficient marine technologies.

- Rising adoption of smart control systems will enhance steering precision and reduce human error in complex navigation conditions.

- Integration of digital monitoring and predictive maintenance tools will improve vessel reliability and lifecycle management.

- Growth in global trade and expanding commercial fleets will increase the need for advanced maneuvering systems in large vessels.

- Manufacturers will invest in lightweight and corrosion-resistant materials to improve durability and reduce maintenance downtime.

- Environmental regulations will continue to push shipbuilders toward hydrodynamic rudder designs that minimize drag and emissions.

- Retrofit projects will rise as aging fleets upgrade to modern rudder systems that meet energy efficiency standards.

- Increased collaboration between shipyards and technology firms will accelerate innovations in automated rudder control solutions.

- Asia Pacific will maintain its dominance due to high shipbuilding activity and export-oriented maritime development.

- Global market competition will intensify as companies expand service networks and introduce customizable solutions for diverse vessel types.