| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Plastic Welding Equipment Market Size 2023 |

USD 3,373.08 Million |

| Asia Pacific Plastic Welding Equipment Market, CAGR |

8.47% |

| Asia Pacific Plastic Welding Equipment Market Size 2032 |

USD 6,465.63 Million |

Market Overview

Asia Pacific Plastic Welding Equipment Market size was valued at USD 3,373.08 million in 2024 and is anticipated to reach USD 6,465.63 million by 2032, at a CAGR of 8.47% during the forecast period (2024-2032).

The Asia Pacific plastic welding equipment market is driven by growing demand across industries such as automotive, electronics, and packaging, where efficient and cost-effective joining solutions are essential. The rise in automotive production and the increasing adoption of lightweight materials to improve fuel efficiency are particularly significant factors. Additionally, the expansion of infrastructure development and the growing need for durable and safe plastic components in construction and healthcare sectors further fuel market growth. Technological advancements in welding methods, such as ultrasonic and laser welding, enhance precision, speed, and quality, driving innovation in the industry. The increasing focus on sustainability and eco-friendly practices also supports the use of plastic welding equipment, as it reduces material waste and supports recycling initiatives. The market is expected to benefit from these trends, alongside the increasing adoption of automation and smart technologies in manufacturing processes.

The Asia Pacific plastic welding equipment market is characterized by diverse regional dynamics, with key players operating across various countries. China, Japan, South Korea, and India are the major contributors to the market, driven by strong manufacturing industries, particularly in automotive, electronics, and packaging. These regions are witnessing increased adoption of advanced plastic welding technologies, such as ultrasonic and laser welding, to meet the growing demand for precision and efficiency. Key players in the region include Emerson Electric Co., Leister Technologies AG, Dukane Corporation, and Herrmann Ultraschalltechnik GmbH & Co. KG, among others. These companies are continuously innovating to offer high-performance, automated systems that cater to diverse industrial applications. As demand for plastic welding solutions grows in infrastructure, medical devices, and consumer electronics, these leading players are well-positioned to capitalize on the expanding opportunities across the Asia Pacific market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Asia Pacific plastic welding equipment market was valued at USD 3,373.08 million in 2024 and is expected to reach USD 6,465.63 million by 2032, growing at a CAGR of 8.47%.

- The global plastic welding equipment market was valued at USD 11,340.00 million in 2024 and is projected to reach USD 19,842.36 million by 2032, growing at a CAGR of 7.24% from 2024 to 2032.

- The automotive and electronics industries are driving significant demand for plastic welding technologies, particularly for lightweight and durable components.

- Technological advancements, such as ultrasonic and laser welding, are becoming increasingly popular for their precision, speed, and efficiency.

- Key players include Emerson Electric Co., Leister Technologies AG, and Herrmann Ultraschalltechnik GmbH & Co. KG, competing through innovation and offering automated solutions.

- High initial investment costs and the need for skilled labor remain key restraints to market growth.

- The market is growing across regions like China, Japan, South Korea, and India, with increasing adoption in automotive, packaging, and medical device sectors.

- Sustainability trends are pushing the demand for eco-friendly plastic welding technologies, supporting recycling and reducing waste.

Report Scope

This report segments the Asia Pacific Plastic Welding Equipment Market as follows:

Market Drivers

Rising Demand from Automotive Industry

The automotive sector is one of the primary drivers of the Asia Pacific plastic welding equipment market. For instance, the Asia-Pacific Automotive Plastics Market Report highlights the increasing use of lightweight plastic components in electric vehicles to enhance fuel efficiency and reduce emissions. Plastic welding technology plays a crucial role in efficiently joining plastic materials used in various automotive applications such as dashboards, bumpers, and body panels. Moreover, the rising trend of electric vehicles (EVs) further boosts the demand for lightweight materials, pushing the automotive industry to adopt advanced plastic welding techniques. As a result, the demand for robust and efficient plastic welding equipment continues to grow within this industry, contributing significantly to the market’s expansion.

Technological Advancements in Welding Methods

Technological innovations in plastic welding methods have substantially contributed to market growth. For instance, the Asia-Pacific Welding Equipment Market highlights advancements such as ultrasonic and laser welding, which offer greater precision and efficiency in manufacturing processes. The introduction of advanced welding technologies such as ultrasonic welding, laser welding, and infrared welding has revolutionized the industry by offering greater precision, speed, and efficiency. These techniques provide high-quality and reliable results, making them ideal for industries that require precision in welding plastic components. Furthermore, automation and integration of smart technologies into welding equipment have improved the overall productivity of manufacturing processes. As manufacturers seek better performance, durability, and automation capabilities, these advancements are expected to fuel further growth in the plastic welding equipment market.

Infrastructure Development and Growing Industrialization

The rapid industrialization and infrastructure development across the Asia Pacific region are significant market drivers for plastic welding equipment. Countries like China, India, and Southeast Asian nations are witnessing a boom in infrastructure projects such as residential complexes, commercial buildings, and transportation networks. Plastic welding technology is crucial in the construction industry, where it is used to join pipes, fittings, and other plastic components in plumbing, drainage, and HVAC systems. Additionally, the construction of new airports, railway stations, and highways demands high-quality plastic materials and efficient welding solutions. The expansion of industries such as construction, energy, and utilities in these regions further stimulates the demand for advanced plastic welding equipment to ensure the durability and reliability of plastic components used in these projects.

Growing Focus on Sustainability and Recycling

Sustainability and environmental concerns are increasingly driving the demand for plastic welding equipment in the Asia Pacific market. As governments and industries worldwide emphasize reducing plastic waste and promoting recycling, plastic welding technologies help improve the efficiency of recycling processes. Plastic welding allows for the repair and reuse of plastic parts, reducing the need for new materials and supporting circular economy initiatives. Furthermore, as industries adopt more eco-friendly practices, plastic welding offers a sustainable alternative to traditional adhesive bonding and mechanical fastening methods, which can be less efficient and environmentally friendly. With the growing emphasis on reducing material waste and carbon footprints, companies in the Asia Pacific region are investing in plastic welding solutions that align with these sustainability goals, driving market growth.

Market Trends

Shift Towards Automation and Smart Manufacturing

One of the key trends shaping the Asia Pacific plastic welding equipment market is the growing adoption of automation and smart manufacturing technologies. For instance, the Asia-Pacific Smart Manufacturing Market Report highlights the integration of IoT capabilities and robotic systems in manufacturing processes, which enhance precision and reduce operational errors. As manufacturers seek to increase operational efficiency and reduce labor costs, automated plastic welding systems have gained significant traction. These systems are equipped with sensors, robotic arms, and advanced software that ensure precision and consistency in the welding process. The integration of Internet of Things (IoT) capabilities allows for real-time monitoring and control, which enhances productivity and minimizes errors. This trend is particularly prevalent in industries such as automotive and electronics, where high-volume production demands consistent and reliable welding solutions. As these technologies continue to evolve, the market for automated plastic welding equipment is expected to expand rapidly in the region.

Rising Preference for Eco-friendly and Sustainable Solutions

Sustainability is a key trend influencing the growth of the plastic welding equipment market in Asia Pacific. Governments and industries are increasingly prioritizing environmentally friendly practices, prompting a shift towards more sustainable plastic processing methods. Plastic welding, especially methods such as ultrasonic and laser welding, is seen as a more eco-friendly alternative to traditional bonding methods that rely on adhesives or solvents. These welding technologies produce minimal waste, reducing the environmental footprint of manufacturing processes. Additionally, the ability to repair and reuse plastic components using welding technology supports the region’s efforts to reduce plastic waste and promote a circular economy. As sustainability becomes a central focus across industries, demand for environmentally friendly plastic welding solutions continues to rise.

Growing Application in the Medical and Electronics Sectors

The medical and electronics sectors are experiencing increasing demand for high-precision, reliable plastic welding solutions, which is influencing market trends in the Asia Pacific region. In the medical field, plastic welding is essential for the production of medical devices, including sterile packaging, surgical instruments, and diagnostic equipment. The demand for clean, reliable, and cost-effective joining techniques in this sector is driving the adoption of advanced plastic welding equipment. Similarly, the electronics industry, which often requires precise and durable plastic components, is also contributing to market growth. Plastic welding plays a crucial role in joining parts in electronic devices such as smartphones, tablets, and computers. As the demand for high-quality, compact, and lightweight electronic devices continues to grow, the use of plastic welding technology in this sector is expected to increase.

Emerging Popularity of Laser and Ultrasonic Welding Techniques

The growing popularity of advanced welding techniques, such as laser and ultrasonic welding, is another significant trend driving the plastic welding equipment market in Asia Pacific. For instance, the Asia Pacific Ultrasonic Welding Machine Industry Report highlights the advantages of ultrasonic welding in producing strong and precise bonds for delicate components. These technologies offer several advantages, including faster processing times, better weld strength, and improved precision compared to traditional methods. As industries demand more efficient and precise welding solutions, these advanced technologies are gaining widespread acceptance. The trend towards laser and ultrasonic welding is expected to continue, further propelling the demand for advanced plastic welding equipment in the region.

Market Challenges Analysis

High Initial Investment and Maintenance Costs

One of the primary challenges faced by the Asia Pacific plastic welding equipment market is the high initial investment and ongoing maintenance costs associated with advanced welding technologies. While automated systems and sophisticated welding methods such as ultrasonic and laser welding offer significant advantages in terms of precision and efficiency, they come with substantial upfront costs. Small and medium-sized enterprises (SMEs) may find it difficult to invest in such equipment due to limited capital or budget constraints. Furthermore, the maintenance and servicing of these high-tech systems can be expensive and require specialized technicians, adding to the overall operational costs. These financial barriers can limit the adoption of advanced plastic welding equipment, particularly in emerging economies where manufacturing industries may not yet be equipped to handle such investments.

Skilled Labor Shortage and Training Requirements

Another challenge hindering market growth is the shortage of skilled labor required to operate and maintain advanced plastic welding equipment. For instance, the Economic Challenges and Opportunities in the Welding Industry highlights the skilled labor shortage as a significant barrier to adopting advanced welding technologies in the Asia Pacific region. As industries in Asia Pacific continue to adopt cutting-edge welding technologies, the demand for highly skilled technicians, engineers, and operators is growing. However, there is a lack of adequately trained professionals who can manage the complex systems effectively. This skills gap can lead to inefficiencies, operational delays, and increased training costs for companies. Moreover, the rapid pace of technological advancements means that even existing operators must constantly update their skills to keep up with the latest developments in plastic welding equipment. Addressing this challenge requires substantial investment in training programs and educational initiatives to ensure that the workforce is capable of fully leveraging the capabilities of advanced plastic welding technologies.

Market Opportunities

The Asia Pacific plastic welding equipment market presents significant opportunities driven by the rapid growth of several key industries. The automotive sector, in particular, offers a promising avenue for market expansion. As automakers increasingly prioritize lightweight materials to improve fuel efficiency and reduce carbon emissions, the demand for plastic components and, consequently, plastic welding technologies is growing. Additionally, the rise of electric vehicles (EVs) further stimulates the need for advanced welding solutions to create lightweight, durable components. As the automotive industry in Asia Pacific continues to grow, the need for high-performance, cost-effective welding equipment will increase, providing ample opportunities for market players.

Furthermore, the region’s ongoing infrastructure development presents substantial growth potential for plastic welding equipment. The construction, energy, and utilities sectors are expanding rapidly, especially in countries like China, India, and Southeast Asia. As plastic pipes, fittings, and other components are widely used in construction and infrastructure projects, the demand for reliable welding solutions to join these materials will rise. Additionally, the increasing emphasis on sustainability and eco-friendly practices opens up new opportunities for plastic welding technologies. With governments across Asia Pacific tightening environmental regulations and industries focusing on reducing waste and promoting recycling, plastic welding equipment that enables material reuse and efficient recycling processes is set to see increased demand. This combination of evolving industry needs, technological advancements, and sustainability initiatives creates a fertile landscape for growth and innovation in the plastic welding equipment market.

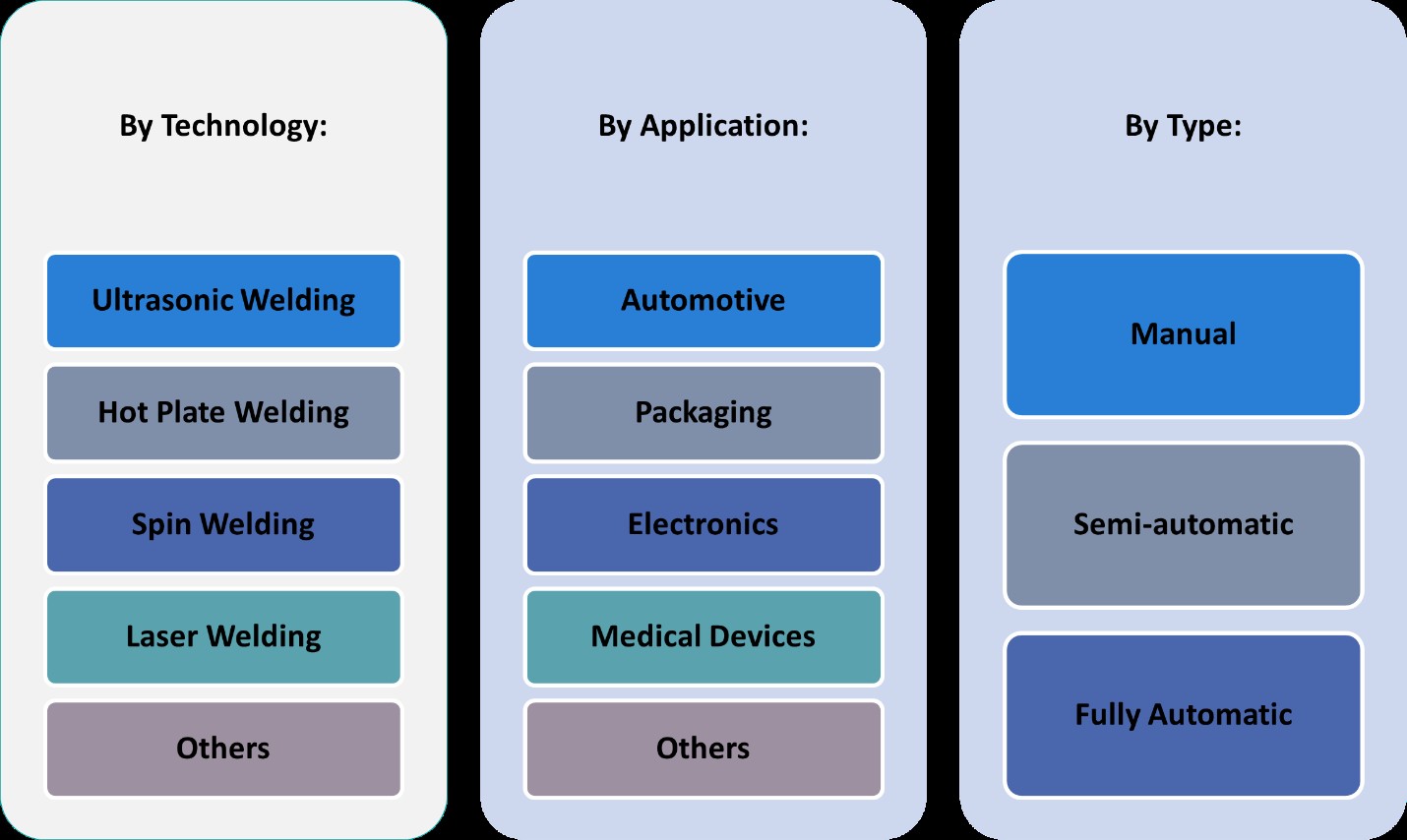

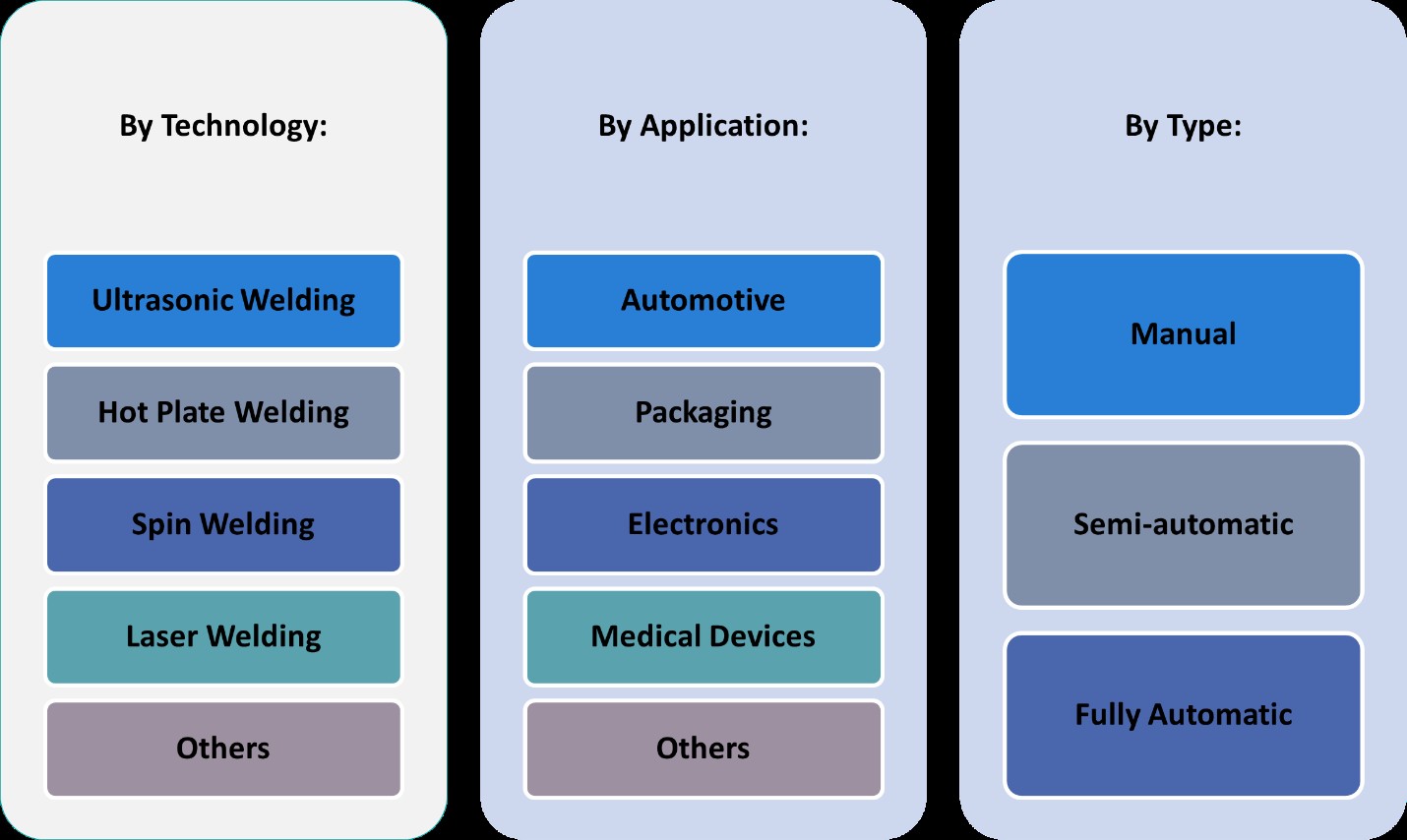

Market Segmentation Analysis:

By Type:

The Asia Pacific plastic welding equipment market can be segmented based on type into manual, semi-automatic, and fully automatic systems. Manual welding systems are primarily used for small-scale operations where flexibility and low upfront costs are prioritized. These systems require skilled operators to manually control the welding process, making them suitable for industries with lower production volumes or specific customizations. However, as industries seek to scale production, semi-automatic and fully automatic systems are gaining preference. Semi-automatic systems combine operator input with automated features, providing a balance between cost-effectiveness and increased efficiency, making them ideal for medium-scale production in industries such as packaging and automotive. Fully automatic systems, on the other hand, are increasingly adopted by large-scale manufacturers looking to improve efficiency, reduce human error, and enhance production output. These systems are particularly beneficial in high-volume industries, including automotive and electronics, where precision and speed are essential. As automation trends continue, the demand for semi-automatic and fully automatic systems is expected to rise.

By Application:

The application of plastic welding equipment spans across various industries, with electronics, packaging, automotive, and medical devices being the key sectors driving growth in the Asia Pacific market. The electronics industry requires high-precision welding to join small, delicate components in devices such as smartphones, laptops, and consumer electronics, leading to a rise in demand for ultrasonic and laser welding technologies. In the packaging sector, plastic welding is used for sealing and joining plastic materials in food and beverage packaging, as well as other consumer goods. The automotive industry, driven by the demand for lightweight and durable materials, heavily relies on plastic welding for manufacturing parts like dashboards, bumpers, and interior components. Lastly, the medical device industry requires advanced plastic welding to produce sterile and high-quality products, such as syringes, blood bags, and medical packaging. As industries expand and modernize, the adoption of plastic welding technologies in these applications will continue to grow, creating significant market opportunities.

Segments:

Based on Type:

- Manual

- Semi-automatic

- Fully Automatic

Based on Application:

- Electronics

- Packaging

- Automotive

- Medical Devices

- Others

Based on Technology:

- Ultrasonic Welding

- Hot Plate Welding

- Spin Welding

- Laser Welding

- Others

Based on the Geography:

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

Regional Analysis

China

China leads the market, accounting for approximately 35% of the total market share. This dominance is driven by its large manufacturing base, particularly in sectors like automotive, electronics, and packaging, where plastic welding plays a vital role in production processes. China’s rapid industrialization, along with the growing adoption of electric vehicles (EVs) and increased investment in infrastructure, further propels the demand for plastic welding equipment. As the largest economy in the region, China is expected to continue driving market growth.

Japan

Japan holds the second-largest market share, contributing around 20% to the Asia Pacific plastic welding equipment market. Japan’s advanced automotive and electronics industries are significant contributors to the high demand for precision plastic welding solutions. The country’s focus on innovation and high-tech manufacturing processes, including the use of ultrasonic and laser welding technologies, reinforces its position as a major market for plastic welding equipment. Japan’s emphasis on automation in production further boosts the demand for fully automatic plastic welding systems, particularly in the automotive and consumer electronics sectors.

South Korea

South Korea, with a market share of approximately 15%, also plays a crucial role in the Asia Pacific plastic welding equipment market. South Korea’s automotive and electronics industries are among the most advanced in the region, driving the need for reliable and high-performance welding solutions. The growing trend towards lightweight materials in automotive manufacturing and the demand for high-precision plastic components in electronics fuel the adoption of advanced welding technologies such as ultrasonic and laser welding. The country’s push for smart manufacturing and increased automation in production lines supports the growth of plastic welding equipment.

India

India, with a market share of around 10%, presents significant growth potential in the Asia Pacific plastic welding equipment market. As one of the fastest-growing economies in the region, India’s automotive, construction, and packaging sectors are expanding rapidly. The demand for plastic welding equipment is increasing as the country continues to develop its infrastructure and manufacturing capabilities. India’s focus on sustainable practices and increasing production of consumer goods also drives the adoption of eco-friendly plastic welding technologies. With ongoing industrialization and the growth of key sectors, India is poised for substantial growth in the plastic welding equipment market.

Key Player Analysis

- Emerson Electric Co.

- Leister Technologies AG

- Dukane Corporation

- Herrmann Ultraschalltechnik GmbH & Co. KG

- Branson Ultrasonics Corporation

- Frimo Group GmbH

- Bielomatik Leuze GmbH & Co. KG

- CHN-TOP Machinery Group

- Haitian International Holdings Ltd.

- Xinpoint Corporation

Competitive Analysis

The competitive landscape of the Asia Pacific plastic welding equipment market is shaped by several key players who are continuously innovating to meet growing demand across various industries. Leading players such as Emerson Electric Co., Leister Technologies AG, Dukane Corporation, Herrmann Ultraschalltechnik GmbH & Co. KG, Branson Ultrasonics Corporation, Frimo Group GmbH, Bielomatik Leuze GmbH & Co. KG, CHN-TOP Machinery Group, Haitian International Holdings Ltd., and Xinpoint Corporation are at the forefront of technological advancements in plastic welding solutions. These companies focus on expanding their product portfolios to offer diverse welding techniques like ultrasonic, laser, and infrared welding, meeting the specific needs of industries such as automotive, electronics, medical devices, and packaging. Automation and integration of smart manufacturing solutions are key trends, with players investing in high-performance, fully automated welding systems to enhance production efficiency and reduce labor costs. In addition, these companies emphasize sustainability by developing eco-friendly welding solutions that support recycling and minimize material waste. The competitive edge lies in technological innovation, product reliability, and the ability to offer tailored solutions for different applications. Strategic partnerships, acquisitions, and geographic expansion are also integral parts of their strategies to maintain dominance in the fast-growing Asia Pacific market.

Recent Developments

- In March 2025, Leister transferred its laser plastic welding business to Hymson Novolas AG, a subsidiary of Hymson Laser Technology Group Co. Ltd. The transition ensures continuity and further development of existing product lines, with a new Laser Technology Center established in Switzerland. Leister will now focus more on its core competencies: plastic welding (hot air, infrared) and industrial process heat.

- In February 2025, Herrmann continues to set industry standards with its ultrasonic welding solutions, particularly for medical devices and sensitive components. The company emphasizes individualized process development, intelligent process control, and digital quality monitoring for reproducible, high-strength welds. Herrmann will showcase new applications and integration options at K 2025, focusing on automation and sustainability in medical and packaging industries.

- In January 2025, Dukane highlighted its patented Q-Factor, Melt-Match®, Low Amplitude Preheat, and Ultra-High Frequency (260–400 Hz) vibration welding technologies, emphasizing their leadership in process control and diagnostics.

- In May 2024, Emerson launched the Branson™ GLX-1 Laser Welder, designed for the automated assembly of small, intricate plastic parts. The GLX-1 features a compact, modular design suitable for cleanroom environments, advanced servo-based actuation, and the ability to “un-weld” plastics for closed-loop recycling. It uses Simultaneous Through-Transmission Infrared® (STTlr) laser-welding technology for high efficiency, weld strength, and aesthetics. Enhanced connectivity, security, and data collection features support Industry 4.0 integration.

Market Concentration & Characteristics

The Asia Pacific plastic welding equipment market exhibits moderate to high concentration, with several leading global players dominating the market. Companies such as Emerson Electric Co., Leister Technologies AG, and Dukane Corporation hold significant market shares, leveraging their technological expertise, extensive product portfolios, and strong customer bases. These players are highly focused on innovation, offering advanced welding technologies such as ultrasonic, laser, and infrared welding, which cater to the diverse needs of industries like automotive, electronics, and medical devices. The market is characterized by a mix of established multinational companies and regional players, creating a competitive environment where both technological advancements and cost-efficiency are key differentiators. While large players dominate the high-volume, automated solutions segment, smaller regional companies continue to cater to niche markets with customized and cost-effective solutions. As a result, the market is dynamic, with significant growth opportunities for both large and small manufacturers in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for plastic welding equipment in the Asia Pacific region is expected to grow due to increasing industrialization and manufacturing activities.

- Technological advancements in welding equipment will drive efficiency, precision, and automation, meeting the needs of various industries.

- The region’s expanding automotive and aerospace industries will significantly contribute to the growth of the plastic welding equipment market.

- Environmental concerns and the rising demand for sustainable production methods will promote the adoption of eco-friendly plastic welding solutions.

- Increasing infrastructure development in emerging markets like India and China will lead to a rise in plastic welding applications across construction and building sectors.

- The growth of the electronics and electrical industries in Asia Pacific will demand advanced plastic welding techniques for components and assemblies.

- Manufacturers will increasingly focus on energy-efficient equipment to reduce operational costs and support environmental sustainability goals.

- The adoption of plastic welding in medical devices and packaging will grow due to the increasing need for high-quality, sterile, and durable products.

- Strong government support and favorable regulations promoting manufacturing and industrialization will fuel market growth.

- The market will see a rise in collaborative innovations and partnerships among manufacturers, suppliers, and research institutions to develop advanced and cost-effective solutions.