Market Overview

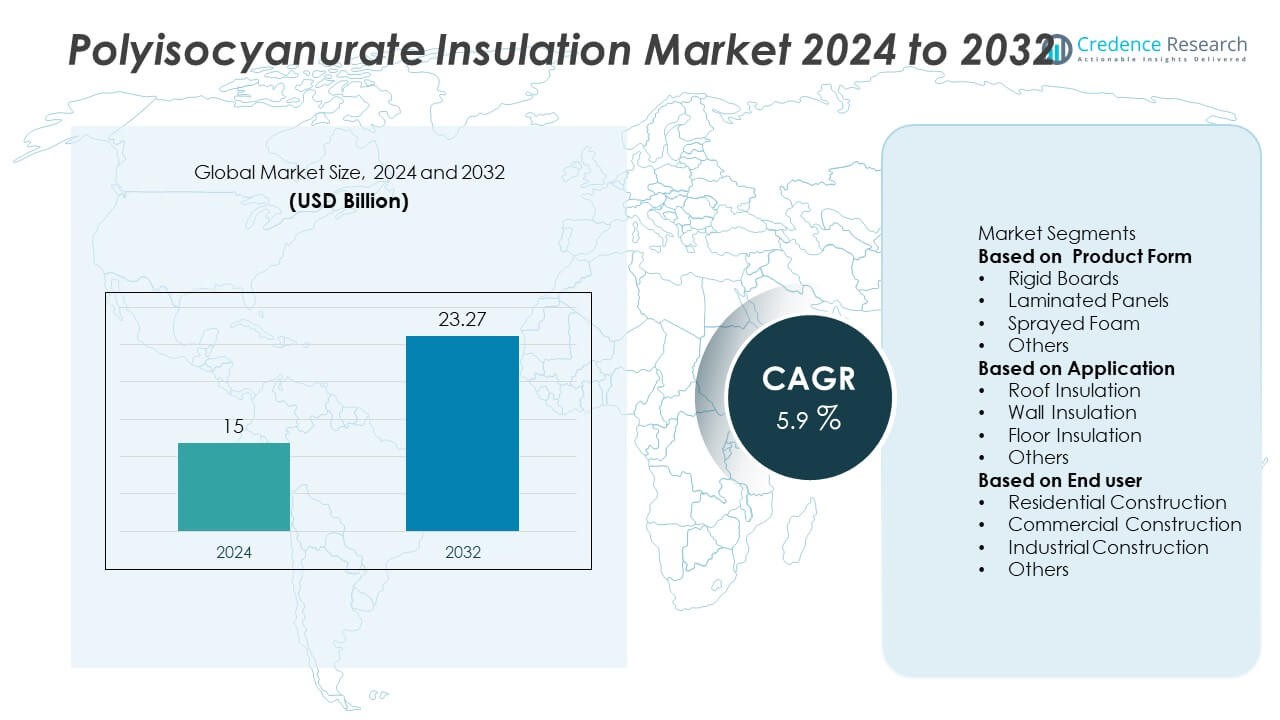

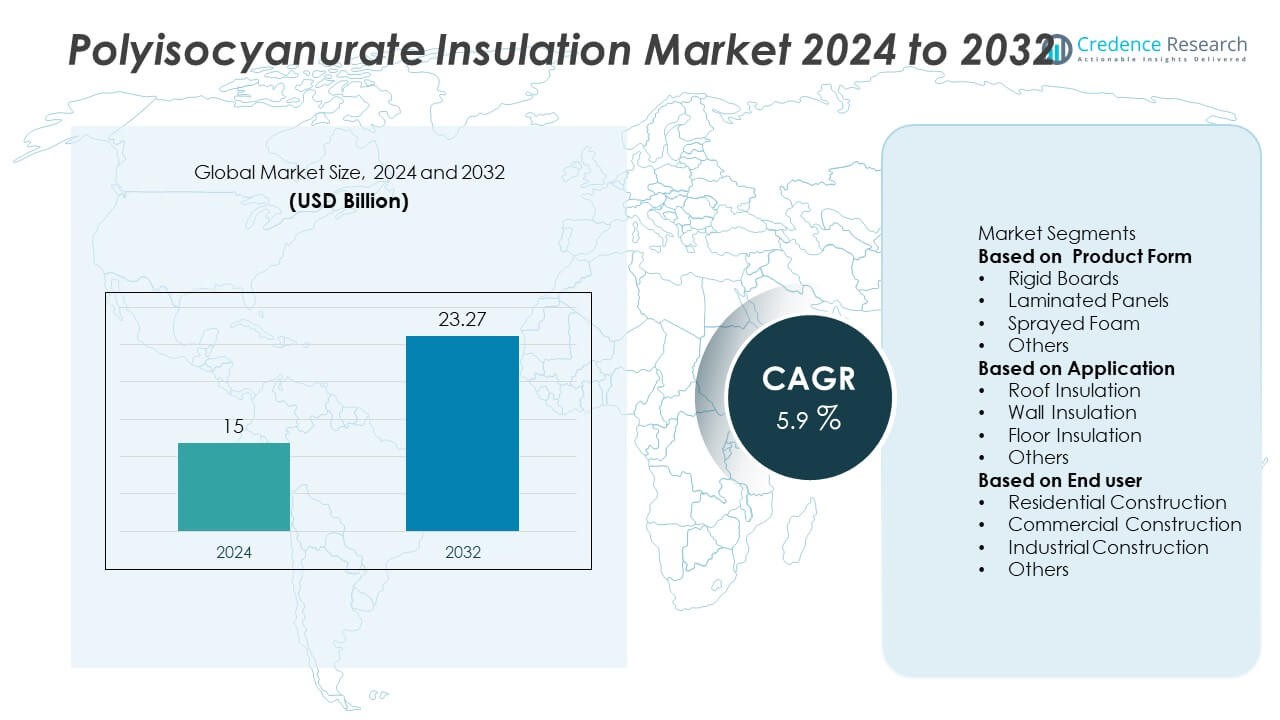

The Polyisocyanurate Insulation Market was valued at USD 15 billion in 2024 and is projected to reach USD 23.27 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyisocyanurate Insulation Market Size 2024 |

USD 15 Billion |

| Polyisocyanurate Insulation Market, CAGR |

5.9% |

| Polyisocyanurate Insulation Market Size 2032 |

USD 23.27 Billion |

The polyisocyanurate insulation market is led by major players such as Owens Corning, Johns Manville, Kingspan Group, Huntsman Corporation, BASF SE, Covestro AG, DuPont, IKO Industries, Saint-Gobain, and Carlisle Companies. These companies dominate through extensive product portfolios, global distribution networks, and continuous investment in sustainable insulation technologies. They focus on developing high thermal-efficiency and low-emission solutions that align with evolving building regulations. Europe emerged as the leading region in 2024, holding a 34.9% market share, driven by stringent energy-efficiency directives and strong adoption of eco-friendly construction materials across industrial, commercial, and residential sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polyisocyanurate Insulation Market was valued at USD 15 billion in 2024 and is projected to reach USD 23.27 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Growing demand for energy-efficient and sustainable insulation materials drives market expansion, supported by government initiatives promoting green building codes and thermal efficiency standards.

- Technological advancements, such as the development of low-GWP blowing agents and high-performance laminated panels, are enhancing product sustainability and performance.

- The market is moderately consolidated, with key players like Owens Corning, Kingspan Group, and BASF SE focusing on product innovation, capacity expansion, and strategic mergers to strengthen global competitiveness.

- Regionally, Europe holds 34.9% of the market share, followed by Asia Pacific with 41.2% due to rapid urbanization, while by product form, rigid boards dominate with 46.3% share, reflecting strong demand across commercial and industrial construction sectors.

Market Segmentation Analysis:

By Product Form

The rigid boards segment held the largest share of 46.3% in the Polyisocyanurate Insulation market in 2024. Their dominance stems from high thermal efficiency, structural strength, and ease of installation across both commercial and residential applications. Rigid boards are widely used in roofing and wall systems, offering superior moisture resistance and dimensional stability. Laminated panels and sprayed foam follow due to their versatility and growing use in retrofitting projects. Increasing preference for energy-efficient building materials continues to strengthen demand for rigid boards globally.

- For instance, Owens Corning’s rigid extruded polystyrene (XPS) foam board products, including their FOAMULAR® NGX® line, have been demonstrated to provide an R-value of 5.0 per inch, contributing to energy efficiency in buildings.

By Application

The roof insulation segment accounted for 51.8% of the market share in 2024, making it the leading application segment. Its growth is driven by strict building energy codes and the need for enhanced thermal performance in roofs of commercial and residential structures. Polyisocyanurate’s high R-value per inch and fire resistance make it a preferred choice for roofing applications. Wall and floor insulation segments are also expanding due to the focus on sustainable construction and reduced heat loss in modern building envelopes.

- For instance, Kingspan’s Thermaroof® product range, widely used in roofing systems, offers a thermal conductivity of 0.022 W/mK, which translates to an R-value of approximately 6.4 per inch, significantly reducing energy consumption in large-scale industrial buildings.

By End User

The commercial construction segment dominated the market with a 48.6% share in 2024. Demand is fueled by large-scale adoption in office complexes, retail centers, and institutional buildings aiming for LEED and BREEAM certifications. The segment benefits from growing awareness of energy efficiency standards and long-term operational cost savings. Residential and industrial construction segments are gaining momentum as governments promote green building initiatives and energy conservation measures, further supporting the use of Polyisocyanurate insulation across diverse infrastructure projects.

Key Growth Drivers

Rising Demand for Energy-Efficient Buildings

The increasing emphasis on reducing energy consumption in residential and commercial buildings drives the demand for polyisocyanurate insulation. Governments worldwide are enforcing stricter building energy codes and green certification standards. Polyisocyanurate’s superior thermal resistance and fire performance make it ideal for meeting these sustainability goals. Its use in roof and wall insulation continues to expand as developers prioritize high R-value materials to lower heating and cooling costs, boosting long-term market growth.

- For instance, DuPont’s Styrofoam™ XPS and polyiso-based insulation products are widely used in commercial construction, providing an R-value of up to 5.0 per inch. Their use in energy-efficient building projects, such as LEED-certified buildings, supports the growing trend of sustainable development in cities worldwide.

Expanding Commercial Construction Sector

Rapid urbanization and infrastructure development across emerging economies are fueling the use of polyisocyanurate insulation in commercial projects. Office spaces, shopping malls, and institutional buildings increasingly adopt the material for its structural rigidity and energy savings. Manufacturers are also offering customized laminated panels and rigid boards to meet diverse project requirements. The growing investment in smart and sustainable buildings globally is creating consistent demand for high-performance insulation solutions.

- For instance, Kingspan Group has played a significant role in this shift, supplying their Kooltherm K10 and K15 phenolic products, known for their high thermal efficiency and slim profile, to various commercial projects to contribute to energy efficiency and a minimized insulation thickness.

Supportive Government Policies and Incentives

Government initiatives promoting energy conservation and sustainable materials are accelerating market expansion. Tax credits, rebates, and green building mandates encourage builders to integrate high-efficiency insulation like polyisocyanurate. The European Union’s directives for near-zero energy buildings (NZEB) and U.S. energy efficiency standards significantly boost adoption. These policies not only enhance environmental compliance but also provide cost advantages, motivating both private developers and public projects to adopt polyisocyanurate insulation extensively.

Key Trends & Opportunities

Growth in Retrofit and Renovation Projects

A notable trend in the market is the growing use of polyisocyanurate insulation in renovation and retrofit activities. Older buildings are being upgraded to meet modern energy performance standards, especially in North America and Europe. The material’s ease of installation and lightweight nature make it suitable for retrofitting roofs and walls. This trend offers significant opportunities for insulation manufacturers targeting sustainable refurbishment projects.

- For instance, Johns Manville has provided polyiso insulation solutions for retrofit projects in commercial buildings, which typically offer an R-value of approximately 6.5 per inch (nominal). The company offers a broad range of polyisocyanurate insulation, including the AP Foil25 polyiso board system designed for continuous insulation in walls and below-grade, to enhance building energy efficiency.

Technological Advancements in Insulation Manufacturing

Manufacturers are focusing on improving product formulations and production efficiency. The development of low-global-warming-potential (GWP) blowing agents and eco-friendly laminates enhances sustainability. Innovations in panel design also improve fire resistance and durability, increasing application versatility. These advancements enable companies to meet evolving environmental standards while offering superior thermal performance, opening new opportunities in high-end construction applications.

- For instance, Covestro AG has pioneered the use of a new low-GWP foam blowing agent in the production of their polyiso insulation panels. Their Baytherm® product line incorporates this innovative agent, achieving better thermal insulation performance while meeting stringent environmental standards for both new and retrofit constructions.

Key Challenges

Fluctuating Raw Material Prices

The market faces challenges due to price volatility of key raw materials such as methylene diphenyl diisocyanate (MDI) and polyols. These petrochemical-based inputs are influenced by crude oil market dynamics. Rising input costs directly impact production margins, making it difficult for manufacturers to maintain competitive pricing. Long-term contracts and supply chain optimization are becoming essential strategies to mitigate these fluctuations.

Environmental Concerns and Regulatory Compliance

Despite its energy efficiency benefits, polyisocyanurate insulation production involves chemicals with potential environmental impacts. Regulatory bodies are tightening restrictions on emissions and the use of high-GWP blowing agents. Compliance with evolving environmental standards increases manufacturing complexity and costs. Companies must invest in sustainable production technologies and research to align with stricter regulations without compromising performance or profitability.

Regional Analysis

North America

The North American region held roughly 30% share of the global polyisocyanurate insulation market in 2024, driven by strong demand in the U.S. and Canada. Strict building‑energy regulations and incentives boosted uptake in commercial and residential buildings. Major retrofit programmes targeting older building stock reinforced growth. Manufacturers focused on supplying high R‑value boards and panels to meet emission‑reduction goals. Economic uncertainties and raw material cost fluctuations posed headwinds, but established supply chains and technological leadership maintained regional momentum.

Europe

Europe accounted for approximately 34.9% of the global polyisocyanurate insulation market revenue in 2024. The region’s dominance arose from rigorous energy‑performance standards and extensive building‑retrofit initiatives, especially in Germany, France and the UK. Manufacturers introduced advanced insulated panels and boards to comply with fire‑safety and sustainability mandates. Growth benefited particularly from targeted renovation schemes under EU directives. However, regulatory complexity and rising production costs required firms to optimise operations and adopt low‑carbon manufacturing methods.

Asia Pacific

The Asia Pacific region delivered the largest share at about 41.2% in 2024 and the fastest growth among regions. Rapid urbanisation, infrastructure build‑out across China, India and Southeast Asia and new housing projects fuelled demand for polyisocyanurate insulation in roofs and walls. Localised manufacturing ensured cost competitiveness in the region. The push for smart and green buildings further amplified uptake. Still, market fragmentation, variable code enforcement and elevated raw‑material volatility represent risks for uniform expansion.

Latin America & Middle East & Africa (LAMEA)

Collectively, the LAMEA region captured a smaller share 15% of the global polyisocyanurate insulation market in 2024. Infrastructure investment in Middle Eastern and African nations and renovation activity in Latin America provided emerging growth opportunities. Harsh climate zones accelerated demand for high‑performance insulation in commercial and industrial facilities. Nonetheless, limited local production, economic instability and lower regulatory enforcement slowed adoption compared with other regions. Suppliers are increasingly targeting this region for longer‑term expansion.

Market Segmentations:

By Product Form

- Rigid Boards

- Laminated Panels

- Sprayed Foam

- Others

By Application

- Roof Insulation

- Wall Insulation

- Floor Insulation

- Others

By End user

- Residential Construction

- Commercial Construction

- Industrial Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape, Owens Corning, Johns Manville, Kingspan Group, Huntsman Corporation, BASF SE, Covestro AG, DuPont, IKO Industries, Saint-Gobain, and Carlisle Companies are the leading participants in the polyisocyanurate insulation market. The competitive environment is shaped by product innovation, sustainability initiatives, and regional expansion strategies. Key manufacturers are focusing on enhancing thermal efficiency, fire resistance, and eco-friendly formulations to comply with global energy standards. Companies are investing in low-emission production processes and advanced facers to improve durability and insulation performance. Strategic mergers and capacity expansions strengthen supply chain efficiency and global presence. Partnerships with construction firms and distributors allow faster market penetration, while digital modeling and energy management tools improve design integration. Competition remains strong, as firms aim to balance performance, cost-effectiveness, and environmental compliance to maintain a competitive edge in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Owens Corning

- Johns Manville

- Kingspan Group

- Huntsman Corporation

- BASF SE

- Covestro AG

- DuPont de Nemours, Inc.

- IKO Industries Ltd.

- Saint-Gobain S.A.

- Carlisle Companies Incorporated

Recent Developments

- In March 2024, Owens Corning completed conversion of its U.S. & Canada extruded‑polystyrene (XPS) insulation production to its “FOAMULAR NGX” line, signalling a shift toward low‑GWP insulation technologies.

- In February 2024, BASF introduced an HFO‑blown PIR (polyisocyanurate) foam system that improves both thermal conductivity and non‑flammability for sandwich panel applications.

- In January 2024, BASF SE and Carlisle Construction Materials announced a collaboration to explore the use of Lupranate ZERO (the world’s first zero‑carbon‑footprint isocyanate) in the production of polyiso insulation boards.

Report Coverage

The research report offers an in-depth analysis based on Product Form, Application, End user and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising energy-efficiency standards in building construction.

- Adoption of sustainable insulation materials will increase as governments tighten environmental regulations.

- Manufacturers will expand production capacities to meet growing demand across residential and commercial sectors.

- Technological advancements will enhance thermal resistance and product durability in insulation materials.

- Green building certifications will further boost the use of polyisocyanurate insulation in modern architecture.

- Strategic mergers and partnerships will strengthen global supply networks and market presence.

- Demand from retrofit and renovation projects will rise, especially in developed economies.

- Investment in low-emission manufacturing processes will become a key competitive focus.

- Asia Pacific will continue to lead in market growth, supported by rapid infrastructure development.

- Digital tools and building information modeling integration will streamline design and installation efficiency.