Market Overview:

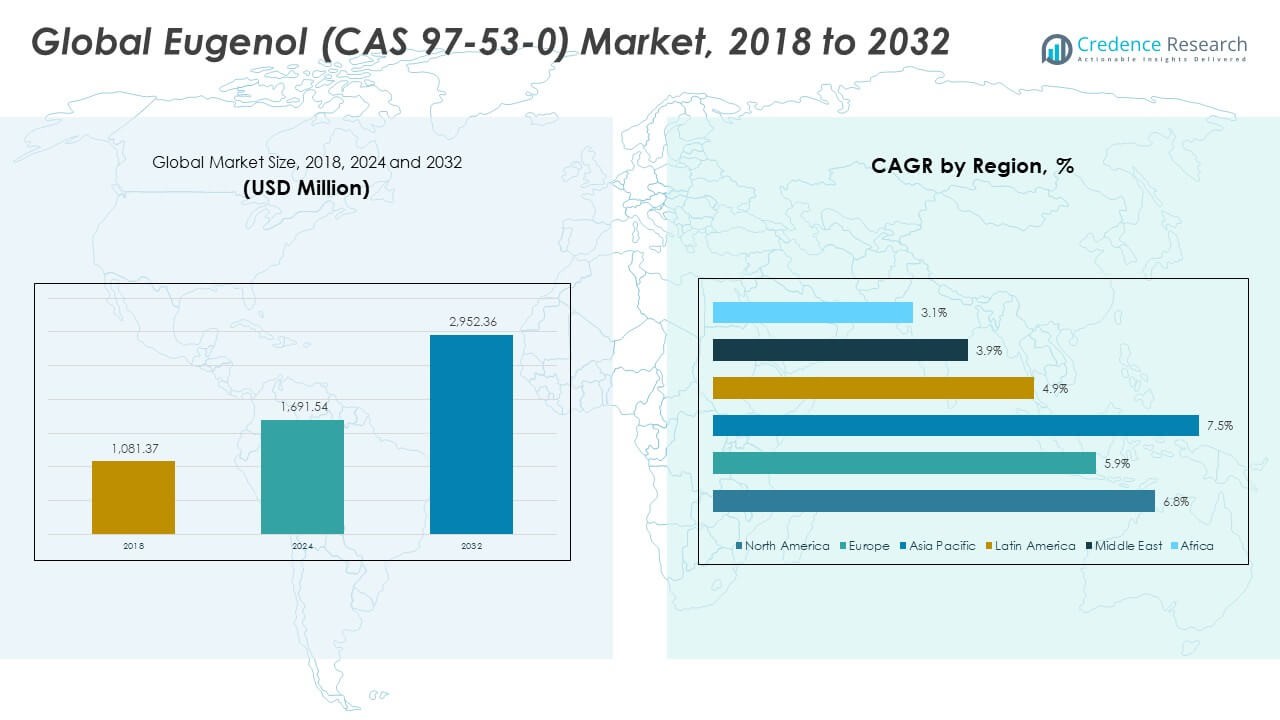

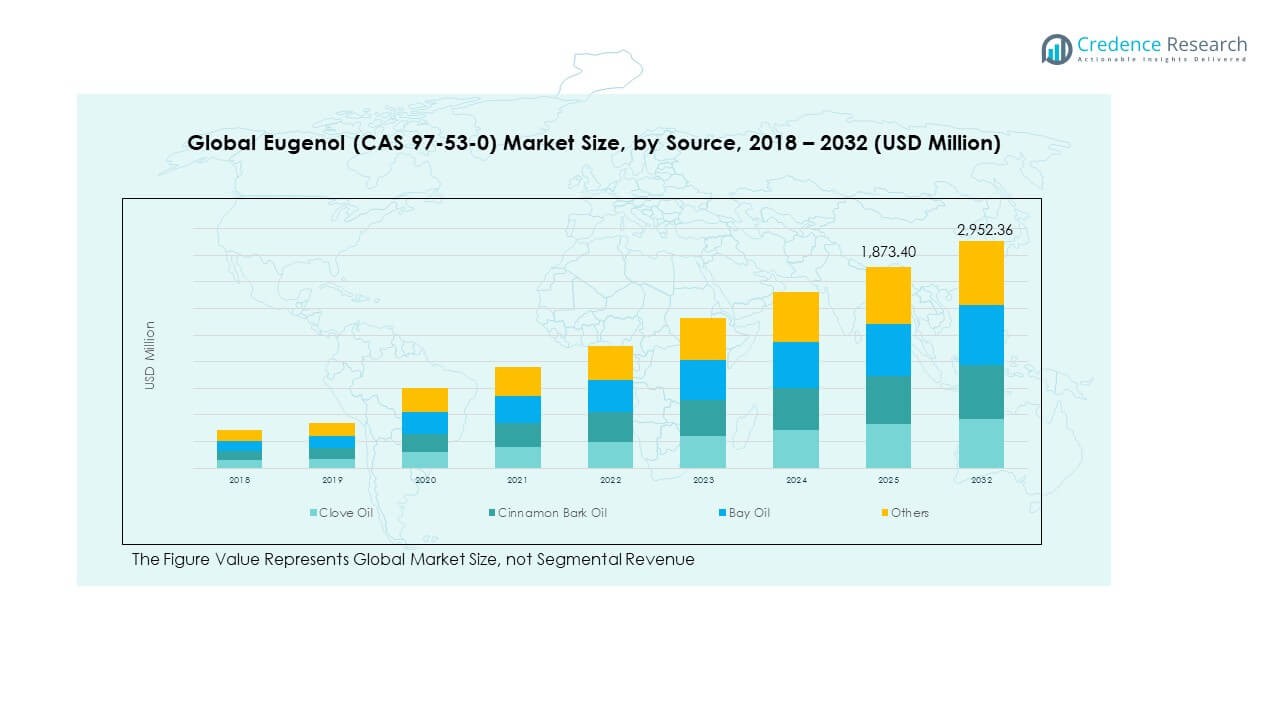

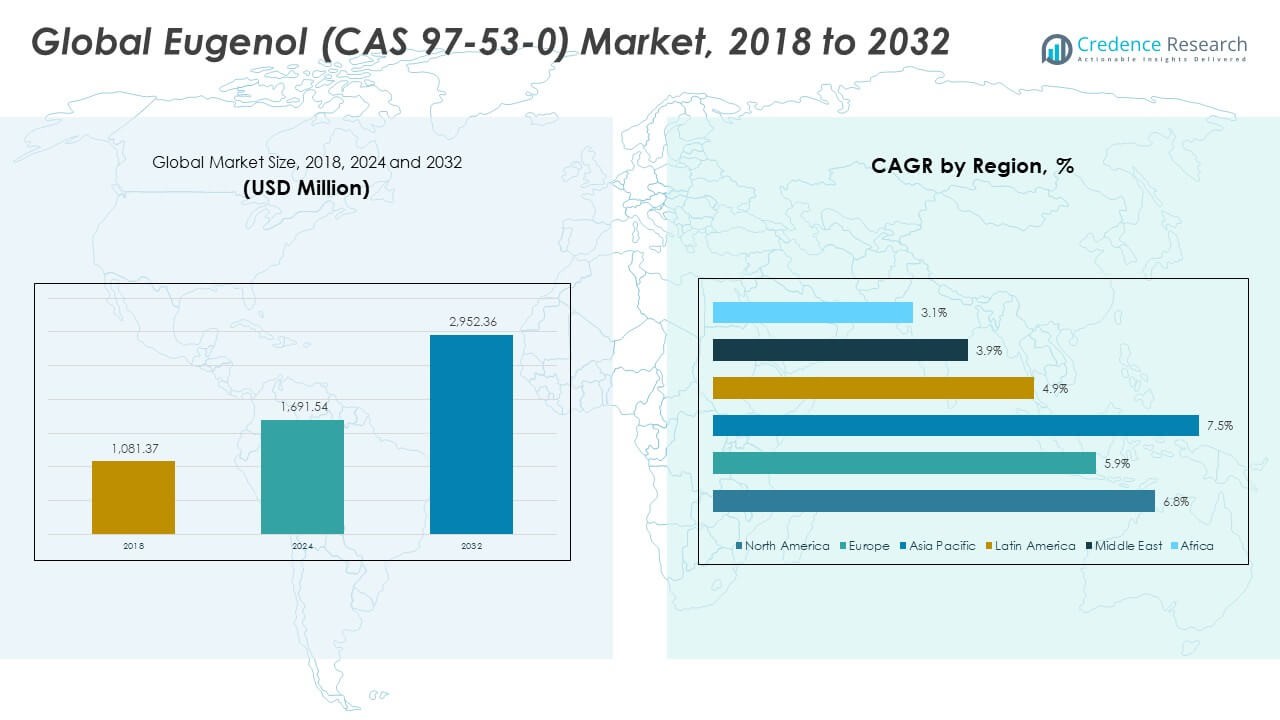

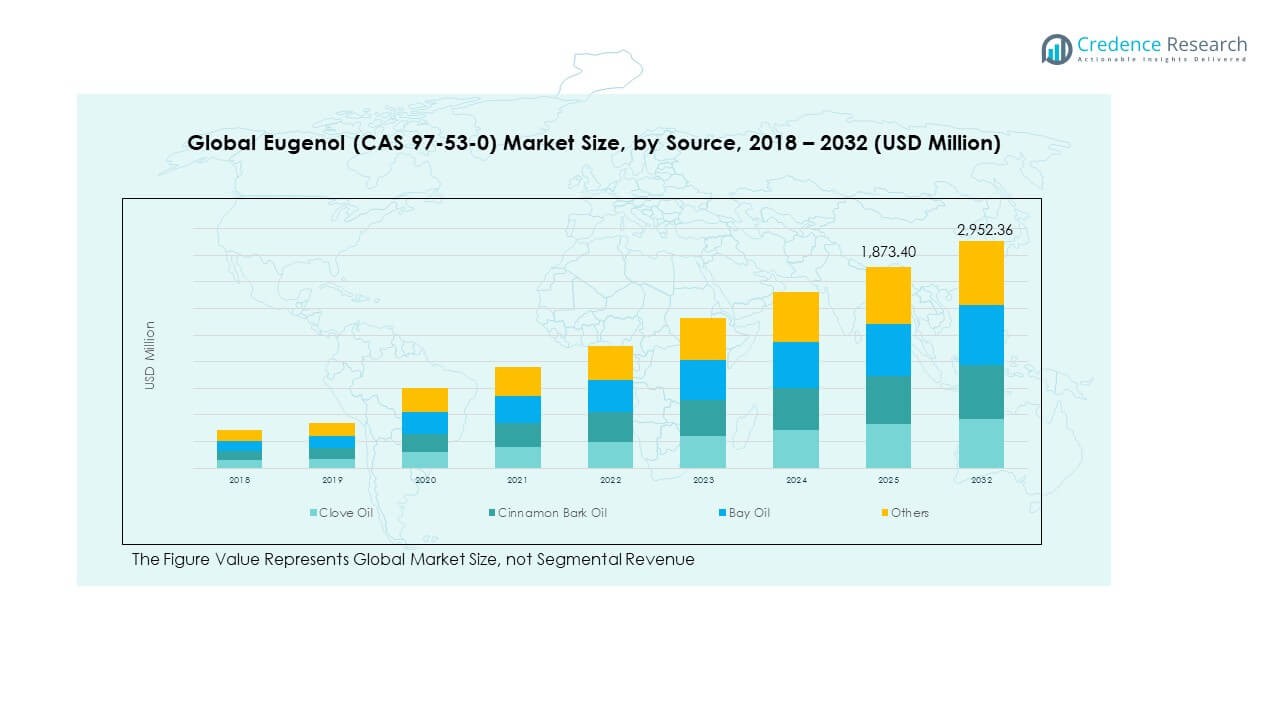

The Global Eugenol (CAS 97-53-0) Market size was valued at USD 1,081.37 million in 2018 to USD 1,691.54 million in 2024 and is anticipated to reach USD 2,952.36 million by 2032, at a CAGR of 6.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Eugenol (CAS 97-53-0) Market Size 2024 |

USD 1,691.54 Million |

| Eugenol (CAS 97-53-0) Market, CAGR |

6.71% |

| Eugenol (CAS 97-53-0) Market Size 2032 |

USD 2,952.36 Million |

The Global Eugenol (CAS 97-53-0) Market is driven by increasing demand in pharmaceutical, cosmetic, and food industries. Its wide application in pain relief formulations, dental care products, and flavoring agents fuels market expansion. Rising use of natural bio-based ingredients in personal care and aromatherapy also strengthens adoption. Moreover, growing research on eugenol’s antimicrobial and antioxidant properties boosts its use in healthcare and food preservation.

Regionally, Asia Pacific dominates due to the abundance of raw materials and established essential oil industries in India, China, and Indonesia. North America and Europe show steady growth with strong demand from pharmaceuticals and cosmetics. Emerging economies in Latin America and the Middle East are adopting eugenol in food processing and personal care applications, supported by growing awareness of natural and sustainable ingredients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Eugenol (CAS 97-53-0) Market was valued at USD 1,081.37 million in 2018, reached USD 1,691.54 million in 2024, and is projected to hit USD 2,952.36 million by 2032, growing at a CAGR of 6.71% during the forecast period.

- Asia Pacific holds the largest share at 41%, driven by strong raw material supply, cost-effective production, and robust demand from pharmaceutical, food, and cosmetic industries.

- Europe follows with 25% of the market, supported by a developed fragrance industry and regulatory preference for natural ingredients, while North America ranks third with 19%, led by innovation in pharmaceuticals and dental applications.

- Asia Pacific is also the fastest-growing region, propelled by increasing manufacturing capacity, expanding essential oil exports, and the rising adoption of natural bio-based compounds.

- By source, Clove Oil dominates the segment with over 55% share, followed by Cinnamon Bark Oil at around 25%, owing to its high aromatic value and wide application across food and fragrance sectors.

Market Drivers:

Growing Demand from the Pharmaceutical and Healthcare Sectors

The Global Eugenol (CAS 97-53-0) Market benefits from its strong demand in pharmaceuticals due to its analgesic, antiseptic, and anti-inflammatory properties. It is widely used in dental care products such as mouthwashes, anesthetic gels, and toothpaste. Pharmaceutical manufacturers prefer eugenol for natural formulations, driving adoption across the healthcare sector. The rise in chronic diseases and oral health awareness increases the need for eugenol-based products. Its effectiveness in treating infections enhances its application scope. The ongoing preference for plant-derived bioactives supports sustained market expansion.

- For instance, research published in 2021 showed that eugenol inhibited Salmonella typhi and Aspergillus ochraceus growth in lab settings, demonstrating activity at concentrations as low as 0.03 mg/mL. It is widely used in dental care products such as mouthwashes, anesthetic gels and toothpaste; for example, zinc-oxide/eugenol dental cements have been studied extensively for root-canal sealing applications.

Expansion of the Cosmetics and Personal Care Industry

The cosmetics and personal care segment significantly supports market growth. Eugenol is a key ingredient in perfumes, deodorants, and creams due to its aromatic and antibacterial properties. It helps enhance fragrance retention and preserve product quality. Consumers increasingly favor natural and chemical-free cosmetic ingredients, creating a steady demand for eugenol. Manufacturers are reformulating products using plant-derived oils, strengthening this trend. The rise of organic beauty brands further amplifies eugenol’s market presence.

- For instance, the ingredient is listed in the INCI database as used in concentrations of 0.2-1 % in skincare creams and 1-3 % in deodorant sticks. It helps enhance fragrance retention and preserve product quality. Consumers increasingly favour natural and chemical-free cosmetic ingredients, creating steady demand for eugenol.

Rising Use in Food Flavoring and Preservation

Eugenol is extensively used in flavoring food and beverages because of its distinct clove-like aroma and safety profile. Food manufacturers use it to improve taste and extend shelf life in processed foods. It offers antimicrobial and antioxidant benefits, reducing dependency on synthetic additives. Growing awareness of food safety and clean labeling boosts its inclusion in flavoring systems. The market gains momentum from rising consumption of natural and functional foods. Its GRAS status approved by food safety authorities encourages broader application.

Increasing Application in Industrial and Chemical Sectors

Industrial demand for eugenol is expanding across fine chemicals, agrochemicals, and polymer industries. It acts as a key intermediate in producing vanillin, isoeugenol, and other derivatives. The Global Eugenol (CAS 97-53-0) Market experiences growth through innovations in synthesis technologies. Companies focus on bio-based production to reduce costs and improve sustainability. The chemical industry uses eugenol for resins, stabilizers, and antioxidants. Rising research in biodegradable polymers and eco-friendly additives further supports its industrial adoption.

Market Trends:

Shift Toward Sustainable and Bio-Based Production Methods

The Global Eugenol (CAS 97-53-0) Market shows a strong shift toward sustainable sourcing and green chemistry. Manufacturers are adopting bio-based extraction processes from clove oil and cinnamon leaves. This move reduces environmental impact and meets global sustainability goals. Growing regulatory emphasis on eco-friendly manufacturing drives this transformation. Companies invest in cleaner technologies to improve purity and yield. The trend supports circular economy practices within the flavor and fragrance sectors.

- For example, one Indonesian supplier expanded its distillation capacity and now works with around 300 farmers to process clove leaves and bud dust in partnership with a major aroma company. This move reduces environmental impact and meets global sustainability goals. Growing regulatory emphasis on eco-friendly manufacturing drives this transformation.

Integration of Eugenol in Advanced Pharmaceutical Formulations

Pharmaceutical companies are integrating eugenol into novel drug delivery systems to enhance bioavailability. Research highlights its potential in pain relief gels, wound care ointments, and antimicrobial coatings. The market benefits from the rising interest in natural actives for topical and oral formulations. Its compatibility with nanocarrier systems expands therapeutic use. The Global Eugenol (CAS 97-53-0) Market gains traction as researchers explore synergistic blends for infection control and anti-inflammatory treatments.

- For instance, studies found eugenol-loaded nano-carriers improved permeation and reduced microbial counts in wound models. The market benefits from the rising interest in natural actives for topical and oral formulations. Its compatibility with nanocarrier systems expands therapeutic use.

Expansion in the Natural Flavor and Fragrance Industry

Consumer preference for natural flavors and fragrances fuels innovation across product lines. Eugenol’s clove-derived scent makes it a preferred raw material for perfumery and aroma applications. The demand for essential oil-based ingredients drives long-term market stability. Companies invest in extraction efficiency to ensure supply consistency. The rise of vegan and cruelty-free products also strengthens its market positioning.

Growing Use in Veterinary and Agricultural Applications

Eugenol is increasingly used in animal care formulations and agricultural bio-pesticides. It acts as a natural insect repellent and antimicrobial agent, reducing synthetic chemical dependence. The Global Eugenol (CAS 97-53-0) Market benefits from regulatory support for natural agrochemicals. Veterinary industries use eugenol for treating microbial infections and pain management. Rising awareness of sustainable farming practices encourages its adoption across multiple regions.

Market Challenges Analysis:

Price Fluctuations and Limited Raw Material Availability

The Global Eugenol (CAS 97-53-0) Market faces challenges from volatile raw material prices, particularly clove oil and other natural sources. Seasonal supply variations affect consistency and pricing. Small-scale producers struggle with yield optimization and resource constraints. Dependence on tropical regions for raw material increases vulnerability to climatic conditions. Manufacturers must invest in sustainable sourcing networks to reduce instability. Price sensitivity among downstream users limits large-scale adoption. Maintaining product quality amid fluctuating input costs remains a critical challenge.

Regulatory and Formulation Constraints in End-Use Industries

The market encounters stringent regulations related to concentration limits and safety compliance in cosmetics, pharmaceuticals, and food products. Variations in international standards complicate global distribution for manufacturers. The Global Eugenol (CAS 97-53-0) Market also struggles with challenges in maintaining consistent quality due to diverse extraction methods. Formulation difficulties arise from its potential allergenic properties and oxidation sensitivity. Producers must adopt standardized testing and advanced stabilization techniques to meet regulatory expectations and consumer safety demands.

Market Opportunities:

Rising Innovation in Pharmaceutical and Cosmetic Applications

The Global Eugenol (CAS 97-53-0) Market holds significant opportunities through expanded pharmaceutical and cosmetic research. Companies are exploring advanced formulations such as encapsulated eugenol for controlled release. The trend toward personalized skincare supports eugenol-based solutions due to its natural origin and therapeutic profile. Growing partnerships between cosmetic brands and natural ingredient suppliers create new business avenues. Increased awareness of herbal and organic product benefits enhances commercial prospects.

Emergence of Bio-Based Manufacturing and New Regional Markets

Technological progress in bio-refining offers new pathways for sustainable eugenol production. Manufacturers are investing in biotechnology-based synthesis to minimize reliance on natural clove resources. The Global Eugenol (CAS 97-53-0) Market benefits from emerging markets in Latin America, Africa, and Southeast Asia due to industrial expansion and evolving consumer preferences. Rising demand for eco-friendly chemicals and natural preservatives strengthens opportunities for new entrants and regional producers.

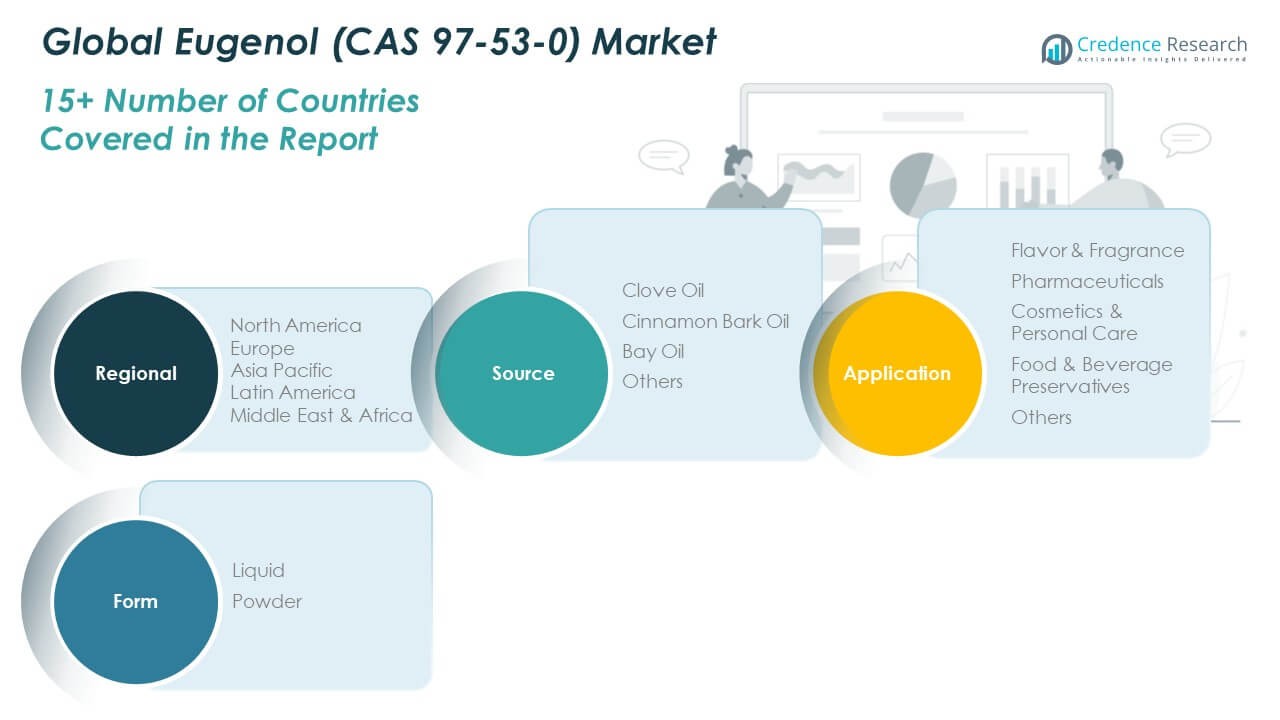

Market Segmentation Analysis:

By Source

The Global Eugenol (CAS 97-53-0) Market is segmented by source into clove oil, cinnamon bark oil, bay oil, and others. Clove oil dominates the segment due to its high eugenol content and widespread availability across tropical regions. It serves as the primary raw material for industrial and pharmaceutical-grade eugenol production. Cinnamon bark oil holds a notable share owing to its growing use in food flavoring and fragrance manufacturing. Bay oil contributes to niche applications, especially in premium cosmetic and aromatherapy products. The others category includes synthetic and blended sources used to maintain supply stability and cost efficiency.

By Application

By application, the market is divided into flavor and fragrance, pharmaceuticals, cosmetics and personal care, food and beverage preservatives, and others. The flavor and fragrance segment leads the market, driven by rising consumer preference for natural aromatic compounds in perfumes and food additives. Pharmaceuticals account for a substantial share supported by eugenol’s analgesic, antimicrobial, and anti-inflammatory properties. Cosmetics and personal care applications are expanding with the demand for plant-derived ingredients. Food and beverage preservatives are gaining importance due to the push for natural alternatives to synthetic additives. The others segment includes uses in agrochemicals, dental formulations, and industrial products, contributing to steady market diversification.

Segmentation:

By Source

- Clove Oil

- Cinnamon Bark Oil

- Bay Oil

- Others

By Application

- Flavor & Fragrance

- Pharmaceuticals

- Cosmetics & Personal Care

- Food & Beverage Preservatives

- Others

By Form

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Eugenol (CAS 97-53-0) Market size was valued at USD 208.00 million in 2018 to USD 317.69 million in 2024 and is anticipated to reach USD 558.03 million by 2032, at a CAGR of 6.8% during the forecast period. North America accounts for nearly 19% of the global market share. The region benefits from high adoption of eugenol in pharmaceuticals, dental care, and flavoring applications. The United States leads due to advanced healthcare infrastructure and established cosmetic brands. Demand for natural bioactive ingredients drives the use of eugenol in food and personal care sectors. Strong regulatory standards ensure consistent product quality. Ongoing innovation in essential oils and aromatherapy markets supports expansion. Canada and Mexico also contribute with rising industrial and food additive applications.

Europe

The Europe Global Eugenol (CAS 97-53-0) Market size was valued at USD 297.63 million in 2018 to USD 448.27 million in 2024 and is anticipated to reach USD 735.16 million by 2032, at a CAGR of 5.9% during the forecast period. Europe holds around 25% of the global market share. The region benefits from a strong fragrance and cosmetic industry centered in France, Germany, and the UK. Regulatory preference for natural flavoring and preservative ingredients strengthens eugenol use in food processing. Pharmaceutical applications continue to expand with growing awareness of natural antiseptic and analgesic compounds. European manufacturers emphasize sustainable sourcing and eco-friendly extraction. The cosmetics sector uses eugenol in essential oils, perfumes, and personal care products. The EU’s clean-label movement further supports steady consumption.

Asia Pacific

The Asia Pacific Global Eugenol (CAS 97-53-0) Market size was valued at USD 489.27 million in 2018 to USD 792.64 million in 2024 and is anticipated to reach USD 1,465.05 million by 2032, at a CAGR of 7.5% during the forecast period. Asia Pacific dominates with about 41% of the global market share. The region leads due to abundant raw material supply, low production costs, and rising industrial output. India, China, and Indonesia serve as key producers of clove and cinnamon oils, supporting strong export potential. Increasing consumption in cosmetics, pharmaceuticals, and food flavoring boosts market growth. Expanding healthcare and manufacturing sectors enhance domestic utilization. Japan and South Korea contribute through advanced cosmetic innovation. Growing demand for organic and herbal ingredients reinforces regional leadership.

Latin America

The Latin America Global Eugenol (CAS 97-53-0) Market size was valued at USD 46.99 million in 2018 to USD 72.51 million in 2024 and is anticipated to reach USD 110.74 million by 2032, at a CAGR of 4.9% during the forecast period. Latin America represents around 4% of the global market share. Brazil and Argentina drive consumption through the food, fragrance, and pharmaceutical sectors. Rising awareness of natural ingredients promotes adoption in cosmetics and oral care products. The presence of regional essential oil industries supports local production. Economic reforms and trade improvements encourage import and export expansion. Demand for processed food and wellness products continues to grow. Local suppliers are investing in sustainable farming of clove and cinnamon crops. The region’s improving industrial ecosystem provides a positive outlook.

Middle East

The Middle East Global Eugenol (CAS 97-53-0) Market size was valued at USD 25.48 million in 2018 to USD 35.79 million in 2024 and is anticipated to reach USD 50.66 million by 2032, at a CAGR of 3.9% during the forecast period. The region accounts for around 3% of the global market share. Rising investments in the cosmetics and fragrance industry drive moderate demand. The UAE and Saudi Arabia are key importers, supporting growth through luxury and wellness product expansion. Pharmaceutical use remains limited but is expected to increase with growing healthcare awareness. Regional producers are focusing on importing natural extracts for blending and manufacturing. The food sector is gradually adopting eugenol-based preservatives to align with global safety standards. Market players are exploring opportunities in local essential oil processing.

Africa

The Africa Global Eugenol (CAS 97-53-0) Market size was valued at USD 13.99 million in 2018 to USD 24.63 million in 2024 and is anticipated to reach USD 32.72 million by 2032, at a CAGR of 3.1% during the forecast period. Africa holds about 2% of the global market share. Demand growth is driven by rising interest in herbal medicine and natural cosmetics. South Africa leads the regional market with expanding pharmaceutical and personal care industries. Limited industrial infrastructure and import dependency constrain market expansion. Nigeria and Egypt show emerging potential with improving healthcare systems. Awareness of essential oils in aromatherapy and wellness applications continues to rise. Investments in local extraction and processing may enhance long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

- The Global Eugenol (CAS 97-53-0) Market is characterized by strong competition among multinational fragrance and flavor companies. It features a blend of integrated producers and niche suppliers focusing on natural extracts. Companies such as Givaudan SA, Symrise AG, and International Flavors & Fragrances Inc. lead through diversified product portfolios and global distribution networks. Mid-sized firms emphasize cost efficiency and regional expansion. The market favors players investing in sustainable sourcing and high-purity extraction methods. Strategic collaborations, mergers, and technology upgrades define competitive differentiation. Innovation in bio-based manufacturing further intensifies rivalry.

- Recent Developments:

- On October 22 2025, Symrise AG invested in U.S-based biotech company Cellibre to gain access to its fermentation platform for high-value natural molecules, including aroma and active ingredients tied to natural eugenol supply chains.

- In June 2025, Givaudan SA launched a “Clove Eugenol” derivative from its NATEMA facility in Madagascar, delivering eugenol of >99% purity, produced sustainably via fair-trade clove sourcing.

Report Coverage:

The research report offers an in-depth analysis based on source and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for natural ingredients will drive growth across cosmetics and pharmaceuticals.

- Bio-based eugenol production will reduce reliance on natural clove sources.

- Innovation in green chemistry will enhance cost efficiency and sustainability.

- Expanding applications in food preservation will broaden market potential.

- Growing use in aromatherapy will create new niche opportunities.

- Asia Pacific will remain the largest and fastest-growing region.

- Strategic investments in extraction technologies will boost competitiveness.

- Regulatory focus on product safety will shape formulation trends.

- Partnerships between biotechnology and flavor firms will accelerate product innovation.

- Expanding essential oil exports from emerging economies will strengthen global supply chains.