Market Overview

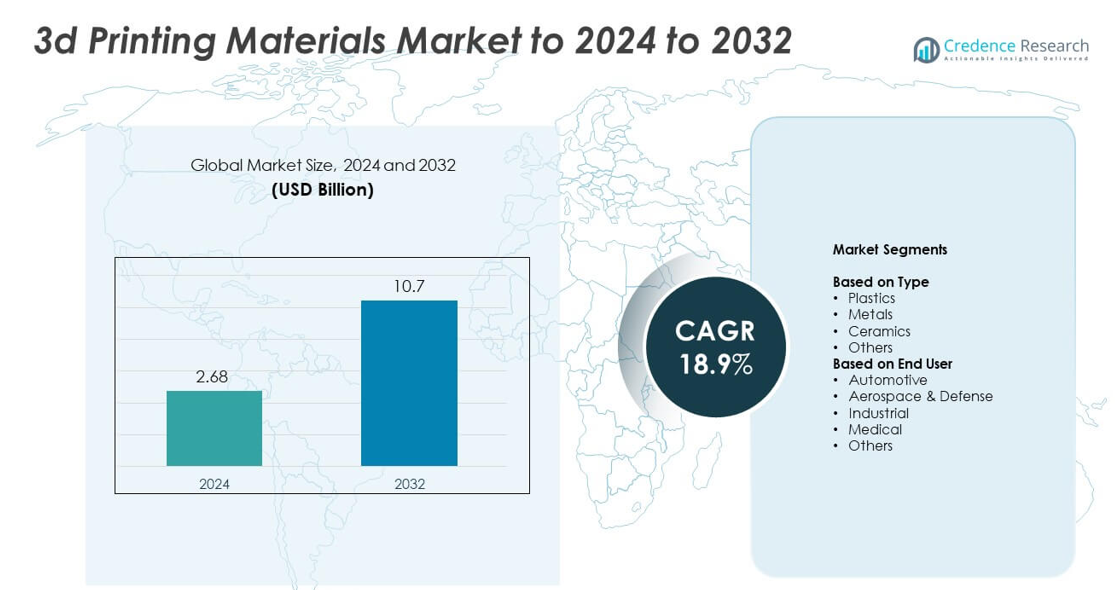

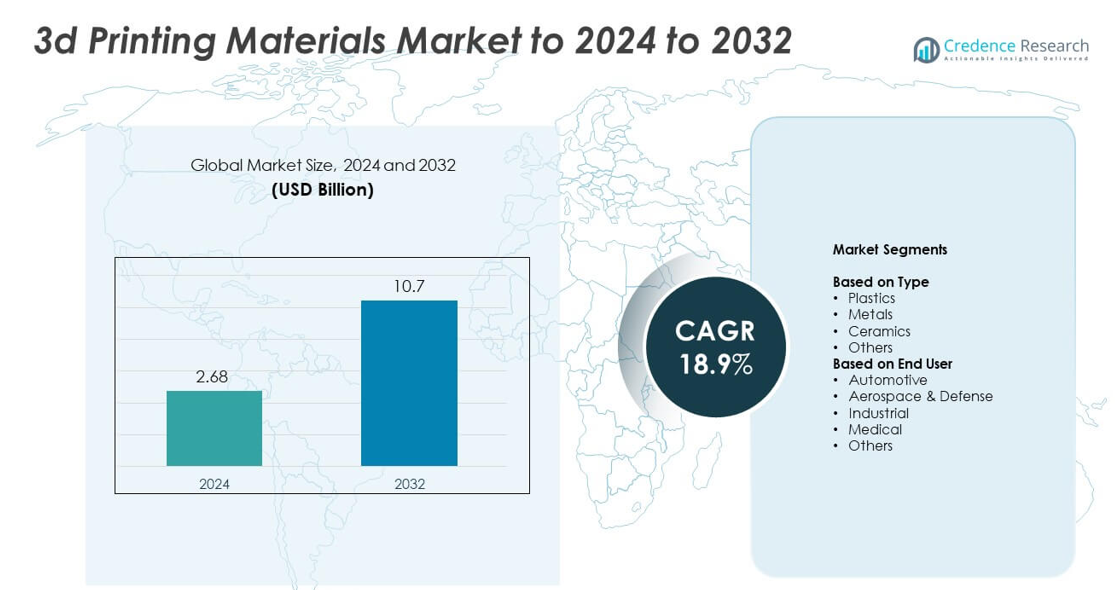

3d Printing Materials Market size was valued at USD 2.68 billion in 2024 and is anticipated to reach USD 10.7 billion by 2032, at a CAGR of 18.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printing Materials MarketSize 2024 |

USD 2.68 billion |

| 3D Printing Materials Market, CAGR |

18.9% |

| 3D Printing Materials Market Size 2032 |

USD 10.7 billion |

The 3d Printing Materials Market is driven by leading companies including CRP Technology, Markforged, ExOne, Arkema, Stratasys Ltd., GE Additive, Materialise NV, EOS GmbH, 3D Systems, Inc., and Höganäs AB. These players strengthen the market through advanced polymers, metal powders, and composite materials designed for industrial, medical, aerospace, and automotive use. North America led the global market in 2024 with about 38% share, supported by strong R&D activity and early adoption of additive manufacturing. Europe followed with nearly 30% share, while Asia Pacific accounted for about 26% due to rapid industrial expansion and rising technological investment.

Market Insights

- The 3d Printing Materials Market was valued at USD 2.68 billion in 2024 and is projected to reach USD 10.7 billion by 2032, growing at a CAGR of 18.9%.

- Strong demand for polymers and metal powders drives growth as industries adopt additive manufacturing for faster prototyping and functional part production, with plastics holding about 52% share in 2024.

- Trends include rising use of sustainable materials, growing adoption of multi-material printing, and expanding applications in medical implants, dental devices, and aerospace components.

- Competition intensifies as global players expand material portfolios, invest in high-performance composites, and strengthen supply chains to meet industrial demand across emerging sectors.

- Regionally, North America led with about 38% share in 2024, followed by Europe at nearly 30% and Asia Pacific at around 26%, supported by rapid industrialization and strong uptake in automotive, aerospace, and healthcare applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Plastics dominated the 3D Printing Materials Market in 2024 with about 52% share. Demand stayed high due to strong use in prototyping, tooling, and lightweight part production across automotive and consumer goods. Plastics such as PLA, ABS, and nylon remained popular because they deliver low cost, easy printability, and wide compatibility with desktop and industrial printers. Metal materials continued to gain traction as industries adopted high-strength alloys for functional parts, while ceramics and other specialty materials grew in niche applications that require heat resistance or precision shaping.

- For instance, HP users produced over 10,000,000 parts in one year with Multi Jet Fusion, by the year 2019

By End User

Automotive led the end-user segment in 2024 with nearly 34% share of the 3D Printing Materials Market. Carmakers used these materials widely to support rapid prototyping, custom tooling, and lightweight component production. Growth accelerated as manufacturers shifted toward shorter design cycles and higher adoption of electric vehicle platforms. Aerospace and defense expanded steadily with rising demand for high-performance metal powders, while medical applications grew due to greater use of biocompatible polymers for implants, dental parts, and patient-specific devices. Industrial applications advanced through increased adoption of additive manufacturing for small-batch parts.

- For instance, the BMW Group produced more than 400,000 3D-printed components for vehicles and production aids across its global manufacturing network in 2023.

Key Growth Drivers

Rising Adoption in Industrial Manufacturing

Growing use of additive manufacturing in industrial production supports strong demand for 3D printing materials. Manufacturers prefer polymers, metals, and composites to shorten design cycles and reduce tooling needs. Industrial firms benefit from faster prototyping, improved customization, and lower waste. Expanding use of lightweight parts in machinery and electronic equipment boosts material consumption. Broader availability of high-performance materials encourages deeper integration of 3D printing into factory workflows, strengthening overall market expansion.

- For instance, GE Aviation manufactured 100,000 additively produced fuel nozzle tips at its Auburn plant.

Expansion of Healthcare and Medical Applications

Healthcare providers increasingly rely on 3D printing for surgical guides, implants, dental products, and patient-specific models. Demand for biocompatible polymers and metal powders rises with the growth of personalized treatment. Medical device companies adopt additive manufacturing to enhance precision and reduce production time. Advancements in materials for bio-resorbable structures and prosthetics further support sector growth. Hospitals and clinics integrate 3D printing labs to improve outcomes, boosting material usage.

- For instance, Align Technology prints about 1,000,000 unique Invisalign aligner parts every single day.

Growth of Metal Additive Manufacturing

Metal 3D printing accelerates across aerospace, defense, and automotive due to the need for strong, lightweight, and complex components. Adoption expands as metal powders become more affordable and reliable. High-strength alloys such as titanium and aluminum gain traction for critical applications. Industries value improved durability and design freedom, which enhances production efficiency. Increasing certification standards and wider machine compatibility drive steady demand for advanced metal materials.

Key Trends and Opportunities

Shift Toward Sustainable and Bio-Based Materials

Producers invest in bio-based polymers and recyclable materials to meet sustainability goals. Demand grows as industries adopt greener production methods and stricter environmental rules. Research focuses on biodegradable filaments and recycled composites. Companies explore low-carbon materials for consumer goods and packaging prototypes. Rising awareness of environmental impact boosts long-term opportunities in eco-friendly 3D printing resources.

- For instance, BASF showcased a 3D-printed surfboard concept created by the French startup YUYO that utilized Ultrafuse rPET filament, a material made from 100% recycled medical waste (specifically PET from surgical trays).

Advancements in High-Performance Composites

High-performance composite materials gain momentum as industries seek greater strength-to-weight ratios. Composites that combine polymers with carbon fiber or glass fiber support advanced applications in aerospace, automotive, and sports equipment. These materials enable high precision and structural stability in demanding environments. Increased R&D investment expands options for heat-resistant and durable composites. Their rising availability boosts adoption in functional, end-use parts.

- For instance, Markforged customers have printed more than 10,000,000 parts on its Digital Forge platform.

Growing Adoption of Multi-Material Printing

Multi-material printing creates complex structures with improved performance, pushing demand for compatible materials. Industries use hybrid combinations of polymers, metals, and elastomers to design advanced prototypes and functional assemblies. This trend increases design flexibility and supports intricate geometries. Machine manufacturers expand support for multi-material capabilities. Wider industrial use opens opportunities for specialized material blends.

Key Challenges

High Material Costs

The cost of advanced filaments, powders, and resins remains a major barrier for many companies. Metal powders and engineering-grade polymers often require strict production controls, which increase prices. High material costs limit adoption among small manufacturers and educational institutions. Industries with tight budgets face difficulty scaling additive manufacturing. Reducing costs through improved supply chains and greater production volumes remains a key need.

Quality and Performance Consistency Issues

Ensuring consistent material quality creates challenges across end-use industries. Variations in powder size, polymer composition, or moisture content can affect part accuracy. Companies must invest in strict testing and certification to meet performance demands. Inconsistent material behavior reduces reliability for mission-critical applications in aerospace and healthcare. Improved standards and better material tracking systems are needed to enhance confidence in large-scale production.

Regional Analysis

North America

North America held about 38% share of the 3D Printing Materials Market in 2024 due to strong adoption across automotive, aerospace, medical, and industrial sectors. The region benefits from advanced manufacturing ecosystems, high R&D funding, and strong presence of material developers. Demand rises as companies expand use of polymers, composites, and metal powders for functional parts and prototyping. Growth accelerates with wider adoption of additive production in medical implants and aerospace components. Supportive government programs and early technology acceptance continue to strengthen the region’s leadership position.

Europe

Europe accounted for nearly 30% share of the 3D Printing Materials Market in 2024, supported by strong demand from automotive, aerospace, dental, and industrial manufacturing. Countries such as Germany, the UK, and France lead due to advanced engineering capabilities and increasing investment in additive manufacturing research. European firms focus on high-performance polymers, metal powders, and sustainable materials that align with strict regulatory standards. Expanding applications in medical devices and customized industrial parts boost regional growth. Supportive digitalization initiatives and strong innovation output reinforce Europe’s solid market position.

Asia Pacific

Asia Pacific captured around 26% share of the 3D Printing Materials Market in 2024, driven by rapid industrial expansion across China, Japan, South Korea, and India. Rising adoption in electronics, automotive, healthcare, and consumer goods fuels strong material demand. Regional manufacturers focus on cost-effective polymers, metal powders, and composite materials as production volumes increase. Government-backed digital manufacturing programs accelerate adoption across small and mid-sized enterprises. Growing aerospace investment and expanding medical device production strengthen long-term growth prospects. The region’s large manufacturing base positions Asia Pacific as the fastest-growing market.

Latin America

Latin America held roughly 4% share of the 3D Printing Materials Market in 2024, with growing adoption in automotive, healthcare, and small-scale industrial manufacturing. Countries such as Brazil and Mexico lead due to expanding production capabilities and rising interest in rapid prototyping. Demand increases for affordable polymers and basic metal materials as local firms integrate additive manufacturing for design flexibility. Growth remains steady as universities and research centers support technology development. Improved access to 3D printing systems and training programs strengthens regional uptake over the forecast period.

Middle East & Africa

Middle East & Africa accounted for about 2% share of the 3D Printing Materials Market in 2024, driven by emerging use in construction, healthcare, and industrial tooling. Growth concentrates in the UAE, Saudi Arabia, and South Africa as these nations invest in digital manufacturing. Demand rises for polymers, resins, and metal powders as sectors adopt additive production for customized parts and prototype development. Government initiatives in smart manufacturing support technology expansion. Although market size remains small, increasing industrial diversification strengthens long-term adoption across the region.

Market Segmentations:

By Type

- Plastics

- Metals

- Ceramics

- Others

By End User

- Automotive

- Aerospace & Defense

- Industrial

- Medical

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The 3D Printing Materials Market is shaped by major players such as CRP Technology, Markforged, ExOne, Arkema, Stratasys, GE Additive, Materialise, EOS, 3D Systems, and Höganäs AB. The competitive landscape reflects strong focus on advanced polymers, metal powders, composite blends, and high-performance resins tailored for industrial, aerospace, medical, and automotive applications. Companies invest heavily in research to improve strength, heat resistance, and reliability of materials used in both prototyping and end-use parts. Firms expand production capacity and global distribution networks to meet rising demand across emerging and developed markets. Partnerships with printer manufacturers, research institutes, and industrial clients help broaden material compatibility and accelerate adoption. Continuous innovations in recyclable materials, sustainable formulations, and multi-material capabilities strengthen overall competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2024, Materialise announced software enhancements for its Magics software that included making its algorithms available via a Software Development Kit (SDK) to enable customer-tailored 3D printing workflows for better quality and efficiency.

- In 2024, Markforged upgraded its FX10 printer to enable 3D printing of both metal and advanced composite materials, expanding material versatility for industrial applications

- In 2023, CRP Technology Launched Windform XT 2.0 IMG, its first injection molding material made entirely from recycled Windform XT 2.0 industrial 3D printing materials to enhance sustainability.

Report Coverage

The research report offers an in-depth analysis based on Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The 3D printing materials market will expand with wider industrial adoption.

- Demand for metal powders will rise as aerospace and automotive increase additive production.

- Bio-based and recyclable materials will gain traction due to sustainability goals.

- Medical applications will grow with higher use of biocompatible polymers and dental materials.

- Composite materials will see strong adoption for lightweight and durable components.

- Multi-material printing will create new opportunities for complex part design.

- Advancements in material certification will support greater use in critical industries.

- Automation in additive manufacturing will boost high-volume material consumption.

- Emerging economies will adopt more 3D printing materials as manufacturing shifts grow.

- Ongoing R&D will introduce advanced polymers and alloys for next-generation applications.