Market Overview

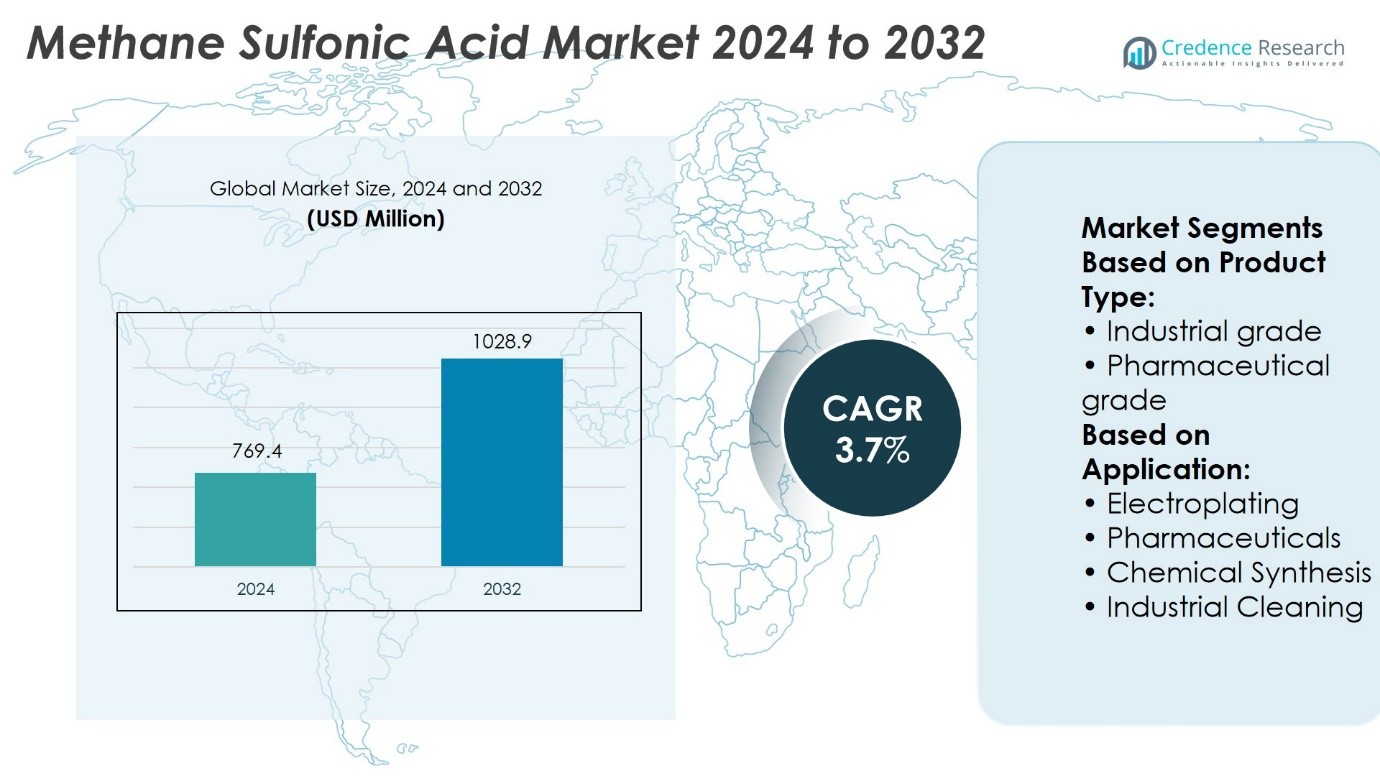

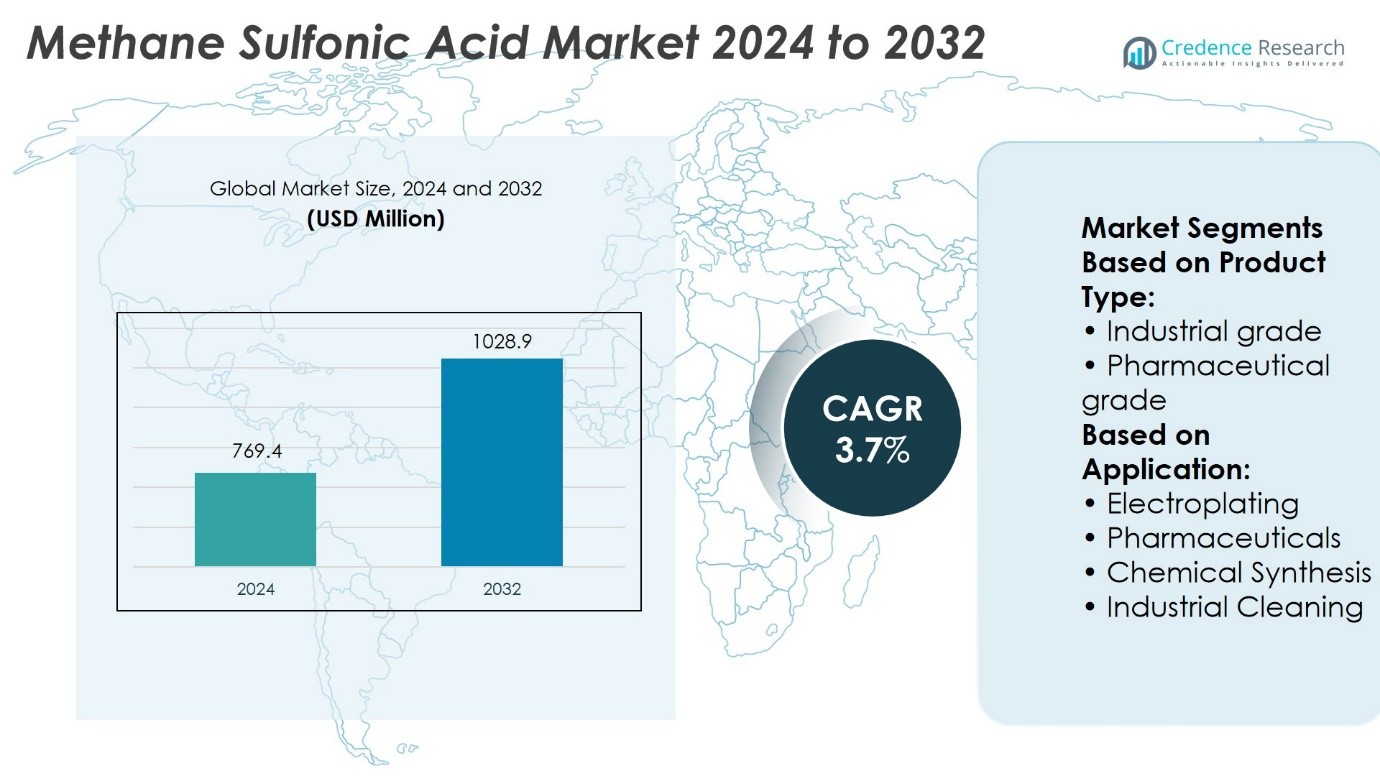

Methane Sulfonic Acid Market size was valued at USD 769.4 million in 2024 and is anticipated to reach USD 1028.9 million by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Methane Sulfonic Acid Market Size 2024 |

USD 769.4 Million |

| Methane Sulfonic Acid Market, CAGR |

3.7% |

| Methane Sulfonic Acid Market Size 2032 |

USD 1028.9 Million |

The Methane Sulfonic Acid Market grows through rising demand in pharmaceuticals, electroplating, and energy storage, supported by its biodegradability and low toxicity compared to conventional acids. It acts as a key catalyst in high-purity drug synthesis, strengthens performance in redox flow batteries, and improves plating quality in electronics and automotive industries. Regulatory shifts toward green chemistry accelerate its replacement of mineral acids, while industrial users adopt it to meet stricter sustainability standards. Continuous research and investment in advanced applications reinforce its role as a versatile chemical, ensuring strong alignment with evolving industrial, environmental, and technological requirements.

The Methane Sulfonic Acid Market shows strong geographical presence, with Asia-Pacific leading due to high demand from pharmaceuticals, electronics, and electroplating industries, while North America and Europe maintain steady growth through regulatory-driven adoption and advanced chemical applications. Latin America and Middle East & Africa represent emerging markets supported by expanding agrochemical and industrial sectors. Key players include Arkema, BASF, Ataman Chemicals, BLDpharm, CDH Fine Chemicals, Finar Chemicals, Glentham Life Sciences, Haihang Industry, Hebei Yanuo Bioscience, and Hydrite Chemical Co.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Methane Sulfonic Acid Market size was valued at USD 769.4 million in 2024 and is anticipated to reach USD 1028.9 million by 2032, at a CAGR of 3.7%.

- Rising demand in pharmaceuticals, electroplating, and energy storage drives market expansion due to its biodegradability and low toxicity.

- Trends highlight its role in high-purity drug synthesis, redox flow batteries, and electronics plating, supported by stricter sustainability standards.

- Competition features global leaders and regional suppliers focusing on purity, compliance, and cost competitiveness.

- Market restraints include high production costs, raw material price fluctuations, and stringent regulatory compliance.

- Asia-Pacific leads with strong adoption across pharma and electronics, while North America and Europe sustain growth through innovation and green policies.

- Latin America and Middle East & Africa emerge as growing regions with rising agrochemical and industrial demand supported by expanding infrastructure.

Market Drivers

Expanding Applications in Electroplating and Metal Surface Treatment

The Methane Sulfonic Acid Market grows on strong demand from the electroplating industry. It supports environmentally safer alternatives to conventional mineral acids by offering high solubility and biodegradability. Electroplating of tin, lead, and precious metals relies on its stable conductivity and low toxicity profile. Manufacturers value its ability to improve current efficiency and reduce sludge generation. Electronics and automotive industries use it extensively for component finishing and corrosion resistance. Rising investments in sustainable plating processes strengthen its adoption in large-scale industrial operations.

- For instance, BASF partnered with JenaBatteries to develop a redox flow battery (RFB) technology tailored for stationary energy storage. The system supports capacities of 400 kWh per unit, with scalable capacities.

Rising Use in Pharmaceuticals and Fine Chemicals

The Methane Sulfonic Acid Market benefits from increasing usage in pharmaceutical synthesis and fine chemical production. It functions as an efficient catalyst for esterification and polymerization reactions, ensuring higher yields with fewer byproducts. Drug manufacturers adopt it for producing antibiotics, cardiovascular drugs, and vitamins with greater purity levels. The compound’s low volatility and strong acid strength provide a safer alternative to traditional acids in synthesis. Its role in green chemistry drives innovation in eco-friendly drug formulations. Growth in contract manufacturing organizations further elevates demand for efficient and compliant catalysts.

- For instance, MSA-based electrolytes have demonstrated storage densities around 40 Wh per kilogram at the laboratory scale—specifically in soluble-lead flow systems tested with electrode sizes.

Strong Demand from Renewable Energy and Battery Manufacturing

The Methane Sulfonic Acid Market gains momentum from its role in renewable energy and energy storage technologies. It enhances performance in redox flow batteries by delivering high ionic conductivity and stable electrolyte composition. Battery producers choose it for systems requiring long cycle life and low maintenance. Growing renewable integration increases reliance on scalable energy storage solutions. Governments promote it as part of energy transition policies that target reduced carbon emissions. Large-scale projects in solar and wind storage underline the importance of this acid in enabling sustainable infrastructure.

Expansion in Agrochemicals and Industrial Cleaning Solutions

The Methane Sulfonic Acid Market advances through its expanding role in agrochemicals and specialty cleaning formulations. It helps in the synthesis of herbicides and pesticides with higher effectiveness and environmental compatibility. Its high solubility supports uniform formulations that improve crop yield performance. In industrial cleaning, it provides low corrosivity toward metals while maintaining strong descaling action. Manufacturers adopt it for cleaning systems in food processing, medical devices, and precision machinery. Regulatory support for eco-friendly cleaning solutions strengthens market penetration across diverse industries.

Market Trends

Increasing Focus on Green Chemistry and Sustainable Production

The Methane Sulfonic Acid Market reflects a clear trend toward sustainable chemical processes. It replaces conventional mineral acids that generate hazardous byproducts, aligning with stricter environmental regulations. Producers emphasize its high biodegradability and low toxicity to meet green chemistry standards. Research initiatives target wider adoption in industrial catalysis that requires safe, recyclable acids. Demand grows from industries seeking to lower their environmental footprint without compromising performance. Companies highlight it as a preferred option for meeting global sustainability commitments.

- For instance, Arkema’s AMSA (Anhydrous Methanesulfonic Acid) is engineered for high-purity applications. Their production process achieves a water content below 5,000 ppm, while simultaneously limiting key impurities to 2 ppm for minimal methyl and ethyl mesylates (MMS and EMS).

Growing Role in Energy Storage and Advanced Batteries

The Methane Sulfonic Acid Market expands with its rising importance in energy storage applications. It serves as a stable electrolyte in redox flow batteries used for renewable energy integration. Battery developers focus on it for delivering high conductivity and long operational life. Projects in solar and wind sectors adopt this technology to ensure reliable grid support. Large-scale installations underscore its ability to provide cost-effective energy storage. Ongoing investments in renewable infrastructure amplify its presence in next-generation battery systems.

- For instance, BASF invested a double-digit million euro amount at least 50,000 metric tons per year EUR to expand MSA production capacities at its Verbund site in Ludwigshafen, enabling increased supply of high-purity, biodegradable acid.

Expanding Use in High-Performance Electronics and Plating

The Methane Sulfonic Acid Market benefits from growing reliance on it in electronics manufacturing. Electroplating for semiconductors and printed circuit boards requires precise surface finishing, where it offers superior conductivity. Industries select it to reduce sludge formation and improve bath stability. Automotive and aerospace producers adopt plating solutions that meet higher durability standards. The trend reflects a move toward efficient, low-waste processes across global supply chains. Its application supports high-value sectors that prioritize quality and sustainability.

Rising Application in Pharmaceuticals and Fine Chemicals

The Methane Sulfonic Acid Market strengthens its position in pharmaceutical and fine chemical production. It functions as a catalyst that delivers high yields and fewer impurities in complex reactions. Drug manufacturers rely on it for producing antibiotics, vitamins, and specialty compounds. Contract research and manufacturing organizations integrate it into scalable processes for global supply. Growth in biologics and specialty formulations increases reliance on efficient, compliant acid catalysts. Its expanding use highlights the trend toward safer and more sustainable production pathways.

Market Challenges Analysis

High Production Costs and Limited Availability of Raw Materials

The Methane Sulfonic Acid Market faces challenges linked to high production costs and dependence on specialized raw materials. Manufacturers require advanced processing facilities to maintain purity standards demanded by pharmaceuticals and electronics. Limited suppliers of methane and sulfur-based inputs create price volatility across regions. Small and medium-scale producers struggle to compete with larger companies that operate integrated value chains. High costs reduce adoption in industries with strict cost efficiency requirements. It restricts market expansion in regions where alternatives remain more economical.

Stringent Regulatory Frameworks and Substitution Risks

The Methane Sulfonic Acid Market encounters hurdles from strict environmental and safety regulations. Governments impose rigorous compliance requirements on chemical handling, storage, and waste management. Smaller companies face financial strain from the high cost of meeting these standards. Substitution risks also impact long-term adoption, with competing acids offering lower prices in certain applications. Industries sensitive to cost often select alternatives despite lower environmental performance. It challenges producers to balance regulatory compliance with competitive pricing strategies.

Market Opportunities

Expanding Role in Renewable Energy Storage and Green Technologies

The Methane Sulfonic Acid Market presents strong opportunities in renewable energy storage and sustainable industrial applications. It supports the development of redox flow batteries that deliver reliable performance for solar and wind integration. Governments and private investors prioritize energy storage solutions that align with low-emission goals. Its high conductivity and stability position it as a key electrolyte for next-generation systems. Growing emphasis on clean technologies widens its use across infrastructure and transportation projects. It creates avenues for manufacturers to target high-growth sectors committed to sustainability.

Rising Adoption in Pharmaceuticals and Specialty Chemicals

The Methane Sulfonic Acid Market gains new opportunities from the expanding pharmaceutical and specialty chemical industries. It serves as a catalyst that enables high-yield, low-impurity synthesis of critical compounds. Contract manufacturing organizations adopt it to improve scalability and meet regulatory standards in drug development. The growing demand for advanced formulations, including biologics and specialty medicines, enhances its relevance. Specialty chemical producers value its role in eco-friendly synthesis, creating scope for broader adoption. It strengthens prospects for companies that focus on compliance-driven, high-value applications.

Market Segmentation Analysis:

By Product Type

The Methane Sulfonic Acid Market divides into industrial grade and pharmaceutical grade, each serving distinct end-use industries. Industrial grade dominates with extensive use in electroplating, industrial cleaning, and large-scale chemical synthesis. Manufacturers prefer it for its stability, high solubility, and low environmental impact compared to mineral acids. Demand remains strong in electronics, automotive, and metal finishing industries that rely on high-quality surface treatment. Pharmaceutical grade focuses on producing drugs, intermediates, and specialty chemicals that require precise purity levels. Drug manufacturers adopt it for efficient synthesis of antibiotics, vitamins, and cardiovascular treatments. It highlights the dual role of methane sulfonic acid as both a bulk industrial input and a high-value pharmaceutical catalyst.

- For instance, CDH Fine Chemicals offers MSA for synthesis featuring a verified assay (alkalimetrically) of 98.0%, a molecular weight of 96.10 g/mol, and is available in four standardized packaging formats.

By Application

The Methane Sulfonic Acid Market shows diverse adoption across electroplating, pharmaceuticals, chemical synthesis, and industrial cleaning. Electroplating represents one of the largest segments, where it ensures stable conductivity, low sludge formation, and improved plating quality. Electronics, aerospace, and automotive industries depend on it for precision coating and corrosion resistance. In pharmaceuticals, it functions as a catalyst that delivers high yields and fewer impurities in complex synthesis, strengthening its role in modern drug development. Chemical synthesis industries adopt it to replace conventional acids, benefiting from its biodegradability and strong acid strength. Industrial cleaning is another important segment, where it provides efficient descaling while remaining less corrosive to metals than traditional options. It secures rising demand across high-performance applications that prioritize sustainability, efficiency, and compliance.

- For instance, a pilot process documented reported a methane sulfonic acid production capacity of 20 million metric tons per year (i.e., 20 metric tons/year), demonstrating early-stage scaling potential for applications including electroplating and formulation research.

Segments:

Based on Product Type:

- Industrial grade

- Pharmaceutical grade

Based on Application:

- Electroplating

- Pharmaceuticals

- Chemical Synthesis

- Industrial Cleaning

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America accounts for 19.7% of the global market in 2025. The United States leads with extensive use in pharmaceuticals, biotech, and advanced chemical synthesis. Canada contributes with regulatory-driven adoption in specialty chemicals and green manufacturing. Strict safety and environmental standards accelerate substitution of mineral acids. Drug development, renewable energy, and high-value industrial applications sustain steady growth. The region’s focus on innovation and compliance ensures a stable market base.

Europe

Europe holds a market share of 17.3% in 2025, with some estimates placing it closer to 21%. Germany leads with about one-third of the regional market, followed by France, the UK, Italy, and Spain. Strong environmental regulations drive adoption in pharmaceuticals, specialty chemicals, and precision plating. The region prioritizes clean manufacturing and low-waste processes. High industrial standards in automotive and electronics sectors sustain demand. Europe remains a mature but steadily growing market.

Asia-Pacific

Asia-Pacific holds the largest share of the Methane Sulfonic Acid Market at 45.6% in 2024. China drives demand through large-scale electronics, electroplating, and pharmaceutical production. India strengthens adoption with strong pharmaceutical exports and agrochemical demand. Japan and South Korea rely on high-purity grades for semiconductors, batteries, and advanced coatings. Taiwan contributes through its packaging and foundry operations. Rapid industrialization, coupled with sustainability policies, positions Asia-Pacific as the most dominant region.

Latin America

Latin America represents 5.9% of global share in 2025. Brazil dominates, followed by Argentina, Colombia, and Chile. Expanding agrochemical industries and pharmaceutical investments create strong demand for methane sulfonic acid. The region’s role in global agricultural exports reinforces need for eco-friendly herbicides and catalysts. Infrastructure development and industrial growth expand opportunities. High growth projections make it a promising market for producers targeting emerging economies.

Middle East & Africa

Middle East & Africa account for 5% to 7% of the global share, equal to around USD 50 million in 2025. Saudi Arabia and UAE lead the regional market, followed by Egypt and South Africa. Applications include metal finishing, refinery processes, and pharmaceuticals. Limited local production results in high import reliance, creating opportunities for new manufacturing investments. Economic diversification and growing chemical sectors increase adoption. Rising sustainability awareness also supports gradual market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hydrite Chemical Co.

- Haihang Industry Co., Ltd.

- BASF

- Glentham Life Sciences

- Hebei Yanuo Bioscience Co Ltd

- Arkema

- Ataman Chemicals

- BLDpharm

- Finar Chemicals

- CDH Fine Chemicals

Competitive Analysis

The competitive landscape of the Methane Sulfonic Acid Market features include Arkema, Ataman Chemicals, BASF, BLDpharm, CDH Fine Chemicals, Finar Chemicals, Glentham Life Sciences, Haihang Industry Co., Ltd., Hebei Yanuo Bioscience Co Ltd, and Hydrite Chemical Co. The Methane Sulfonic Acid Market demonstrates a competitive environment shaped by innovation, sustainability, and regulatory compliance. Producers focus on delivering high-purity grades that meet the stringent requirements of pharmaceuticals, electronics, and advanced chemical synthesis. Companies differentiate through advancements in green chemistry, emphasizing biodegradable and low-toxicity solutions that replace traditional mineral acids. Investments in expanding production capacities, particularly in Asia-Pacific and North America, strengthen supply reliability for fast-growing end-use industries. Competition also extends to pricing strategies, with regional suppliers addressing cost-sensitive markets while global leaders target high-value applications. The market reflects a balance between established producers consolidating their position and emerging firms capturing opportunities in niche and developing sectors.

Recent Developments

- In June 2025, VAUDE and BASF unveiled the TRAILCONTROL ZERO 20+ bike backpack, made with Ultramid® ZeroPCF, a polyamide 6 with a net-zero carbon footprint. Produced using renewable electricity and bio-based feedstock via an ISCC+ certified mass balance approach, the material matches conventional polyamide in performance but excels in sustainability.

- In June 2025, Arkema received ISCC PLUS certification for its waterborne acrylic resin production in Saint Charles, Louisiana (USA). These mass balance-certified resins contain up to 90% bio-attributed content, supporting sustainable solutions in coatings, adhesives, mobility, infrastructure, and more.

- In December 2023, Arkema partners with a leading pharmaceutical company to develop a new drug using MSA as a key ingredient. This collaboration could significantly increase MSA demand in the healthcare sector.

- In November 2023, Hubei Xingchi expands its MSA production capacity by 20%, aiming to capture a larger share of the growing industrial segment.

Market Concentration & Characteristics

The Methane Sulfonic Acid Market reflects a moderately concentrated structure with a mix of global chemical corporations and regional producers shaping competition. It is characterized by high barriers to entry due to stringent regulatory standards, the need for advanced production technology, and the requirement for consistent product purity. Large multinational companies dominate with extensive R&D investments, global distribution networks, and strong integration across value chains, while smaller firms compete by serving niche applications and regional demand. It demonstrates strong alignment with green chemistry principles, offering biodegradable and low-toxicity alternatives to conventional acids. Demand concentration remains high in pharmaceuticals, electroplating, and energy storage applications, where reliability and compliance play a critical role. It continues to evolve through innovation in sustainable production, expansion of high-purity grades, and partnerships across industries seeking eco-friendly and efficient chemical solutions.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Methane Sulfonic Acid Market will expand with rising adoption in green chemistry applications.

- It will gain traction in energy storage through wider use in redox flow batteries.

- Demand will increase in pharmaceuticals due to its role in high-purity drug synthesis.

- It will see stronger use in electroplating for electronics, automotive, and aerospace industries.

- Producers will invest in sustainable and low-emission manufacturing technologies.

- Regulatory frameworks will continue to favor it over conventional mineral acids.

- Emerging economies will drive growth through expanding industrial and chemical infrastructure.

- Strategic partnerships between chemical firms and battery manufacturers will strengthen its applications.

- Research on advanced catalysts and specialty chemicals will enhance its relevance.

- It will maintain steady demand from industrial cleaning solutions aligned with eco-friendly standards.