Market Overview:

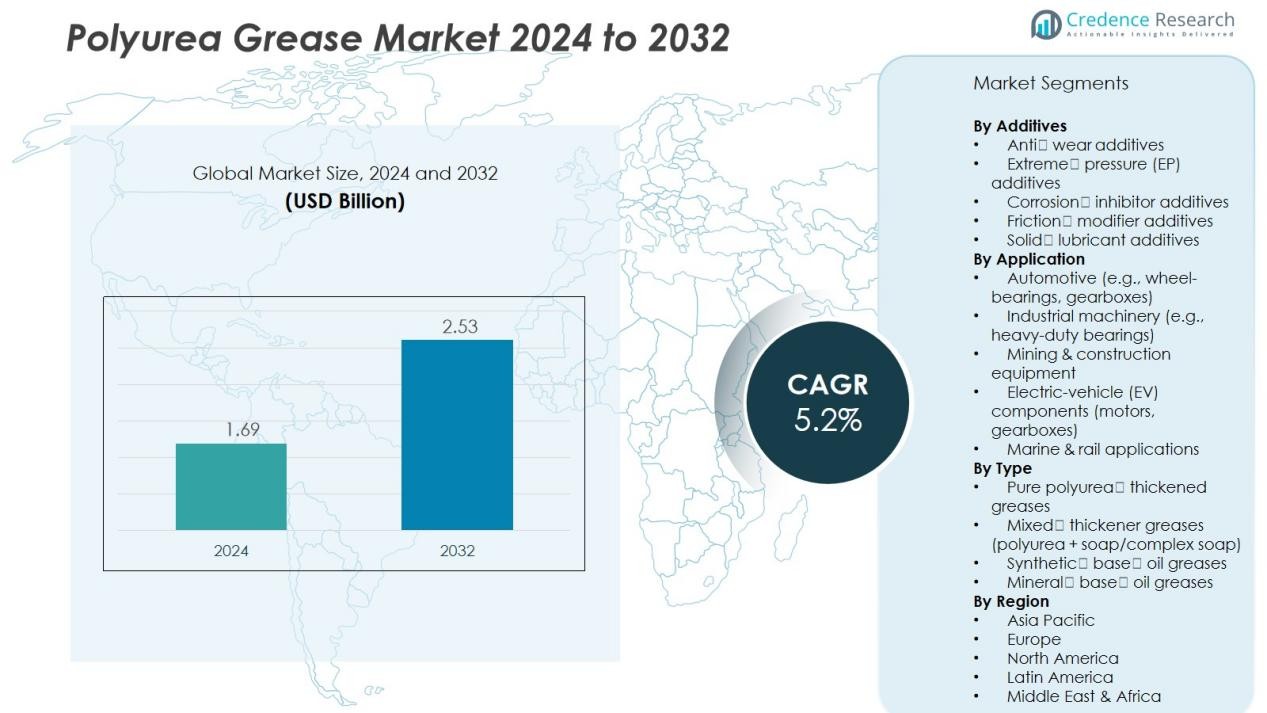

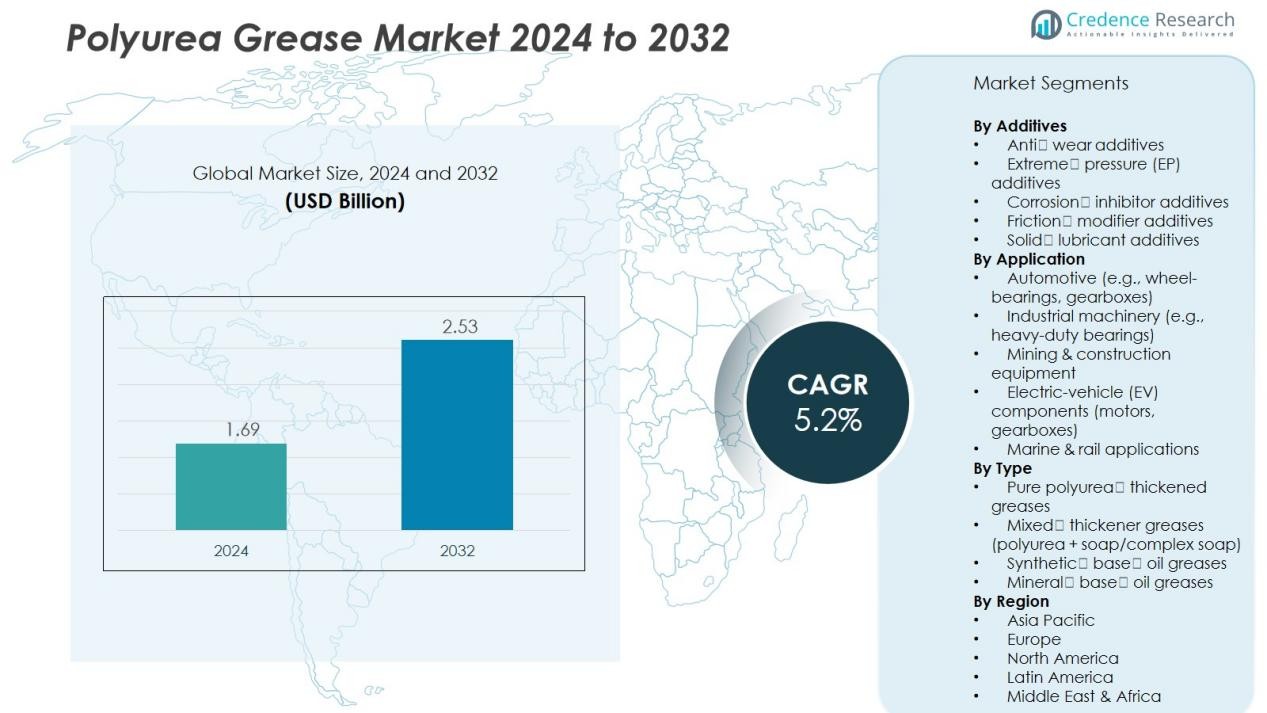

The Polyurea Grease Market size was valued at USD 1.69 billion in 2024 and is anticipated to reach USD 2.53 billion by 2032, at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyurea Grease Market Size 2024 |

USD 1.69 Billion |

| Polyurea Grease Market, CAGR |

5.2% |

| Polyurea Grease Market Size 2032 |

USD 2.53 Billion |

Key drivers of the polyurea grease market include the growing need for lubricants that offer superior thermal stability, wear resistance, and water resistance in demanding environments. The automotive sector, including electric vehicles, and industrial applications, particularly in mining and heavy machinery, are expected to be significant contributors to market expansion. Additionally, the rising focus on minimizing equipment downtime, lowering maintenance costs, and meeting regulatory standards related to lubricant performance and environmental impact is propelling the adoption of polyurea-based greases.

Regionally, North America dominates the polyurea grease market, driven by a robust industrial base, strong automotive and manufacturing sectors, and stringent regulations that promote the use of advanced lubricants. The Asia-Pacific region is projected to experience the highest growth, fueled by rapid industrialization, infrastructure development, and expanding automotive and construction activities in countries like China, India, and Japan. Europe, Latin America, and the Middle East & Africa are also expected to witness moderate growth during the forecast period.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyurea Grease Market was valued at USD 1.69 billion in 2024 and is expected to reach USD 2.53 billion by 2032, growing at a CAGR of 5.2% during the forecast period.

- North America holds the largest market share of approximately 40%, driven by a robust industrial base, strong automotive and manufacturing sectors, and strict environmental regulations that favor advanced lubricants like polyurea greases.

- Europe follows with a market share of around 30%, supported by its automotive manufacturing strength, focus on sustainability, and well-established industrial maintenance culture that prioritizes long-life lubricants.

- The Asia-Pacific region is the fastest-growing market, holding nearly 20% of the global share, fueled by rapid industrialization, rising automotive production, and expanding infrastructure projects in countries like China, India, and Japan.

- By segment, polyurea greases in automotive applications dominate, with a significant share in wheel bearings and gearboxes, while industrial machinery and mining applications also account for a substantial portion of the market share.

Market Drivers:

Market Drivers:

Demand for High-Performance Lubricants

The Polyurea Grease Market is experiencing growth driven by the increasing demand for high-performance lubricants. Industries such as automotive, manufacturing, and mining require lubricants that offer superior thermal stability, wear resistance, and water resistance. Polyurea-based greases meet these requirements, making them ideal for applications in extreme conditions. This demand is particularly strong in industries dealing with high-speed machinery and harsh environments, where traditional lubricants may fail to deliver the necessary performance.

- For Instance, For industrial and some automotive applications, Shell produces polyurea (diurea) greases, such as the Shell Gadus S3 T100 series, which are designed for superior high-temperature and long-life performance.

Advancements in Automotive and Industrial Applications

The automotive sector, including the rise of electric vehicles, is a significant driver for the Polyurea Grease Market. Polyurea greases are being increasingly used in electric vehicle (EV) applications due to their superior performance in high-temperature environments and their ability to extend the life of key components. The adoption of polyurea grease in electric motors, gearboxes, and other automotive parts is expanding. Similarly, in industrial applications such as mining and construction, the shift towards advanced lubricants like polyurea is improving the longevity and efficiency of machinery.

- For Instance, SKF offers polyurea-thickened greases like SKF LGHP 2 and LGHQ 2, which are designed for electric motor applications and provide high thermal and mechanical stability, long life, and low noise properties suitable for electric vehicle powertrains.

Focus on Reducing Maintenance and Downtime Costs

A growing emphasis on reducing operational downtime and maintenance costs is fueling the adoption of polyurea grease. Polyurea-based lubricants have a longer lifespan than traditional greases, reducing the frequency of replacements and the need for machine servicing. This advantage leads to significant cost savings for businesses, especially in sectors where equipment downtime can lead to substantial losses. The increased reliability of polyurea grease enhances operational efficiency and reduces maintenance efforts, making it a preferred choice for many industries.

Stringent Regulatory Standards and Sustainability Focus

The Polyurea Grease Market is also driven by stringent regulatory standards and a growing focus on sustainability. Governments worldwide are implementing stricter environmental regulations that push industries to adopt more sustainable and effective lubricants. Polyurea greases, which offer better efficiency and lower environmental impact compared to conventional greases, are being adopted to meet these standards. Their ability to perform in various conditions while adhering to environmental guidelines makes them an attractive option for companies seeking to comply with regulations.

Market Trends:

Expansion of Preference for Polyurea Grease Over Traditional Lithium Grease

The Polyurea Grease Market reports a clear shift in end‑user preference toward polyurea‑based formulations from conventional lithium‑based greases thanks to superior thermal stability, oxidation resistance and service life. It is winning favour in sectors that involve high temperatures, heavy loads and wet conditions, such as automotive wheel‑bearings, electric motors and heavy‑duty industrial equipment. Manufacturers are offering formulations tailored for life‑lubrication scenarios where extended intervals between maintenance support cost savings and operational efficiency. This transition creates opportunity for producers willing to invest in product development and brand positioning. The move also pressures older grease technologies to evolve or cede market share in more demanding applications.

- For instance, in electric motor bearings used in industrial drives, it has been demonstrated in various case studies that adopting a polyurea grease engineered for high-temperature operation can significantly increase bearing life under continuous high-temperature service conditions, such as 100°C.

Advances in Formulation Technology and Application‑Specific Customisation

The Polyurea Grease Market is seeing innovation in formulation chemistry to meet increasingly stringent performance criteria and sector‑specific demands. Researchers and manufacturers enhance thickener systems, additive packages and base‑oil blends to achieve improved low‑temperature start‑up behaviour, enhanced water resistance or compatibility with electric vehicle components. These innovations enable use of polyurea greases in emerging applications such as e‑motors, renewable‑energy equipment and precision manufacturing systems. It also supports differentiation and premium pricing strategies across segments. The result sees companies accelerating development cycles and marketing advanced product grades for targeted niches.

- For Instance, Shell produces advanced synthetic polyurea greases, including Shell Gadus S5 T460 and Shell Stamina EP2, which are designed for long life and superior high-temperature performance compared to conventional lithium-soap greases.

Market Challenges Analysis:

High Raw-Material and Manufacturing Costs Pose Entry Barriers

The Polyurea Grease Market faces significant challenges related to raw-material and manufacturing expenses. It involves the use of specialized thickeners, additives, and base oils, which often come at a higher cost and face supply constraints. These cost pressures can limit adoption in cost-sensitive sectors or regions where users prefer more affordable conventional greases. The lack of economies of scale in some manufacturing operations further amplifies the cost disadvantage for smaller producers. Additionally, the higher upfront investment required for the development and application of polyurea greases reduces the ease of market entry, which hinders broader market expansion.

Compatibility, Awareness, and Supply Chain Stability Present Adoption Risks

The market also struggles with compatibility issues with existing lubricants, limited awareness among end users, and supply chain instability. Polyurea greases may not always perform optimally when used in systems designed for other thickener types, which can lead to hesitation among potential adopters. Many end-users are unfamiliar with the performance advantages of polyurea greases and are reluctant to make the switch without proven results. Furthermore, supply disruptions and fluctuations in the availability of petrochemical feedstocks add unpredictability to raw-material procurement and pricing. These factors combine to increase perceived risks, slowing adoption despite the clear performance benefits offered by polyurea greases.

Market Opportunities:

Growth Through Expansion in Emerging Economies and New Applications

The Polyurea Grease Market presents substantial opportunity via rapid industrialisation in emerging economies. Demand in regions such as Asia‑Pacific and Latin America is rising due to increased manufacturing, construction and infrastructure activity. Manufacturers can target these markets by offering formulations tailored for cost‑sensitive customers, boosting uptake in segments that traditionally relied on conventional greases. It also allows players to diversify geographically and reduce dependence on mature markets. By aligning product development with regional specifications and regulations, companies can gain early‑mover advantage.

Innovation in Formulation and Service‑Life Enhancement as Value Levers

There lies significant potential in the development of next‑generation formulations that deliver longer service life and superior performance under extreme conditions. The Polyurea Grease Market can benefit from greases engineered for electric‑vehicle motors, wind‑turbine bearings and heavy‑duty mining equipment, where maintenance intervals and operational reliability matter most. Providers can establish premium pricing by emphasising durability, thermal stability and water resistance. It also opens collaboration opportunities with OEMs seeking customised lubrication solutions, which strengthens value‑chain integration and creates differentiated offerings in a competitive landscape.

Market Segmentation Analysis:

By Additives

The Polyurea Grease Market divides additive usage into categories such as anti‑wear agents, extreme‑pressure (EP) additives, corrosion inhibitors, and solid lubricants. It uses anti‑wear additives to protect metal surfaces under repeated stress while EP additives enhance load‑carrying capability in heavy‑duty applications. Corrosion inhibitors help prevent rust in moist or marine environments, broadening the grease’s suitability. Solid lubricants contribute during extreme friction or high‑temperature exposure by embedding materials like graphite or molybdenum disulfide. Manufacturers tailor additive packages to match specific performance demands and differentiate products across service grades.

- For Instance, Certain specialized formulations, such as those used for high-performance polymers and industrial sealants, are designed to maintain consistency across a broad temperature range from -40 to 150 degrees Celsius, enabling stable performance in diverse environments.

By Type

The market segments by type focus on thickener systems and base‑oil chemistry. It includes pure polyurea‑thickened greases, mixed‑thickener greases (polyurea combined with soap or complex soap systems), synthetic‑base oil grades and mineral‑base oil grades. Pure polyurea types dominate high‑temperature, long‑life, high‑speed applications due to superior thermal and mechanical stability. Mixed‑thickener types serve cost‑sensitive or transitional applications where compatibility with existing systems matters. Synthetic‑base oil varieties command premium pricing while mineral‑base options address standard load/temperature regimes.

- For Instance, Lubrizol’s urea-derivative thickeners have shown improved bearing life and high-temperature stability. Urea-derivative greases generally provide superior thermal resistance and oxidation stability compared to lithium greases, suitable for continuous use up to 180°C or higher in specific formulations.

By Application

The application segmentation covers automotive, industrial machinery, mining & construction, electric vehicles (EVs), and other sectors such as marine and rail. It targets the automotive sector for wheel bearings, joints and gearboxes where long service intervals reduce maintenance. It serves industrial machinery and mining for heavy‑duty bearings, conveyors and high‑temperature environments. For EVs, it addresses motor/gearbox lubricant needs unique to high‑speed silent operation. Marine and rail sectors present niche but growing demand where water‑resistance and durability matter. This segmentation enables suppliers to align product design and channel strategy with end‑user requirements.

Segmentations:

By Additives

- Anti‑wear additives

- Extreme‑pressure (EP) additives

- Corrosion‑inhibitor additives

- Friction‑modifier additives

- Solid‑lubricant additives

By Type

- Pure polyurea‑thickened greases

- Mixed‑thickener greases (polyurea + soap/complex soap)

- Synthetic‑base‑oil greases

- Mineral‑base‑oil greases

By Application

- Automotive (e.g., wheel‑bearings, gearboxes)

- Industrial machinery (e.g., heavy‑duty bearings)

- Mining & construction equipment

- Electric‑vehicle (EV) components (motors, gearboxes)

- Marine & rail applications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America — Market share close to 40%

North America holds the largest share of the market and leads in adoption of high‑performance polyurea greases. It benefits from a mature industrial base, strong automotive sector and stringent environmental regulations that drive demand for advanced lubricants. Manufacturers in the region invest heavily in research and development to tailor polyurea greases for heavy machinery, EVs and manufacturing plants. It also features a strong supply‑chain infrastructure and presence of major global players, which support product availability and innovation. The region’s end‑users increasingly prioritise maintenance reduction and equipment efficiency, favouring polyurea grease solutions. Continued replacement of conventional greases with polyurea‑based variants strengthens market growth in this geography.

Europe — Market share around 30%

Europe captures a significant portion of the market thanks to its strong automotive manufacturing and strict regulatory environment. Germany, France and the UK lead demand for high‑spec lubrication products in industrial and automotive applications. It also has a well‑established industrial maintenance culture that favours long‑life lubricants such as polyurea greases. The region’s focus on sustainability and clean‑technology adoption encourages the shift from traditional greases to more efficient alternatives. Suppliers align product features with European emissions, durability and performance standards to gain acceptance. Investment in localized manufacturing and distribution ensures that the regional market remains competitive and responsive to end‑user needs.

Asia‑Pacific & Middle East / Africa — APAC share near 20%, MEA & Latin America smaller but growing

Asia‑Pacific commands a growing share of the market due to rapid industrialisation, rising automotive production and infrastructure expansion in countries like China and India. It offers considerable opportunity for polyurea greases in mining, construction equipment and EV applications. It also faces challenges such as cost sensitivity and compatibility issues in legacy systems, but growth is strong. The Middle East and Africa region, along with Latin America, includes smaller shares but progress in petrochemicals, oil & gas and mining sectors creates demand for durable lubricants. Suppliers targeting MEA and Latin America customise offerings for harsh‑environment conditions and water‑resistance requirements. Strategic partnerships with local distributors and infrastructure investments help enhance reach and penetration in these emerging regions.

Key Player Analysis:

- Martin Lubricants

- Chevron

- Imperator

- BECHEM

- HUSK-ITT Corporation

- Lubricant Consult GmbH

- Canoil Canada Ltd.

- Schaeffer Manufacturing Co

Competitive Analysis:

The Polyurea Grease Market features a competitive landscape with prominent players such as Martin Lubricants, Chevron, Imperator, BECHEM, HUSK‑ITT Corporation, Lubricant Consult GmbH, Canoil Canada Ltd. and Schaeffer Manufacturing Co. Each company leverages R&D, proprietary thickener technology and additive packages to establish differentiation and secure market positions. Martin Lubricants emphasises contract manufacturing and custom polyurea formulations. BECHEM develops high‑spec polyurea greases for automotive and industrial segments, offering low‑noise, thermal‑stable solutions. Companies such as Chevron and Imperator deploy global supply chains and scale, while smaller specialist firms like HUSK‑ITT and Lubricant Consult focus on niche applications and targeted service‑life extension greases. It remains critical for players to enhance application support, broaden geographic reach and manage raw‑material cost pressures to sustain their competitive edge.

Recent Developments:

- In August 2025, BECHEM acquired CLC Lubricants, a US-based producer specializing in industrial oils and metalworking fluids, expanding its operational footprint in North America and establishing BECHEM’s first wholly owned production facility in the United States.

- In October 2025, Chevron expanded its partnership with Arkestro by rolling out AI-driven predictive procurement software across more business units to enhance supplier management and procurement efficiency.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Additives, Type, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Polyurea Grease Market will expand into emerging economies where industrialisation and infrastructure build‑out increase demand for high‑performance lubricants.

- Companies will grow offerings that target electric‑vehicle motors and gearboxes, since it presents a major application area for advanced greases with high thermal and oxidation resistance.

- Firms will invest in formulation innovation to deliver greases that support longer re‑lubrication intervals, greater wear protection and improved reliability in heavy‑duty and mining equipment.

- Suppliers will emphasise customisation of additive packages and base‑oil blends to differentiate products for specific sectors including marine, rail and renewable‑energy equipment.

- The industry will shift toward sustainable, eco‑friendly polyurea greases with biodegradable or bio‑based components to meet stricter environmental regulations and customer preferences.

- Manufacturers will expand regionally by building local production, distribution and technical support in high‑growth zones to improve service levels and market penetration.

- Strategic partnerships and collaborations with OEMs will increase, enabling grease makers to integrate lubrication solutions early in equipment design and provide value‑added services.

- Digitalisation of maintenance practices will boost demand for smart greases and condition‑monitoring capabilities, allowing users to optimise lubricant life and reduce downtime.

- The market will face pressure to reduce cost per unit through scale and process improvement, enabling polyurea greases to move beyond premium segments into mainstream applications.

- Competitive intensity will rise, pushing companies to build stronger brand value, expand service portfolios and enter adjacent segments such as bearing systems and system lubrication services.

Market Drivers:

Market Drivers: