Market Overview

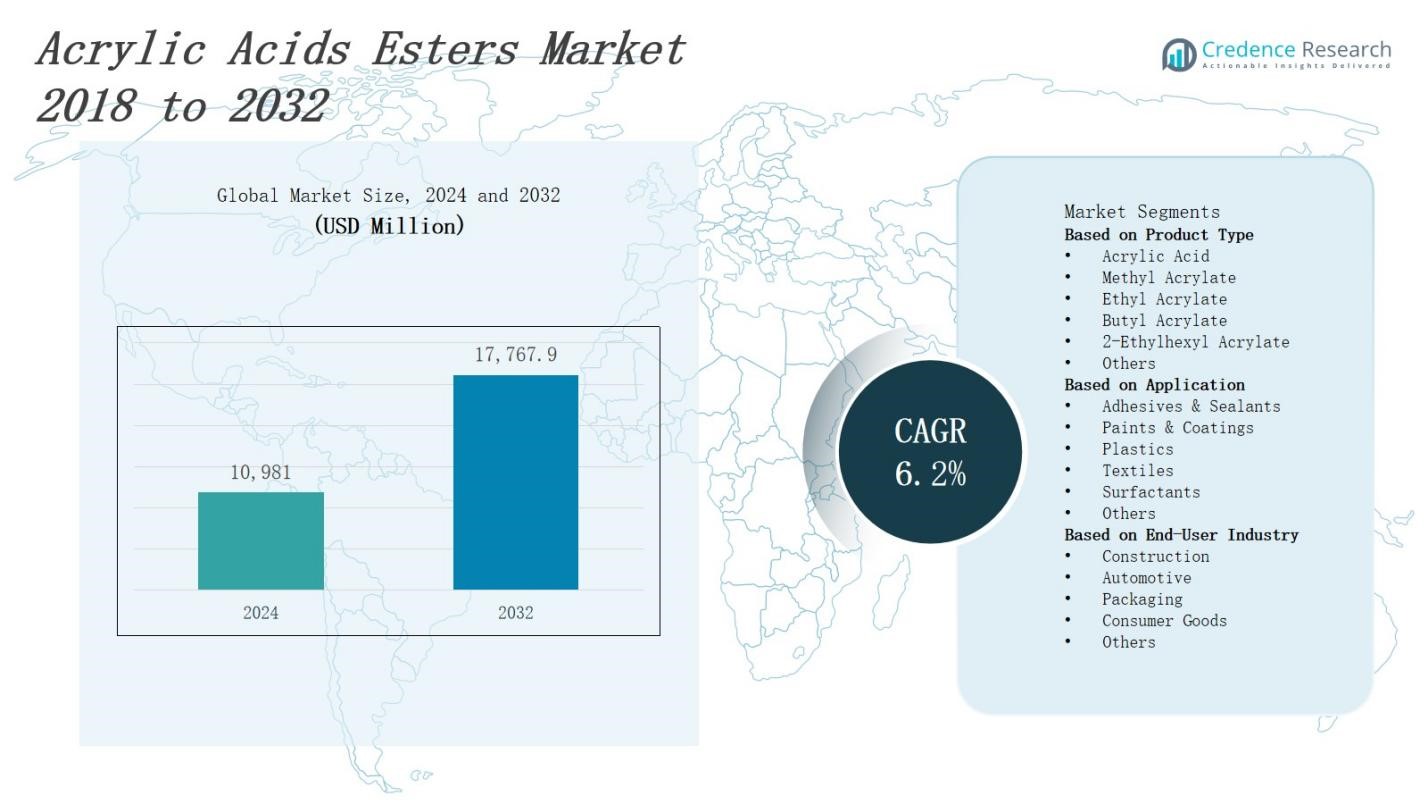

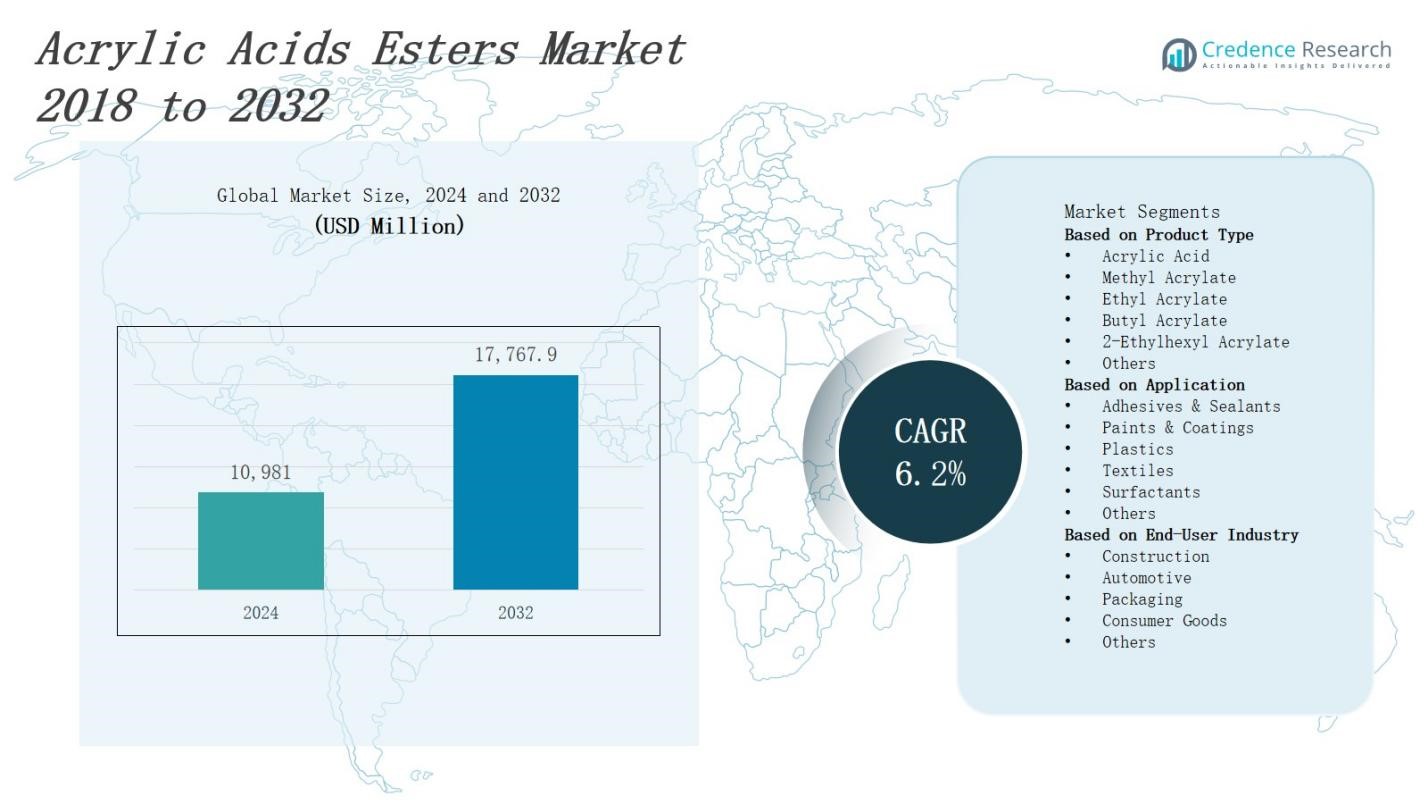

The acrylic acids esters market is projected to grow from USD 10,981 million in 2024 to USD 17,767.9 million by 2032, expanding at a CAGR of 6.2%.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Acrylic Acids Esters Market Size 2024 |

USD 10,981 Million |

| Acrylic Acids Esters Market, CAGR |

6.2% |

| Acrylic Acids Esters Market Size 2032 |

USD 17,767.9 Million |

The acrylic acids esters market grows driven by rising demand in adhesives, coatings, and paints across construction and automotive sectors. Increasing industrialization and urbanization fuel the need for high-performance, durable materials, boosting ester consumption. Manufacturers focus on developing eco-friendly and low-VOC formulations to comply with stringent environmental regulations. Technological advancements in polymerization techniques enhance product efficiency and versatility. Growing use in personal care and textile industries further supports market expansion. These factors collectively accelerate innovation and adoption of acrylic acid esters, positioning the market for sustained growth throughout the forecast period.

The acrylic acids esters market spans key regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific leads with the largest market share due to rapid industrialization and urbanization. North America and Europe follow, driven by advanced industries and stringent environmental regulations. Latin America and the Middle East & Africa show steady growth supported by expanding construction and automotive sectors. Key players such as BASF SE, Arkema Group, The Dow Chemical Company, Nippon Shokubai, and LG Chem actively compete across these regions, focusing on innovation and sustainability to capture market opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The acrylic acids esters market is projected to grow from USD 10,981 million in 2024 to USD 17,767.9 million by 2032, expanding at a CAGR of 6.2%.

- Rising demand in adhesives, coatings, and paints within construction and automotive sectors fuels market growth by boosting the need for durable, high-performance materials.

- Manufacturers prioritize eco-friendly and low-VOC formulations to comply with stringent environmental regulations, accelerating adoption across industries.

- Technological advancements in polymerization enhance product efficiency and versatility, enabling customized solutions for textiles, personal care, and other applications.

- Asia Pacific leads with 35% market share due to rapid industrialization and urbanization, followed by North America (28%) and Europe (25%) driven by advanced industries and regulatory frameworks.

- The market faces challenges from raw material price volatility and supply chain disruptions, impacting production planning and cost structures.

- Increasing regulatory compliance pressures companies to invest in sustainable production processes, balancing environmental concerns with cost efficiency to maintain competitiveness.

Market Drivers

Rising Demand in Adhesives and Coatings Industries

The acrylic acids esters market benefits from growing consumption in adhesives, paints, and coatings, particularly in construction and automotive sectors. These esters enhance product durability, flexibility, and resistance to weathering, making them ideal for protective coatings. Urbanization and infrastructure development increase demand for advanced materials with superior performance. It also supports manufacturers in producing eco-friendly, low-VOC formulations that comply with environmental standards. The trend towards high-performance adhesives fuels consistent market growth.

- For instance, BASF uses acrylic esters to formulate protective industrial and marine coatings that offer enhanced UV resistance and durability, which significantly extend the lifespan of treated surfaces.

Technological Advancements Driving Product Efficiency

Innovation in polymerization and esterification processes improves the quality and versatility of acrylic acid esters. The market leverages advancements to develop specialized esters with enhanced properties such as faster curing times and better adhesion. These improvements reduce production costs and expand application areas, including textiles and personal care products. It enables manufacturers to meet specific customer requirements and regulatory demands. Enhanced product efficiency accelerates adoption across diverse end-use industries.

- For instance, Eastman Chemicals utilizes reactive distillation processes allowing simultaneous reaction and separation, boosting efficiency and lowering costs in producing methyl and ethyl acrylates.

Growing Environmental Regulations and Sustainability Focus

Stringent environmental regulations push manufacturers to adopt sustainable practices in acrylic acids esters production. It drives the shift towards low-VOC and bio-based esters that reduce ecological impact while maintaining product performance. Companies invest in green chemistry and cleaner production technologies to minimize hazardous emissions. Consumer preference for environmentally responsible products further accelerates market adoption. This regulatory pressure ensures continuous innovation focused on sustainability throughout the market.

Expanding Applications Across End-Use Industries

The acrylic acids esters market expands its footprint in diverse industries such as textiles, personal care, and packaging. These esters improve flexibility, clarity, and durability in products ranging from coatings to cosmetics. Rising disposable incomes and urban lifestyles increase demand for high-quality consumer goods that rely on acrylic esters. It supports manufacturers in exploring new application segments and customizing products accordingly. The broadening application scope ensures long-term market growth and resilience.

Market Trends

Increasing Adoption of Sustainable and Bio-Based Esters

The acrylic acids esters market witnesses a significant shift toward sustainable and bio-based alternatives. Manufacturers respond to environmental concerns and regulatory pressures by developing esters derived from renewable resources. These eco-friendly esters reduce carbon footprint while maintaining performance standards across applications. It encourages innovation in green chemistry and expands the product portfolio. Growing consumer awareness about sustainability drives demand for such products in coatings, adhesives, and personal care sectors. This trend strengthens the market’s alignment with global environmental goals.

- For instance, BASF has introduced bio-based esters derived from vegetable oils that serve as effective, biodegradable solvents in coatings and adhesives, reducing environmental impact without sacrificing performance.

Integration of Advanced Polymerization Technologies

The market leverages advanced polymerization techniques to enhance product quality and tailor acrylic acids esters for specific applications. Improved control over molecular weight distribution and polymer architecture optimizes performance parameters such as adhesion, flexibility, and durability. It enables producers to offer customized solutions for diverse industries including automotive, construction, and textiles. The use of cutting-edge catalysts and reactors reduces production time and costs. Continuous technological upgrades position the market for increased efficiency and broader application potential.

- For instance, Arkema has developed tailored polymerization processes that allow customization of acrylic esters for high-performance textile finishes, increasing durability without compromising fabric feel.

Expansion of Applications in Personal Care and Textiles

The acrylic acids esters market expands its presence in the personal care and textile industries, driven by demand for high-performance, safe ingredients. It provides flexibility, gloss, and water resistance in cosmetic formulations and fabric finishes. Rising consumer focus on product aesthetics and durability supports ester adoption in shampoos, lotions, and apparel coatings. Manufacturers tailor esters to meet regulatory standards and enhance sensory properties. The broadening application scope diversifies revenue streams and strengthens market resilience.

Growing Demand for Low-VOC and High-Performance Products

Regulatory mandates and consumer preferences drive the acrylic acids esters market toward low-VOC formulations without compromising product performance. It fosters innovation in solvent-free and waterborne esters that reduce environmental impact. These high-performance esters offer superior adhesion, weather resistance, and durability, meeting industry standards. Adoption in architectural coatings, automotive finishes, and industrial adhesives accelerates market growth. The focus on environmentally compliant products positions the market for sustainable long-term expansion.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Disruptions

The acrylic acids esters market faces challenges due to fluctuations in raw material prices, particularly acrylic acid and alcohol derivatives. Supply chain disruptions caused by geopolitical tensions, natural disasters, or logistical constraints further exacerbate cost instability. It impacts manufacturers’ production planning and profit margins, leading to price volatility in finished products. Limited availability of high-quality raw materials forces companies to seek alternative sources, increasing operational complexity. Managing these uncertainties requires strategic procurement and inventory management to maintain market competitiveness.

Stringent Regulatory Compliance and Environmental Concerns

Regulatory frameworks impose strict limits on emissions, volatile organic compounds (VOCs), and hazardous substances in acrylic acids esters production. It compels manufacturers to invest heavily in process modifications and pollution control technologies, increasing operational costs. Compliance with varying regional regulations complicates global market operations, affecting product formulation and approval timelines. Environmental concerns over chemical waste and toxicity raise public scrutiny, influencing market acceptance. Companies must balance regulatory demands with cost efficiency to sustain growth and reputation.

Market Opportunities

Emerging Demand in High-Growth End-Use Industries

The acrylic acids esters market benefits from expanding applications in rapidly growing sectors such as automotive, construction, and personal care. It offers opportunities to develop specialized esters that enhance product performance, including improved durability, flexibility, and aesthetic appeal. Rising urbanization and infrastructure development fuel demand for advanced coatings and adhesives. Increasing consumer awareness of product quality and safety drives adoption in cosmetics and textiles. Targeting these high-growth segments allows manufacturers to diversify their portfolios and capture new revenue streams.

Advancements in Sustainable and Green Chemistry Solutions

Growing environmental concerns create opportunities for the acrylic acids esters market to innovate in bio-based and low-VOC ester formulations. It encourages manufacturers to invest in green chemistry technologies that reduce environmental impact while meeting regulatory standards. Development of renewable raw material sources opens pathways to differentiate products and gain competitive advantage. Collaborations with research institutions and sustainable material suppliers support these initiatives. Embracing sustainability enhances brand reputation and meets increasing consumer demand for eco-friendly products, driving long-term market growth.

Market Segmentation Analysis:

By Product Type

The acrylic acids esters market segments into key product types including acrylic acid, methyl acrylate, ethyl acrylate, butyl acrylate, 2-ethylhexyl acrylate, and others. Each product serves distinct functions across applications, with butyl acrylate and 2-ethylhexyl acrylate commanding significant demand due to their flexibility and weather resistance properties. It supports manufacturers in tailoring formulations for coatings, adhesives, and plastics. Methyl and ethyl acrylates find extensive use in polymer production, enhancing mechanical and chemical properties. Diversification of product types enables the market to meet varied industry requirements.

- For instance, Mitsubishi Chemical Corporation, which uses butyl acrylate as a crucial raw material in adhesives, coatings, and acrylic rubber, emphasizing its versatility in fiber processing and plastics.

By Application

Applications such as adhesives & sealants, paints & coatings, plastics, textiles, surfactants, and others drive the acrylic acids esters market’s growth. It fuels innovation in adhesives and coatings by improving adhesion, durability, and resistance to environmental factors. Plastics and textile industries benefit from esters that enhance flexibility, clarity, and water repellence. Surfactants leverage acrylic esters to improve performance in detergents and personal care products. Expanding application areas provide opportunities for customized ester solutions and market expansion.

- For instance, Arkema produces a broad range of acrylic esters used in adhesives and coatings, focusing on innovations for enhanced durability and environmental resistance.

By End-User Industry

Construction, automotive, packaging, consumer goods, and other industries represent major end users in the acrylic acids esters market. It supports the construction sector with high-performance coatings and sealants that improve durability and weather resistance. Automotive manufacturers rely on esters for lightweight coatings and adhesives that enhance fuel efficiency. Packaging benefits from acrylic esters that offer clarity and barrier properties. Consumer goods industries use these esters to improve product aesthetics and functionality. The wide end-user base sustains steady demand and diversified growth opportunities.

Segments:

Based on Product Type

- Acrylic Acid

- Methyl Acrylate

- Ethyl Acrylate

- Butyl Acrylate

- 2-Ethylhexyl Acrylate

- Others

Based on Application

- Adhesives & Sealants

- Paints & Coatings

- Plastics

- Textiles

- Surfactants

- Others

Based on End-User Industry

- Construction

- Automotive

- Packaging

- Consumer Goods

- Others

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a 28% share of the acrylic acids esters market, driven by strong industrial growth and technological innovation. It benefits from established automotive, construction, and personal care industries demanding high-performance esters. Manufacturers focus on developing eco-friendly and low-VOC products to comply with stringent environmental regulations. The presence of major chemical producers and advanced research facilities supports product development and customization. Growing consumer awareness about sustainability further accelerates market adoption. It maintains leadership through continuous innovation and strategic investments.

Europe

Europe commands a 25% share of the acrylic acids esters market, supported by stringent regulatory frameworks and sustainability initiatives. It leads in adopting bio-based and green esters to reduce environmental impact across applications such as coatings, adhesives, and textiles. The region’s construction and automotive sectors actively integrate advanced materials to meet performance and environmental standards. It fosters collaborations between industry and research organizations to drive innovation. Strong demand for sustainable personal care and packaging products also fuels market growth. Europe remains a key hub for regulatory-driven product development.

Asia Pacific

Asia Pacific captures the largest share at 35% of the acrylic acids esters market, fueled by rapid urbanization, industrialization, and rising disposable incomes. It witnesses expanding applications in construction, automotive, textiles, and consumer goods sectors. China, India, and Southeast Asian countries drive demand through infrastructure development and growing manufacturing bases. It attracts investments from global and local manufacturers to establish production facilities and R&D centers. The focus on affordable yet high-quality products supports market expansion. Emerging environmental regulations encourage sustainable product innovation across the region.

Latin America and Middle East & Africa

Latin America and Middle East & Africa collectively hold a 12% share of the acrylic acids esters market, driven by growing construction and automotive industries. It benefits from increasing investments in infrastructure and consumer goods manufacturing. The regions face challenges from fluctuating raw material prices but focus on leveraging local resources and partnerships. Demand for sustainable products grows steadily, promoting adoption of low-VOC and bio-based esters. Market participants prioritize expanding distribution networks and enhancing product portfolios to capture emerging opportunities. These regions present moderate yet promising growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Formosa Plastics Corporation

- BASF SE

- Jiangsu Jurong Chemical Co., Ltd.

- Hexion Inc.

- Mitsubishi Chemical Corporation

- Shenyang Chemical Co., Ltd.

- Toagosei Co., Ltd.

- Arkema Group

- Shanghai Huayi Acrylic Acid Co., Ltd.

- Sasol Limited

- LG Chem Ltd.

- Nippon Shokubai Co., Ltd.

- Evonik Industries AG

- The Dow Chemical Company

Competitive Analysis

The acrylic acids esters market features strong competition among global chemical manufacturers focused on innovation, quality, and sustainability. Leading players such as BASF SE, Arkema Group, and The Dow Chemical Company invest heavily in research and development to enhance product performance and develop eco-friendly formulations. It drives market growth by introducing bio-based and low-VOC esters that meet evolving regulatory standards. Regional players like Shenyang Chemical and Jiangsu Jurong Chemical strengthen their presence through localized production and cost advantages. The market’s competitive landscape emphasizes strategic partnerships, capacity expansions, and technology upgrades. It compels companies to optimize supply chains and improve customer service to maintain market share. Continuous innovation and responsiveness to environmental demands remain critical for success in this dynamic market.

Recent Developments

- On March 21, 2024, SIBUR acquired JSC Acrylate, the only CIS-based producer of acrylic acid and its esters, from ATEK Group. This acquisition strengthens SIBUR’s position in the acrylic acid esters market in Russia and the CIS region.

- In July 2025, BASF achieved mechanical completion of its acrylics complex at the Zhanjiang Verbund site in China.

- In January 2024, Arkema obtained ISCC+ certification for its acrylic acid and ester production facility in Taixing, Jiangsu Province, China. This milestone underscores Arkema’s commitment to sustainable practices in its acrylics production chain.

- In June 2025, Dow announced the sale of its 50% stake in DowAksa Advanced Composites Holdings BV to its joint venture partner, Aksa Akrilik Kimya Sanayii A.Ş. The transaction, valued at $125 million, reflects Dow’s strategic focus on core business areas.

Market Concentration & Characteristics

The acrylic acids esters market exhibits a moderately concentrated competitive landscape dominated by a few global chemical manufacturers such as BASF SE, Arkema Group, and The Dow Chemical Company. It benefits from the presence of established players investing heavily in research, innovation, and sustainable product development to maintain market leadership. Regional producers contribute to market diversity by focusing on localized production and cost-effective solutions. The market’s characteristics include continuous technological advancements that improve product performance and expand application areas across adhesives, coatings, textiles, and personal care industries. It faces pressures from stringent environmental regulations, prompting companies to develop low-VOC and bio-based esters. Supply chain complexities and raw material price volatility further shape market dynamics. The interplay between global players’ scale advantages and regional firms’ agility defines the market structure, fostering innovation while maintaining competitive pricing and customer responsiveness.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End-User Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The acrylic acids esters market will expand due to increased demand in construction and automotive sectors.

- Manufacturers will focus more on developing sustainable and bio-based ester products.

- Technological innovations will improve product performance and broaden application areas.

- Regulatory pressures will drive adoption of low-VOC and eco-friendly formulations.

- Asia Pacific will continue to lead growth driven by rapid urbanization and industrialization.

- North America and Europe will emphasize green chemistry and regulatory compliance.

- Personal care and textile industries will present new growth opportunities.

- Supply chain resilience will become a critical focus for market players.

- Strategic partnerships and capacity expansions will intensify competition.

- Customization and innovation will remain key factors for market success.