Market Overview

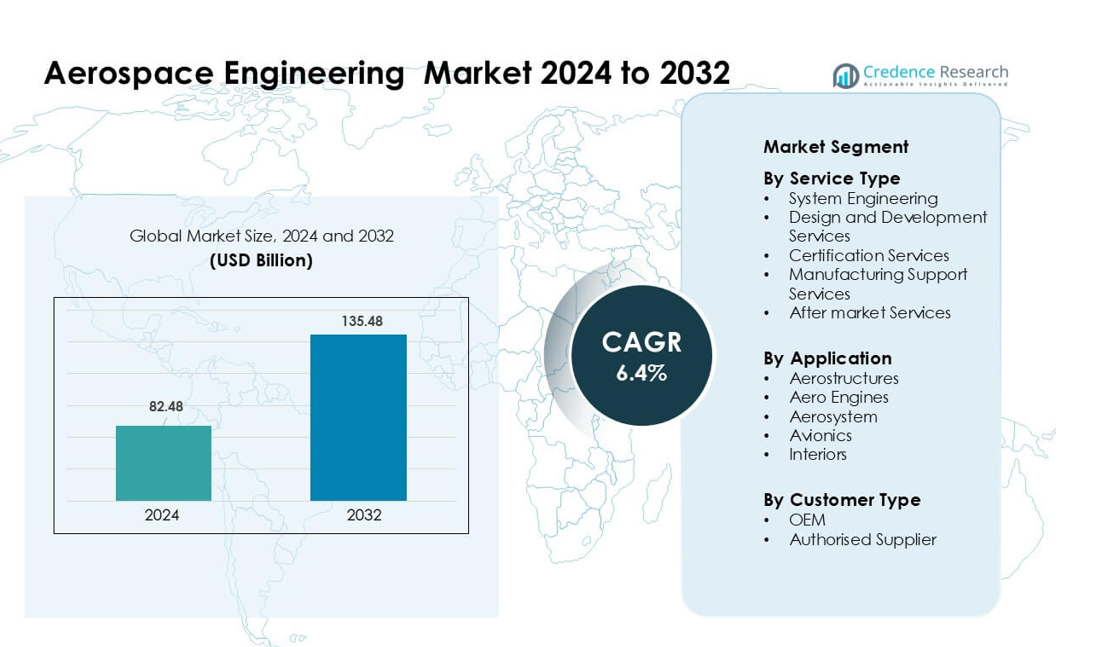

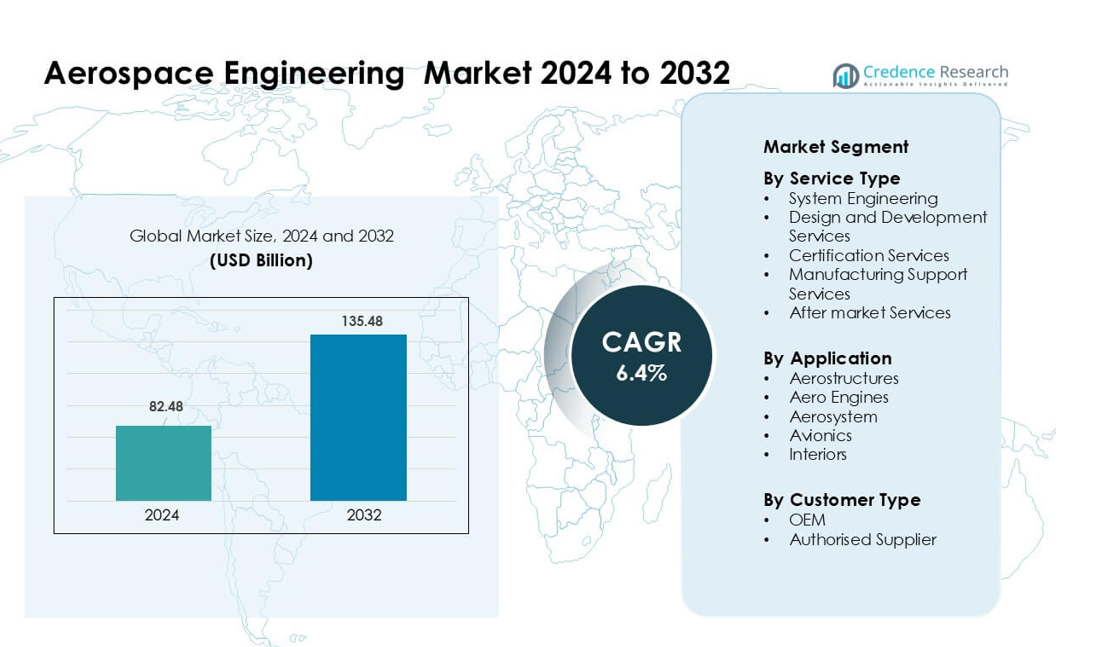

Aerospace Engineering Market was valued at USD 82.48 billion in 2024 and is anticipated to reach USD 135.48 billion by 2032, growing at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aerospace Engineering Market Size 2024 |

USD 82.48 billion |

| Aerospace Engineering Market , CAGR |

6.4% |

| Aerospace Engineering Market Size 2032 |

USD 135.48 billion |

Top players in the aerospace engineering market include Capgemini, Teledyne Technologies Incorporated, Bertrandt AG, Honeywell International Inc., L&T Technology Services Limited, EWI, Altair Engineering Inc., LISI GROUP, ITK Engineering GmbH, and Alten Group, each offering strong capabilities in system integration, digital engineering, simulation, and advanced material design. These companies expanded global engineering centers and strengthened partnerships with major OEMs to support rising demand for lightweight structures, avionics upgrades, and sustainable propulsion programs. **North America led the aerospace engineering market in 2024 with a 37% share, driven by high defense spending, strong OEM presence, and robust R&D investments across next-generation aircraft platforms.

Market Insights

- The aerospace engineering market reached USD 82.48 billion in 2024 and is projected to hit USD 135.48 billion by 2032 at a 6.4 % CAGR.

- Demand grew due to rising aircraft production, higher engineering outsourcing, and strong adoption of digital engineering for faster validation and system integration.

- Trends showed increasing use of composite materials, wider adoption of digital twins, and strong opportunities in hybrid-electric propulsion and autonomous flight engineering.

- Competition intensified as Capgemini, Teledyne Technologies, Bertrandt AG, Honeywell, and others expanded simulation capability, certification support, and global engineering centers to secure long-term OEM contracts.

- North America held the largest share in 2024 at 37%, followed by Europe at 29%, while Asia Pacific expanded rapidly. System engineering dominated service type with 36% share, and aerostructures led application with 41% share, supported by rising production of commercial and defense aircraft.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service Type

System engineering dominated this segment in 2024 with about 36% share, supported by rising integration needs across flight-control systems, propulsion, digital twins, and autonomous platforms. Aerospace firms relied on system engineering to manage complex architectures and ensure real-time coordination between hardware and software blocks. Demand grew further as OEMs adopted model-based engineering to cut testing cycles and improve certification readiness. Design and development services also expanded due to the push for lightweight materials, while certification services advanced as regulators tightened safety and sustainability norms.

- For instance, Boeing’s T‑7A Red Hawk trainer was developed using a digital thread and model‑based engineering: it achieved 80% less assembly hours, 50% faster software development, and recorded a 75% increase in first‑time quality.

By Application

Aerostructures led the application segment in 2024 with nearly 41% share, driven by higher production rates of commercial aircraft and wider use of composite materials. Aircraft manufacturers invested in advanced wing, fuselage, and empennage engineering to cut weight and improve fuel efficiency. Growth in narrow-body deliveries also pushed demand for structural modeling and digital fabrication support. Aero engines followed with strong momentum as engine programs required thermal analysis, CFD modeling, and durability testing to support fleet modernization and lower-emission propulsion systems.

- For instance, Airbus’s A350 XWB uses 53% carbon‑fibre composite in its airframe, including the fuselage, wings, and tail, which helps reduce structural weight and enables longer, more efficient wing designs.

By Customer Type

OEMs dominated the customer type segment in 2024 with about 54% share, supported by continued investment in next-generation platforms and large engineering outsourcing contracts. Aircraft manufacturers shifted more design validation, simulation, and system integration work to engineering partners to meet delivery targets. The rise of hybrid-electric programs and autonomous flight projects also boosted OEM-led engineering demand. Authorized suppliers grew steadily as tier-1 and tier-2 vendors expanded component-level analysis, material testing, and certification compliance to align with stricter OEM performance requirements.

Key Growth Drivers

Rising Production of Commercial and Defense Aircraft

Global aerospace engineering demand grew as manufacturers raised production rates for both commercial and defense platforms. Airbus and Boeing expanded build schedules for A320neo and 737 families, which pushed engineering requirements for aerostructures, avionics, and system integration. Defense programs such as next-generation fighters and surveillance aircraft added more workload for advanced modeling, fatigue analysis, propulsion upgrades, and mission-system design. Engineering firms gained steady contracts for digital validation and supply-chain coordination as OEMs worked to clear delivery backlogs. The shift toward lighter structures, robust safety frameworks, and improved engine performance also strengthened engineering needs across global fleets.

- For instance, Airbus produced 602 A320 Family aircraft in 2024, including A320neo variants, which placed intense demand on its system‑engineering and digital‑thread infrastructure.

Adoption of Digital Engineering and Model-Based Systems

Digital engineering transformed aircraft development as companies adopted model-based system engineering, simulation-driven design, and digital twins. Aerospace firms used these technologies to reduce physical prototyping, cut rework, and accelerate certification timelines. Model-based workflows enabled seamless coordination between structural, mechanical, electrical, and software teams, reducing integration risks in complex aircraft programs. Digital twins supported predictive maintenance and optimized fleet performance for airlines and defense users. Growth also came from expanded use of cloud-based engineering platforms that improved design traceability and regulatory documentation. These advances boosted productivity and reduced lifecycle costs, driving strong demand for engineering services.

- For instance, Boeing’s T-7A Red Hawk was developed using a fully digital foundation: it moved from computer‑screen design to first flight in just 36 months, thanks to model‑based engineering and advanced 3D design.

Shift Toward Sustainable Aviation Solutions

Sustainability goals pushed engineering investments in cleaner propulsion, lightweight materials, and energy-efficient systems. Aerospace companies accelerated development of hybrid-electric propulsion, hydrogen-ready aircraft, and advanced aerodynamic designs to meet global emission-reduction targets. Engineering tasks expanded across battery integration, thermal management, hydrogen storage, and fuel-cell architecture. Composite-rich structures gained traction as aircraft manufacturers sought improved strength-to-weight ratios. Airlines also supported this shift by adopting sustainable aviation fuel initiatives, which required engine component redesigns and combustion optimization. These sustainability-driven programs strengthened long-term engineering demand and opened new design and testing opportunities.

Key Trend & Opportunity

Growth of Autonomous and Smart Aircraft Systems

Autonomous flight systems created major opportunities across control algorithms, sensor fusion, redundant architectures, and onboard computing. Aerospace engineering teams expanded work on detect-and-avoid systems, automated landing functions, and enhanced flight-management software. Rising development of unmanned cargo aircraft, urban air mobility vehicles, and advanced drones generated more demand for avionics integration and high-reliability electronics. Smart cabin and cockpit systems also gained traction with upgrades in real-time monitoring, connectivity, and pilot-assist technologies. These projects opened new opportunities for engineering companies to partner with OEMs and tech firms on next-generation flight platforms.

- For instance, EHang’s EH216‑S autonomous aerial vehicle has completed over 30,000 trial flights, including passenger-carrying ones in diverse environments such as typhoons and high altitudes a massive validation of its redundant systems and onboard autonomy.

Expansion of Additive Manufacturing and Advanced Materials

Additive manufacturing created new opportunities for lighter, more durable parts with faster production cycles. Aerospace firms increased use of 3D-printed components for brackets, fuel nozzles, interior modules, and complex thermal systems. Engineering work grew in topology optimization, material characterization, structural testing, and certification of printed components. Advanced composites such as thermoplastic materials and high-temperature resins also expanded engineering needs for bonding, inspection, and stress modeling. These technologies improved performance and reduced cost, offering strong growth potential for engineering providers specializing in manufacturing support and structural innovation.

- For instance, GE Aviation has printed over 100,000 fuel‑nozzle tips at its Auburn facility, where each LEAP engine uses 18–19 of these additively manufactured nozzles the design replaces ~20 welded parts with a single piece and reduces tip weight by 25%.

Integration of Cybersecurity and Connected Aircraft Systems

Connected aircraft platforms increased demand for cybersecurity-focused engineering. Real-time data exchange between aircraft, satellites, and ground stations required robust encryption, intrusion detection, and secure software architecture. Engineering work expanded to secure avionics networks, protect flight-critical systems, and meet evolving airworthiness cybersecurity standards. Growth in inflight connectivity, predictive maintenance platforms, and cloud-linked avionics created new opportunities for specialized engineering services. As airlines and defense organizations adopted more connected systems, cybersecurity engineering became a high-value opportunity across the aerospace ecosystem.

Key Challenge

Supply Chain Disruptions and Limited Engineering Resources

Global aerospace supply chains continued to face shortages in skilled engineers, advanced materials, and certified components. OEMs struggled to meet delivery schedules as tier-1 and tier-2 vendors faced staffing issues, certification delays, and production bottlenecks. Engineering teams had to increase coordination to manage redesigns, alternative material sourcing, and validation tasks. The shortage of specialized engineers in avionics, propulsion, and system integration created heavy workload pressures. These constraints slowed program timelines, increased development risk, and forced companies to outsource more engineering tasks to maintain progress on active aircraft programs.

Rising Complexity of Certification and Safety Compliance

Stricter aviation regulations increased engineering workload for documentation, simulation, testing, and redesign cycles. Certification authorities introduced tougher requirements for digital systems, sustainable propulsion, and structural safety, which extended approval timelines. Engineering teams spent more time on traceability, model validation, and software verification to meet standards for both civil and defense aircraft. As aircraft architectures grew more complex with hybrid-electric propulsion, autonomous systems, and high-integration avionics, meeting these regulations became costly and time-consuming. This challenge raised development expenses and slowed the pace of innovation for many aerospace companies.

Regional Analysis

North America

North America led the aerospace engineering market in 2024 with about 37% share, supported by strong OEM presence, high defense spending, and continuous investment in next-generation aircraft programs. The U.S. drove most demand through advanced engineering needs in fighter jets, space systems, UAV platforms, and commercial fleet upgrades. Engineering firms benefited from large-scale digital transformation, system integration work, and sustainability-focused R&D across propulsion and materials. Canada contributed additional growth through regional aircraft engineering and MRO-linked design support. Broad innovation, high R&D budgets, and robust regulatory frameworks kept North America ahead of other regions.

Europe

Europe held nearly 29% share in 2024, driven by strong engineering demand across commercial aircraft, defense platforms, and space programs. Countries such as Germany, France, and the U.K. supported steady growth through investments in composite structures, hybrid-electric propulsion, and advanced avionics. Airbus and major Tier-1 suppliers expanded engineering partnerships to meet rising production requirements. The region also advanced sustainable aviation projects, boosting work in fuel-cell systems and lightweight architectures. Europe’s broad technology base, strong regulatory oversight, and innovation-focused supply chain ensured solid demand for engineering services across airframes and propulsion systems.

Asia Pacific

Asia Pacific accounted for about 24% share in 2024 and showed the fastest expansion as domestic aircraft production, MRO networks, and defense modernization programs increased engineering needs. China, Japan, and India strengthened local aerospace capabilities through new commercial jet platforms, engine development programs, and avionics integration projects. Rising passenger traffic and fleet expansion encouraged airlines and OEMs to invest in advanced engineering for structures, cabin systems, and digital modeling. Regional suppliers also grew their role in global aerospace value chains. Strong industrialization and government-backed aerospace programs drove sustained engineering demand.

Latin America

Latin America captured around 6% share in 2024, supported by steady growth in regional jet engineering, structural design work, and avionics modernization. Brazil played the leading role through engineering activities linked to commercial and defense aircraft development. Rising MRO demand across Mexico and Colombia created additional opportunities in system upgrades, interiors, and component testing. Engineering work also expanded due to airline fleet renewal and increasing interest in digital platforms for predictive maintenance. Although smaller in scale, the region continued to build engineering capacity through partnerships with OEMs and technology suppliers.

Middle East & Africa

The Middle East & Africa region held nearly 4% share in 2024, driven by strong aviation expansion, growing MRO hubs, and engineering needs for fleet modernization. Gulf countries increased investment in avionics upgrades, digital cockpit systems, and advanced cabin engineering to support premium fleets. Defense procurement programs in the UAE and Saudi Arabia added more engineering work in systems integration and structural evaluation. Africa saw modest growth through fleet expansion and rising demand for maintenance-linked engineering services. Continued infrastructure development and partnerships with global OEMs gradually strengthened the region’s engineering contribution.

Market Segmentations:

By Service Type

- System Engineering

- Design and Development Services

- Certification Services

- Manufacturing Support Services

- After market Services

By Application

- Aerostructures

- Aero Engines

- Aerosystem

- Avionics

- Interiors

By Customer Type

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Capgemini, Teledyne Technologies Incorporated, Bertrandt AG, Honeywell International Inc., L&T Technology Services Limited, EWI, Altair Engineering Inc., LISI GROUP, ITK Engineering GmbH, and Alten Group shaped the competitive landscape through broad engineering portfolios and strong technological capability. These companies focused on system integration, digital engineering, model-based development, and advanced material solutions to support complex aerospace programs. Many strengthened partnerships with OEMs and Tier-1 suppliers to address rising demand for lightweight structures, autonomous systems, and sustainable propulsion. Expansion of global engineering centers, investment in simulation tools, and emphasis on certification support helped firms enhance competitiveness. Companies also pursued innovation in digital twins, testing automation, composite engineering, and avionics software to meet evolving regulatory and performance requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In November 2025, LISI Group confirmed the sale of its medical division (LISI MEDICAL) to SK Capital. As part of the deal, LISI retains a minority stake (~9.988 %) in the new entity (renamed Precera Medical).

- In May 2025, Capgemini, in partnership with Dassault Systèmes, promoted a push to embed Model-Based Systems Engineering (MBSE) across the aerospace product lifecycle from design through manufacturing as a way to boost efficiency and innovation in production.

- In February 2025, Capgemini exhibited next-generation defence and aerospace solutions at Aero India 2025, showcasing services around digital-continuity, AI/Cloud, digital-twin, immersive tech, IoT/AR/VR.

Report Coverage

The research report offers an in-depth analysis based on ServiceType, Application, Customer Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Aerospace engineering demand will rise as aircraft production rates continue to scale globally.

- Digital engineering adoption will expand, with model-based systems becoming the core development approach.

- Hybrid-electric, hydrogen, and next-generation propulsion programs will create new engineering opportunities.

- Autonomous flight systems will drive deeper investments in avionics, sensor fusion, and software validation.

- Composite structures and advanced materials will gain a larger role in structural engineering work.

- Engineering outsourcing will increase as OEMs rely more on global partners to meet delivery targets.

- Additive manufacturing will reshape part design, testing, and certification cycles across major aircraft programs.

- Cybersecurity engineering needs will grow as connected aircraft systems become standard.

- Defense modernization programs will push demand for high-reliability systems integration and simulation.

- Asia Pacific will emerge as the fastest-growing region, supported by strong domestic aerospace development.