Market Overview

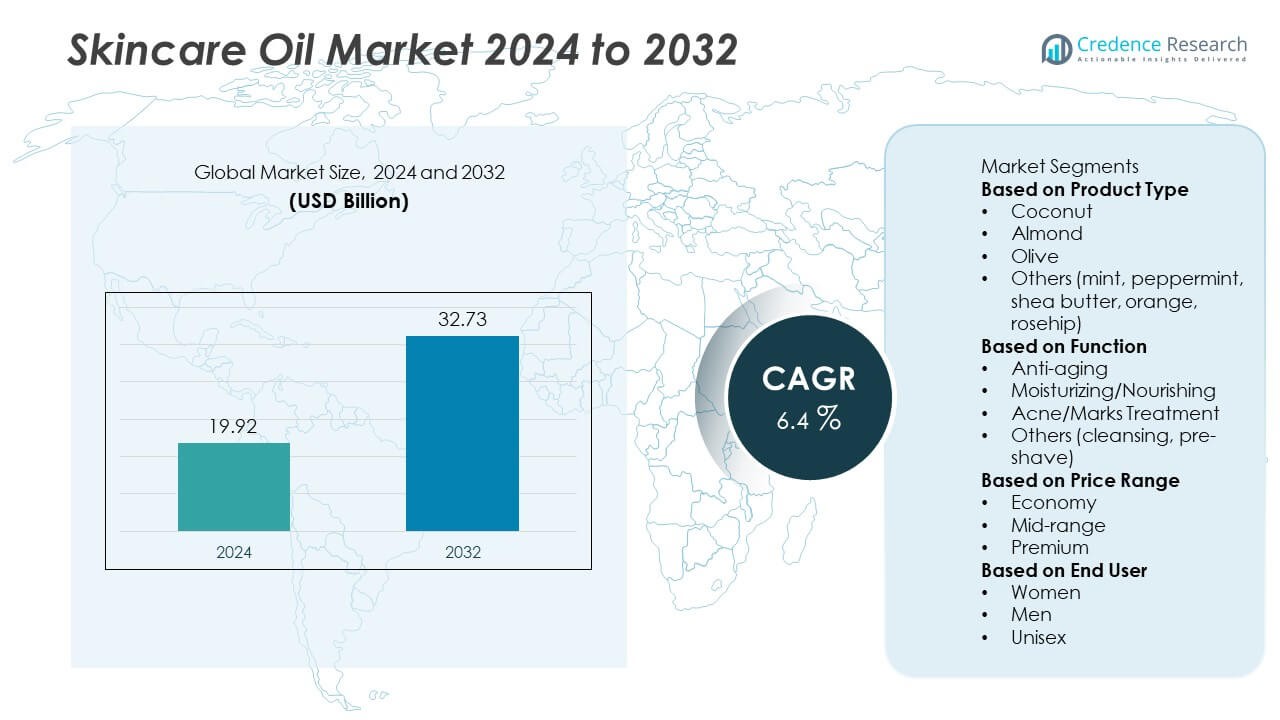

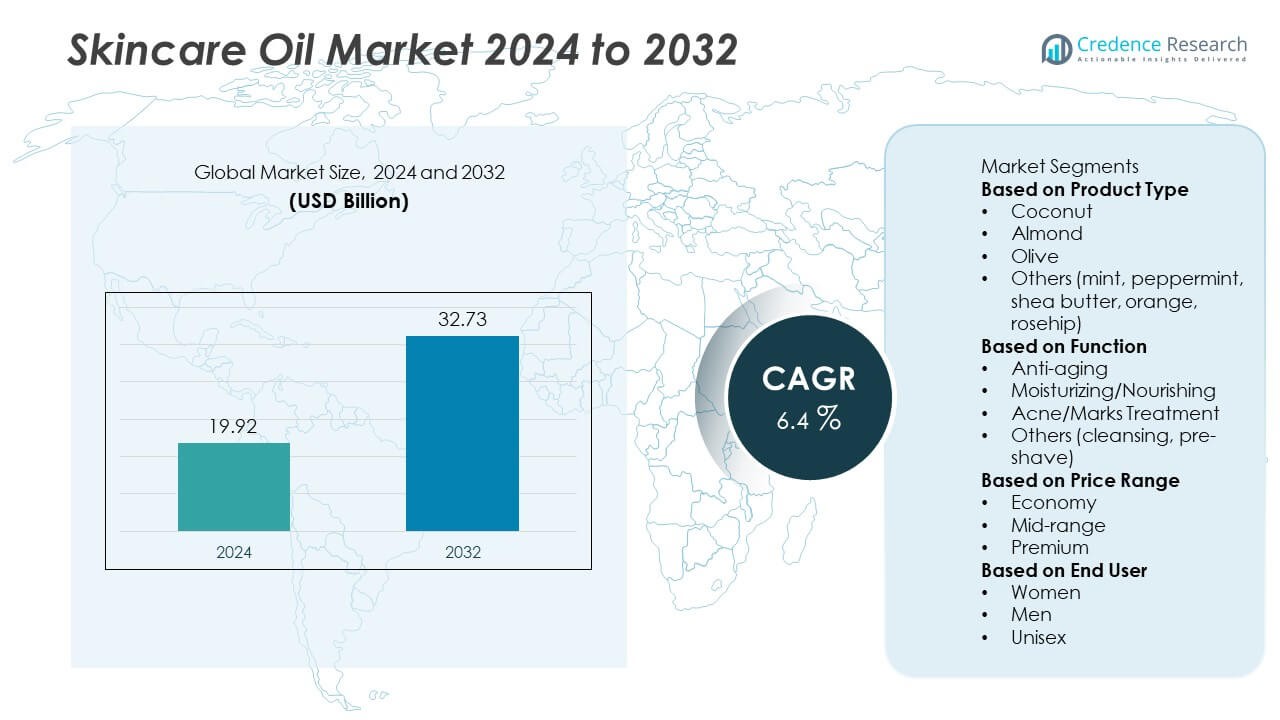

The global Skincare Oil Market was valued at USD 19.92 billion in 2024 and is projected to reach USD 32.73 billion by 2032, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Skincare Oil Market Size 2024 |

USD 19.92 Billion |

| Skincare Oil Market, CAGR |

6.4% |

| Skincare Oil Market Size 2032 |

USD 32.73 Billion |

The global skincare oil market is led by major players including L’Oréal, Unilever, Estée Lauder Companies, Shiseido, Procter & Gamble Co., Beiersdorf AG, Avon Products, Inc., Amway, Chanel S.A., and Burberry Group Plc. These companies dominate through extensive product portfolios, strong distribution networks, and continuous innovation in natural and multi-functional skincare formulations. Asia-Pacific emerged as the leading region with a 37.2% share in 2024, driven by large consumer bases in China, Japan, and India and growing demand for organic and plant-based oils. North America followed with a 29.8% share, supported by rising awareness of clean beauty, premium product adoption, and strong brand penetration across e-commerce and retail platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global skincare oil market was valued at USD 19.92 billion in 2024 and is projected to reach USD 32.73 billion by 2032, expanding at a CAGR of 6.4% during the forecast period.

- Key drivers include increasing demand for natural and organic skincare products, rising awareness of anti-aging benefits, and growing adoption of plant-based oils in daily beauty routines.

- The market is witnessing strong trends toward clean beauty, sustainable packaging, and multifunctional formulations combining hydration, nourishment, and anti-aging properties.

- Competitive dynamics are defined by major players such as L’Oréal, Unilever, Estée Lauder, and Shiseido focusing on eco-friendly innovations, digital marketing, and premium product launches.

- Regionally, Asia-Pacific held 37.2% share, followed by North America with 29.8%, driven by strong brand presence and consumer preference for moisturizing and nourishing segments, which together accounted for over 42% of total market share in 2024.

Market Segmentation Analysis:

By Product Type

The coconut oil segment dominated the skincare oil market in 2024, holding a 31.6% share. Its leadership is supported by its rich moisturizing properties, high lauric acid content, and antioxidant benefits. Coconut oil is widely used in body care, facial serums, and hair treatments for hydration and protection against dryness. Increasing consumer preference for multipurpose and organic products drives coconut oil demand. Meanwhile, almond and olive oils are gaining momentum due to their vitamin E and anti-inflammatory benefits, attracting consumers seeking natural alternatives for skin nourishment.

- For instance, Unilever’s brand Vaseline offers products like the Radiant X and Cera-Glow collections, which are formulated with technologies and ingredients to address skin moisture and barrier repair. Some of these products contain Ultra-Hydrating Lipids, which are designed to help the skin replenish its own ceramides for a more resilient barrier.

By Function

The moisturizing and nourishing segment led the market in 2024 with a 42.3% share. Growth is fueled by rising demand for daily hydration products and nutrient-rich formulations. Consumers increasingly choose oils with natural emollients that maintain skin elasticity and barrier protection. The segment benefits from the inclusion of plant-based actives like argan and jojoba oils in premium blends. Expanding e-commerce sales of hydration-focused facial oils and growing awareness of dry-skin treatments further strengthen its dominance across global skincare portfolios.

- For instance, L’Oréal Paris offers multiple products in its Extraordinary Oil line, including a Facial Oil featuring a blend of eight essential oils and a different “Extraordinary Boosting Oil” that contains rosehip fruit oil. The composition details, such as concentrations or standardization amounts like 9.7 mg/ml or 320 µg/g of linoleic acid, are not publicly disclosed, as they are part of a proprietary formula.

By Price Range

The mid-range segment accounted for the largest 46.8% share in 2024. This category balances affordability with perceived product quality, appealing to a wide consumer base. Leading brands offer mid-priced formulations with natural and organic claims, targeting both mass and premium consumers. Growth is supported by expanding availability in retail chains and online platforms. Increased brand competition in emerging economies and the popularity of dermatologist-backed oils within this price tier reinforce its sustained market leadership globally.

Key Growth Drivers

Rising Demand for Natural and Organic Skincare Oils

Consumers are increasingly shifting toward plant-based and chemical-free skincare solutions. Oils derived from coconut, almond, and rosehip are gaining popularity due to their natural moisturizing and anti-aging properties. The growing awareness of ingredient transparency and sustainability supports this trend. Leading brands are reformulating product lines with eco-certified ingredients, boosting demand across premium and mid-range segments. Expanding adoption of clean beauty standards and higher disposable incomes among millennials further enhance market growth globally.

- For instance, Beiersdorf AG, the parent company of NIVEA, develops various skincare oils and lotions, some containing naturally sourced oils like jojoba and avocado. Other products, like the NIVEA 4-in-1 Firming Body Oil, contain ingredients like avocado oil and Q10 to improve firmness and reduce the appearance of stretch marks, with clinically supported claims. The company also has a “Naturally Good” range featuring products made with 99% natural ingredients.

Expansion of E-commerce and Direct-to-Consumer Channels

Online retail has become a crucial driver for skincare oil sales, enabling brands to reach global consumers efficiently. E-commerce platforms offer easy product comparisons, reviews, and subscription options, increasing brand visibility and accessibility. Direct-to-consumer strategies allow companies to provide personalized recommendations and loyalty programs. The integration of virtual try-ons, digital skin diagnostics, and influencer marketing continues to accelerate online sales. Emerging digital-native brands are using social commerce to expand into new demographics and geographies.

- For instance, Estée Lauder Companies (ELC) uses AI-powered tools, such as the iMatch Virtual Shade Expert, which analyzes skin tone using deep learning technology to recommend optimal foundation shades from its portfolio. ELC also uses AI for consumer insights and trend forecasting, which helps in more targeted product recommendations.

Growing Awareness of Anti-Aging and Multi-Functional Benefits

Rising consumer awareness about early skin aging and dryness-related issues is driving skincare oil adoption. Formulations combining moisturizing, antioxidant, and anti-wrinkle properties appeal to consumers seeking simplified routines. Anti-aging oils enriched with retinol, vitamin C, and essential fatty acids are expanding their presence in both mass and premium segments. The increasing preference for multi-use oils that nourish, cleanse, and protect the skin has become a major factor fueling consistent market expansion.

Key Trends & Opportunities

Shift Toward Sustainable and Eco-Friendly Packaging

Sustainability has become central to skincare innovation, with brands adopting recyclable glass bottles, biodegradable materials, and refillable systems. This approach attracts environmentally conscious consumers and aligns with corporate ESG goals. Companies are investing in carbon-neutral packaging and minimal plastic usage to strengthen brand value. The trend toward eco-responsible packaging not only reduces environmental impact but also enhances consumer trust, creating long-term opportunities in premium and organic skincare categories.

- For instance, Unilever has implemented a refillable system for its Dove Body Wash using recyclable aluminum bottles and concentrated refills that use less plastic. In one version of this system, consumers receive two 4oz concentrate refills that each make a 16oz body wash. After two refills, the plastic usage is reduced by 50% compared to single-use bottles.

Technological Integration in Product Formulation

Advancements in formulation technology are transforming skincare oil effectiveness. Brands are integrating nanoemulsion and encapsulation techniques to improve absorption and stability of active ingredients. The use of AI-driven research enables rapid testing and customization of blends for specific skin concerns. This innovation allows manufacturers to create lightweight, non-greasy oils suitable for diverse skin types. The convergence of technology and skincare science continues to open opportunities for differentiation and consumer engagement.

- For instance, Shiseido developed its ReNeura Technology+ platform to make skin more responsive to skincare products by addressing neural communication within the skin. Through its extensive research and development, including advancements in vesicle-based formulation technology, Shiseido has demonstrated its ability to enhance the penetration of active ingredients into the skin.

Key Challenges

High Competition and Market Saturation

The skincare oil market faces intense competition from global and regional brands offering similar natural formulations. Continuous product launches have led to market saturation, reducing brand differentiation. Price sensitivity in emerging economies further pressures profit margins. Smaller players struggle to maintain shelf visibility against multinational corporations with strong distribution networks. Sustaining brand loyalty requires innovation, clear positioning, and targeted marketing in an increasingly crowded marketplace.

Regulatory Barriers and Ingredient Compliance

Varying cosmetic regulations across countries pose significant challenges for skincare oil manufacturers. Strict standards on ingredient labeling, purity, and safety testing increase production complexity and compliance costs. Natural and organic claims often require third-party certifications, delaying product approvals. Failure to meet evolving safety norms can lead to recalls or penalties, impacting brand credibility. Companies must invest in robust quality assurance systems and transparent supply chains to ensure consistent compliance and consumer trust.

Regional Analysis

North America

North America held a 29.8% share of the global skincare oil market in 2024. The region’s dominance stems from high consumer spending on premium personal care and organic beauty products. Strong retail penetration, coupled with the rising popularity of clean beauty brands, supports steady market expansion. The U.S. leads demand due to the increasing adoption of anti-aging and hydration-focused oils. Key players are introducing vitamin-enriched and dermatologist-tested formulations to meet diverse skin needs, while growing awareness of sustainable sourcing continues to influence purchasing decisions.

Europe

Europe accounted for a 25.6% share in 2024, driven by established cosmetics industries and a strong preference for natural ingredients. Consumers in Germany, France, and the U.K. emphasize eco-friendly and cruelty-free skincare oils. Regulatory support for organic certifications further encourages clean-label formulations. Brands focus on botanical oils such as argan, rosehip, and almond to attract health-conscious consumers. Growing male grooming trends and expanding spa culture are also fostering product innovation. Increased retail visibility and private-label developments continue to strengthen market presence across the continent.

Asia-Pacific

Asia-Pacific dominated the skincare oil market with a 37.2% share in 2024. The region’s leadership is driven by large consumer bases in China, Japan, India, and South Korea. Rising disposable incomes, beauty-conscious younger populations, and growing K-beauty influence fuel rapid adoption of facial and body oils. Local manufacturers emphasize natural ingredients like camellia and rice bran oils to cater to traditional skincare preferences. Expanding online distribution and influencer-led marketing campaigns continue to accelerate growth, making Asia-Pacific the most dynamic region in the global skincare oil market.

Latin America

Latin America captured a 4.3% share in 2024, supported by increasing awareness of skin nourishment and wellness trends. Brazil and Mexico lead consumption, driven by tropical climates that heighten demand for lightweight, hydrating oils. The shift toward locally sourced ingredients such as andiroba and babassu oils supports sustainable production. Regional brands are expanding product portfolios through organic certifications and online retail partnerships. Although price sensitivity remains a restraint, evolving consumer preferences for natural beauty products are driving moderate but consistent market expansion.

Middle East & Africa

The Middle East & Africa region held a 3.1% share in 2024, reflecting growing interest in luxury skincare and traditional oil-based products. The region’s climate conditions favor high use of moisturizing oils for skin hydration. Markets such as the UAE and Saudi Arabia show rising demand for argan, jojoba, and rose oils in premium formulations. Local producers integrate cultural beauty practices with modern skincare innovations. Expanding retail infrastructure, rising female workforce participation, and increased social media influence are gradually driving demand across both urban and emerging areas.

Market Segmentations:

By Product Type

- Coconut

- Almond

- Olive

- Others (mint, peppermint, shea butter, orange, rosehip)

By Function

- Anti-aging

- Moisturizing/Nourishing

- Acne/Marks Treatment

- Others (cleansing, pre-shave)

By Price Range

- Economy

- Mid-range

- Premium

By End User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The skincare oil market is characterized by strong competition among major players such as L’Oréal, Unilever, Estée Lauder Companies, Shiseido, Procter & Gamble Co., Beiersdorf AG, Avon Products, Inc., Amway, Chanel S.A., and Burberry Group Plc. These companies focus on product innovation, ingredient transparency, and sustainable formulations to strengthen their global presence. Leading brands are investing in research to develop multi-functional and dermatologically tested oils enriched with vitamins, antioxidants, and natural extracts. Strategic initiatives such as mergers, acquisitions, and collaborations with dermatology experts enhance market positioning. Growing e-commerce expansion and digital marketing allow companies to reach new consumer segments effectively. Premiumization trends and clean beauty movements continue to shape competition, with top players introducing organic, cruelty-free, and refillable packaging options. Continuous innovation and strong brand reputation remain crucial factors in maintaining dominance across global and regional skincare oil markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amway

- Beiersdorf AG

- Chanel S.A.

- Shiseido

- Unilevehttps

- Avon Products, Inc.

- L’Oréal

- Procter & Gamble Co.

- Estée Lauder Companies

- Burberry Group Plc.

Recent Developments

- In October 2025, Amway India launched the Artistry Skin Nutrition Defying and Correcting Serums, next-generation skincare products powered by Nutrilite botanicals.

- In 2025, L’Oréal Groupe launched the Cell BioPrint device, meaning to personalise skincare by analysing tiny facial tape-strip samples in 5 minutes; the launch supports its oil- and serum-based skincare product platforms.

- In 2025, Estée Lauder Companies announced a Glossy Pout Lip Oil alongside two new fragrances, expanding its oil-based formulations in its beauty line.

- In January 2023, OLEHENRIKSEN introduced a Hydra barrier Hydrating Face Oil, containing Scandinavian berry oils and peptides for softer, bouncy skin.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Function, Price Range, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for natural and organic skincare oils will continue to rise globally.

- Brands will focus more on sustainable sourcing and eco-friendly packaging solutions.

- Personalized skincare oils based on skin type and lifestyle will gain popularity.

- Technological advancements will improve formulation stability and ingredient absorption.

- Online retail and direct-to-consumer channels will further expand market reach.

- Premium and mid-range product categories will experience stronger growth than economy lines.

- Anti-aging and multi-functional oils will dominate new product developments.

- Emerging economies in Asia-Pacific and Latin America will offer new growth opportunities.

- Collaborations with dermatologists and beauty influencers will enhance brand credibility.

- Investments in research and clean beauty innovations will shape long-term market competitiveness.