Market Overview

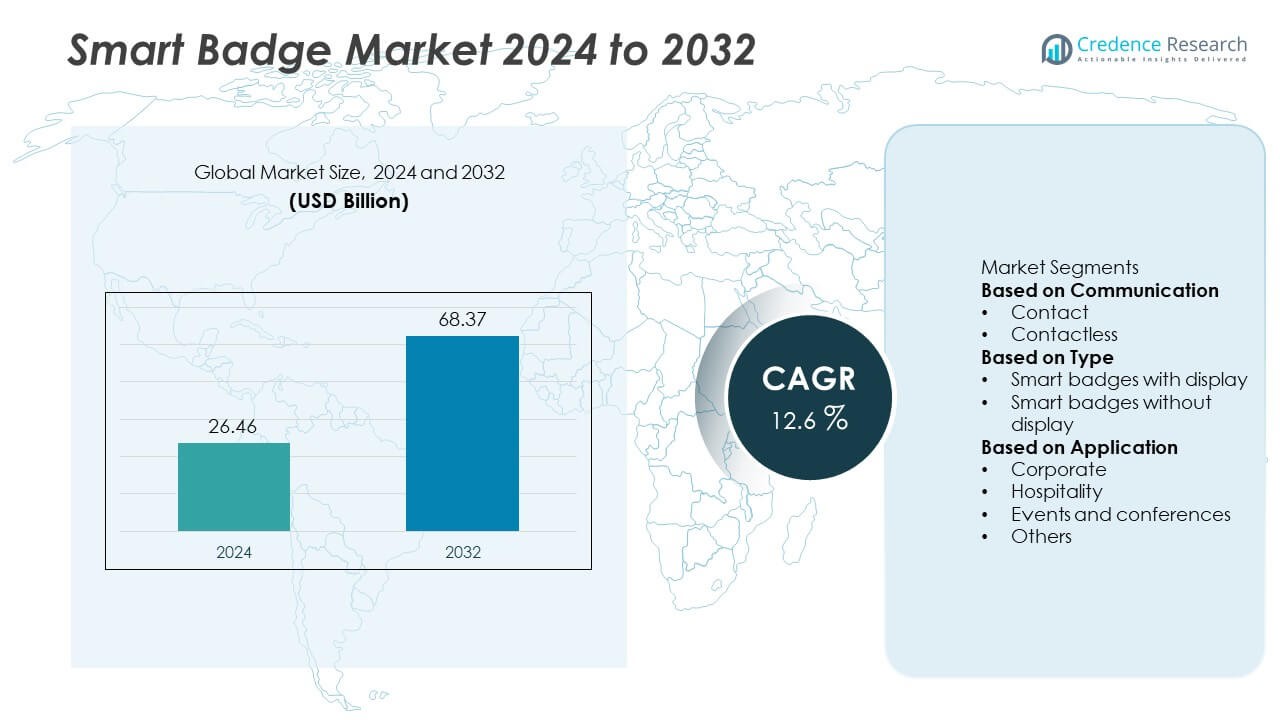

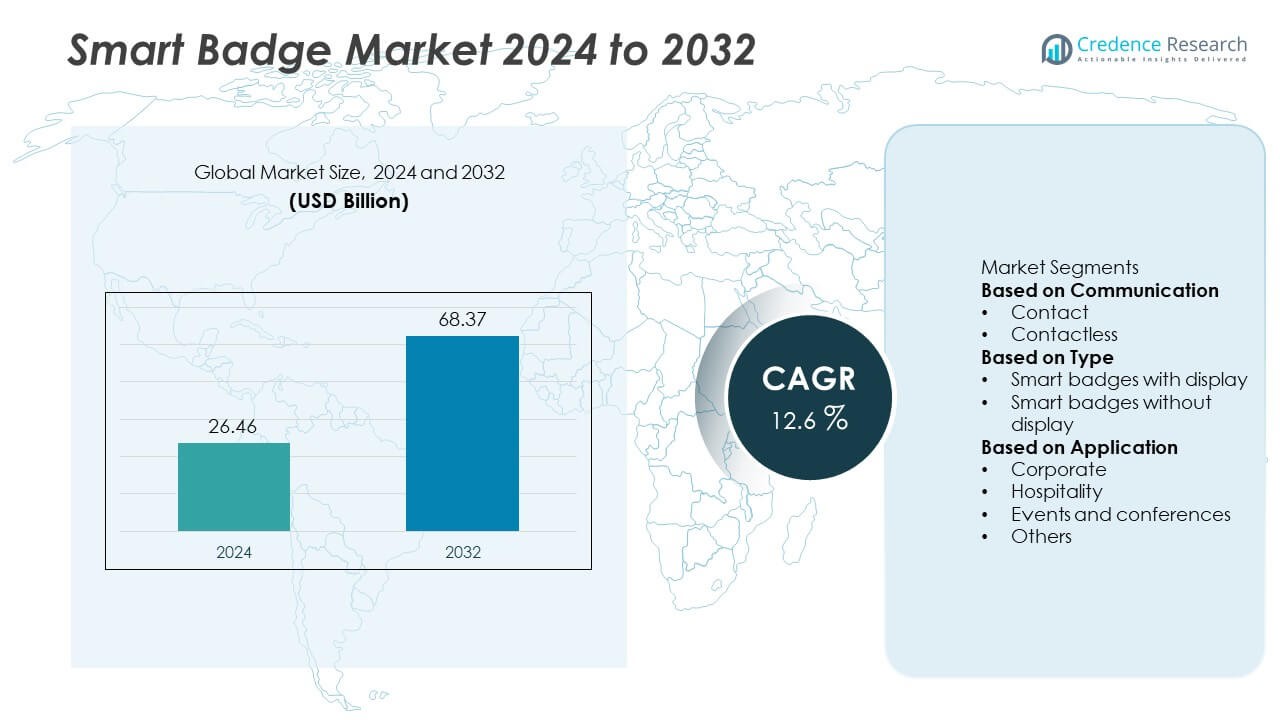

The Smart Badge Market was valued at USD 26.46 billion in 2024 and is projected to reach USD 68.37 billion by 2032, growing at a CAGR of 12.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smart Badge Market Size 2024 |

USD 26.46 Billion |

| Smart Badge Market, CAGR |

12.6% |

| Smart Badge Market Size 2032 |

USD 68.37 Billion |

The smart badge market is led by major players such as Cisco, Beamian, Dorma+Kaba Holdings AG, CardLogix Corporation, ASSA ABLOY, Aioi-Systems Co., Ltd., Brady Worldwide, Inc., Sber, Abeeway, and Evolis. These companies dominate the industry by offering innovative RFID, NFC, and Bluetooth-enabled badge solutions for secure access, workforce tracking, and identity management. North America held the leading 34.1% market share in 2024, supported by high adoption in corporate and government sectors. Europe followed with a 28.6% share, driven by strict data security regulations, while Asia-Pacific accounted for 27.8%, fueled by rapid digital transformation and increased deployment of smart ID systems across enterprises and public institutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The smart badge market was valued at USD 26.46 billion in 2024 and is projected to reach USD 68.37 billion by 2032, growing at a CAGR of 12.6%.

- Rising demand for contactless authentication and identity verification solutions drives market growth, with the contactless segment holding a 63.4% share due to its widespread use in corporate, healthcare, and event management applications.

- Integration of IoT, RFID, and biometric technologies is shaping new trends, enabling real-time tracking, secure data access, and cloud-based management across organizations.

- The market is competitive, with leading players such as Cisco, ASSA ABLOY, and Brady Worldwide focusing on innovation in NFC-enabled and AI-integrated badge systems to enhance security and convenience.

- North America led with a 34.1% share in 2024, followed by Europe at 28.6% and Asia-Pacific at 27.8%, supported by rapid digital transformation, increased data security regulations, and adoption of smart access control systems across industries.

Market Segmentation Analysis:

By Communication

The contactless segment dominated the smart badge market in 2024, accounting for a 63.4% share. Growth is driven by rising demand for secure and hygienic access control solutions across corporate offices, healthcare institutions, and government facilities. Contactless smart badges use RFID, NFC, and Bluetooth technologies to enable touch-free identification and real-time tracking. Their adoption surged with increasing focus on data security and operational efficiency in workplaces. The expansion of smart building ecosystems and growing preference for digital access systems continue to strengthen the dominance of contactless smart badges globally.

- For instance, ASSA ABLOY’s HID Mobile Access platform enables employees to access secured areas with NFC-based badges stored in Apple Wallet on iPhones or Apple Watches. HID Global has noted a strong increase in mobile credentials usage, with reports from 2024 indicating that more than 2 million people worldwide prefer mobile access for door entry.

By Type

Smart badges without display held the largest 58.9% share of the smart badge market in 2024. Their compact design, cost-effectiveness, and suitability for large-scale deployments make them highly preferred in corporate and event management applications. These badges offer reliable identity verification and access authentication through embedded chips and wireless communication modules. Manufacturers focus on improving battery life and encryption technologies to ensure enhanced data security. The demand for minimalistic yet functional smart identification solutions drives sustained growth in this segment across industries.

- For instance, Beamian’s RFID-enabled smart badges have been used in events to boost lead capture, facilitate networking, and provide real-time data on attendee movement, showcasing their potential for efficient identity verification and lead tracking.

By Application

The corporate segment led the smart badge market in 2024, capturing a 44.7% share. Increasing adoption of smart workplace solutions for employee authentication, attendance tracking, and access management drives this dominance. Businesses are implementing smart badges integrated with NFC and BLE to enhance security and streamline entry systems. The growing trend toward hybrid work models and digital identity management solutions further fuels demand. Continuous investment in enterprise IoT infrastructure and workplace automation supports widespread adoption of smart badges in corporate environments worldwide.

Key Growth Drivers

Rising Demand for Secure and Contactless Identification

The growing need for secure, hygienic, and efficient identification systems is a major driver of the smart badge market. Organizations across healthcare, corporate, and government sectors are adopting contactless smart badges integrated with RFID, NFC, and Bluetooth for access control and real-time tracking. Rising awareness of data security and the shift toward touchless solutions post-pandemic have accelerated adoption. These badges not only streamline operations but also enhance workplace safety and compliance through advanced authentication and encrypted data exchange systems.

- For instance, Cisco’s Smart Badge technology under its DNA Spaces ecosystem tracks over 20,000 active devices with room-level accuracy using infrared and Bluetooth Low Energy sensors, strengthening secure access management in large corporate buildings.

Technological Advancements and IoT Integration

Advances in IoT, AI, and sensor technologies are fueling innovation in smart badges. Modern badges now feature GPS tracking, biometric verification, and wireless communication capabilities, enabling seamless connectivity and monitoring. Integration with enterprise IoT ecosystems enhances security, automates attendance, and optimizes workforce management. The demand for multifunctional badges that combine identification, communication, and analytics continues to rise. Continuous investment in R&D by tech companies is further expanding the application scope across industries.

- For instance, Abeeway’s Smart Badge IoT tracker incorporates multi-technology geolocation using GPS, Wi-Fi, LoRaWAN, and BLE, offering varying levels of accuracy and battery life depending on the specific usage mode.

Increasing Adoption in Corporate and Event Management Applications

The rapid digitization of workplaces and event venues drives the demand for smart badges. Corporates use them for access management, time tracking, and secure entry to restricted areas, while event organizers deploy them for attendee identification and networking. These systems improve operational efficiency and visitor engagement while collecting valuable analytics. Growth in global events, hybrid workplaces, and large-scale corporate infrastructure has strengthened the adoption of smart badges as part of integrated identity management systems.

Key Trends & Opportunities

Emergence of Display-Integrated and Biometric Smart Badges

Smart badges with embedded displays and biometric features are emerging as a key trend in digital identity management. Display badges provide real-time information, digital credentials, and interactive communication. Biometric-enabled badges enhance security by integrating fingerprint or facial recognition. Companies are developing lightweight and energy-efficient devices to support extended use in healthcare, defense, and enterprise sectors. This evolution presents significant opportunities for manufacturers to offer advanced and user-friendly authentication devices.

- For instance, Evolis developed its Elypso card printer capable of encoding magnetic stripe, contact, and contactless smart cards, supporting up to 300 dpi color printing.

Growth of Cloud-Based Access and Data Management Solutions

Cloud integration in smart badge systems enables centralized control, analytics, and seamless scalability. Organizations can manage access rights, monitor activities, and update permissions remotely through cloud platforms. This model supports global workforce mobility and hybrid work structures. The growing shift toward SaaS-based identity management and real-time analytics offers new revenue streams for service providers while improving data transparency and operational flexibility for end users.

- For instance, Beamian’s event cloud system provides instant credential updates, attendee tracking, and behavioral analytics through its secure cloud dashboard.

Key Challenges

High Implementation and Maintenance Costs

The deployment of smart badge systems involves significant costs for hardware, software integration, and data management infrastructure. Small and medium enterprises often face financial barriers to adopting these solutions. Continuous upgrades and maintenance, including battery replacement and firmware updates, further increase operational expenses. Cost-efficient and modular solutions will be essential to enable broader adoption across industries.

Data Privacy and Cybersecurity Risks

As smart badges collect and transmit sensitive personal and organizational data, concerns over data breaches and unauthorized access remain prominent. Weak encryption and network vulnerabilities can expose critical information to cyber threats. Compliance with data protection regulations such as GDPR and CCPA adds complexity for global deployments. Strengthening cybersecurity frameworks and implementing end-to-end encryption are vital to ensuring secure, reliable smart badge systems.

Regional Analysis

North America

North America held a 34.1% share of the smart badge market in 2024, driven by strong adoption in corporate security, healthcare, and government sectors. The United States leads the region, supported by advanced IT infrastructure and stringent security regulations. Organizations are increasingly integrating smart badges for identity verification, access control, and attendance tracking. High demand for contactless authentication and workforce monitoring solutions also contributes to growth. The presence of major technology companies and growing use of IoT-enabled smart ID systems further reinforce North America’s dominance in the global market.

Europe

Europe accounted for a 28.6% share of the smart badge market in 2024. The region’s growth is supported by strict data protection regulations and increasing focus on workplace security. Countries such as Germany, France, and the U.K. are major adopters, using smart badges across corporate offices, manufacturing sites, and public institutions. Expansion of digital identity frameworks under the European Union’s eIDAS regulation promotes greater deployment. The rising adoption of contactless authentication systems in healthcare and education sectors further strengthens Europe’s market position. Investments in sustainable and energy-efficient badge technology also drive regional advancement.

Asia-Pacific

Asia-Pacific captured a 27.8% share of the smart badge market in 2024, emerging as the fastest-growing regional market. Rapid urbanization, expanding corporate infrastructure, and digital transformation initiatives in countries like China, Japan, and India drive market growth. The region’s increasing use of RFID and NFC-enabled identification systems supports security modernization across workplaces and events. Governments are promoting digital identity verification systems to enhance administrative efficiency and public safety. Growing adoption in the hospitality, healthcare, and education sectors, along with rising investments in smart city projects, positions Asia-Pacific as a key growth hub.

Latin America

Latin America held a 5.4% share of the smart badge market in 2024. Growth is driven by increasing demand for secure access management in corporate offices and public infrastructure. Brazil and Mexico lead regional adoption, supported by expanding event management and government digitalization programs. However, high implementation costs and limited awareness in smaller enterprises restrain widespread adoption. Growing emphasis on improving workplace safety and the introduction of cloud-based access control systems are creating new opportunities. Collaboration between local IT firms and global manufacturers is expected to enhance smart badge penetration in the region.

Middle East & Africa

The Middle East & Africa region accounted for a 4.1% share of the smart badge market in 2024. Increasing investments in smart city projects and digital security infrastructure fuel market growth. The UAE and Saudi Arabia lead adoption, using smart badges for secure access in government buildings, corporate facilities, and events. Rising deployment in healthcare and hospitality sectors further supports expansion. However, limited local manufacturing and higher product costs pose challenges. Ongoing public-sector digitalization and partnerships with global technology providers are expected to drive steady market growth across the region.

Market Segmentations:

By Communication

By Type

- Smart badges with display

- Smart badges without display

By Application

- Corporate

- Hospitality

- Events and conferences

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The smart badge market is highly competitive, featuring key players such as Cisco, Beamian, Dorma+Kaba Holdings AG, CardLogix Corporation, ASSA ABLOY, Aioi-Systems Co., Ltd., Brady Worldwide, Inc., Sber, Abeeway, and Evolis. These companies focus on developing advanced identification and access management solutions using RFID, NFC, and Bluetooth technologies. Leading players are integrating IoT connectivity, cloud-based access systems, and AI-driven security analytics to enhance user authentication and data protection. Strategic collaborations with corporate enterprises, government agencies, and event organizers help strengthen market reach and application diversity. Continuous investment in R&D supports innovations in biometric verification, energy-efficient badge designs, and real-time tracking capabilities. Mergers and acquisitions are common strategies to expand technological capabilities and global presence. The increasing emphasis on cybersecurity, contactless access, and digital identity management continues to drive competition among market leaders in this rapidly evolving industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cisco

- Beamian

- Dorma+Kaba Holdings AG

- CardLogix Corporation

- ASSA ABLOY

- Aioi-Systems Co., Ltd.

- Brady Worldwide, Inc.

- Sber

- Abeeway

- Evolis

Recent Developments

- In 2025, Cisco Systems, Inc. listed its Smart Badge device on the Cisco DNA Spaces Outcome Store, detailing a badge that converts a standard ISO ID card with IR room-level location accuracy and two programmable call-buttons.

- In August 2024, Event Footprints launched the UK’s first Smart Badge Accreditation Program, focusing on Klik SmartBadge by Bizzabo. The four-part training, attended by major event agencies, aims to address industry knowledge gaps in smart badge deployment.

- In January 2024, ASSA ABLOY Group announced its “Aperio works with employee badge in Apple Wallet” initiative, enabling staff badges to be stored and used via Apple Wallet for door access.

Report Coverage

The research report offers an in-depth analysis based on Communication, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of contactless and biometric smart badges will continue to expand across industries.

- Integration of IoT and AI will enhance real-time data tracking and access management.

- Demand for NFC and Bluetooth-enabled badges will increase in corporate and healthcare sectors.

- Cloud-based identity management platforms will become central to access control systems.

- Smart badges with displays and biometric verification will gain popularity for high-security applications.

- Governments and enterprises will invest more in digital identity and workforce monitoring solutions.

- Technological advancements will lead to smaller, more energy-efficient badge designs.

- Partnerships between IT firms and security solution providers will strengthen innovation.

- Rising focus on cybersecurity and data protection will shape product development.

- Asia-Pacific will emerge as a key growth hub driven by rapid digitalization and smart infrastructure projects.