| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

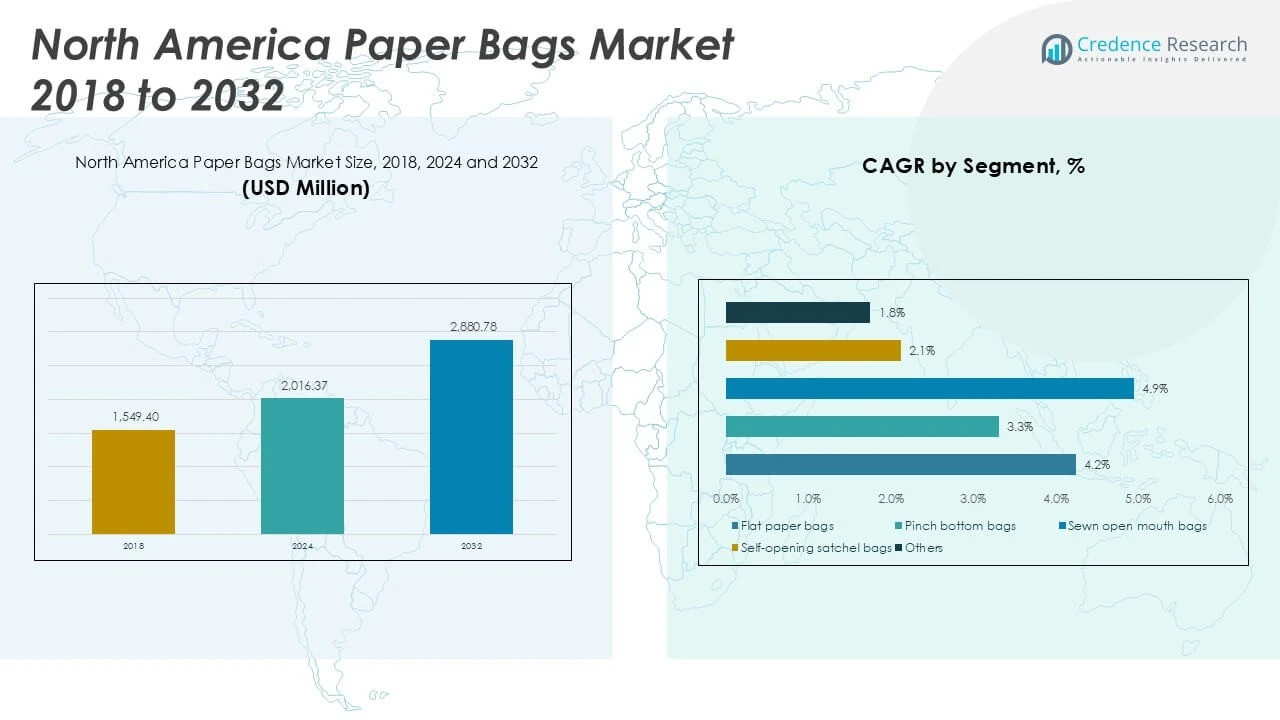

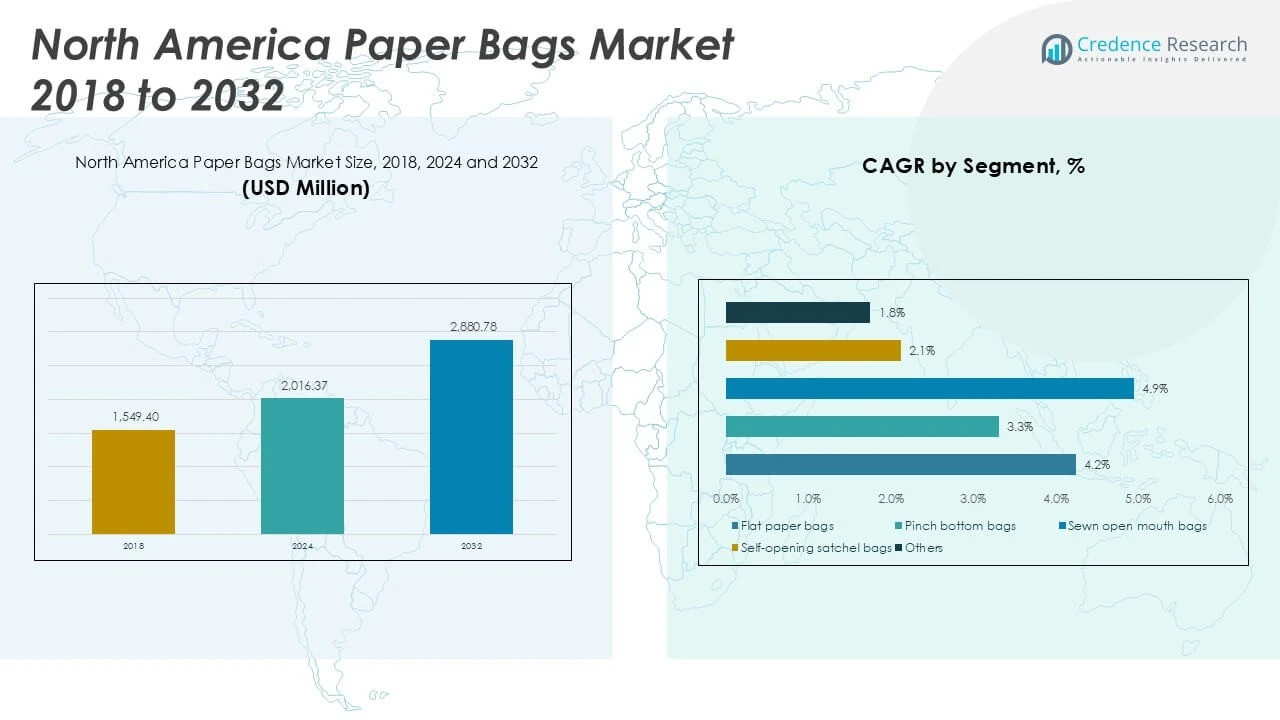

| North America Paper Bags Market Size 2024 |

USD2,016.37 million |

| North America Paper Bags Market, CAGR |

4.25% |

| North America Paper Bags Market Size 2032 |

USD2,880.78 million |

Market Overview

The North America Paper Bags Market is projected to grow from USD2,016.37 million in 2024 to an estimated USD2,880.78 million based on 2032, with a compound annual growth rate (CAGR) of 4.25% from 2025 to 2032.

Key market drivers include stringent environmental regulations and corporate sustainability mandates, which are compelling businesses to transition to paper-based packaging. Trends such as the rise of eco-conscious consumers, the proliferation of paper bags in premium and branded retail, and innovations in barrier coatings and paper strength enhancement are shaping the market landscape. Furthermore, increasing urbanization and the rapid growth of the food delivery sector are creating additional demand for durable and customizable paper bags.

Geographically, the United States holds the largest share of the North America Paper Bags Market, supported by a robust retail infrastructure, advanced recycling systems, and active policy initiatives banning plastic bags in several states. Canada also contributes significantly to regional growth due to its expanding retail and food service industries and sustainability commitments. Key players operating in the market include Novolex Holdings LLC, Mondi Group, WestRock Company, Hood Packaging Corporation, and Smurfit Kappa Group, all of whom are focusing on product innovation and expanding production capabilities.

Market Insights

- The North America Paper Bags Market is projected to grow from USD2,016.37 million in 2024 to USD2,880.78 million by 2032, at a CAGR of 4.25% from 2025 to 2032.

- Rising environmental awareness and strict bans on single-use plastics are driving the widespread adoption of paper bags across industries.

- Retailers and foodservice providers are increasingly shifting to biodegradable and customizable paper bags to meet consumer sustainability expectations.

- High production costs and limited raw material availability present challenges for small and mid-sized manufacturers in the region.

- Technological innovation in moisture-resistant coatings and high-strength paper is expanding the usability of paper bags in demanding applications.

- The United States dominates the regional market share due to advanced recycling infrastructure and active state-level plastic bag bans.

- Canada and Mexico are experiencing steady growth driven by expanding retail sectors, regulatory initiatives, and rising demand for eco-friendly packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Government Regulations and Bans on Single-Use Plastics Are Pushing Businesses Toward Paper Alternatives

Governments across North America continue to implement strict regulations targeting single-use plastics. Several U.S. states and Canadian provinces have enforced bans or imposed heavy taxes on plastic bags. These legislative actions have forced retailers and manufacturers to seek eco-friendly alternatives. The North America Paper Bags Market benefits directly from this shift, with rising demand for biodegradable packaging solutions. Businesses are replacing plastic with paper to comply with evolving policies and maintain brand reputation. It aligns well with government goals to reduce environmental waste.

- For instance, India generates 3.5 million metric tonnes of plastic waste annually, prompting regulatory actions such as the ban on 19 single-use plastic items in 2022 to curb environmental damage

Rising Consumer Awareness of Sustainability Is Creating New Demand Patterns

Consumers are increasingly favoring environmentally responsible products and packaging. Awareness campaigns and climate change discussions influence purchasing decisions across all age groups. The North America Paper Bags Market reflects this trend, with customers actively supporting brands that adopt sustainable practices. Retailers and food service providers are adapting to these preferences by integrating paper-based packaging into their supply chains. Paper bags provide a tangible way for brands to demonstrate environmental responsibility. It reinforces trust and enhances customer loyalty in competitive markets.

- For instance, a five-year study analyzing 44,000 brands found that products with sustainability-related claims experienced higher consumer spending, demonstrating a clear shift toward eco-conscious purchasing

Retail Expansion and E-Commerce Growth Are Driving Packaging Needs

Retailers and e-commerce businesses are expanding operations across the region, creating demand for flexible and sustainable packaging. Paper bags serve both brick-and-mortar stores and delivery-based retail effectively. The North America Paper Bags Market captures value from this dual-channel growth. Brands seek paper bags for in-store purchases and online order deliveries due to their durability and branding potential. It enables companies to meet environmental targets while maintaining a consistent customer experience. Supply chains are adjusting to meet increased order volumes efficiently.

Innovation in Paper Bag Design Is Enhancing Performance and Adoption Rates

Manufacturers are investing in advanced paper technologies to improve bag strength, moisture resistance, and customization. The North America Paper Bags Market is benefiting from these innovations that make paper bags more versatile. Enhanced design features expand the use of paper bags across foodservice, grocery, and fashion industries. It supports a wider range of product categories and operational conditions. Brands prefer paper bags with improved graphics and finishes to elevate customer engagement. Innovation continues to improve functionality without compromising environmental benefits.

Market Trends

Adoption of Premium and Branded Paper Bags in Retail and Fashion Sectors

Retailers in fashion and luxury goods are adopting high-quality, branded paper bags to elevate in-store experiences. These bags serve both functional and promotional purposes, supporting brand identity and sustainability goals. The North America Paper Bags Market reflects this shift, with brands seeking customizable designs, embossed logos, and textured finishes. It enables premium brands to replace plastic without compromising aesthetics. Consumer perception of value increases when products are presented in visually appealing packaging. This trend is strengthening the role of paper bags beyond basic utility.

- For instance, major converters like Mondi and Dobis have introduced mono-material shopping bags with lower grammage, reducing fiber usage while maintaining durability for premium retail applications.

Shift Toward Recyclable and Compostable Multi-Layer Paper Materials

Manufacturers are shifting from conventional paper bags to those made from recyclable or compostable multi-layer materials. These innovations enhance performance by offering better strength and moisture resistance. The North America Paper Bags Market benefits from this shift in materials, which aligns with stricter environmental regulations. It allows paper bags to compete with plastic in heavy-duty and food-grade applications. Multi-layer options are now widely used in grocery, foodservice, and takeaway packaging. The transition supports both environmental and functional priorities.

- For instance, UPM Specialty Papers and Eastman launched biopolymer-covered paper, a compostable packaging solution that enhances oxygen and grease barriers for food products.

Growth of On-Demand Food Delivery Is Fueling Paper Bag Consumption

On-demand food delivery services have seen exponential growth, driving demand for convenient and sustainable packaging. Paper bags offer a biodegradable and brandable solution for restaurants and third-party delivery platforms. The North America Paper Bags Market gains momentum from this segment, as food chains increasingly choose eco-friendly alternatives. It ensures compliance with food safety while enhancing customer experience. Features like grease resistance and secure closures are being incorporated into modern paper bag designs. These adaptations ensure suitability for hot, fresh, and heavy items.

Focus on Localized Production and Supply Chain Resilience Is Gaining Importance

Companies are investing in local manufacturing facilities to reduce lead times and logistics costs. Localized production supports the regional economy while ensuring a steady supply of paper bags during demand surges. The North America Paper Bags Market is responding to this trend with capacity expansions across the U.S. and Canada. It helps reduce dependency on imports and mitigates supply chain disruptions. Local producers can also tailor products to regional regulatory and consumer requirements. This trend is reinforcing domestic resilience and sustainability.

Market Challenges

High Production Costs and Limited Raw Material Availability Are Affecting Profit Margins

Paper bag manufacturing involves higher production costs compared to plastic alternatives. The cost of kraft paper and sustainable coatings adds financial pressure on producers. The North America Paper Bags Market faces challenges due to fluctuating pulp prices and limited access to high-quality raw materials. It affects scalability and pricing strategies for both small and large manufacturers. Transportation and energy expenses further increase operational burdens. These factors make it difficult for paper bags to compete purely on cost with synthetic packaging options.

- For instance, over 85,000 tons of paper bags were produced in North America in 2023, with more than 12,500 manufacturers operating across the region.

Durability Limitations and Performance Concerns Are Restricting Broader Applications

Paper bags have inherent limitations in moisture resistance and load-bearing capacity, especially under harsh conditions. This restricts their use in sectors requiring high durability and secure containment. The North America Paper Bags Market must address concerns from industries that handle frozen, liquid, or heavy products. It limits growth opportunities in segments where plastics still dominate due to their superior performance. Brand owners may hesitate to transition if paper alternatives compromise product protection or consumer convenience. Innovation is essential to overcome these material constraints and expand adoption.

Market Opportunities

Growing Demand for Eco-Friendly Packaging in E-Commerce and Grocery Retail Creates Expansion Potential

The rise of e-commerce and grocery retail provides a significant opportunity for sustainable packaging solutions. Consumers increasingly expect environmentally responsible packaging for online orders and daily purchases. The North America Paper Bags Market can capitalize on this trend by offering scalable and customizable options. It can meet diverse packaging needs from lightweight delivery to durable grocery transport. Brands can enhance consumer trust by aligning with eco-conscious practices. Expanding into online retail packaging opens a large and growing customer base.

Customization and Branding Opportunities Strengthen Competitive Advantage for Paper Bag Manufacturers

Paper bags offer excellent surfaces for printing, embossing, and other forms of customization. Businesses can leverage this to build brand identity and improve consumer engagement. The North America Paper Bags Market can grow by providing high-quality, brand-focused packaging solutions across retail and hospitality. It creates new value for businesses aiming to reinforce sustainability without compromising marketing potential. Small and mid-sized enterprises seek affordable ways to differentiate, and paper bags provide that platform. This opens a clear path for manufacturers to scale premium offerings.

Market Segmentation Analysis

By Product Type

The North America Paper Bags Market includes various product types such as flat paper bags, pinch bottom bags, sewn open mouth bags, self-opening satchel bags, and others. Flat paper bags hold a significant share due to their simplicity, affordability, and wide use in retail. Pinch bottom bags are preferred in food packaging for their strong sealing capabilities. Sewn open mouth bags are ideal for industrial and agricultural uses where durability is critical. Self-opening satchel bags remain popular in grocery and foodservice applications due to their ease of use and efficient handling. It continues to evolve with innovations tailored to sector-specific requirements.

By Material

Brown kraft and white kraft dominate the material segment in the North America Paper Bags Market. Brown kraft leads the segment due to its high tensile strength, natural appearance, and cost-efficiency, making it ideal for eco-conscious packaging. White kraft appeals to premium retail brands seeking a cleaner and more polished look. It offers better printing surfaces for branding and design clarity. The choice between brown and white kraft depends on the end use and brand positioning. Manufacturers invest in both types to serve varied customer preferences.

By End User

Retail and food and beverage sectors are the primary end users driving demand in the North America Paper Bags Market. Retailers use paper bags to align with sustainability goals and enhance brand presentation. The food and beverage industry uses them extensively for takeaway and delivery, where eco-friendly packaging improves brand perception. Construction and pharmaceutical sectors utilize durable paper bags for safe material handling. It finds expanding applications across segments that value recyclability and custom branding. Growth in each end-use sector supports market diversification.

By Distribution Channel

Offline channels account for the larger share in the North America Paper Bags Market due to bulk procurement by retail and commercial establishments. Distributors and direct vendor relationships play a key role in offline sales. Online channels are gaining traction as small businesses and individual consumers seek convenient access to customizable and eco-friendly packaging. It allows for wider reach and lower overhead for manufacturers. E-commerce is expected to boost sales through online platforms, particularly for startups and SMEs focusing on sustainable operations.

Segments

Based on Product Type

- Flat paper bags

- Pinch bottom bags

- Sewn open mouth bags

- Self-opening satchel bags

- Others

Based on Material

Based on End User

- Retail

- Food and beverage

- Construction

- Pharmaceutical

- Others

Based on Distribution Channel

Based on Region

Regional Analysis

U.S. Paper Bags Market

The U.S. holds the largest share of the North America Paper Bags Market, accounting for over 68% of the regional revenue in 2024. Strict legislation at the state and municipal levels, including plastic bag bans in states like California, New York, and Oregon, has accelerated the shift toward paper alternatives. Consumer awareness and retailer adoption of sustainable practices have reinforced demand. The retail, grocery, and foodservice industries drive high-volume consumption. It benefits from a well-established manufacturing base and robust supply chain infrastructure. Innovation in materials and bag designs further strengthens its dominance.

Canada Paper Bags Market

Canada contributes around 22% to the North America Paper Bags Market and continues to expand due to federal and provincial policies phasing out single-use plastics. Major urban centers like Toronto and Vancouver are early adopters of paper-based alternatives. The growth of fast-food chains and eco-conscious retail outlets supports rising demand. Canadian consumers increasingly prefer biodegradable packaging, creating opportunities for domestic suppliers. It sees rising investment in local production to meet sustainability goals and reduce imports. Retail and grocery sectors remain key application areas.

Mexico Paper Bags Market

Mexico represents nearly 10% of the North America Paper Bags Market, with growth driven by new regulations on plastic packaging and increasing consumer awareness. Major metropolitan regions such as Mexico City have introduced restrictions that boost paper bag usage. The expanding foodservice and retail sectors also support demand. Local manufacturers are ramping up production capacities to reduce dependency on imports. It creates opportunities for regional and international suppliers to expand market reach. Government-led campaigns continue to influence packaging choices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Mondi plc

- International Paper Company

- Amcor plc

- Smurfit Westrock plc

- Novolex Holdings LLC

- Oji Holdings Corporation

- BioPak

- ProAmpac Intermediate, Inc.

- Ronpak

- E.I. Bag Co. Ltd.

Competitive Analysis

The North America Paper Bags Market is highly competitive, with key players focusing on sustainability, customization, and operational scalability. Mondi plc, International Paper Company, and Amcor plc hold strong positions through diverse portfolios and strategic acquisitions. Novolex Holdings LLC leverages regional manufacturing and advanced design capabilities to serve retail and food sectors efficiently. Smurfit Westrock plc and ProAmpac Intermediate, Inc. prioritize eco-friendly innovations to gain market share. It witnesses continuous investment in localized production and product innovation, reflecting rising consumer and regulatory demand for sustainable packaging. Smaller players like BioPak and Ronpak target niche segments with biodegradable and compostable offerings. Strategic partnerships and capacity expansions remain central to competitive advantage.

Recent Developments

- In May 2025, Mondi expanded its re/cycle MailerBAG production capacity at its Krapkowice plant in Poland to meet the growing demand for sustainable eCommerce packaging solutions.

- In February 2025, ProAmpac participated in the Packaging Innovations 2025 convention, displaying advancements in fiber-based packaging and recyclable films.

- On July 8, 2024, Smurfit Kappa and WestRock completed their merger, forming Smurfit Westrock, the world’s largest boxmaker by sales, with a primary listing on the New York Stock Exchange.

Market Concentration and Characteristics

The North America Paper Bags Market demonstrates moderate market concentration, with a mix of global corporations and regional players competing across product types and end-user segments. It features a strong presence of vertically integrated manufacturers that control raw material sourcing, production, and distribution. Market leaders invest in sustainable technologies, capacity expansion, and customized design capabilities to differentiate their offerings. Smaller firms focus on niche applications and local contracts, maintaining competitiveness through flexibility and cost efficiency. The market is characterized by rising demand for biodegradable packaging, strict environmental regulations, and growing consumer preference for eco-friendly alternatives. Strategic partnerships and innovation drive competitive positioning across all tiers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material, End User, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to increasing regulatory pressure against single-use plastics. Policies at both federal and state levels will reinforce adoption across retail and foodservice sectors.

- E-commerce expansion will create new demand for strong, branded, and eco-friendly packaging. Businesses will use paper bags to align with sustainability goals and consumer expectations.

- Innovation in moisture-resistant coatings and high-strength paper materials will enable broader usage across demanding applications. It will allow paper bags to replace plastics in more sectors, including frozen food and industrial packaging.

- Retailers will increasingly adopt premium and customizable paper bags to enhance in-store branding. These will serve as tools for marketing and sustainability commitments simultaneously.

- Local manufacturing will grow as companies invest in reducing supply chain risk and carbon emissions. Regional production hubs in the U.S. and Canada will support faster delivery and customization.

- Eco-conscious consumer behavior will shape product design and purchasing trends. Brands that offer biodegradable, recyclable, and aesthetically pleasing paper bags will gain market preference.

- Foodservice and takeaway industries will generate higher demand for paper bags with heat resistance and grease-proof features. This will encourage R\&D investment and specialized product lines.

- Cross-border trade with Mexico will offer opportunities for manufacturers to scale operations. Regional trade agreements and shared environmental goals will strengthen market integration.

- Investment in automation and digital printing technologies will enhance production efficiency and product differentiation. These advancements will support cost competitiveness and design flexibility.

- Strategic partnerships between packaging manufacturers, retailers, and sustainability-focused organizations will foster innovation. Collaboration will drive new product development and expand the reach of sustainable packaging solutions.