Market Overview

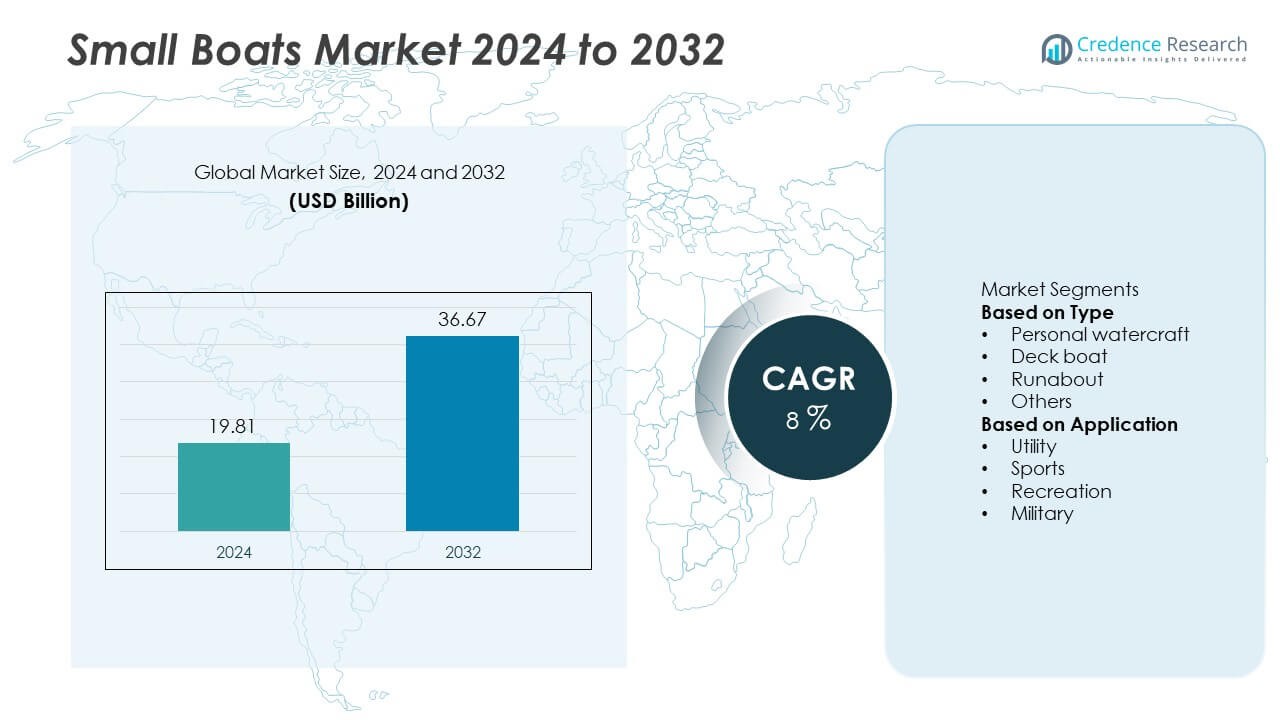

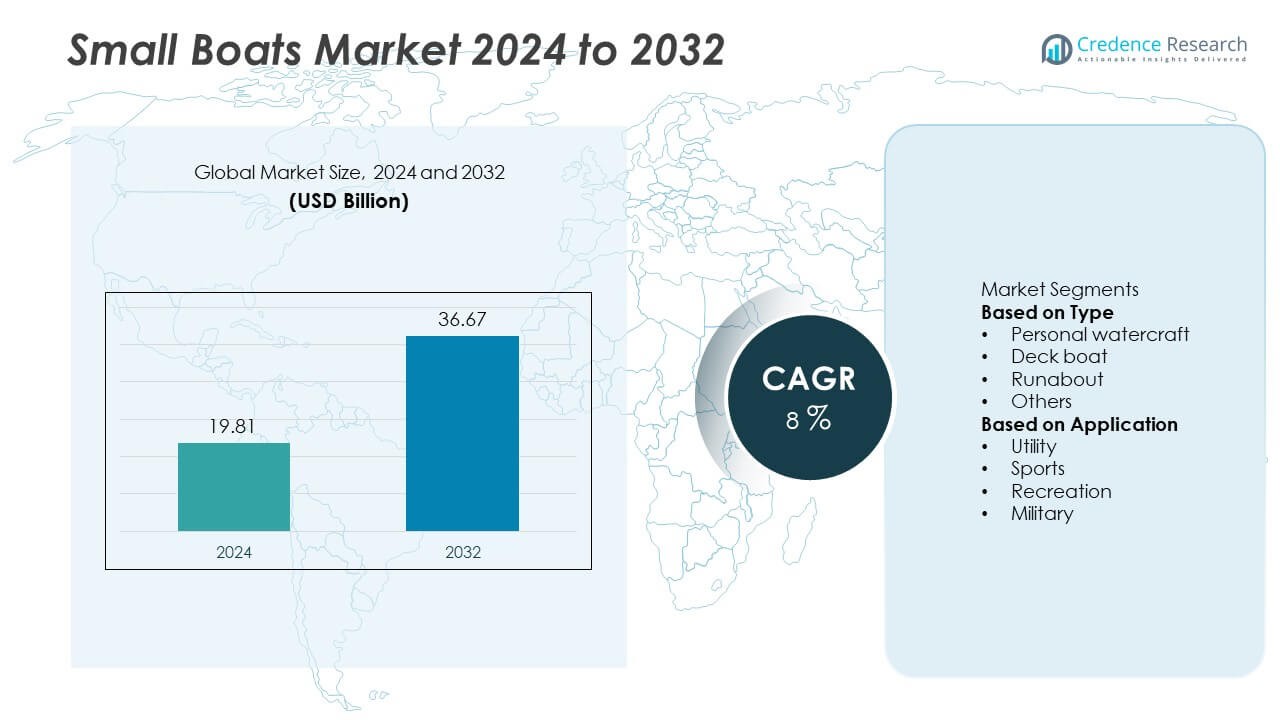

The global Small Boats Market was valued at USD 19.81 billion in 2024 and is projected to reach USD 36.67 billion by 2032, expanding at a CAGR of 8 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Small Boats Market Size 2024 |

USD 19.81 Billion |

| Small Boats Market, CAGR |

8 % |

| Small Boats Market Size 2032 |

USD 36.67 Billion |

The global small boats market is led by major companies including Brunswick Corporation, Bombardier Recreational Products, Honda Motor Co., Ltd., MasterCraft Boat Holdings, Inc., Polaris Inc., Chaparral Boats, Malibu Boats, Regal Boats, Kawasaki Motors Corp., USA, and American Sail Inc. These players dominate through technological innovation, strong dealer networks, and a focus on performance, safety, and sustainability. North America led the market with a 39.4% share in 2024, driven by high participation in recreational boating and robust marine infrastructure. Europe followed with 27.6%, supported by rising coastal tourism and eco-friendly boat adoption. Both regions continue to invest in electric propulsion and smart navigation technologies, reinforcing their leadership in the global market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global small boats market was valued at USD 19.81 billion in 2024 and is projected to reach USD 36.67 billion by 2032, expanding at a CAGR of 8.0% during the forecast period.

- Growth is driven by increasing recreational boating activities, rising coastal tourism, and advancements in electric and hybrid propulsion systems enhancing efficiency and sustainability.

- The market is witnessing trends such as lightweight composite construction, smart navigation integration, and customization features to improve safety and comfort.

- Competitive dynamics are shaped by key players like Brunswick Corporation, Bombardier Recreational Products, and MasterCraft Boat Holdings focusing on innovation, digital marketing, and product diversification.

- Regionally, North America held a 39.4% share in 2024, followed by Europe at 27.6% and Asia-Pacific at 23.8%, while the personal watercraft segment led with a 38.5% share, supported by strong consumer demand for compact, high-performance recreational boats.

Market Segmentation Analysis:

By Type

The personal watercraft segment dominated the small boats market in 2024, holding a 38.5% share. Its dominance is attributed to increasing consumer interest in recreational and adventure water activities, along with ease of handling and compact design. The segment benefits from technological innovations such as lightweight hulls, advanced propulsion systems, and improved fuel efficiency. Leading manufacturers are integrating GPS-based navigation and safety systems to enhance user experience. The growing popularity of leisure boating and water sports across coastal and inland waterways continues to boost the demand for personal watercraft globally.

- For instance, Kawasaki Motors Corp., USA introduced the Jet Ski Ultra 310LX-S featuring a 1,498 cc supercharged inline-4 marine engine producing 228 kW (310 PS) at 8,000 rpm. The model includes a 7-inch TFT display and an electric trim-control system to adjust the hull’s attitude. Some sources also list GPS functionality and smartphone connectivity.

By Application

The recreation segment led the small boats market in 2024, accounting for a 46.2% share. Rising disposable income and growing participation in boating clubs and marine tourism have strengthened this segment’s leadership. Consumers are increasingly investing in small boats for leisure cruising, fishing, and family outings. Governments and private marinas are expanding coastal infrastructure to support recreational boating activities. Advancements in hybrid and electric propulsion models are also attracting eco-conscious users, ensuring steady growth in the recreational small boat segment worldwide.

- For instance, Brunswick Corporation’s Mercury Marine brand launched its Avator 20e electric outboard system, which delivers 2.2 kW of rated prop shaft power and is compatible with a modular battery system. When equipped with four 2.3 kWh batteries for a total capacity of 9.2 kWh, the propulsion unit can provide several hours of runtime at a cruising speed of 4 knots, depending on the boat and conditions.

Key Growth Drivers

Rising Popularity of Recreational Boating Activities

Growing interest in leisure and adventure water activities is a major driver for the small boats market. Increasing disposable income and lifestyle changes are encouraging consumers to invest in personal watercraft and deck boats for relaxation and tourism. Coastal regions in North America and Europe are witnessing strong participation in boating clubs and marina-based recreation. Expanding rental services and the rising appeal of family-oriented water leisure further strengthen market demand globally.

- For instance, MasterCraft Boat Holdings, Inc. launched its XT25 model featuring a 6.2-liter Ilmor GDI V8 engine delivering 321 kW (430 hp) of output. The model integrates a digitally tuned SurfStar system with a maximum ballast capacity of 3,200 pounds (1,451 kg), enabling precision wake formation and enhanced recreational performance for family and sport boating.

Technological Advancements in Boat Design and Propulsion

Innovations in materials and propulsion systems are enhancing small boat efficiency, safety, and performance. Manufacturers are adopting lightweight composites, electric outboard motors, and digital control systems to improve maneuverability and reduce emissions. Integration of smart navigation, remote monitoring, and automatic docking systems is gaining traction among premium consumers. These advancements are reshaping the market, offering eco-friendly, low-maintenance solutions and driving adoption across both recreational and utility applications.

- For instance, Bombardier Recreational Products (BRP) introduced its Rotax ACE 300 engine and the iBR (Intelligent Brake and Reverse) system. The iBR system allows watercraft to stop significantly sooner than models without a brake, with BRP citing a stopping distance of up to 48 meters sooner in its second-generation system.

Expansion of Coastal Tourism and Marine Infrastructure

The global growth of marine tourism and infrastructure development is creating new opportunities for small boat usage. Governments are investing in marina construction, waterways, and coastal facilities to boost tourism activities. This expansion supports both recreational and commercial boating operations. Additionally, growing demand for sightseeing and fishing excursions in emerging economies contributes to rising boat sales. Enhanced safety standards and waterway regulations further promote consumer confidence, supporting sustained market growth.

Key Trends & Opportunities

Adoption of Electric and Hybrid Propulsion Systems

The industry is rapidly shifting toward electric and hybrid propulsion due to stricter emission norms and rising fuel costs. Electric small boats offer quieter operation, reduced maintenance, and lower environmental impact, making them ideal for lakes and protected waterways. Leading manufacturers are investing in battery efficiency and fast-charging technologies. The growing focus on sustainability and government incentives for clean marine transport create significant opportunities for market expansion in the coming years.

- For instance, Pure Watercraft introduced its electric pontoon, the Pure Pontoon, which is equipped with a 25 kW direct-drive outboard motor (with options for single or dual motors) and powered by a General Motors-sourced 66 kWh automotive-grade lithium-ion battery pack.

Integration of Smart and Connected Boating Technologies

Smart technologies are redefining the small boats segment, offering advanced navigation, telematics, and remote monitoring systems. Features such as GPS tracking, digital dashboards, and real-time diagnostics enhance safety and user convenience. Connectivity allows owners to manage boat performance and maintenance through mobile apps. This trend aligns with rising consumer expectations for automation and personalization, enabling manufacturers to differentiate their products and strengthen brand loyalty in competitive markets.

- For instance, Yamaha Motor Co., Ltd. introduced its Helm Master EX control system, which integrates joystick steering with GPS-linked Autopilot features. The system offers precise low-speed maneuverability for docking and a suite of SetPoint modes, such as FishPoint and DriftPoint, for holding position and heading.

Key Challenges

High Initial Costs and Maintenance Expenses

The small boats market faces challenges related to high purchase and maintenance costs, limiting adoption among middle-income consumers. Advanced materials, digital systems, and electric propulsion add to production expenses, making boats less affordable in emerging regions. Maintenance requirements for engines and storage facilities also increase long-term ownership costs. Manufacturers are focusing on modular designs and low-maintenance solutions to reduce total cost of ownership and attract broader consumer segments.

Regulatory Constraints and Environmental Compliance

Stringent environmental regulations on emissions, fuel efficiency, and noise levels create operational challenges for manufacturers. Meeting international standards such as IMO and EPA guidelines requires costly design modifications and testing. Non-compliance can result in fines or restricted market access. Additionally, the disposal of fiberglass boats and battery waste raises sustainability concerns. To address these issues, companies are investing in recyclable materials, cleaner propulsion technologies, and advanced waste management practices.

Regional Analysis

North America

North America dominated the small boats market in 2024, holding a 39.4% share. The region’s leadership is driven by strong participation in recreational boating, advanced marine infrastructure, and favorable government policies supporting leisure craft ownership. The United States leads the market with high demand for personal watercraft and runabouts, supported by an established boating culture and extensive coastline. Innovation in electric propulsion systems and the expansion of marina facilities are further driving sales. Canada also contributes significantly due to rising interest in inland lake boating and fishing activities.

Europe

Europe accounted for a 27.6% share of the small boats market in 2024, supported by a strong maritime tradition and growing coastal tourism. Countries such as Italy, France, and the United Kingdom are key markets due to their thriving yacht and personal watercraft segments. Stringent emission norms have accelerated the adoption of electric and hybrid small boats. Manufacturers are focusing on eco-friendly designs and safety advancements. Increased consumer preference for leisure boating and expanding boating clubs across the Mediterranean and Nordic regions continue to reinforce Europe’s position in the global market.

Asia-Pacific

Asia-Pacific captured a 23.8% share of the global small boats market in 2024. The region’s growth is fueled by rising coastal tourism, expanding water sports activities, and growing disposable incomes in China, Japan, and Australia. Government initiatives promoting marine recreation and infrastructure development are encouraging boating participation. Local manufacturers are introducing cost-efficient and lightweight models to attract new buyers. Increasing popularity of leisure boating among younger consumers and the rapid expansion of marina networks are transforming Asia-Pacific into one of the fastest-growing regions for small boats globally.

Latin America

Latin America held a 5.4% share of the small boats market in 2024, driven by expanding marine tourism and the growing popularity of recreational fishing. Brazil and Mexico dominate regional demand, supported by favorable weather conditions and coastal leisure development. Investments in port modernization and increasing adoption of mid-range boats for private use are strengthening the market. Economic recovery and rising middle-class income levels are encouraging personal boat ownership. Although import costs remain a restraint, the expansion of local manufacturing is expected to improve market accessibility and affordability.

Middle East & Africa

The Middle East & Africa accounted for a 3.8% share in 2024, supported by rising demand for luxury and recreational boats. The UAE and Saudi Arabia lead regional growth, driven by increasing waterfront developments, tourism investments, and premium marina projects. Favorable weather conditions and expanding interest in coastal leisure are encouraging small boat usage. Africa’s emerging markets, particularly South Africa and Kenya, are witnessing gradual adoption of personal and utility boats. Government support for coastal tourism and growing disposable income among urban consumers continue to stimulate market expansion in this region.

Market Segmentations:

By Type

- Personal watercraft

- Deck boat

- Runabout

- Others

By Application

- Utility

- Sports

- Recreation

- Military

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The small boats market is characterized by intense competition among leading manufacturers such as Brunswick Corporation, Bombardier Recreational Products, Honda Motor Co., Ltd., MasterCraft Boat Holdings, Inc., Polaris Inc., Chaparral Boats, Malibu Boats, Regal Boats, Kawasaki Motors Corp., USA, and American Sail Inc. These companies compete through continuous innovation in design, propulsion technology, and material engineering. Leading players are focusing on expanding their product portfolios with electric and hybrid models to meet evolving environmental standards. Strategic collaborations, dealer network expansions, and digital marketing initiatives enhance market reach and brand visibility. Manufacturers are investing in lightweight composites, improved fuel efficiency, and advanced onboard features to attract recreational and professional users. Growing emphasis on customization, safety technologies, and sustainability continues to shape competition, with global brands leveraging R&D and strong after-sales service networks to maintain their dominance across regional markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Regal Boats

- Malibu Boats

- Kawasaki Motors Corp., USA

- MasterCraft Boat Holdings, Inc.

- American Sail Inc.

- Polaris Inc.

- Chaparral Boats

- Brunswick Corporation

- Honda Motor Co., Ltd.

- Bombardier Recreational Products

Recent Developments

- In September 2025, Malibu Boats, Inc. unveiled the 2026 Wakesetter 21 LX, measuring 21’5” in length, with a 102” beam, 13-person capacity, 3,425 lbs of ballast, and a 55-gallon fuel tank.

- In September 2025, Brunswick Corporation announced the consolidation of its global fibre-glass boat manufacturing operations, closing its Reynosa (Mexico) and Flagler Beach (Florida) facilities and moving production to U.S. sites in Vonore (Tennessee) and Merritt Island (Florida).

- In February 2025, Honda Motor Co., Ltd. launched refreshed models of its large-size outboard motors (BF250, BF225, BF200, etc.) at the Miami Boat Show, incorporating features like a 7-inch multifunction display and drive-by-wire control systems.

- In October 2024, Regal Boats introduced its new 43 SAV model, filling the size gap between its 38 SAV and 50 SAV, offering enhanced performance and luxury features.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for recreational and personal watercraft will continue to rise globally.

- Electric and hybrid propulsion systems will gain wider adoption across new boat models.

- Manufacturers will focus on lightweight materials to enhance fuel efficiency and speed.

- Technological advancements will improve navigation, automation, and onboard safety systems.

- Coastal and marine tourism growth will create strong opportunities for small boat sales.

- Expansion of marina infrastructure will support higher boat ownership rates.

- Customization and smart connectivity features will attract younger consumers.

- Environmental regulations will encourage the shift toward sustainable boat designs.

- Strategic partnerships and acquisitions will strengthen global brand presence.

- Asia-Pacific and Latin America will emerge as high-growth markets driven by rising incomes and leisure boating activities.