| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Industrial Hemp Market Size 2023 |

USD 2,347.45 Million |

| Asia Pacific Industrial Hemp Market, CAGR |

23.1% |

| Asia Pacific Industrial Hemp Market Size 2032 |

USD 15,241.57 Million |

Market Overview

Asia Pacific Industrial Hemp Market size was valued at USD 2,347.45 million in 2023 and is anticipated to reach USD 15,241.57 million by 2032, at a CAGR of 23.1% during the forecast period (2023-2032).

The Asia Pacific industrial hemp market is experiencing robust growth driven by increasing awareness of the plant’s diverse applications across industries such as textiles, food and beverages, personal care, and pharmaceuticals. Governments across the region are progressively easing regulations and promoting hemp cultivation due to its sustainability and economic potential. Rising demand for plant-based and eco-friendly products further accelerates market expansion, especially in countries like China, India, and Australia. Technological advancements in hemp processing and innovation in end-use products are also fostering market development. Moreover, the growing acceptance of CBD-based wellness products and the surge in vegan and organic lifestyles contribute significantly to the rising consumption of hemp-derived goods. Strategic investments by major players and the expansion of distribution channels, both online and offline, are enhancing product accessibility and consumer reach. These combined factors are shaping a dynamic and rapidly evolving industrial hemp landscape in the Asia Pacific region.

The Asia Pacific industrial hemp market is geographically diverse, with key contributions from countries such as China, India, Australia, Thailand, and emerging Southeast Asian nations including Vietnam, Indonesia, and the Philippines. China leads in hemp fiber production and processing, while India is rapidly developing its capabilities in hemp-based wellness and textile products. Australia and Thailand have established supportive regulatory frameworks, encouraging innovation and investment in hemp-derived foods and cosmetics. Across the region, expanding cultivation zones and evolving policies are creating new opportunities for growth. Key players driving the market include Green Thumb Industries, Canopy Growth Corporation, Aurora Cannabis Inc., The Cronos Group, Ecofibre Ltd, and Curaleaf Holdings, Inc. These companies are actively investing in research, product development, and regional expansion. Local firms like IND HEMP and Hemp Oil Canada Inc. are also gaining traction by focusing on sustainable practices and region-specific applications, further enhancing competitiveness in the evolving Asia Pacific hemp market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific industrial hemp market was valued at USD 2,347.45 million in 2023 and is projected to reach USD 15,241.57 million by 2032, growing at a CAGR of 23.1% during the forecast period.

- The global industrial hemp market was valued at USD 7,987.24 million in 2023 and is expected to reach USD 46,774.80 million by 2032, growing at a CAGR of 21.7% from 2023 to 2032.

- The market is expanding rapidly due to increasing demand for sustainable, plant-based, and multi-purpose raw materials across various industries.

- Regulatory reforms in countries like China, India, Thailand, and Australia are encouraging legal cultivation and industrial use of hemp.

- There is a rising trend of hemp-based foods, skincare, textiles, and wellness products driven by health-conscious and eco-aware consumers.

- The market is competitive with key players like Green Thumb Industries, Canopy Growth Corporation, Aurora Cannabis Inc., and Ecofibre Ltd investing in innovation and regional outreach.

- Challenges such as inconsistent regulations, limited processing infrastructure, and public misperception about hemp hinder growth.

- China, India, Australia, and Southeast Asian nations are key contributors, with emerging opportunities in Vietnam and Indonesia.

Report Scope

This report segments the Asia Pacific Industrial Hemp Market as follows:

Market Drivers

Government Support and Regulatory Reforms

One of the primary drivers of the industrial hemp market in the Asia Pacific region is the increasing support from governments through favorable policies and regulatory reforms. Countries such as China, India, Australia, and Thailand have taken significant steps to legalize and regulate the cultivation and processing of industrial hemp. For instance, the Himachal Pradesh government in India has initiated pilot programs to legalize hemp cultivation for medicinal and industrial purposes, including the establishment of seed banks and geo-tagging land. In Australia, the government has approved hemp-based food products and continues to fund research into hemp’s applications in agriculture and industry. This shift in policy stems from growing recognition of hemp’s economic value and its low environmental impact. These regulatory changes are opening up new avenues for investment and encouraging farmers to adopt hemp cultivation as a viable and profitable alternative to traditional crops.

Expanding Applications Across Industries

The versatility of industrial hemp is another strong driver behind its market expansion. Industrial hemp serves as a sustainable raw material in a wide range of industries, including textiles, construction, automotive, food and beverages, cosmetics, and pharmaceuticals. In particular, the textile industry in countries like China and India is increasingly incorporating hemp fibers due to their strength, durability, and eco-friendliness. Additionally, the food and beverage sector is seeing a surge in demand for hemp seeds and hemp oil, known for their high nutritional value. The beauty and wellness industry is also capitalizing on the antioxidant and moisturizing properties of hemp-derived products, especially cannabidiol (CBD), which is gaining popularity for skincare and therapeutic uses. This broad spectrum of applications continues to fuel consistent demand and innovation within the market.

Rising Consumer Preference for Sustainable and Plant-Based Products

Growing consumer awareness around sustainability and health is significantly influencing the demand for industrial hemp products. For instance, surveys conducted by the United Nations Conference on Trade and Development (UNCTAD) highlight hemp’s minimal water requirements and rapid growth cycle as key factors driving eco-conscious consumer choices. The Asia Pacific region, with its expanding middle-class population and shifting lifestyle trends, is witnessing a strong preference for natural and organic goods. Hemp-based foods, supplements, textiles, and personal care items are aligning well with the values of health-conscious and environmentally aware consumers. This shift in consumer behavior is not only driving demand but also encouraging brands to diversify their product portfolios to include more hemp-derived items.

Technological Advancements and Investment in R&D

Technological innovation and increased investment in research and development are further propelling the industrial hemp market in Asia Pacific. Advancements in processing technology have enhanced the efficiency of extracting hemp fibers, oils, and cannabinoids, making production more cost-effective and scalable. Companies and research institutions are collaborating to explore new uses of hemp and improve the quality and performance of hemp-based products. Additionally, growing venture capital interest and strategic partnerships are accelerating the commercialization of innovative hemp applications across sectors. These developments are fostering a competitive market environment and positioning the Asia Pacific region as a key player in the global industrial hemp industry.

Market Trends

Growing Demand for Hemp-Based Food and Beverages

A key trend in the Asia Pacific industrial hemp market is the rising demand for hemp-based food and beverage products. For instance, the Food Safety and Standards Authority of India (FSSAI) has approved the use of hemp seeds and oil in food products, recognizing their nutritional value. Companies like Nutiva are leveraging this approval to introduce hemp-based protein powders and snacks to health-conscious consumers. As plant-based diets gain popularity, particularly among health-conscious urban populations, hemp is becoming a favored ingredient in products such as protein powders, snacks, milk alternatives, and health supplements. The functional food trend, combined with growing awareness of hemp’s benefits, is encouraging both established food companies and start-ups to innovate and expand their hemp product portfolios.

Expansion of the Hemp-based Personal Care and Cosmetics Sector

The personal care and cosmetics industry in the Asia Pacific region is rapidly integrating hemp-derived ingredients, especially cannabidiol (CBD), into skincare, haircare, and wellness products. For instance, South Korea’s Ministry of Food and Drug Safety has approved the use of CBD in cosmetics, paving the way for brands like K-beauty giant Amorepacific to launch hemp-infused skincare lines. In Japan, companies such as Elixinol are capitalizing on hemp’s anti-inflammatory and moisturizing properties to develop innovative beauty products. This growing sector reflects a broader shift toward holistic wellness and natural product preferences among consumers.

Rise in Industrial Applications and Eco-Friendly Materials

Another notable trend is the rising use of hemp in industrial applications, particularly in textiles, bioplastics, construction, and automotive components. With sustainability becoming a top priority for manufacturers and governments alike, hemp is being recognized as a renewable and low-impact alternative to traditional materials. In textiles, hemp fiber is appreciated for its durability and breathability, while the construction industry is exploring hempcrete as an environmentally friendly building material. Furthermore, hemp-based bioplastics and composites are gaining traction in automotive interiors and packaging. These applications align with global efforts to reduce carbon footprints and adopt circular economy practices, fueling industrial hemp demand in the Asia Pacific region.

Digitalization and E-commerce Driving Market Penetration

Digital transformation and the rapid expansion of e-commerce platforms are significantly shaping the distribution landscape for industrial hemp products. Online channels have become vital for reaching a broader consumer base, especially in emerging markets where physical retail infrastructure is still developing. E-commerce enables easy access to hemp-derived food, wellness, and cosmetic products, while also offering brands the ability to educate consumers and build awareness. Social media and digital marketing are playing a pivotal role in promoting hemp products and dispelling myths around their use. This shift toward digital retail is enhancing market accessibility and driving faster product adoption across diverse demographics.

Market Challenges Analysis

Regulatory Complexity and Lack of Harmonization

Despite growing acceptance, regulatory complexity remains a significant challenge for the industrial hemp market in the Asia Pacific region. For instance, the United Nations Conference on Trade and Development (UNCTAD) has highlighted the lack of harmonized regulations across countries, which complicates cross-border trade and collaboration. Each country follows its own set of rules governing the cultivation, processing, and commercialization of hemp, leading to inconsistencies and confusion across markets. In several countries, the legal distinction between industrial hemp and psychoactive cannabis remains unclear, resulting in cautious policymaking and delayed approvals. Furthermore, stringent licensing procedures, limited access to certified seeds, and restrictions on THC content create additional barriers for farmers and manufacturers. These regulatory ambiguities discourage foreign investment and limit the scalability of operations, especially for small and medium-sized enterprises. The lack of a unified regional framework continues to hinder cross-border trade and collaboration, ultimately slowing down the growth potential of the industry.

Limited Infrastructure and Market Awareness

Another critical challenge lies in the underdeveloped infrastructure for large-scale hemp cultivation and processing. Many Asia Pacific countries lack modern harvesting, extraction, and manufacturing facilities tailored specifically for industrial hemp, which leads to inefficiencies in production and supply chain bottlenecks. In addition, the region faces a shortage of skilled labor and technical expertise required for cultivating and processing high-quality hemp for industrial use. On the demand side, there remains limited consumer awareness and lingering stigma associated with hemp due to its historical association with marijuana. This perception gap hampers widespread acceptance, particularly in conservative markets. Without robust education campaigns and proactive engagement from both public and private stakeholders, consumer trust and adoption will remain subdued. These infrastructure and perception challenges must be addressed for the region to fully leverage the economic and environmental benefits of industrial hemp.

Market Opportunities

The Asia Pacific industrial hemp market presents substantial opportunities driven by shifting consumer preferences, regulatory progress, and the region’s strong agricultural base. As consumers increasingly seek sustainable, plant-based, and functional products, industrial hemp is positioned to meet diverse market needs across food, personal care, textiles, and wellness sectors. Countries like China, India, and Thailand have favorable climatic conditions for large-scale hemp cultivation, creating the potential for cost-effective production and regional supply chain development. In particular, the rising popularity of hemp-derived health supplements, protein powders, and beauty products offers lucrative opportunities for manufacturers and retailers. Additionally, as governments gradually ease restrictions and clarify regulations surrounding hemp cultivation and use, new entrants especially startups and international brands can capitalize on emerging demand and secure a competitive foothold in high-growth segments.

Beyond consumer applications, industrial hemp’s use in eco-friendly construction materials, biodegradable plastics, and textile innovation provides promising long-term opportunities. With increasing pressure to adopt sustainable practices, industries are exploring hemp as a renewable resource to reduce carbon footprints and meet environmental goals. Investment in research and development is expected to accelerate product innovation and unlock new high-margin applications, particularly in sectors such as automotive, biocomposites, and advanced materials. Furthermore, the expansion of e-commerce and digital marketing in the region enables companies to reach wider audiences, educate consumers, and foster brand loyalty for hemp-based products. By aligning with global sustainability trends and leveraging digital tools, businesses operating in the Asia Pacific hemp market can create value while contributing to environmental and economic resilience. As infrastructure improves and market awareness grows, the region is well-positioned to emerge as a major global hub for industrial hemp production and innovation.

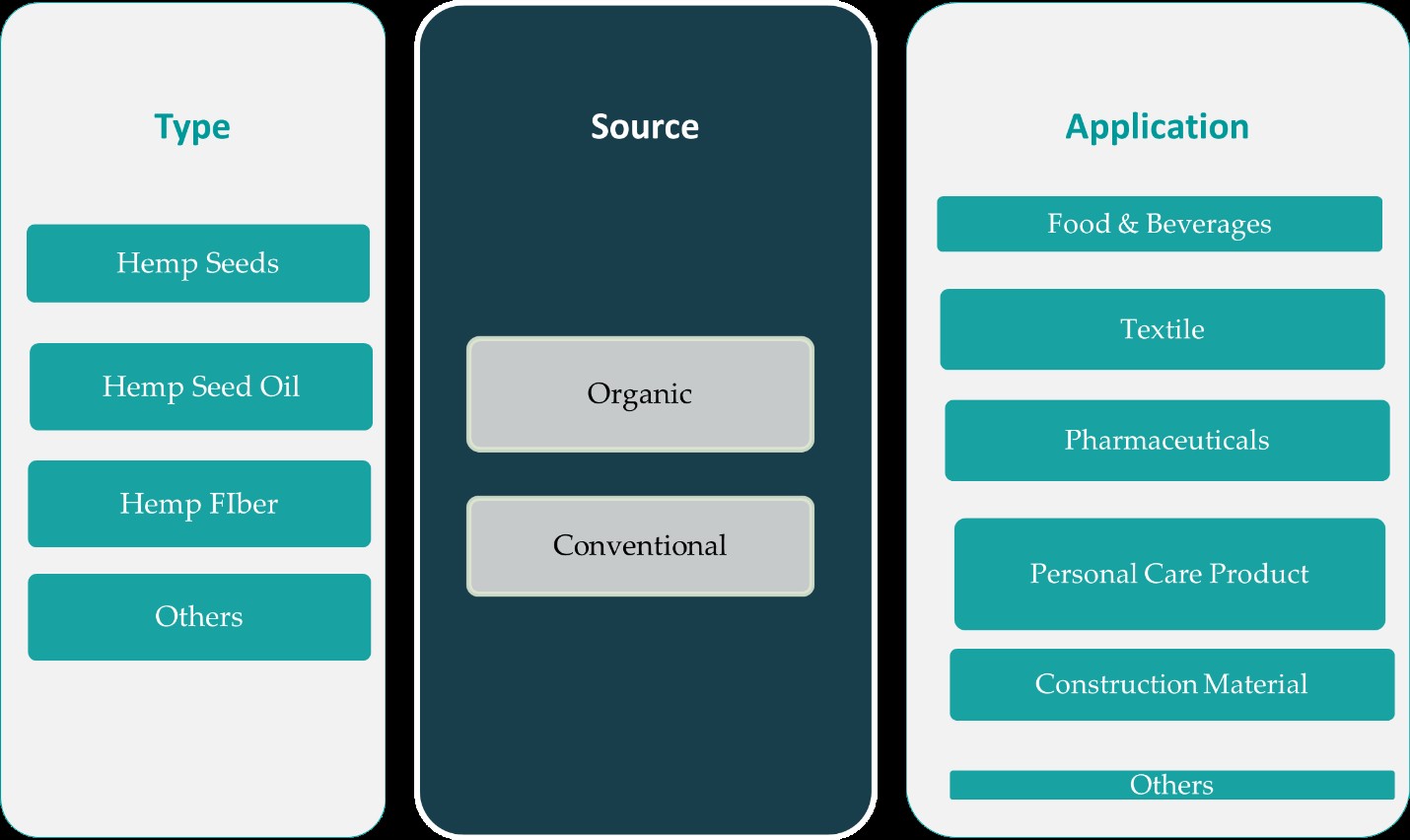

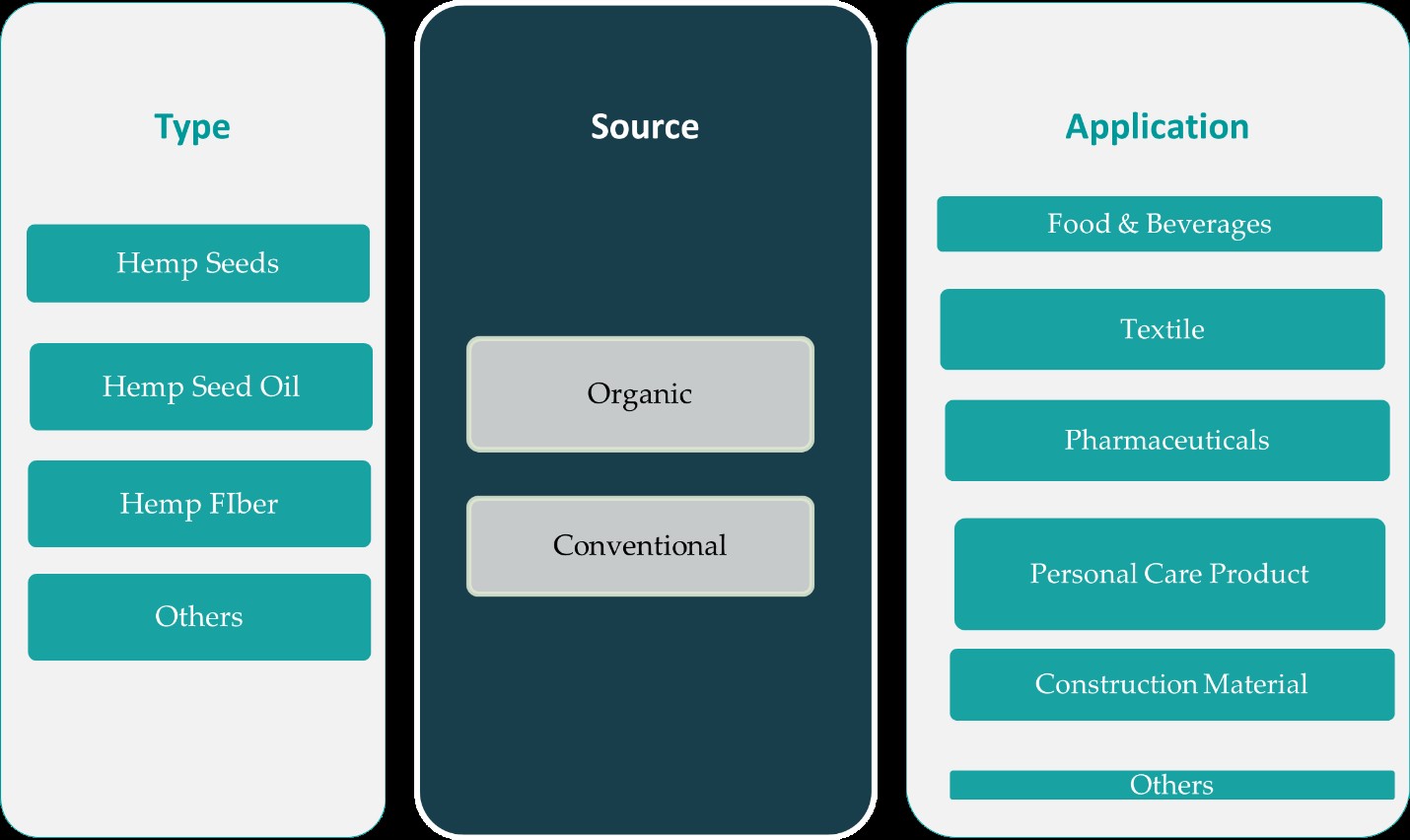

Market Segmentation Analysis:

By Type:

The Asia Pacific industrial hemp market is segmented by type into hemp seed, hemp seed oil, hemp fiber, and others. Among these, hemp fiber holds a dominant position due to its extensive application in textiles, construction materials, and biocomposites. Its strength, durability, and eco-friendly characteristics make it a preferred choice for sustainable fabric and insulation materials. Hemp seeds are also gaining traction in the food and beverage sector, as they are rich in protein, omega-3 fatty acids, and essential nutrients, aligning well with plant-based dietary trends. Hemp seed oil is increasingly used in personal care and wellness products due to its moisturizing and anti-inflammatory properties, driving demand in cosmetics and skincare industries. The “Others” category, which includes cannabidiol (CBD) and industrial applications, is witnessing rising interest as awareness grows around hemp’s versatility. Each of these segments contributes to a diversified market structure, offering multiple growth avenues across industries, supported by consumer demand for natural, sustainable alternatives.

By Source:

Based on source, the market is divided into organic and conventional hemp. The conventional segment currently accounts for the larger market share, owing to its widespread cultivation practices and cost-effective production methods. It is commonly used in industrial applications such as textiles, construction, and bio-composites, where large-scale, efficient supply chains are crucial. However, the organic segment is gaining momentum as consumers increasingly prefer clean-label, chemical-free products in food, personal care, and wellness categories. Organic hemp is particularly popular in health foods and skincare, where product purity and sustainability are valued. Although organic cultivation involves higher production costs and stricter regulatory compliance, the premium pricing and consumer trust it commands make it a high-potential segment. As awareness of organic products and environmental concerns continues to rise across Asia Pacific, the organic hemp segment is expected to grow at a faster pace, supported by evolving consumer preferences and enhanced certification standards across the region.

Segments:

Based on Type:

- Hemp Seed

- Hemp Seed Oil

- Hemp Fiber

- Others

Based on Source:

Based on Application:

- Food & Beverages

- Textile

- Pharmaceuticals

- Construction Material

- Others

Based on the Geography:

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Regional Analysis

China

China holds the largest share in the Asia Pacific industrial hemp market, accounting for approximately 35% of the regional revenue. The country’s dominance is attributed to its long-standing history of hemp cultivation, well-established processing infrastructure, and supportive regulatory framework. China leads in the production of hemp fiber, primarily used in textiles, bioplastics, and construction materials. With robust government backing and significant investments in research and development, the country is also expanding into high-value applications such as CBD extraction and hemp-based wellness products. The large-scale availability of arable land and cost-efficient labor further strengthens China’s competitive advantage. Domestic demand, especially for sustainable textiles and hemp seed-based food products, is rising steadily, while China continues to export industrial hemp to North America and Europe. Its role as both a manufacturing hub and a growing consumer market positions it as a key player in driving regional and global hemp industry growth.

India

India holds an estimated 18% share of the Asia Pacific industrial hemp market and is considered one of the most promising emerging markets in the region. The country has favorable agro-climatic conditions for hemp cultivation, particularly in the northern states like Uttarakhand and Himachal Pradesh, which have already legalized hemp farming under regulated frameworks. India’s industrial hemp sector is gaining traction in both wellness and textile applications. Startups and small enterprises are exploring hemp for nutritional supplements, skincare, and eco-friendly fabrics, catering to a growing urban consumer base seeking natural and sustainable products. The government’s support through pilot programs and research initiatives is creating a conducive environment for private investment. However, the market remains in its early stages and faces regulatory and infrastructure challenges. As awareness and policy clarity improve, India is expected to become a major regional contributor in the coming years.

Australia and New Zealand

Australia, along with New Zealand, captures a combined 14% market share in the Asia Pacific industrial hemp market. These countries have advanced regulatory systems that permit hemp cultivation and commercial use across a variety of segments, including food, beverages, and cosmetics. Australia legalized hemp food products in 2017, which significantly boosted domestic consumption. The market is characterized by high consumer awareness and preference for organic, clean-label, and plant-based products, making it ideal for premium hemp goods. Moreover, companies in Australia are investing in product innovation and expanding export opportunities, particularly in North America and East Asia. Despite limited production capacity compared to larger countries, the region’s strong demand for wellness and environmentally friendly products supports continued market growth.

Southeast Asia

Southeast Asian countries including Thailand, Indonesia, Vietnam, Malaysia, and the Philippines collectively hold around 21% of the regional market share and represent the fastest-growing segment of the Asia Pacific industrial hemp market. Thailand leads the sub-region due to its progressive cannabis and hemp legislation, becoming the first Southeast Asian nation to legalize hemp for industrial and medical purposes. Other countries are gradually exploring similar regulatory frameworks to capitalize on hemp’s economic and environmental potential. The region benefits from favorable climates for cultivation and increasing consumer interest in herbal wellness, sustainable materials, and alternative nutrition. However, limited infrastructure, regulatory uncertainty, and social stigma still pose challenges. As more Southeast Asian governments adopt clear regulations and attract foreign investment, the region is poised for significant growth in hemp-based foods, textiles, and cosmetics over the next decade.

Key Player Analysis

- Green Thumb Industries

- Canopy Growth Corporation

- AURORA CANNABIS INC.

- The Cronos Group

- Ecofibre Ltd

- Curaleaf Holdings, Inc.

- Fresh Hemp Foods Ltd.

- GenCanna

- IND HEMP

- American Hemp

- Hemp, Inc

- Medical Marijuana Inc

- Hemp Oil Canada Inc.

- Industrial Hemp Manufacturing, Inc.

- Others

Competitive Analysis

The competitive landscape of the Asia Pacific industrial hemp market is characterized by the presence of several established global and regional players, each leveraging their strengths in innovation, product diversification, and strategic expansion. Leading companies such as Green Thumb Industries, Canopy Growth Corporation, Aurora Cannabis Inc., The Cronos Group, Ecofibre Ltd, Curaleaf Holdings, Inc., Fresh Hemp Foods Ltd., GenCanna, IND HEMP, American Hemp, Hemp, Inc, Medical Marijuana Inc., Hemp Oil Canada Inc., and Industrial Hemp Manufacturing, Inc. play a significant role in shaping the market dynamics.

These key players focus on developing high-quality hemp-based products across diverse segments including food and beverages, textiles, wellness, and personal care. Most of them are investing heavily in research and development to improve processing technologies and create differentiated offerings. Strategic collaborations, mergers, and acquisitions are commonly adopted to strengthen market presence and regional outreach. Moreover, players are actively entering emerging Asia Pacific markets by aligning with local regulations and consumer needs. With growing demand and evolving regulations, competition is intensifying, encouraging innovation, sustainable practices, and scalable production models across the region. The emphasis on quality, branding, and compliance remains critical for companies to gain a competitive edge in this fast-evolving market.

Recent Developments

- In October 2024, Canopy Growth Corporation acquired Wana, which includes Wana Wellness, LLC, The CIMA Group, LLC, and Mountain High Products, LLC. With this acquisition, Canopy USA holds 100% of Wana’s equity interests. The acquisition will help the company to build a leading brand-focused cannabis company in the US.

- In October 2024, AURORA CANNABIS INC. launched an expanded range of premium medical cannabis oils in Australia in partnership with MedReleaf Australia. Designed to meet diverse patient needs, the new offerings include Aurora THC 25 (Sativa), Aurora THC 25 (Indica), Aurora 12.5:12.5 oil, Aurora 50:50 oil, and Aurora 10:100 oil, all available in 30 ml bottles for physician prescription.

- In June 2024, Curaleaf Holdings, Inc. launched new lines of hemp-derived THC products under its Select and Zero Proof brands. These products will be available across 25 states and the District of Columbia through direct-to-consumer delivery and Curaleaf’s national distribution network.

- In May 2024, The Cronos Group partnered with GROW Pharma, a leading distributor of medicinal cannabis in the UK, to expand its PEACE NATURALS brand into the UK. Through this collaboration, Cronos will supply high-quality, premium cannabis products, ensuring patients in the UK have access to the globally recognized brand PEACE NATURALS.

- In February 2024, RISE Dispensaries, the cannabis retail chain owned by Green Thumb Industries Inc., expanded its presence with the opening of its 15th retail location in Florida and 92nd nationwide. The new store will feature special promotions and complimentary merchandise for its first customers. It opens the company to a much larger reach of its products like chocolate, mints, gummies, and tarts made by its Incredibles brand.

- In January 2023, HempMeds Brasil launched two new full-spectrum products. These new products were created to suit the new requirements of Brazilian doctors who intend to suggest it to their patients.

Market Concentration & Characteristics

The Asia Pacific industrial hemp market demonstrates a moderately concentrated structure, with a mix of global corporations and emerging regional players shaping its competitive environment. Market concentration is higher in countries with established legal frameworks and infrastructure, such as China and Australia, where leading companies dominate through vertical integration and large-scale production capabilities. However, as regulatory clarity improves across other parts of the region, particularly in India and Southeast Asia, new entrants are gradually emerging, contributing to a dynamic and evolving marketplace. The market is characterized by high growth potential, increasing consumer demand for natural and sustainable products, and a strong push toward innovation. Product diversity, ranging from hemp-based food and cosmetics to textiles and bioplastics, reflects the sector’s versatility. While barriers to entry remain in the form of regulatory hurdles and limited awareness, the overall market exhibits strong momentum, driven by favorable trends in health, sustainability, and industrial innovation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific industrial hemp market is expected to witness sustained growth driven by increasing demand for sustainable raw materials.

- Governments across the region are likely to introduce more supportive regulations to promote legal cultivation and processing.

- Investment in advanced processing technologies will improve product quality and operational efficiency.

- Consumer awareness around hemp’s nutritional and wellness benefits is projected to grow significantly.

- Expansion of e-commerce platforms will enhance accessibility and boost product visibility across emerging markets.

- Hemp-based food and beverages will continue gaining traction among health-conscious consumers.

- Industrial applications such as textiles, construction, and bioplastics will see increasing adoption.

- Companies will focus on strategic partnerships and regional expansion to strengthen their market presence.

- Organic hemp production is expected to rise in response to growing demand for clean-label products.

- Southeast Asia will emerge as a high-growth region due to favorable climate and evolving policy frameworks.