Market Overview

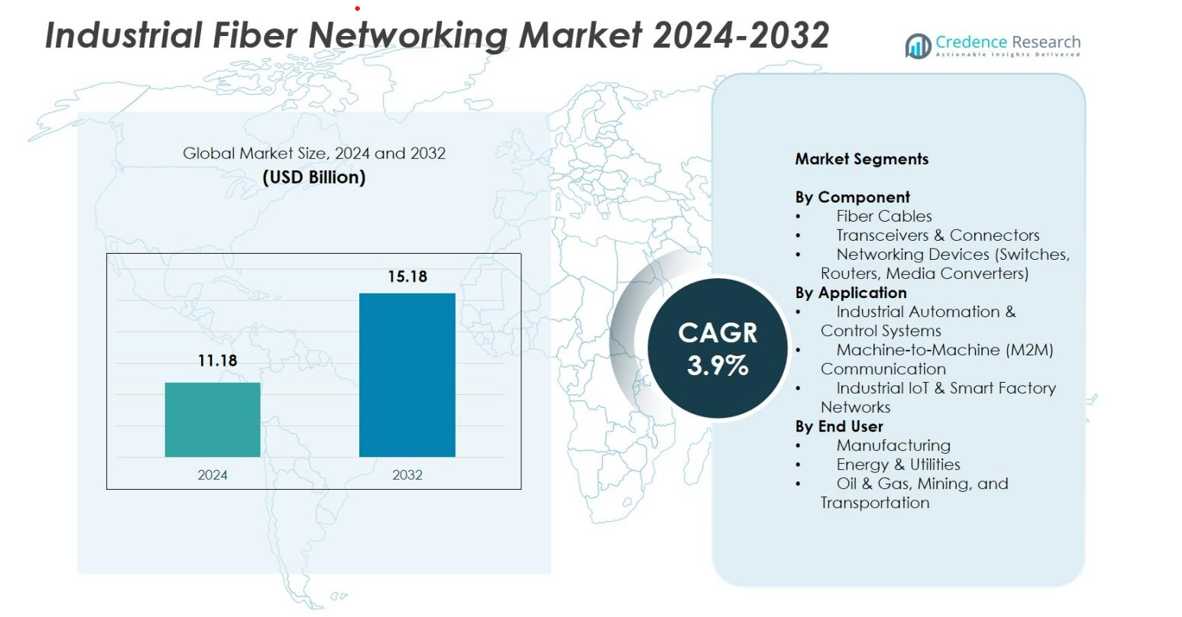

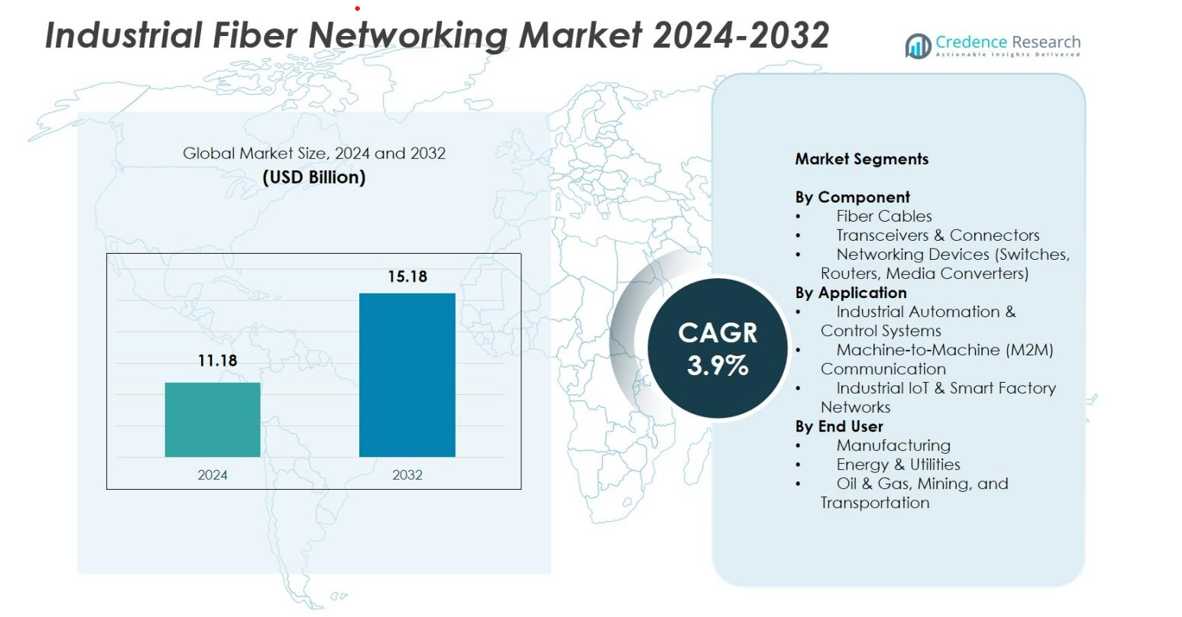

Industrial Fiber Networking Market size was valued at USD 11.18 Billion in 2024 and is anticipated to reach USD 15.18 Billion by 2032, at a CAGR of 3.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Fiber Networking Market Size 2024 |

USD 11.18 Billion |

| Industrial Fiber Networking Market, CAGR |

3.9% |

| Industrial Fiber Networking Market Size 2032 |

USD 15.18 Billion |

Industrial Fiber Networking Market is driven by strong participation from major players including Siemens AG, Cisco Systems, Inc., Belden Inc., Moxa Inc., Schneider Electric SE, Rockwell Automation, ABB Ltd., Hirschmann, Advantech Co., Ltd., and Fiberstore (FS.com), all of which focus on high-performance fiber switches, transceivers, and rugged industrial networking solutions. These companies enhance market growth through continuous innovation, automation-focused product lines, and expanded IIoT connectivity portfolios. Regionally, North America led the market with a 34.6% share in 2024, supported by advanced industrial automation adoption, while Europe and Asia-Pacific followed due to strong digital transformation initiatives and expanding smart manufacturing ecosystems.

Market Insights

- Industrial Fiber Networking Market reached USD 11.18 Billion in 2024 and will grow at a 3.9% CAGR to hit USD 15.18 Billion by 2032.

- Growing automation and IIoT adoption drive demand, with Networking Devices holding 46.2% share, supported by the need for secure, high-speed industrial communication.

- Trends include rising deployment of AI-enabled network management and edge connectivity, enhancing real-time monitoring and smart factory performance.

- Key players such as Siemens, Cisco, Belden, Moxa, ABB, and Schneider Electric strengthen the market through innovation in rugged fiber switches, routers, and transceivers.

- North America leads with 34.6%, followed by Europe at 28.4% and Asia-Pacific at 25.1%, while manufacturing remains the dominant end user with a 52.4% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Component

The Industrial Fiber Networking Market shows strong adoption across components, with Networking Devices switches, routers, and media converters leading the segment with a 46.2% share in 2024. Their dominance stems from rising automation, higher data throughput needs, and expanding OT-IT convergence across industrial environments. Fiber cables follow closely as industries prioritize low-latency and EMI-resistant communication, while transceivers and connectors gain traction through continuous upgrades in industrial Ethernet infrastructure. The increasing deployment of high-bandwidth architectures in robotics, SCADA systems, and remote operations continues to propel demand across all component categories.

- For instance, Cisco’s Industrial Ethernet 4000 Series switches deliver Gigabit connectivity with hardened designs rated for -40°C to 70°C operation, enabling reliable networking in factory automation, energy, transportation, and mining sites where vibration, shock, and electrical noise would overwhelm conventional IT switches.

By Application

Within applications, Industrial Automation & Control Systems accounted for 48.7% of the market share in 2024, driven by the widespread adoption of PLCs, distributed control systems, and real-time industrial communication frameworks. Machine-to-Machine (M2M) communication continues expanding with rising sensor integration and predictive maintenance initiatives, while Industrial IoT and smart factory networks accelerate due to digital transformation investments. The shift toward fully integrated, fiber-backed automation ecosystems supporting faster decision-making, enhanced safety, and process optimization underpins strong future growth across this segment.

- For instance, Siemens’ SIMATIC S7-1500 PLC platform featuring Profinet-based high-speed communication and integrated motion control is increasingly installed in automotive and process industries to support deterministic, fiber-enabled automation networks capable of handling real-time operational data.

By End User

The Manufacturing sector dominated the end-user landscape with a 52.4% share in 2024, supported by rapid smart factory rollouts, robotics deployment, and continuous modernization of production lines. Energy & utilities adopt fiber networks for grid automation, substation communication, and secure remote operations, while oil & gas, mining, and transportation industries rely on rugged fiber solutions for high-reliability communication in harsh environments. Growing emphasis on operational efficiency, safety compliance, and real-time monitoring continues to boost fiber network integration across all end-user categories.

Key Growth Drivers

Rapid Expansion of Industrial Automation and Smart Manufacturing

The rapid expansion of industrial automation and smart manufacturing remains a primary growth driver for the Industrial Fiber Networking Market. As factories transition toward Industry 4.0, the demand for high-speed, low-latency, and interference-resistant communication infrastructure has surged. Fiber networking supports advanced automation technologies, including PLCs, CNC systems, robotics, and autonomous material-handling systems, by enabling secure and reliable real-time data exchange. Manufacturers increasingly adopt fiber-based Ethernet networks to streamline operations, improve production visibility, and enhance predictive maintenance capabilities. Government-led smart factory initiatives and modernization programs further strengthen this segment’s growth, making fiber networking a vital enabler of digital industrial transformation.

- For instance, FANUC integrates fiber-optic communication in its CNC and robotic automation platforms to ensure ultra-low latency motion control and noise-immune data transmission, particularly in high-precision machining and advanced assembly lines.

Rising Need for High-Bandwidth and Low-Latency Communication

The rising need for high-bandwidth and ultra-low-latency communication across industrial environments significantly drives market expansion. Fiber networks deliver superior bandwidth capacity essential for supporting data-intensive applications such as machine vision, real-time monitoring, high-resolution imaging, and multisensor networks. As IIoT ecosystems grow, industries replace legacy copper networks with fiber solutions to eliminate latency issues and electromagnetic interference. This capability is crucial for SCADA systems, distributed control networks, and remote robotic operations. Increasing adoption of cloud-integrated manufacturing and edge computing further accelerates demand for robust fiber communication, supporting seamless interoperability and faster industrial decision-making.

- For instance, ABB integrates fiber-optic redundancy in its SCADA and DCS platforms such as Ability™ System 800xA to support long-distance, EMI-immune communication for process plants requiring continuous, deterministic control.

Growing Adoption of Industrial IoT and Connected Assets

The expanding adoption of Industrial IoT and connected asset ecosystems continues to fuel strong market growth. Modern industrial facilities deploy thousands of interconnected sensors, smart devices, and monitoring systems that require high-speed, reliable communication to exchange operational data. Fiber networking offers the scalability, security, and bandwidth needed to support predictive maintenance, asset tracking, remote diagnostics, and digital twin applications. Its role becomes even more critical as industries integrate connected systems across smart grids, automated plants, logistics hubs, and energy networks. The push for end-to-end operational visibility and resilience ensures sustained adoption of fiber networking across diverse industrial sectors.

Key Trends & Opportunities

Integration of AI, Edge Computing, and Advanced Network Management

A major trend shaping the Industrial Fiber Networking Market is the integration of AI-driven analytics, edge computing, and intelligent network management solutions. As industries handle massive data volumes, edge processing reduces latency by enabling real-time decision-making near operational assets. Fiber networks provide the robust backbone needed to interconnect edge nodes with centralized systems efficiently. AI-powered network tools automate fault detection, bandwidth optimization, and predictive maintenance, enhancing operational resilience. Vendors increasingly develop AI-compatible fiber solutions with embedded diagnostics and secure routing. This convergence strengthens opportunities for highly optimized networks suited for autonomous factories, precision manufacturing, energy automation, and remote industrial environments.

- For instance, Cisco’s DNA Center uses AI/ML analytics to monitor industrial Ethernet and fiber-linked networks, automating traffic optimization and detecting anomalies across manufacturing and energy sites in real time.

Growing Investments in Smart Infrastructure and Digital Industrial Ecosystems

Investments in smart grids, connected transportation, renewable energy systems, and digital industrial ecosystems are generating major opportunities for fiber networking providers. Governments and enterprises prioritize modernizing infrastructure that depends on reliable high-speed data flow, including utilities, rail networks, mining operations, and industrial power systems. Fiber networking enables real-time asset monitoring, grid automation, remote control, fault detection, and enhanced safety operations. The rise of private industrial 5G networks also increases demand for fiber as essential backhaul infrastructure. As industries advance toward interconnected and carbon-efficient operations, fiber networks become foundational to building scalable, future-ready smart environments.

- For instance, Hitachi Energy’s digital substations use fiber-optic communication to connect protection relays, sensors, and control units, enabling real-time grid automation and reducing electromagnetic interference in high-voltage environments.

Key Challenges

High Initial Deployment Costs and Integration Complexity

High initial deployment costs and integration complexity remain critical challenges for market adoption. Fiber network installation requires significant investment in specialized equipment, skilled labor, trenching, and retrofitting especially in older industrial facilities. Upgrading legacy copper-based communication systems adds cost and requires coordinated downtime, making many small and medium industries hesitant. Integrating new fiber solutions with diverse industrial protocols, existing control systems, and cybersecurity frameworks requires careful planning. Although long-term operational benefits outweigh expenses, the upfront financial and operational burden continues to slow adoption in cost-sensitive industrial environments.

Cybersecurity Risks and Network Vulnerabilities in Connected Environments

Cybersecurity challenges intensify as industries expand connected operations and IoT-driven infrastructures. While fiber provides inherent transmission security, routers, switches, edge devices, and control systems remain vulnerable to cyberattacks. Critical industries such as energy, oil and gas, transportation, and manufacturing face heightened threats due to distributed assets and legacy operational technology environments. Ensuring strong security requires advanced encryption, real-time monitoring, intrusion detection, and seamless IT-OT integration—capabilities many facilities still lack. Evolving cyber risks heighten the need for resilient fiber-backed communication systems, making cybersecurity a key barrier to efficient network modernization.

Regional Analysis

North America

North America held a 34.6% share of the Industrial Fiber Networking Market in 2024, driven by strong adoption of automation technologies, advanced industrial IoT deployments, and early integration of smart manufacturing systems. The United States leads regional demand due to heavy investments in robotics, aerospace production, energy automation, and digitalized manufacturing plants. Fiber infrastructure upgrades across utilities, oil & gas, and transportation further accelerate market penetration. Canada strengthens growth through expanding smart grid modernization and industrial digitalization programs. The region’s emphasis on cybersecurity, edge computing, and high-speed industrial communication continues to support long-term adoption.

Europe

Europe accounted for a 28.4% share in 2024, supported by robust Industry 4.0 initiatives, stringent industrial safety standards, and strong adoption of fiber-backed automation across manufacturing and energy sectors. Germany, the UK, and France lead the deployment of high-bandwidth networks in automotive production, electronics manufacturing, and renewable energy facilities. Fiber networking also benefits from the region’s focus on decarbonization, grid modernization, and efficient industrial operations. Increasing investments in smart factories and digital infrastructure drive further adoption, while the expansion of remote monitoring and advanced control systems reinforces Europe’s growing demand for fiber-based industrial connectivity.

Asia-Pacific

The Asia-Pacific region captured a 25.1% share in 2024 and remains the fastest-growing market due to rapid industrial expansion, rising IIoT adoption, and large-scale smart manufacturing investments in China, Japan, South Korea, and India. The region benefits from strong government-led digitalization initiatives, supporting widespread deployment of fiber infrastructure in manufacturing, energy, transportation, and smart city projects. High-density industrial zones and fast-growing export-oriented manufacturing sectors accelerate fiber integration. Increasing demand for automation, AI-enabled inspection systems, and remote operations further enhances growth, positioning Asia-Pacific as a dominant future contributor to global fiber networking demand.

Latin America

Latin America held a 6.3% share in 2024, driven by strengthening industrial modernization efforts across Brazil, Mexico, and Chile. The market benefits from rising adoption of fiber-based communication in mining operations, oil & gas facilities, and energy distribution networks. Expanding manufacturing hubs and increasing need for reliable operational connectivity support fiber integration. Government initiatives aimed at improving digital infrastructure and industrial safety further enhance market potential. Although adoption remains slower than in developed regions due to cost constraints, growing investments in automation and industrial IoT place Latin America on a steady growth trajectory.

Middle East & Africa

The Middle East & Africa region accounted for a 5.6% share in 2024, supported by continued expansion in oil & gas, energy, mining, and large-scale infrastructure projects. Countries such as Saudi Arabia, the UAE, and South Africa lead fiber adoption due to heavy investments in industrial automation, smart utilities, and secure communication networks. Fiber networking enables remote monitoring and efficient operations in harsh industrial environments typical of the region. Growing smart city initiatives, digital transformation programs, and industrial diversification plans further drive demand, although high installation costs and skill shortages limit broader adoption across some developing markets.

Market Segmentations

By Component

- Fiber Cables

- Transceivers & Connectors

- Networking Devices (Switches, Routers, Media Converters)

By Application

- Industrial Automation & Control Systems

- Machine-to-Machine (M2M) Communication

- Industrial IoT & Smart Factory Networks

By End User

- Manufacturing

- Energy & Utilities

- Oil & Gas, Mining, and Transportation

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial Fiber Networking Market features a diverse and dynamic competitive landscape, with leading players focusing on advanced networking technologies, ruggedized industrial solutions, and high-speed communication infrastructure. Companies such as Siemens AG, Cisco Systems, Inc., Belden Inc., Moxa Inc., Schneider Electric SE, Rockwell Automation, ABB Ltd., Hirschmann (Belden brand), Advantech Co., Ltd., and Fiberstore (FS.com) actively expand their product portfolios to meet rising demand for low-latency, secure, and scalable industrial networks. These players invest heavily in R&D to develop fiber-based switches, routers, transceivers, and IIoT-ready communication platforms tailored for harsh industrial environments. Strategic partnerships, geographic expansion, and smart factory integrations further enhance market competitiveness. Additionally, growing emphasis on cybersecurity, AI-enabled network management, and edge connectivity drives innovation, enabling established vendors and emerging specialists to strengthen their presence in manufacturing, energy, oil & gas, and transportation sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Vero Fiber Networks expanded its “AI-ready” fiber network by 790 miles across multiple U.S. states signalling growth in high-capacity fiber rollouts for data- and industry-driven demands.

- In September 2025, Lumen Technologies announced a multi-billion-dollar expansion plan, to add 34 million new intercity fiber miles by end of 2028 reflecting a major push in fiber-network capacity for industrial and enterprise use.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will advance as industries accelerate smart factory adoption and require faster, more secure communication networks.

- Fiber networking usage will rise with increasing integration of AI, robotics, and autonomous industrial systems.

- IIoT expansion will drive higher deployment of fiber-backed sensors, control systems, and connected industrial assets.

- Edge computing growth will boost demand for low-latency fiber infrastructure to support real-time processing.

- Upgrades from legacy copper networks to fiber will intensify as industries prioritize reliability and scalability.

- Cybersecurity concerns will push companies to adopt fiber networks with enhanced secure routing and monitoring capabilities.

- Renewable energy and grid modernization projects will increase fiber deployment across utility networks.

- Transportation, mining, and oil & gas sectors will adopt more rugged fiber solutions for harsh environments.

- Private industrial 5G networks will expand fiber backhaul requirements across factories and industrial zones.

- Emerging economies will adopt fiber networking rapidly as they invest in automation and digital industrial infrastructure.