Market Overview:

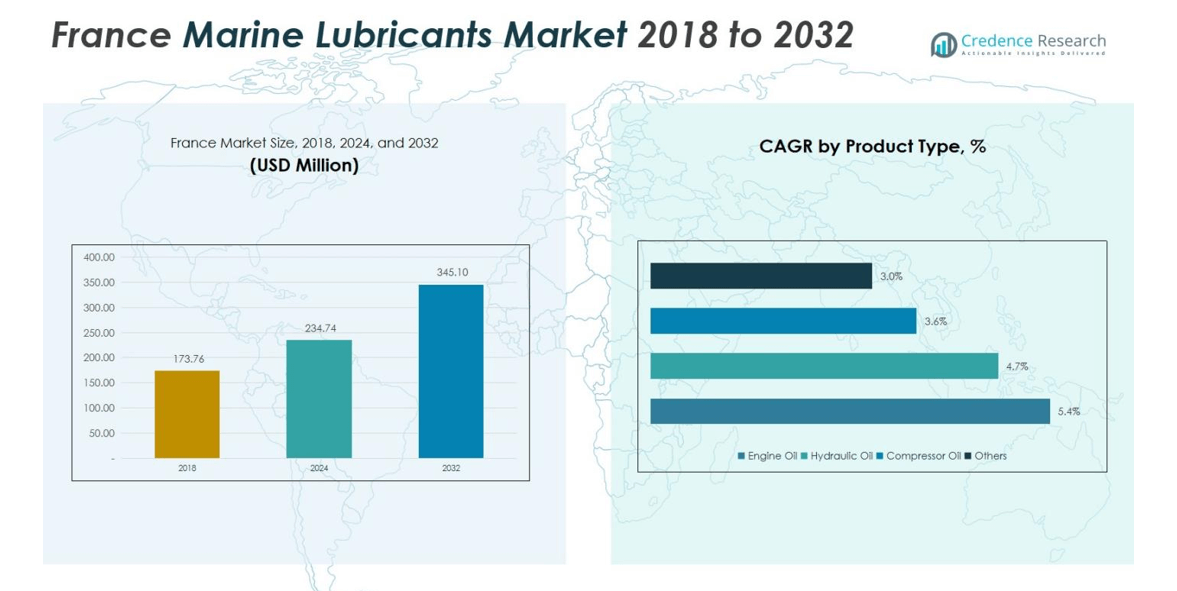

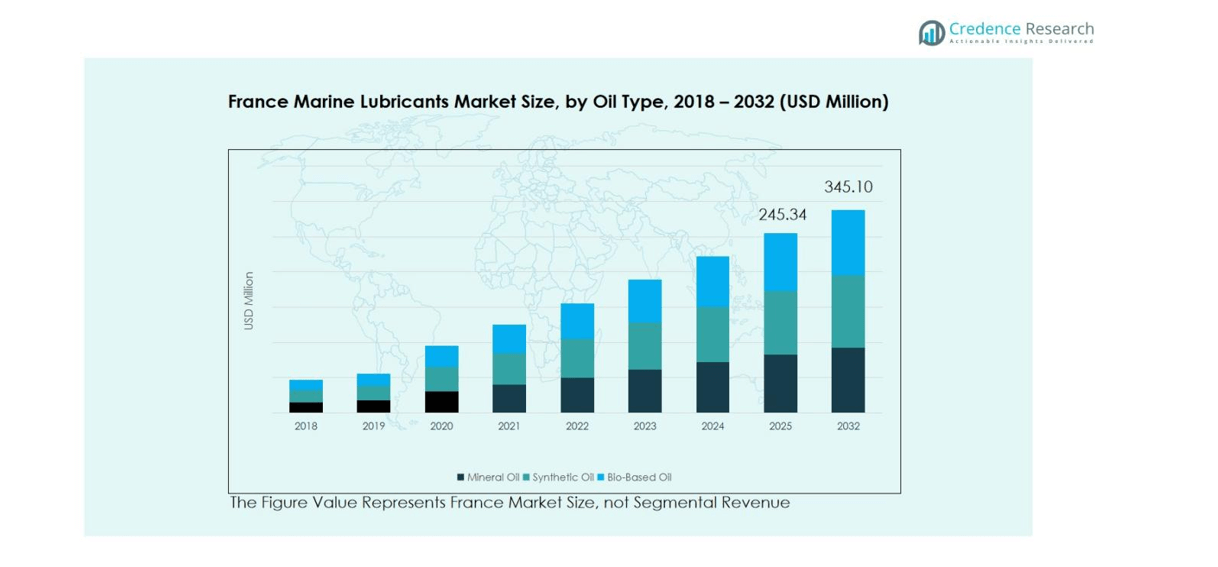

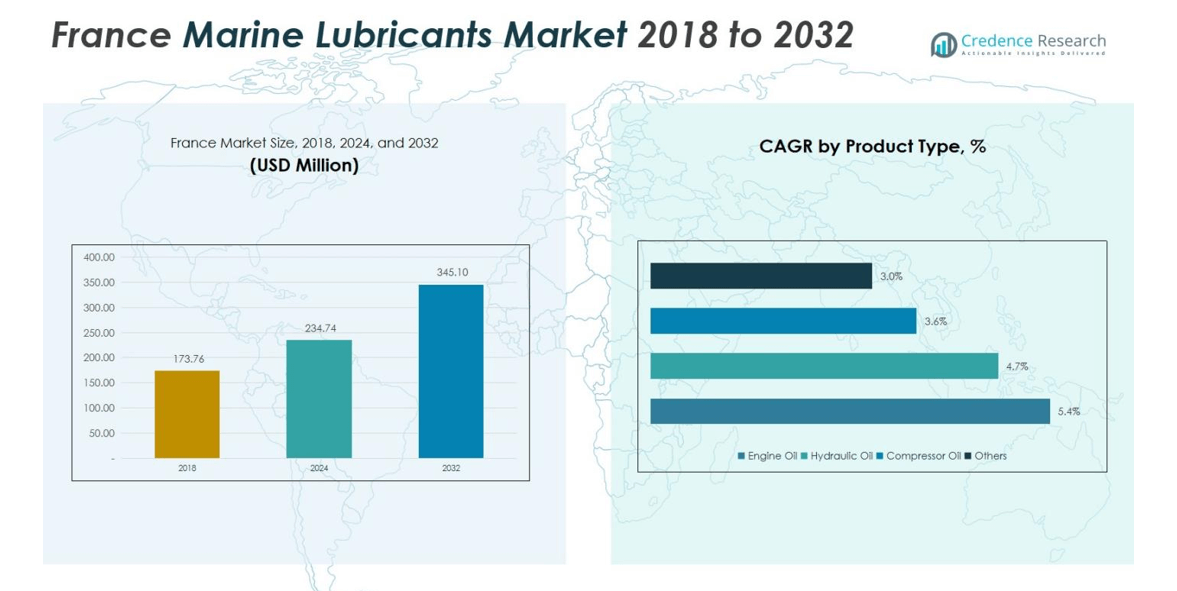

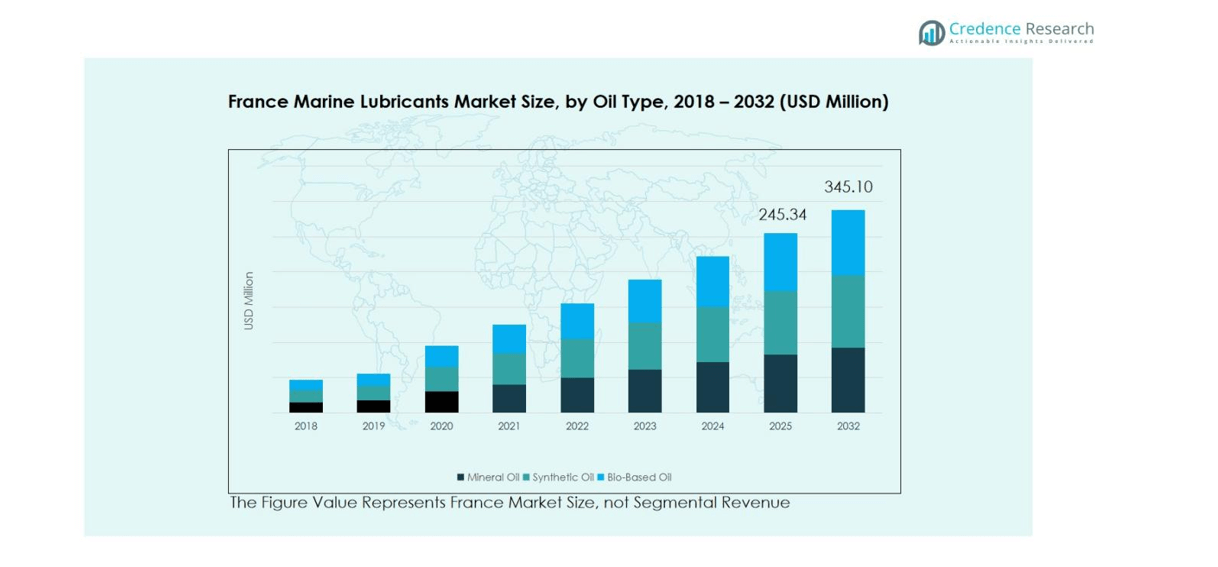

France Marine Lubricants Market size was valued at USD 173.76 million in 2018, increasing to USD 234.74 million in 2024, and is anticipated to reach USD 345.10 million by 2032, at a CAGR of 5.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Marine Lubricants Market Size 2024 |

USD 234.74 million |

| France Marine Lubricants Market, CAGR |

5.00% |

| France Marine Lubricants Market Size 2032 |

USD 345.10 million |

The France Marine Lubricants Market is characterized by strong competition among leading players such as BP p.l.c., ExxonMobil Marine Limited, Chevron Corporation, Shell Plc, TotalEnergies, Klüber Lubrication, Fuchs Lubricants, Eiffel Lubricants, and Kenzol Multi Industries FZC. These companies maintain dominance through extensive product portfolios, advanced lubricant technologies, and strategic distribution across major French ports. Shell and TotalEnergies lead in sustainability-focused innovations, offering synthetic and bio-based lubricants that comply with IMO regulations. Regionally, Northern France emerged as the leading market in 2024, holding 38% of total revenue, driven by intensive maritime trade and port operations at Le Havre, Dunkirk, and Calais.

Market Insights

- The France Marine Lubricants Market was valued at USD 234.74 million in 2024 and is projected to reach USD 345.10 million by 2032, growing at a CAGR of 5.0% during the forecast period.

- Market growth is driven by increasing maritime trade, port expansion projects, and the growing demand for high-performance lubricants to enhance vessel efficiency and reduce maintenance costs.

- Rising adoption of synthetic and bio-based lubricants, along with digital monitoring technologies for predictive maintenance, represents key emerging trends in the market.

- The market is highly competitive, with major players such as BP p.l.c., ExxonMobil, Shell Plc, TotalEnergies, and Chevron Corporation focusing on product innovation, sustainability, and expanded distribution across key French ports.

- Northern France dominated the market with a 38% share in 2024 due to its strong port infrastructure, while the mineral oil segment held the largest share owing to its affordability and widespread use in older fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Oil Type

In the oil-type segment of the French marine lubricants market, the mineral oil sub-segment holds the dominant position, estimated at around 70 %, driven by its cost-effectiveness and widespread compatibility with older marine propulsion and auxiliary systems. Legacy fleets in France favour mineral-based formulations due to established maintenance practices and lower upfront cost, even as regulatory pressures and performance demands begin nudging users toward alternatives. Meanwhile, synthetic oil with 20 % is gaining appeal thanks to better temperature resilience and longer service intervals, and bio-based oil is emerging on the back of increased environmental regulation and sustainability commitments.

- For instance, Repsol has developed biodegradable marine lubricants that minimize ecological impact and meet regulatory standards in port operations.

By Product Type

Within the product-type segment, engine oil leads the French market with a share of around 50 %, reflecting the critical role of main and auxiliary marine engines in vessel operations and their high lubricant consumption. The dominance of engine oils is underpinned by stringent demands for wear protection, high-load performance and compliance with low-sulphur fuel regimes. Hydraulic oil contributes 25 %, propelled by automated winches and thrusters aboard modern vessels, while compressor oil and the others category occupy the remaining ~30 %, driven by niche equipment such as refrigeration compressors, steering gears and system oils in specialist ship-types.

- For instance, TotalEnergies supplies high-performance marine engine oils designed to meet stringent wear protection and low-sulphur fuel compliance standards for main and auxiliary engines.

By Application

In the application segment, bulk carriers stand out as the dominant sub-segment, accounting for 60 % share of the French marine lubricants market, owing to their volume, high engine power ratings and intensive lubrication needs across large fleets transporting dry cargo. Container ships, with a share of around 20%, follow as the next major application, supported by global trade growth and port logistics expansion in France. Oil tankers account for 15 %, influenced by high-specification inert-gas and corrosion-resistant systems, while the others category (including Ro-Ro, LNG carriers and offshore support vessels) fills the remainder and is set for faster growth as niche shipping segments expand.

Key Growth Drivers

Rising Maritime Trade and Port Expansion

France’s growing maritime trade volumes and the modernization of key ports such as Marseille, Le Havre, and Dunkirk are significantly boosting demand for marine lubricants. Increasing vessel traffic and the expansion of logistics infrastructure have driven higher lubricant consumption across both commercial and industrial fleets. The need for efficient engine and hydraulic performance to support continuous operations has also led shipowners to invest in premium lubricant solutions that enhance fuel efficiency and reduce maintenance costs, thereby driving steady market growth.

- For instance, Dunkirk’s port continues its multi-annual development plan, improving infrastructure to support higher vessel throughput, further boosting lubricant consumption by fleets requiring reliable lubrication for operational efficiency.

Shift Toward Environmentally Acceptable Lubricants (EALs)

The implementation of stricter environmental standards, including the IMO’s MARPOL regulations, is encouraging the use of environmentally acceptable lubricants across French maritime operations. Ship operators are increasingly adopting bio-based and low-toxicity formulations to minimize ecological impact in coastal waters and comply with emission control area (ECA) mandates. This regulatory push, combined with corporate sustainability commitments from major fleet operators, is accelerating the transition toward advanced synthetic and bio-based lubricants that ensure both compliance and operational reliability.

- For instance, Chevron Marine offers Clarity® EALs, engineered to meet IMO’s stringent requirements while providing high performance and biodegradability.

Technological Advancements in Marine Engines

The development of next-generation marine engines with higher operating pressures and lower fuel emissions is driving the need for specialized, high-performance lubricants. Modern two-stroke and four-stroke engines require advanced formulations to manage heat, friction, and fuel contamination. French ship maintenance and engineering sectors are adopting synthetic and additive-rich lubricants to extend drain intervals and improve overall engine efficiency. This technological evolution is fostering demand for premium-grade lubricants capable of supporting newer propulsion technologies and emission-reduction systems.

Key Trends & Opportunities

Growth of Bio-Based and Synthetic Lubricants

An increasing emphasis on sustainability has positioned bio-based and synthetic lubricants as the most promising growth segments in France’s marine sector. These lubricants offer improved biodegradability, lower volatility, and enhanced performance under extreme marine conditions. As French and EU policies continue to prioritize carbon reduction, leading suppliers are investing in R&D to develop cost-effective, eco-friendly formulations. This trend presents strong opportunities for companies offering innovative, compliant solutions to capture emerging demand from environmentally conscious fleet operators.

- For instance, Neste, a leading producer in Europe, utilizes its proprietary NEXBTL technology to produce high-quality renewable base oils from waste and residue raw materials, enhancing the performance and environmental credentials of bio-lubricants.

Digitalization and Predictive Maintenance Adoption

The integration of IoT and data analytics into ship maintenance practices is transforming the marine lubricants landscape. Predictive monitoring tools enable operators to analyze lubricant performance in real time, optimize replacement intervals, and reduce unplanned downtime. French shipping firms are increasingly adopting these digital platforms to ensure efficient asset management and compliance with operational standards. This trend creates new opportunities for lubricant manufacturers to offer value-added monitoring services and smart solutions aligned with digital fleet management.

- For instance, ExxonMobil’s Mobil℠ Lubricant Analysis service uses advanced testing and a global engine database to detect potential equipment failures early, helping ship operators reduce unscheduled downtime and lower lubricant consumption.

Key Challenges

Stringent Environmental Regulations and Compliance Costs

While environmental policies encourage innovation, they also pose financial challenges for lubricant producers and vessel operators. Compliance with IMO standards and local environmental directives increases operational costs due to the need for eco-friendly formulations and certification processes. Smaller suppliers often face difficulty meeting these evolving requirements, limiting their competitiveness. Additionally, fluctuating crude oil prices affect base oil availability and pricing, putting pressure on margins for both manufacturers and distributors in the French market.

High Competition and Price Sensitivity

The French marine lubricants market remains highly competitive, with multinational players such as Shell, TotalEnergies, and BP dominating through extensive distribution networks and brand recognition. This competitive intensity creates pricing pressure, particularly in the mineral oil segment, where fleet operators often prioritize cost savings over product innovation. Maintaining profitability while meeting quality and regulatory standards becomes challenging, especially for smaller or regional suppliers seeking to expand market presence amid aggressive pricing and narrow customer margins.

Regional Analysis

Northern France

Northern France holds the largest share of the national marine lubricants market, accounting for 38% of total revenue. The dominance of this region is driven by the presence of major seaports such as Le Havre, Dunkirk, and Calais, which handle a significant share of the country’s maritime trade. The high concentration of cargo handling, container shipping, and ferry operations fuels strong demand for engine and hydraulic oils. Strategic investments in port modernization and sustainable maritime infrastructure further support lubricant consumption across commercial and industrial fleets in this region.

Western France

Western France accounts for 27% of the marine lubricants market, supported by active shipping routes and port operations in Nantes, Saint-Nazaire, and Lorient. The region benefits from a growing offshore wind sector and ship repair activities, driving steady lubricant demand for maintenance and machinery applications. Increasing deployment of bio-based and synthetic oils aligns with regional sustainability goals and environmental compliance. Local manufacturing and logistics infrastructure strengthen supply chain efficiency, enabling timely delivery of lubricants to both commercial vessels and coastal support operations.

Southern France

Southern France represents 22% of the market, led by the strategic Port of Marseille-Fos, which serves as the primary hub for Mediterranean shipping and cruise operations. The region’s lubricant demand is propelled by high vessel traffic, oil tanker operations, and tourism-driven marine activities. Engine and compressor oils dominate consumption due to continuous vessel movement and high-performance engine requirements. Growing adoption of eco-friendly lubricants is also evident, influenced by emission control area (ECA) regulations in the Mediterranean Sea and France’s commitment to sustainable maritime practices.

Eastern France

Eastern France captures 13% of the marine lubricants market, largely driven by inland waterway transport along the Rhine and Rhône river corridors. This region supports a mix of cargo vessels, barges, and industrial fleets, contributing to steady lubricant consumption. Demand is primarily concentrated in hydraulic and engine oils used for propulsion and mechanical systems. Expansion of inland logistics hubs and integration with European river networks enhance lubricant distribution efficiency. Although smaller in market share, Eastern France is expected to experience gradual growth as inland maritime transport gains policy and infrastructure support.

Market Segmentations:

By Oil Type

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

By Product Type

- Engine Oil

- Hydraulic Oil

- Compressor Oil

- Others

By Application

- Bulk Carriers

- Container Ships

- Oil Tankers

- Others

By Region

- Northern France

- Western France

- Southern France

- Eastern France

Competitive Landscape

The competitive landscape of the France Marine Lubricants Market features major players such as BP p.l.c., ExxonMobil Marine Limited, Chevron Corporation, Shell Plc, TotalEnergies, Klüber Lubrication, Fuchs Lubricants, Eiffel Lubricants, and Kenzol Multi Industries FZC. These companies compete through extensive distribution networks, diversified product portfolios, and strong relationships with ship operators and maritime service providers. Leading firms like Shell and TotalEnergies focus on premium synthetic and environmentally acceptable lubricants to meet evolving regulatory requirements under IMO and MARPOL standards. Continuous investments in R&D, sustainability initiatives, and digital monitoring technologies are shaping the market’s innovation trajectory. Local players strengthen competitiveness by offering cost-effective mineral oil formulations and region-specific technical support. Strategic partnerships with ship maintenance firms, expansion of supply chains across key ports such as Le Havre and Marseille, and growing emphasis on eco-friendly products define the current market dynamics, reinforcing both brand presence and long-term customer loyalty.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2024, TotalEnergies’ Lubmarine introduced a new brand identity to strengthen its commitment to sustainable maritime operations, highlighting eco-friendly marine lubricants and advanced digital service solutions.

- In 2024, Klüber Lubrication launched a new portfolio of environmentally acceptable lubricants (EALs) for marine applications, featuring synthetic gear oils and greases designed to meet stringent environmental and performance standards.

- In September 2024, FUCHS LUBRICANTS GERMANY GmbH and LENOL DMCC announced the successful completion of their two-year partnership, which resulted in the launch of a new marine lubricant brand tailored to challenging maritime environments.

- In May 2025, FUCHS SE unveiled its new “TITAN MARINE” range of engine oils specifically developed for marine applications, offering approvals for various engine types including outboard, inboard, two-stroke and four-stroke shipboard engines.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Oil Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The France marine lubricants market is expected to witness steady growth driven by rising maritime trade and port modernization projects.

- Increasing adoption of environmentally acceptable lubricants will remain a key focus due to stringent emission and sustainability regulations.

- Synthetic and bio-based lubricants are likely to gain a stronger foothold as vessel operators shift toward high-performance, eco-friendly solutions.

- Ongoing technological advancements in marine engine designs will drive demand for specialized lubricant formulations.

- Expansion of France’s offshore wind and marine energy sectors will create new opportunities for lubricant suppliers.

- Digitalization and predictive maintenance tools will enhance operational efficiency and optimize lubricant usage across fleets.

- Local manufacturers are expected to strengthen their position through customized products and regional supply networks.

- The government’s commitment to reducing marine emissions will accelerate innovation in low-toxicity and biodegradable lubricants.

- Collaboration between lubricant producers and shipping companies will grow to ensure compliance and performance optimization.

- Overall market growth will be supported by France’s strong maritime infrastructure and increasing investment in green shipping initiatives.