Market Overview

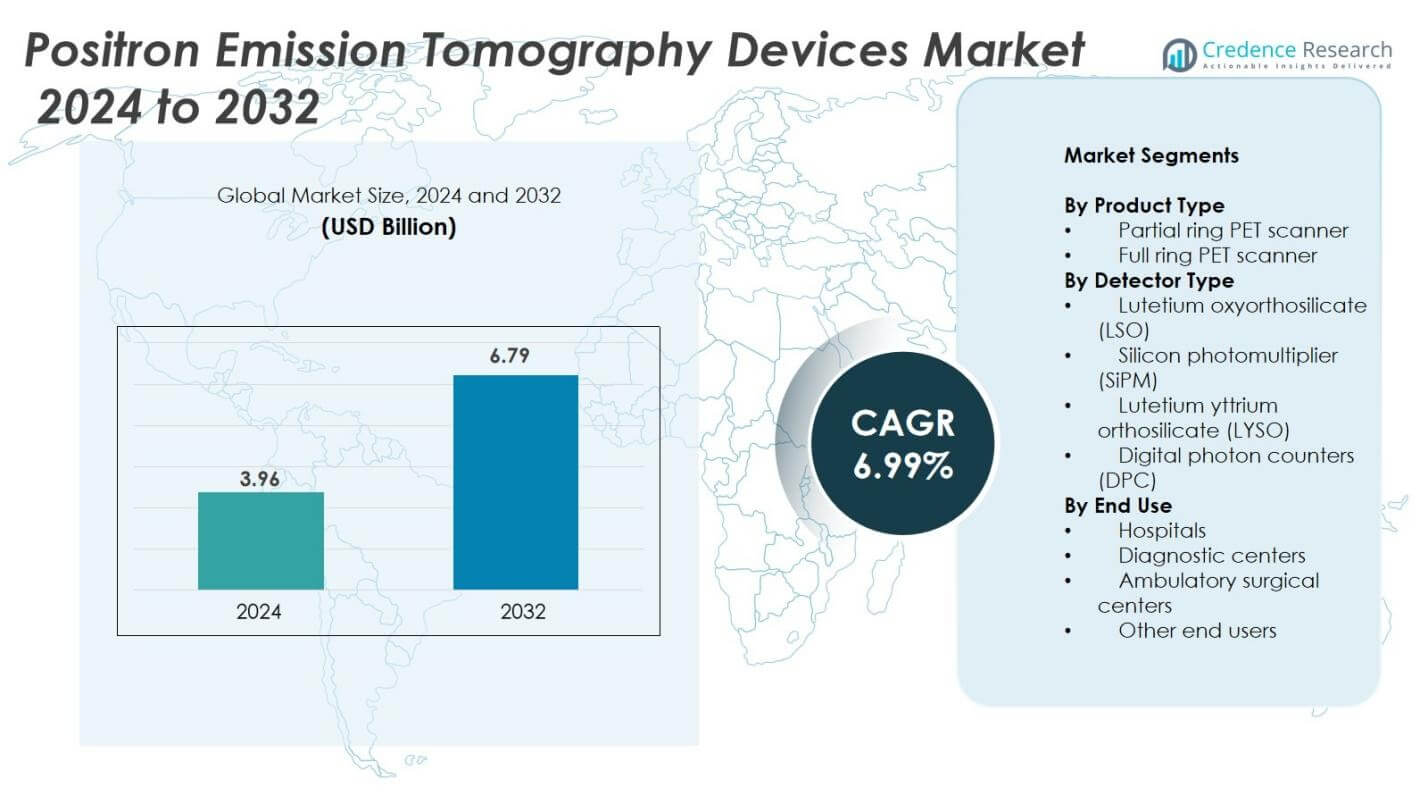

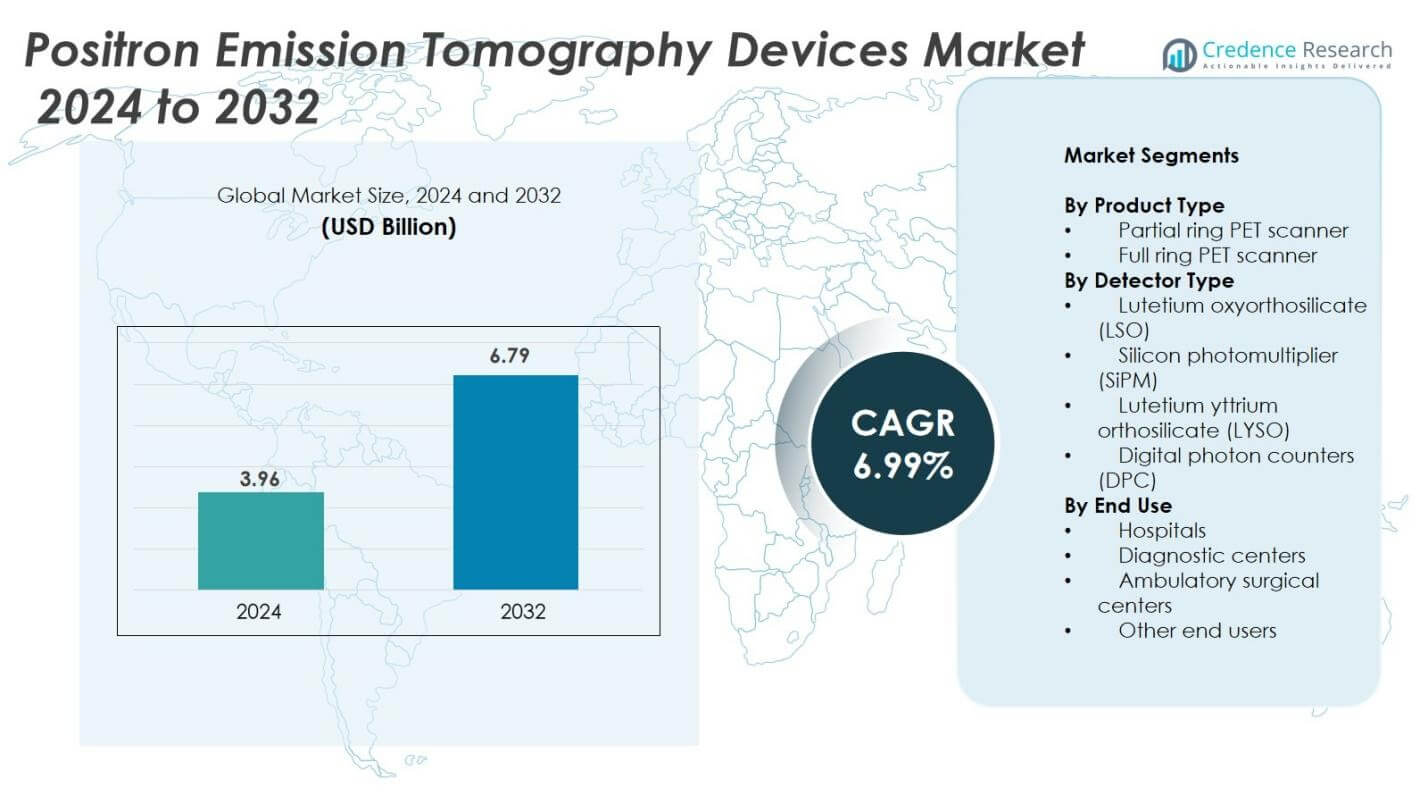

Positron Emission Tomography Devices market size was valued at USD 3.96 Billion in 2024 and is anticipated to reach USD 6.79 Billion by 2032, at a CAGR of 6.99% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Positron Emission Tomography Devices Market Size 2024 |

USD 3.96 Billion |

| Positron Emission Tomography Devices Market, CAGR |

6.99% |

| Positron Emission Tomography Devices Market Size 2032 |

USD 6.79 Billion |

The Positron Emission Tomography Devices market is led by established imaging manufacturers and specialized scanner developers. Major participants include Molecubes, Mediso, Neusoft Corporation, GE Healthcare, Minfound Medical Systems, Fujifilm Holdings Corporation, Oncovision, Koninklijke Philips, Canon Medical Systems Corporation, and CMR Naviscan. These companies compete through full-ring digital PET systems, hybrid PET/CT platforms, and advanced reconstruction software that supports precision oncology, cardiology, and neurology diagnostics. North America remains the largest region with a 38% market share in 2024, supported by strong reimbursement systems, radiopharmacy networks, and high adoption of time-of-flight and digital detector technologies across hospital and diagnostic center installations.

Market Insights

- The Positron Emission Tomography Devices market reached USD 3.96 billion in 2024 and is projected to hit USD 6.79 billion by 2032, advancing at a CAGR of 6.99%.

- Rising cancer prevalence and wider use of PET for therapy planning boost demand, while hospitals invest in hybrid PET/CT platforms for faster and more accurate diagnostics.

- Digital detectors, time-of-flight technology, and compact scanner designs support image clarity, lower dose scans, and broader outpatient adoption, especially in emerging markets.

- Full-ring PET scanners lead the product segment with a 72% share, and key players such as GE Healthcare, Fujifilm, Philips, and Canon Medical Systems expand portfolios to strengthen premium product offerings.

- North America holds 38% of the market, followed by Europe at 29% and Asia Pacific at 22%, but high installation and radiotracer supply costs remain key restraints in Latin America and the Middle East & Africa.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

Full ring PET scanners hold the dominant share of 72% in 2024. Their circular detector geometry delivers higher sensitivity, shorter scan times, and superior image resolution for oncology and neurology cases. The clinical preference for whole-body imaging, reduced motion artifacts, and improved signal-to-noise ratio continues to drive adoption. Partial ring scanners remain relevant for research labs and smaller budgets, but hospitals favor full-ring platforms due to faster workflow and stronger reimbursement support. Integration with CT and MRI raises clinical value and expands usage in oncology treatment planning, staging, and follow-up diagnostics.

- For instance, Siemens Healthineers’ Biograph Vision full ring PET/CT system has been adopted across major cancer centers to enable whole-body scans with reduced motion artifacts, supporting more accurate staging and follow-up.

By Detector Type

Lutetium yttrium orthosilicate (LYSO) detectors lead the segment with a 41% market share. LYSO crystals enable fast decay times, high density, and strong spatial resolution, which enhances lesion detection in low-dose scans. Their durability and compatibility with digital readout systems make them the preferred option for high-performance systems. Silicon photomultipliers (SiPM) gain traction in next-generation scanners, but LYSO remains dominant due to reliability in clinical workloads. The surge in hybrid PET/CT and PET/MRI installations, along with demand for improved time-of-flight accuracy, supports continued LYSO expansion in high-volume imaging centers.

- For instance, the LIGHTENING® PET detector developed by a research team, employing a 13 × 13 LYSO crystal array with a 6 × 6 SiPM array, achieving an energy resolution of 14.3% and coincidence timing resolution of 972 ps, ideal for time-of-flight PET systems.

By End Use

Hospitals account for the largest share of 64% in 2024. They lead adoption due to extensive oncology and cardiology patient volumes, strong capital budgets, and advanced radiopharmacy access. Diagnostic centers expand faster, but hospitals dominate because they operate integrated imaging departments, reimbursement-covered workflows, and advanced PET/CT suites. Rising cancer screening programs and investments in nuclear medicine technology support demand for higher throughput systems. Ambulatory surgical centers and other users take a smaller portion, mainly for specialized or outsourced imaging services, but the clinical preference for hospital-based scans sustains market leadership.

Key Growth Drivers

Rising Cancer Prevalence and Expanding Clinical Use

The growing incidence of cancer worldwide is driving the increased demand for PET devices, as early detection and accurate treatment planning become more crucial. Hospitals are increasingly relying on PET imaging to detect tumors at earlier stages, significantly improving treatment outcomes. The ability of PET to monitor therapy response in real time enables oncologists to adjust treatments promptly, optimizing patient care. This rising prevalence of cancer, coupled with advancements in imaging technology, is propelling PET adoption in oncology departments, helping to refine the diagnostic process and enable personalized therapies that contribute to higher survival rates.

- For instance, Canon Medical’s Digital TOF PET/CT system, featuring advanced AI-based image reconstruction, facilitates earlier disease assessment and tailored treatment in cancer patients, as documented in recent FDA-cleared clinical applications.

Advances in Hybrid PET/CT and PET/MRI Systems

Hybrid PET/CT and PET/MRI systems have revolutionized medical imaging by combining anatomical and metabolic data, leading to improved image clarity and reduced scan times. These integrated platforms allow clinicians to make more accurate and informed diagnostic decisions, which is critical in complex cases. Continuous advancements in digital detectors, reconstruction software, and motion correction technologies further support enhanced clinical outcomes by providing clearer images and more precise measurements. The integration of multiple imaging modalities in a single scan allows for faster diagnosis and treatment planning, while improving patient throughput and minimizing patient discomfort during procedures.

- For instance, GE Healthcare has advanced PET technology with sophisticated digital detectors and silicon photomultiplier sensors that increase sensitivity and improve raw data quality, enabling clinicians to capture more detailed images with lower radiation doses.

Shift Toward Digital PET and Time-of-Flight Technology

Digital PET systems, equipped with advanced detectors, offer higher image resolution with lower radiation doses, improving patient safety while enhancing diagnostic accuracy. Time-of-flight technology further improves lesion visibility, particularly in obese patients where traditional imaging may struggle to produce clear images. These innovations are driving the development of compact, more efficient PET systems with smaller footprints, ideal for hospitals and diagnostic centers with space constraints. By offering faster workflows, better sensitivity, and reduced scan times, these modern systems enable healthcare providers to handle a higher volume of patients, contributing to more efficient operations and improved clinical outcomes.

Key Trends & Opportunities

Growth of Mobile and Compact PET Systems

Mobile PET units are playing a pivotal role in extending diagnostic services to rural and underserved areas, improving access to crucial cancer screenings and treatments. These units enable healthcare providers to deliver fast scan access, reducing patient wait times and enhancing overall healthcare accessibility. Compact PET systems, designed for smaller spaces, are enabling hospitals with limited infrastructure to incorporate advanced imaging capabilities without the need for costly renovations. This trend is fueling the growth of outpatient imaging centers and expanding PET services to new geographical regions, increasing patient volumes while also lowering operational costs for smaller facilities.

- For instance, Philips Healthcare’ ‘Vereos PET/CT’ system achieved whole-body scan slots of up to 18 patients per day at one centre after replacing analog equipment.

Rising Use of PET in Neurology and Cardiology

PET imaging has gained significant traction in neurology and cardiology, helping physicians diagnose Alzheimer’s disease, Parkinson’s disease, and various cardiac perfusion disorders with unparalleled precision. The ability to assess brain metabolism and heart function in real-time offers insights into the progression of these complex diseases, enabling early intervention and better treatment outcomes. The expanding radiotracer pipeline is further broadening the scope of PET applications, facilitating innovations in imaging for a range of neurological and cardiovascular conditions. These advances are driving new demand for PET systems outside of oncology, attracting substantial investment into specialized PET programs and research.

- For instance, Siemens Healthineers’ ‘Biograph Vision PET/CT’ system delivers true time-of-flight (TOF) performance of 214 ps and a volumetric resolution of 48 mm³, enhancing detectability in neurology and cardiac cases.

Key Challenges

High Purchase and Operational Costs

PET scanners involve significant upfront capital investment, requiring specialized infrastructure such as dedicated radiation shielding, which adds to the financial burden for healthcare facilities. The ongoing operational costs are also considerable, with expenses for radiotracer supply, service contracts, and regular maintenance. These costs can be particularly challenging for smaller hospitals and imaging centers, which often delay the purchase of PET systems due to financial constraints and limited reimbursement coverage in certain regions. The high initial and ongoing expenses create barriers for healthcare providers, especially in low-income or underserved areas, where cost-effective solutions are crucial for adoption. This financial burden impacts the widespread use and growth of PET technology in many regions, limiting its accessibility to only well-funded facilities.

Short Half-Life and Limited Radiotracer Supply

Many PET radiotracers have a short half-life, requiring facilities to have on-site cyclotrons for immediate production or depend on rapid delivery from specialized radiopharmacies. This limitation poses challenges for regions with underdeveloped logistics or inadequate access to timely deliveries, leading to delays and compromised image quality. In some areas, this issue can significantly hinder the effectiveness of PET imaging, as delays in tracer supply can result in suboptimal scans, reducing diagnostic accuracy. Additionally, ongoing supply chain disruptions further exacerbate these challenges, limiting patient throughput and slowing the adoption of PET technology in underserved and remote areas. These supply chain bottlenecks hinder the ability of healthcare providers to meet growing demand for PET scans, especially in regions with limited infrastructure.

Regional Analysis

North America

North America holds the leading 38% share in the Positron Emission Tomography Devices market in 2024. High cancer screening rates, strong reimbursement coverage, and early adoption of hybrid PET/CT systems support market dominance. Major hospitals invest in digital detectors, time-of-flight technology, and radiopharmacies, which improves scan accuracy and workflow. The United States accounts for most installations due to advanced oncology networks and stable tracer supply chains. Growth also stems from neurological PET programs focused on Alzheimer’s research. Continuous upgrades in imaging suites and expansion of outpatient diagnostic centers further strengthen the regional lead.

Europe

Europe represents 29% of the global market driven by well-established nuclear medicine infrastructure and government-funded healthcare systems. Germany, the U.K., France, and Italy lead scanner deployment in oncology and cardiology diagnostics. Hospitals implement PET/CT and PET/MRI platforms to support precision imaging and treatment planning. Research institutions adopt advanced digital detectors, which boosts demand for next-generation systems. Strong regulatory guidelines for cancer care and rising radiotracer production capacity help reduce scan wait times. Expansion of specialized neurology imaging centers also supports sustained adoption across Western and Northern Europe.

Asia Pacific

Asia Pacific holds a 22% share and remains the fastest-growing region due to cancer burden, rising healthcare spending, and modernization of diagnostic infrastructure. China, Japan, South Korea, and India increase procurement of full-ring PET/CT systems in major cancer hospitals. Government programs for oncology care and domestic radiotracer manufacturing improve access in urban centers. Private diagnostic networks expand installations to serve large patient populations. Academic institutes invest in PET/MRI research, pushing high-end product demand. Despite uneven rural access, rapid urban adoption drives strong future growth across Asia Pacific.

Latin America

Latin America captures 6% of the market, supported by rising use of PET for oncology staging and therapy monitoring. Brazil and Mexico lead installations due to stronger hospital infrastructure and growing nuclear medicine departments. Private diagnostic chains invest in compact PET/CT scanners to improve service reach. Expanding radiotracer distribution networks reduce dependence on imports and shorten delivery times. However, capital constraints and limited reimbursement slow adoption in smaller healthcare facilities. Gradual modernization of cancer care centers continues to create demand for mid-range scanners across major cities.

Middle East & Africa

Middle East & Africa account for 5% of global share, driven by rising cancer awareness and investments in specialty hospitals. Gulf countries adopt PET/CT systems to upgrade oncology imaging services and support early diagnosis. Research partnerships and medical tourism increase demand for high-resolution digital scanners. However, limited radiopharmacy networks and high operating costs restrict wider deployment in African countries. Government-funded cancer treatment centers and new nuclear medicine units in the UAE, Saudi Arabia, and South Africa are expected to improve accessibility over the forecast period.

Market Segmentations

By Product Type

- Partial ring PET scanner

- Full ring PET scanner

By Detector Type

- Lutetium oxyorthosilicate (LSO)

- Silicon photomultiplier (SiPM)

- Lutetium yttrium orthosilicate (LYSO)

- Digital photon counters (DPC)

By End Use

- Hospitals

- Diagnostic centers

- Ambulatory surgical centers

- Other end users

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Positron Emission Tomography Devices market remains moderately consolidated, with global manufacturers and specialized imaging firms competing through technological innovation and clinical performance. Key players include Molecubes, Mediso, Neusoft Corporation, GE Healthcare, Minfound Medical Systems, Fujifilm Holdings Corporation, Oncovision, Koninklijke Philips, Canon Medical Systems Corporation, and CMR Naviscan. These companies focus on digital PET platforms, full-ring scanners, and advanced time-of-flight capabilities to enhance image resolution and workflow efficiency. Strategic priorities include expanding radiotracer portfolios, integrating PET with CT and MRI systems, and improving software-based reconstruction for faster reporting. Leading vendors strengthen market position through partnerships with hospitals, research institutes, and radiopharmacies to support precision oncology and neurology programs. Mid-size players introduce compact scanners to meet demand from outpatient diagnostic centers and emerging markets. Continuous development in silicon photomultipliers, LYSO detectors, and artificial intelligence–based image processing shapes competition and accelerates product upgrades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Molecubes

- Mediso

- Neusoft Corporation

- GE Healthcare

- Minfound Medical Systems

- Fujifilm Holdings Corporation

- Oncovision

- Koninklijke Philips

- Canon Medical Systems Corporation

- CMR Naviscan

Recent Developments

- In January 2025, GE HealthCare and Sutter Health finalized a seven-year pact to deploy AI-powered imaging, including state-wide PET/CT upgrades, across 300 facilities.

- In December 2024, Siemens Healthineers acquired Advanced Accelerator Applications Molecular Imaging from Novartis, gaining 13 European PET radiopharmaceutical production sites.

- In June 2024, Positron Corporation entered into an agreement to acquire FDA 510(k) clearance for the NeuSight PET-CT from Neusoft Medical Systems’ subsidiary.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Detector Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of digital PET systems will rise as hospitals replace older analog scanners.

- Hybrid PET/CT and PET/MRI platforms will gain higher clinical preference for precision diagnostics.

- Radiotracer production capacity will expand, improving access in emerging markets.

- Compact and mobile PET units will grow in demand for outpatient and rural imaging.

- AI-based image reconstruction will enhance lesion detection and reduce reporting time.

- Neurology and cardiology applications will represent a larger share of total PET procedures.

- Research investments will push development of new tracers for metabolic and molecular imaging.

- Vendors will offer service-based models to reduce capital barriers for smaller centers.

- Time-of-flight technology will become a standard feature across mid-range and premium scanners.

- Growth of cancer screening programs will drive higher installation rates in hospitals and diagnostic centers.