Market Overview

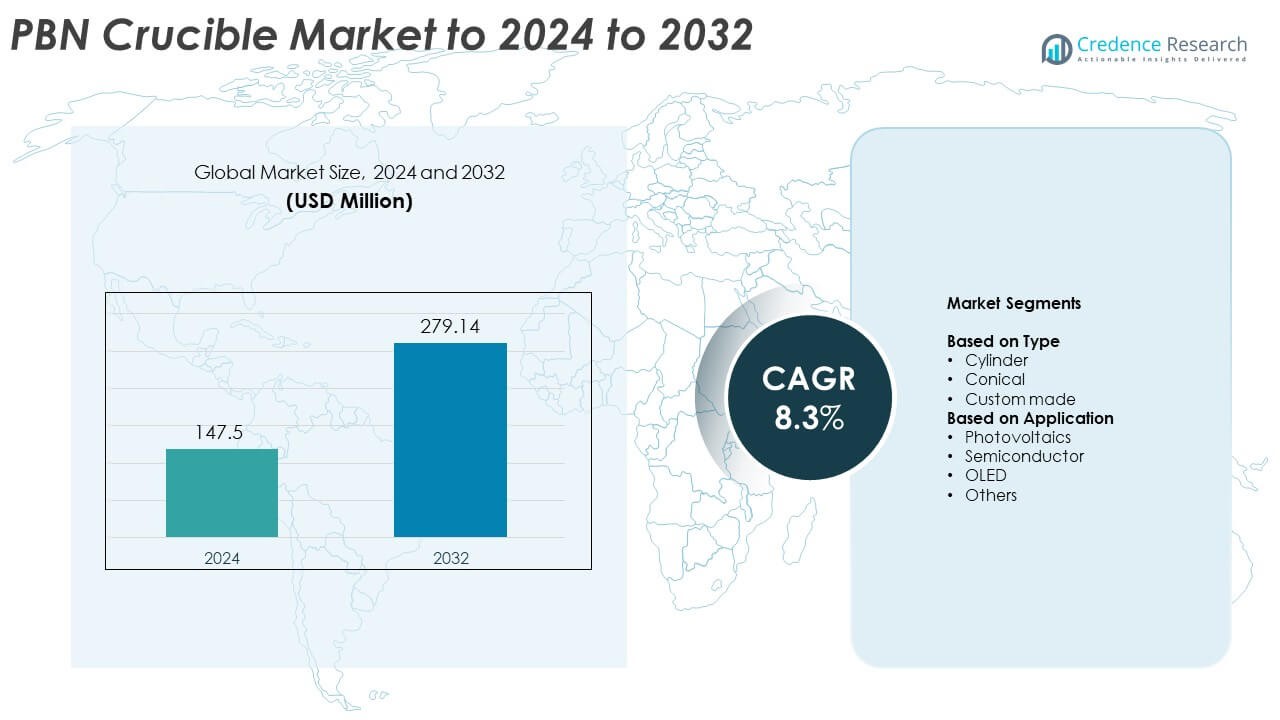

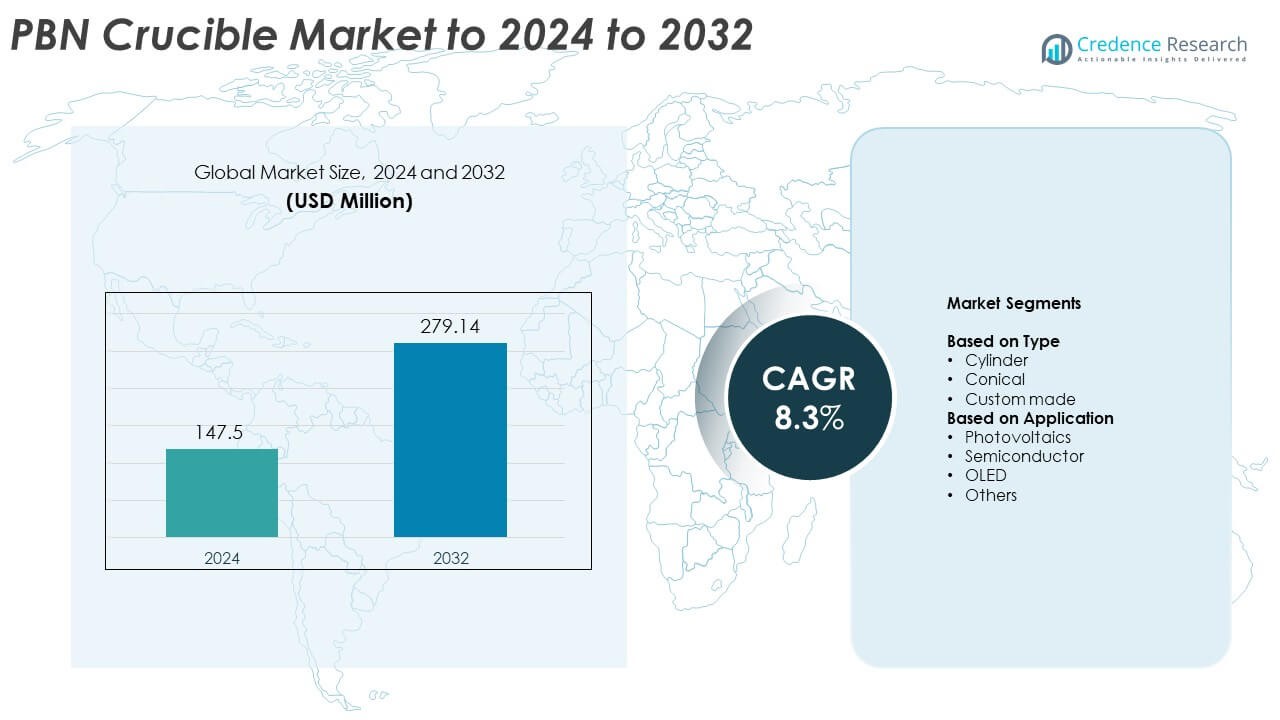

PBN Crucible Market size was valued at USD 147.5 million in 2024 and is anticipated to reach USD 279.14 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PBN Crucible Market Size 2024 |

USD 147.5 Million |

| PBN Crucible Market , CAGR |

8.3% |

| PBN Crucible Market Size 2032 |

USD 279.14 Million |

The PBN Crucible Market is shaped by leading companies such as METTLER TOLEDO, Riber, SciTECH Solutions, Morgan Advanced Materials, Eberl MBE-Komponenten GmbH, Shin-Etsu MicroSi, Inc., Vital Materials Co., Limited, Stanford Advanced Materials, Luxel Corporation, and Veeco Instruments Inc. These companies compete through high-purity CVD processing, improved thermal performance, and tailored crucible geometries for semiconductor and photovoltaic applications. Asia Pacific stands as the leading region with about 31% share in 2024, supported by extensive wafer fabrication and display manufacturing. North America follows with around 37% share due to strong R&D activity and advanced semiconductor facilities. Europe maintains steady demand with nearly 24% share across research and energy-focused industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The PBN Crucible Market reached USD 147.5 million in 2024 and will rise to USD 279.14 million by 2032, growing at a CAGR of 8.3%.

- Strong demand from semiconductor manufacturing drives market growth as the segment holds about 52% share due to high-purity needs in MBE and epitaxy processes.

- Rising adoption in OLED and photovoltaic production strengthens market trends as manufacturers seek stable, contamination-free high-temperature crucibles.

- Competition remains active as leading companies focus on higher purity levels, improved CVD processes, and custom-geometry crucibles, increasing product differentiation.

- Asia Pacific accounts for about 31% share, North America holds nearly 37%, and Europe captures close to 24%, highlighting broad regional adoption across advanced material fabrication.

Market Segmentation Analysis:

By Type

The cylinder type leads the PBN Crucible Market with about 48% share in 2024 due to its broad use in high-temperature evaporation and crystal growth tasks. Manufacturers favor cylinder designs because they provide uniform heat distribution and stable thermal performance in vacuum and MBE systems. Conical crucibles gain steady demand from precision material processing, while custom-made formats grow in niche research setups that require specialized geometry. Adoption rises as industries seek crucibles with high purity, low porosity, and improved mechanical strength for advanced deposition workflows.

- For instance, Applied Materials disclosed that it had over 52,000 semiconductor, display, and other manufacturing systems installed worldwide as of their 2023 Form 10-K filing, demonstrating a verifiable metric of an installed base.

By Application

The semiconductor segment dominates this category with nearly 52% share in 2024, supported by rising wafer fabrication, epitaxy processes, and high-purity material evaporation. Chipmakers prefer PBN crucibles because the material withstands extreme temperatures, maintains chemical inertness, and ensures contamination-free thin-film formation. Photovoltaics record stable growth as solar producers adopt MOCVD and PVD systems that rely on precise thermal control. OLED and other applications expand as display and optoelectronic manufacturers scale production of high-efficiency device architectures.

- For instance, AEM Deposition’s website lists the purity specification for its PBN crucibles as 99.99% or higher

Key Growth Drivers

Rising Demand from Semiconductor Manufacturing

Expanding semiconductor production drives strong adoption of PBN crucibles due to their high purity, thermal stability, and resistance to chemical reaction during epitaxy and MBE processes. Fabrication lines prefer PBN because the material supports consistent thin-film deposition and reduces contamination risk. Growing investments in advanced logic and memory nodes strengthen demand as manufacturers require reliable crucibles for high-temperature environments. The shift toward wide-bandgap materials also pushes the need for robust crucible performance across diverse process conditions.

- For instance, TSMC aimed to expand its 3nm wafer capacity to approximately 90,000 to 100,000 wafers per month by the end of 2024, rising from about 50,000-60,000 wafers per month at the end of 2023.

Expansion of Photovoltaic and Power Electronics Production

Growth in photovoltaic and power electronics industries boosts PBN crucible use in evaporation and crystal growth systems. Solar cell producers rely on PBN to maintain uniform heat distribution, enabling efficient deposition of absorber layers and high-quality crystal formation. Power electronics manufacturing increases adoption as SiC and GaN devices require stable and inert containers for high-temperature synthesis. Rising deployment of renewable-energy systems continues to lift consumption across global production facilities.

- For instance, LONGi reported 125.42 gigawatts of monocrystalline wafer shipments globally in 2023.

Increasing Preference for High-Purity, Non-Reactive Materials

Demand grows for high-purity materials in processes that cannot tolerate contamination or thermal degradation, positioning PBN as a preferred crucible choice. Its non-reactive surface, low porosity, and strong mechanical integrity support consistent product output in sensitive deposition environments. Industries shift toward materials that protect device performance and extend equipment lifespan. This trend increases reliance on PBN crucibles in research labs, pilot fabrication lines, and full-scale industrial operations.

Key Trends and Opportunities

Rising Use in OLED and Advanced Display Fabrication

OLED manufacturers adopt more PBN crucibles to support precise evaporation of organic and metal materials used in display layers. PBN helps maintain stable heating profiles and prevents reactions that compromise pixel uniformity. Expanding production of flexible and high-resolution displays enhances opportunities for crucible suppliers. Growth in consumer electronics, automotive displays, and wearable devices further accelerates demand across global fabrication setups.

- For instance, Samsung Display reports cumulative shipments above 1 million QD-OLED monitor panels.

Shift Toward Custom Geometry and Application-Specific Designs

Producers develop customized PBN crucibles to meet specific thermal and geometric requirements in advanced manufacturing. Custom shapes improve compatibility with next-generation vacuum chambers, MBE sources, and thermal evaporation tools. Demand increases as research and industrial users seek crucibles optimized for unique deposition conditions and high-efficiency material consumption. This shift opens new design and engineering opportunities for specialized manufacturers.

- For instance, Ferrotec’s EV M-10 e-beam source supports large-capacity, customer-specified crucible designs.

Integration with Next-Generation Deposition Technologies

Advancements in deposition systems, including higher-temperature epitaxy and ultra-clean vacuum processes, increase the need for crucibles with enhanced performance. PBN’s durability and inert behavior align with these emerging technologies, making it a key enabler of next-generation device manufacturing. Companies adopt improved production methods to deliver longer-lasting crucibles that support new semiconductor and photonic architectures.

Key Challenges

High Production Costs and Complex Manufacturing Processes

PBN crucibles remain expensive due to complex manufacturing steps, including high-temperature CVD processes and tight purity controls. These requirements raise production costs and limit availability for price-sensitive applications. Smaller manufacturers face difficulty scaling operations while maintaining consistency in purity and structural integrity. The cost barrier restricts adoption among emerging producers seeking lower-priced alternatives for non-critical uses.

Limited Supplier Base and Supply Chain Dependence

A small number of specialized companies dominate PBN crucible production, creating supply chain dependency for semiconductor and photovoltaic manufacturers. Fluctuations in raw material availability or production capacity disrupt timely deliveries. Growing demand magnifies pressure on existing suppliers, leading to longer lead times and limited customization flexibility. This challenge pushes users to seek diversified sourcing while relying heavily on a constrained global supply network.

Regional Analysis

North America

North America holds about 37% share in the PBN Crucible Market in 2024, supported by strong semiconductor fabrication, advanced research facilities, and rapid adoption of high-purity materials. Growth in epitaxy, MBE processes, and wafer-level developments strengthens demand across the United States. Increasing investments in compound semiconductor production, driven by rising use of SiC and GaN devices, further expand adoption. The region benefits from a mature ecosystem that values thermal stability and contamination-free processing, making PBN crucibles a preferred choice for high-performance manufacturing environments.

Europe

Europe accounts for nearly 24% share of the PBN Crucible Market in 2024, driven by expanding photovoltaic manufacturing, power electronics development, and research-grade thin-film deposition. Countries such as Germany and France lead usage due to strong R&D activity and advanced material science programs. Increased focus on clean energy technologies boosts crucible adoption for precise thermal evaporation tasks. Demand also grows from the region’s semiconductor supply chain, where reliability, purity, and inert processing conditions remain critical for next-generation device fabrication.

Asia Pacific

Asia Pacific dominates several application areas and holds about 31% share in 2024, supported by the world’s largest semiconductor and electronics manufacturing base. China, Japan, South Korea, and Taiwan drive high consumption due to their strong fabrication capacity and rapid scaling of display and photovoltaic production. Rising investment in advanced deposition methods enhances reliance on PBN crucibles. The region’s fast industrialization and focus on high-efficiency materials further elevate market growth, positioning Asia Pacific as a critical hub for demand and production.

Latin America

Latin America captures around 5% share of the PBN Crucible Market in 2024, with demand gradually rising from developing electronics, renewable energy projects, and research institutions. Growth remains steady as countries expand photovoltaic deployment and adopt high-purity materials for precision evaporation tasks. Brazil and Mexico contribute most of the regional uptake due to their increasing involvement in materials processing and industrial R&D. Although adoption is moderate, modernization of manufacturing capabilities continues to support long-term market expansion.

Middle East & Africa

Middle East & Africa holds nearly 3% share in 2024, with demand primarily driven by emerging semiconductor assembly units, advanced research setups, and expanding renewable-energy projects. Countries in the Gulf region invest in high-technology infrastructure, which increases the adoption of high-purity crucibles for specialized material processing. Growth remains gradual, but rising interest in photovoltaic manufacturing and advanced materials research improves long-term prospects. The market expands steadily as more industries shift toward contamination-free and thermally stable crucible materials.

Market Segmentations:

By Type

- Cylinder

- Conical

- Custom made

By Application

- Photovoltaics

- Semiconductor

- OLED

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The PBN Crucible Market features active competition among METTLER TOLEDO, Riber, SciTECH Solutions, Morgan Advanced Materials, Eberl MBE-Komponenten GmbH, Shin-Etsu MicroSi, Inc., Vital Materials Co., Limited, Stanford Advanced Materials, Luxel Corporation, and Veeco Instruments Inc. Companies compete through advancements in high-purity material processing, improved thermal stability, and enhanced crucible durability for demanding semiconductor and photovoltaic applications. Manufacturers focus on refining CVD processes to deliver uniform density and lower porosity, which strengthens compatibility with MBE, MOCVD, and high-temperature evaporation systems. Several players invest in automated production methods to improve consistency across batch outputs, reducing defects and extending crucible lifespan. Firms also expand custom-design capabilities as research labs and device manufacturers require application-specific geometries tailored to next-generation deposition chambers. Strategic partnerships with semiconductor fabs and research institutes help suppliers align product development with evolving industry needs. Growing demand for contamination-free processing continues to intensify competition across global markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- METTLER TOLEDO

- Riber

- SciTECH Solutions

- Morgan Advanced Materials

- Eberl MBE-Komponenten GmbH

- Shin-Etsu MicroSi, Inc.

- Vital Materials Co., Limited

- Stanford Advanced Materials

- Luxel Corporation

- Veeco Instruments Inc.

Recent Developments

- In 2025, Vital Materials announced its participation in OFC 2025, showcasing its advancements in specialty functional materials, including PBN crucibles used in semiconductor and advanced technology manufacturing.

- In 2025, Stanford Advanced Materials highlighted its extensive experience in manufacturing and supplying high-quality PBN crucibles, targeting applications in research, semiconductor crystal growth, and analytical chemistry.

- In 2022, Morgan Advanced Materials introduced a new line of high-purity PBN crucibles optimized for GaN crystal growth.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as semiconductor fabs expand advanced node production worldwide.

- Adoption will grow in SiC and GaN device manufacturing due to high-temperature needs.

- Photovoltaic producers will increase usage as thin-film and high-efficiency cell designs scale.

- OLED and display fabrication growth will boost reliance on high-purity crucibles.

- Custom-shaped crucibles will see stronger demand for next-generation deposition chambers.

- Research labs will adopt more PBN units for precision material studies and pilot lines.

- Manufacturers will invest in improved CVD processes to enhance purity and durability.

- Supply chain diversification will gain priority due to limited global suppliers.

- Automation in deposition tools will increase demand for stable and long-life crucibles.

- Growth in power electronics will push broader adoption across high-temperature synthesis.