Market Overview

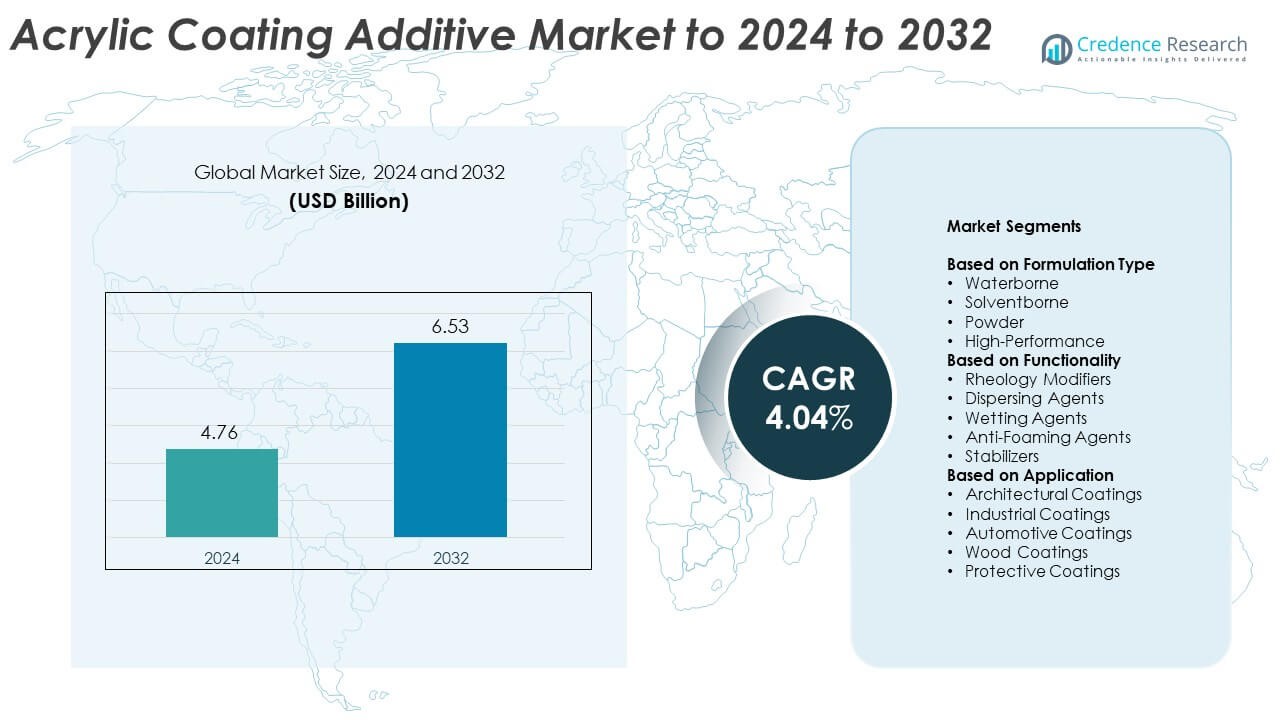

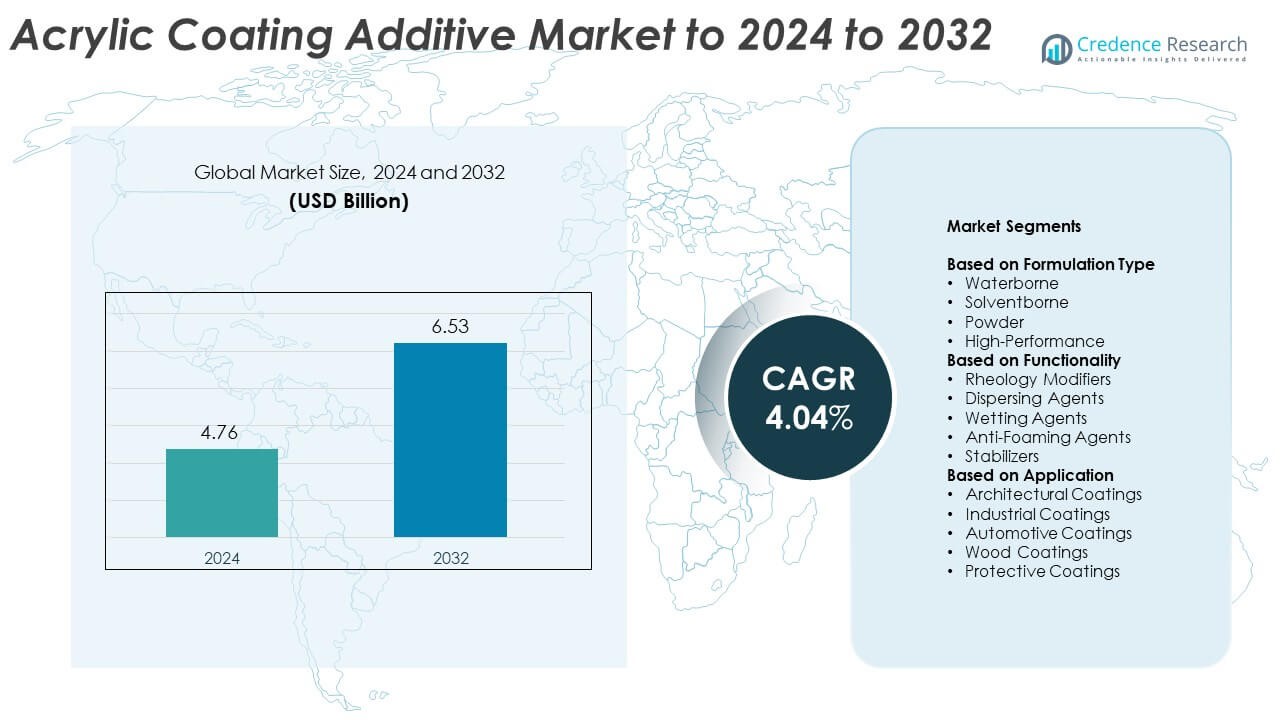

The Acrylic Coating Additive Market size was valued at USD 4.76 billion in 2024 and is anticipated to reach USD 6.53 billion by 2032, at a CAGR of 4.04% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acrylic Coating Additive Market Size 2024 |

USD 4.76 Billion |

| Acrylic Coating Additive Market, CAGR |

4.04% |

| Acrylic Coating Additive Market Size 2032 |

USD 6.53 Billion |

The acrylic coating additive market is highly competitive, led by major companies such as BASF, Arkema, Huntsman, RPM International, Wacker Chemie, Evonik Industries, Solvay, Dow, and Eastman Chemical. These players focus on innovation, sustainable product development, and regional expansion to strengthen their market presence. They invest heavily in R&D to develop low-VOC and high-performance additives catering to architectural, automotive, and industrial coatings. Asia-Pacific emerged as the leading region, commanding 37.4% of the global market share in 2024, driven by rapid industrialization, infrastructure development, and growing demand for eco-friendly coating solutions across construction and manufacturing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Acrylic Coating Additive Market reached USD 4.76 billion in 2024 and is expected to hit USD 6.53 billion by 2032, growing at a CAGR of 4.04%.

- Rising demand for sustainable and low-VOC coatings is driving growth, with waterborne formulations dominating at 46.8% share due to eco-friendly and high-adhesion properties.

- Ongoing trends include technological innovations in polymer chemistry and nanotechnology that enhance durability, UV resistance, and multi-functionality in coatings.

- Leading companies such as BASF, Arkema, Dow, Evonik Industries, and Wacker Chemie focus on sustainable R&D, product diversification, and strategic regional expansions to maintain competitiveness.

- Asia-Pacific led the market with 37.4% share in 2024, followed by North America at 34.7% and Europe at 28.6%, while the rheology modifiers segment accounted for 32.5% share, reflecting strong demand in architectural and automotive coating applications.

Market Segmentation Analysis:

By Formulation Type

The waterborne segment dominated the acrylic coating additive market in 2024, accounting for around 46.8% share. Its dominance is driven by rising demand for low-VOC, eco-friendly coatings in construction, automotive, and industrial applications. Waterborne formulations offer superior adhesion, easy cleanup, and minimal environmental impact compared to solventborne alternatives. Regulatory pressure to reduce emissions and advancements in water-based acrylic dispersions continue to boost adoption. Meanwhile, high-performance and powder formulations are gaining traction in heavy-duty coatings, offering enhanced weatherability, chemical resistance, and durability across infrastructure and marine sectors.

- For instance, BASF’s Joncryl 541 supports ultra-low-VOC formulas at 50 g/L and achieves >80 gloss (60°).

By Functionality

The rheology modifiers segment held the largest share of approximately 32.5% in 2024, owing to their critical role in improving coating flow, leveling, and sag resistance. These additives ensure uniform film thickness and stability during application, enhancing overall coating performance. Growing use in architectural and automotive coatings supports segment growth. Dispersing agents and wetting agents are also witnessing steady demand due to their contribution to pigment dispersion and substrate wettability. Increasing R&D on multi-functional additives that combine stabilization and anti-foaming properties further drives this segment’s expansion.

- For instance, Arkema’s Coapur 830 W lists 50% solids and 9,000 mPa·s Brookfield viscosity at pH 7.

By Application

The architectural coatings segment led the market in 2024, representing nearly 41.2% share. Strong growth in residential and commercial construction fuels demand for durable, weather-resistant, and aesthetically appealing coatings. Acrylic additives enhance color retention, UV resistance, and surface finish, making them ideal for walls, facades, and exterior applications. Industrial and automotive coatings also contribute significantly, supported by manufacturing growth and high-performance surface protection needs. Expanding infrastructure projects and the shift toward sustainable, long-lasting coatings continue to drive the architectural segment’s dominance in the overall market.

Key Growth Drivers

Rising Demand for Sustainable and Low-VOC Coatings

Growing environmental regulations and consumer awareness are driving the shift toward low-VOC and waterborne acrylic coatings. Manufacturers increasingly adopt eco-friendly additives that reduce emissions and enhance recyclability. The construction and automotive industries are leading adopters, using these coatings to meet sustainability standards. This trend supports consistent market expansion as end users favor greener products that maintain durability and performance while meeting environmental compliance requirements across global markets.

- For instance, Behr Premium Plus interior paint is labeled as Zero-VOC and lists VOC <5 g/L for its base formula. It’s important to note that the final VOC level can increase after tinting with colorants, and the product holds certifications like UL GREENGUARD GOLD for low chemical emissions.

Expanding Construction and Infrastructure Development

Rapid urbanization and infrastructure growth across Asia-Pacific, North America, and Europe are propelling demand for acrylic coating additives. These additives improve weatherability, gloss retention, and protection in exterior and architectural coatings. Governments’ increased spending on housing, roads, and commercial spaces boosts consumption. Rising renovation projects and the trend toward energy-efficient buildings further strengthen product adoption, creating steady opportunities for suppliers to expand their reach in high-growth urban centers.

- For instance, Asian Paints announced a water-based unit of 4 lakh kL per year capacity in Indore.

Technological Advancements in Additive Formulation

Continuous R&D efforts have led to high-performance additives with better rheology control, dispersion, and UV resistance. Innovations in polymer chemistry and nanotechnology enhance coating lifespan and functionality. Companies are focusing on multi-functional products that combine stabilization and anti-foaming effects, reducing the need for multiple components. These advancements improve process efficiency and cost-effectiveness, encouraging manufacturers to integrate innovative additive systems in their product lines to meet evolving performance standards.

Key Trends and Opportunities

Shift Toward High-Performance Coatings

The demand for high-performance coatings is rising due to industrial expansion and the need for durable protective finishes. Acrylic additives designed for heavy-duty and automotive coatings offer superior corrosion and chemical resistance. Growing adoption in marine, aerospace, and industrial maintenance applications presents opportunities for additive producers. This shift encourages investment in advanced formulations that can withstand harsh environmental and operational conditions while ensuring product longevity.

- For instance, Hempel’s ISO 12944 guidance references durability classes up to 15–25 years for suitable systems.

Integration of Smart and Functional Additives

Manufacturers are developing smart additives that enable self-healing, antimicrobial, or anti-fouling properties in coatings. These innovations align with increasing interest in intelligent surface technologies. The trend enhances end-use value, especially in healthcare, electronics, and construction applications. The integration of functional additives supports higher performance and differentiation, helping companies cater to advanced coating systems that deliver beyond traditional aesthetics and protection.

- For instance, Sherwin-Williams’ Paint Shield microbicidal paint kills over 99.9% of certain bacteria within two hours of exposure on a painted surface and continues to kill 90% of bacteria for up to four years, as long as the surface integrity is maintained.

Key Challenges

Volatility in Raw Material Prices

Fluctuating costs of key raw materials such as acrylic monomers and solvents create pricing uncertainty for producers. Dependence on petrochemical-derived inputs and global supply chain disruptions further strain profit margins. Manufacturers face difficulty maintaining stable pricing while ensuring quality and compliance. This challenge drives firms to explore bio-based alternatives and regional sourcing strategies to mitigate volatility and ensure cost-effective production.

Stringent Environmental and Regulatory Compliance

Strict global regulations on VOC emissions and hazardous substances challenge manufacturers to reformulate products without compromising performance. Compliance with REACH and EPA standards requires additional investment in testing, certification, and R&D. Smaller firms often struggle to meet these requirements, limiting market participation. The growing emphasis on sustainability compels the industry to continuously innovate and adapt, increasing operational costs but ensuring long-term environmental alignment.

Regional Analysis

North America

North America held a 34.7% share of the acrylic coating additive market in 2024, driven by strong demand from construction, automotive, and industrial sectors. The United States leads the region due to widespread adoption of waterborne and low-VOC coatings supported by strict environmental standards. Growth in renovation and infrastructure projects continues to fuel product use in architectural applications. Rising investments in advanced additive technologies and the presence of major manufacturers further strengthen the regional market, with Canada and Mexico contributing through expanding industrial production and increasing preference for eco-friendly coatings.

Europe

Europe accounted for 28.6% share in 2024, supported by stringent regulations promoting sustainable and emission-free coatings. Countries such as Germany, the United Kingdom, and France are key consumers, driven by construction modernization and automotive refinishing industries. Growing adoption of powder and high-performance formulations aligns with the region’s energy efficiency and environmental goals. The focus on bio-based additives and rising industrial renovation projects are creating steady growth opportunities. European manufacturers continue investing in R&D to enhance additive performance, reduce carbon footprint, and meet the European Green Deal objectives.

Asia-Pacific

Asia-Pacific dominated the global market with a 37.4% share in 2024, supported by rapid urbanization, expanding infrastructure, and strong manufacturing activity. China, India, and Japan lead in consumption due to increasing construction output and rising automotive production. Demand for cost-effective and durable coatings in residential and industrial segments fuels additive usage. Government initiatives promoting sustainable and energy-efficient construction further drive adoption. Local producers are expanding capacity and developing advanced formulations to meet diverse end-user needs, positioning Asia-Pacific as the fastest-growing region in the acrylic coating additive market.

Latin America

Latin America accounted for 6.3% share in 2024, with Brazil and Mexico serving as key markets. Economic recovery and infrastructure investment support steady growth in construction and industrial coatings. Rising demand for durable and weather-resistant coatings in building projects drives the use of acrylic additives. Increasing automotive production and greater awareness of eco-friendly coatings contribute to regional development. While market expansion remains moderate, manufacturers are targeting localized production and distribution to enhance accessibility and cater to emerging sustainability trends across major Latin American economies.

Middle East & Africa

The Middle East & Africa region held a 4.8% share in 2024, driven by infrastructure growth and industrial diversification initiatives. Demand from construction, oil and gas, and transportation sectors fuels steady additive consumption. The United Arab Emirates and Saudi Arabia lead the region, supported by large-scale urban projects and industrial expansion. Growing focus on performance coatings for harsh climatic conditions strengthens regional adoption. Manufacturers are increasingly introducing advanced waterborne and UV-stable additives to meet environmental goals, reflecting gradual but consistent progress in sustainable coating solutions across the region.

Market Segmentations:

By Formulation Type

- Waterborne

- Solventborne

- Powder

- High-Performance

By Functionality

- Rheology Modifiers

- Dispersing Agents

- Wetting Agents

- Anti-Foaming Agents

- Stabilizers

By Application

- Architectural Coatings

- Industrial Coatings

- Automotive Coatings

- Wood Coatings

- Protective Coatings

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The acrylic coating additive market features strong competition among major players such as BASF, Arkema, Huntsman, RPM International, Wacker Chemie, Evonik Industries, Solvay, Dow, Eastman Chemical, Kraton, Ashland, Momentive Performance Materials, SABIC, Celanese, and Avery Dennison. The market is characterized by continuous product innovation, strategic partnerships, and R&D investments aimed at developing low-VOC and high-performance additive solutions. Companies focus on sustainable manufacturing and advanced formulations to meet evolving environmental and regulatory standards. Competitive strategies include capacity expansion, technology integration, and mergers to strengthen global distribution networks. Market participants are leveraging advancements in polymer chemistry and surface modification technologies to enhance coating performance, durability, and efficiency. Collaboration with coating producers helps in customizing additive properties for diverse applications such as architectural, industrial, and automotive coatings. The competitive landscape continues to evolve as firms emphasize innovation, sustainability, and customer-centric solutions to secure long-term market leadership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2025, Huntsman launched a new range of safer and more sustainable ARALDITE® epoxy adhesives

- In 2023, BASF introduced a new, proprietary method for manufacturing the acrylic monomer 2-Octyl Acrylate (2-OA), which has 73% bio-based content and is made from 2-Octanol derived from castor oil

- In 2022, Arkema launched a new range of bio-based rheology additives for waterborne coatings, with the product line gaining traction throughout 2023.

Report Coverage

The research report offers an in-depth analysis based on Formulation Type, Functionality, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to growing demand for eco-friendly and low-VOC coatings.

- Waterborne acrylic additives will continue to dominate with strong adoption across industries.

- Construction and infrastructure growth will drive higher consumption in architectural coatings.

- Technological innovations will improve additive performance, durability, and sustainability.

- Asia-Pacific will remain the fastest-growing region with industrial and urban development.

- Manufacturers will focus on bio-based and multifunctional additive formulations.

- Rising automotive production will boost demand for high-performance coating additives.

- Stringent environmental norms will accelerate the shift toward sustainable solutions.

- Partnerships between coating and chemical producers will strengthen product innovation.

- Increased R&D investment will enhance coating efficiency and expand end-use applications.