Market Overview

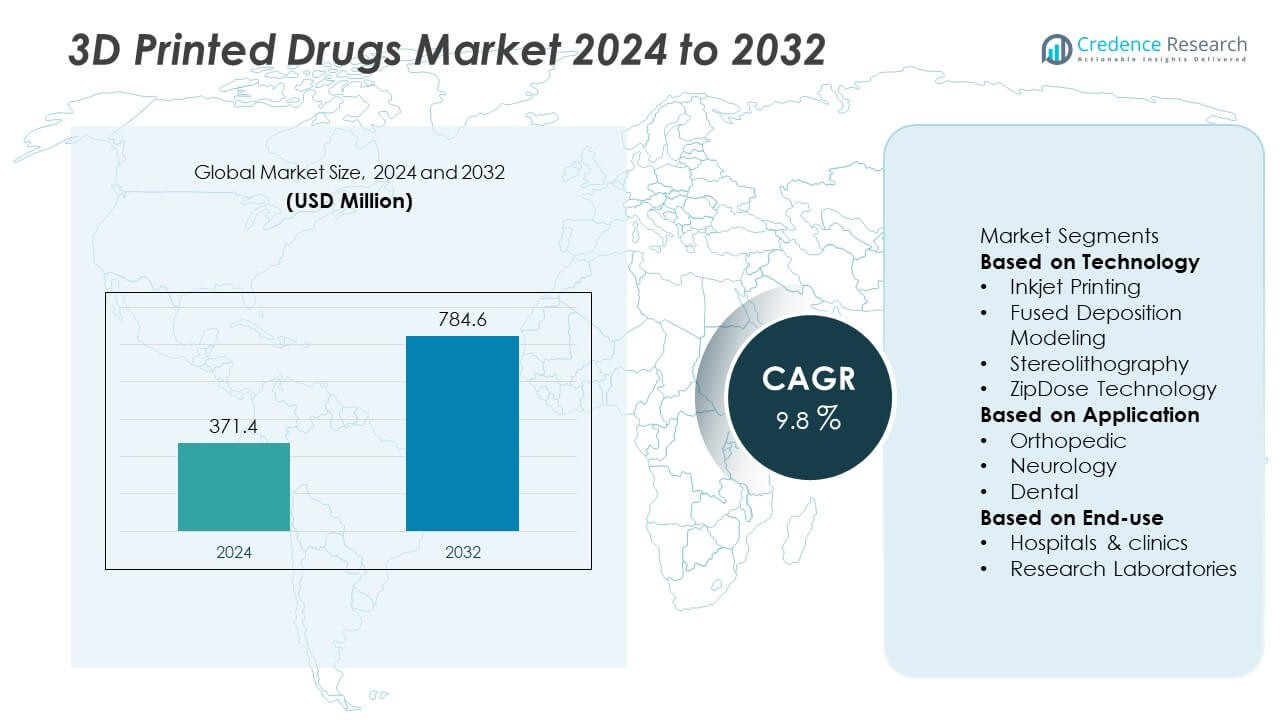

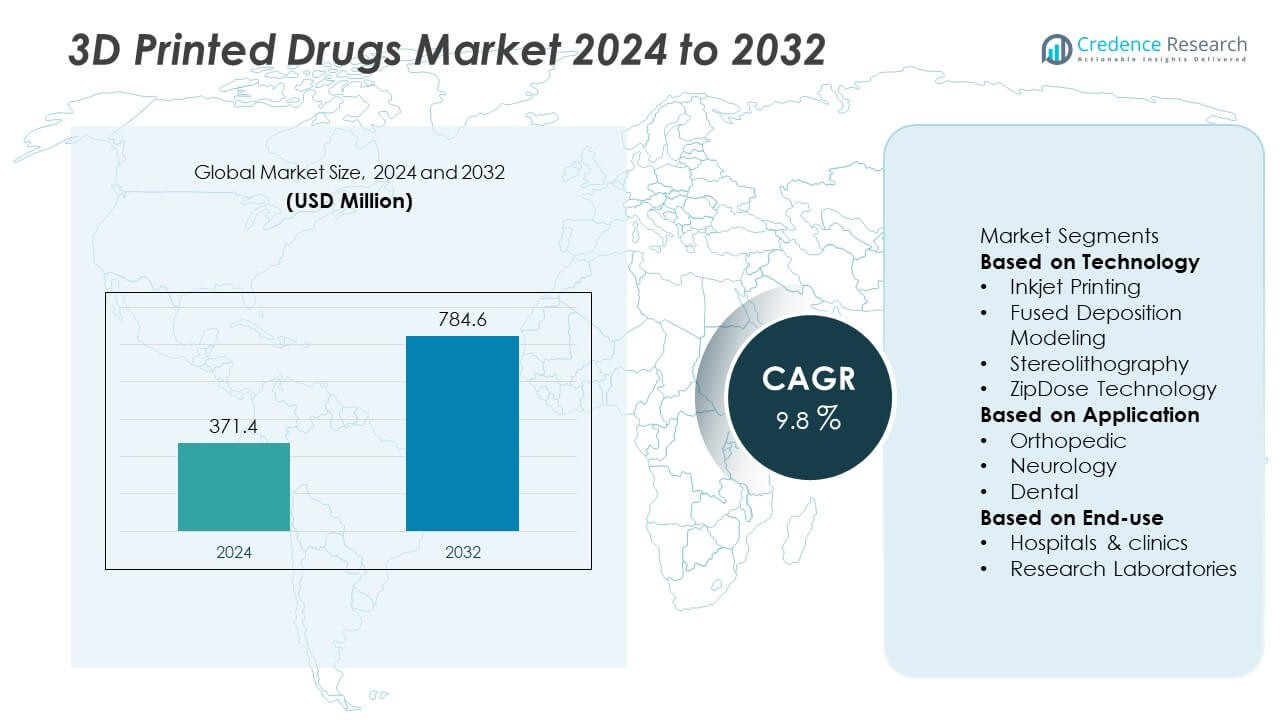

The 3D Printed Drugs Market was valued at USD 371.4 million in 2024 and is anticipated to reach USD 784.6 million by 2032, expanding at a Compound Annual Growth Rate (CAGR) of 9.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| 3D Printed Drugs Market Size 2024 |

USD 371.4 Million |

| 3D Printed Drugs Market , CAGR |

9.8% |

| 3D Printed Drugs Market Size 2032 |

USD 784.6 Million |

The 3D Printed Drugs Market is driven by rising demand for personalized medicine, rapid drug prototyping, and the need for precise dosing in complex therapies. It supports on-demand manufacturing, reduces waste, and enables multi-drug layering in a single tablet. Regulatory advancements and FDA-approved products strengthen commercial confidence.

The 3D Printed Drugs Market demonstrates strong geographical presence across North America, Europe, and Asia-Pacific. North America leads innovation with early regulatory approvals and active pharmaceutical research initiatives, particularly in the United States. Europe shows high adoption through academic-industry collaborations and a growing focus on personalized medicine in countries like Germany and the United Kingdom. Asia-Pacific experiences rapid growth driven by expanding healthcare infrastructure and government-backed R&D in countries such as China and Japan. Key players shaping the market include Aprecia Pharmaceuticals LLC, the developer of SPRITAM®, the first FDA-approved 3D printed drug; FabRx Ltd, which specializes in 3D printed medicines and personalized drug formulations; GlaxoSmithKline Plc, which invests in digital pharmaceutical technologies; and Merck, which collaborates on 3D printing for advanced drug delivery systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The 3D Printed Drugs Market was valued at USD 371.4 million in 2024 and is projected to reach USD 784.6 million by 2032, growing at a CAGR of 9.8% during the forecast period.

- Rising demand for personalized medicine and precision dosing in chronic and complex treatments drives market adoption across multiple therapeutic areas.

- Technological trends include integration of fused deposition modeling (FDM) and inkjet printing for layered, controlled-release formulations with high accuracy.

- Key players such as Aprecia Pharmaceuticals LLC, FabRx Ltd, GlaxoSmithKline Plc, and Merck focus on scalable drug printing, regulatory approval, and customized production platforms.

- Regulatory uncertainty, high setup costs, and limited compatibility of APIs with current printing methods remain primary restraints for large-scale commercial deployment.

- North America leads development with FDA-approved formulations and strong R&D infrastructure, while Europe advances through academic-industry collaborations and Asia-Pacific shows rapid adoption backed by government support.

- The market moves toward decentralized, on-demand manufacturing models supported by AI-driven formulation design and increased clinical trial integration.

Market Drivers

Rising Demand for Personalized Medicine Drives Custom Drug Fabrication

The 3D Printed Drugs Market benefits significantly from the growing demand for patient-specific treatments. The ability to produce individualized dosages based on patient age, weight, or metabolic profile enables better clinical outcomes and improved adherence. This trend supports chronic disease management, especially in oncology, cardiology, and neurology. Healthcare providers prefer on-demand drug printing to reduce waste and adjust therapies in real time. It supports flexible dosing schedules and multi-drug combinations in a single tablet. The integration of pharmacogenomics into drug development further increases the relevance of 3D printed formulations.

- For instance, Aprecia’s ZipDose® platform enables production of tablets containing up to 1,000 mg of active ingredients, while in the patient’s mouth disperses within approximately 10 seconds.

Regulatory Approvals and Institutional Support Facilitate Adoption

Supportive regulatory frameworks in the United States and Europe contribute to the acceleration of 3D printed drug commercialization. The FDA’s approval of the first 3D printed tablet, SPRITAM®, marked a pivotal moment in this market. It demonstrated that 3D printed formulations can meet stringent safety and efficacy standards. Regulatory bodies now recognize the role of additive manufacturing in advancing pharmaceutical innovation. Institutions invest in pilot-scale production units to test regulatory compliance and scale-up feasibility. This regulatory clarity boosts confidence among drug developers and technology providers.

- For instance, SPRITAM disintegrates in a mean time of 11 seconds (ranging from 2 to 27 seconds) in the mouth when taken with a sip of liquid.

Technological Advancements in 3D Printing Enable Complex Formulations

Continuous innovation in 3D printing technologies supports the fabrication of intricate drug geometries and multi-layered compositions. Techniques such as inkjet printing, fused deposition modeling (FDM), and stereolithography allow the production of controlled-release and orodispersible tablets. It allows for precise control over drug release kinetics and structural composition. The technology supports efficient layering of active ingredients, excipients, and coatings in a single production cycle. Pharmaceutical manufacturers adopt these methods to improve production efficiency and treatment outcomes. The flexibility of these systems accelerates prototype development and clinical testing.

Expanding Pharmaceutical R&D and Clinical Application Drives Investment

Pharmaceutical companies increase R&D investments to explore 3D printing applications across therapeutic areas. It enables rapid iteration in drug formulation, supporting faster clinical trial timelines and cost savings. Companies collaborate with academic institutions to develop novel excipient blends and print-compatible APIs. Clinical studies increasingly evaluate the efficacy of 3D printed tablets in pediatric and geriatric populations. The flexibility to tailor dose frequency and delivery mechanisms attracts investment from contract manufacturing organizations. The 3D Printed Drugs Market gains momentum as more proof-of-concept trials validate its therapeutic value.

Market Trends

Adoption of Binder Jetting and Fused Deposition Modeling in Pharmaceutical Production

Pharmaceutical manufacturers increasingly adopt binder jetting and fused deposition modeling (FDM) for on-demand drug fabrication. These technologies enable layer-by-layer deposition of active pharmaceutical ingredients with high precision and minimal material waste. It supports the production of porous tablets for rapid disintegration and controlled-release formats for extended therapies. Companies utilize FDM to integrate multiple drugs into a single dosage form, enhancing patient compliance. Research institutions develop print-friendly drug formulations that match industrial scale requirements. The trend strengthens commercial interest in scalable, precise, and cost-effective drug production methods.

- For instance, FabRx’s breakthrough 3D printer, the M3DIMAKER™, aims to deliver unique personalised medicines with appearance and dosages that can be tailored directly to the patient on demand.

Growth in Pediatric and Geriatric-Specific Formulations

The 3D Printed Drugs Market benefits from the need to customize drugs for pediatric and geriatric patients. These populations often require specific dosages, swallowable formats, or orodispersible tablets that traditional manufacturing cannot easily supply. It allows developers to print drugs in customized shapes, sizes, and flavors to improve adherence. Healthcare providers focus on reducing polypharmacy by consolidating medications into single-print formats. Hospitals and care centers begin evaluating bedside drug printing for tailored treatments. This trend reflects the shift toward individualized therapy across all age groups.

- For instance, FabRx’s personalised medicine 3D printer was into a hospital setting to treat children (3–16 years) with a metabolic disorder maple syrup urine disease (MSUD).

Emergence of Decentralized Drug Manufacturing Models

There is a growing trend toward decentralized drug manufacturing, enabled by compact and portable 3D printers. Pharmaceutical companies explore local production hubs and hospital-based printing units for emergency or remote-area medication delivery. It reduces supply chain dependency and accelerates response in personalized care scenarios. It facilitates rapid formulation changes without overhauling central production lines. Regulatory bodies begin drafting standards for point-of-care drug printing infrastructure. The shift promotes a responsive and distributed pharmaceutical manufacturing ecosystem.

Integration of AI and Software Tools in 3D Drug Design

Software platforms integrated with artificial intelligence now support design, simulation, and optimization of 3D printed drugs. These tools automate drug geometry modeling and simulate release profiles before physical prototyping. It shortens the development timeline and minimizes formulation errors. Machine learning algorithms analyze drug-excipient interactions to guide formulation decisions. Pharmaceutical companies deploy AI-based systems for predictive quality assurance in printed drug batches. This trend enhances precision and efficiency in custom drug design workflows.

Market Challenges Analysis

Regulatory Complexity and Lack of Standardization Limits Commercial Scaling

The 3D Printed Drugs Market faces regulatory uncertainty that restricts widespread commercialization. Regulatory frameworks for additive manufacturing in pharmaceuticals are still evolving, and global harmonization remains limited. It requires clear validation protocols, reproducibility standards, and quality control measures tailored to layer-by-layer drug fabrication. Current Good Manufacturing Practices (cGMP) must be reinterpreted for decentralized and on-demand production models. Companies encounter delays in obtaining approvals for 3D printed formulations due to limited precedent and undefined compliance criteria. This lack of regulatory clarity slows investment and impedes the development of a robust manufacturing pipeline.

High Production Costs and Technical Barriers Restrain Adoption

High initial investment in specialized 3D printing equipment and formulation development increases the cost burden on pharmaceutical companies. It demands the use of pharmaceutical-grade polymers, APIs compatible with thermal and mechanical constraints, and dedicated infrastructure for sterile production. Technical barriers such as nozzle clogging, poor reproducibility, and limited excipient compatibility hinder consistent output. Skilled workforce requirements and the absence of standardized training programs further challenge operational scalability. The complexity of scaling up prototypes into high-volume production remains unresolved. These cost and technical constraints limit adoption across resource-constrained and mid-tier pharmaceutical manufacturers.

Market Opportunities

Expansion of Personalized Therapies and On-Demand Manufacturing

The 3D Printed Drugs Market presents strong opportunities through the advancement of personalized therapies. It enables precise control over dosage, release timing, and drug layering, supporting complex treatment regimens in oncology, neurology, and rare diseases. Pharmaceutical companies can leverage this flexibility to deliver tailored formulations for individuals with unique metabolic profiles or polypharmacy requirements. Hospitals and clinical centers can explore bedside printing of emergency or pediatric drugs, eliminating the need for mass inventory. The ability to produce medication on demand reduces waste, improves compliance, and accelerates therapeutic response. This evolution aligns with global healthcare trends prioritizing personalization and efficiency.

Integration into Clinical Trials and Drug Development Pipelines

3D printing offers significant advantages in early-stage drug development and clinical trial environments. It reduces formulation turnaround time and supports rapid prototyping of dosage forms with varying release profiles. The 3D Printed Drugs Market gains traction as contract manufacturing organizations adopt this technology to support adaptive trial designs. It facilitates faster dose titration studies and real-time adjustments without halting manufacturing lines. Research institutions can customize placebos, active comparators, and blinding configurations with minimal retooling. These capabilities improve trial efficiency and attract investment into flexible, technology-enabled R&D workflows.

Market Segmentation Analysis:

By Technology:

The 3D Printed Drugs Market is segmented by technology into inkjet printing, fused deposition modeling (FDM), stereolithography, and selective laser sintering (SLS). Inkjet printing holds strong relevance for its ability to deposit precise drug dosages in layered formats, suitable for orodispersible tablets and rapid-release applications. FDM is widely adopted for its compatibility with heat-stable polymers and APIs, enabling sustained-release formulations. Stereolithography supports high-resolution drug geometries, beneficial in complex dosage designs for customized therapies. SLS remains at a nascent stage due to challenges with heat-sensitive pharmaceutical ingredients but shows promise for structural integrity and multipart compositions. Each technology brings specific advantages in print resolution, material flexibility, and scalability.

- For instance, researchers at the University of Nottingham demonstrated multi-material inkjet printing that produced 56 personalized tablets per batch, each with controlled-release profiles based on internal structure design

By Application:

The 3D Printed Drugs Market covers applications in neurological disorders, infectious diseases, cardiovascular conditions, diabetes, and others. Neurological disorder treatments lead the segment due to the need for customized dosing in epilepsy and Parkinson’s disease, where drug responsiveness varies widely across patients. SPRITAM® (levetiracetam), approved for epilepsy, showcases commercial feasibility in this segment. Infectious disease applications benefit from 3D printing’s ability to combine multiple APIs into a single tablet, enhancing compliance during long-duration treatments. Cardiovascular drugs often require controlled-release mechanisms, which align well with the structural customization enabled by 3D printing. The flexibility to tailor form, frequency, and dosage continues to drive demand across therapeutic categories.

- For instance, Triastek’s T19 controlled-release formulation, designed for circadian dosing in rheumatoid arthritis, advanced to FDA IND approval-demonstrating a design that releases drug to peak in the morning while maintaining stable levels throughout the day.

By End-Use:

The end-use segmentation includes hospitals, pharmaceutical companies, and research laboratories. Pharmaceutical companies lead adoption by integrating 3D printing into formulation development and clinical prototyping. It allows them to iterate dosage formats without restructuring traditional manufacturing lines. Hospitals begin to explore point-of-care drug printing for tailored prescriptions in oncology, geriatrics, and pediatric care. Research laboratories utilize 3D printing for developing novel drug delivery systems and conducting in vitro testing. It supports fast turnaround in experimental formulations and personalized medicine trials. Each end-user group leverages 3D printing to increase flexibility, reduce time-to-market, and improve treatment specificity.

Segments:

Based on Technology

- Inkjet Printing

- Fused Deposition Modeling

- Stereolithography

- ZipDose Technology

Based on Application

- Orthopedic

- Neurology

- Dental

Based on End-use

- Hospitals & clinics

- Research Laboratories

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for approximately 38% of the global 3D Printed Drugs Market, driven by advanced pharmaceutical infrastructure, strong R&D funding, and early regulatory support. The United States leads regional growth with the FDA’s approval of SPRITAM®, the world’s first 3D printed prescription drug. It showcases the region’s willingness to adopt innovation within regulated frameworks. Pharmaceutical companies and research institutions actively invest in additive manufacturing technologies for personalized drug development and rapid clinical prototyping. Universities and hospitals collaborate with technology providers to implement point-of-care printing pilots, especially in pediatric and geriatric treatment scenarios. Canada supports the market through government-backed research grants focused on digital health and drug innovation. The region benefits from a skilled technical workforce and mature digital manufacturing ecosystem.

Europe

Europe holds around 27% share of the 3D Printed Drugs Market, supported by strong academic-industry partnerships, progressive healthcare reforms, and a growing emphasis on personalized medicine. Germany, the United Kingdom, and the Netherlands serve as major hubs for pharmaceutical research and medical device manufacturing. The European Medicines Agency (EMA) explores guidelines for 3D printed formulations, boosting regulatory clarity. Hospitals across the region increasingly evaluate 3D printed dosage forms to improve treatment adherence and minimize adverse drug reactions. Pharmaceutical companies collaborate with research centers to develop customizable drug release profiles tailored to patient-specific needs. The region’s focus on decentralized production models aligns well with the capabilities of additive manufacturing.

Asia-Pacific

Asia-Pacific represents an estimated 23% of the global market, with rapid growth driven by expanding healthcare infrastructure, increasing pharmaceutical R&D investments, and supportive government policies. China, Japan, South Korea, and India are key contributors. China promotes 3D printing through national innovation programs and is investing in domestic pharmaceutical manufacturing capabilities. Japan focuses on integrating 3D printing into eldercare and personalized medication regimens, leveraging its aging population dynamics. South Korean pharmaceutical firms collaborate with tech startups to develop modular drug printers. India supports the market through academic research, pilot trials, and low-cost drug development initiatives. The region presents strong potential due to its large patient base, rising prevalence of chronic diseases, and emphasis on localized manufacturing.

Latin America

Latin America captures roughly 7% of the market, led by Brazil, Mexico, and Argentina. The region focuses on improving access to customized medications and reducing reliance on imported pharmaceuticals. Universities and research centers in Brazil explore 3D printed dosage forms for low-income populations and rare disease therapies. Mexico invests in digital health technology integration, including additive manufacturing in public hospitals. Limited regulatory maturity and infrastructure challenges remain key hurdles, but ongoing reforms and public-private partnerships offer positive momentum.

Middle East & Africa

The Middle East & Africa accounts for around 5% of the market, with growth driven by healthcare digitization, infrastructure modernization, and government-led innovation strategies. The UAE and Saudi Arabia explore 3D printed pharmaceuticals as part of broader initiatives in smart healthcare. South Africa supports academic research in bioengineering and drug printing. While market penetration is still low, interest in localized drug manufacturing and emergency-response medication solutions continues to increase. The region gradually strengthens its capabilities through international collaboration and pilot-scale adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Osmotica Pharmaceuticals

- GlaxoSmithKline Plc

- FabRx Ltd

- Extend Biosciences

- Affinity Therapeutics

- Merck

- Aprecia Pharmaceuticals LLC

- Bioduro

- Hewlett Packard Caribe

- Aprecia

Competitive Analysis

The 3D Printed Drugs Market features a competitive landscape shaped by innovation-driven pharmaceutical and technology firms. Key players include Aprecia Pharmaceuticals LLC, FabRx Ltd, GlaxoSmithKline Plc, Merck, Extend Biosciences, Bioduro, Affinity Therapeutics, Hewlett Packard Caribe, Osmotica Pharmaceuticals, and Aprecia. Aprecia Pharmaceuticals LLC holds a pioneering position with SPRITAM®, the first FDA-approved 3D printed drug, setting a regulatory and technological benchmark. FabRx Ltd leads in personalized drug development through its proprietary Printlets® platform, offering modular dosage customization for clinical and research applications. GlaxoSmithKline Plc explores additive manufacturing for flexible drug release and packaging innovations. Merck invests in collaborative research to integrate 3D printing into future drug pipelines, focusing on scalable pharmaceutical production. Players such as Hewlett Packard and Extend Biosciences contribute with printing technology and targeted delivery systems, respectively. The market shows increasing collaboration among pharmaceutical firms, academic institutions, and technology providers to accelerate commercialization, reduce production timelines, and advance personalized therapeutics.

Recent Developments

- In February 2025, the company announced a study demonstrating that its M3DIMAKER 1 3D printer can automate capsule filling in community pharmacies, improving cost efficiency, time, and safety in compounding practices.

- In September 2024, Aprecia released a scientific poster detailing its development of 3D‑printed oral disintegrating tablets of oxcarbazepine using co‑processed excipients, highlighting the porous structure and rapid dispersion benefits of its ZipDose® technology

- In November 2023, Aprecia partnered with Battelle to develop next-generation 3D printing platforms aimed at transforming the way medicines are developed, manufactured, distributed, and administered.

Market Concentration & Characteristics

The 3D Printed Drugs Market exhibits a moderately concentrated structure with a small group of innovation-driven players holding technological and regulatory advantages. It is characterized by early-stage commercialization, high R&D intensity, and a strong focus on personalized medicine. The market remains innovation-led, with companies like Aprecia Pharmaceuticals LLC and FabRx Ltd pioneering product development and regulatory engagement. It involves a blend of pharmaceutical firms, additive manufacturing specialists, and academic institutions collaborating to develop scalable, compliant drug-printing platforms. Barriers to entry include complex validation protocols, high capital costs, and limited compatibility of APIs with current printing technologies. It benefits from increasing regulatory support, evidenced by FDA and EMA initiatives that guide safe adoption of additive manufacturing in drug production. Demand concentrates around therapeutic areas requiring precise dosing, such as neurology, oncology, and pediatrics. It also favors geographies with robust pharmaceutical manufacturing infrastructure, digital health adoption, and favorable regulatory outlooks. The market continues to evolve through pilot-scale trials, strategic alliances, and integration of AI into design and prototyping.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Pharmaceutical companies will expand 3D printing capabilities to support personalized drug regimens.

- Hospitals and care centers will adopt point-of-care drug printing for tailored treatment delivery.

- Regulatory bodies will establish more defined guidelines for 3D printed drug approval and GMP compliance.

- Advances in printing technologies will enable multi-drug tablets with controlled and targeted release profiles.

- Integration of AI will accelerate drug formulation design and print process optimization.

- Pediatric and geriatric treatments will benefit from dose customization and patient-friendly formats.

- Contract manufacturing organizations will offer 3D printing as a service for clinical trials and specialty drugs.

- Academic-industry collaborations will drive innovation in excipient development and print stability.

- Low-volume, high-value therapies such as orphan drugs will leverage 3D printing for efficient production.

- Regional manufacturing hubs will emerge to decentralize pharmaceutical production and reduce supply chain dependency.