| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Latin America Biomaterials Market Size 2024 |

USD 10,517.51 Million |

| Latin America Biomaterials Market, CAGR |

13.76% |

| Latin America Biomaterials Market Size 2032 |

USD 29,503.84 Million |

Market Overview

Latin America Biomaterials Market size was valued at USD 10,517.51 million in 2024 and is anticipated to reach USD 29,503.84 million by 2032, at a CAGR of 13.76% during the forecast period (2024-2032).

The Latin America biomaterials market is experiencing robust growth, driven by increasing demand for advanced medical treatments, a rising aging population, and expanding healthcare infrastructure. Governments across the region are investing in modernizing healthcare systems, which is accelerating the adoption of biomaterials in orthopedic, dental, and cardiovascular applications. Technological advancements in biocompatible materials, such as bioresorbable polymers and natural biomaterials, are fostering innovation and broadening clinical use. Additionally, the growing prevalence of chronic diseases and a surge in cosmetic and reconstructive surgeries are further propelling market expansion. Collaborations between global manufacturers and local players are enhancing product accessibility and fostering regional expertise. The trend towards personalized medicine and regenerative therapies is also gaining traction, supported by increased research and development activities. These combined drivers and emerging trends are positioning Latin America as a dynamic and increasingly competitive market in the global biomaterials landscape.

The geographical analysis of the Latin America biomaterials market reveals significant growth potential across countries such as Brazil, Argentina, Colombia, Chile, and Peru, each exhibiting increasing demand for advanced medical technologies and improved healthcare infrastructure. Urban centers in these regions are becoming key hubs for medical innovation, driven by rising surgical procedures, aging populations, and expanding public and private healthcare investments. As the market grows, both local and international companies are establishing a stronger presence to meet the rising demand. Key players operating in the region include Neodent, Implantcast, Marubeni Corporation, Biocross, and Dentsply Sirona, each contributing through specialized product offerings, strategic partnerships, and technological innovation. These companies are focusing on enhancing their biomaterial portfolios, investing in research and development, and expanding distribution networks to strengthen their market positions and cater to the diverse needs of Latin America’s evolving healthcare sector.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Latin America biomaterials market was valued at USD 10,517.51 million in 2024 and is expected to reach USD 29,503.84 million by 2032, growing at a CAGR of 13.76% during the forecast period (2024-2032).

- The global biomaterials market was valued at USD 2,03,827.80 million in 2024 and is projected to reach USD 6,19,828.57 million by 2032, growing at a CAGR of 14.91% during the forecast period.

- Increasing demand for advanced medical treatments, especially in orthopedics, dental, and cardiovascular fields, is driving the market’s growth.

- Technological advancements in biocompatible materials and the shift toward personalized healthcare are key market trends.

- Strong government investments and regional healthcare infrastructure improvements are fostering the adoption of biomaterials in medical procedures.

- The market faces challenges such as regulatory complexities, high import dependency, and limited standardization across countries.

- Brazil, Mexico, and Argentina dominate the regional market, with strong growth observed in Colombia, Chile, and Peru due to healthcare development.

- Key players like Neodent, Dentsply Sirona, and Marubeni Corporation are leading the market with innovative product offerings and strategic partnerships.

Report Scope

This report segments the Latin America Biomaterials Market as follows:

Market Drivers

Rising Demand for Advanced Medical Treatments

The growing need for innovative and effective medical treatments is a key driver of the biomaterials market in Latin America. As the regional healthcare sector shifts towards advanced therapeutic solutions, biomaterials are increasingly utilized in a wide range of applications including orthopedics, cardiovascular interventions, dental procedures, and wound care. Countries like Brazil, Mexico, and Argentina are witnessing an upsurge in the adoption of minimally invasive procedures and implantable devices, which heavily rely on biocompatible materials. The demand for next-generation materials such as hydrogels, bioresorbable polymers, and bioactive ceramics is surging as clinicians seek safer, more effective solutions to treat complex medical conditions.

Expanding Healthcare Infrastructure and Government Support

Significant investments in healthcare infrastructure across Latin America are creating favorable conditions for biomaterials market expansion. For instance, Brazil accounted for more hospitals than the United States alone, with 6,451 hospitals in 2021. Public and private sector initiatives aimed at improving access to quality healthcare are encouraging the integration of modern medical technologies. Governments are increasingly supporting research institutions and facilitating collaborations with international biomedical firms, boosting innovation and local production. Regulatory improvements and increased awareness of global quality standards have also streamlined the approval and commercialization of biomaterial-based products. Additionally, the expansion of health insurance coverage in several Latin American countries has contributed to a broader patient base capable of accessing advanced biomaterial-based treatments.

Growing Aging Population and Chronic Disease Burden

Demographic trends are significantly influencing the biomaterials market. For instance, Latin America is experiencing a steady increase in its elderly population, which is highly prone to age-related health issues such as osteoarthritis and musculoskeletal disorders. Latin America is experiencing a steady increase in its elderly population, which is particularly susceptible to conditions that require surgical intervention and long-term care—such as osteoarthritis, cardiovascular diseases, and dental degeneration. The World Health Organization projects a sharp rise in chronic disease incidence in the region, further driving the demand for biomaterials used in implants, tissue engineering, and regenerative medicine. The aging demographic not only boosts demand for orthopedic and cardiovascular devices but also encourages the development of tailored biomaterial solutions to enhance patient outcomes and quality of life.

Technological Advancements and Strategic Collaborations

Innovation in biomaterials technology is playing a vital role in shaping the Latin American market landscape. Breakthroughs in material science, including nanotechnology and 3D bioprinting, are enabling the production of more precise, functional, and cost-effective biomaterials. Local companies are increasingly engaging in partnerships with global biotech and medical device manufacturers to gain access to cutting-edge technologies and expand their product portfolios. These collaborations are not only enhancing the quality and availability of biomaterial-based solutions but also fostering knowledge transfer and skill development across the region. As R&D activities gain momentum, the market is poised for continued advancement, underpinned by a strong focus on innovation and regional capacity-building.

Market Trends

Shift Toward Regenerative Medicine and Personalized Care

A notable trend in the Latin America biomaterials market is the growing focus on regenerative medicine and personalized healthcare. As healthcare providers aim to deliver more patient-specific solutions, biomaterials are increasingly being tailored to individual biological profiles for better integration and efficacy. This shift is particularly evident in fields such as tissue engineering, orthopedics, and reconstructive surgery, where custom-designed implants and scaffolds enhance treatment outcomes. Advances in cell biology, bioengineering, and 3D printing are facilitating this personalized approach, encouraging local biotech firms and research institutions to explore patient-centric innovations.

Increased Adoption of Natural and Sustainable Biomaterials

Sustainability has emerged as a significant factor influencing material selection in biomedical applications. For instance, Latin America is witnessing a rising preference for biodegradable biomaterials derived from natural sources such as collagen and chitosan. These materials are not only biocompatible but also align with regional goals of reducing environmental impact and promoting green healthcare solutions. The abundance of natural resources in the region has encouraged local production and research into plant- and animal-based biomaterials. This trend is creating opportunities for sustainable product development and positioning Latin America as a competitive supplier in the global biomaterials ecosystem.

Advancement of Local Manufacturing and Technological Capabilities

The biomaterials industry in Latin America is evolving through advancements in local manufacturing capabilities and technological integration. For instance, Brazil, Mexico, and Colombia are investing in domestic production to reduce reliance on imports and enhance supply chain resilience. Improvements in manufacturing technologies such as computer-aided design (CAD), additive manufacturing, and precision machining are enabling the production of high-quality, cost-effective biomaterials. Furthermore, initiatives to strengthen the biomedical engineering workforce and promote tech transfer from international partners are contributing to the region’s growing self-sufficiency and innovation capacity.

Strategic Collaborations and Market Expansion by Global Players

Global medical device and biomaterial companies are actively expanding their footprint in Latin America through strategic partnerships, acquisitions, and distribution agreements. These collaborations allow international firms to tap into emerging markets while offering local players access to advanced technologies and broader distribution channels. This trend is fostering a more dynamic and competitive market environment, with increased product availability and faster adoption of cutting-edge solutions. Additionally, trade agreements and regulatory harmonization across Latin American countries are simplifying market entry for foreign companies, further accelerating the globalization of the regional biomaterials industry.

Market Challenges Analysis

Regulatory Complexities and Limited Standardization

One of the primary challenges facing the Latin America biomaterials market is the complexity and inconsistency of regulatory frameworks across the region. For instance, Brazil’s ANVISA requires manufacturers to adhere to stringent classification and documentation processes, with post-market surveillance playing a crucial role in maintaining compliance. Although some countries, such as Brazil and Mexico, have established regulatory bodies like ANVISA and COFEPRIS to oversee medical device approval, the lack of harmonized standards poses difficulties for manufacturers operating across multiple jurisdictions. Varying requirements, lengthy approval timelines, and limited transparency can delay product launches and increase compliance costs. Moreover, smaller local manufacturers often lack the resources or technical expertise to navigate these regulatory processes efficiently, hindering their ability to scale operations or compete with international players. The absence of region-wide standardization also limits cross-border collaboration and slows the adoption of innovative biomaterial technologies.

Infrastructure Gaps and Economic Volatility

Infrastructure limitations and economic instability present additional hurdles for the biomaterials sector in Latin America. Many regions still face challenges such as inadequate healthcare facilities, insufficient R&D funding, and a shortage of skilled professionals in biomedical engineering and materials science. These issues constrain both the development and application of biomaterials in clinical settings. Additionally, economic volatility—including currency fluctuations, inflation, and political uncertainty—can deter foreign investment and impact procurement decisions within public and private healthcare systems. High production and importation costs further compound these challenges, especially in less-developed markets where affordability remains a significant concern. While efforts are being made to strengthen healthcare infrastructure and foster innovation, progress is often uneven, limiting the overall growth potential of the biomaterials industry across the region.

Market Opportunities

The Latin America biomaterials market presents significant growth opportunities driven by the region’s evolving healthcare needs and expanding medical infrastructure. With increasing demand for advanced medical devices and surgical procedures, there is a rising need for innovative biomaterials that enhance patient outcomes and reduce recovery times. The growing adoption of regenerative medicine, tissue engineering, and minimally invasive procedures creates a fertile landscape for manufacturers offering high-performance, biocompatible materials. Additionally, the expanding middle-class population and greater access to healthcare services are broadening the patient base, particularly in urban centers across Brazil, Mexico, Argentina, and Colombia. This demographic shift is encouraging healthcare providers to invest in state-of-the-art treatments that rely heavily on biomaterials, including orthopedic implants, cardiovascular devices, and dental solutions.

Moreover, local production and regional research initiatives are opening up new avenues for growth. Latin America has an abundance of natural resources that can be harnessed for the development of sustainable biomaterials, such as collagen, chitosan, and plant-based polymers. With the support of government incentives and public-private partnerships, domestic companies have the potential to reduce dependency on imports while stimulating innovation and job creation. Collaborations between academic institutions, biotech firms, and multinational corporations are also enhancing technological capabilities and facilitating the transfer of knowledge and best practices. As regulatory frameworks become more harmonized and favorable, foreign investors and global manufacturers are likely to increase their presence in the region, accelerating the market’s expansion. These combined factors make Latin America a promising and strategically valuable region for future biomaterials development and commercialization.

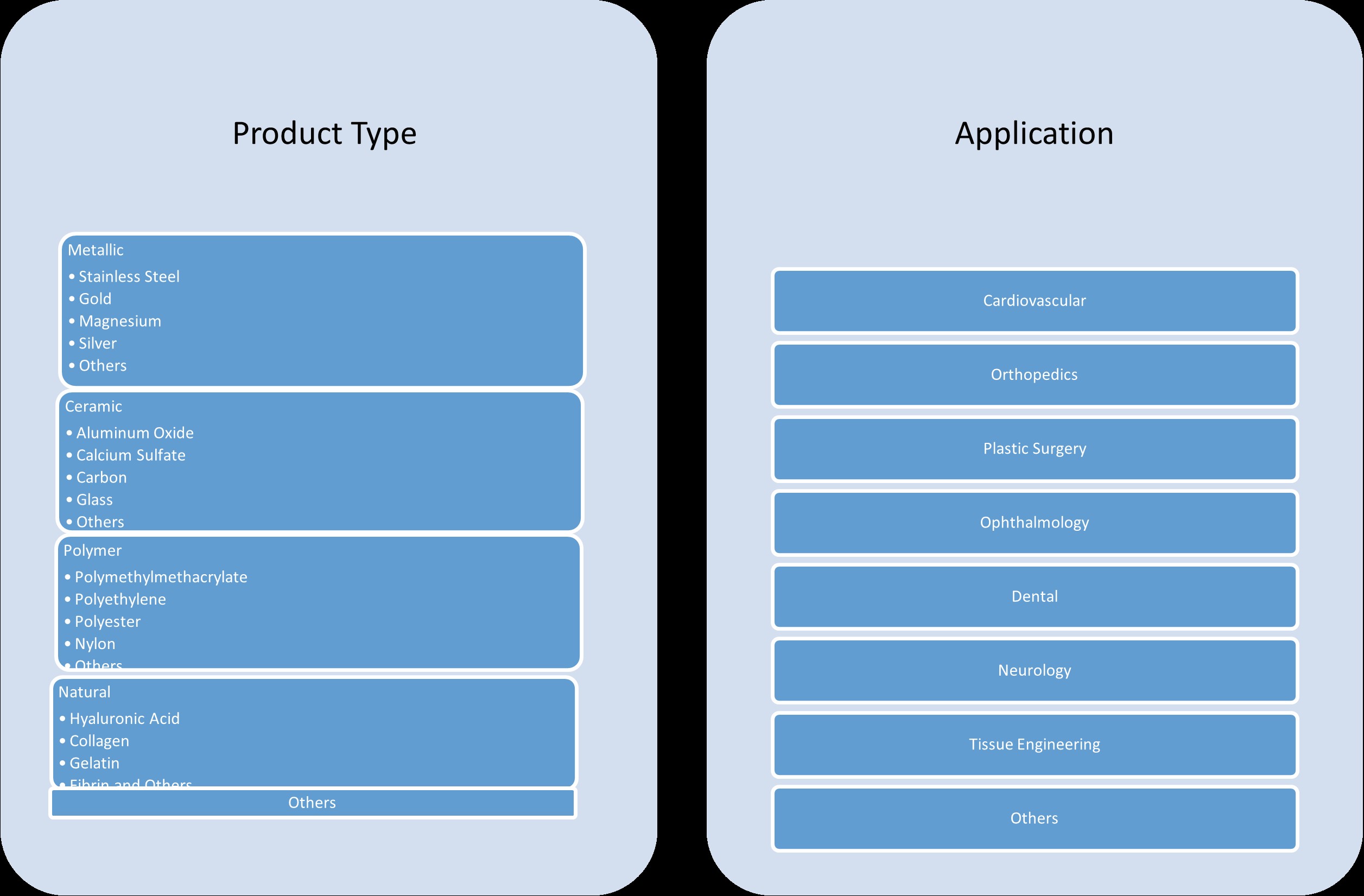

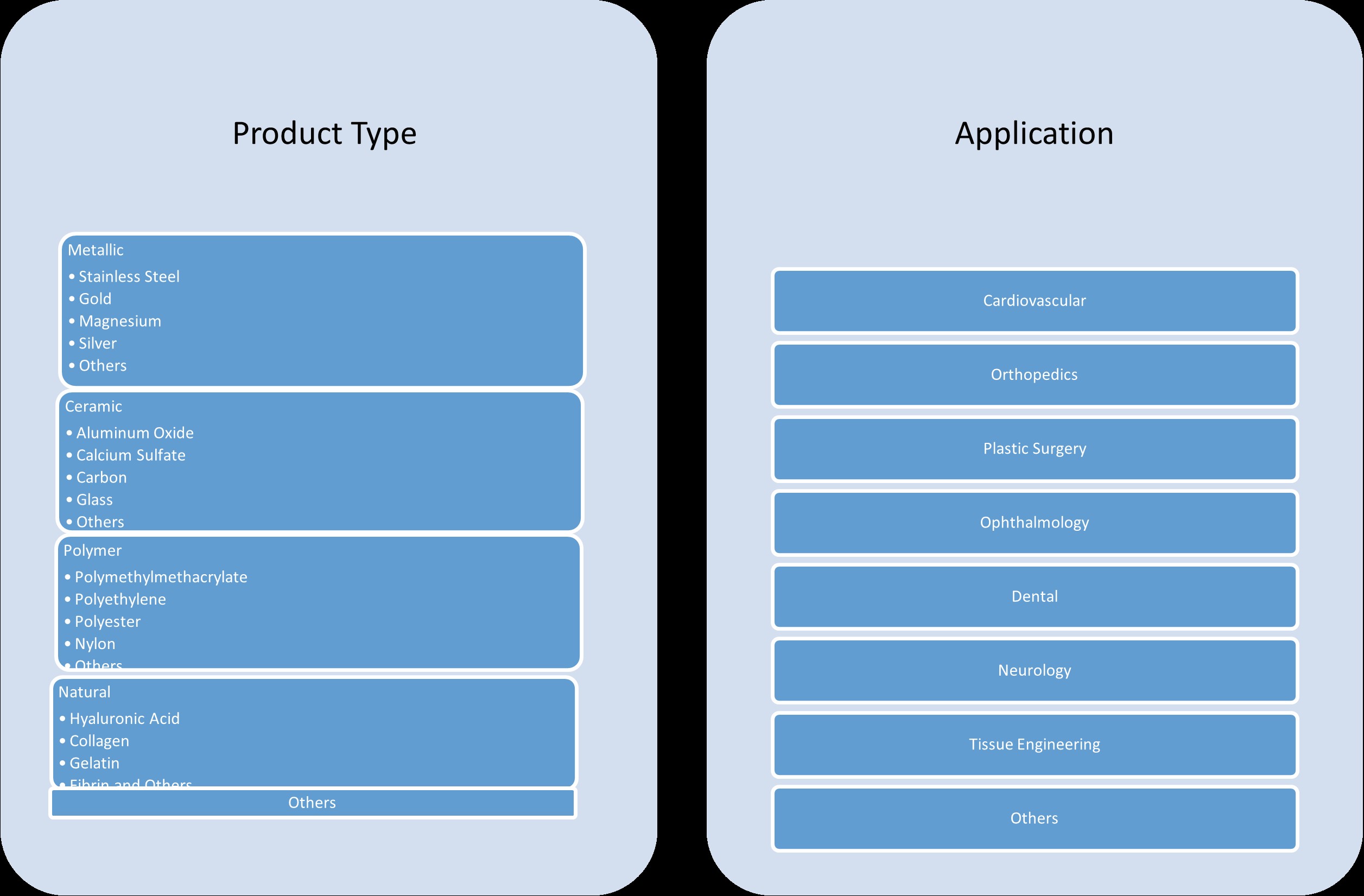

Market Segmentation Analysis:

By Product Type:

The Latin America biomaterials market is segmented into metallic, ceramic, polymer, natural, and other biomaterials, with each category playing a distinct role across various medical applications. Metallic biomaterials, including stainless steel, magnesium, gold, silver, and other alloys, are widely used in orthopedic implants and cardiovascular devices due to their strength and durability. Ceramic biomaterials, such as aluminum oxide, calcium sulfate, carbon, and bioglass, are gaining traction in dental and orthopedic applications for their excellent biocompatibility and resistance to wear. Polymer-based biomaterials—like polymethylmethacrylate, polyethylene, polyester, and nylon—are extensively utilized for prosthetics, drug delivery systems, and soft tissue implants owing to their versatility and ease of customization. Natural biomaterials, including hyaluronic acid, collagen, gelatin, and fibrin, are witnessing rising demand in tissue engineering and cosmetic procedures because of their regenerative properties and minimal immune response. The diversification of biomaterial types supports a broad spectrum of healthcare needs, driving continuous innovation and market penetration across Latin America.

By Application:

In terms of application, the Latin America biomaterials market is primarily driven by cardiovascular, orthopedic, and dental uses, with expanding potential in plastic surgery, ophthalmology, neurology, and tissue engineering. Cardiovascular applications, including stents and grafts, are gaining momentum due to the increasing prevalence of heart disease across the region. Orthopedic biomaterials remain in high demand for joint replacements, fracture fixation, and spinal surgeries, particularly among the aging population. Dental biomaterials, such as implants and bone grafts, are growing steadily with the rising awareness of oral health and cosmetic dentistry. Plastic surgery and tissue engineering applications are seeing rapid adoption fueled by the growing interest in aesthetic enhancements and regenerative treatments. Additionally, ophthalmic and neurological applications are emerging as promising segments, with biomaterials being developed for use in intraocular lenses and neural regeneration. This broad and diverse application base reinforces the critical role biomaterials play in modern medicine, positioning the industry for sustained growth throughout Latin America.

Segments:

Based on Product Type:

- Metallic

- Stainless Steel

- Gold

- Magnesium

- Silver

- Others

- Ceramic

- Aluminum Oxide

- Calcium Sulfate

- Carbon

- Glass

- Others

- Polymer

- Polymethylmethacrylate

- Polyethylene

- Polyester

- Nylon

- Others

- Natural

- Hyaluronic Acid

- Collagen

- Gelatin

- Fibrin and others

- Others

Based on Application:

- Cardiovascular

- Orthopedics

- Plastic Surgery

- Ophthalmology

- Dental

- Neurology

- Tissue Engineering

- Others

Based on the Geography:

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

Regional Analysis

Brazil

Brazil holds the largest share of the Latin America biomaterials market, accounting for approximately 38% of the regional revenue in 2024. This dominant position is driven by the country’s advanced healthcare infrastructure, strong demand for orthopedic and cardiovascular devices, and a growing population of aging individuals requiring surgical implants. Brazil’s regulatory body, ANVISA, plays a critical role in supporting market development through increasingly streamlined processes for medical device approvals. Additionally, Brazil hosts a number of local manufacturers and research institutions actively engaged in biomaterial innovation, particularly in polymers and natural materials. Government incentives for healthcare modernization and international collaboration are further accelerating the integration of cutting-edge biomaterials across public and private healthcare sectors.

Mexico, Colombia, and the Rest of Latin America

Together, Colombia, Mexico, and the rest of Latin America contribute to about 32% of the total market share, showcasing significant potential for growth. Colombia is rapidly expanding its healthcare infrastructure and has become a hub for cosmetic and dental procedures, which rely heavily on biomaterials. Mexico, while not individually outlined in this breakdown, contributes strongly through its proximity to North American markets and robust manufacturing capacity. Other countries such as Ecuador, Bolivia, and the Caribbean nations are gradually adopting advanced biomaterial-based solutions, primarily in urban centers with developed healthcare systems. This segment benefits from growing medical tourism, international investment, and increasing awareness about regenerative medicine and personalized care.

Argentina

Argentina accounts for approximately 14% of the Latin America biomaterials market. The country has a relatively well-established medical system and a tradition of biomedical research, especially in university hospitals and public institutions. Biomaterials are used extensively in orthopedic, dental, and cardiovascular applications, with polymer-based materials being the most prominent. However, challenges related to economic instability and import dependence hinder rapid expansion. Despite these hurdles, Argentina’s consistent investment in public health, combined with a technically skilled workforce, makes it a reliable contributor to the regional market with promising growth potential as economic conditions stabilize.

Chile and Peru

Chile and Peru together represent roughly 16% of the market share and are emerging as niche markets with strong upward momentum. Chile, with its stable economy and high healthcare standards, is increasingly integrating biomaterials in specialized treatments, including ophthalmology and reconstructive surgery. Peru, on the other hand, is focusing on expanding healthcare access and improving clinical capabilities, especially in urban hospitals. Both countries are witnessing growing interest from international medical device companies and are investing in medical research partnerships, signaling a favorable environment for biomaterial innovation and adoption in the near future.

Key Player Analysis

- Neodent

- Implantcast

- Marubeni Corporation

- Biocross

- Dentsply Sirona

Competitive Analysis

The Latin America biomaterials market is highly competitive, with key players actively driving innovation, expanding their product portfolios, and forming strategic partnerships. Leading companies such as Neodent, Implantcast, Marubeni Corporation, Biocross, and Dentsply Sirona are shaping the market landscape with advanced biomaterial solutions across various applications, including orthopedics, dental, cardiovascular, and tissue engineering. This competitive environment is driven by innovation in biocompatible materials, including polymers, ceramics, metals, and natural materials, which are widely used in orthopedics, dental, cardiovascular, and tissue engineering fields. As the market grows, competition intensifies in terms of pricing, product quality, and technological advancements. Companies are increasingly investing in sustainable and patient-specific biomaterials to meet the diverse needs of Latin America’s evolving healthcare sector. Additionally, partnerships between local and global companies are becoming more common, facilitating the transfer of technology and expanding market reach. Regulatory compliance, manufacturing capabilities, and local market expertise are crucial differentiators in this competitive environment. Companies that can navigate the complex regulatory landscapes of different Latin American countries, while offering affordable, high-quality solutions, are likely to maintain a competitive advantage. The emphasis on personalized healthcare and regenerative medicine further propels innovation, making the region an increasingly attractive market for biomaterial manufacturers.

Recent Developments

- In April 2025, BASF expanded its EcoBalanced portfolio for Care Chemicals in North America, introducing the first EcoBalanced personal care products in the region. These include Dehyton® PK 45 and Dehyton® KE UP, both certified as EcoBalanced grades using a biomass balance (BMB) approach to reduce carbon footprint. Additionally, six U.S. Care Chemicals production sites are now powered entirely by renewable electricity, saving approximately 33,000 tons of CO₂ annually.

- In November 2024, Covestro began production of Desmophen® CQ NH, a partially bio-based polyaspartic resin (at least 25% bio-based content), at its Foshan, China site. The facility is powered entirely by renewable energy, and the product is used in wind turbine and flooring coatings, supporting both local supply and sustainability goals.

- In January 2025, BASF’s Performance Materials division transitioned all European sites to 100% renewable electricity, covering engineering plastics, polyurethanes, thermoplastic polyurethanes, and specialty polymers.

- In June 2023, Invibio announced a collaboration with Paragon Medical to scale up manufacturing of PEEK-OPTIMA Ultra-Reinforced composite trauma devices in China, responding to growing global demand for high-performance biomaterials in trauma fixation.

- In February 2023, Celanese introduced ECO-B, more sustainable versions of Acetyl Chain materials, incorporating mass balance bio-content to provide chemically identical, bio-based alternatives for engineered materials.

Market Concentration & Characteristics

The Latin America biomaterials market exhibits moderate to high concentration, with a mix of large multinational companies and smaller regional players. The market is characterized by a strong presence of global manufacturers, who are increasingly focusing on expanding their operations in the region through partnerships, acquisitions, and local manufacturing. This trend is driven by the growing demand for advanced medical treatments and the region’s expanding healthcare infrastructure. Despite the dominance of international players, local companies are gaining ground by leveraging cost advantages and offering customized solutions that cater to regional healthcare needs. The market’s characteristics are also shaped by technological innovation, with a focus on biocompatible, sustainable, and patient-specific biomaterials. Regulatory complexity, differing healthcare standards across countries, and economic volatility add to the competitive dynamics, making it essential for companies to adapt quickly and navigate diverse market conditions to succeed in the Latin American biomaterials sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Latin America biomaterials market is expected to continue growing at a strong pace due to increasing healthcare investments and an aging population.

- Technological advancements in biomaterial production, such as 3D printing and nanotechnology, will drive innovation and improve patient outcomes.

- The demand for sustainable and biodegradable biomaterials will rise as environmental concerns and regulations push for greener solutions.

- A shift towards personalized medicine will lead to more customized biomaterial solutions tailored to individual patient needs.

- Government initiatives and healthcare reforms in several Latin American countries will create favorable conditions for biomaterial adoption and market growth.

- The rise in medical tourism across the region will boost demand for advanced biomaterial-based treatments, particularly in cosmetic and dental applications.

- Local manufacturers will increase their market share by focusing on cost-effective solutions and improving production capabilities.

- Strategic collaborations between global and regional companies will expand access to cutting-edge biomaterial technologies.

- The growing focus on regenerative medicine and tissue engineering will open up new avenues for biomaterial applications in Latin America.

- Regulatory harmonization across Latin American countries will simplify market entry and foster greater market integration for biomaterial manufacturers.