Market Overview

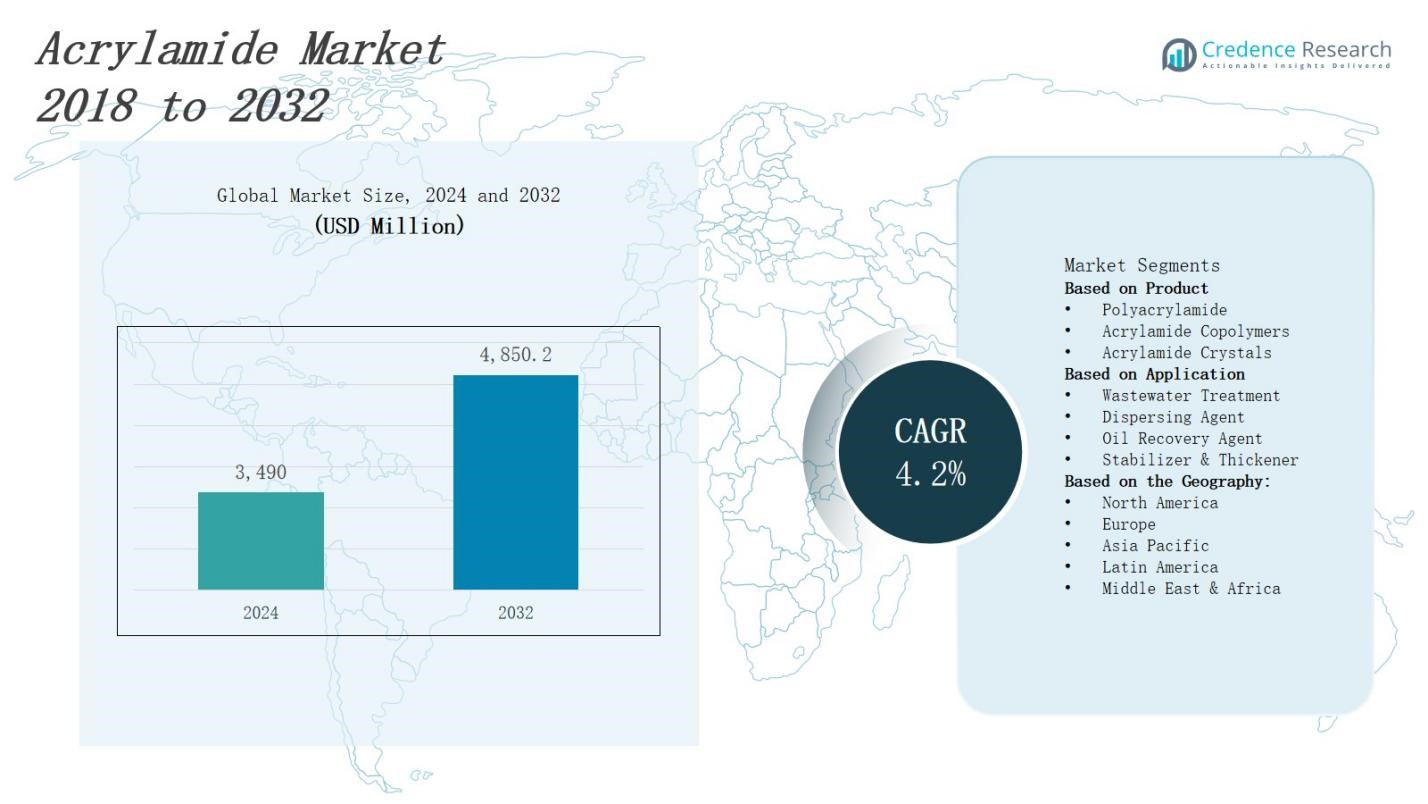

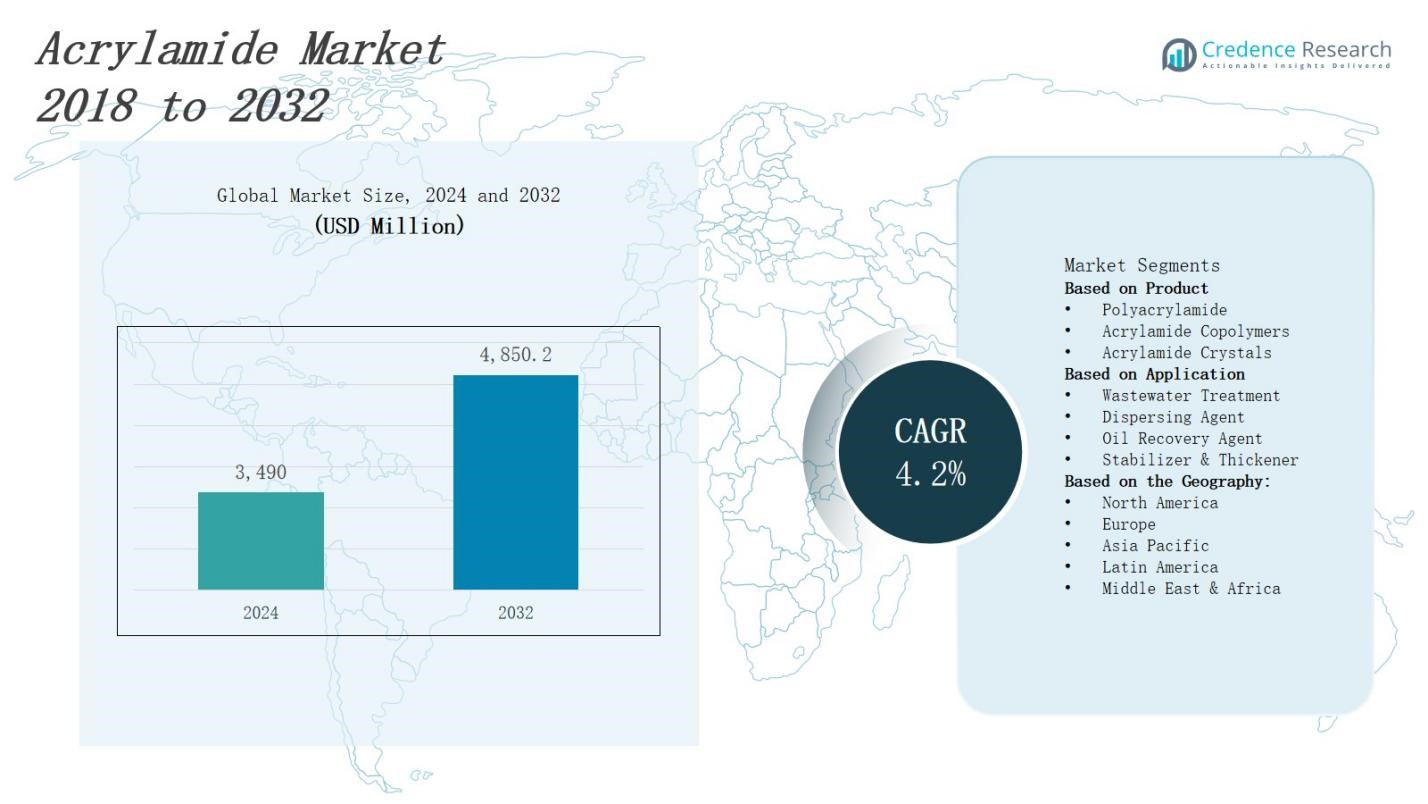

The acrylamide market is projected to grow from USD 3,490 million in 2024 to USD 4,850.2 million by 2032, expanding at a CAGR of 4.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acrylamide Market Size 2024 |

USD 3,490 Million |

| Acrylamide Market , CAGR |

4.2%. |

| Acrylamide Market Size 2032 |

USD 4,850.2 Million |

The acrylamide market grows driven by rising demand from wastewater treatment, paper manufacturing, and enhanced oil recovery industries. Increasing industrialization and urbanization boost the need for efficient water purification solutions, propelling acrylamide use as a flocculant. Advances in polymer technology improve product performance, encouraging adoption across end-use sectors. Growing emphasis on environmental regulations and sustainable processes further supports market expansion. Additionally, expanding applications in agriculture and cosmetics present new growth opportunities. These factors collectively accelerate innovation and increase acrylamide consumption globally, reinforcing its critical role in industrial and environmental applications.

The acrylamide market spans key regions including North America, Europe, Asia Pacific, and the Rest of the World. North America and Europe lead with established industrial bases and stringent environmental regulations, holding significant market shares. Asia Pacific emerges as the fastest-growing region, driven by rapid industrialization and infrastructure development. The Rest of the World, including Latin America, the Middle East, and Africa, shows gradual growth supported by expanding industrial activities. Leading players such as INEOS, Kemira Oyj, The Dow Chemical Company, and Mitsui Chemicals drive innovation and market expansion globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The acrylamide market is expected to grow from USD 3,490 million in 2024 to USD 4,850.2 million by 2032, with a CAGR of 4.2%.

- Rising demand in wastewater treatment, paper manufacturing, and enhanced oil recovery drives market expansion.

- Industrialization and urbanization increase the need for water purification solutions, promoting acrylamide use as a flocculant.

- Advances in polymer technology improve product performance, encouraging wider adoption across end-use sectors.

- Environmental regulations and sustainability initiatives support market growth globally.

- Emerging applications in agriculture and cosmetics offer new growth opportunities and diversify the market.

- Asia Pacific leads with 35% market share due to rapid industrialization, followed by North America (30%) and Europe (25%), while the Rest of the World accounts for 10%.

Market Drivers

Rising Demand from Wastewater Treatment Industry

The acrylamide market benefits significantly from increased demand in wastewater treatment applications. It serves as an effective flocculant and coagulant, helping remove suspended solids and contaminants from industrial and municipal wastewater. Stricter environmental regulations worldwide compel industries to adopt advanced water treatment solutions, boosting acrylamide consumption. Urbanization and industrial growth increase wastewater volumes, expanding treatment needs. The chemical’s ability to improve treatment efficiency and reduce operational costs drives its adoption. These factors collectively contribute to sustained growth in the wastewater treatment segment.

- For instance, SNF, the world’s leading manufacturer of acrylamide-based water-soluble polymers, operates large production sites including one in Visakhapatnam, India, supplying polyacrylamide products specially designed for municipal and industrial wastewater treatment.

Expanding Use in Paper Manufacturing Sector

The acrylamide market gains momentum through its extensive use in the paper manufacturing industry. It improves paper strength, retention, and drainage, enhancing product quality and manufacturing efficiency. Growing demand for high-quality paper products across packaging, printing, and hygiene applications fuels its usage. Technological improvements in polymer chemistry optimize acrylamide-based additives for better performance in paper mills. Increasing global paper consumption, particularly in emerging economies, further supports market growth. It remains a critical component in paper production processes, ensuring continued demand.

Enhanced Oil Recovery Applications Drive Growth

Acrylamide plays a crucial role in enhanced oil recovery (EOR) techniques, supporting the acrylamide market’s expansion. It forms polymers that increase the viscosity of injection fluids, improving oil displacement efficiency in mature reservoirs. Rising global energy demand and depletion of conventional reserves push companies to invest in EOR technologies. Governments encourage efficient resource utilization, favoring polymer-based recovery methods. Innovations in polymer formulations improve thermal and chemical stability, broadening EOR applicability. These developments make acrylamide indispensable in the oil and gas sector’s secondary recovery operations.

- For instance, BASF developed a polyacrylamide-based polymer that enhanced oil extraction by increasing sweep efficiency in the North Sea, demonstrating improved thermal stability in harsh reservoir conditions.

Diversification into Agriculture and Cosmetics

The acrylamide market expands with growing applications in agriculture and personal care sectors. It acts as a soil conditioner and water retention agent in agriculture, improving crop yields and resource efficiency. The rising focus on sustainable farming practices enhances its appeal among farmers and agribusinesses. In cosmetics, acrylamide-based polymers serve as thickening and film-forming agents, meeting consumer demand for improved product texture and durability. Growing awareness of multifunctional ingredients boosts adoption in personal care products. This diversification strengthens the market by opening new avenues beyond traditional industrial uses.

Market Trends

Increasing Adoption of Acrylamide in Wastewater Treatment to Meet Environmental Standards

The acrylamide market experiences significant growth driven by its widespread use in wastewater treatment applications. It serves as an effective flocculant and coagulant, aiding industries and municipalities in removing suspended solids and contaminants from water. Stricter environmental regulations globally compel adoption of advanced treatment chemicals to ensure compliance. Urbanization and industrial expansion increase wastewater volumes, creating demand for efficient purification solutions. The chemical’s ability to improve water treatment efficiency and reduce operational costs supports its strong market position. Investment in wastewater infrastructure in emerging economies further propels acrylamide consumption.

- For instance, Dow Chemical employs high molecular weight cationic acrylamide copolymer flocculants in oil sands produced water treatment, effectively removing suspended solids and reducing chemical oxygen demand (COD) at dosages around 35 ppm.

Expansion in Paper Manufacturing Industry Fuels Demand for High-Performance Polymers

The acrylamide market benefits from growing applications in the paper manufacturing sector, where it enhances paper strength, retention, and drainage. It enables manufacturers to produce higher-quality paper products for packaging, printing, and hygiene applications. Rising demand for sustainable and durable paper products in developed and developing regions drives market growth. Technological advances improve polymer formulations, optimizing performance under various manufacturing conditions. The shift toward eco-friendly additives increases the preference for acrylamide-based solutions. These factors ensure consistent demand from paper mills worldwide, reinforcing its market relevance.

- For instance, The Dow Chemical Company developed an acrylamide polymer surface sizing process that improves paper gloss, ink hold-out, and grease resistance by applying 0.4 to 20 pounds of polymer per million square inches of paper, significantly reducing ink feathering during printing.

Advancements in Enhanced Oil Recovery Techniques Support Acrylamide Usage

Acrylamide polymers play a crucial role in enhanced oil recovery (EOR) by increasing the viscosity of injection fluids, thereby improving oil displacement efficiency in mature reservoirs. The rising global energy demand and depletion of easily accessible reserves drive investments in EOR technologies. Governments promote resource-efficient recovery methods, favoring polymer-based solutions. Innovations in thermal and chemical stability of acrylamide-based polymers expand their applicability in harsh reservoir conditions. The growing importance of maximizing extraction from existing fields sustains acrylamide’s role in the oil and gas sector. This application remains a key growth driver for the market.

Diversification into Agriculture and Personal Care Sectors Opens New Growth Avenues

The acrylamide market expands with increased use in agriculture and cosmetics industries. It functions as a soil conditioner and water retention agent in agriculture, improving crop yield and resource management. Sustainable farming practices boost the demand for such additives among agribusinesses and farmers. In personal care, acrylamide-based polymers enhance product texture, stability, and durability, responding to evolving consumer preferences. Growth in these sectors diversifies acrylamide’s application base beyond traditional industrial uses. It supports sustained market expansion by opening new opportunities in emerging fields.

Market Challenges Analysis

Stringent Regulatory Constraints and Environmental Concerns Impacting Market Growth

The acrylamide market faces significant challenges due to strict regulatory frameworks governing its production and usage. Regulatory bodies worldwide impose limits on acrylamide content in consumer products because of its toxic and carcinogenic properties. Compliance with these safety standards increases manufacturing costs and complicates product formulation. Environmental concerns regarding acrylamide’s potential impact on ecosystems lead to tighter controls on effluent discharge and waste management. Manufacturers must invest in advanced treatment technologies to minimize environmental risks, which can restrict operational flexibility. These regulatory pressures slow market expansion and demand continuous innovation to meet compliance without compromising performance.

Raw Material Price Volatility and Health Risks Limit Market Penetration

Fluctuations in raw material prices, particularly acrylonitrile and other key feedstocks, create cost uncertainties for producers, affecting profitability and pricing strategies. It challenges manufacturers to maintain competitive pricing while ensuring product quality. Public awareness of acrylamide’s health risks, including neurotoxicity and carcinogenicity, limits its acceptance in certain applications, especially in food-related industries. The need for safer alternatives and stricter workplace safety protocols adds operational complexity and cost. These factors constrain acrylamide market penetration and prompt ongoing research for safer, cost-effective substitutes. Balancing market demand with safety and cost considerations remains a critical challenge for industry stakeholder

Market Opportunities

Expanding Applications in Emerging Sectors and Technological Innovations Driving Market Growth

The acrylamide market benefits from expanding applications in emerging industries such as agriculture, personal care, and enhanced oil recovery. Its use as a soil conditioner and water retention agent in agriculture presents significant growth potential due to rising demand for sustainable farming solutions. Advances in polymer technology improve acrylamide’s performance and safety profile, enabling it to meet stringent regulatory requirements and broaden its applicability. Innovations in formulation enhance product efficiency, encouraging adoption across diverse sectors. Investments in research and development support the creation of specialty acrylamide grades tailored for specific end-use needs. This diversification opens new revenue streams and strengthens market resilience amid regulatory challenges.

Increasing Infrastructure Development and Environmental Initiatives Offering Growth Prospects

Rapid urbanization and industrialization drive demand for efficient wastewater treatment solutions, presenting a lucrative opportunity for acrylamide in water purification applications. Governments worldwide promote investments in infrastructure upgrades and environmental protection, boosting the use of flocculants and coagulants like acrylamide. Growing awareness of water scarcity and pollution intensifies the focus on sustainable treatment methods, further supporting market expansion. It benefits from collaborations between chemical manufacturers and environmental agencies to develop eco-friendly products. Expansion in developing regions with evolving regulatory frameworks offers untapped potential for market penetration. These factors collectively create a favorable environment for sustained growth in the acrylamide market.

Market Segmentation Analysis:

By Product Type

The acrylamide market segments primarily into polyacrylamide, acrylamide copolymers, and acrylamide crystals. Polyacrylamide dominates due to its extensive use in wastewater treatment and oil recovery, attributed to its high molecular weight and superior flocculating properties. Acrylamide copolymers offer tailored performance by combining acrylamide with other monomers, enhancing efficiency in specific applications such as dispersants and stabilizers. Acrylamide crystals find use in manufacturing processes and intermediate applications. Each product type addresses distinct industry requirements, driving overall market growth by catering to specialized end-user demands.

- For instance, SNF Group, a global leader with a production capacity of 1100 kt/y, supplies partially hydrolyzed polyacrylamide (HPAM) widely used in enhanced oil recovery to improve crude oil extraction efficiency.

By Application

Wastewater treatment constitutes the largest application segment in the acrylamide market, where it serves as a critical flocculant to remove suspended solids and contaminants. Its ability to improve water clarity and treatment efficiency makes it indispensable for municipal and industrial sectors. The oil recovery agent segment gains traction through enhanced oil recovery methods, leveraging acrylamide polymers to increase injection fluid viscosity and boost extraction rates. Dispersing agents and stabilizers & thickeners contribute to market growth by improving product performance in agriculture, cosmetics, and industrial formulations. These application segments collectively sustain strong demand and support innovation within the market.

- For instance, BASF’s flocculants have been widely adopted in European municipal wastewater plants, leading to up to 30% faster sedimentation rates and clearer effluents.

Segments:

Based on Product

- Polyacrylamide

- Acrylamide Copolymers

- Acrylamide Crystals

Based on Application

- Wastewater Treatment

- Dispersing Agent

- Oil Recovery Agent

- Stabilizer & Thickener

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share of 30% in the acrylamide market, driven by well-established wastewater treatment infrastructure and stringent environmental regulations. It benefits from strong industrial growth in chemicals, oil & gas, and agriculture sectors, fueling demand for acrylamide-based products. The region leads in technological advancements and polymer innovation, supporting enhanced application performance. Government initiatives to improve water quality and reduce pollution further stimulate market growth. North American manufacturers invest heavily in R&D to develop eco-friendly and high-efficiency acrylamide variants. These factors maintain the region’s dominant position and steady demand in the global market.

Europe

Europe accounts for 25% of the acrylamide market share, supported by widespread adoption of sustainable water treatment solutions and robust regulatory frameworks. It experiences high demand from industrial sectors like paper manufacturing, mining, and oil recovery. European countries prioritize environmental protection, mandating efficient wastewater treatment practices that rely on acrylamide-based flocculants. The market benefits from collaborations between industry players and research institutes to develop safer, high-performance polymers. It faces moderate challenges due to strict chemical usage regulations but leverages innovation to sustain growth. Europe remains a key region for acrylamide consumption with steady expansion prospects.

Asia Pacific

The Asia Pacific region captures 35% market share, driven by rapid industrialization, urbanization, and expanding infrastructure development. It experiences growing demand for wastewater treatment chemicals from countries like China, India, and Japan. Rising oil exploration activities and agricultural modernization fuel acrylamide use in oil recovery and soil conditioning. The region’s growing population and increasing environmental awareness encourage investments in water purification projects. Manufacturers capitalize on low production costs and expanding chemical industries to meet rising demand. Asia Pacific offers substantial growth potential, emerging as the fastest-growing market for acrylamide products.

Rest of the World

The Rest of the World holds 10% of the acrylamide market share, including Latin America, Middle East, and Africa. Market growth in these regions stems from increasing industrial activities and gradual adoption of wastewater treatment technologies. Investments in oil and gas exploration create opportunities for acrylamide in enhanced oil recovery. Environmental regulations are evolving, promoting demand for efficient water treatment chemicals. Limited infrastructure development and economic constraints slow rapid expansion but create future growth prospects. The market here benefits from increasing awareness of sustainable industrial practices and gradual technological adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- INEOS

- Jiangxi Changjiu Agrochemical Co., Ltd

- Petro China Daiqing

- The Dow Chemical Company

- Rudong Natian

- Dia-Nitrix Co., Ltd

- Kemira Oyj

- Cytec Industries Incorporated

- Mitsui Chemicals, Inc

- National Aluminum Company Limited

- Beijing Hengju

- Ecolab Inc

Competitive Analysis

The acrylamide market features intense competition among leading global and regional players focusing on product innovation, quality, and regulatory compliance. Key companies invest heavily in research and development to enhance polymer performance and develop eco-friendly, low-toxicity variants. Strategic partnerships, mergers, and acquisitions enable market participants to expand their geographic presence and product portfolios. Companies emphasize cost-effective manufacturing and supply chain optimization to maintain competitive pricing. Continuous advancements in production technology support improved efficiency and sustainability. Market players actively respond to regulatory changes by adopting safer formulations and sustainable practices. Strong customer relationships and technical support services further differentiate competitors. It remains crucial for companies to balance innovation with compliance to sustain market leadership and capitalize on emerging growth opportunities.

Recent Developments

- On June 4, 2024, Trillium announced the selection of INEOS Nitriles’ Green Lake facility in Port Lavaca, Texas, to establish the world’s first demonstration plant for converting plant-based glycerol into acrylonitrile, named “Project Falcon.”

- In January 2024, SNF, the world’s leading polyacrylamide maker, launched a $250 million development plan in the Sultanate of Oman. This plan includes self-financing and collaborations to expand production capacity for chemical enhanced oil recovery (EOR) solutions.

- In 2024, Kemira and IFF announced the successful completion of a market-entry scale renewable polymer plant in Finland and are exploring broadening their strategic cooperation, including investments for a manufacturing joint venture.

- In June 2023, INEOS Nitriles launched Invireo™, a bio-based acrylonitrile product line, produced at their facility in Cologne, Germany, utilizing bio-attributed propylene to reduce reliance on fossil fuels.

Market Concentration & Characteristics

The acrylamide market exhibits a moderately concentrated structure, dominated by several key global players who hold significant market shares through extensive product portfolios and advanced manufacturing capabilities. These companies focus on continuous innovation to enhance polymer performance, meet regulatory requirements, and develop eco-friendly solutions. It experiences high entry barriers due to strict environmental regulations, capital-intensive production processes, and the need for specialized technical expertise. Market participants emphasize strategic collaborations, mergers, and acquisitions to expand geographic reach and strengthen their supply chains. The market’s competitive dynamics encourage investment in research and development to create differentiated products that cater to diverse applications such as wastewater treatment, paper manufacturing, and enhanced oil recovery. Despite regulatory challenges and raw material price volatility, established players maintain dominance by leveraging economies of scale and robust distribution networks. It remains essential for companies to balance innovation with compliance to sustain long-term growth and market leadership.

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The acrylamide market will expand due to increased demand in wastewater treatment worldwide.

- Advances in polymer technology will improve product efficiency and safety.

- Growing environmental regulations will drive the development of eco-friendly acrylamide variants.

- Emerging applications in agriculture and cosmetics will diversify market opportunities.

- Asia Pacific will remain a key growth region driven by rapid industrialization.

- Manufacturers will focus on sustainable production processes to reduce environmental impact.

- Enhanced oil recovery applications will continue to support market expansion.

- Strategic partnerships and acquisitions will shape competitive dynamics.

- Raw material price fluctuations will influence market strategies and product pricing.

- Investment in research and development will drive innovation and new product launches.