Market Overview

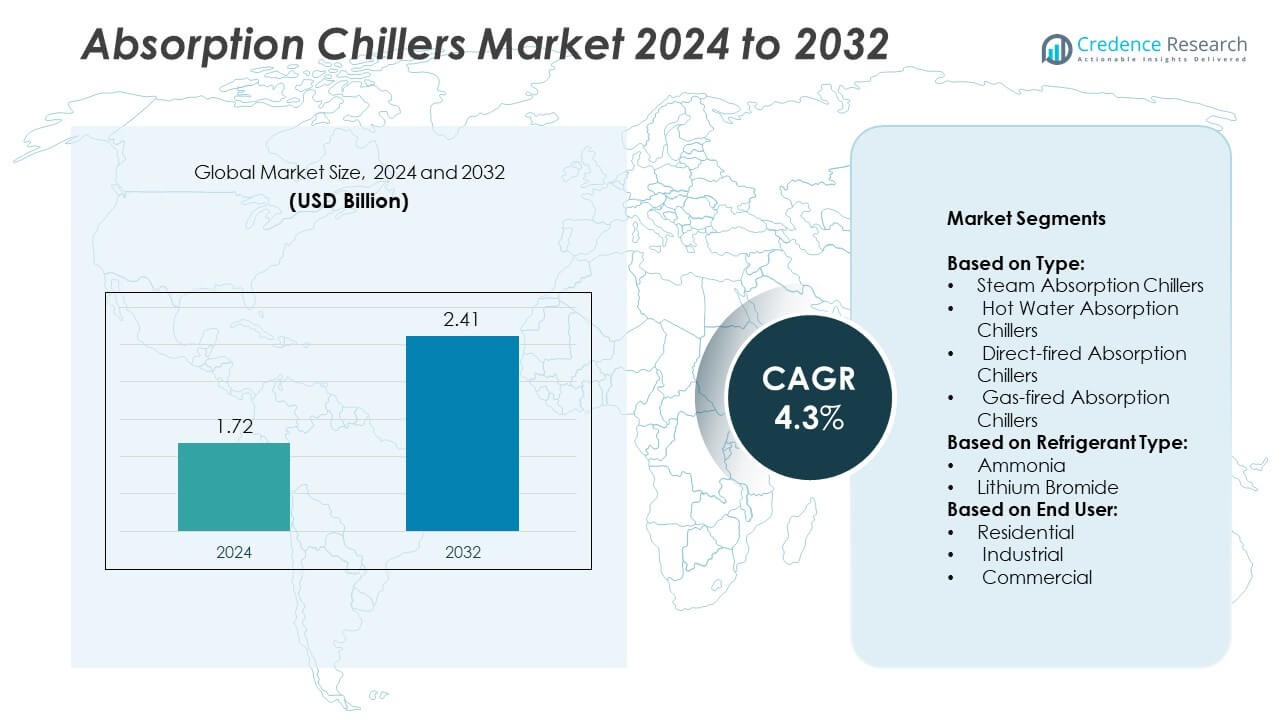

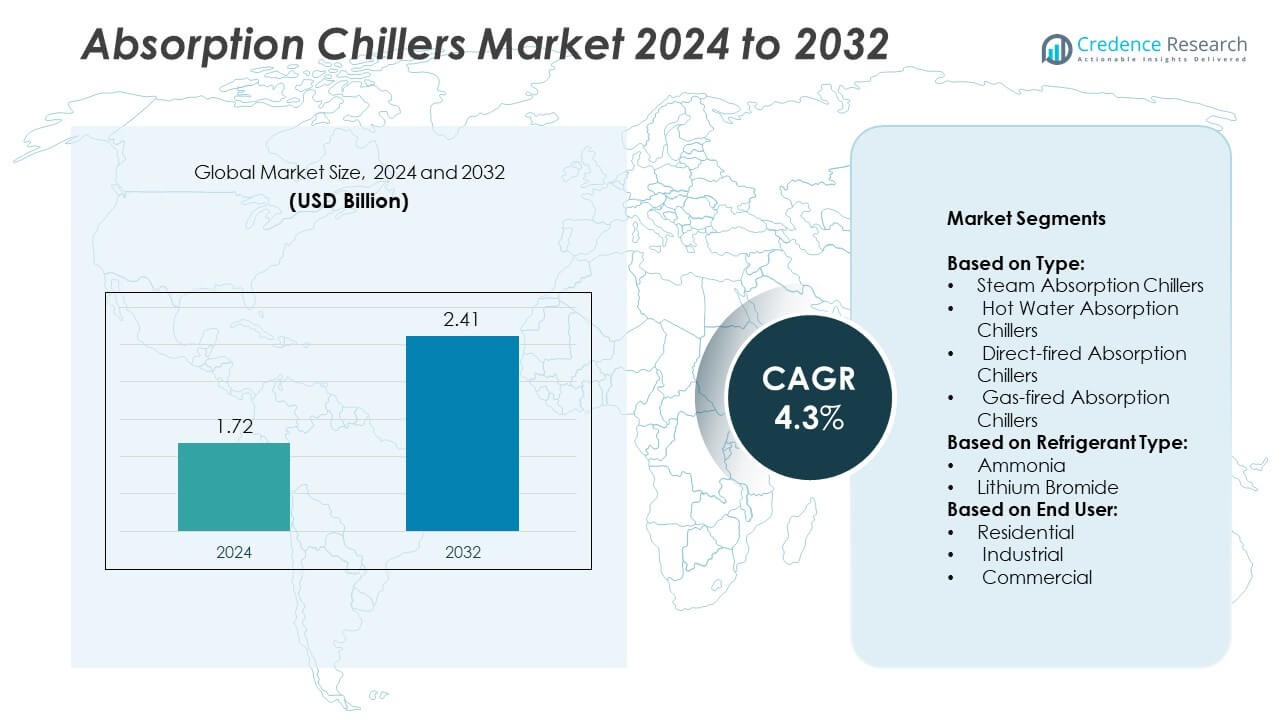

Absorption Chillers Market size was valued at USD 1.72 billion in 2024 and is projected to reach USD 2.41 billion by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Absorption Chillers Market Size 2024 |

USD 1.72 Billion |

| Absorption Chillers Market, CAGR |

4.3% |

| Absorption Chillers Market Size 2032 |

USD 2.41 Billion |

Broad Air Conditioning Ltd., Kirloskar Pneumatic Company Ltd., Carrier Corporation, Kawasaki Thermal Engineering Co., Ltd., Yazaki Corporation, EAW Energieanlagenbau GmbH, Johnson Controls, Robur Corporation, Shuangliang Eco-Energy Systems Co Ltd, Hyundai Climate Control Co., Ltd., Hitachi Ltd, Thermax Ltd, Trane Inc., and LG Electronics are the top players shaping the absorption chillers market. Asia-Pacific leads the market with over 35% share, driven by rapid industrialization, district cooling expansion, and strong manufacturing presence. North America follows with around 30% share, supported by combined heat and power installations and energy-efficiency initiatives. Europe holds over 25% share, benefitting from stringent energy regulations and retrofitting of commercial buildings. The Middle East & Africa and Latin America together contribute nearly 10%, fueled by district cooling projects and industrial adoption. These players focus on energy-efficient designs, product customization, and global service networks to strengthen their competitive positioning.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The absorption chillers market was valued at USD 1.72 billion in 2024 and is projected to reach USD 2.41 billion by 2032, growing at a CAGR of 4.3%.

- Rising demand for energy-efficient cooling systems and waste-heat recovery solutions drives market growth across industrial and commercial sectors.

- Key trends include adoption of lithium bromide chillers for district cooling, integration with CHP plants, and development of low-emission gas-fired models.

- The market is moderately consolidated, with leading players focusing on product innovation, global expansion, and strong after-sales service networks to maintain competitiveness.

- Asia-Pacific leads with over 35% share, followed by North America at around 30% and Europe at more than 25%; steam absorption chillers hold over 40% share among types, driven by industrial applications and combined heat and power projects.

Market Segmentation Analysis:

By Type

Steam absorption chillers dominate the market with more than 40% share due to their ability to use waste steam from industrial processes and power plants efficiently. They are widely deployed in combined heat and power (CHP) plants, which reduces operating costs and boosts energy efficiency. Direct-fired absorption chillers are gaining adoption in regions with robust natural gas infrastructure, supporting cooling for large commercial spaces. Hot water absorption chillers remain essential for district cooling and renewable energy-based heating networks, while gas-fired units cater to high-capacity cooling applications requiring fuel flexibility.

- For instance, in a CHP‐integrated food processing facility in the US, two 415 kW reciprocating engine generators supply waste heat to an absorption chiller that delivers 160 tons of refrigeration at 25°F (≈ −4°C) using that low‐pressure steam heat.

By Refrigerant Type

Lithium bromide-based absorption chillers lead with over 70% market share, driven by their extensive use in HVAC systems for commercial and district cooling applications. Lithium bromide offers excellent thermodynamic stability, enabling consistent performance for large-capacity cooling loads. Ammonia-based absorption chillers continue to serve industrial refrigeration applications, especially in chemical, pharmaceutical, and food processing sectors, because of their efficiency and zero ozone depletion potential. Growing focus on sustainability and eco-friendly refrigerants ensures steady demand for both lithium bromide and ammonia systems across industries.

- For instance, the company AGO (“AGO Congelo” chillers) offers ammonia/water absorption chillers with cooling capacity averaging 100 kW to 1,500 kW for systems with supply thermal heat of ~90-160°C.

By End User

The industrial segment accounts for over 50% market share, fueled by rising process cooling requirements in petrochemical, chemical, and food manufacturing facilities. Industrial users adopt absorption chillers to recover waste heat and improve energy efficiency. The commercial segment is expanding with higher installations in hotels, shopping complexes, and office buildings, driven by green building initiatives and energy-saving regulations. The residential segment holds a smaller share but is growing in premium housing and district cooling projects where centralized, efficient cooling solutions are preferred.

Key Growth Drivers

Growing Demand for Energy-Efficient Cooling Solutions

Rising energy costs and strict efficiency regulations drive adoption of absorption chillers worldwide. These systems utilize waste heat or renewable energy sources, significantly lowering electricity consumption compared to mechanical chillers. Industrial sectors such as chemical, food processing, and petrochemical industries increasingly implement absorption chillers to improve energy utilization and meet sustainability goals. Government incentives for green buildings and carbon reduction initiatives further accelerate demand, making energy efficiency a major growth driver for the global market during the forecast period.

- For instance, in the Panasonic demonstration at H2 KIBOU FIELD in Japan, they lowered the minimum heat source temperature requirement of a fuel cell + absorption chiller system from 80°C to 70°C, enabling use of waste heat from hydrogen fuel cells in cooling.

Expansion of District Cooling Networks

Rapid urbanization and infrastructure growth fuel demand for centralized cooling systems, particularly in hot-climate regions. District cooling networks favor absorption chillers for their ability to operate using steam or hot water, improving overall system efficiency. Large-scale installations in commercial complexes, airports, and hospitals support higher adoption. The technology reduces peak electricity load, making it attractive for cities focusing on smart energy management. Growing investments in district cooling projects across Asia, the Middle East, and Europe are expected to significantly contribute to market growth in coming years.

- For instance, World Energy installed an absorption heat pump at Kumho Petrochemical in Korea. The system recovers latent heat from a solvent mixed gas at approximately 83°C, which is generated during synthetic rubber production. The heat pump produces 8 tons per hour of steam at a pressure of 1 bar G, with a saturation temperature of 120°C. A similar installation produced 8 tons per hour of steam from waste heat at the same site

Increasing Industrial Waste-Heat Recovery Projects

Industrial facilities are increasingly investing in waste-heat recovery solutions to optimize energy use. Absorption chillers offer a cost-effective way to convert surplus heat into useful cooling, improving overall plant efficiency. Sectors such as steel, cement, and power generation adopt these systems to cut operating costs and meet emission reduction targets. This trend aligns with global sustainability objectives and corporate ESG commitments. As industries move toward carbon-neutral operations, demand for absorption chillers utilizing waste-heat sources is set to grow significantly across multiple geographies.

Key Trends & Opportunities

Rising Adoption of Lithium Bromide-Based Chillers

Lithium bromide-based chillers dominate the market due to their reliability, thermodynamic stability, and suitability for large-capacity cooling. Their ability to deliver consistent performance in HVAC and district cooling applications makes them the preferred choice for commercial and industrial sectors. Growing awareness about low-GWP refrigerants and sustainability targets strengthens the shift toward lithium bromide systems. Manufacturers are investing in developing advanced designs with higher efficiency and longer life cycles, which will further boost demand and market penetration over the forecast period.

- For instance, the Trane Classic single‐stage LiBr absorption chillers operate with steam at up to 14 psig (≈0.97 bar above atmospheric) and steam temperatures up to 340°F (≈171°C), providing chilled water in the range 40-50°F (≈4-10°C).

Integration with IoT and Smart Building Systems

The trend toward digitalization is reshaping the absorption chillers market. Integration with IoT platforms and smart building management systems enables remote monitoring, predictive maintenance, and optimized energy use. Real-time data analytics help operators improve performance and reduce downtime. Smart controls are particularly valuable for large facilities and district cooling plants where system reliability is critical. This shift toward connected solutions opens new opportunities for manufacturers to offer value-added services, strengthening customer relationships and driving recurring revenue streams.

- For instance, the YORK YHAU-CW Double-effect Steam-Fired Absorption Chiller has a capacity range from 120 to 4,000 tons of refrigeration (≈ 422 to 14,067 kW).

Key Challenges

High Initial Investment and Installation Costs

One of the major challenges restraining market growth is the high upfront cost of absorption chillers and associated installation expenses. These systems require significant capital investment, including piping and integration with heat sources, which can be prohibitive for small and mid-sized facilities. Long payback periods also discourage adoption in cost-sensitive markets. To overcome this challenge, manufacturers and service providers are exploring financing models and performance-based contracts that spread costs over time, making the technology more accessible to a broader customer base.

Limited Awareness in Emerging Markets

In developing economies, lack of awareness about absorption chiller benefits and technical requirements poses a challenge. Many industries still rely on conventional electric chillers due to familiarity and lower initial investment. Limited availability of skilled technicians for installation and maintenance further slows adoption. Market players must invest in training programs, demonstration projects, and targeted marketing to educate potential customers. Growing focus on sustainability and rising energy costs are expected to gradually bridge this knowledge gap and create opportunities for wider deployment.

Regional Analysis

North America

North America holds over 30% share of the absorption chillers market, driven by strong adoption in industrial facilities and district cooling networks. The United States leads the region, supported by investments in energy-efficient HVAC systems and combined heat and power (CHP) plants. Demand is further supported by government incentives promoting sustainable cooling technologies and carbon reduction initiatives. Canada contributes steadily with rising deployment in commercial spaces, particularly in large office complexes and healthcare facilities. The market benefits from the availability of natural gas, which supports the use of direct-fired chillers in industrial and commercial applications.

Europe

Europe accounts for more than 25% of the global market, supported by stringent EU energy efficiency regulations and rising adoption of low-carbon technologies. Germany, France, and the U.K. are leading countries, driven by industrial waste heat recovery projects and district heating and cooling networks. The region favors lithium bromide absorption chillers for commercial and residential applications due to their environmental compatibility. Government initiatives and funding programs such as Horizon Europe encourage energy-efficient cooling solutions. Growth is also supported by retrofitting projects across aging infrastructure and increasing demand for sustainable HVAC systems in both commercial and public sector facilities.

Asia-Pacific

Asia-Pacific dominates with over 35% share, driven by rapid industrialization, urbanization, and growing investments in district cooling projects. China, India, and Japan are key contributors, with strong adoption in petrochemical, chemical, and food processing industries. Rising demand for energy-efficient solutions aligns with government policies focused on reducing carbon emissions and optimizing power consumption. The availability of cost-effective labor and equipment manufacturing supports large-scale chiller production, reducing system costs. Commercial sectors in Southeast Asia are also investing in absorption chillers for malls, hotels, and airports, further boosting regional growth.

Middle East & Africa

The Middle East & Africa region holds around 5% share, with growth driven by large-scale district cooling projects in the Gulf Cooperation Council (GCC) countries. The UAE, Saudi Arabia, and Qatar are major markets, using absorption chillers to meet cooling needs in high-temperature climates while utilizing waste heat from power plants and desalination facilities. Government initiatives for energy efficiency and green building standards accelerate adoption in commercial complexes and residential projects. Africa contributes through industrial and infrastructure development projects, particularly in South Africa, though overall adoption remains at a relatively early stage compared to other regions.

Latin America

Latin America captures nearly 5% share, supported by steady demand from industrial and commercial sectors. Brazil and Mexico lead the market, with installations in chemical processing, food and beverage production, and commercial buildings. Government efforts to modernize infrastructure and adopt sustainable cooling solutions drive adoption. The region also benefits from growing foreign investments in manufacturing plants, which create demand for waste heat recovery systems. Rising awareness of energy efficiency and operational cost savings encourages companies to shift from conventional electric chillers to absorption chillers, improving energy utilization across diverse applications.

Market Segmentations:

By Type:

- Steam Absorption Chillers

- Hot Water Absorption Chillers

- Direct-fired Absorption Chillers

- Gas-fired Absorption Chillers

By Refrigerant Type:

By End User:

- Residential

- Industrial

- Commercial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Broad Air Conditioning Ltd., Kirloskar Pneumatic Company Ltd., Carrier Corporation, Kawasaki Thermal Engineering Co., Ltd., Yazaki Corporation, EAW Energieanlagenbau GmbH, Johnson Controls, Robur Corporation, Shuangliang Eco-Energy Systems Co Ltd, Hyundai Climate Control Co., Ltd., Hitachi Ltd, Thermax Ltd, Trane Inc., and LG Electronics lead the global absorption chillers market. The market is shaped by continuous advancements in energy-efficient designs, waste-heat recovery integration, and large-capacity installations for industrial and commercial projects. Strong focus on sustainability drives demand for low-emission and eco-friendly systems, supporting adoption in district cooling and green building projects. Competitive strategies center on product innovation, global expansion, and robust after-sales service networks. Increasing investments in research and development, along with customized solutions for diverse end-user requirements, strengthen competitive positioning and enable players to capture emerging opportunities across manufacturing, infrastructure, and commercial sectors worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Broad Air Conditioning Ltd.

- Kirloskar Pneumatic Company Ltd.

- Carrier Corporation

- Kawasaki Thermal Engineering Co., Ltd.

- Yazaki Corporation

- EAW Energieanlagenbau GmbH

- Johnson Controls

- Robur Corporation

- Shuangliang Eco-Energy Systems Co Ltd

- Hyundai Climate Control Co., Ltd.

- Hitachi Ltd

- Thermax Ltd

- Trane Inc.

- LG Electronics

Recent Developments

- In 2025, Johnson Controls launched Silent-Aire Coolant Distribution Units for data centers.

- In 2025, Kirloskar Pneumatic is expanding its air conditioning and refrigeration segment, which includes vapor absorption chillers, with plans for capacity expansion and new product launches through 2026.

- In 2024, Broad Air Conditioning Ltd. launched a 2024 service-training webinar series for absorption chillers.

Report Coverage

The research report offers an in-depth analysis based on Type, Refrigerant Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising adoption of energy-efficient cooling technologies.

- Demand will increase for chillers integrated with combined heat and power systems.

- Lithium bromide chillers will remain the preferred choice for large commercial applications.

- Gas-fired models will gain traction in regions with strong natural gas infrastructure.

- Industrial users will continue driving adoption through waste-heat recovery projects.

- District cooling projects in urban areas will support large-capacity chiller installations.

- Manufacturers will invest in R&D to enhance efficiency and reduce emissions.

- Digital monitoring and IoT-enabled controls will improve operational performance and maintenance.

- Asia-Pacific will remain the largest market due to rapid industrialization and infrastructure growth.

- Retrofit opportunities in Europe and North America will create steady replacement demand.