Market Overview:

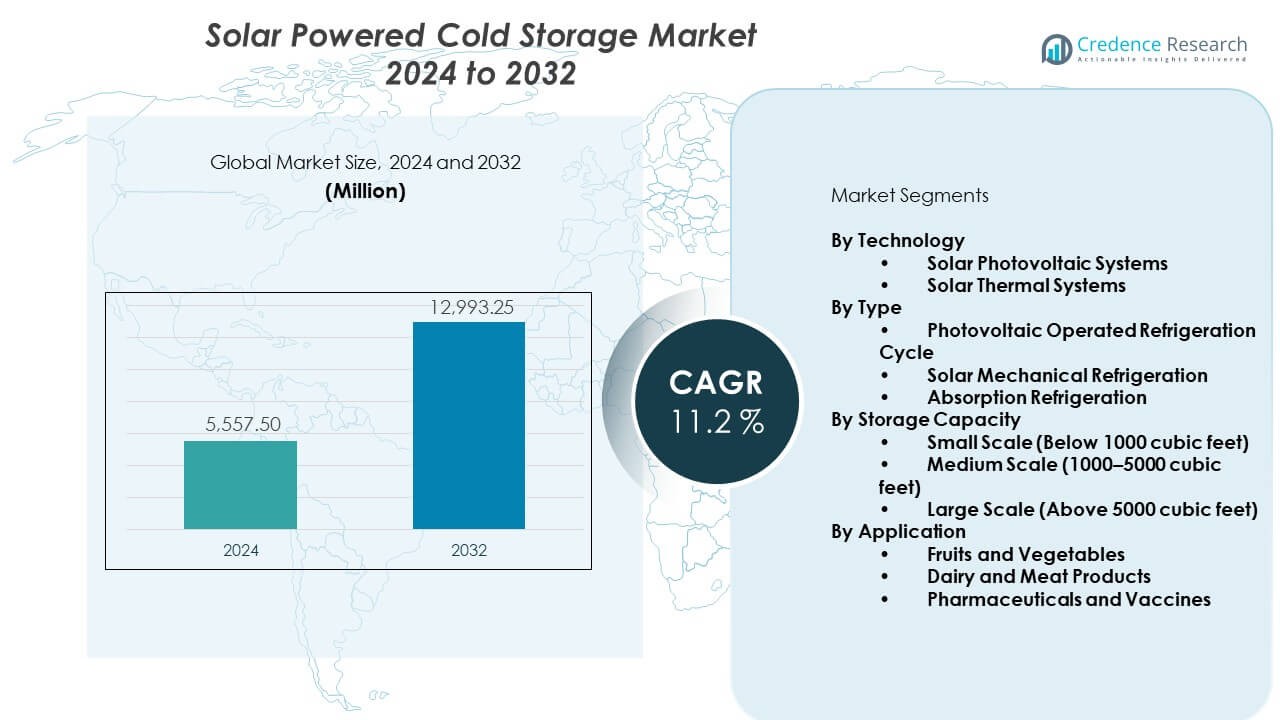

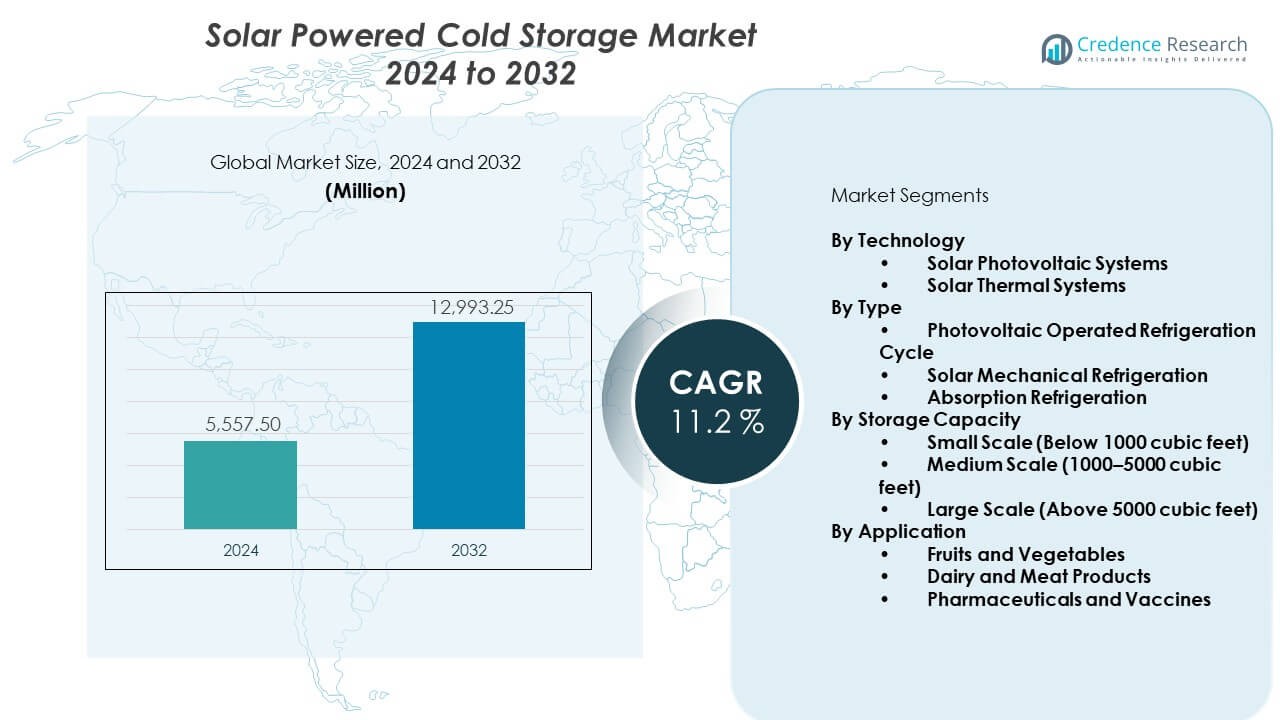

The Solar powered cold storage market is projected to grow from USD 5,557.5 million in 2024 to USD 12,993.25 million by 2032, with a CAGR of 11.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solar-Powered Cold Storage Market Size 2024 |

USD 5,557.5 Million |

| Solar-Powered Cold Storage Market, CAGR |

11.2% |

| Solar-Powered Cold Storage Market Size 2032 |

USD 12,993.25 Million |

The market gains momentum due to wider need for energy-secure cold chains. Solar cooling helps farmers reduce spoilage during transport and storage. Governments support renewable cold storage to improve rural supply chains. Companies create stronger designs to improve uptime in high-heat zones. Food exporters use these systems to protect produce during early handling. Rising fruit and vegetable trade drives wider use across developing regions. Better battery storage improves reliability during low sunlight periods.

North America leads due to strong solar adoption and wider cold chain penetration. Europe grows due to strict food safety rules and support for clean storage designs. Asia Pacific emerges as a major growth hub due to high farm output and poor rural grid access. African countries adopt solar cooling fast due to heavy post-harvest losses. Latin America expands use across fruit and dairy clusters. Middle East nations deploy systems to handle extreme heat and improve food security.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Solar powered cold storage market stands at USD 5,557.5 million in 2024 and is projected to reach USD 12,993.25 million by 2032, growing at a CAGR of 11.2% during the period.

- Asia Pacific (34%), North America (28%), and Europe (25%) hold the highest shares due to strong solar adoption, large farm output, and well-developed cold chain infrastructure.

- Asia Pacific is the fastest-growing region with a 34% share, driven by weak grid access, high agricultural density, and rising need for off-grid cooling.

- Fruits and vegetables hold the leading segment share due to high perishability and strong first-mile cooling demand.

- Small-scale systems lead capacity distribution as they support village-level storage and smallholder farming networks.

Market Drivers:

Rising Demand for Reliable Cold Chains in Off-Grid Agriculture

The Solar powered cold storage market benefits from rapid demand for dependable farm storage in remote zones. Farmers rely on solar units to cut losses during peak harvest periods. Strong adoption improves shelf life for fruits and vegetables across rural belts. Governments promote solar storage to stabilize food supply chains in weaker grid regions. Technology firms build durable systems that work under harsh climate conditions. Cold chain gaps drive faster use of compact solar modules across small farms. Exporters push adoption to protect produce before transport. It strengthens farm income stability by reducing spoilage. The shift supports long-term sector growth.

- For instance, SokoFresh in Kenya reduced post-harvest loss to as low as 2% (compared to the 30-40% loss common across Kenya’s horticulture value chains) while increasing farmers’ income by 20% on average, serving over 14,500 farmers since its 2020 pilot. The shift supports long-term sector growth.

Expanding Push for Clean Energy Systems Across Food Supply Chains

Policy support lifts installations across horticulture hubs in many countries. The Solar powered cold storage market grows due to wide interest in renewable cooling options. Food companies deploy solar units to meet sustainability goals and reduce diesel reliance. High fuel savings encourage faster replacement of old generators in rural zones. Cold room operators use hybrid solar models to improve uptime. Remote villages gain better access to cooling for dairy and meat products. Agricultural cooperatives invest in shared facilities to support smallholder networks. It helps reduce operating risks tied to unstable grid supply. Stronger climate policies widen adoption.

- For instance, Selco Foundation deployed approximately 69 solar-powered cold storage units ranging from 2 MT to 30 MT capacity across 11 states of India, primarily adopted by Farmer Producer Organizations and cooperatives since 2018. It helps reduce operating risks tied to unstable grid supply.

Rapid Shift Toward Cost-Efficient Storage for High-Value Perishables

Producers of berries, spices, and dairy push demand for solar storage to protect delicate products. The Solar powered cold storage market moves forward due to rising focus on quality retention. Cold room networks expand near farm clusters to limit spoilage during first-mile handling. Solar systems lower operating costs for growers in regions with long sunlight hours. Food distributors invest in mobile solar units for flexible deployment. Many users choose solar to offset maintenance issues linked to diesel engines. It supports continuous preservation even during fuel shortages. Technology upgrades improve energy output on cloudy days. Demand grows across niche crop segments.

Growing Integration of Advanced Batteries and Remote Monitoring Tech

Renewable energy storage improves energy reliability for rural cold rooms. The Solar powered cold storage market advances due to strong battery innovation. Operators deploy lithium-based systems that enable longer cooling hours at night. Remote monitoring platforms help track performance metrics and reduce downtime. Cold chain companies use analytics to predict maintenance needs. Better control systems support stable temperatures under fluctuating sunlight. It encourages higher adoption among organized farm groups. Solar units with IoT controls build confidence among new users. Continuous tech upgrades boost market visibility.

Market Trends:

Rising Use of Modular and Portable Solar Cold Rooms for Flexible Deployment

Users adopt portable units to serve shifting farm locations during different harvest seasons. The Solar powered cold storage market moves toward modular setups that scale with farm output. Mobile systems support daily relocation across market yards. Seasonal crop clusters gain value from flexible deployment patterns. Manufacturers design compact models that fit small land areas. It supports stronger access to cold storage in dense farm belts. Lightweight roof-mounted structures help expand reach. Rapid assembly improves asset use across regions. Portability becomes a strategic trend.

- For instance, Aldelano Solar ColdBox units ship fully assembled and require minimal setup time, featuring drive-in T-floors that support forklift access and facilitate air circulation, with complete unit handling as a standard shipping container. Portability becomes a strategic trend.

Growing Preference for Hybrid Solar-Grid Cold Storage Designs

Cold chain operators select hybrid setups to improve reliability during cloudy periods. The Solar powered cold storage market gains traction due to demand for stable power. Hybrid models enable smooth switching between solar and grid supply. Users value lower downtime during heavy storage cycles. Many operators prefer hybrid control panels for balanced energy use. It enhances storage consistency for dairy, fish, and meat. Hybrid adoption grows in peri-urban belts with partial grid access. Improved inverter designs support better energy flow. This trend boosts overall performance.

- For instance, off-grid/hybrid inverters such as the Selectronic SP PRO and Victron Multiplus achieve maximum efficiency of 97.6% with no reduced power output in backup mode, and SolarEdge inverters allow DC/AC ratios up to 220% on 10kW inverters where excess PV production flows into batteries rather than being clipped. This trend boosts overall performance.

Increasing Digitalization of Storage Assets Through IoT Platforms

Cold room owners deploy sensors for real-time temperature control. The Solar powered cold storage market benefits from strong digital tracking interest. IoT platforms reduce product loss during power fluctuations. Cloud tools help manage storage data across remote sites. Users lower maintenance effort with automated diagnostics. It strengthens predictability during high-load hours. Data dashboards guide operators toward efficient energy use. Digital adoption spreads through cooperatives and FPO networks. The trend supports long-term storage quality.

Rising Adoption of Community-Owned Solar Storage Clusters

Village-level groups adopt shared solar cold rooms to support small producers. The Solar powered cold storage market sees rising momentum for community models. Shared assets reduce the financial burden on individual farmers. Users gain better market access due to improved produce quality. Community units improve food safety in rural distribution channels. It supports cooperative-led trading networks. Local groups use shared systems to build stronger bargaining power. Many regions replicate these models due to visible benefits. Adoption strengthens local cold chain ecosystems.

Market Challenges Analysis:

High Initial Capital Cost and Limited Financing Options for Rural Users

Capital intensity creates barriers for small farmers in remote zones. The Solar powered cold storage market faces pressure due to limited credit support. Many rural banks hesitate to finance solar cold rooms without steady income proof. Users struggle with down payments for advanced units. It reduces adoption speed across underserved belts. Long payback periods discourage individual ownership. Spare parts costs increase operational pressure in some regions. Training gaps limit proper system use. Slow financial access restricts faster transformation.

Performance Variations Under Harsh Climate Conditions and Operational Skill Gaps

High heat zones challenge the stability of cooling cycles during peak seasons. The Solar powered cold storage market experiences performance issues when sunlight drops. Dust accumulation reduces panel efficiency in dry regions. Many users lack technical skill for maintenance tasks. It leads to longer downtime for farm-level installations. Battery degradation also impacts long-term reliability. Operators face difficulties in sourcing trained technicians in rural areas. High load conditions stress cooling components. These hurdles slow market expansion.

Market Opportunities:

Growing Demand for Decentralized Solar Cooling Across High-Output Farm Clusters

Rural producers seek decentralized systems to protect harvests near fields. The Solar powered cold storage market gains opportunity through expanding horticulture output. Users prefer solar units for low operating cost and strong uptime. Many global programs promote renewable storage for smallholders. Community buyers show rising interest in shared cold rooms. It supports farmers who need reliable cooling for export crops. Wider sunlight availability strengthens project feasibility. The opportunity favors regions with seasonal surpluses.

Strong Push for Solar Innovation Through Better Batteries and Efficient Panels

Technology firms invest in improved solar panels with higher energy yields. The Solar powered cold storage market benefits from better storage chemistries. New systems deliver longer cooling during night hours. Energy-efficient compressors improve output. It gives operators confidence to scale usage. Many pilot programs test AI-based controllers for better stability. Strong R&D supports faster adoption. These advancements widen future project potential.

Market Segmentation Analysis:

By Technology

The Solar powered cold storage market expands due to strong adoption of solar photovoltaic systems that deliver steady power output in rural zones. Solar thermal systems gain interest in regions with high radiation levels and lower grid access. Users prefer PV-driven setups for easier installation and wider compatibility with modern compressors. Thermal units support applications where heat-based absorption cycles fit local climate patterns. It supports reliable cooling across varied farm environments and helps reduce dependence on diesel units.

- For instance, a solar-assisted absorption chiller integrated with evacuated glass tube collectors covering 200 m² area achieved collector efficiency of 0.32, heat removal factor of 0.87, and total heat loss coefficient of 2.99 W/m²K, supplying 65% of the refrigeration unit’s yearly thermal energy requirements. It supports reliable cooling across varied farm environments and helps reduce dependence on diesel units.

By Type

Photovoltaic operated refrigeration cycles lead due to strong efficiency and better temperature control. Solar mechanical refrigeration gains traction in high-output farms that need stable cooling in remote belts. Absorption refrigeration supports areas with high sunlight and limited electrical access. Each system type aligns with different crop requirements and ambient conditions. It supports broader deployment across horticulture, dairy, and meat clusters.

- For instance, the U.S. solar mechanical refrigeration segment benefits from ease of integrating solar panels into existing mechanical refrigeration infrastructure, offering a straightforward and cost-effective retrofit path that minimizes the need for major system overhauls while offsetting energy consumption.

By Storage Capacity

Small-scale units below 1000 cubic feet support village-level users and smallholder groups. Medium-scale systems between 1000 and 5000 cubic feet serve cooperatives and regional collection centers. Large-scale units above 5000 cubic feet support bulk storage across major farm hubs and food distribution networks. Capacity selection depends on crop volume, handling cycles, and supply chain needs. It strengthens cold chain availability across fragmented rural markets.

By Application

Fruits and vegetables dominate due to high sensitivity to temperature shifts. Dairy and meat products gain stable storage support in regions with weak grid supply. Pharmaceuticals and vaccines use solar units to maintain strict temperature ranges during transport and village-level distribution. Each application demands reliable performance under fluctuating weather conditions. It drives steady expansion across healthcare and agriculture sectors.

Segmentation:

By Technology

- Solar Photovoltaic Systems

- Solar Thermal Systems

By Type

- Photovoltaic Operated Refrigeration Cycle

- Solar Mechanical Refrigeration

- Absorption Refrigeration

By Storage Capacity

- Small Scale (Below 1000 cubic feet)

- Medium Scale (1000–5000 cubic feet)

- Large Scale (Above 5000 cubic feet)

By Application

- Fruits and Vegetables

- Dairy and Meat Products

- Pharmaceuticals and Vaccines

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a market share of 28% due to strong solar adoption and mature cold chain networks. The solar powered cold storage market grows across farming belts that seek clean and low-cost cooling solutions. Rural producers use solar units to protect dairy and fresh produce during long transport cycles. State programs support renewable storage for small and mid-scale farms. Technology providers deploy advanced PV systems that ensure higher uptime. It benefits from strong distribution hubs and wider integration of digital monitoring tools.

Europe

Europe accounts for 25% of the global share, driven by strict food safety rules and high emphasis on renewable infrastructure. The region promotes solar cooling to reduce carbon emissions in food distribution. Farmers use thermal and PV solutions to protect horticulture output across southern regions with long sunlight hours. Cold chain operators integrate hybrid systems to maintain stable temperatures during variable weather. Many governments fund rural solar projects to improve storage reliability. It gains support from policy frameworks that encourage low-emission storage designs.

Asia Pacific, Latin America, and Middle East & Africa

Asia Pacific leads globally with a 34% share due to high agricultural output and weak grid access in many rural areas. The solar powered cold storage market expands across India, China, and Southeast Asia where farmers need low-cost storage to reduce harvest losses. Latin America holds 8%, supported by rising fruit exports and deployment of field-level solar units. Middle East & Africa secure 5%, driven by demand for cooling in hot climates and limited electricity access. Countries across Africa adopt portable units to cut food waste during first-mile handling. It gains momentum across emerging regions due to wide sunlight availability and growing need for decentralized storage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Sundanzer

- DGridEnergy, LLC

- Promethean Power Systems

- Viking Cold Solutions, Inc.

- GoSun

- PLUSS

- Aldelano Solar Solutions

- Coldwell Solar

- Ecozen Solutions Pvt. Ltd.

- ColdHubs Ltd.

- Sunshine Solar Cold Storage

- Ice Make Refrigeration Ltd.

- Inspira Farms Ltd.

- Contained Energy Systems B.V.

- Ahata Industries (India) Pvt. Ltd.

Competitive Analysis:

The Solar powered cold storage market features active competition driven by technology upgrades, regional expansion, and strong interest in off-grid cooling solutions. Key companies focus on advanced PV systems, higher battery efficiency, and compact refrigeration modules to improve uptime in remote zones. Firms strengthen portfolios with hybrid systems that support stable temperatures during variable weather. Several players expand through rural projects that support farm cooperatives and smallholder networks. It gains momentum from rising demand for decentralized cold chains across agriculture and healthcare. Competitors invest in IoT controls and remote monitoring to deliver better performance insights. New entrants build portable units that support flexible deployment across multiple crop clusters. The market moves toward differentiated solutions tailored to farm scale and product type.

Recent Developments:

- In October 2025, Mondelez India announced a strategic investment in Promethean Power Systems through its global impact investment platform. The investment aims to scale Promethean’s proprietary heat-pump, thermal-storage, and monitoring technology to reduce industrial greenhouse gas emissions. The company reports its platform has abated over 100,000 tonnes of CO2 to date, reflecting the investor’s strategy to embed sustainability across its supply chain and support commercially viable low-carbon solutions.

- In September 2025, Koolboks (based in Nigeria and France) raised USD 11 million to scale its solar freezer business, having deployed over 10,000 units in 25 countries. InspiraFarms in Kenya raised USD 1.09 million in 2024 to expand off-grid projects.

- In June 2025, PLUSS Advanced Technologies announced a strategic collaboration with Ecodome Logistics to introduce validated, IoT-enabled Reusable PCM (Phase Change Material) boxes for the safe transport of temperature-sensitive medicines and biologicals across India. This partnership reduces vaccine and biologic waste by up to 25%, cuts carbon emissions from single-use Styrofoam by up to 80%, and ensures complete shipment visibility that adheres to strict regulatory requirements. The rollout began in key pharmaceutical hubs including Hyderabad, Mumbai, Ahmedabad, Pune, and the National Capital Region.

- In January 2025, Ecozen Solutions secured over USD 23 million in debt funding to expand its product portfolio. The company plans to introduce new technologies in 2025 that cater to the evolving needs of communities and businesses. With the ongoing success of its solar-powered irrigation systems and cold storage units, Ecozen is well-positioned to explore new market opportunities, furthering its mission to drive climate-smart solutions globally.

Report Coverage:

The research report offers an in-depth analysis based on By Technology, By Type, By Storage Capacity, and By Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Wider use of solar-hybrid systems across rural cold chain infrastructure.

- Faster adoption of battery technologies that extend night cooling hours.

- Stronger demand from horticulture belts with frequent post-harvest losses.

- Expansion of portable solar cold rooms for field-level deployment.

- Higher integration of IoT platforms for real-time temperature control.

- Growth of community-owned storage hubs supporting smallholder networks.

- New models designed for vaccine and pharmaceutical cooling in remote zones.

- Rising investment in PV systems engineered for humid and high-heat climates.

- Stronger partnership models between agri-cooperatives and technology firms.

- Increased focus on sustainable storage systems that reduce diesel dependence.